Haitong 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive haitong review examines a financial services provider that has maintained a presence in the securities and brokerage industry since 1988. Haitong International Securities Group operates under the regulatory oversight of the Hong Kong Securities and Futures Commission. The company offers a range of financial instruments including stocks, fixed income products, commodities, and forex trading services.

The broker presents a mixed profile for retail traders. Notable features include demo account availability and flexible leverage options ranging from 1:30 to 1:500 for forex trading, and 1:5 to 1:20 for stock trading. The primary trading platform offered is eHaitong PC, which caters to traders seeking desktop-based trading solutions.

Based on available user feedback, Haitong International Securities Group receives a moderate rating of 3 out of 5. Only 34% of users indicate they would recommend the platform to friends. This positioning suggests the broker serves adequately as an intermediate option for small to medium-sized investors who require leveraged trading capabilities, though it may not excel in areas that distinguish top-tier brokers in the competitive forex and securities market.

The broker's target demographic primarily consists of retail traders seeking access to diverse asset classes with moderate leverage requirements. These traders are particularly comfortable with traditional desktop trading platforms rather than cutting-edge mobile or web-based solutions.

Important Notice

Regional Entity Variations: Haitong operates through different regional entities and subsidiaries. Each entity is potentially subject to varying regulatory requirements and service offerings. Investors should verify the specific regulatory status and available services in their jurisdiction before engaging with any Haitong entity, as conditions may differ significantly between regions.

Review Methodology: This evaluation is based on publicly available information, user feedback data, and industry standard assessment criteria. The analysis incorporates regulatory filings, user testimonials, and platform specifications available through official channels and third-party review platforms. Readers should conduct independent research and consider their specific trading requirements when evaluating this broker.

Overall Rating Framework

Broker Overview

Company Foundation and Background

Haitong International Securities Group emerged as a significant player in the Asian financial services sector following its establishment in 1988. Operating as a subsidiary of Haitong International Holdings Limited, the company has built its reputation primarily around securities brokerage and comprehensive financial services delivery. The organization's longevity in the market spans over three decades. This positions it as an established entity within the competitive landscape of Asian financial markets.

The company's business model centers on traditional securities brokerage services, complemented by broader financial service offerings that cater to both institutional and retail client segments. This dual-focus approach has enabled Haitong to maintain relevance across various market cycles while adapting to evolving regulatory environments in the Hong Kong financial sector.

Service Portfolio and Platform Infrastructure

Haitong's service architecture encompasses multiple asset classes. These include equities, fixed income instruments, commodities, and foreign exchange products. This diversified offering reflects the company's strategy to serve as a comprehensive financial services provider rather than specializing in a single market segment. The haitong review indicates that this broad approach appeals to traders seeking consolidated access to multiple markets through a single provider.

The technological foundation rests primarily on the eHaitong PC platform. This represents the company's main trading interface for retail clients. While this desktop-focused approach may appear traditional compared to newer mobile-first platforms, it continues to serve traders who prefer comprehensive desktop trading environments. The platform supports the company's multi-asset strategy by providing integrated access to various financial instruments under a unified interface.

Regulatory Framework and Compliance

Haitong operates under the regulatory supervision of the Hong Kong Securities and Futures Commission. This provides a foundation of regulatory compliance within one of Asia's most respected financial jurisdictions. This regulatory oversight ensures adherence to established standards for client fund protection, operational transparency, and market conduct.

Asset Class Availability and Trading Options

The broker's trading universe spans multiple asset categories. It shows particular strength in traditional securities markets. Equity trading forms a core component of the service offering, while fixed income products provide opportunities for conservative investors. Commodity trading access enables portfolio diversification, and forex services cater to currency market participants seeking leveraged exposure.

Leverage Structure and Risk Management

Forex trading leverage ranges from 1:30 to 1:500. This provides flexibility for traders with varying risk appetites and regulatory constraints. Stock trading leverage is more conservative, ranging from 1:5 to 1:20, reflecting the different risk profiles associated with equity markets compared to currency trading.

Platform Technology and Accessibility

The eHaitong PC platform serves as the primary trading interface. It emphasizes desktop-based trading functionality. While specific technical specifications remain undisclosed in available documentation, the platform supports the broker's multi-asset trading approach through integrated market access.

