CFI Group 2025 Review: Everything You Need to Know

Executive Summary

CFI Group operates under CFI Financial Group and offers a mixed deal for forex and CFD traders in 2025. Our detailed CFI Group review shows an overall rating of 2.6 out of 5, which means moderate user satisfaction with only 36% of users recommending it. The broker does offer several good features that certain types of traders might like, despite these average ratings.

CFI Group stands out because it offers zero-pip spreads, no commission fees, and strong negative balance protection. These features work together with a $0 minimum deposit to create an easy trading environment that works well for traders who want to keep costs low. The broker also offers advanced technology like AI-powered trading assistants, copy trading, and complete educational resources.

CFI Group mainly targets beginner and intermediate traders who care more about low-cost trading than premium service features. The broker's competitive prices and educational support make it attractive for people entering the forex market or traders who want to reduce transaction costs. However, potential clients should know that user feedback shows the company needs to improve customer service quality and overall trading satisfaction.

Important Disclaimer

CFI Group operates in multiple countries with different regulatory rules and service offerings. The company follows regulatory compliance, but some products or services they promote may be based on the CFI Group level and might not apply in different countries. This review uses publicly available information and user feedback from various sources, including trusted review platforms and the company's official communications.

Traders should check the specific regulations, available instruments, and terms of service that apply in their country before opening an account. The information in this review reflects general offerings and may not represent the exact conditions available to all potential clients.

Overall Rating Framework

Broker Overview

CFI Financial Group, which owns CFI Group, started in 1998 and has built a strong presence across the Middle East and North Africa (MENA) region over more than 25 years. CFI Group itself launched in 2015 as part of the company's expansion strategy. The organization has positioned itself as MENA's leading online trading broker by using extensive regional experience and regulatory compliance to serve different markets.

The company maintains offices in multiple key financial centers including London, Dubai, Larnaca, Beirut, Amman, and Cairo. This geographic spread lets CFI Group serve clients across different time zones while following regulations in various countries. The Dubai headquarters serves as the main coordination center for the group's activities, showing the company's strong focus on the Middle Eastern market.

CFI Group operates as a full-service online trading provider that offers access to multiple asset classes including stocks, currencies, and commodities. The broker's business model focuses on competitive trading conditions, especially through their zero-pip spread offerings and commission-free trading structure. This CFI Group review shows that the company mainly targets retail traders who want cost-effective market access rather than institutional clients who need advanced execution services.

The regulatory framework supporting CFI Group's operations centers around CySEC (Cyprus Securities and Exchange Commission) oversight, which provides European-standard investor protections. This regulatory foundation supports the company's expansion across multiple markets while maintaining compliance with international trading standards and client fund protection requirements.

Regulatory Jurisdiction: CFI Group operates under CySEC regulation, ensuring compliance with European investor protection standards. This regulatory framework provides segregated client fund protection and negative balance guarantees for retail traders.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options was not detailed in available resources, though the broker maintains a $0 minimum deposit requirement. This makes account opening accessible to traders with limited initial capital.

Minimum Deposit Requirements: The broker sets an extremely low barrier to entry with a $0 minimum deposit requirement. This effectively eliminates initial capital constraints for new traders interested in exploring the platform.

Bonus Programs: Detailed information about specific promotional offers and bonus programs was not explicitly mentioned in available documentation. This suggests traders should ask directly about current promotional offerings.

