ETO Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eto markets review looks at a forex broker that has worked in financial markets since 2013. ETO Markets shows itself as a regulated broker offering different trading conditions and tools, though our study shows a mixed picture with limited specific user feedback available in public forums.

The broker works under dual regulation from the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (SFSA), which gives a foundation of regulatory oversight. Key highlights include competitive spreads starting from 0.0 pips, leverage up to 1:500, and a relatively accessible minimum deposit requirement of $100 USD. The platform supports multiple asset classes including forex, commodities, energy, and stock indices through the popular MetaTrader 4 and MetaTrader 5 platforms.

ETO Markets appears positioned mainly for beginners seeking low-barrier entry into forex markets and traders looking for high leverage options. However, the lack of detailed customer feedback and limited transparency in certain operational aspects warrant careful consideration. The broker offers both STP (Straight Through Processing) and ECN (Electronic Communication Network) business models, catering to different trading preferences and strategies.

Important Disclaimers

Regional Variations: ETO Markets works under different regulatory frameworks across jurisdictions. The Australian entity is regulated by ASIC, while operations in other regions fall under SFSA oversight from Seychelles. These regulatory differences may impact user experience, available leverage, and investor protection measures depending on your location and the specific entity you trade with.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and data analysis from multiple sources. We have not conducted primary user research or surveys for this assessment. Potential clients should conduct their own due diligence and consider consulting with financial advisors before making trading decisions.

Rating Framework

Broker Overview

ETO Markets was established in 2013 and is headquartered in Sydney, Australia, with additional operations in Mahé, Seychelles. The broker works under a dual business model offering both STP (Straight Through Processing) and ECN (Electronic Communication Network) execution types. This structure allows the company to cater to different trading styles and preferences, from retail traders seeking market maker-style execution to more experienced traders requiring direct market access.

According to available information, ETO Markets has positioned itself as a multi-asset broker serving clients across more than 100 countries. The company's regulatory framework includes oversight from ASIC in Australia and SFSA in Seychelles, providing different levels of protection and operational standards depending on the client's jurisdiction and the specific entity they trade with.

The broker's platform infrastructure centers around the widely-adopted MetaTrader ecosystem, offering both MT4 and MT5 platforms. This eto markets review finds that the broker supports trading across multiple asset categories including major and minor forex pairs, commodities such as gold and silver, energy products, and various stock indices. The company also provides automated trading capabilities and supports custom indicators, appealing to both manual and algorithmic traders.

Regulatory Oversight: ETO Markets works under dual regulation, with the Australian entity supervised by ASIC and international operations regulated by SFSA in Seychelles. This regulatory structure provides varying levels of investor protection depending on jurisdiction.

