CMB 2025 Review: Everything You Need to Know

Executive Summary

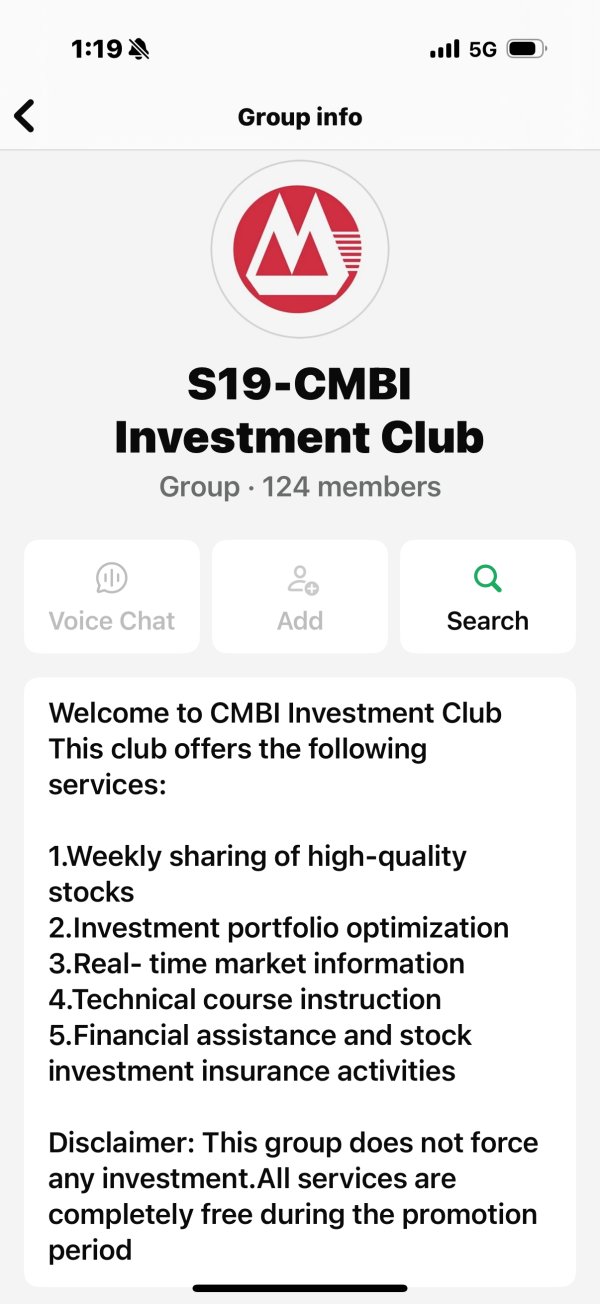

This cmb review shows big differences in user experiences across different CMB companies in financial services. Our analysis reveals that CMB Financial Services gets positive feedback from clients who report excellent customer experiences, but other CMB-related services face major criticism. Coffee Meets Bagel gets extremely low user ratings of just 1 out of 10 on major review platforms.

Our investigation shows that CMB Financial Services, based in Hattiesburg, Mississippi, has built a reputation for quality customer service. However, concerns remain about the overall CMB brand's safety and legitimacy, with mixed signals from various user communities. The target audience includes forex traders seeking reliable brokerage services and clients needing lending solutions.

CMB Financial Services operates from 3720 Hardy St #19, Hattiesburg, MS, 39402, which suggests a real physical presence in the United States. The big difference between various CMB companies' performance ratings shows why it's important to tell apart different companies operating under similar names in financial services.

Important Notice

Cross-Regional Entity Differences: Potential users must understand that CMB includes multiple business companies operating across different financial sectors, including forex trading and lending services. Users should carefully check which specific CMB company they are dealing with before starting any financial transactions or services.

Review Methodology Statement: This evaluation uses comprehensive analysis of user feedback, market research, and available public information. Our assessment method includes data from multiple review platforms, regulatory filings where available, and industry reports to provide a balanced view on CMB's service offerings and performance standards.

