FPG Fortune Prime Global 2025 Review: Everything You Need to Know

Executive Summary

FPG Fortune Prime Global has become a notable player in the forex trading industry since its founding in 2011. This fpg fortune prime global review reveals that the broker shows strong performance in regulatory compliance and customer service excellence, which sets it apart from many competitors in the crowded forex market. The company has earned significant recognition, including the prestigious 2023 "Global Forex Broker Of The Year" award from WikiFX and the 2024 "Best Trading Liquidity" award from BrokersView. These awards highlight its commitment to providing superior trading conditions.

The broker serves both novice traders seeking educational resources and experienced professionals requiring advanced trading tools. With Trustpilot ratings showing 84% of users awarding 5-star reviews, FPG Fortune Prime Global shows substantial customer satisfaction across its user base. The company operates under the supervision of the Vanuatu Financial Services Commission (VFSC) with license number 700507. This provides regulatory oversight for its operations.

FPG's focus on competitive spreads, comprehensive customer support, and educational resources makes it a viable option for traders across different experience levels. However, potential clients should carefully evaluate the broker's offerings against their specific trading requirements and risk tolerance before making any commitments.

Important Notice

FPG Fortune Prime Global operates under different regulatory frameworks across various jurisdictions. Traders should be aware that regulatory protections may vary depending on their location, which can affect their rights and protections as clients. The company's primary regulation comes from the Vanuatu Financial Services Commission (VFSC), which may offer different investor protections compared to tier-one regulators.

This evaluation is based on publicly available information, user feedback from platforms like Trustpilot, and industry reports as of 2025. Traders should conduct their own research and consider seeking independent financial advice before making trading decisions, as market conditions and broker terms can change rapidly. Regulatory requirements and broker offerings may change over time, and prospective clients should verify current terms and conditions directly with the broker.

Rating Framework

Broker Overview

FPG Fortune Prime Global was established in 2011 and has built a reputation over more than a decade in the financial trading sector. According to available information, the company has positioned itself as a provider of competitive trading environments with a particular focus on forex markets, which represents the largest financial market in the world. The broker's longevity in the industry, spanning over 13 years, shows its ability to adapt to changing market conditions and maintain operations through various market cycles.

The company has received notable industry recognition, including the 2023 "Global Forex Broker Of The Year" award from WikiFX and the 2024 "Best Trading Liquidity" award from BrokersView. These awards suggest that FPG has distinguished itself among industry peers through its service quality and trading conditions, which is no small feat in the competitive forex industry.

FPG Fortune Prime Global operates primarily as a forex broker, offering trading services with emphasis on competitive spreads and customer service excellence. The broker operates under the regulatory supervision of the Vanuatu Financial Services Commission (VFSC) with license number 700507, which provides a framework for oversight and compliance. While Vanuatu regulation provides oversight, traders should understand that this jurisdiction may offer different investor protections compared to major financial centers. The company's business model focuses on providing accessible trading conditions for both beginners and experienced traders, supported by educational resources and multilingual customer support services.

Regulatory Status: FPG Fortune Prime Global operates under the authorization of the Vanuatu Financial Services Commission (VFSC) with license number 700507. This regulatory framework provides oversight for the broker's operations, though traders should understand the specific protections offered under this jurisdiction, which may differ from other regulatory environments.

