CWG Markets 2025 Review: Everything You Need to Know

Executive Summary

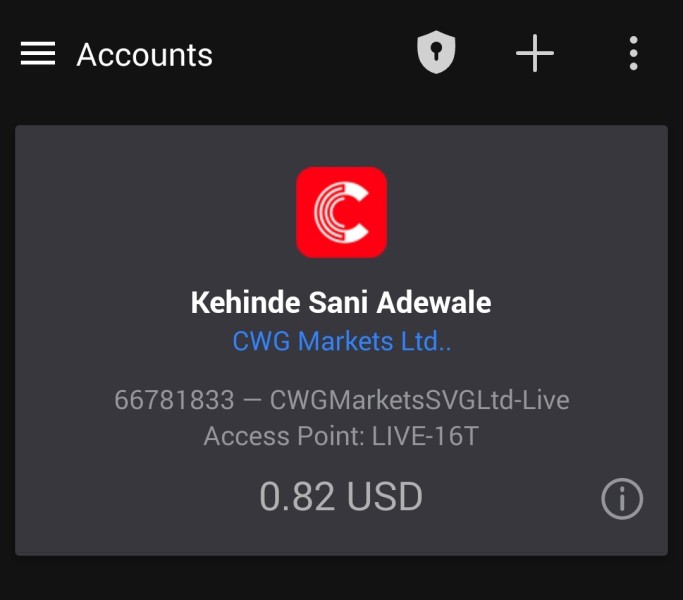

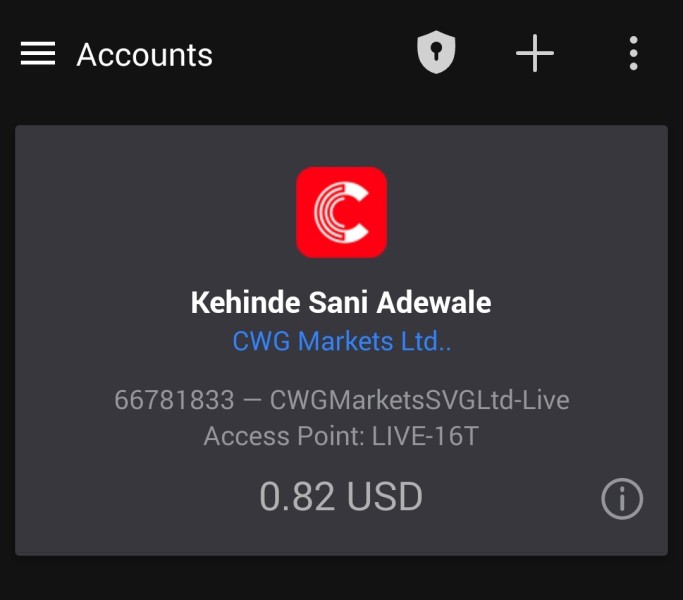

CWG Markets is a multi-asset trading platform that gets attention for its competitive trading conditions and high leverage offerings. Our comprehensive cwg markets review shows this broker gives traders a mixed experience when they look for low-cost trading solutions. The company started in 2017 and has its headquarters in the United Kingdom, operating under ECN and STP business models while offering traders access to major financial markets with leverage up to 1:1000 and minimum deposits starting from just $10.

The broker supports popular trading platforms like MetaTrader 4 and MetaTrader 5. It provides access to forex, indices, commodities, cryptocurrencies, futures, and precious metals. CWG Markets operates under regulatory oversight from the Financial Conduct Authority (FCA) and Vanuatu Financial Services Commission (VFSC), targeting beginner to intermediate traders who want low spreads and high leverage capabilities. Customer service quality stays inconsistent based on user feedback, with spreads starting from 0 pips and commission structures beginning at $0, making it especially appealing to cost-conscious traders.

Important Notice

CWG Markets operates under different regulatory jurisdictions. Specific services and trading conditions may change depending on where the client lives. The broker keeps separate entities regulated by FCA and VFSC, which may offer different terms and protections to clients based on where they live. This review comes from comprehensive analysis of user feedback, market research, and information provided by the broker across its various platforms. Future clients should check their eligibility and applicable terms based on their location before opening an account. Trading involves significant risk, and past performance does not guarantee future results.

Rating Framework

Broker Overview

CWG Markets started in 2017 as a UK-based financial services provider. The company positions itself to serve global traders through diverse trading solutions. CWG Markets operates with a focus on providing competitive spreads and high leverage ratios, using both ECN (Electronic Communication Network) and STP (Straight Through Processing) execution models. This approach ensures transparent pricing and efficient order execution, allowing traders to access institutional-grade liquidity. According to TradingBrokers.com, the broker has built its reputation on offering low-cost trading solutions while maintaining regulatory compliance across multiple jurisdictions.

The platform supports MetaTrader 4 and MetaTrader 5. These are two of the industry's most recognized trading platforms, providing traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. CWG Markets offers trading across multiple asset classes including forex pairs, global indices, commodities, cryptocurrencies, futures contracts, and precious metals. The broker operates under regulatory oversight from the UK's Financial Conduct Authority (FCA) and the Vanuatu Financial Services Commission (VFSC), providing clients with regulatory protection and ensuring adherence to industry standards. This cwg markets review shows that the broker's multi-regulatory approach aims to serve clients across different geographical regions while maintaining appropriate oversight.

Regulatory Jurisdictions: CWG Markets maintains regulatory compliance through FCA and VFSC oversight. This ensures client fund protection and operational transparency. The FCA regulation provides enhanced protection for UK and EU clients, while VFSC oversight serves international traders with appropriate regulatory standards.

