FXBTG 2025 Review: Everything You Need to Know

Executive Summary

This detailed fxbtg review looks at a forex and CFD broker that has faced major regulatory problems. FXBTG started in 2014 and was based in New Zealand, but regulatory authorities removed its registration for breaking legal rules, which raises serious questions about whether people can trust it and if it operates legally.

The broker offered multiple trading platforms like MetaTrader 4 and the FXBTG App, plus many different assets including forex, CFDs, indices, precious metals, cryptocurrencies, and futures. However, its regulatory problems are much more important than these features. FXBTG mainly focused on individual forex and CFD traders, but since it lost its registration, it's not a good choice for any investor.

FXBTG was registered in New Zealand and used to work under ASIC oversight. But after breaking legal rules, the company lost its official registration, which means it no longer has regulatory protection or legitimacy. This is a major warning sign for people thinking about using this broker for trading.

Important Notice

Regulatory Variations: FXBTG was first registered and regulated in New Zealand under ASIC supervision. The company lost its official registration because it violated legal directives. Investors should know about the serious risks of trading through companies that have lost their registration and don't have regulatory protection in any country.

Review Methodology: This review uses currently available information and past data about how FXBTG operated. Since the broker lost its registration, some information might be old or might not apply to actual trading experiences anymore.

Rating Framework

Broker Overview

FXBTG started in 2014 as a forex and CFD broker with its main office in New Zealand. The company said it provided online trading services and focused on individual retail traders who wanted to trade foreign exchange and contracts for difference. FXBTG first operated under regulatory oversight and tried to offer complete trading solutions through modern platforms and many different assets.

But the broker ran into serious problems when regulatory authorities found it had violated legal directives, which led to losing its registration. This change seriously hurt the company's reputation and whether it could legally operate, turning it from a regulated company into one without registration and questionable trustworthiness.

The company's business plan focused on giving people access to global financial markets through electronic trading platforms. FXBTG offered services like MetaTrader 4 and its own FXBTG App, supporting trading across multiple types of assets. The broker's asset list included traditional forex pairs, contracts for difference, market indices, precious metals, cryptocurrencies, and futures contracts, trying to be a complete trading solution provider.

Even though FXBTG first operated under ASIC regulation in New Zealand, its regulatory status got worse after authorities found violations. The company losing its registration was a critical turning point that completely changed its market position and removed the regulatory protections that licensed brokers usually have.

Regulatory Status: FXBTG was previously registered in New Zealand and operated under ASIC regulatory oversight. But because it violated legal directives, the company officially lost its registration, removing its regulatory legitimacy and investor protections.

Deposit and Withdrawal Methods: The available sources don't give specific information about deposit and withdrawal options, which is a major information gap for potential clients.

Minimum Deposit Requirements: Available documentation doesn't specify the minimum deposit requirements for opening accounts with FXBTG, making it hard for traders to know what barriers they face.

Bonus and Promotions: No information is available about promotional offers, welcome bonuses, or ongoing incentive programs that the broker may have offered.

Tradeable Assets: According to available information, FXBTG gave access to multiple asset classes including foreign exchange pairs, contracts for difference, market indices, precious metals, cryptocurrency instruments, and futures contracts, offering traders diversified market exposure.

Cost Structure: The source materials don't have specific details about spreads, commissions, overnight fees, and other trading costs, which is another critical information gap for traders who care about costs.

Leverage Ratios: Available documentation doesn't specify information about maximum leverage offerings and margin requirements, limiting traders' ability to assess risk management parameters.

Platform Options: FXBTG offered trading through MetaTrader 4, a widely recognized industry-standard platform, as well as their own FXBTG App for mobile and web-based trading access.

Geographic Restrictions: Given the lost registration status and regulatory violations, trading through FXBTG is especially not recommended in New Zealand and other places with strict regulatory oversight.

Customer Support Languages: The provided sources don't have specific information about the languages that FXBTG's customer service team supported.

This fxbtg review shows major information gaps that potential clients would normally expect to find when evaluating a broker, further emphasizing the problems with this company that lost its registration.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions that FXBTG offered represent one of the most problematic parts of this fxbtg review. Available information gives almost no details about account types, minimum deposit requirements, or specific features that would normally be essential for trader decision-making. This lack of transparency is especially concerning given that the broker lost its registration.