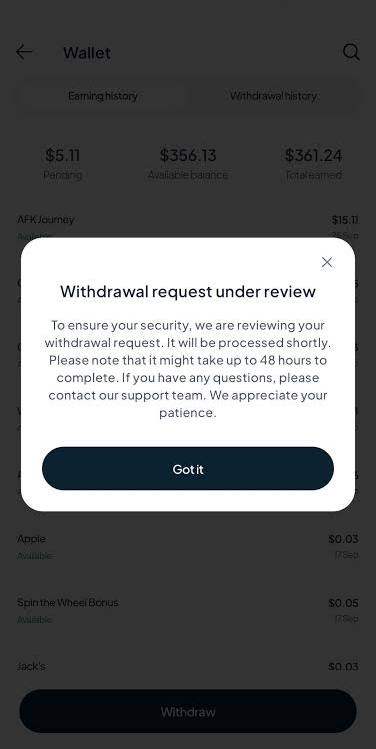

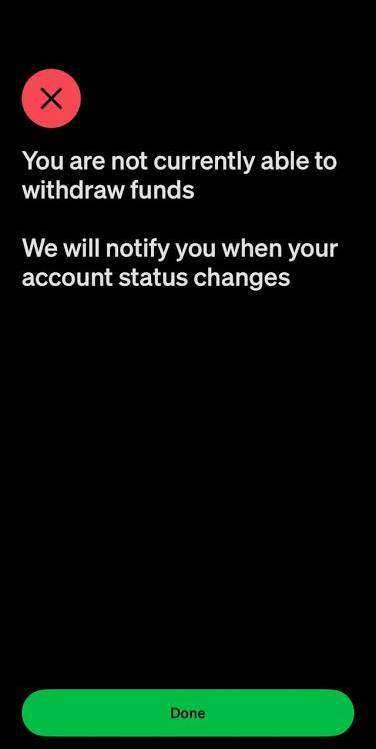

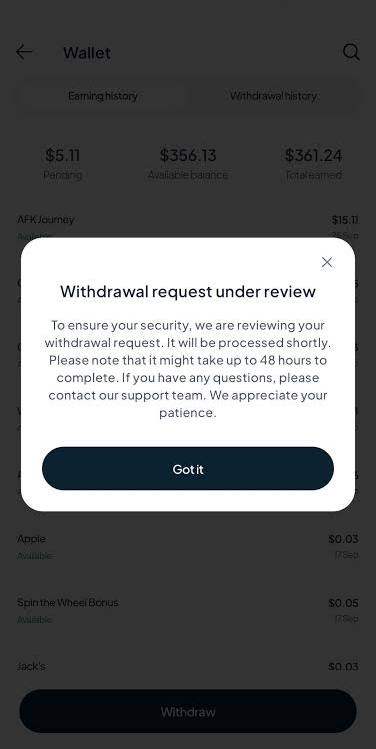

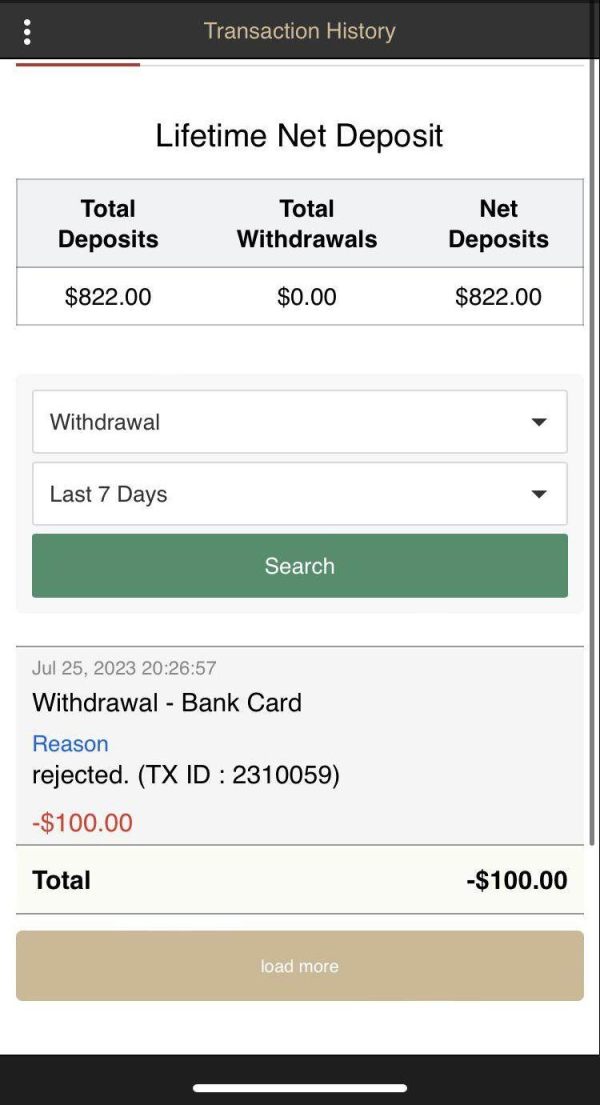

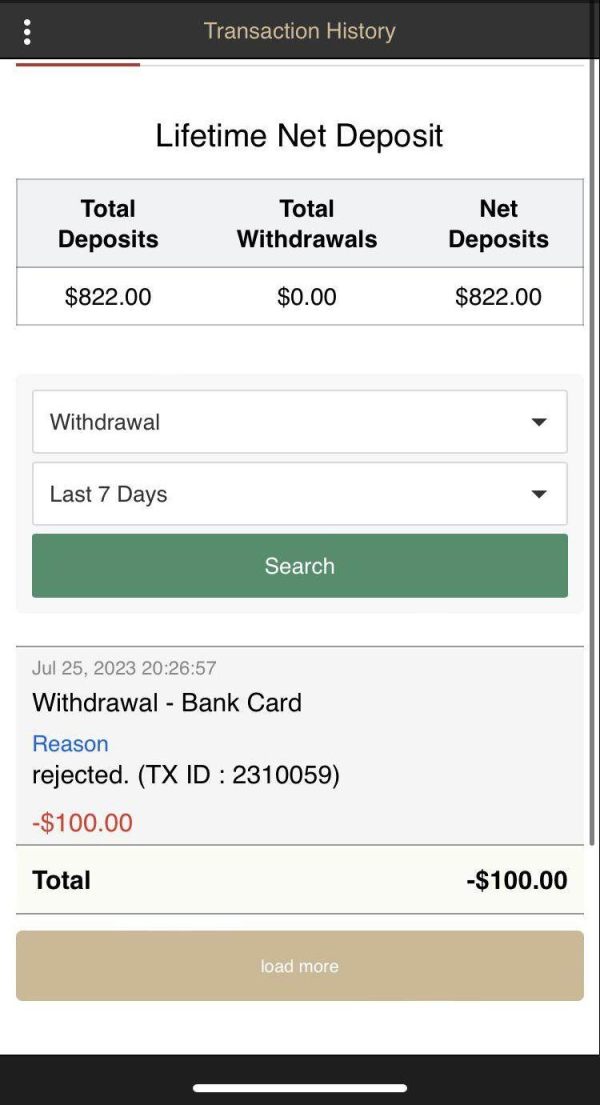

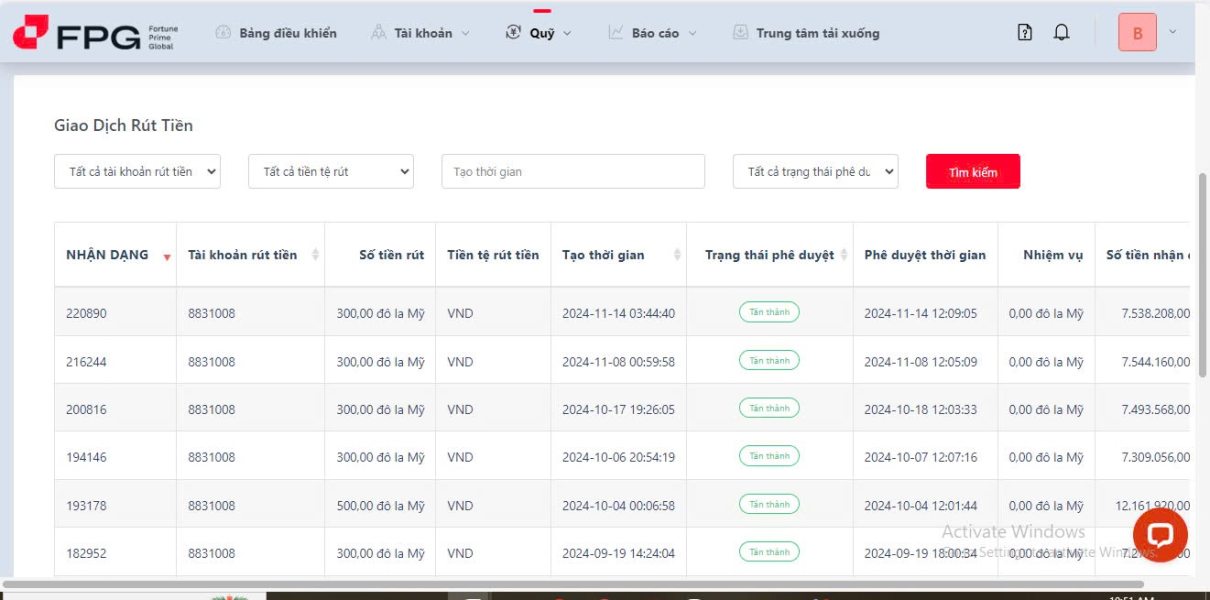

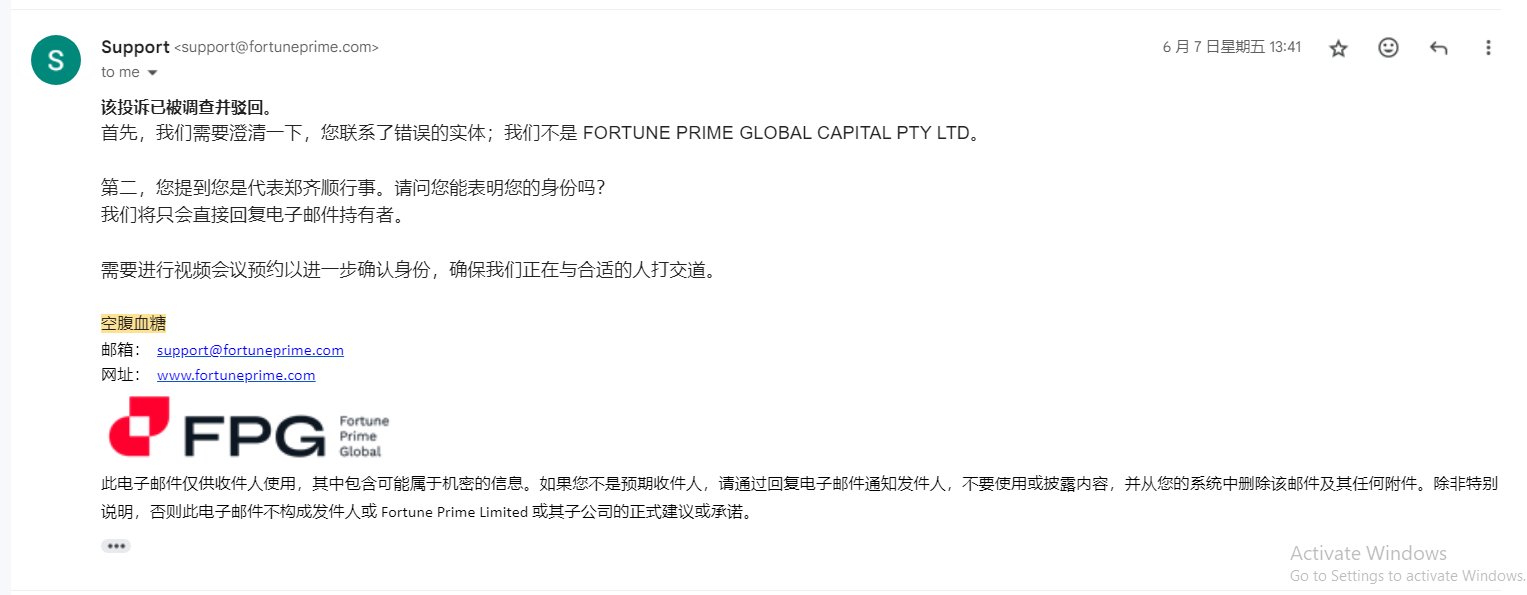

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials. Prospective clients should contact the broker directly to understand available funding options, processing times, and any associated fees that may apply to their transactions.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This information gap affects transparency for potential clients evaluating account accessibility and may require direct inquiry with the broker.

Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in the available information. Traders interested in promotional benefits should inquire directly with FPG Fortune Prime Global to understand current offers and their terms and conditions.

Tradeable Assets: The broker primarily focuses on forex trading services, though the complete range of available instruments is not comprehensively detailed in public materials. This represents an area where additional transparency would benefit potential clients.

Cost Structure: FPG Fortune Prime Global advertises competitive spreads as a key feature of their trading environment. However, specific spread ranges, commission structures, and other trading costs are not detailed in available information, which may impact traders' ability to fully evaluate the cost-effectiveness of the platform compared to competitors.

Leverage Options: Information regarding maximum leverage ratios and leverage options across different account types is not specified in available materials. This represents an important gap for traders who rely on leverage as part of their trading strategy.