Operational Information Gaps

Several operational details remain unclear in available documentation. These include specific deposit and withdrawal methods, minimum account funding requirements, promotional offerings, geographic restrictions, and customer service language capabilities. This lack of transparency represents a significant limitation for potential clients seeking comprehensive service information.

Account Conditions Analysis

The evaluation of Haitong's account conditions reveals significant transparency challenges that impact the overall client experience. This haitong review identifies substantial information gaps regarding fundamental account parameters that typically influence trader decision-making processes.

Account Structure and Accessibility

Available documentation provides limited insight into the variety of account types offered by Haitong. The absence of clear account tier descriptions, feature comparisons, and eligibility criteria creates uncertainty for potential clients attempting to understand their options. This lack of transparency extends to minimum deposit requirements, which remain unspecified in publicly available materials.

Account Opening Process and Requirements

The account establishment procedure lacks detailed documentation. This makes it difficult for prospective clients to understand the steps, timeline, and documentation required for account activation. This opacity contrasts unfavorably with industry standards where clear onboarding processes are typically well-documented and easily accessible.

Specialized Account Features

Information regarding specialized account options remains unavailable in current documentation. This includes Islamic trading accounts for clients requiring Sharia-compliant trading conditions. Similarly, details about professional or institutional account categories are not clearly specified.

User Feedback and Market Reception

The moderate user rating of 3 out of 5 for Haitong International Securities Group reflects client dissatisfaction with account-related transparency issues. The relatively low recommendation rate of 34% among existing users suggests that account conditions may not meet contemporary trader expectations for clarity and competitive features.

Haitong's trading infrastructure centers around the eHaitong PC platform. This represents a traditional approach to retail trading technology. The platform emphasizes desktop-based functionality, catering to traders who prefer comprehensive workstation-style trading environments over mobile or web-based alternatives.

Platform Capabilities and Functionality

The eHaitong PC platform provides integrated access to multiple asset classes. This supports the broker's diversified trading approach. However, detailed specifications regarding advanced charting capabilities, technical analysis tools, and automated trading features remain insufficiently documented in available materials.

Research and Market Analysis Resources

Information regarding proprietary research offerings, market analysis publications, and third-party research integrations is notably absent from available documentation. This gap represents a significant limitation for traders who rely on comprehensive market intelligence to inform their trading decisions.

Educational and Training Materials

The availability of educational resources remains unclear based on current documentation. This includes webinars, tutorials, trading guides, and market education materials. This absence of educational support information may impact the platform's appeal to developing traders seeking comprehensive learning resources.

Technology Integration and Automation

Details regarding algorithmic trading support, API access for automated strategies, and integration with third-party trading tools are not specified in available materials. This lack of information makes it difficult to assess the platform's suitability for sophisticated trading approaches or institutional-grade automation requirements.

Customer Service and Support Analysis

Haitong's customer support infrastructure employs traditional communication channels. Telephone and email support form the primary contact methods. This conventional approach reflects the broker's overall emphasis on established service delivery methods rather than innovative customer engagement technologies.

Support Channel Availability and Accessibility

The broker provides phone and email support options. However, specific availability hours, response time commitments, and escalation procedures remain undocumented in available materials. The absence of live chat functionality or modern messaging platforms may limit accessibility for clients accustomed to immediate support responses.