Without clear information about account tiers, minimum funding requirements, or special account features such as Islamic accounts for Sharia-compliant trading, potential clients cannot properly assess whether FXBTG's offerings match their trading needs and financial abilities. The absence of detailed account specifications suggests either poor communication practices or deliberate secrecy in the broker's operations.

Also, losing registration status means that any account protection measures that may have existed under regulatory oversight no longer apply. This removes crucial safeguards such as segregated client funds, compensation schemes, and regulatory dispute resolution mechanisms that legitimate brokers typically provide.

The combination of limited available information and compromised regulatory status creates an environment where account holders would face significant risks without adequate protection or clear understanding of their rights and obligations.

FXBTG's tools and resources represent one of the few areas where the broker showed some ability before it lost its registration. The platform offered MetaTrader 4, which is widely recognized as an industry-standard trading platform providing essential charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

The broker also developed its own FXBTG App, suggesting some investment in technology infrastructure to serve mobile and web-based trading needs. The variety of tradeable assets, including forex, CFDs, indices, precious metals, cryptocurrencies, and futures, showed an attempt to provide comprehensive market access for different trading strategies and preferences.

However, available information lacks details about research and analysis resources, educational materials, or advanced trading tools that modern traders typically expect. Without information about market analysis, trading signals, economic calendars, or educational content, it's difficult to assess the true value of the broker's resource offerings.

Losing registration status also raises questions about the continued availability and reliability of these tools and resources, as regulatory violations may have impacted the broker's ability to maintain proper technology infrastructure and support services.

Customer Service and Support Analysis (Score: 2/10)

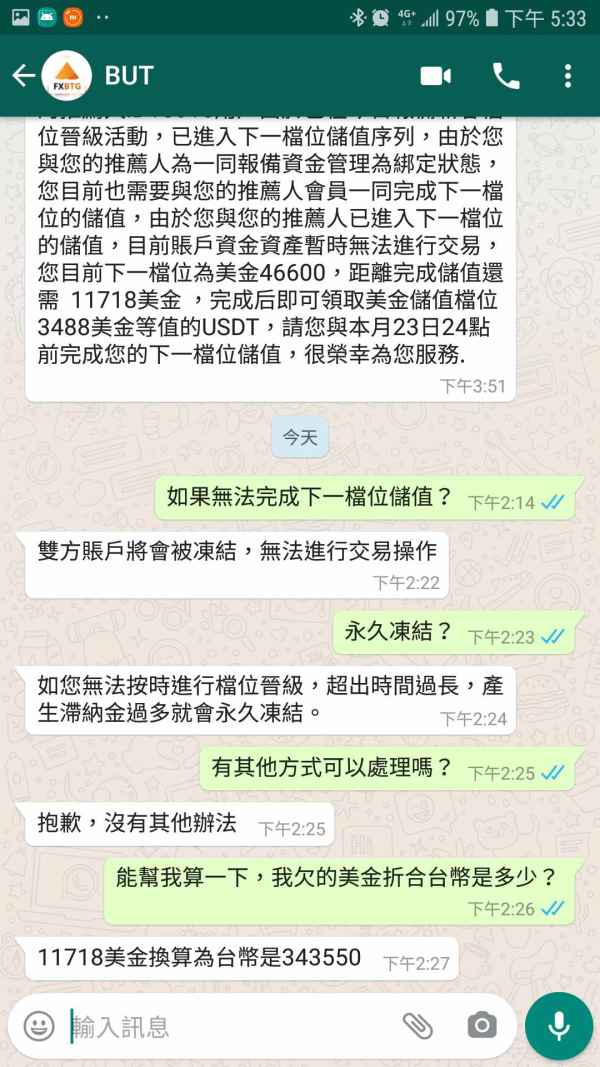

Customer service represents a critical weakness in this fxbtg review, with almost no information available about support channels, response times, or service quality. The absence of clear customer service details is especially problematic for a financial services provider where timely support can be crucial for resolving trading issues and account problems.

Without information about available communication channels such as phone support, live chat, email assistance, or help desk hours, potential clients cannot assess the accessibility of customer support when needed. This lack of transparency about support services raises serious concerns about the broker's commitment to client service and problem resolution.

