Regarding the legitimacy of Fortune Prime Global forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is Fortune Prime Global safe?

Pros

Cons

Is Fortune Prime Global markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FORTUNE PRIME GLOBAL CAPITAL PTY LTD

Effective Date: Change Record

2011-05-13Email Address of Licensed Institution:

linda.lin@fortuneprime.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

U 5 20 PROSPECT ST BOX HILL VIC 3128Phone Number of Licensed Institution:

0399175819Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Fortune Prime Limited

Effective Date:

2022-12-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FPG Fortune Prime Global A Scam?

Introduction

FPG Fortune Prime Global (FPG) is a forex and CFD broker that has emerged in the competitive online trading landscape, claiming to offer a range of trading services across various asset classes. Established in 2019, FPG markets itself as a reliable platform for both retail and institutional traders, boasting features such as tight spreads, high leverage, and multiple trading instruments. However, with the proliferation of online trading platforms, traders must exercise caution in evaluating the legitimacy and trustworthiness of brokers.

This article aims to provide a comprehensive analysis of FPG Fortune Prime Global, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. By utilizing a mix of narrative and structured information, we will assess whether FPG is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. FPG Fortune Prime Global claims to be regulated by two entities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). While ASIC is considered a tier-1 regulator with stringent compliance standards, the VFSC is often viewed as a tier-3 regulator, which may not provide the same level of protection for investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 400364 | Australia | Verified |

| VFSC | 700507 | Vanuatu | Verified |

The presence of ASIC regulation offers some assurance to traders, as it requires brokers to maintain client funds in segregated accounts and adhere to strict financial standards. However, the VFSC's oversight is less rigorous, which raises concerns about the security of funds and the broker's accountability. Historically, brokers with a tier-3 regulatory status have been associated with higher risks, including potential issues related to fund security and operational transparency.

Company Background Investigation

FPG Fortune Prime Global was established in 2019 and is registered in both Australia and Vanuatu. The company claims to have a team with over 30 years of industry experience, which is positioned as a strength in building trust with clients. However, details regarding the ownership structure and management team are somewhat opaque.

The lack of transparency regarding the companys ownership and the experience of its management team can be a red flag for potential investors. A well-established broker typically provides clear information about its leadership and operational history, which helps in building trust with clients. Additionally, the company's limited operational history—just a few years—may not provide sufficient evidence of its reliability in the long term.

Trading Conditions Analysis

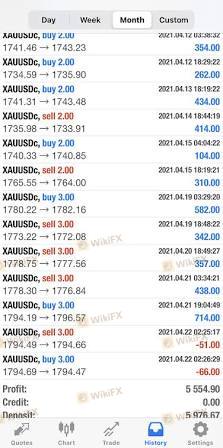

FPG offers a variety of trading conditions that are appealing to many traders, including high leverage of up to 1:500 and a low minimum deposit requirement. However, it is essential to analyze the overall fee structure and any hidden costs.

| Fee Type | FPG Fortune Prime Global | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.1 - 1.1 pips | 0.5 - 1.5 pips |

| Commission Model | $3.5 per lot (ECN) | $5 - $7 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads and commission rates appear competitive, traders should be cautious of any unusual fee policies. For instance, the commission fee on the ECN account is relatively low compared to industry standards, but this may indicate a more complex fee structure that could lead to higher costs in other areas, such as withdrawal fees or inactivity fees. Transparency in fee disclosure is crucial for traders to make informed decisions.

Customer Funds Security

The security of customer funds is paramount when evaluating a broker. FPG claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures largely depends on the regulatory framework under which the broker operates.