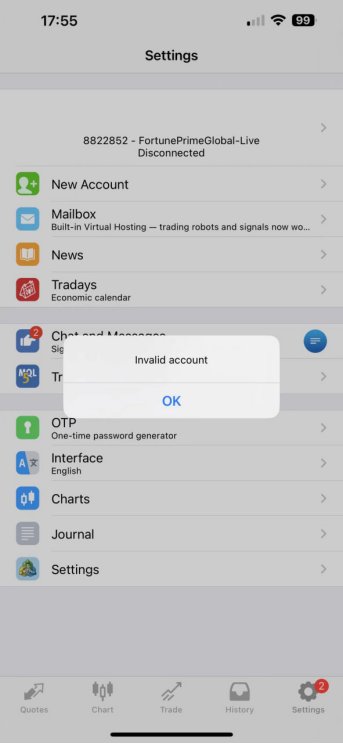

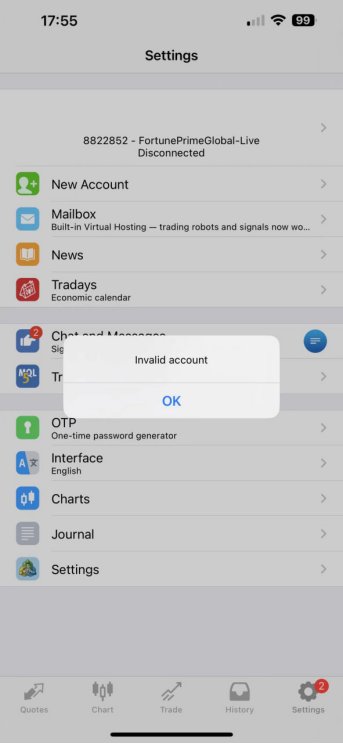

Trading Platforms: The specific trading platforms offered by FPG Fortune Prime Global are not detailed in current documentation. This represents an information gap for this fpg fortune prime global review and may require direct contact with the broker for clarification.

Geographic Restrictions: Regional limitations and restricted territories are not specified in available information. Potential clients should verify their eligibility based on their location before attempting to open an account.

Customer Support Languages: The broker provides multilingual customer support, though the complete list of supported languages is not detailed in available materials. This suggests an effort to serve international clients but lacks specific details about language availability.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions evaluation for FPG Fortune Prime Global reveals several areas where information transparency could be improved. Available materials do not specify the range of account types offered, making it difficult for potential clients to understand which options best suit their trading needs and capital requirements, which is a significant limitation for informed decision-making. This lack of detailed account information affects the overall assessment of accessibility and user-friendliness.

Minimum deposit requirements are not disclosed in public documentation. This represents a significant transparency gap for traders evaluating account accessibility, as most brokers clearly communicate their minimum deposit thresholds to help traders understand entry requirements. The absence of this information may create uncertainty for prospective clients and could indicate a need for improved communication.

The account opening process details are not comprehensively outlined in available materials. While the broker operates under VFSC regulation, which typically requires standard KYC procedures, specific documentation requirements, verification timeframes, and account activation processes are not detailed in public information. Additionally, information about specialized account features such as Islamic accounts, professional trader accounts, or other customized offerings is not available in current documentation, which limits options for traders with specific requirements.

User feedback regarding account conditions varies, with some clients expressing satisfaction while others have provided critical reviews. This is evidenced by the 11% of users providing 1-star ratings on Trustpilot, which suggests that while most clients are satisfied, some have experienced significant issues. This fpg fortune prime global review notes that improved transparency in account condition details would benefit potential clients in making informed decisions.

FPG Fortune Prime Global's approach to trading tools and educational resources shows promise, though specific details about the quality and comprehensiveness of these offerings are limited in available documentation. The broker advertises providing multiple trading tools, which suggests an effort to support traders with analytical and decision-making resources, though the specific nature and quality of these tools are not detailed in current materials. This represents an area where additional transparency would benefit potential clients.

Educational resources are mentioned as part of the broker's offerings. This indicates a commitment to trader development and knowledge enhancement, which is particularly important for novice traders entering the complex forex market. However, the scope, quality, and format of these educational materials are not comprehensively described in available information, making it difficult to assess their value. For traders seeking substantial educational support, particularly beginners, more detailed information about curriculum, delivery methods, and content quality would be beneficial.

Research and analysis resources provided by the broker are not specifically detailed in current documentation. Many traders rely on broker-provided market analysis, economic calendars, and research reports to inform their trading decisions, making this information gap significant for evaluation purposes. The absence of detailed information about these resources represents a gap in this evaluation that may require direct inquiry with the broker.

Automated trading support capabilities, including Expert Advisor compatibility and algorithmic trading features, are not specified in available materials. For traders interested in automated strategies, this information gap may require direct communication with the broker to understand available options and limitations, which could be inconvenient for potential clients.

Customer Service and Support Analysis (Score: 8/10)

Customer service emerges as one of FPG Fortune Prime Global's stronger performance areas, with user feedback consistently highlighting positive experiences with support interactions. The broker provides multilingual support, which demonstrates commitment to serving an international client base and ensuring effective communication across language barriers, though the specific languages supported are not detailed. This inclusive approach can be particularly valuable for traders whose first language is not English.

Trustpilot reviews indicate that users generally experience responsive and helpful customer service. Many clients specifically praise the quality of support interactions, which suggests that FPG has invested in training support staff and establishing effective communication protocols with clients. This positive feedback pattern is encouraging for potential clients who value responsive support.