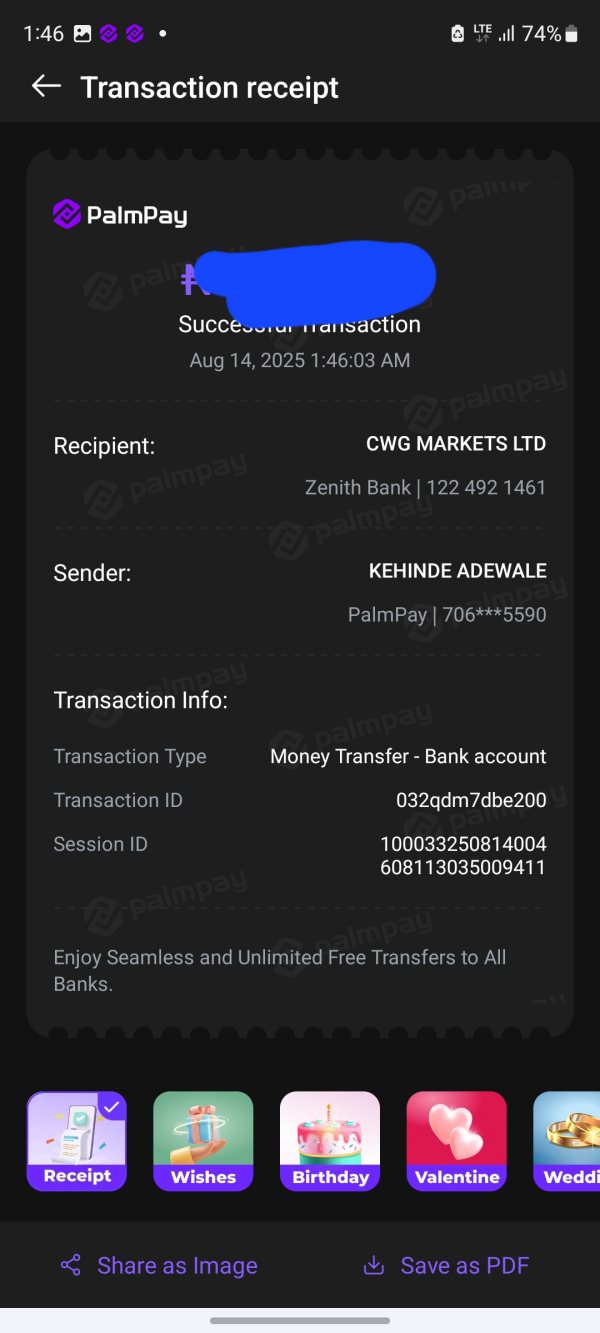

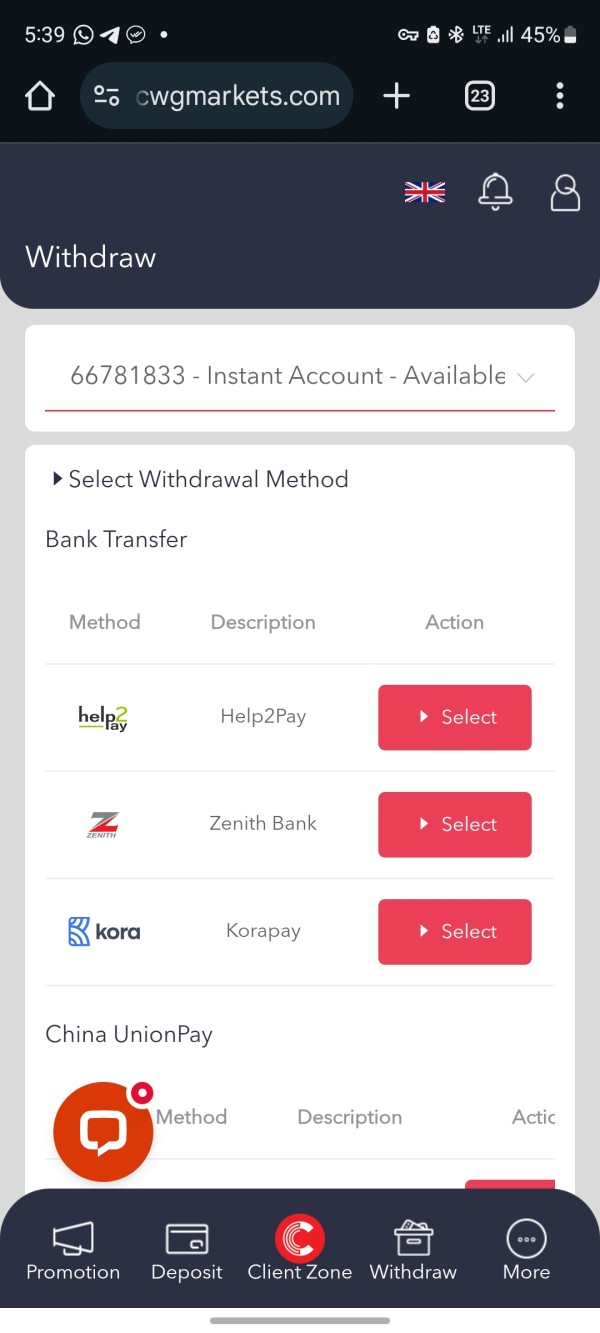

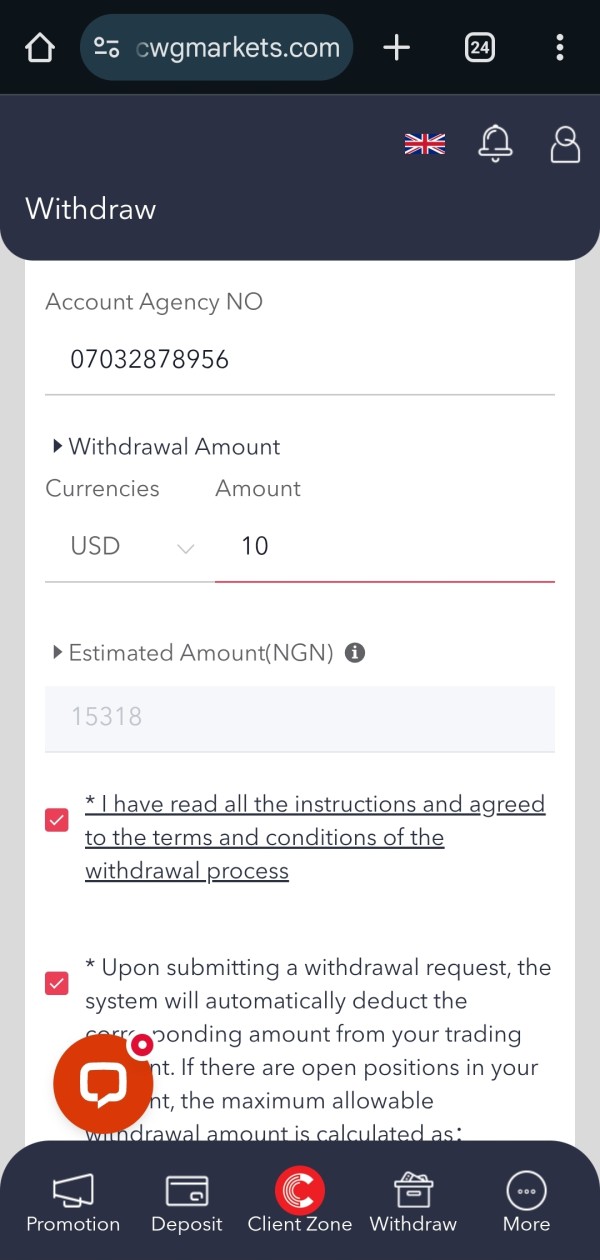

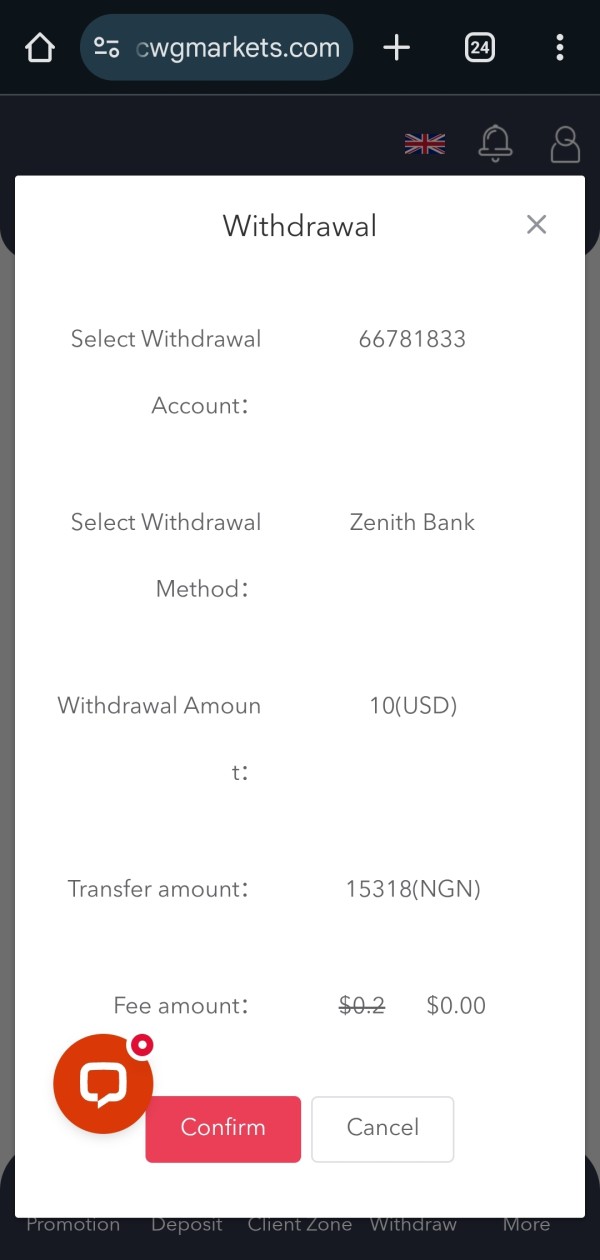

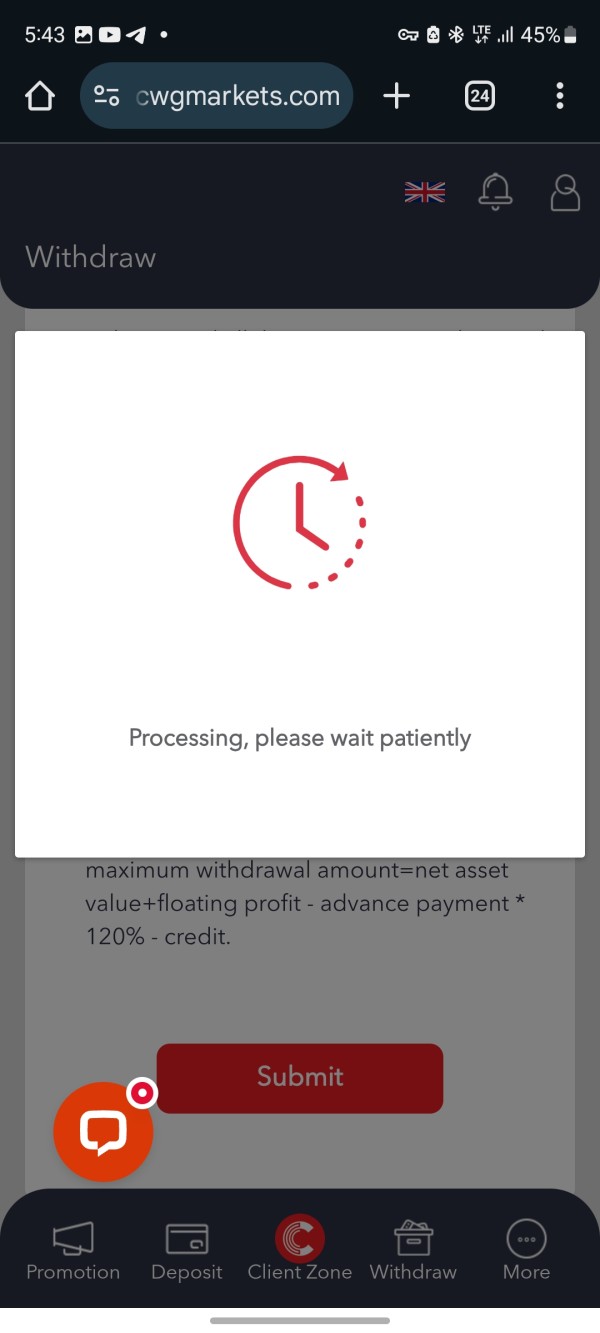

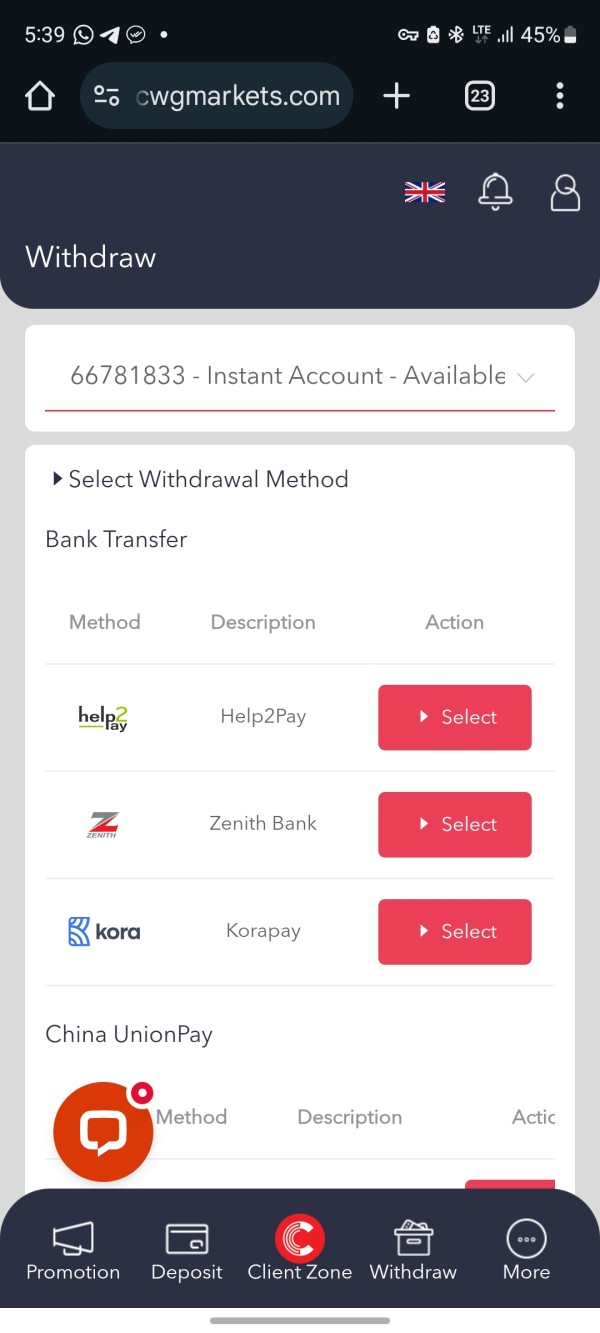

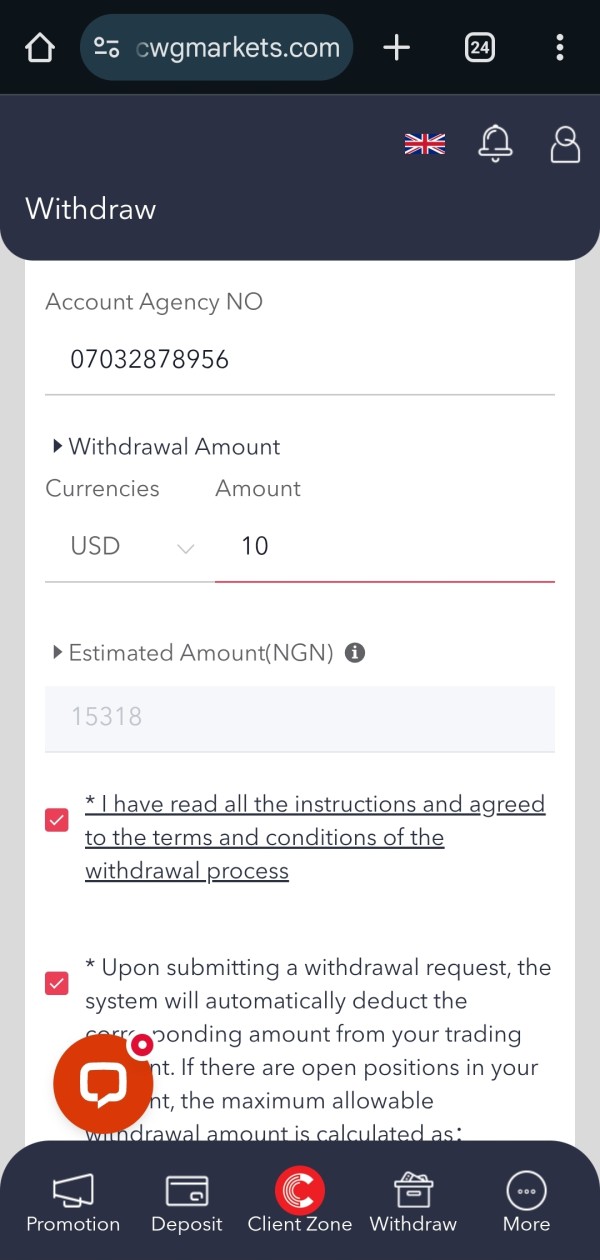

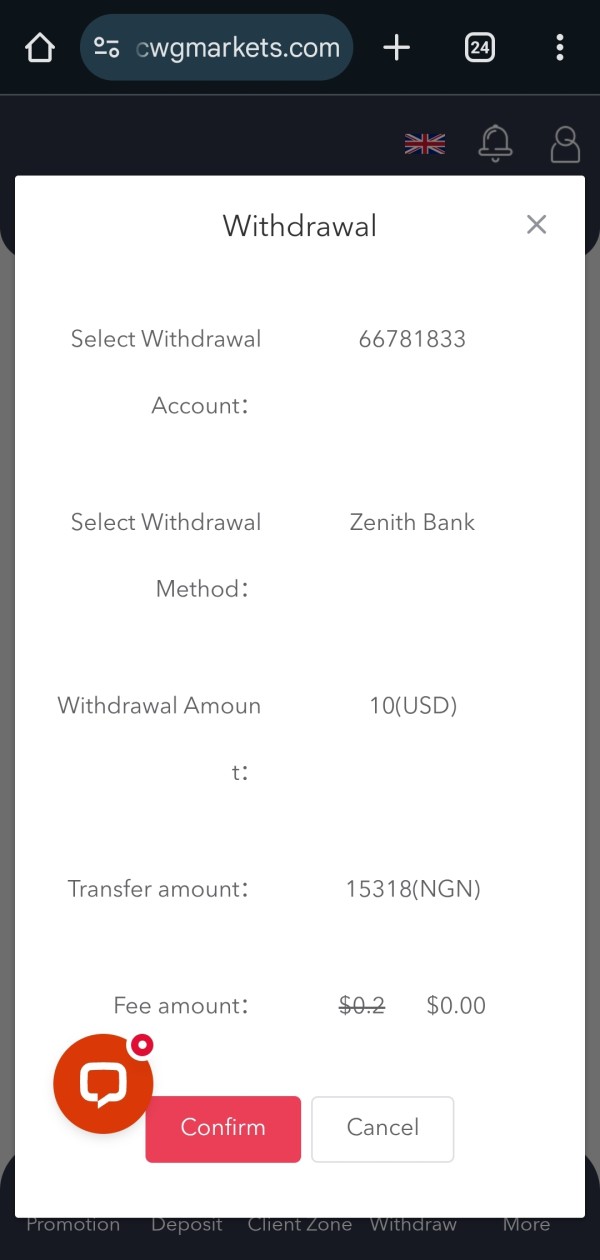

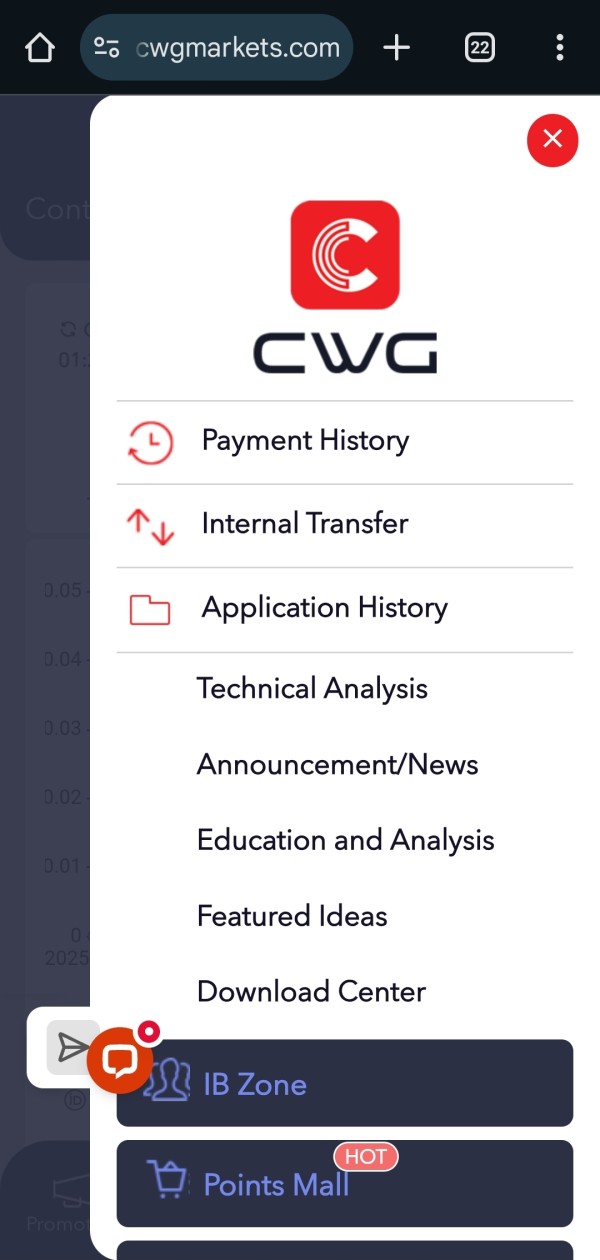

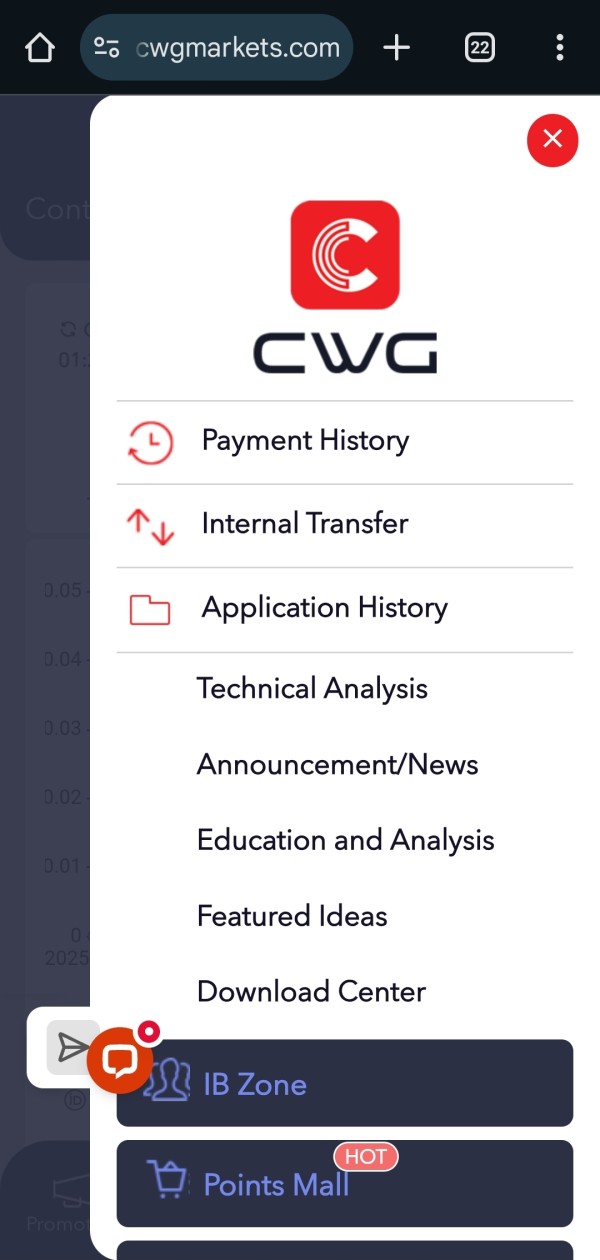

Deposit and Withdrawal Methods: The broker offers multiple funding options. These include credit and debit cards, wire transfers, and various e-wallet solutions. Specific payment methods and processing times may vary by region and account type.

Minimum Deposit Requirements: CWG Markets requires a minimum deposit of just $10. This positions the broker as accessible to beginning traders and those testing the platform with limited capital.