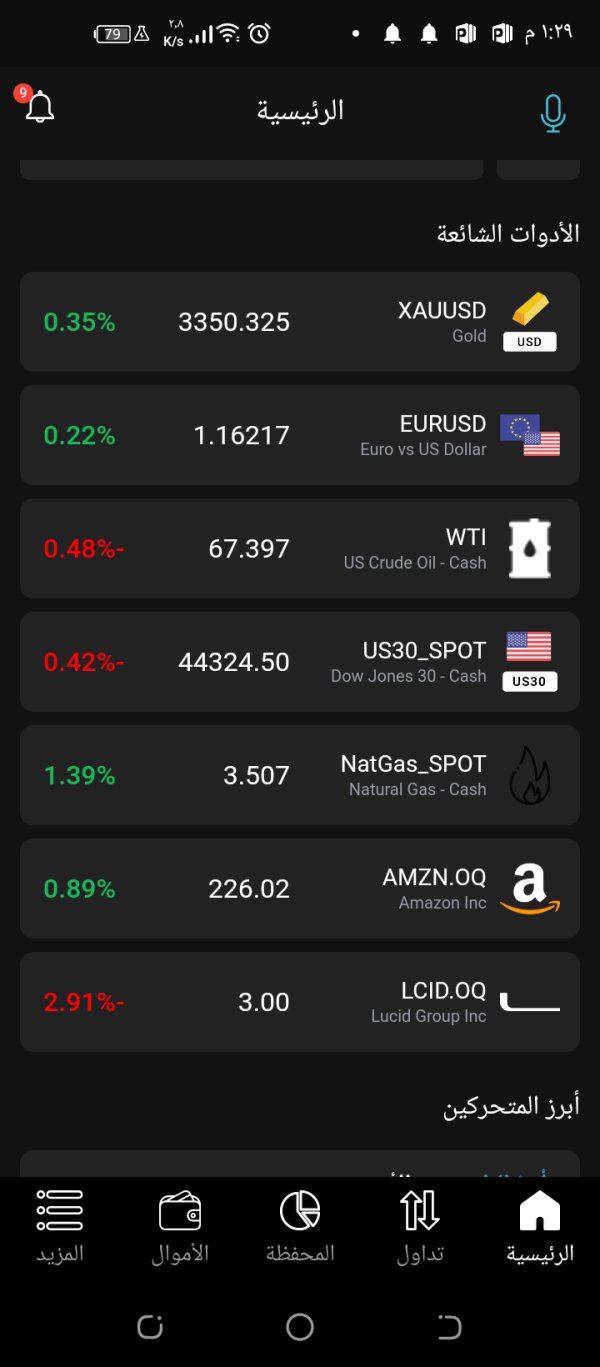

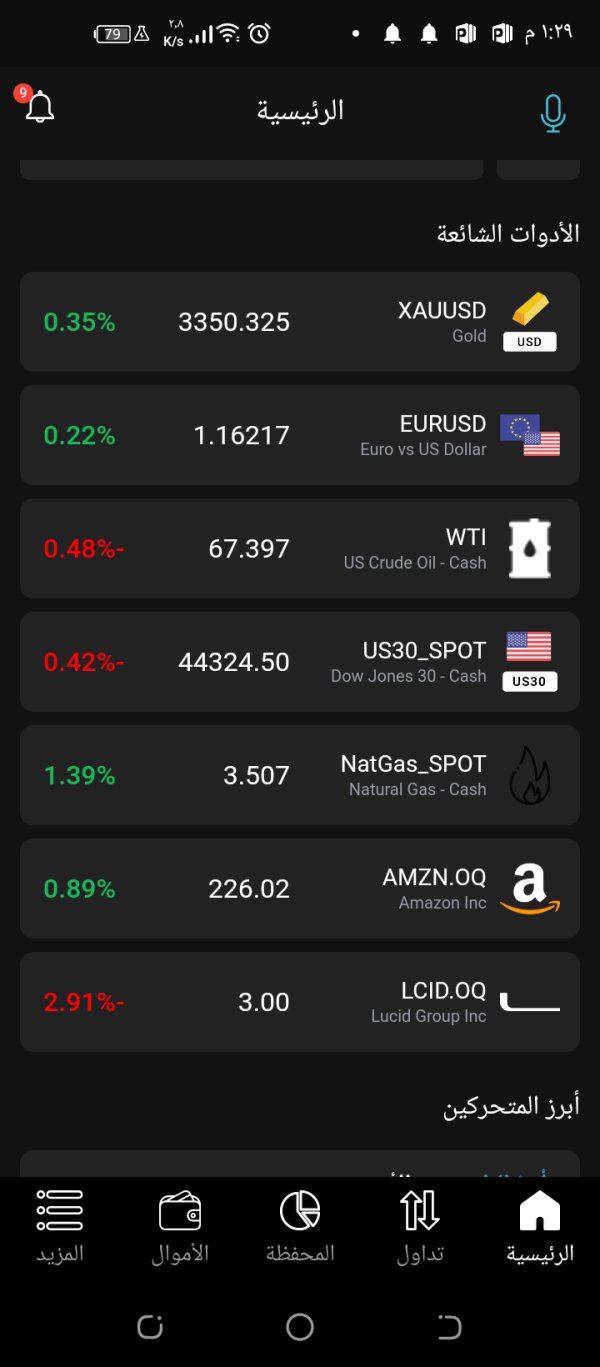

Tradeable Assets: CFI Group provides access to a diverse range of financial instruments including stocks, major and minor currency pairs, and various commodity markets. This enables portfolio diversification across multiple asset classes.

