Regarding the legitimacy of CWG Markets forex brokers, it provides FCA, FSCA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is CWG Markets safe?

Pros

Cons

Is CWG Markets markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CWG Markets Ltd

Effective Date:

2018-07-02Email Address of Licensed Institution:

support@cwgmarkets.co.uk, complaints@cwgmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.cwgmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

76 Cannon Street 3rd Floor London EC4N 6AE UNITED KINGDOMPhone Number of Licensed Institution:

+442039471777Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

CWG MARKETS SA (PTY) LTD

Effective Date:

2024-06-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1 ST FLOOR 3 GWEN LANE SANDTON JOHANNESBURG GAUTENG 0044Phone Number of Licensed Institution:

0828934101Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

CWG MARKETS LTD

Effective Date:

2023-10-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CWG Markets A Scam?

Introduction

CWG Markets is an online forex and CFD broker that has gained attention in the trading community since its establishment in 2018. With its headquarters in the United Kingdom and an offshore presence in Vanuatu, CWG Markets aims to provide a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. However, in an industry rife with scams and unreliable brokers, it is crucial for traders to carefully evaluate the legitimacy and reliability of any trading platform before committing their funds. This article seeks to provide a comprehensive analysis of CWG Markets, examining its regulatory status, company background, trading conditions, and user experiences to determine whether it is a trustworthy broker or a potential scam.

To conduct this investigation, we have analyzed various sources, including regulatory filings, user reviews, expert evaluations, and industry reports. Our assessment framework focuses on key areas such as regulatory compliance, company transparency, trading conditions, client fund safety, and customer feedback. By synthesizing this information, we aim to present a balanced view of CWG Markets, helping traders make informed decisions.

Regulation and Legitimacy

Regulatory oversight is a critical factor in assessing the legitimacy of a broker. CWG Markets claims to be regulated by two authorities: the Financial Conduct Authority (FCA) in the United Kingdom and the Vanuatu Financial Services Commission (VFSC). The FCA is known for its stringent regulatory standards, which require brokers to adhere to strict compliance measures to protect clients' interests. Conversely, the VFSC is often considered a less stringent regulator, raising concerns about the level of protection it offers to traders.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 785129 | United Kingdom | Verified |

| VFSC | 41694 | Vanuatu | Verified |

Despite being regulated by the FCA, CWG Markets has faced scrutiny due to negative disclosures reported by various regulatory bodies. For instance, there have been complaints regarding unauthorized activities and issues related to fund withdrawals. These factors raise questions about the broker's overall compliance and adherence to regulatory standards. It is essential to note that while the FCA provides a higher level of consumer protection, the presence of negative disclosures may indicate potential operational issues within the broker.

Company Background Investigation

CWG Markets was established in 2018, positioning itself as a global broker catering to a diverse clientele. The company's ownership structure is not entirely transparent, which can be a red flag for potential investors. While it is registered in the UK, the lack of detailed information about its management team and operational history raises concerns about its credibility.

The management teams background and experience play a crucial role in a broker's reliability. However, CWG Markets has not disclosed sufficient information about its leadership, making it challenging to assess their qualifications and expertise in the financial industry. Transparency in management and operations is vital for building trust with clients, and the absence of this information may deter potential traders from engaging with the platform.

Furthermore, the company's commitment to transparency and information disclosure is questionable. While they provide basic details about their services and trading conditions, potential clients may find it difficult to obtain comprehensive information regarding the company's operations, policies, and financial health.

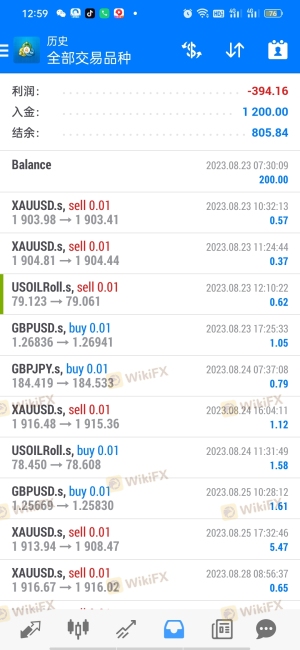

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. CWG Markets offers various account types, including Instant, Classic, Advanced, and Institutional accounts, with minimum deposits ranging from $10 to $50,000. The broker claims to provide competitive spreads and low trading costs, but the actual cost structure may vary significantly based on market conditions.

| Cost Type | CWG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 3.0 pips |

| Commission Model | $3 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While CWG Markets advertises spreads starting from 0.0 pips, traders should be cautious of potential hidden fees or unfavorable trading conditions that may arise during volatile market periods. The commission structure, particularly for higher-tier accounts, appears competitive; however, traders should verify these costs through their own trading experiences.