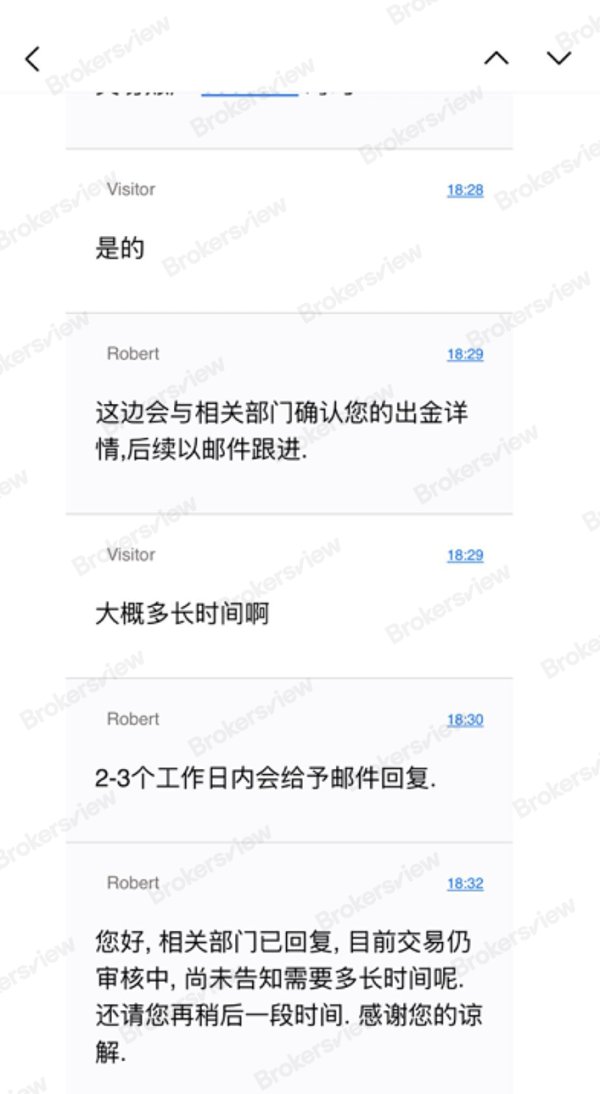

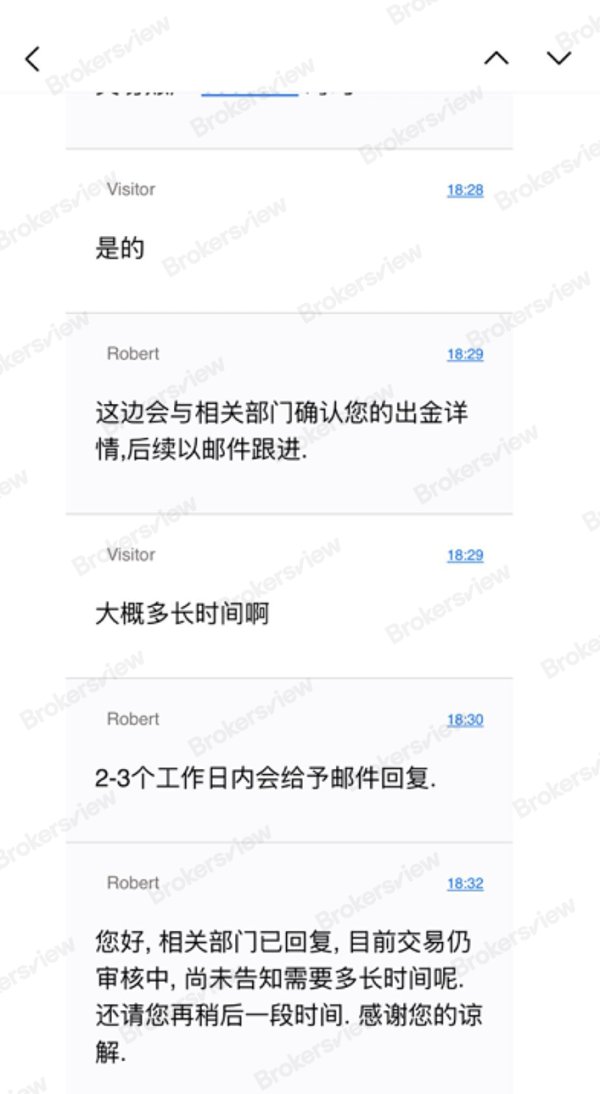

Response times appear to meet user expectations based on available feedback. However, specific service level agreements or guaranteed response timeframes are not detailed in public documentation, which would provide clearer expectations for potential clients. The availability of multiple contact channels is mentioned, though the specific options (live chat, email, phone) and their operating hours are not comprehensively outlined.

User testimonials reflect satisfaction with problem resolution capabilities. This suggests that the support team is equipped to handle various client inquiries and issues effectively, which is crucial for maintaining client satisfaction in the forex industry. However, the 11% of users providing negative ratings on Trustpilot indicates that some clients have experienced service issues, and understanding the nature of these concerns would provide a more complete picture of service consistency.

Trading Experience Analysis (Score: 7/10)