Rating Framework

Broker Overview

Capital Markets Banc operates within a complex landscape of financial services, with various companies using similar branding across different market segments. CMB Financial Services runs its operations from 3720 Hardy St #19, #19, Hattiesburg, MS, 39402, United States, showing an established physical presence in the American financial services market.

The company's business model appears to include multiple financial service offerings, though specific details about trading platforms, asset management, and client onboarding processes remain limited in public documentation. The correspondent mortgage broker classification suggests involvement in lending services, where CMB works as a middleman making loans in its own name using funds provided by banking partners or other financial companies.

This cmb review finds significant differences in service quality and user satisfaction across different CMB-branded companies. Some divisions receive good feedback for customer service excellence, but others face major criticism about operational reliability and user experience quality. The regulatory oversight and compliance framework details are not fully detailed in available source materials, requiring potential clients to do additional research.

Regulatory Jurisdiction: Specific regulatory authority information is not detailed in available source materials, though the Mississippi location suggests potential state-level oversight.

Deposit and Withdrawal Methods: Specific funding and withdrawal options are not outlined in available documentation.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in current source materials.

Bonus and Promotional Offers: Information about promotional incentives or bonus structures is not mentioned in available sources.

Tradeable Assets: Specific asset classes and trading instruments are not detailed in accessible documentation.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in current source materials. The correspondent mortgage broker model suggests fee-based payment structures for lending services.

Leverage Ratios: Specific leverage offerings are not mentioned in available sources.

Platform Options: Trading platform specifications and technology infrastructure details are not provided in accessible materials.

Geographic Restrictions: Regional availability limitations are not specified in current documentation.

Customer Support Languages: Supported communication languages are not detailed in available sources.

This cmb review highlights the need for potential clients to request detailed information directly from CMB companies about these operational details.

Detailed Rating Analysis

Account Conditions Analysis

The account structure and conditions offered by CMB companies remain largely undocumented in public sources, creating challenges for potential clients seeking detailed information about account types, features, and requirements. Without specific information about standard, premium, or specialized account offerings, prospective users cannot properly assess whether CMB's account conditions match their trading or investment goals.

The absence of detailed minimum deposit requirements, account maintenance fees, and special features such as Islamic accounts or professional trader accommodations limits our ability to provide complete guidance. Industry standards typically expect clear disclosure of account conditions, including any restrictions, benefits, or special requirements associated with different account levels.

For potential clients considering CMB services, direct communication with the company becomes essential to understand available account options, associated costs, and any special conditions or requirements. The lack of readily available account condition information may indicate either limited online presence or a preference for personalized consultation approaches.

This cmb review emphasizes the importance of getting detailed account documentation before making any commitment to ensure full understanding of terms, conditions, and available features across different account types offered by CMB companies.

The trading tools and educational resources provided by CMB companies are not fully documented in available public sources, creating uncertainty for traders seeking advanced analytical capabilities or learning materials. Modern forex and financial services typically offer sophisticated charting tools, technical indicators, economic calendars, and market analysis resources to support informed decision-making.

Without specific information about research and analysis resources, automated trading support, or educational content availability, potential clients cannot assess whether CMB's technology infrastructure meets contemporary trading standards. The absence of detailed tool specifications may indicate either limited online disclosure or a focus on personalized service delivery rather than self-service platform capabilities.

Professional traders often require advanced features such as algorithmic trading support, comprehensive market data feeds, and sophisticated risk management tools. The lack of publicly available information about these capabilities requires direct inquiry with CMB representatives to understand the full scope of available trading and analytical resources.

Educational resources, including webinars, tutorials, and market analysis, play crucial roles in trader development and decision-making. The unavailability of information about CMB's educational offerings limits our ability to assess their commitment to client development and market education.

Customer Service and Support Analysis

CMB Financial Services shows notable strength in customer service delivery, with available feedback indicating positive client experiences and satisfaction with support quality. This represents a significant competitive advantage in the financial services sector, where responsive and knowledgeable customer support often determines client retention and satisfaction levels.

The positive customer feedback suggests that CMB Financial Services has invested in training and developing customer service capabilities that meet or exceed client expectations. However, specific details about support channel availability, response times, multilingual capabilities, and operating hours are not detailed in available sources.

