Regarding the legitimacy of ETO Markets forex brokers, it provides ASIC, FSA and WikiBit, (also has a graphic survey regarding security).

Is ETO Markets safe?

Pros

Cons

Is ETO Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ETO GROUP PTY LTD

Effective Date: Change Record

2013-02-01Email Address of Licensed Institution:

jbarratt@etomarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'02 TOWER B CITADEL TOWERS' SE 12 L 12 799 PACIFIC HWY CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0280981310Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ETO MARKETS LIMITED

Effective Date:

--Email Address of Licensed Institution:

info@eto.groupSharing Status:

No SharingWebsite of Licensed Institution:

https://www.eto.groupExpiration Time:

--Address of Licensed Institution:

Office No. 20, First Floor, Abis 1, Abis Centre, Providence Industrial Estate, Mahé, SeychellesPhone Number of Licensed Institution:

+248 4374772Licensed Institution Certified Documents:

Is ETO Markets A Scam?

Introduction

ETO Markets is a forex and CFD broker established in 2013, with its headquarters located in Sydney, Australia, and an offshore presence in Seychelles. The broker aims to provide a comprehensive trading environment for retail and institutional investors, offering access to a variety of financial instruments, including forex, commodities, and indices. However, as the forex market can be rife with scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to objectively assess whether ETO Markets is a scam or a legitimate trading platform. Our investigation is based on a thorough review of regulatory compliance, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential for determining its legitimacy and the level of protection it offers to its clients. ETO Markets operates under the supervision of two regulatory bodies: the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA). While ASIC is known for its stringent regulatory standards, the FSA is often criticized for its lenient oversight, which raises concerns about the level of protection it offers to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 420224 | Australia | Verified |

| FSA | SD062 | Seychelles | Verified |

The importance of regulation cannot be overstated. A well-regulated broker like ETO Markets under ASIC is required to adhere to strict financial standards, ensuring that client funds are held in segregated accounts and that the broker operates with transparency. In contrast, the FSA's tier-3 regulatory status implies that while ETO Markets is legally recognized, it may not offer the same level of investor protection as brokers regulated by tier-1 authorities. This dual regulatory structure can create a perception of reliability, but the offshore regulation may also introduce risks associated with less stringent oversight.

Company Background Investigation

Founded in 2013, ETO Markets has established itself as a player in the forex trading industry. The company is owned by ETO Group Pty Ltd, which operates under the ASIC license. The management team comprises professionals with backgrounds in finance and trading, which can lend credibility to the firm's operations. However, the lack of detailed information regarding the company's ownership structure and the specific qualifications of its executive team raises questions about transparency.

In terms of operational history, ETO Markets has been relatively stable, but it has faced some customer complaints regarding its services. While the company has made efforts to provide clear information on its website, the overall level of disclosure remains limited. This lack of transparency can be a red flag for potential investors, as it may indicate that the company is not fully forthcoming about its practices.

Trading Conditions Analysis

ETO Markets offers a variety of trading accounts, with a minimum deposit requirement of $100. The broker provides access to popular trading platforms such as MetaTrader 4 and MetaTrader 5, which are widely regarded for their user-friendly interfaces and advanced trading features. However, the overall fee structure and trading conditions warrant closer scrutiny.

| Fee Type | ETO Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 - 1.2 pips | 0.5 - 1.0 pips |

| Commission Model | $3.5 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While ETO Markets advertises competitive spreads, the actual trading costs can be higher than the industry average, particularly for standard accounts. Additionally, the commission structure may not be as favorable for all traders, especially those who prefer lower-cost trading options. The presence of hidden fees or unfavorable trading conditions can significantly impact a trader's profitability, making it essential for potential clients to fully understand the fee structure before opening an account.