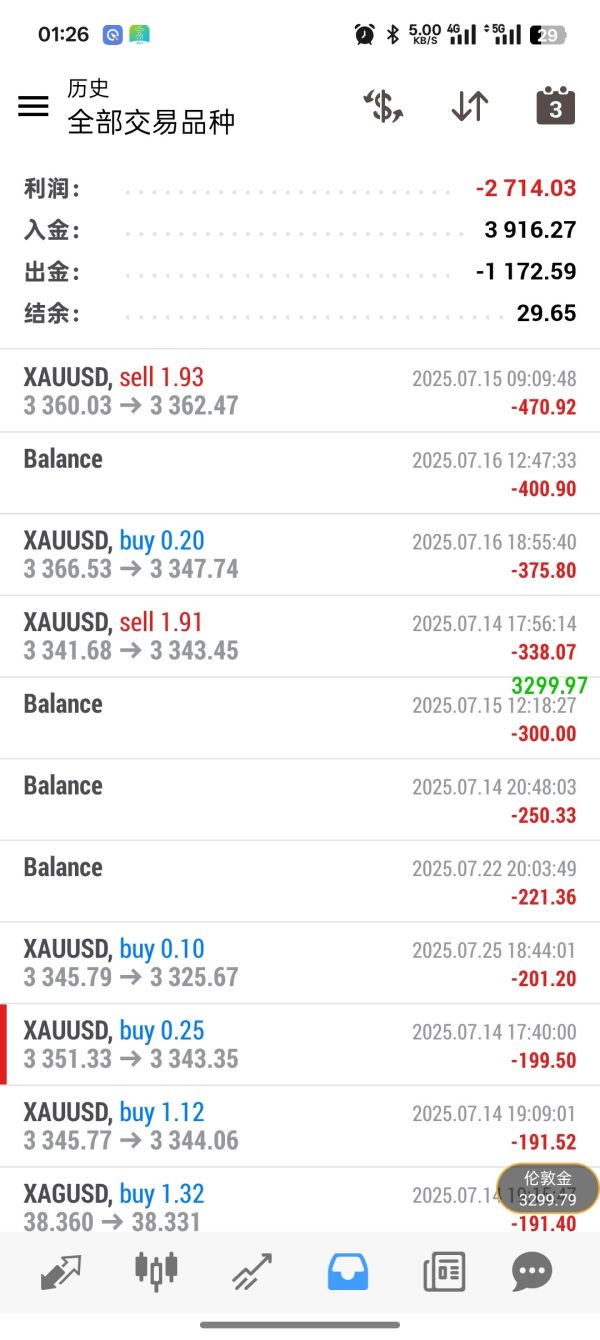

The trading experience evaluation for FPG Fortune Prime Global is somewhat limited by the lack of detailed technical specifications in available documentation. The broker emphasizes competitive spreads as a key feature, which is crucial for trading cost management and can significantly impact profitability, though specific spread ranges across different currency pairs and market conditions are not provided in current materials. This information would be valuable for traders comparing brokers based on trading costs.

Platform stability and execution speed information is not detailed in available documentation. These are critical factors for traders, particularly those employing scalping strategies or trading during high-volatility periods when market conditions can change rapidly. Without specific performance metrics or user testimonials about platform reliability, it's challenging to fully assess the technical trading environment that clients can expect.

Order execution quality, including information about slippage rates, rejection frequencies, and execution speeds, is not comprehensively addressed in available materials. These factors significantly impact trading profitability and user experience, particularly for active traders and those using automated strategies that require consistent execution quality. The absence of this information represents a significant gap in evaluating the overall trading experience.

Mobile trading capabilities and platform functionality are not specifically detailed. This represents an information gap in today's increasingly mobile-focused trading environment, where many traders require robust mobile platforms for managing positions and monitoring markets while away from desktop computers. Modern traders often expect seamless integration between desktop and mobile platforms.

The overall trading environment appears to focus on forex markets with competitive pricing. However, the lack of detailed platform specifications and performance data limits the ability to provide a comprehensive assessment in this fpg fortune prime global review, suggesting that potential clients may need to contact the broker directly for technical details.

Trust and Safety Analysis (Score: 8/10)

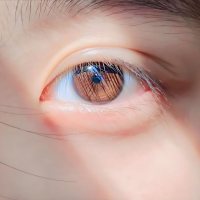

FPG Fortune Prime Global demonstrates solid credentials in terms of regulatory oversight and industry recognition. The broker operates under Vanuatu Financial Services Commission (VFSC) supervision with license number 700507, providing regulatory framework and oversight for its operations, which offers some protection for client interests. While VFSC regulation offers supervision, traders should understand that this jurisdiction may provide different investor protections compared to tier-one regulatory environments such as those found in the UK, EU, or Australia.

Industry recognition through awards including the 2023 "Global Forex Broker Of The Year" from WikiFX and 2024 "Best Trading Liquidity" from BrokersView indicates peer and industry acknowledgment of the broker's service quality and operational standards. These awards suggest that FPG has distinguished itself among industry competitors through various performance metrics, which is encouraging for potential clients evaluating the broker's credibility.

The company's operational history spanning over 13 years since 2011 demonstrates longevity and stability in the competitive forex industry. This track record suggests the ability to maintain operations through various market conditions and regulatory environments, including the significant market volatility experienced during events like the 2020 pandemic and various economic crises.