Bonus and Promotions: Information about specific bonus programs and promotional offers was not detailed in available materials. These may vary by account type and client location.

Tradeable Assets: The platform provides access to comprehensive asset classes. These include major and minor forex pairs, global stock indices, energy commodities, precious metals, cryptocurrency CFDs, and futures contracts across various markets.

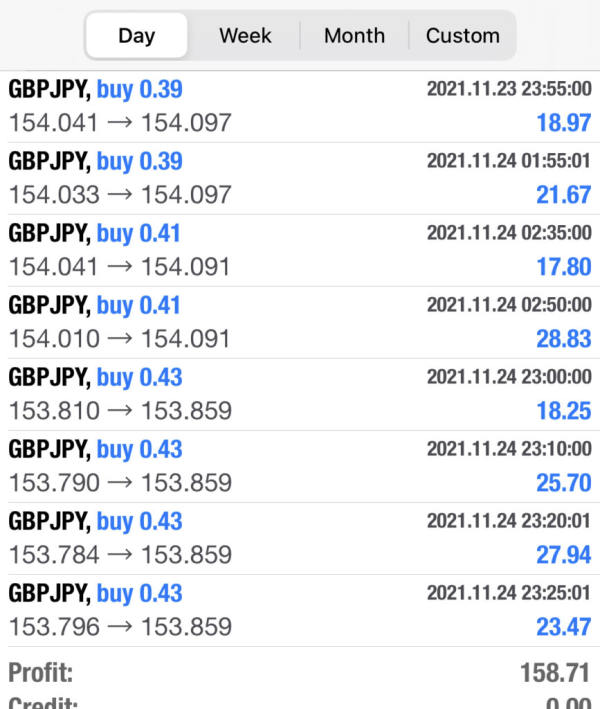

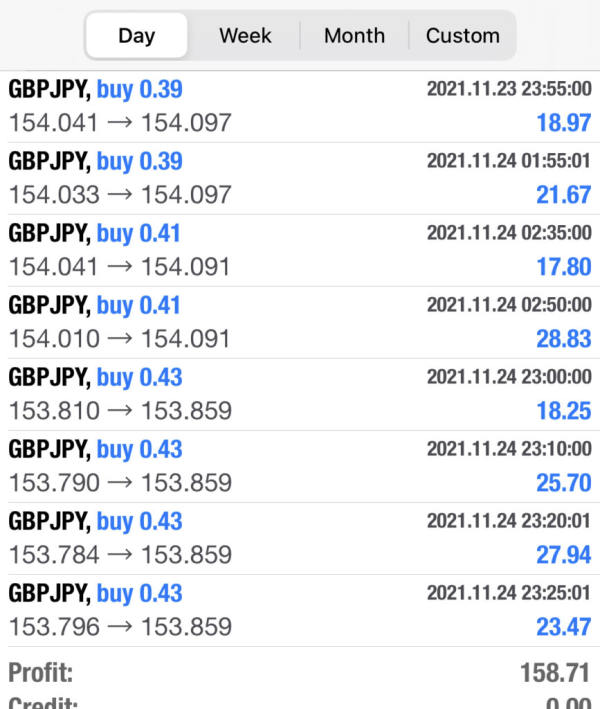

Cost Structure: CWG Markets operates with variable spreads starting from 0 pips on major currency pairs. Commission structures begin at $0 depending on account type. The transparent pricing model allows traders to understand their trading costs clearly.

Leverage Ratios: Maximum leverage reaches 1:1000. This provides significant capital amplification for experienced traders while requiring careful risk management due to increased exposure potential.

Platform Options: MetaTrader 4 and MetaTrader 5 platforms offer comprehensive trading functionality. This includes advanced charting, automated trading systems, and mobile trading capabilities.

Geographic Restrictions: Specific regional limitations and service availability information should be verified directly with the broker. This depends on client location.

Customer Support Languages: Multi-language customer support is available. However, specific language options were not detailed in available documentation.