Professional financial services require robust support infrastructure capable of addressing technical issues, account inquiries, and trading-related questions promptly and accurately. The positive client feedback indicates that CMB Financial Services likely maintains adequate support staffing and training programs to deliver quality assistance.

The contrast between positive feedback for CMB Financial Services and negative experiences reported for other CMB-branded companies highlights the importance of identifying the specific service provider when evaluating customer support quality. This difference suggests varying operational standards and service delivery approaches across different CMB companies.

Trading Experience Analysis

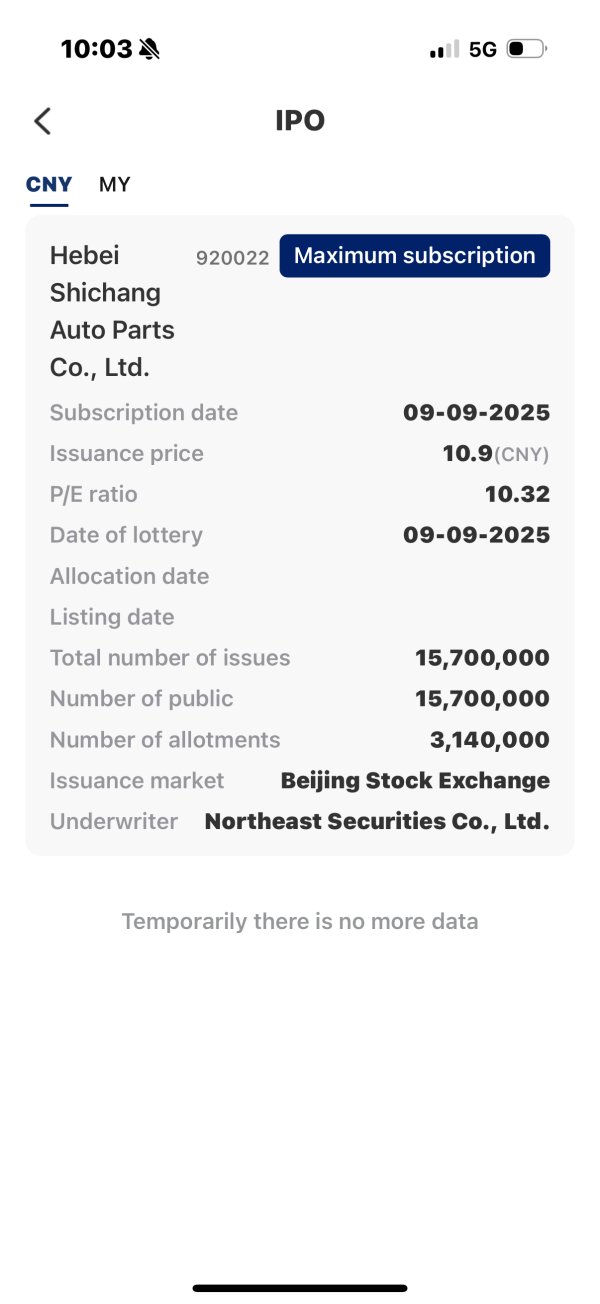

The trading experience offered by CMB companies lacks comprehensive documentation in available public sources, making it challenging to assess platform stability, execution quality, and overall trading environment effectiveness. Modern trading platforms typically provide real-time market data, reliable order execution, and intuitive user interfaces across desktop and mobile applications.

Without specific information about platform technology, execution speeds, or trading environment characteristics, potential clients cannot evaluate whether CMB's trading infrastructure meets professional standards or supports various trading strategies effectively. The absence of technical performance data or user experience feedback about trading platforms limits our analytical capability.

Mobile trading capabilities have become essential for modern forex and financial market participants who require flexibility and accessibility. The lack of information about mobile platform availability, features, and performance represents a significant information gap for potential clients evaluating CMB's technology offerings.

Order execution quality, including speed, accuracy, and price improvement opportunities, directly impacts trading profitability and user satisfaction. The unavailability of specific execution statistics or user feedback about trading performance makes it difficult to assess CMB's competitive position in this critical area.