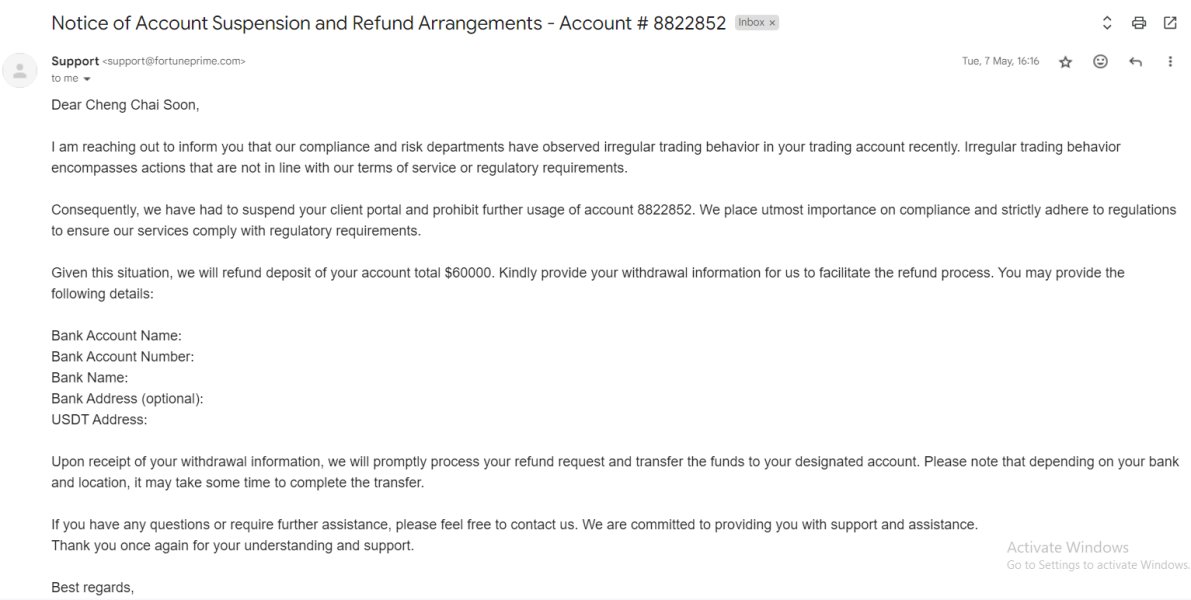

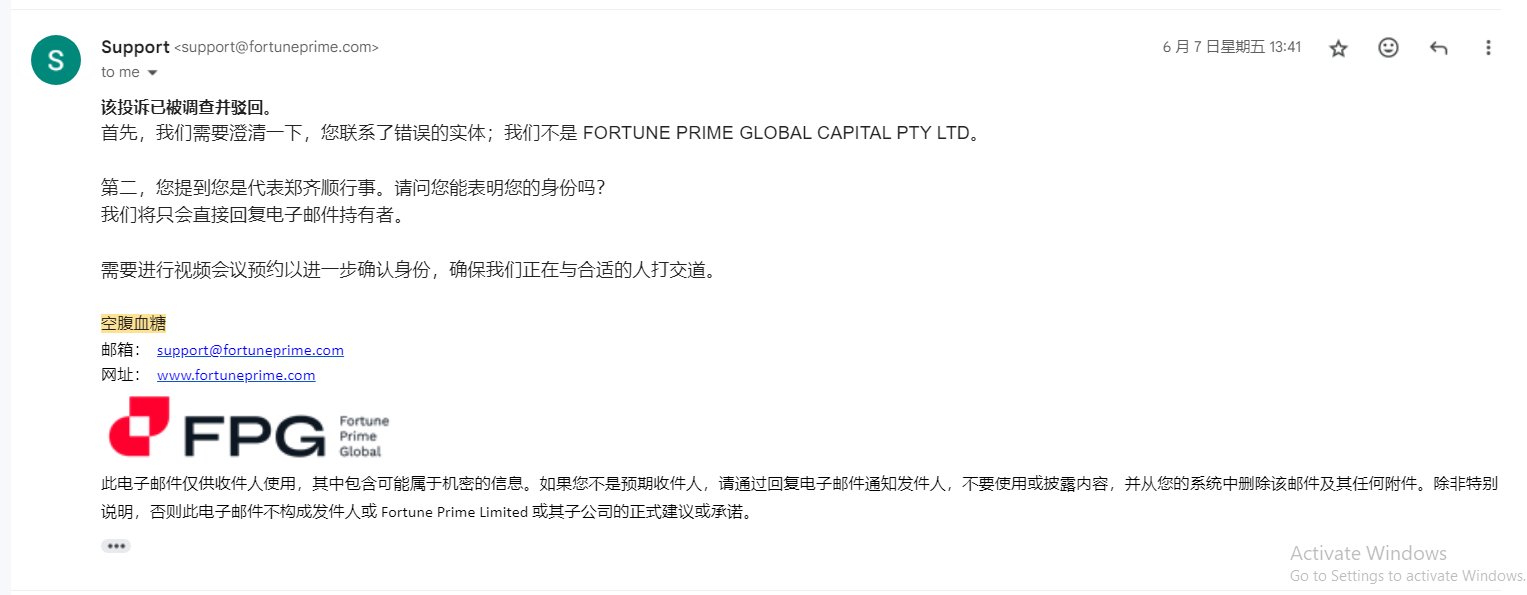

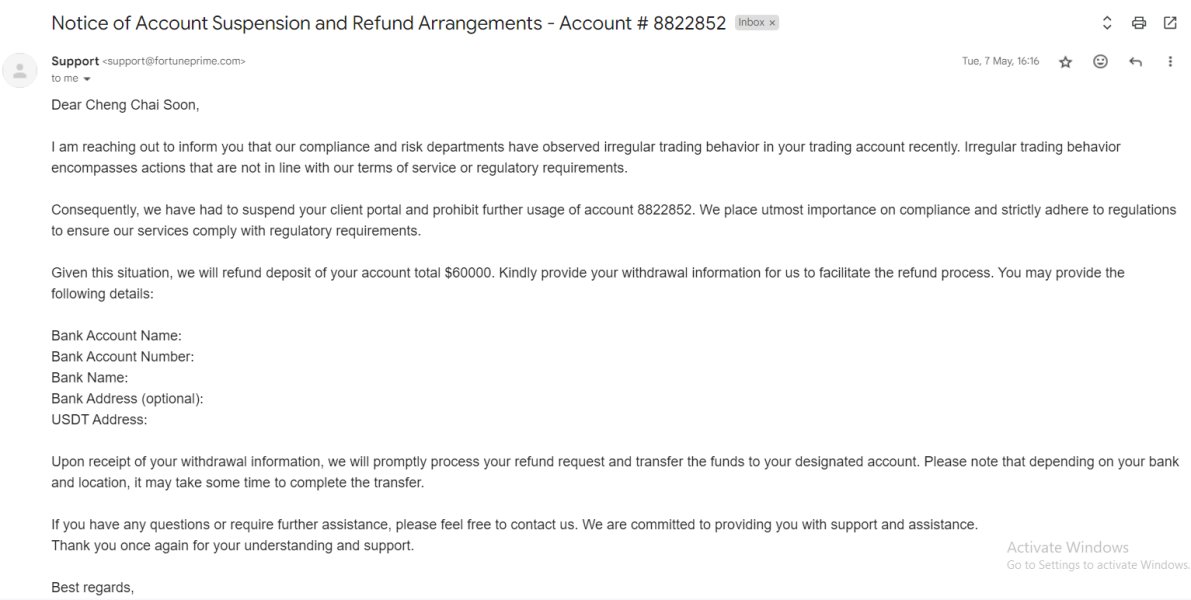

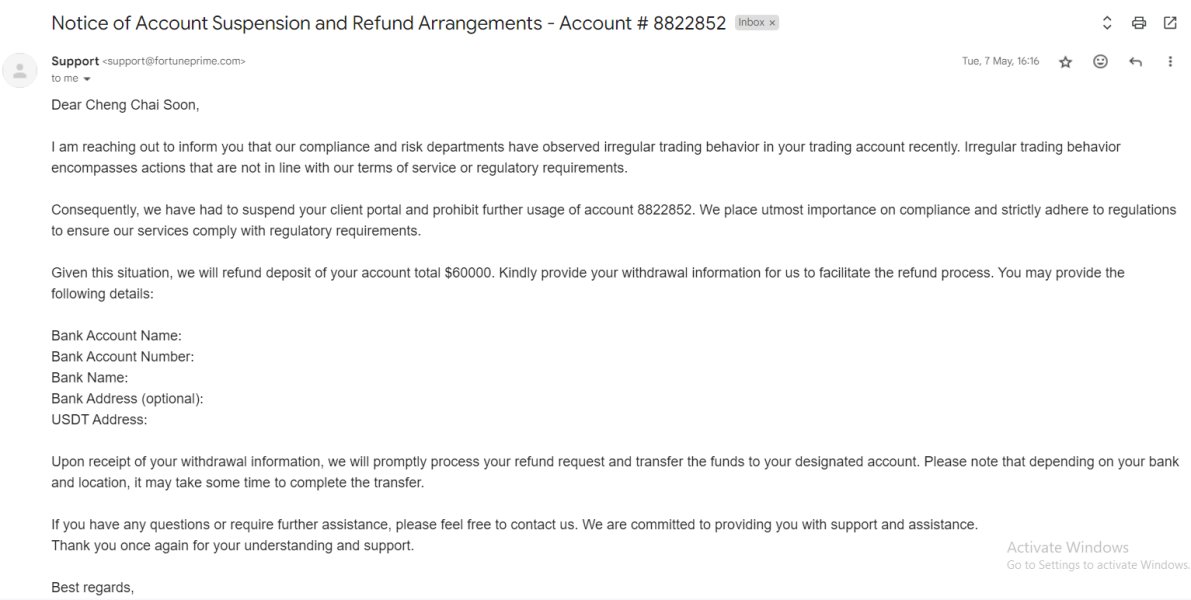

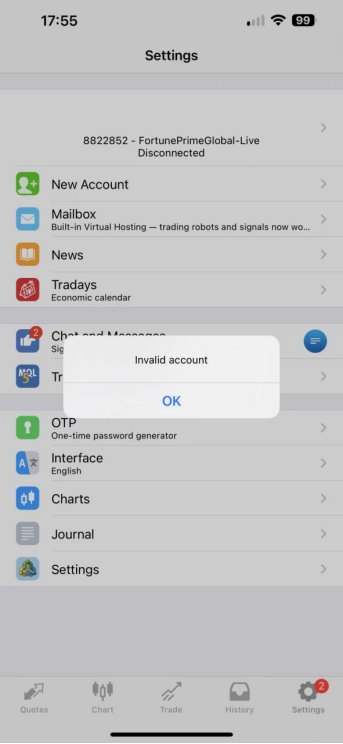

However, the 11% of users providing 1-star ratings on Trustpilot indicates that some clients have experienced significant issues with the broker's services. Understanding the nature of these negative experiences would provide valuable insight into potential risk areas that prospective clients should consider. Additionally, specific information about client fund protection measures, segregation policies, and compensation schemes is not detailed in available documentation, which represents an important transparency gap.

User Experience Analysis (Score: 7/10)

User experience evaluation reveals a generally positive but mixed picture for FPG Fortune Prime Global. The high percentage of 5-star ratings (84%) on Trustpilot indicates that the majority of users have satisfactory experiences with the broker's services, suggesting effective service delivery and client satisfaction in most cases, which is encouraging for potential clients. This high satisfaction rate suggests that the broker is meeting most clients' expectations effectively.

The broker's positioning as suitable for both beginners and experienced traders suggests an effort to design services that accommodate different skill levels and trading approaches. This inclusive approach can be beneficial for traders at various stages of their development, from those just starting their forex journey to seasoned professionals with specific requirements. However, specific features supporting each user group are not detailed in available materials, which would help potential clients understand how their needs would be addressed.

Interface design and platform usability information is not comprehensively available in current documentation. This limits the ability to assess the user-friendliness of trading platforms and account management systems, which are crucial factors in the overall user experience. Modern traders expect intuitive interfaces and efficient navigation, particularly when managing multiple positions or analyzing complex market data under time pressure.