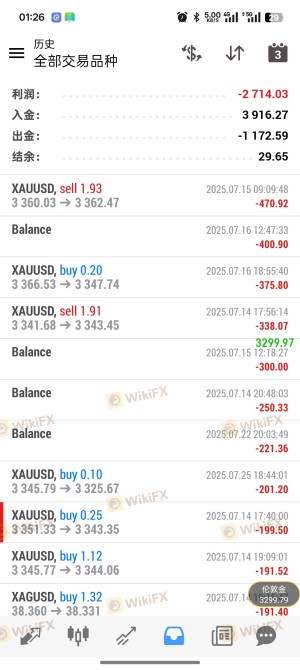

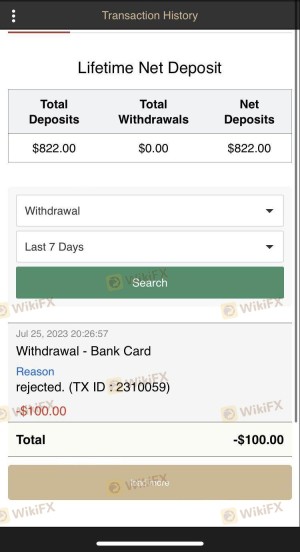

FPG does not appear to participate in any investor compensation schemes, which are vital for providing additional protection to clients in the event of broker insolvency. Moreover, there have been reports of clients experiencing difficulties when attempting to withdraw funds, raising concerns about the broker's commitment to safeguarding client assets. Historical disputes related to fund withdrawals can significantly impact a broker's reputation and should be taken seriously by potential investors.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of FPG Fortune Prime Global reveal a mixed bag of experiences. While some traders report satisfactory experiences with the trading platform and customer service, others highlight significant issues, particularly regarding fund withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited hours |

| Account Closure Complaints | High | No clear resolution |

Several traders have reported being unable to withdraw their funds after achieving profits, with some alleging that their accounts were closed without explanation. Such complaints are serious and indicate potential operational issues within the brokerage. A few documented cases show clients facing prolonged delays in accessing their funds, which can be a significant deterrent for new customers.

Platform and Trade Execution

The trading platform is a critical aspect of the trading experience. FPG utilizes the popular MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, the performance of the platform, including order execution speed and slippage, is equally important.

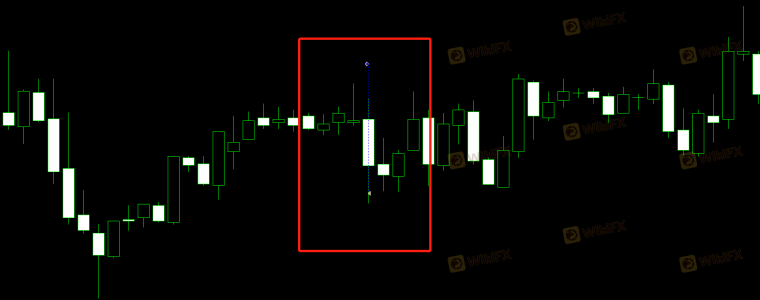

Traders have reported varying experiences with order execution, with some indicating that slippage occurs during volatile market conditions. While slippage is common in trading, excessive slippage can be detrimental to trading strategies, particularly for scalpers and day traders. Signs of potential platform manipulation, such as frequent re-quotes or unexpected order cancellations, should be closely monitored.

Risk Assessment

Using FPG Fortune Prime Global does come with inherent risks. The combination of its offshore regulation, mixed customer feedback, and reports of withdrawal issues raises concerns about the security and reliability of the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack adequate oversight. |

| Operational Risk | Medium | Reports of withdrawal issues and account closures. |

| Market Risk | Medium | High leverage increases the potential for significant losses. |

To mitigate these risks, potential investors should conduct thorough research, consider starting with a small investment, and ensure they understand the broker's fee structure and policies before committing significant funds.

Conclusion and Recommendations

In conclusion, while FPG Fortune Prime Global presents itself as a legitimate broker with appealing trading conditions, there are several concerns that potential traders should consider. The mixed regulatory framework, lack of transparency regarding company ownership, and reports of withdrawal issues suggest that traders should proceed with caution.

For those considering trading with FPG, it is advisable to start with a small investment and closely monitor account activity. Additionally, traders may want to explore alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Brokers such as IG Markets, OANDA, or Forex.com may provide more reliable trading environments with better customer support and fund security measures.

Ultimately, thorough due diligence is essential to ensure that your trading experience is both secure and profitable.

Is Fortune Prime Global a scam, or is it legit?

The latest exposure and evaluation content of Fortune Prime Global brokers.

Fortune Prime Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fortune Prime Global latest industry rating score is 7.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.