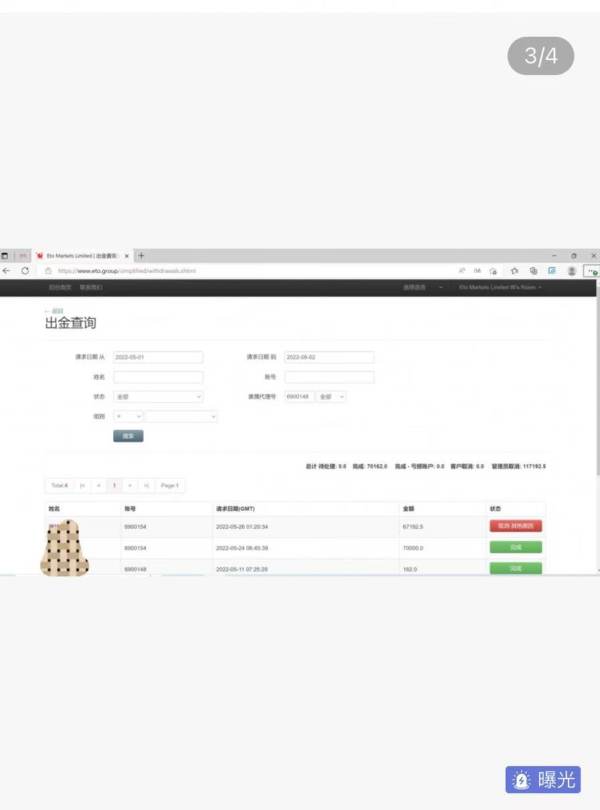

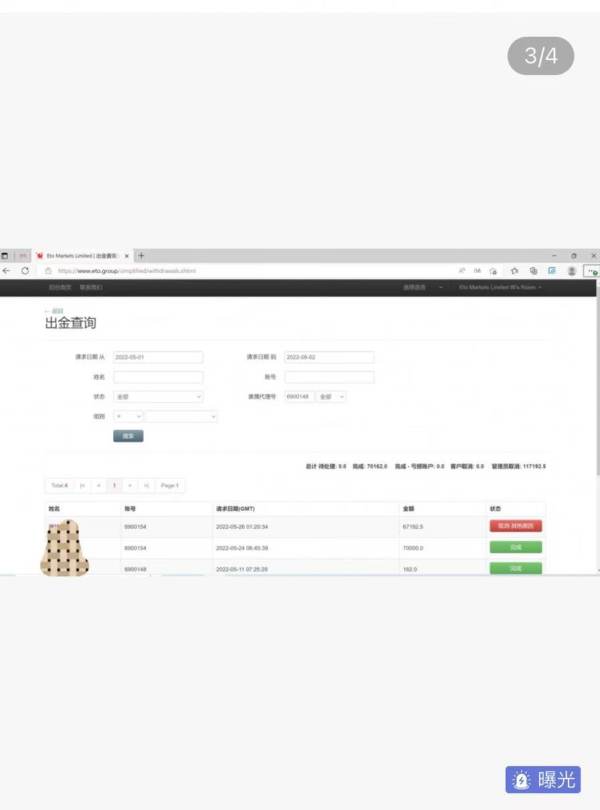

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods are not detailed in available public information, though standard industry options are likely supported.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100 USD, making it accessible to traders with limited starting capital.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specifically mentioned in available documentation.

Tradeable Assets: ETO Markets offers access to forex currency pairs, commodities including precious metals, energy products, and stock indices, providing diversification opportunities across multiple markets.

Cost Structure: Spreads begin from 0.0 pips, though specific commission structures and additional fees are not clearly detailed in public information.

Leverage Options: Maximum leverage reaches 1:500, though actual available leverage may vary based on account type, asset class, and regulatory jurisdiction.

