Regarding the legitimacy of CMB forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is CMB safe?

Business

Risk Control

Is CMB markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

CMB International Futures Limited

Effective Date:

2006-07-21Email Address of Licensed Institution:

licensing@cmbi.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.cmbi.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環花園道三號冠君大廈46 樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CMB Safe or Scam?

Introduction

CMB, also known as Capital Markets Banc, positions itself as a forex and CFD broker, providing trading services to clients across various regions. Established in Dominica, CMB claims to offer a range of financial products, including forex, commodities, and indices. However, the forex market is notorious for its potential risks, making it crucial for traders to carefully evaluate the brokers they choose to work with. The safety of a broker can significantly influence a trader's overall experience and financial outcomes. This article aims to assess whether CMB is a safe trading option or a potential scam. Our evaluation is based on a thorough investigation of regulatory status, company background, trading conditions, customer feedback, and overall risk factors.

Regulation and Legitimacy

When considering whether CMB is safe, the first aspect to evaluate is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial responsibility. CMB operates without a license from any reputable regulatory authority, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that CMB is not obligated to follow strict guidelines that protect client funds and ensure fair trading practices. Moreover, several regulatory bodies, including the UK's FCA, have issued warnings against CMB for operating without authorization. This lack of oversight can increase the risk of fraud and malpractice, making it essential for traders to exercise caution when dealing with unregulated brokers. Historical compliance issues further indicate that CMB may not prioritize the safety and security of its clients.

Company Background Investigation

CMB's history and ownership structure are critical in assessing its reliability. Founded in Dominica, CMB has positioned itself as a global broker, claiming to operate in over 160 countries. However, the lack of transparency regarding its ownership raises concerns. The company's management team and their professional backgrounds are not well-documented, leaving potential clients without insight into the qualifications of those running the operation.

Furthermore, the absence of clear information about the company's history and development trajectory diminishes trust. Transparency is a key factor in establishing credibility in the financial sector, and CMB's limited disclosure practices may indicate underlying issues. A broker's ability to provide clear and comprehensive information about its operations is crucial for traders looking to ensure their investments are safe.

Trading Conditions Analysis

Understanding the trading conditions offered by CMB is essential in determining whether it is a safe option for traders. CMB presents a variety of account types, but the specifics regarding spreads, commissions, and fees are often vague.

| Fee Type | CMB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips (EUR/USD) | 1-2 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not specified | Varies |

The spread of 3 pips on major currency pairs like EUR/USD is significantly higher than the industry average, which could erode potential profits for traders. Additionally, the lack of clarity regarding commissions and other fees can lead to unexpected costs, further complicating the trading experience. Traders should be aware of any unusual fees that may be imposed, as these can indicate a broker's attempt to capitalize on client transactions rather than providing a fair trading environment.

Client Fund Safety

A critical aspect of evaluating whether CMB is safe involves examining its client fund safety measures. Reputable brokers implement strict protocols to protect client funds, including segregated accounts and investor protection schemes. However, CMB's lack of regulation means there are no guarantees regarding the safety of client funds.

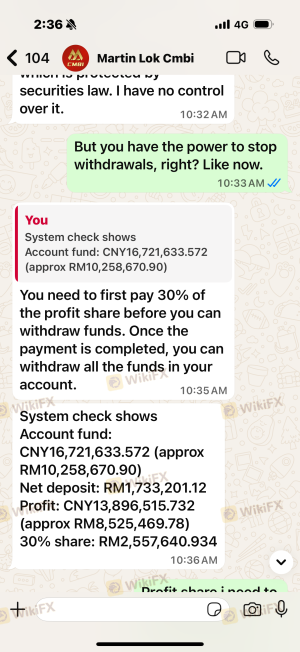

CMB does not provide clear information on how it manages client deposits or whether it offers negative balance protection. This lack of transparency can be alarming, especially for traders who prioritize the security of their investments. Furthermore, there have been reports of withdrawal issues, where clients claim they have faced difficulties in accessing their funds. Such incidents can significantly undermine trust and raise red flags about the broker's operational integrity.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience with CMB. Many users report issues related to fund withdrawals, with complaints indicating that the broker often delays or denies withdrawal requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Misleading Promotions | Medium | Poor |

Common complaints include accounts being blocked without clear explanations and misleading promotional offers that ultimately lead to financial losses. These patterns of dissatisfaction highlight significant concerns regarding CMB's customer service and operational practices. A broker's ability to address client grievances effectively is a critical component of its overall reliability, and CMB appears to fall short in this regard.

Platform and Execution

The trading platform offered by CMB is another vital factor in determining its safety. A reliable platform should provide a seamless trading experience, characterized by stability and efficient order execution. However, there are concerns regarding CMB's platform performance, with reports of slippage and rejected orders.

While the broker claims to offer a user-friendly interface, the absence of detailed information about the platform's capabilities raises questions about its effectiveness. Traders should be cautious of any signs of platform manipulation, as these can indicate deeper issues within the brokerage's operations.

Risk Assessment

Using CMB for trading entails several risks that traders should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of transparency regarding fund management. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

Given these risks, it is advisable for traders to exercise extreme caution when considering CMB as a trading option. Implementing strategies to mitigate these risks, such as diversifying investments and maintaining a cautious approach to fund transfers, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that CMB is not a safe trading option for most investors. The lack of regulation, combined with numerous customer complaints regarding fund withdrawals and transparency issues, raises significant red flags. Traders should be particularly wary of the high spreads and unclear fee structures, which can erode profitability.

For those seeking to engage in forex trading, it is advisable to choose brokers that are regulated by reputable authorities, ensuring a higher level of security and accountability. Alternatives such as brokers regulated by the FCA in the UK or ASIC in Australia may provide a more secure trading environment.

Overall, while CMB may present itself as a legitimate trading platform, the risks associated with using its services far outweigh the potential benefits. Traders should prioritize their safety and opt for brokers with proven track records of reliability and customer satisfaction.

Is CMB a scam, or is it legit?

The latest exposure and evaluation content of CMB brokers.

CMB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CMB latest industry rating score is 4.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.