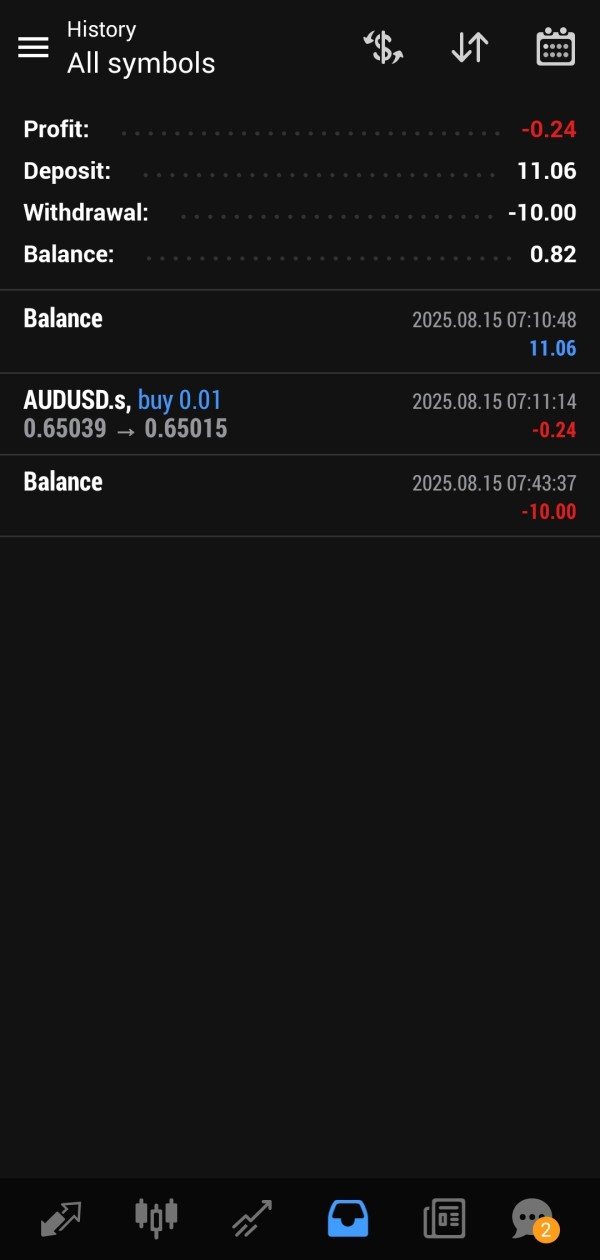

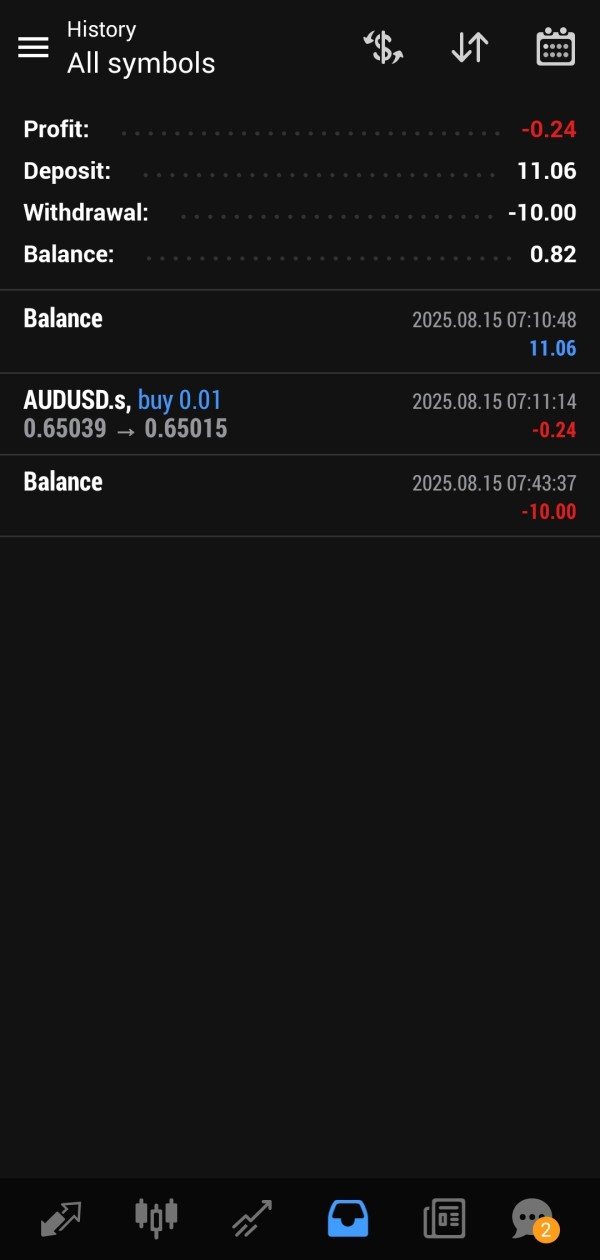

Account Conditions Analysis

CWG Markets shows strong performance in account conditions, earning an 8/10 rating based on several favorable factors. According to TradingFinder.com, the broker offers multiple account types designed to accommodate different trading styles and experience levels. The standout feature remains the exceptionally low minimum deposit requirement of $10. This makes the platform accessible to novice traders and those seeking to test strategies with minimal capital commitment. This low barrier to entry significantly outperforms many competitors who typically require deposits of $100 or more.

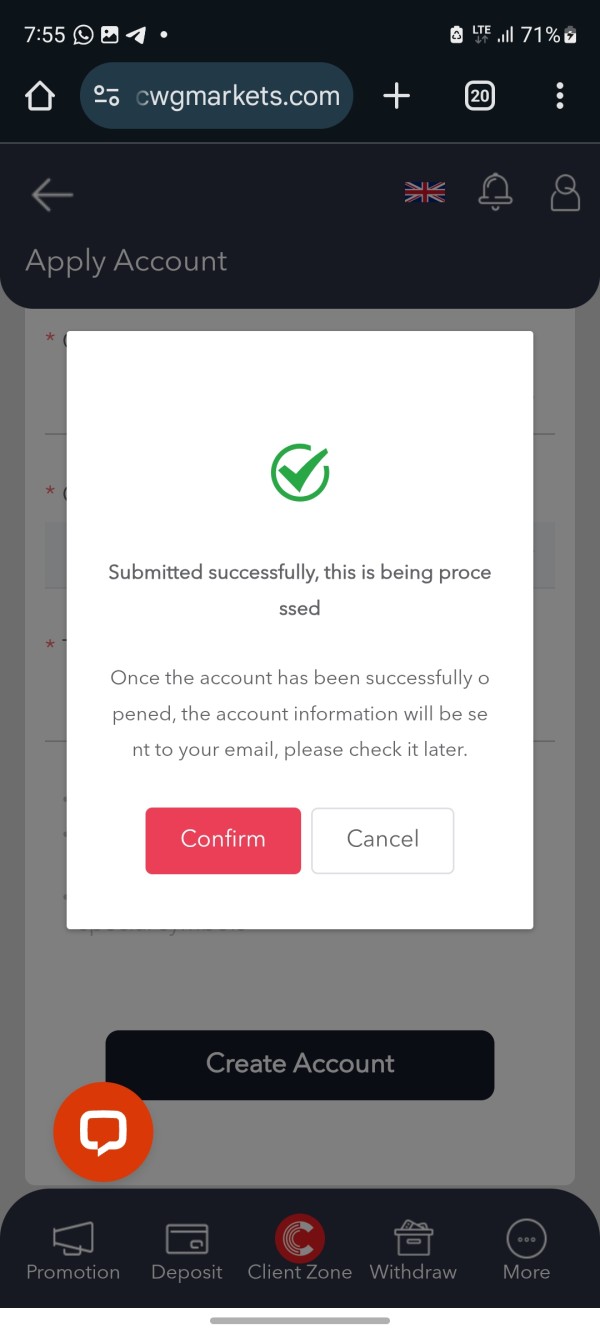

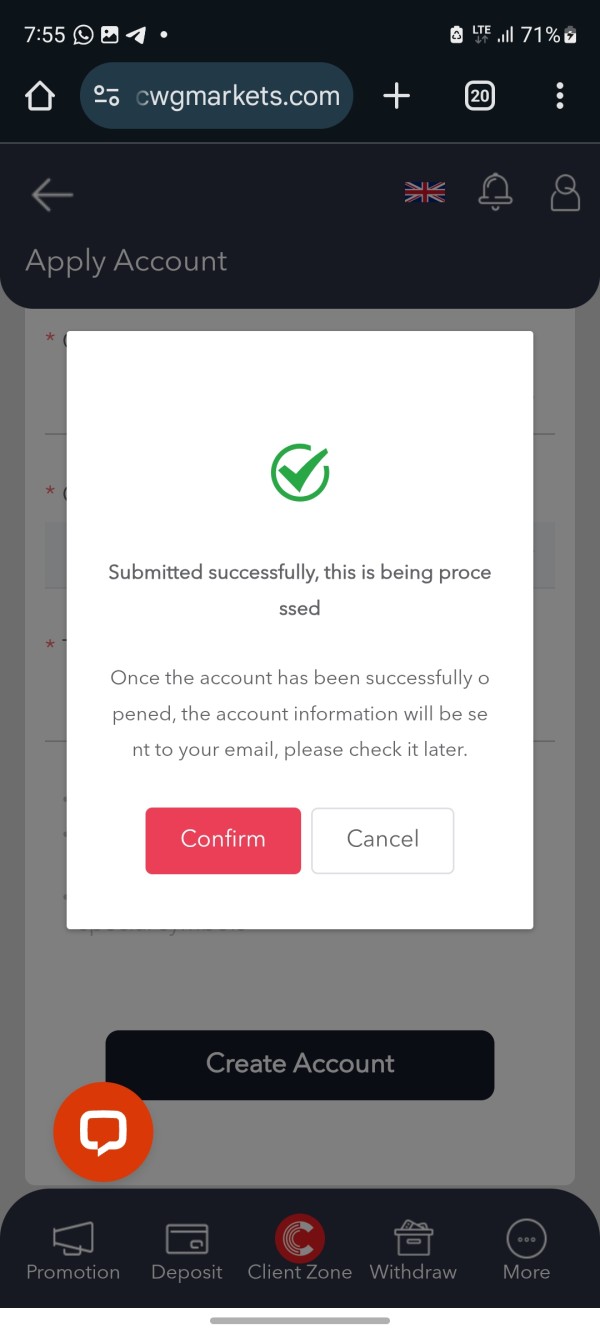

The account opening process appears streamlined based on user feedback. Digital verification procedures expedite account activation. Users report relatively smooth onboarding experiences, though some note that document verification can occasionally experience delays. The broker's fee structure enhances the account conditions appeal, with no deposit or withdrawal fees reported across standard payment methods. However, clients should verify specific terms based on their chosen funding method and geographical location.

User feedback regarding account management features shows general satisfaction with the platform's account dashboard and fund management capabilities. The availability of different account tiers allows traders to select conditions that match their trading volume and strategy requirements. This cwg markets review finds that the broker's account conditions particularly benefit smaller traders and those beginning their trading journey. More experienced traders may seek additional premium features not detailed in available documentation.