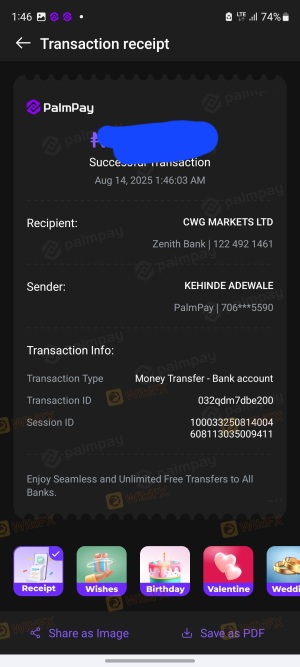

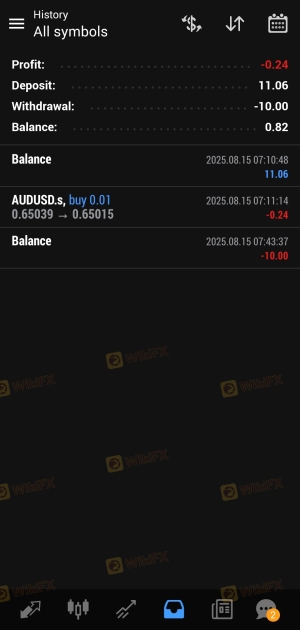

Moreover, the broker's fee policies, including withdrawal fees and inactivity charges, should be scrutinized. Some users have reported unexpected fees or complications when attempting to withdraw funds, which can be a significant concern for traders.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. CWG Markets claims to implement various safety measures, such as segregating client funds from operating capital and offering negative balance protection. However, the effectiveness of these measures depends on the broker's adherence to regulatory requirements and operational integrity.

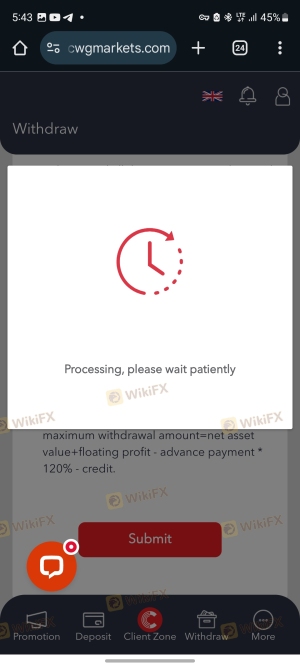

The broker's commitment to fund segregation is essential for protecting client assets in case of financial difficulties. However, there have been reports of withdrawal issues and delays, raising concerns about the actual implementation of these safety measures. Additionally, the lack of participation in an investor compensation scheme could leave clients vulnerable in the event of broker insolvency.

Historically, there have been instances of complaints regarding fund withdrawals from CWG Markets, with some users claiming their requests were unjustifiably denied or delayed. Such issues can severely impact traders' trust in the broker's ability to safeguard their investments.

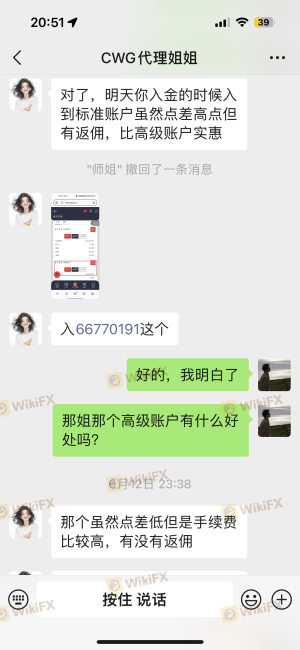

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. An analysis of user reviews for CWG Markets reveals a mixed sentiment, with some traders reporting positive experiences while others express significant dissatisfaction. Common complaints include withdrawal difficulties, poor customer service, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Execution Problems | High | Limited action |

Several users have reported lengthy delays in processing withdrawals, often requiring multiple communications with customer support. In some cases, clients have expressed frustration over the perceived lack of responsiveness from the support team, which can exacerbate issues related to fund access.

For instance, one user reported that their withdrawal request was pending for weeks, leading them to believe that the broker was intentionally delaying access to their funds. This type of feedback raises concerns about the broker's operational transparency and responsiveness to client needs.

Platform and Execution

The trading platform used by a broker significantly impacts the trading experience. CWG Markets provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely regarded as robust trading platforms. However, user experiences regarding platform performance have varied, with some traders reporting issues related to stability and execution quality.

Order execution is a critical aspect of trading, and traders expect timely and accurate fills. Reports of slippage and re-quotes can be detrimental to a trader's performance, particularly during high volatility. Users have raised concerns about instances where their orders were not executed at expected prices, leading to potential losses.

Additionally, any signs of platform manipulation, such as artificially widening spreads during critical market events, can severely undermine trust in the broker. Although there is no definitive evidence of such practices at CWG Markets, the presence of user complaints regarding execution quality warrants caution.

Risk Assessment

Engaging with any broker carries inherent risks, and CWG Markets is no exception. An overall risk assessment reveals several areas of concern that potential traders should consider before opening an account.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight may impact client protection. |

| Fund Safety Risk | High | Historical withdrawal issues raise concerns about fund security. |

| Execution Risk | High | Reports of slippage and re-quotes may affect trading outcomes. |

| Customer Support Risk | Medium | Inconsistent support responses can exacerbate client issues. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a demo account, and remain vigilant about their trading activities. Diversifying investments across multiple brokers can also help reduce exposure to any single platform's potential shortcomings.

Conclusion and Recommendations

In conclusion, while CWG Markets is regulated by the FCA, which offers a degree of legitimacy, the broker has faced various complaints and concerns that warrant caution. The mixed reviews from users, coupled with reports of withdrawal issues and execution problems, suggest that potential traders should approach this broker with care.

For those considering trading with CWG Markets, it is advisable to start with a small investment and utilize a demo account to assess the platform's performance. Additionally, traders should stay informed about the broker's policies and any changes in their operational practices.

If you are seeking alternatives, consider exploring brokers with a stronger reputation for reliability and customer service, such as those regulated in tier-one jurisdictions. Always prioritize brokers with transparent practices, robust customer support, and a proven track record of client satisfaction.

Is CWG Markets a scam, or is it legit?

The latest exposure and evaluation content of CWG Markets brokers.

CWG Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CWG Markets latest industry rating score is 7.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.