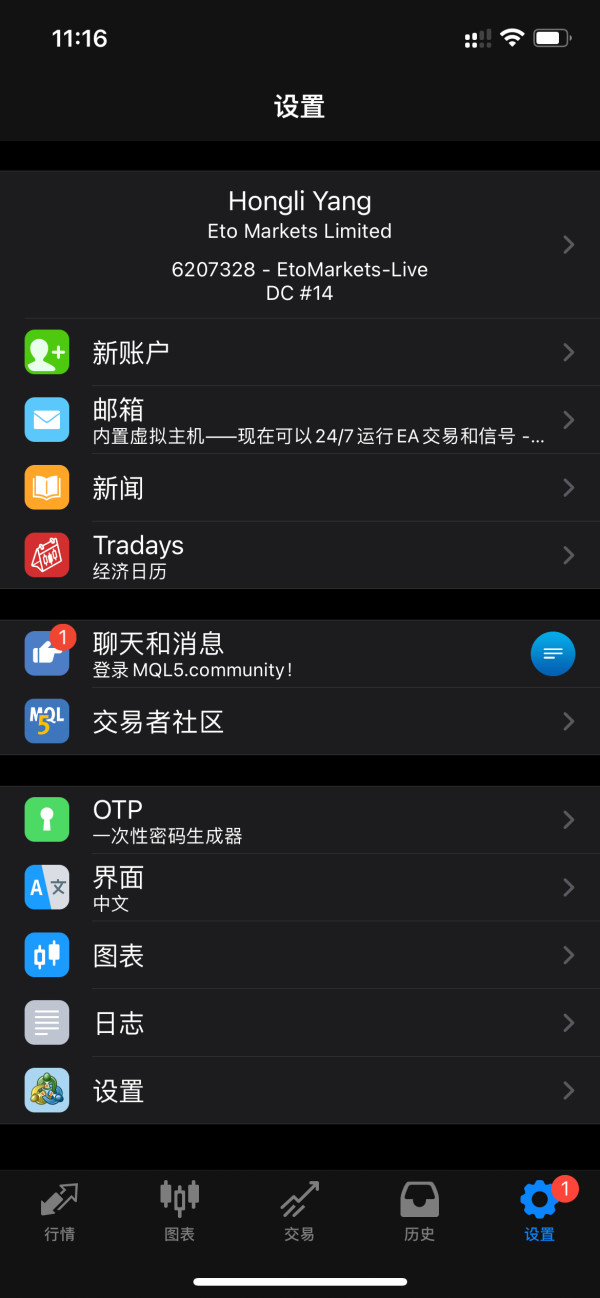

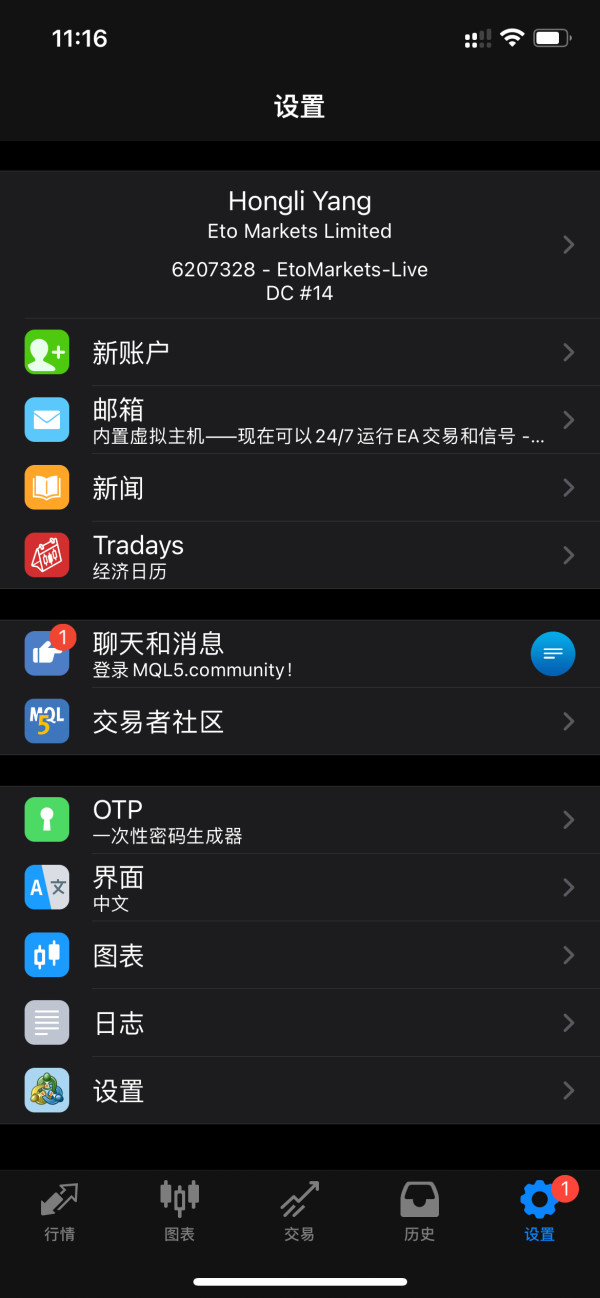

Platform Availability: The broker provides access to MetaTrader 4 and MetaTrader 5 platforms, industry-standard solutions offering comprehensive charting and analysis tools.