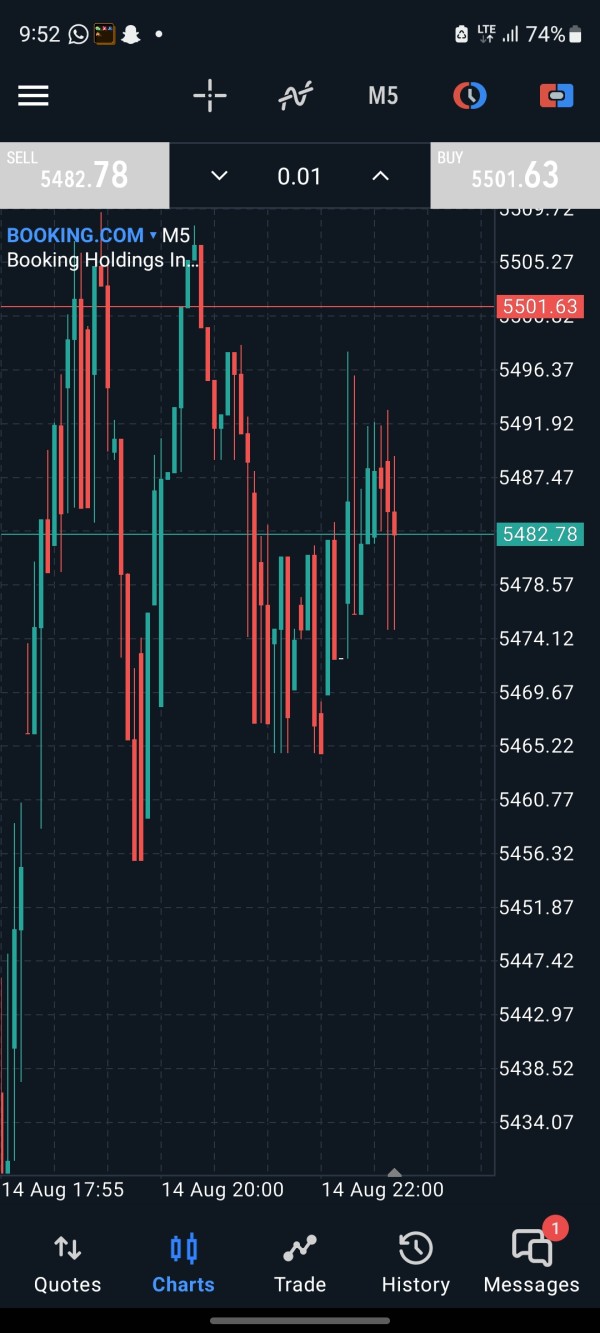

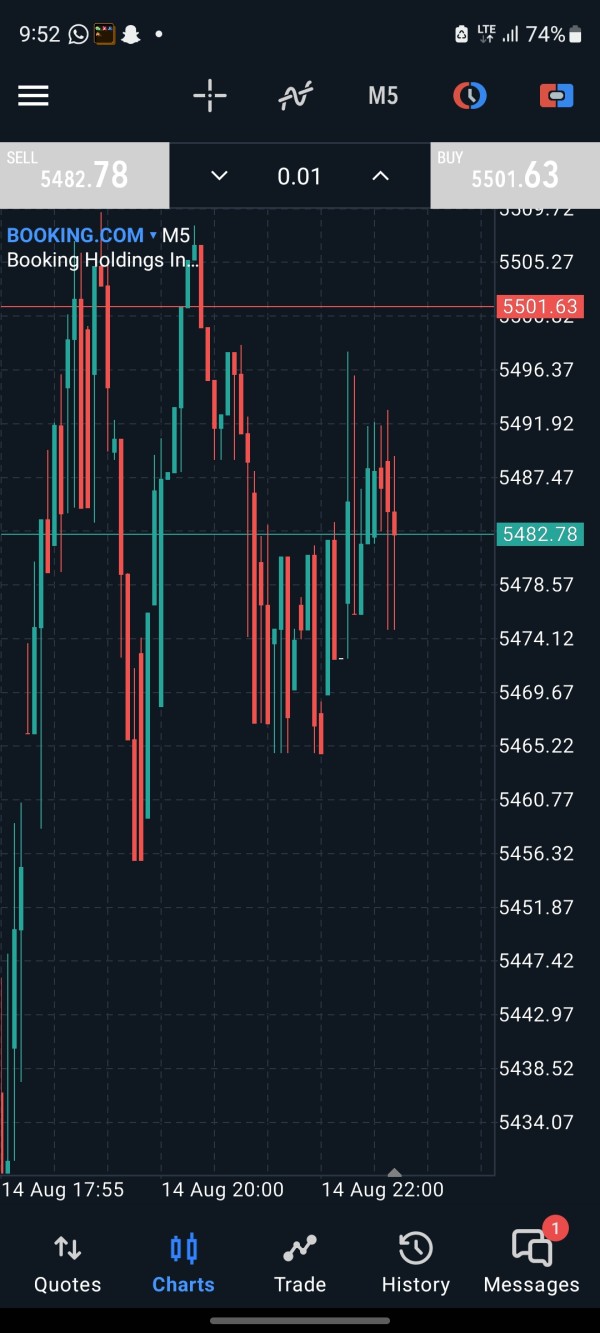

CWG Markets receives a 7/10 rating for tools and resources. This rating comes primarily from its platform offerings and technical capabilities. The broker provides access to both MetaTrader 4 and MetaTrader 5 platforms, which represent industry-standard solutions with comprehensive functionality. These platforms offer advanced charting capabilities, technical indicators, automated trading support through Expert Advisors (EAs), and mobile trading applications for iOS and Android devices.

According to TradingBrokers.com, the MT4 and MT5 platforms available through CWG Markets include standard features. These features include one-click trading, trailing stops, and comprehensive order management systems. The platforms support algorithmic trading and signal services, enabling traders to implement sophisticated trading strategies. However, user feedback suggests that while the platforms themselves are robust, the broker could enhance its educational resources and market analysis offerings.

The available research and analysis tools appear limited compared to larger brokers. Users note a desire for more comprehensive market commentary, economic calendars, and educational content. While the trading platforms provide essential technical analysis capabilities, the broker's proprietary research offerings and educational materials were not extensively detailed in available sources. This represents an area where CWG Markets could improve to better serve traders seeking comprehensive market insights and learning resources alongside their trading platform access.