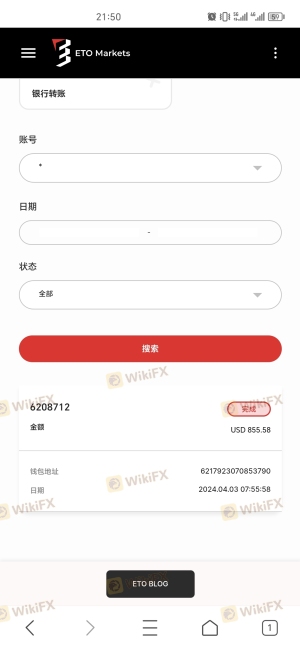

Client Funds Security

The security of client funds is a critical consideration for any trading platform. ETO Markets claims to implement several measures to protect client funds, including segregated accounts that ensure client deposits are kept separate from the company's operational funds. This practice is a standard requirement for regulated brokers and adds a layer of security for traders.

Moreover, ETO Markets does not offer negative balance protection, which means that clients can potentially lose more than their initial deposit. This lack of protection could pose significant risks for inexperienced traders, particularly in a volatile market. While there have been no major reported incidents of fund mismanagement or security breaches at ETO Markets, the absence of a robust investor protection scheme raises concerns about the overall safety of client funds.

Customer Experience and Complaints

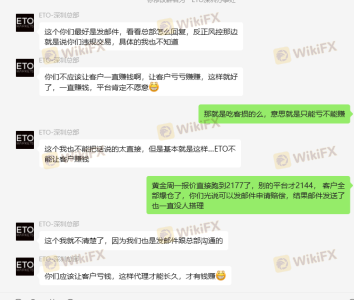

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of ETO Markets reveal a mixed bag of experiences, with some traders praising the platform's ease of use and customer support, while others have reported issues related to withdrawals and communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Average Response |

| Account Liquidation Issues | High | No Resolution |

Common complaints include delays in processing withdrawals and unresponsive customer service. In some cases, traders have reported that their accounts were liquidated without adequate explanation. These issues can severely undermine trust in the broker and suggest that potential clients should proceed with caution.

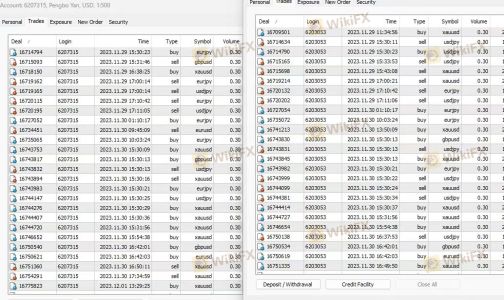

Platform and Execution

ETO Markets offers trading through the widely-used MetaTrader platforms, which are known for their stability and range of features. However, the execution quality has been a point of contention among users. Instances of slippage and order rejections have been reported, which can be detrimental to trading performance.

The broker's claims of fast execution times and deep liquidity pools are not universally supported by user experiences. Traders have noted that during periods of high volatility, the execution quality may suffer, leading to unfavorable trading outcomes. This inconsistency in execution can be a significant drawback for those who rely on precision in their trading strategies.

Risk Assessment

Using ETO Markets involves various risks that potential clients should be aware of. The dual regulatory structure, while providing some level of oversight, may not be sufficient to ensure full protection for traders. Additionally, the lack of negative balance protection and the presence of customer complaints regarding withdrawals and account management further exacerbate the risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Oversight | Medium | Dual regulation with tier-3 oversight |

| Fund Security | High | No negative balance protection |

| Customer Support | Medium | Reports of unresponsive support |

To mitigate these risks, potential clients should consider starting with a smaller investment, utilizing demo accounts to familiarize themselves with the platform, and thoroughly reviewing the terms and conditions before proceeding.

Conclusion and Recommendations

In summary, while ETO Markets is a regulated broker with a presence in both Australia and Seychelles, there are significant concerns regarding its overall reliability. The dual regulatory structure, coupled with the lack of negative balance protection and mixed customer feedback, suggests that traders should approach this broker with caution.

For those considering trading with ETO Markets, it is advisable to conduct thorough research and possibly look for alternative brokers with stronger regulatory oversight and better customer service records. Brokers such as IG Group and OANDA may offer more robust protection and a better overall trading experience for those seeking reliable forex trading options.

Is ETO Markets a scam, or is it legit?

The latest exposure and evaluation content of ETO Markets brokers.

ETO Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ETO Markets latest industry rating score is 8.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.