Geographic Restrictions: Services are reportedly available in over 100 countries, though specific restrictions may apply based on local regulations.

Customer Support Languages: Specific language support information is not detailed in available materials.

This eto markets review notes that while basic operational information is available, some detailed specifications regarding costs, procedures, and service levels require direct inquiry with the broker.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

ETO Markets offers account conditions that appear competitive within the retail forex space, though specific account type variations are not clearly detailed in available information. The $100 minimum deposit requirement positions the broker favorably for new traders or those testing services with limited capital commitment. This threshold is considerably lower than many established brokers who may require $500 or more for standard accounts.

The spread structure beginning from 0.0 pips suggests the broker offers competitive pricing, likely through ECN-style accounts where commission charges would apply separately. However, the lack of transparent commission information in public materials creates uncertainty about total trading costs. This eto markets review finds that potential clients would need to contact the broker directly for comprehensive cost breakdowns.

Account opening procedures and verification requirements are not specifically detailed in available documentation. The absence of information about Islamic accounts, professional trader classifications, or institutional account options suggests either these services are not offered or are not prominently marketed. For traders requiring specific account features such as swap-free trading or enhanced leverage for professional classifications, direct inquiry would be necessary.

The leverage offering up to 1:500 provides significant trading power, though regulatory restrictions may limit this for certain jurisdictions, particularly for retail clients under ASIC oversight where leverage caps apply.

ETO Markets shows strength in platform and tool provision through its support of both MetaTrader 4 and MetaTrader 5. These platforms provide comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors (EAs). The availability of custom indicators and automated trading options appeals to both discretionary and systematic traders.

The multi-asset offering including forex, commodities, energy, and indices provides portfolio diversification opportunities within a single trading environment. This breadth of instruments allows traders to capitalize on various market conditions and implement cross-asset strategies.

However, specific research and analysis resources are not detailed in available information. Many competitive brokers provide daily market analysis, economic calendars, trading signals, or educational webinars. The absence of such information in public materials suggests either these resources are limited or not prominently featured in the broker's marketing approach.

Educational resources and trader development programs are not specifically mentioned in available documentation. For new traders, the availability of comprehensive educational materials, demo accounts, and learning resources can significantly impact the trading experience and success rates.

The platform's support for automated trading and algorithmic strategies through MetaTrader's EA functionality provides advanced traders with systematic trading capabilities, though specific backtesting environments or strategy development tools are not detailed.

Customer Service and Support Analysis (6/10)

Customer service evaluation for ETO Markets is challenging due to limited publicly available feedback and specific service level information. The broker's contact methods, response times, and service quality metrics are not detailed in accessible documentation, making comprehensive assessment difficult.

The absence of specific customer service reviews or testimonials in major review platforms suggests either limited user engagement with public review systems or a relatively smaller client base compared to more established brokers. This eto markets review cannot provide definitive assessments of service quality, response times, or problem resolution effectiveness based on available information.

Multi-language support capabilities are not specified, though given the broker's claimed presence in over 100 countries, some level of international language support would be expected. However, the extent and quality of such support cannot be verified from available sources.

Customer service hours, available contact methods (phone, email, live chat), and escalation procedures are not clearly outlined in public materials. These factors significantly impact user experience, particularly for traders in different time zones or those requiring urgent assistance during volatile market conditions.

The regulatory oversight from ASIC and SFSA does provide some framework for complaint resolution and dispute handling, though specific procedures and success rates are not publicly documented.

Trading Experience Analysis (7/10)

The trading experience at ETO Markets centers around the MetaTrader platform ecosystem, providing traders with familiar and robust trading environments. MT4 and MT5 offer comprehensive charting, analysis tools, and order management capabilities that have become industry standards. However, specific performance metrics such as execution speeds, slippage rates, or requote frequencies are not detailed in available information.