Losing registration status makes these concerns even worse, as regulatory violations may have impacted the broker's ability to maintain adequate customer support infrastructure. Also, the absence of regulatory oversight means that clients have limited options if customer service issues arise or if the broker fails to respond to legitimate concerns.

The combination of limited available information and compromised regulatory status suggests that customers would likely face significant challenges in getting adequate support for their trading activities and account management needs.

Trading Experience Analysis (Score: 4/10)

The trading experience that FXBTG offered presents a mixed picture in this fxbtg review. On the positive side, the broker provided access to MetaTrader 4, which offers reliable trading functionality, comprehensive charting capabilities, and support for automated trading strategies. This platform choice shows some understanding of trader needs for professional-grade trading tools.

However, available information lacks crucial details about platform stability, execution speed, order processing quality, and overall trading environment characteristics. Without user reviews or performance data, it's impossible to assess whether the broker provided competitive spreads, fast execution, or reliable platform uptime that traders require for effective market participation.

The FXBTG App represents an attempt to provide mobile trading solutions, but without specific information about its functionality, user interface, or performance characteristics, its value proposition remains unclear. Also, the absence of information about trading conditions such as spread stability, liquidity provision, and slippage rates makes it difficult to evaluate the actual trading experience.

The broker losing its registration raises serious concerns about the continued reliability and integrity of trading services, as regulatory violations may indicate broader operational problems that could affect trade execution and platform performance.

Trust and Security Analysis (Score: 1/10)

Trust and security represent the most critical failure in this FXBTG evaluation. The broker losing its registration by New Zealand authorities following violations of legal directives fundamentally undermines any basis for client trust. This regulatory action indicates serious compliance failures that resulted in losing official authorization to operate as a financial services provider.

Losing registration removes crucial investor protections typically associated with regulated brokers, including segregated client funds, compensation schemes, and regulatory oversight of business practices. Without these safeguards, clients face significantly elevated risks of fund loss and have limited recourse in case of disputes or operational problems.

ASIC's confirmation of FXBTG's lost registration status provides official verification of the broker's compromised regulatory standing. This regulatory action represents a clear warning to potential clients about the risks associated with engaging with this entity for trading activities.

The absence of information about fund security measures, company transparency, and risk management practices further adds to the trust deficit. Without regulatory oversight and clear operational transparency, clients cannot adequately assess the safety of their funds or the reliability of the broker's business practices.

User Experience Analysis (Score: 3/10)

User experience assessment for FXBTG is severely limited by the lack of available user feedback and testimonials in the source materials. Without direct user reviews, satisfaction surveys, or detailed user journey documentation, it's impossible to provide a comprehensive evaluation of the actual client experience with this broker.

The absence of information about interface design, ease of use, registration processes, account verification procedures, and fund management experiences represents a significant gap in understanding how clients interact with FXBTG's services. This lack of user perspective data makes it difficult to assess whether the broker's platforms and services meet modern usability standards.

Given the broker's lost registration status and regulatory violations, any user experience would likely be negatively impacted by concerns about fund security, service reliability, and the absence of regulatory protections. The regulatory issues probably created negative user sentiment and trust concerns that would significantly hurt the overall user experience.

The combination of limited available user feedback and the broker's compromised regulatory status suggests that the user experience would be characterized by uncertainty, security concerns, and limited confidence in the service provider's reliability and legitimacy.

Conclusion

This comprehensive fxbtg review reveals a broker that poses significant risks to potential clients due to its lost registration status and regulatory violations. While FXBTG initially offered some positive features including MetaTrader 4 access and diverse asset classes, the company's violation of legal directives and subsequent loss of registration by New Zealand authorities fundamentally undermines its viability as a trading partner.

The broker is not suitable for any type of trader, regardless of experience level or trading objectives. The regulatory violations and lost registration create an environment where client funds and trading activities lack adequate protection and oversight. The significant information gaps regarding account conditions, customer service, and operational details further add to the risks associated with this broker.

The primary advantages of asset class diversity and platform availability are completely overshadowed by critical disadvantages including extremely low trustworthiness, absence of regulatory protection, limited customer service information, and unclear account conditions. These fundamental weaknesses make FXBTG an unsuitable choice for serious trading activities and highlight the importance of selecting properly regulated and transparent brokers for financial market participation.