Registration and account verification processes are not detailed in available materials. These processes significantly impact the initial user experience, as streamlined onboarding can enhance user satisfaction while complex or lengthy procedures may create friction for new clients. Clear information about these processes would help set appropriate expectations for potential clients.

The 11% negative rating pattern on Trustpilot warrants attention. While most users are satisfied, a notable minority have experienced significant issues, which suggests areas for potential improvement. Common complaint patterns could provide insights into areas requiring improvement and help potential clients understand possible risk factors they should consider before opening an account.

Conclusion

This fpg fortune prime global review reveals a broker with notable strengths in customer service and regulatory compliance, balanced against areas where increased transparency would benefit potential clients. FPG Fortune Prime Global's 13-year operational history and industry awards demonstrate established credibility, while the strong customer satisfaction ratings indicate effective service delivery for the majority of users, which provides confidence for potential clients considering the broker.

The broker appears well-suited for both novice traders seeking supportive customer service and experienced traders requiring competitive trading conditions. The multilingual support and educational resources suggest a commitment to serving diverse client needs across different experience levels, though more detailed information about these offerings would strengthen the value proposition.

Key strengths include excellent customer service ratings, regulatory oversight, and industry recognition through multiple awards. However, areas for improvement include greater transparency in account conditions, detailed platform specifications, and comprehensive cost structures that would help clients make more informed decisions. The mixed user feedback, while predominantly positive, suggests that potential clients should carefully evaluate their specific requirements against the broker's offerings and consider direct communication with FPG to address any information gaps relevant to their trading needs.