Cost Structure: The broker's competitive advantage lies in its zero-pip spread policy combined with commission-free trading. This significantly reduces transaction costs compared to traditional spread-plus-commission models offered by many competitors.

Leverage Options: Maximum leverage reaches 1:500, providing substantial capital efficiency for experienced traders while maintaining compliance with regulatory requirements for retail client protection. However, high leverage also increases risk significantly.

Platform Selection: Specific trading platform information was not detailed in available resources. This indicates potential clients should verify platform compatibility and features directly with the broker.

Geographic Restrictions: Detailed information about specific geographic limitations was not provided in available documentation. Traders should check if their country is accepted before applying.

Customer Support Languages: Available customer service language options were not specified in the reviewed materials. This comprehensive CFI Group review reveals a broker focused on cost-effective trading solutions, though some operational details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

CFI Group excels in providing accessible and cost-effective account conditions that particularly benefit new and cost-conscious traders. The broker's zero-pip spread policy represents a significant competitive advantage by eliminating one of the primary trading costs that typically affect profitability. Combined with their no-commission fee structure, these conditions create an environment where traders can focus on market movements rather than transaction cost calculations.

The $0 minimum deposit requirement removes traditional barriers to entry and allows traders to begin with any amount they're comfortable risking. This approach makes forex markets accessible to everyone and enables gradual capital building without pressure to meet arbitrary minimum thresholds. User feedback regarding account conditions has been notably positive, with many traders appreciating the straightforward cost structure.

However, while basic account opening appears streamlined, specific information about account types, Islamic account availability, and premium account features remains limited in available documentation. The CFI Group review data suggests that while the fundamental account conditions are competitive, traders seeking specialized account features may need to inquire directly about available options.

Compared to industry standards, CFI Group's account conditions rank favorably, particularly for traders prioritizing cost minimization over premium service features. The combination of zero spreads and no commissions positions the broker competitively against both traditional spread-based and commission-based pricing models.

CFI Group demonstrates strong commitment to trader empowerment through comprehensive technological tools and educational resources. The broker's AI-powered trading assistant represents a forward-thinking approach to retail trading support and potentially helps traders identify opportunities and manage risk more effectively. This technology integration suggests the company's commitment to innovation in retail trading services.

The copy trading functionality enables less experienced traders to benefit from successful traders' strategies and creates a social trading environment that can accelerate learning and potentially improve trading outcomes. This feature particularly benefits the broker's target demographic of beginner and intermediate traders seeking to develop their trading skills.

Educational resources appear comprehensive, though specific details about content quality, delivery methods, and ongoing support were not extensively detailed in available materials. The inclusion of automated trading support indicates recognition of algorithmic trading's growing importance in retail markets.

User feedback regarding tools and resources has been generally positive, with traders appreciating the technological sophistication relative to the broker's cost structure. However, some users have noted that while tools are available, the learning curve for effectively utilizing advanced features can be steep for complete beginners.

Customer Service and Support Analysis (6/10)

Customer service represents an area where CFI Group shows room for improvement based on available user feedback. While specific customer service channels and availability hours were not detailed in reviewed materials, user experiences suggest inconsistent service quality and response times that don't always meet trader expectations.

Response time concerns appear in multiple user reviews, with some clients reporting delays in receiving support for account-related inquiries and technical issues. The professional competency of support staff has received mixed feedback, with some users praising knowledgeable assistance while others report difficulty obtaining satisfactory resolution to their concerns.

The absence of detailed information about multilingual support capabilities may indicate limitations in serving CFI Group's geographically diverse client base. Given the broker's presence across multiple regions, comprehensive language support would be expected to match their international operational scope.