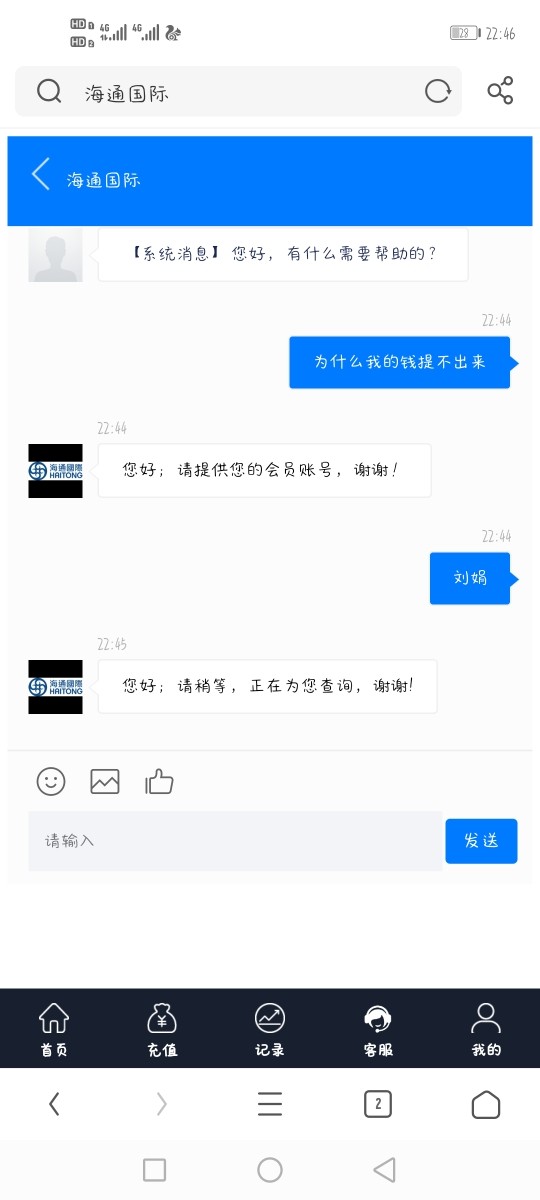

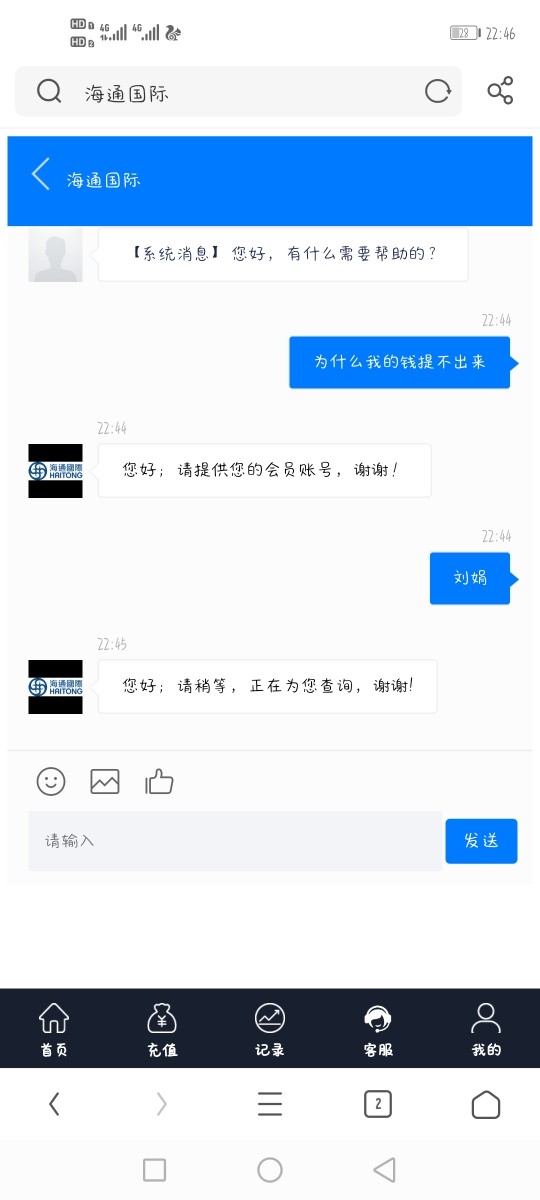

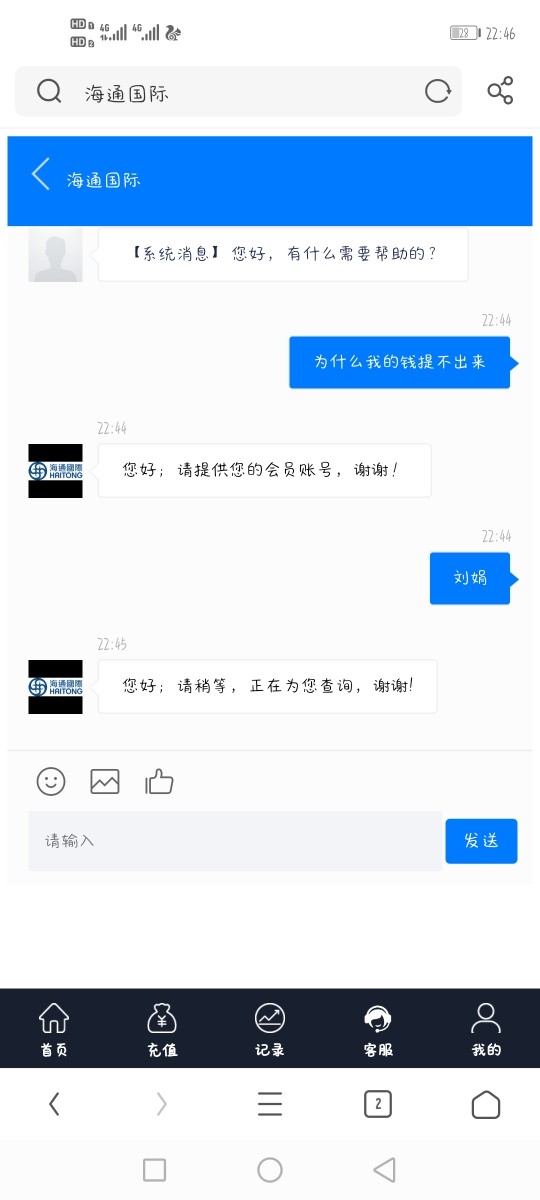

Service Quality and User Satisfaction

User feedback indicates moderate satisfaction levels with customer service quality. This contributes to the overall rating of 3 out of 5 for the Haitong International Securities Group. Client testimonials suggest that while support is available, the quality and efficiency of problem resolution may not consistently meet contemporary service expectations.

Multilingual Support and Regional Adaptation

Information regarding language support capabilities and regional customer service adaptation remains unspecified in current documentation. This gap is particularly relevant for an international broker serving diverse geographic markets with varying linguistic requirements.

