Regarding the legitimacy of GUOTAI HAITONG forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is GUOTAI HAITONG safe?

Pros

Cons

Is GUOTAI HAITONG markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Haitong International Futures Limited

Effective Date:

2004-10-06Email Address of Licensed Institution:

lccs.correspondence@htisec.comSharing Status:

No SharingWebsite of Licensed Institution:

www.htisec.comExpiration Time:

--Address of Licensed Institution:

香港中環港景街一號國際金融中心一期28樓, 30樓3001-10, 15-16室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Haitong A Scam?

Introduction

Haitong Securities, established in 1988, has positioned itself as a prominent player in the forex market, particularly within the Asian financial landscape. As a broker based in Hong Kong, Haitong offers various trading services, primarily focusing on equities, fixed income products, and foreign exchange. However, the rapid growth of online trading has led to a proliferation of brokers, making it crucial for traders to carefully evaluate their options. With the increasing risk of scams and fraudulent practices in the trading industry, it is imperative for potential investors to conduct thorough research before engaging with any broker. This article aims to objectively assess whether Haitong is a reputable broker or a potential scam by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk factors.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and safety. Haitong Securities claims to be regulated by the Securities and Futures Commission (SFC) in Hong Kong, a regulatory body known for its stringent standards. However, the exact nature of its licensing and compliance history requires closer scrutiny.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AAF 806 | Hong Kong | Verified |

While Haitong is indeed regulated by the SFC, the quality of this regulation is a point of concern. The SFC oversees a wide range of financial activities, ensuring that firms adhere to strict operational standards. However, the lack of transparency regarding specific compliance measures and any historical infractions leaves room for doubt. The absence of a clear history of regulatory compliance could imply potential risks for traders. Therefore, while Haitong is regulated, traders must remain vigilant and consider the implications of operating under such regulatory oversight.

Company Background Investigation

Haitong Securities has a long-standing history dating back to its founding in 1988. Over the years, it has evolved into one of the largest securities firms in China, with a diverse range of services that include brokerage, investment banking, and asset management. The company is publicly listed on both the Shanghai and Hong Kong stock exchanges, which adds a layer of accountability.

The management team at Haitong comprises experienced professionals with a solid track record in the finance industry. However, the clarity of the company's ownership structure and its transparency in operations are areas that warrant attention. While Haitong has made strides in establishing its reputation, the level of information disclosed to the public can sometimes be limited. This lack of transparency may lead to concerns about the company's operational integrity and its commitment to investor protection.

Trading Conditions Analysis

Haitong offers a range of trading conditions that are competitive within the market. However, the overall fee structure and potential hidden costs need careful examination. Traders should be aware of the various fees associated with trading, as these can significantly impact profitability.

| Fee Type | Haitong | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 3% | 0.5% - 2% |

The spread on major currency pairs at Haitong appears to be slightly higher than the industry average, which may be a concern for high-frequency traders. Additionally, the commission structure is variable, which could lead to unexpected costs. Traders should ensure they fully understand these costs before committing to trading with Haitong.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's credibility. Haitong asserts that it employs various measures to protect client funds. However, the specifics of these measures, such as whether client funds are kept in segregated accounts or if there are any negative balance protection policies, are not clearly stated.

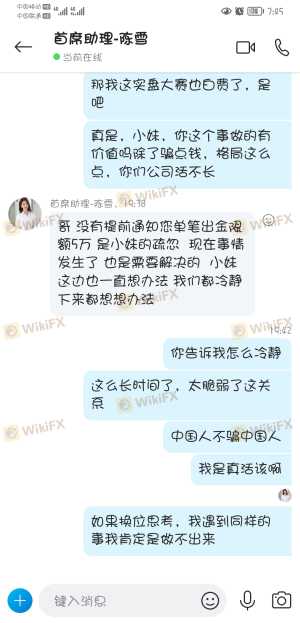

Historically, there have been instances reported by users regarding difficulties in fund withdrawals, which raises questions about the broker's commitment to safeguarding client interests. Such issues can be indicative of deeper operational problems and should not be overlooked by potential investors.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Haitong highlight a mixed bag of experiences, with some users praising the platform's functionality while others express frustration over withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Average |

A notable case involved a trader who reported being unable to withdraw funds after multiple attempts, citing vague reasons from customer support. Such complaints are concerning and suggest that potential clients should approach Haitong with caution.

Platform and Execution

Haitong's trading platform is designed to cater to a variety of trading styles, offering features that are generally well-received. However, the quality of order execution, including slippage and rejection rates, is a critical aspect that needs evaluation.

Traders have reported instances of slippage during volatile market conditions, which can affect trading outcomes. The platform's performance during peak trading hours is also an essential consideration, as any downtime could lead to missed opportunities.

Risk Assessment

Using Haitong comes with inherent risks that traders should be aware of. The overall risk profile of the broker can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Claims regulation but lacks transparency |

| Fund Security | High | Historical issues with withdrawals |

| Trading Conditions | Medium | Higher spreads and variable commissions |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while Haitong Securities presents itself as a legitimate broker with a long history in the financial market, several red flags warrant caution. The regulatory oversight it claims to have does not fully alleviate concerns regarding transparency and operational integrity. Potential clients should be particularly wary of the reported withdrawal issues and the overall customer service experience.

For traders considering Haitong, it is advisable to proceed with caution. Those who are risk-averse or require high levels of customer support may want to explore alternative brokers with stronger reputations and clearer regulatory compliance. Recommended alternatives include brokers with robust regulatory frameworks, transparent fee structures, and positive customer feedback. Ultimately, ensuring that your trading experience is safe and reliable should be the top priority.

Is GUOTAI HAITONG a scam, or is it legit?

The latest exposure and evaluation content of GUOTAI HAITONG brokers.

GUOTAI HAITONG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GUOTAI HAITONG latest industry rating score is 7.02, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.02 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.