However, the company's regulatory compliance and formal complaint handling procedures through CySEC provide structured recourse for serious service issues. This offers some protection for clients experiencing persistent problems with direct customer service channels.

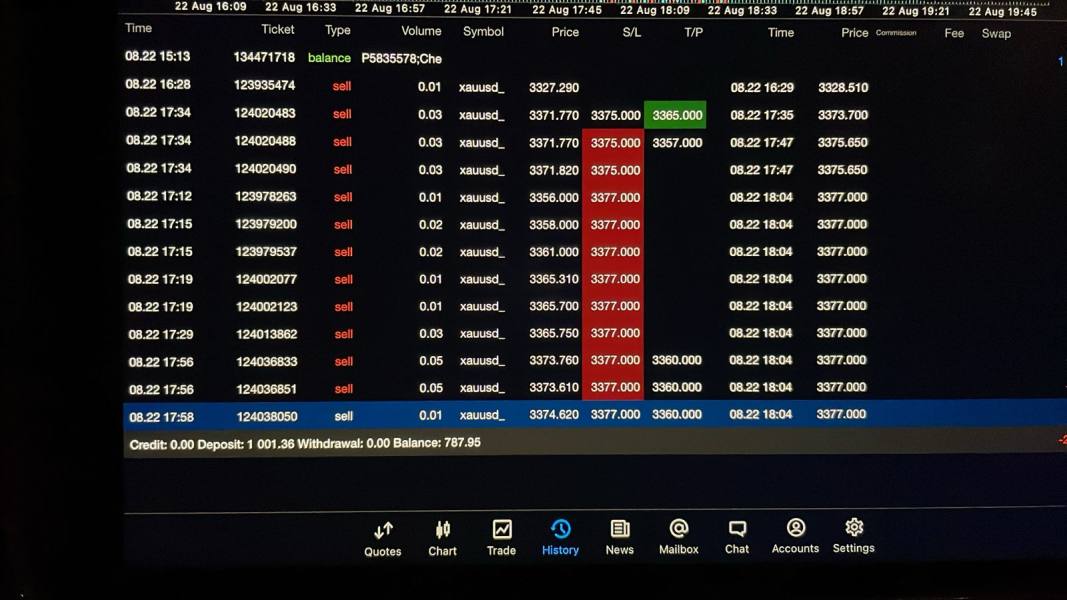

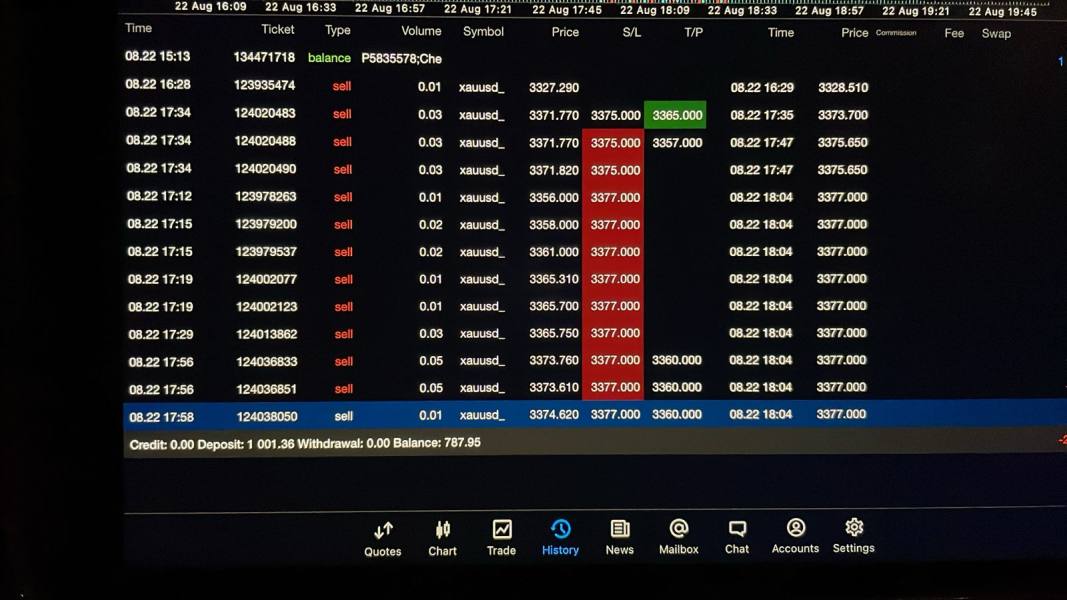

Trading Experience Analysis (6/10)