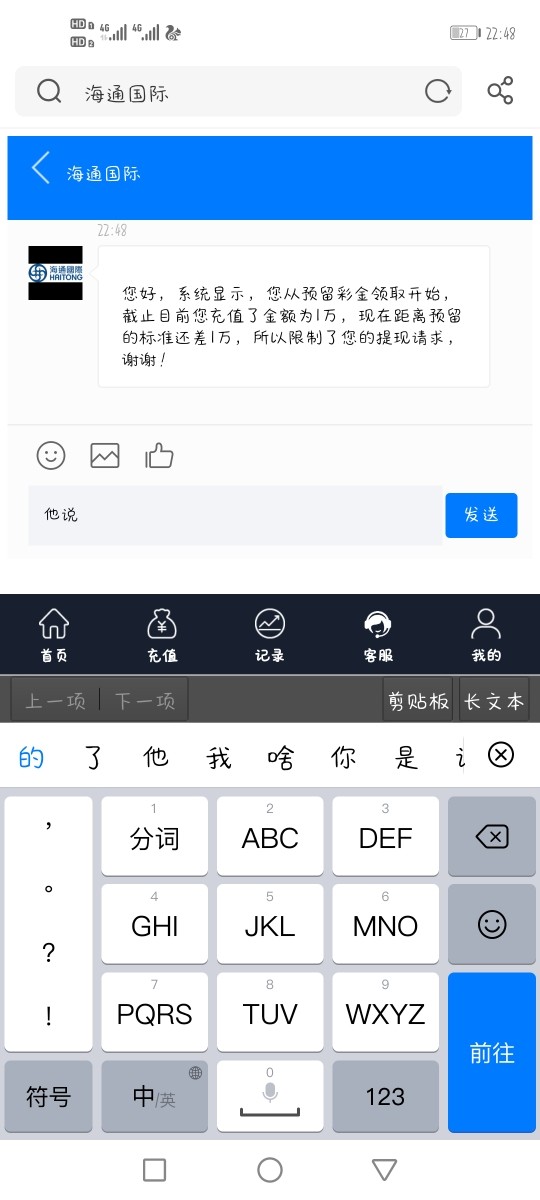

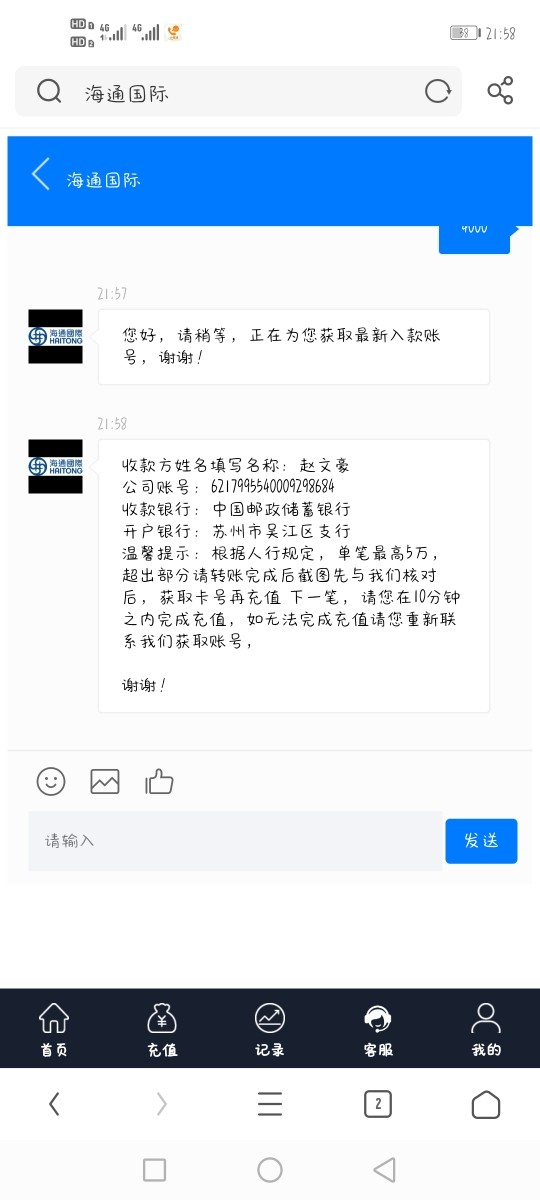

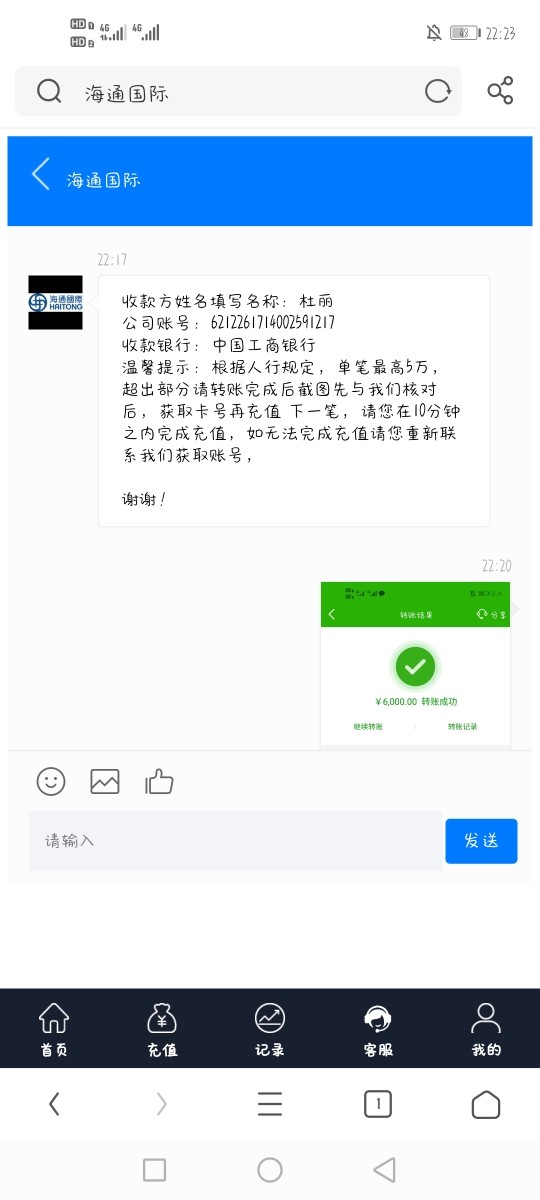

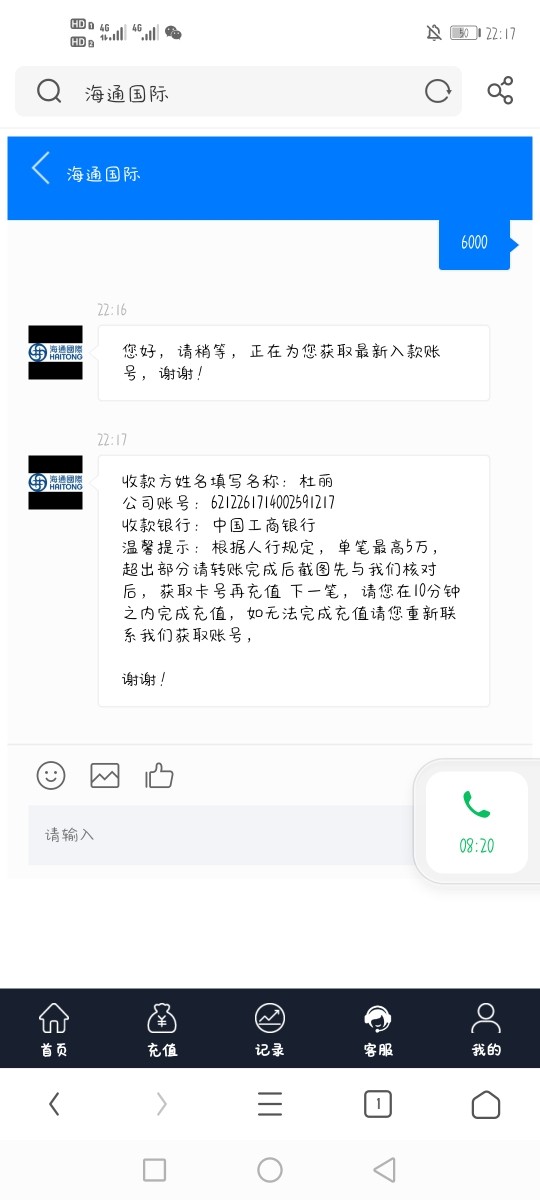

Issue Resolution and Client Advocacy

Specific procedures for complaint handling, dispute resolution, and client advocacy processes are not detailed in available materials. This lack of transparency regarding client protection measures may impact confidence among potential users seeking assurance about support quality during challenging situations.

Trading Experience Analysis

The trading experience evaluation reveals a generally positive reception among users. Feedback indicates satisfactory platform performance despite limitations in cost transparency and execution detail disclosure. This comprehensive haitong review shows that while users report acceptable trading conditions, several areas require enhanced transparency.

Platform Stability and Performance

User testimonials suggest that the eHaitong PC platform delivers reliable performance during normal market conditions. However, specific data regarding system uptime, latency measurements, and performance during high-volatility periods remains unavailable in current documentation.

Order Execution Quality and Transparency

Information regarding order execution methodology, slippage statistics, and requote frequency is notably absent from available materials. This lack of execution transparency makes it challenging for traders to assess the platform's suitability for specific trading strategies or market conditions.

Trading Environment and Market Access

The platform provides access to multiple asset classes. However, detailed information about spreads, commission structures, and liquidity sources remains insufficiently documented. This transparency gap impacts traders' ability to accurately calculate trading costs and compare competitive positioning.

Mobile and Alternative Platform Options

Documentation regarding mobile trading applications, web-based platform alternatives, or tablet-optimized interfaces is not available in current materials. This suggests a primarily desktop-focused approach that may limit accessibility for traders requiring mobile trading capabilities.

Advanced Trading Features

Specific information about advanced order types, risk management tools, and sophisticated trading features remains unclear based on available documentation. This lack of detail makes it difficult to assess the platform's suitability for experienced traders requiring advanced functionality.