Customer Service and Support Analysis

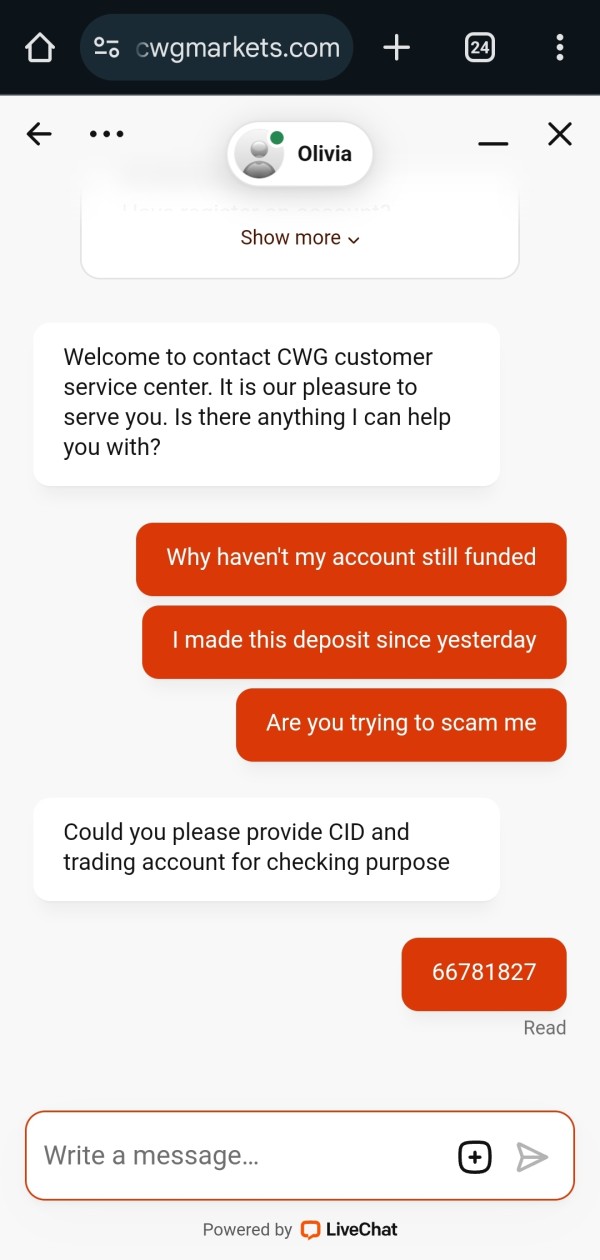

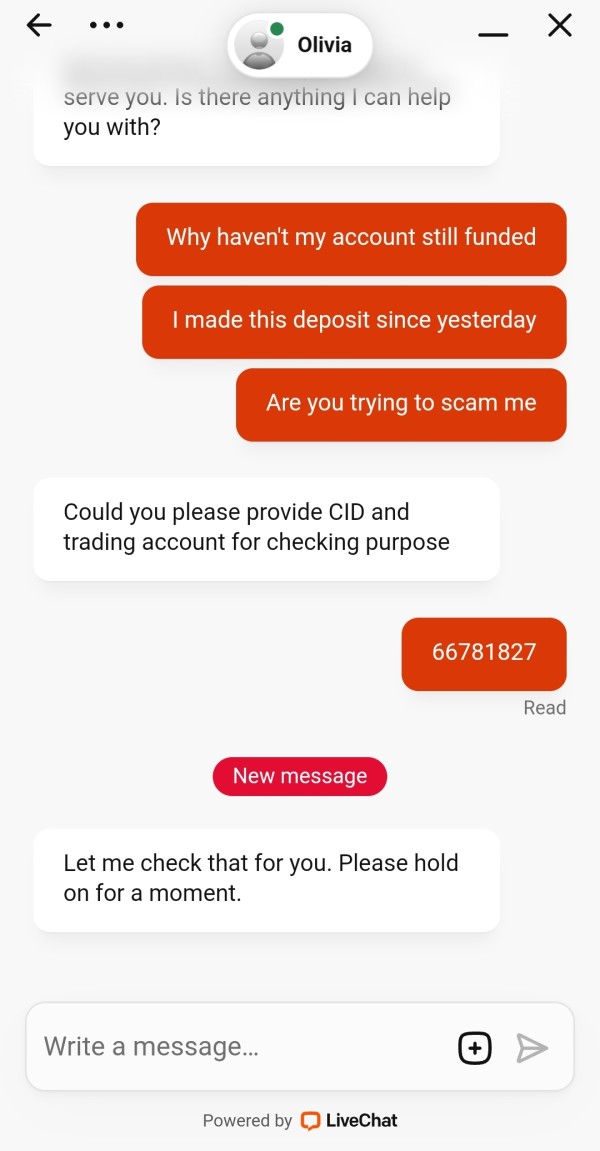

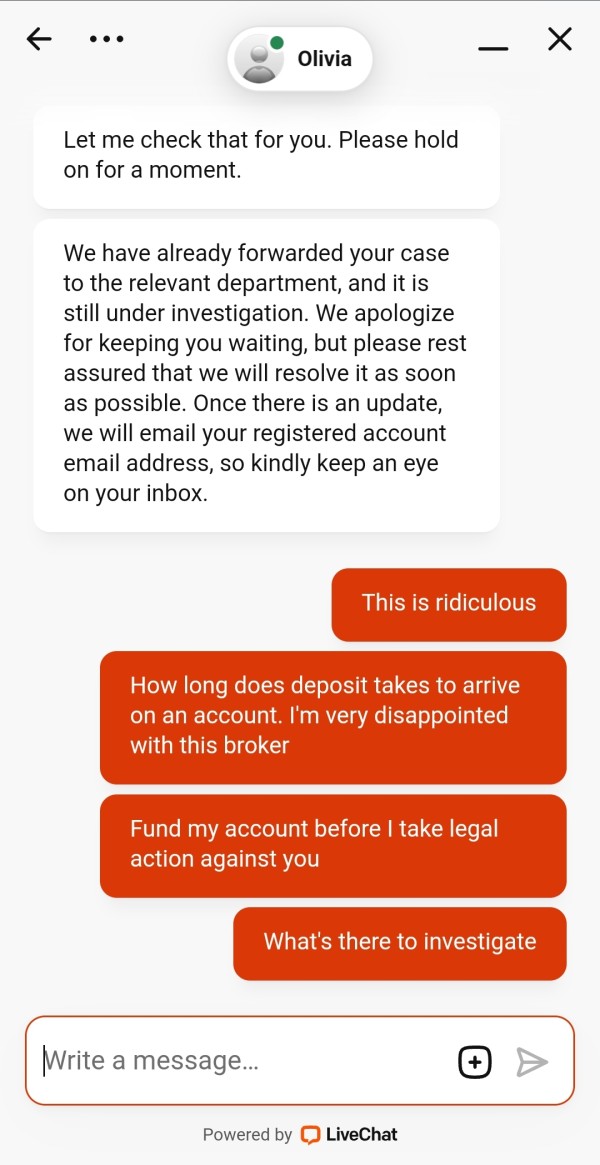

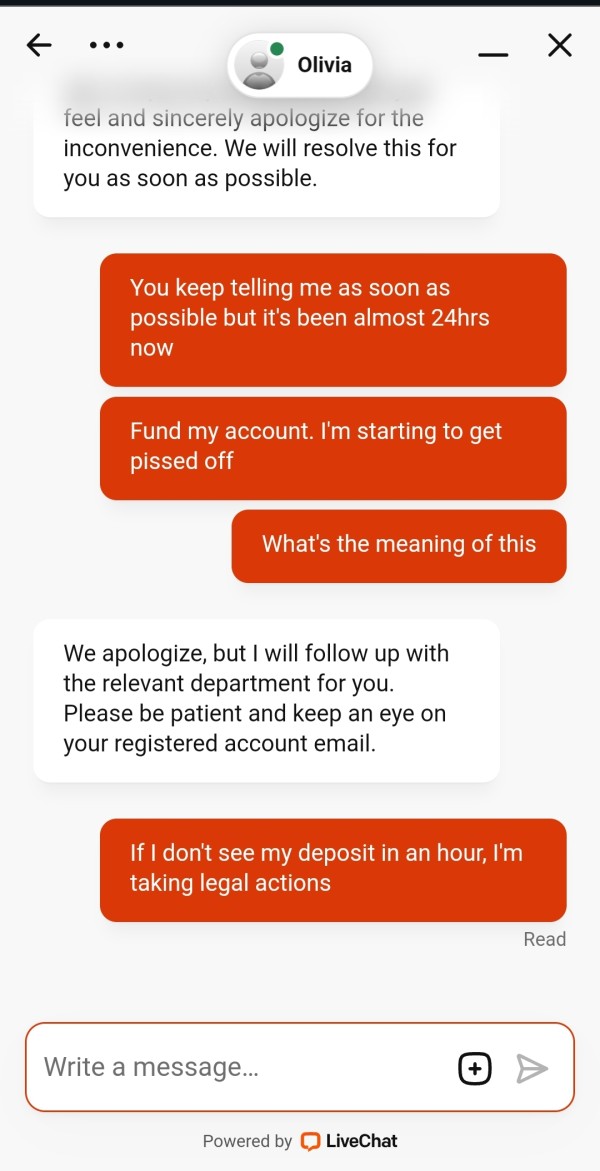

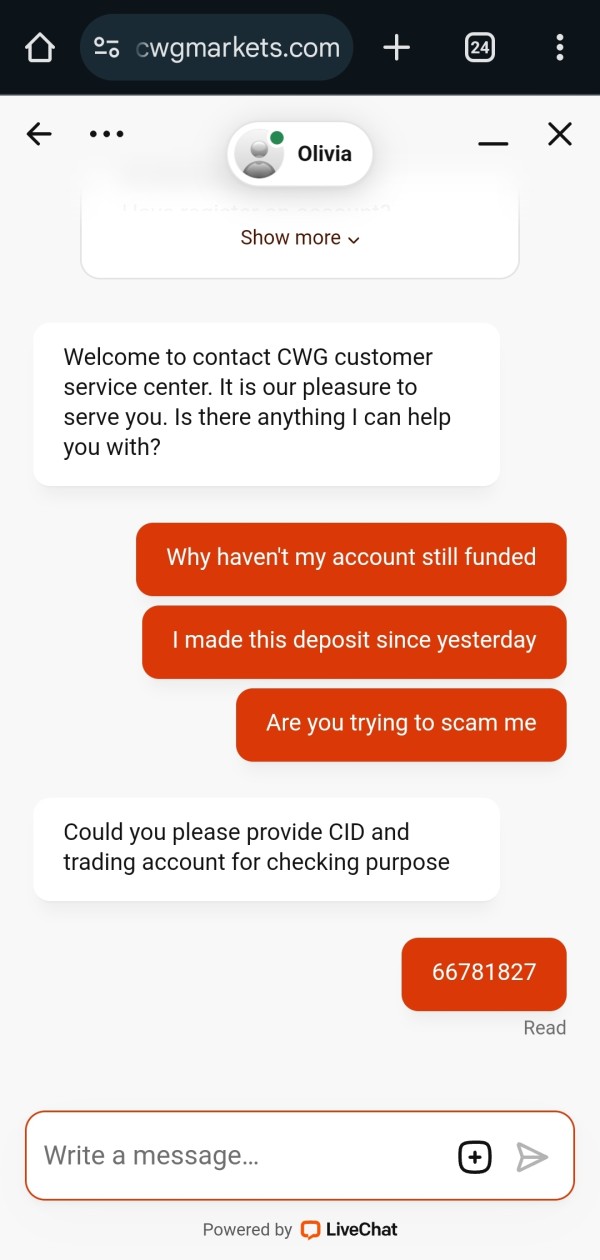

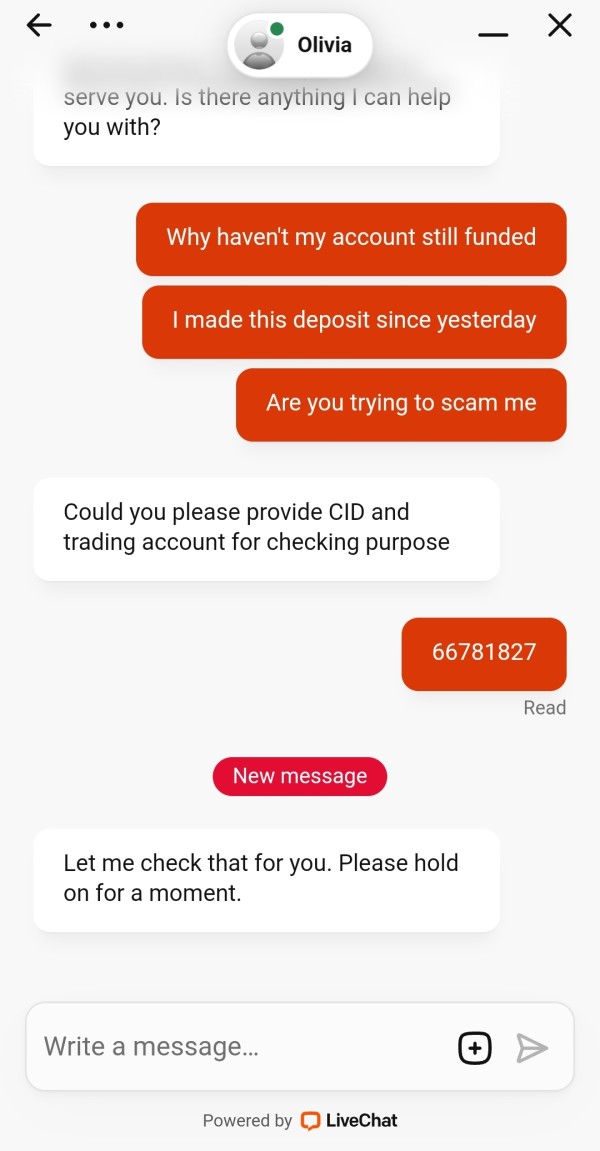

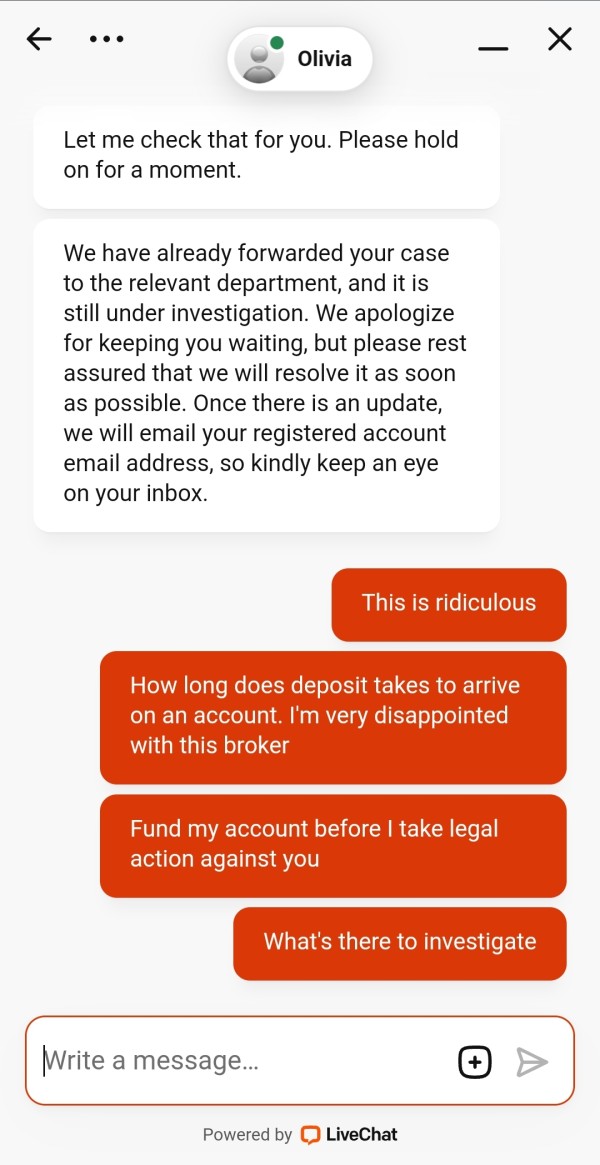

Customer service represents CWG Markets' weakest area, receiving a 5/10 rating based on mixed user experiences and feedback patterns. The broker offers multiple communication channels including telephone support, email correspondence, and live chat functionality. However, user reviews consistently highlight concerns regarding response times and service quality consistency.

According to consumer review platforms, clients report varying experiences with customer support responsiveness. Some users show satisfaction with initial inquiries and account setup assistance, while others express frustration with delayed responses to technical issues and account-related questions. The support team's technical knowledge and problem-resolution capabilities receive mixed reviews, with some clients noting that complex issues require multiple contact attempts for satisfactory resolution.

Multi-language support is available, though the specific languages and regional support availability were not comprehensively detailed in available documentation. Users report that while basic inquiries are generally handled adequately, more complex technical or account-specific issues sometimes require escalation and extended resolution timeframes. The customer service challenges appear to impact overall user satisfaction significantly, as evidenced by the lower ratings in user experience metrics. This cwg markets review identifies customer service improvement as a critical area requiring attention to enhance client retention and satisfaction levels.

Trading Experience Analysis

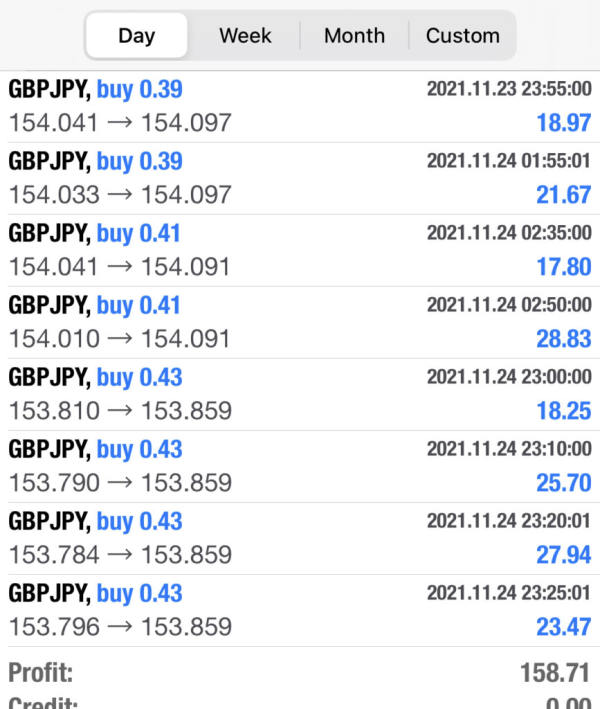

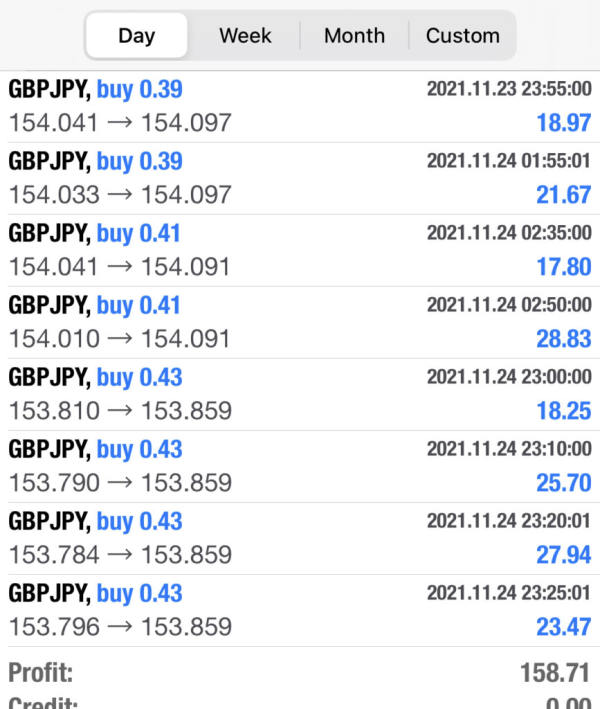

The trading experience with CWG Markets merits an 8/10 rating. This reflects strong performance in execution quality and platform stability. Users consistently report favorable experiences regarding order execution speed and minimal slippage occurrences during normal market conditions. The ECN and STP execution models contribute to transparent pricing and efficient trade processing, with most users noting reliable platform performance during standard trading hours.

Platform stability receives positive feedback. Both MT4 and MT5 demonstrate consistent uptime and responsive performance. Traders report that the platforms handle multiple simultaneous positions effectively and provide reliable real-time data feeds. The technical infrastructure appears robust enough to support active trading strategies without significant interruptions or technical failures that could impact trading outcomes.

The spread stability and liquidity provision generally meet user expectations. Competitive pricing is maintained across major currency pairs and popular trading instruments. However, some users note that during high-volatility periods or major news events, spreads may widen beyond typical ranges, which is common across the industry. Mobile trading applications receive adequate ratings for functionality, though some users suggest improvements in interface design and feature completeness compared to desktop versions. Overall, the trading environment provided by CWG Markets supports effective trading execution, contributing positively to the user experience despite other service area challenges. This cwg markets review finds that the core trading functionality represents one of the broker's strongest attributes.

Trustworthiness Analysis

CWG Markets achieves a 6/10 trustworthiness rating. This reflects a mixed assessment of regulatory protection and user confidence levels. The broker's regulatory status under the Financial Conduct Authority (FCA) and Vanuatu Financial Services Commission (VFSC) provides legitimate oversight and client protection frameworks. FCA regulation, in particular, offers robust consumer protections including segregated client funds and compensation scheme participation for eligible clients.