Trust and Reliability Analysis

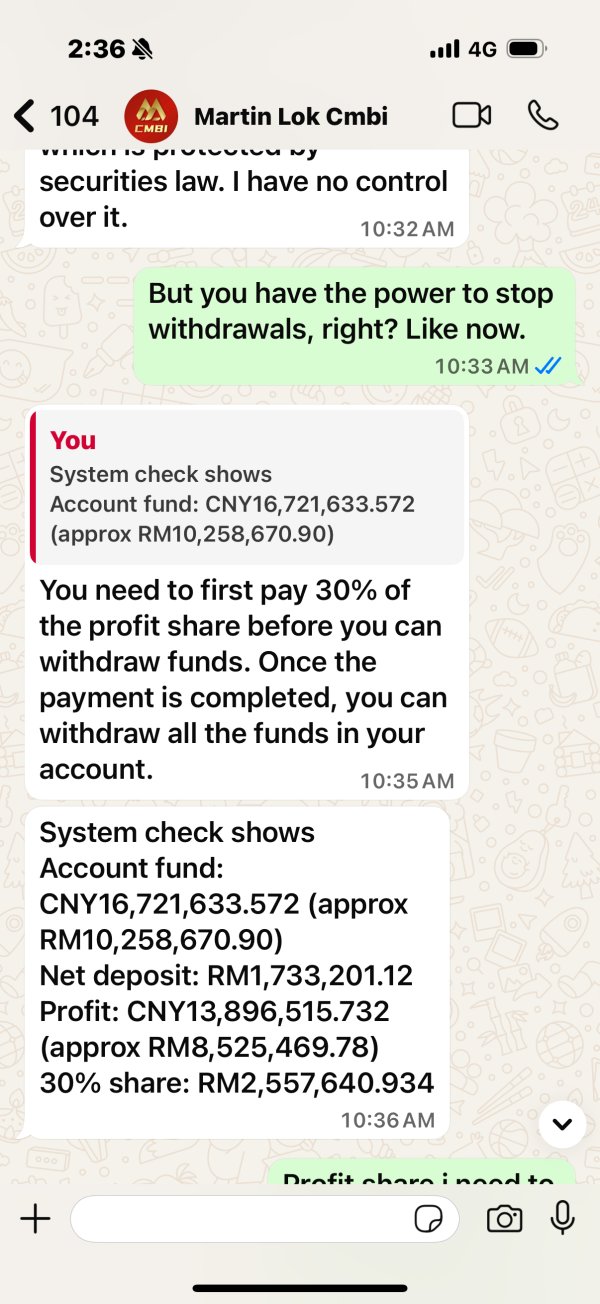

Trust and reliability concerns surrounding CMB companies present mixed signals, with questions about safety and legitimacy creating uncertainty for potential clients. Available information shows ongoing discussions about whether certain CMB operations represent legitimate business practices or potential scam activities, requiring careful evaluation by prospective users.

The regulatory oversight framework for CMB companies is not clearly documented in available sources, limiting our ability to verify compliance with financial services regulations and consumer protection requirements. Legitimate financial services providers typically maintain transparent regulatory relationships and provide clear documentation of their authorization and oversight arrangements.

Company transparency about ownership, operational history, and business practices plays a crucial role in establishing trust with potential clients. The limited availability of comprehensive background information about CMB companies may raise concerns for users seeking detailed research information before engaging financial services.

Industry reputation and track record verification become essential when evaluating financial services providers, particularly given the mixed feedback and safety concerns identified in available sources. Potential clients should conduct thorough research and verification processes before committing funds or personal information to any CMB company.