Trust and Security Analysis

Haitong's regulatory foundation rests on supervision by the Hong Kong Securities and Futures Commission. This provides a framework of oversight within one of Asia's most established financial regulatory environments. This regulatory relationship forms the primary basis for client trust and operational legitimacy.

Regulatory Compliance and Oversight

The SFC regulatory status ensures compliance with Hong Kong's financial services standards. These include capital adequacy requirements, operational risk management, and client fund protection protocols. However, specific license numbers and detailed regulatory compliance disclosures are not readily available in current documentation.

Client Fund Protection and Security Measures

Information regarding client fund segregation practices, deposit insurance coverage, and additional security measures remains insufficiently detailed in available materials. This transparency gap impacts potential clients' ability to assess fund safety protocols and protection mechanisms.

Corporate Transparency and Disclosure

Details regarding corporate governance, financial reporting standards, and management team disclosure are not comprehensively available through standard channels. This limited transparency may impact client confidence, particularly for larger account holders seeking detailed corporate information.

Industry Recognition and Third-Party Validation

Available documentation does not include information about industry awards, third-party security certifications, or independent audit results. The absence of external validation sources limits the ability to assess the broker's standing within the broader industry context.

Risk Management and Business Continuity

Specific information about business continuity planning, disaster recovery procedures, and operational risk management frameworks is not detailed in current materials. This documentation gap affects the assessment of the broker's preparedness for various operational challenges.

User Experience Analysis

The overall user experience assessment reveals moderate satisfaction levels. The Haitong International Securities Group receives a rating of 3 out of 5 from users. This intermediate positioning suggests adequate service delivery while highlighting significant opportunities for enhancement across multiple touchpoints.

Overall Satisfaction and User Retention

The recommendation rate of 34% among existing users indicates that the platform serves basic trading needs. However, it may not deliver the exceptional experience necessary to generate strong user advocacy. This moderate endorsement level suggests that users find the service acceptable but not particularly compelling compared to alternatives.

Interface Design and Usability Assessment

Specific feedback regarding the eHaitong PC platform's user interface design, navigation efficiency, and learning curve remains limited in available documentation. The desktop-focused approach may appeal to traditional traders while potentially limiting accessibility for users preferring modern, responsive design standards.

Onboarding and Account Management Experience

Details regarding the account opening process, verification procedures, and initial platform orientation are not well-documented in available materials. This lack of transparency about the client journey may create uncertainty for prospective users considering the platform.