The trading experience with CFI Group receives moderate ratings based on user feedback, indicating adequate but not exceptional platform performance and execution quality. Platform stability appears generally acceptable, though some users report occasional connectivity issues during high-volatility market periods when reliable execution becomes most critical.

Order execution quality has received mixed reviews, with some traders reporting satisfactory fill rates and pricing while others express concerns about slippage during fast-moving market conditions. The zero-pip spread promise appears generally honored, though the overall trading environment's quality depends on factors beyond spread costs alone.

Platform functionality details remain limited in available documentation, making it difficult to assess the comprehensiveness of charting tools, technical indicators, and order management capabilities. Mobile trading experience information was similarly limited, representing a significant gap given the importance of mobile accessibility in modern trading.

The trading environment's liquidity and execution speed appear adequate for typical retail trading needs, though professional or high-frequency traders may find limitations compared to institutional-grade platforms. This CFI Group review suggests the platform serves its target demographic appropriately while acknowledging room for enhancement in execution consistency.

Trustworthiness Analysis (7/10)

CFI Group demonstrates solid regulatory foundations through CySEC oversight, providing European-standard investor protections including segregated client funds and negative balance protection. These regulatory safeguards represent fundamental trust elements that protect retail traders from broker insolvency and excessive loss scenarios.

The company's 25-year operational history under the CFI Financial Group umbrella provides substantial evidence of business continuity and market presence. This longevity in the competitive financial services sector suggests adequate business management and regulatory compliance over multiple market cycles.

Negative balance protection and segregated account policies align with best practices for retail broker operations, ensuring client funds remain separate from company operational funds. These protections become particularly important during volatile market conditions when rapid price movements might otherwise expose traders to losses exceeding their account balances.

However, specific information about the company's financial transparency, audit procedures, and handling of past regulatory issues was not extensively documented in available materials. While no major negative incidents were identified, comprehensive due diligence would benefit from additional transparency regarding the company's financial stability and regulatory compliance history.

User Experience Analysis (5/10)

Overall user satisfaction with CFI Group appears below industry averages, with the 2.6 rating and 36% recommendation rate indicating significant room for improvement in user experience delivery. Interface design and platform usability have received criticism from users who report that navigation and functionality could be more intuitive.

The account registration and verification process details were not extensively covered in available materials, though user feedback suggests potential streamlining opportunities to improve onboarding experience. First-time users appear to face a learning curve that could be reduced through better interface design and guided tutorials.

Common user complaints center around customer service responsiveness and platform stability during peak trading hours. These issues directly impact user satisfaction and contribute to the below-average recommendation rates observed in review aggregations.

However, the broker's cost advantages and educational resources do attract positive feedback from users who prioritize value over premium service features. The user base appears split between those satisfied with basic, low-cost service and those expecting more comprehensive support and platform sophistication.

Improvement opportunities clearly exist in interface design, customer service training, and platform stability enhancement to better serve the broker's target demographic of cost-conscious retail traders.

Conclusion

CFI Group presents a complex value proposition in the competitive forex brokerage landscape. While the broker excels in providing cost-effective trading conditions through zero-pip spreads and commission-free trading, user satisfaction metrics indicate significant opportunities for service improvement. The 2.6 overall rating and 36% recommendation rate reflect this mixed performance profile.

The broker appears best suited for beginner and intermediate traders who prioritize low transaction costs and are willing to accept moderate service levels in exchange for competitive pricing. Traders seeking premium customer service, advanced platform features, or institutional-grade execution may find better alternatives elsewhere in the market.

CFI Group's primary strengths lie in accessible account conditions, innovative trading tools, and regulatory compliance, while weaknesses center on customer service consistency and overall user experience delivery. Potential clients should carefully weigh these factors against their individual trading priorities and service expectations before making account opening decisions.