User Experience Analysis

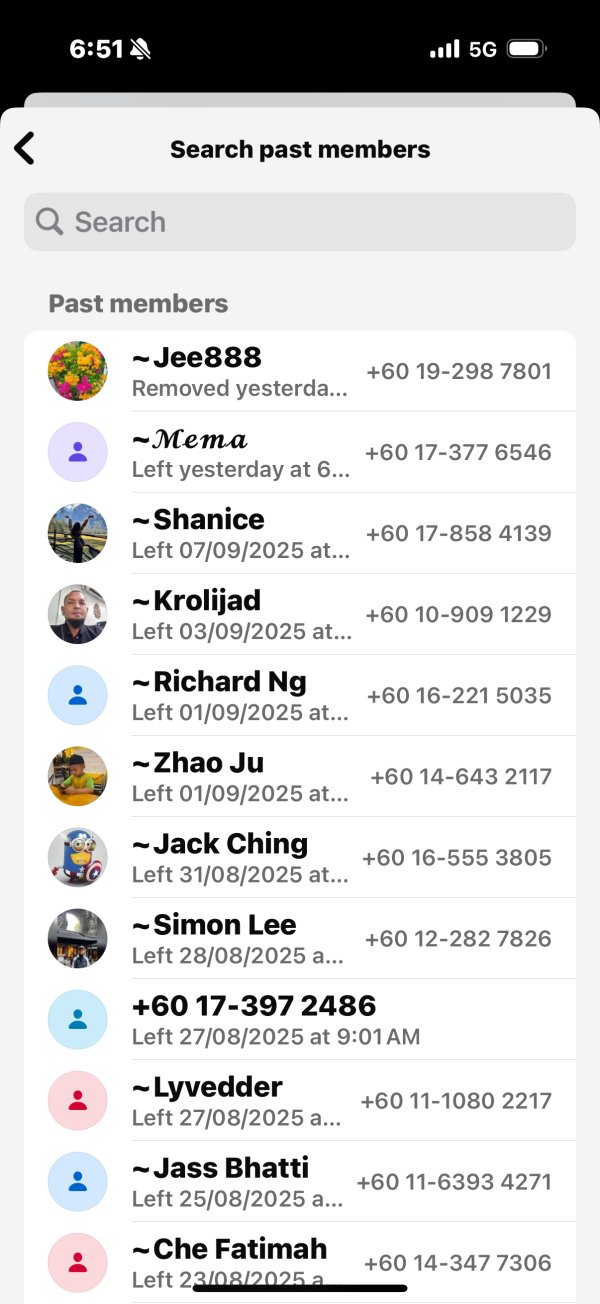

User experience across CMB-branded companies shows dramatic variation, with Coffee Meets Bagel receiving extremely negative ratings of 1 out of 10, indicating widespread user dissatisfaction and operational problems. The reported "numerous technical issues" suggest significant platform reliability and functionality problems that severely impact user satisfaction and service delivery quality.

The stark contrast between positive feedback for CMB Financial Services and negative experiences with Coffee Meets Bagel highlights the importance of distinguishing between different companies operating under similar branding. This difference suggests varying operational standards, technical infrastructure quality, and customer service approaches across different CMB-branded services.

User interface design and platform usability significantly impact client satisfaction and operational efficiency. The negative feedback about technical issues indicates potential problems with system reliability, feature functionality, or user interface design that create frustration and operational difficulties for users.

Registration and account verification processes, fund management capabilities, and overall platform navigation contribute to user experience quality. The extremely low ratings suggest fundamental problems with these core operational elements that require immediate attention and improvement to meet basic user expectations and industry standards.

Conclusion

This comprehensive cmb review reveals significant differences in service quality and user satisfaction across different CMB-branded companies in the financial services sector. CMB Financial Services shows commendable customer service capabilities and receives positive client feedback, but other companies operating under similar branding face substantial criticism and extremely low user satisfaction ratings.

For potential clients seeking quality customer service and reliable financial services support, CMB Financial Services may represent a viable option based on available positive feedback. However, users must exercise caution and conduct thorough verification to ensure they engage with the appropriate company and avoid services associated with negative user experiences.

The primary advantages include strong customer service delivery from CMB Financial Services, while significant disadvantages include the negative user experiences and technical issues reported for Coffee Meets Bagel and ongoing questions about safety and legitimacy across various CMB companies. Prospective users should prioritize direct communication and comprehensive research before engaging any CMB-branded financial services.