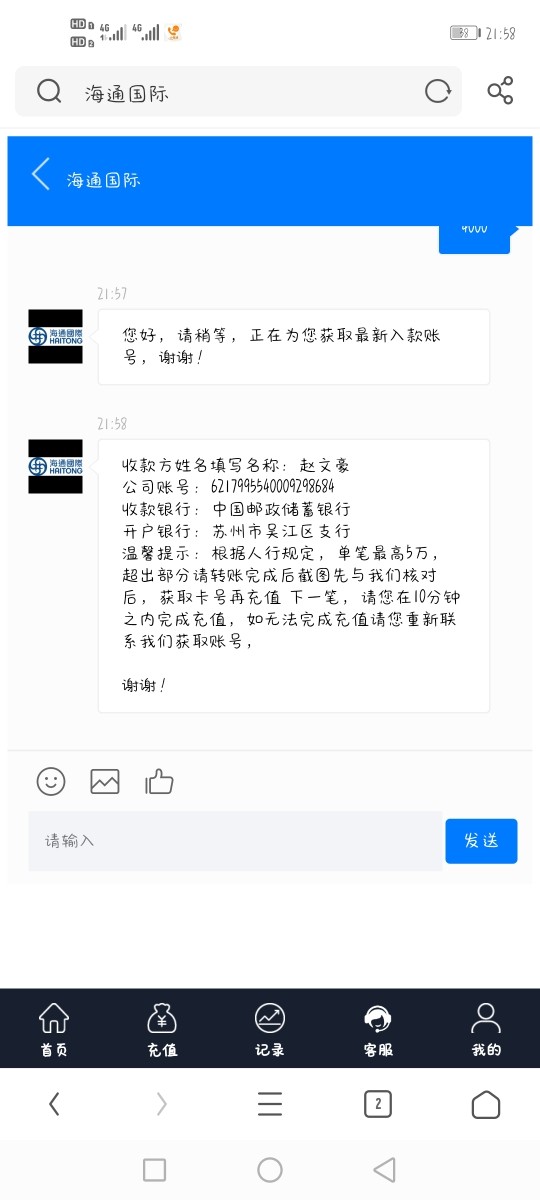

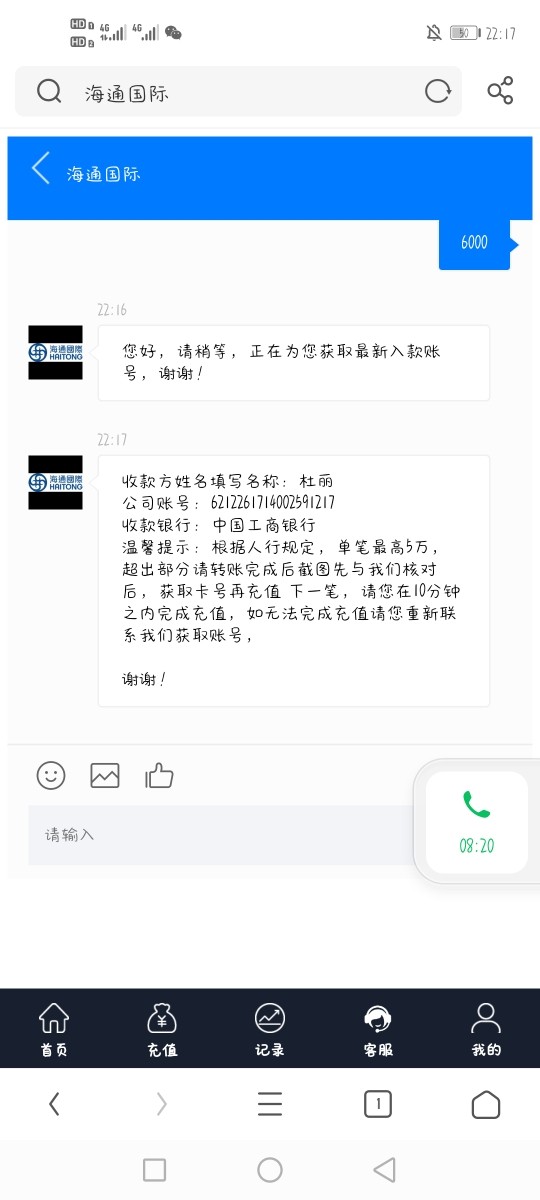

Operational Efficiency and Transaction Processing

User feedback suggests generally acceptable performance in core trading functions. However, specific data regarding deposit and withdrawal processing times, transaction efficiency, and operational reliability remains undisclosed in current documentation.

Common User Concerns and Improvement Areas

Feedback patterns indicate that transparency issues regarding account conditions and service quality represent primary areas of user concern. The moderate satisfaction levels suggest that while basic functionality meets expectations, enhanced transparency and service quality improvements could significantly impact user experience and retention rates.

Conclusion

This comprehensive haitong review reveals a broker that occupies a middle-ground position in the competitive financial services landscape. Haitong International Securities Group presents as an established entity with regulatory oversight and multi-asset trading capabilities, yet faces significant challenges in transparency and service excellence that impact its overall market positioning.

The broker's suitability centers primarily on small to medium-sized investors who prioritize regulatory compliance and basic multi-asset access over cutting-edge features or exceptional service quality. Traders requiring leveraged exposure across various asset classes may find the platform adequate for fundamental trading needs, particularly those comfortable with traditional desktop-based trading environments.

Key Strengths and Limitations Summary

Primary advantages include regulatory oversight by the Hong Kong SFC, availability of demo trading accounts, and flexible leverage options spanning from conservative to moderate risk levels. The multi-asset platform approach provides consolidated access to stocks, fixed income, commodities, and forex markets through a single provider relationship.

However, significant limitations include insufficient transparency regarding account conditions, limited documentation of trading costs and execution quality, and moderate user satisfaction levels that suggest room for substantial improvement. The lack of modern customer service options and comprehensive educational resources further constrains the platform's appeal to contemporary retail traders seeking enhanced service experiences.