Order execution quality is a critical factor for trading success, yet specific data about ETO Markets' execution statistics, average fill times, or price improvement rates are not publicly available. The broker's STP and ECN business models suggest direct market access capabilities, though the quality of liquidity providers and execution venues is not specified.

Platform stability and uptime statistics are not documented in available materials. For active traders, platform reliability during high-volatility periods and major economic events is crucial, yet no specific performance data or user feedback regarding system stability is accessible.

Mobile trading capabilities through MetaTrader mobile applications would be expected, though specific mobile platform features, functionality, or user experience enhancements are not detailed. The quality of mobile execution, chart functionality, and account management features can significantly impact trading flexibility.

Trading environment factors such as spread stability during news events, weekend gap handling, and stop-loss execution quality are not specifically addressed in available documentation, leaving important trading experience factors unclear.

Trust and Safety Analysis (8/10)

ETO Markets' regulatory framework provides a foundation for trust through oversight by recognized financial authorities. ASIC regulation in Australia offers substantial investor protections including segregated client funds, compensation schemes, and strict operational requirements. The additional SFSA regulation in Seychelles provides international operational flexibility, though with different protection standards.

However, specific fund safety measures beyond basic regulatory requirements are not detailed in available information. Client fund segregation policies, the use of tier-1 banking institutions, or additional insurance coverage are not specifically documented. These factors significantly impact client fund security and should be clarified directly with the broker.

Company transparency regarding management, financial statements, or operational updates is limited in publicly available materials. Many established brokers provide regular company updates, management profiles, or financial performance indicators that enhance transparency and trust.

Industry reputation and recognition through awards, certifications, or third-party endorsements are not evident in available documentation. While not essential, such recognition can indicate industry standing and operational quality.

The handling of negative events, regulatory actions, or client disputes is not documented in accessible sources. The absence of significant negative publicity or regulatory sanctions is positive, though proactive transparency in addressing challenges would enhance trust assessment.

User Experience Analysis (6/10)

User experience evaluation for ETO Markets is constrained by limited publicly available user feedback and testimonials. Major review platforms do not contain substantial user commentary, making comprehensive user satisfaction assessment challenging. This absence could indicate either limited market presence or users not actively engaging with public review platforms.

The overall account opening and verification process efficiency is not detailed in available materials. Modern traders expect streamlined digital onboarding with clear documentation requirements and reasonable processing times. The absence of specific process information suggests potential clients should inquire directly about account opening procedures and timeframes.

Fund management experience including deposit and withdrawal processing times, available payment methods, and associated fees are not comprehensively detailed. These operational aspects significantly impact user satisfaction and trading efficiency, yet specific information is not readily available.

Platform user interface and usability beyond standard MetaTrader functionality are not described. While MT4 and MT5 provide established functionality, broker-specific enhancements, educational integration, or account management tools can differentiate user experience.

The broker's responsiveness to user feedback, platform updates, or service improvements is not documented in available sources. Progressive brokers typically demonstrate continuous improvement and user-centric development, though evidence of such approaches is not accessible for ETO Markets.

Conclusion

This eto markets review reveals a forex broker with solid regulatory foundations and competitive basic offerings, yet limited transparency in operational details and user feedback. ETO Markets appears suitable for beginning traders seeking low-barrier market entry through the accessible $100 minimum deposit and established MetaTrader platforms. The dual ASIC and SFSA regulatory oversight provides some investor protection, particularly for Australian clients under ASIC jurisdiction.

However, the limited availability of detailed user feedback, customer service information, and operational transparency creates uncertainty about day-to-day trading experience quality. Traders seeking high leverage up to 1:500 may find the offering attractive, though regulatory restrictions may limit availability depending on jurisdiction.

The broker's strengths include competitive spreads starting from 0.0 pips, multi-asset trading capabilities, and support for automated trading strategies. Weaknesses center around limited publicly available information about customer service quality, detailed cost structures, and user satisfaction metrics. Potential clients should conduct thorough due diligence and consider direct contact with the broker to clarify operational details before committing funds.