The company's transparency regarding its regulatory status and business operations appears adequate. Clear disclosure of its UK headquarters and regulatory numbers supports this assessment. However, user feedback patterns suggest some concerns regarding overall business practices and service delivery consistency. While no major regulatory violations or significant negative events were identified in available sources, the mixed customer service experiences and user satisfaction ratings impact the overall trust assessment.

Third-party evaluations and industry reviews present a moderate assessment of the broker's reliability. Recognition of its regulatory compliance is balanced against user experience concerns. The segregation of client funds and regulatory oversight provide fundamental safety measures, though users should conduct their own due diligence regarding fund safety and business practices. The broker's relatively recent establishment in 2017 means it has a shorter operational history compared to more established firms. This may influence some traders' confidence levels in the platform's long-term stability and reliability.

User Experience Analysis

User experience with CWG Markets receives a 6/10 rating. This indicates moderate satisfaction levels with room for improvement. According to Trustpilot reviews, the overall user satisfaction rating averages around 2.99 out of 5, suggesting mixed experiences across the client base. The platform interface design receives generally positive feedback for its intuitive navigation and user-friendly layout, particularly regarding the MT4 and MT5 platform integration.

The account registration and verification process appears streamlined. Most users report straightforward onboarding experiences. Digital document submission and account approval procedures generally meet user expectations for efficiency, though some clients note occasional delays in verification completion. Fund management operations, including deposits and withdrawals, receive adequate ratings for convenience and processing speed.

Common user complaints center primarily around customer service responsiveness and support quality rather than core platform functionality. Users frequently mention frustrations with delayed responses to inquiries and inconsistent service levels across different support interactions. The trading platform performance itself receives more favorable feedback, with users appreciating the low minimum deposit requirements and competitive trading conditions.

The user profile analysis suggests that CWG Markets appeals most strongly to beginning and intermediate traders. These traders prioritize low-cost access to financial markets over premium service features. More experienced traders may find the service limitations and support deficiencies less acceptable, particularly when requiring sophisticated assistance or account management services. Overall user experience improvements would likely require enhanced customer service capabilities and more comprehensive support resources.

Conclusion

This comprehensive cwg markets review reveals a broker that offers competitive trading conditions with significant room for service improvement. CWG Markets successfully attracts traders through its low minimum deposit requirement of $10, tight spreads starting from 0 pips, and high leverage up to 1:1000. This makes it particularly suitable for beginning and intermediate traders seeking cost-effective market access. The regulatory oversight from FCA and VFSC provides legitimate operational framework and basic client protections.

However, the broker's customer service deficiencies and mixed user feedback present notable concerns that prospective clients should carefully consider. While the core trading experience and platform functionality receive positive assessments, the support infrastructure requires substantial improvement to match industry standards. CWG Markets appears most appropriate for self-directed traders who prioritize low trading costs and high leverage over premium customer service and educational resources. Potential clients should weigh the competitive trading conditions against the service limitations when evaluating this broker for their trading needs.