AC Capital 2025 Review: Everything You Need to Know

Executive Summary

This ac capital review gives you a complete look at AC Capital Market. AC Capital Market is a CFD broker that works under Vanuatu rules and offers many different types of assets for trading. The broker covers CFD products like forex, precious metals, indices, commodities, and cryptocurrencies. AC Capital Market stands out because it offers high leverage up to 800:1, which makes it very appealing to experienced traders who want bigger market exposure.

AC Capital Market is based in Sydney, Australia. The broker calls itself a one-stop trading service for investors around the world. AC Capital Market mainly serves intermediate and advanced traders who feel comfortable with high-leverage trading and want access to many asset types through one platform. The broker offers good leverage ratios and many trading instruments, but potential clients should know that it only has regulation from Vanuatu. This may not give you the same protection as top-tier regulatory bodies would provide.

The broker targets smart investors who care more about trading flexibility and leverage than premium regulatory oversight. This makes it good for traders who have lots of market experience and strong risk management skills.

Important Disclaimers

Jurisdictional Variations: AC Capital Market's leverage and trading conditions can change a lot based on where you live. The broker doesn't always tie leverage ratios to your specific location, but rules in different regions may create different limits on trading conditions and available services.

Review Methodology: This review uses only public information from official sources and industry databases. The assessment doesn't include user reviews, complaint records, or customer satisfaction surveys because this data wasn't available in the source materials. Potential clients should do more research and get current information directly from the broker before making investment decisions.

Rating Framework

Broker Overview

AC Capital Market works as a CFD broker based in Sydney, Australia. The company offers complete trading services across many financial markets. AC Capital Market calls itself a technology-focused financial services provider that emphasizes innovation in trading platforms and tools. The broker serves global investors who want exposure to forex, precious metals, indices, commodities, and various financial derivatives.

The broker's business model focuses on giving leveraged trading opportunities through CFD products. This lets clients trade on margin across diverse asset classes. This ac capital review finds that the company markets itself as committed to "constantly innovating and upgrading trading technology" while providing "more robust trading platforms and professional trading tools" to its clients.

AC Capital Market operates under Vanuatu regulation. The broker offers trading instruments including spot forex, CFDs on commodities, bonds, metals, energies, stocks, indices, and cryptocurrency CFDs. AC Capital Market's maximum leverage ratio reaches 800:1, which puts it among the higher-leverage providers in the international CFD market. The company targets investors who want flexible trading conditions and access to multiple markets through a single trading account.

Regulatory Status: AC Capital Market operates under Vanuatu jurisdiction. Specific license numbers and regulatory details were not available in the source materials. Vanuatu regulation typically provides less strict oversight compared to major financial centers.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and fees was not detailed in available sources. Potential clients should check current payment options directly with the broker.

Minimum Deposit Requirements: The exact minimum deposit amount was not specified in the available documentation. You need to confirm current account opening requirements directly from the broker.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns were not available in the source materials reviewed for this assessment.

Available Assets: AC Capital Market provides CFD trading across spot forex, precious metals, commodities, bonds, energies, stocks, indices, and cryptocurrencies. This offers substantial market diversity for portfolio construction.

Cost Structure: Specific information about spreads, commissions, overnight financing rates, and other trading costs was not available in the reviewed materials. You need to ask the broker directly about these details.

Leverage Ratios: Maximum leverage reaches 800:1. Actual availability may depend on your jurisdiction and asset class. This ac capital review notes that leverage terms may vary based on regulatory requirements.

Trading Platforms: Platform specifications, including software types, mobile applications, and advanced trading tools, were not detailed in available sources.

Geographic Restrictions: Information about restricted countries or regional limitations was not available in the source materials.

Customer Support Languages: Supported languages for customer service were not specified in the reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions assessment for AC Capital Market faces problems because there isn't enough detailed information in available sources. AC Capital Market offers CFD trading across multiple asset classes, but specific account types, their features, and service levels remain unclear. This ac capital review cannot give you a complete analysis of account opening procedures, verification requirements, or account maintenance policies because of limited source material.

The lack of clear minimum deposit information makes it hard for potential clients to assess accessibility and plan their initial investment. Without detailed account specifications, traders cannot compare AC Capital Market's offerings against industry standards or competitor services effectively. The broker's website talks about technological innovation and professional trading tools, but it lacks transparency about account structure and client categorization.

For intermediate and advanced traders considering AC Capital Market, the limited account information creates a big research challenge. Potential clients must rely on direct communication with the broker to understand available account options, associated benefits, and qualification requirements. This information gap may discourage traders who prefer complete upfront disclosure when evaluating broker services.

AC Capital Market shows strength in asset diversity. The broker offers CFD products across forex, precious metals, indices, commodities, bonds, energies, stocks, and cryptocurrencies. This complete instrument selection gives traders substantial opportunities for portfolio diversification and cross-market strategies. The broker's emphasis on "constantly innovating and upgrading trading technology" suggests ongoing platform development, though specific tool details were not available.

The availability of cryptocurrency CFDs alongside traditional financial instruments puts AC Capital Market in a competitive position in the evolving digital asset space. However, the assessment is limited by lack of information about research resources, market analysis tools, educational materials, and automated trading support. Without details on charting capabilities, technical indicators, or fundamental analysis resources, traders cannot fully evaluate the platform's analytical capabilities.

The broker's Sydney-based operations and focus on fintech innovation suggest potential for advanced trading tools. However, concrete specifications remain undisclosed. For traders who prioritize complete analytical resources and educational support, the limited available information makes thorough evaluation challenging.

Customer Service and Support Analysis (Score: 5/10)

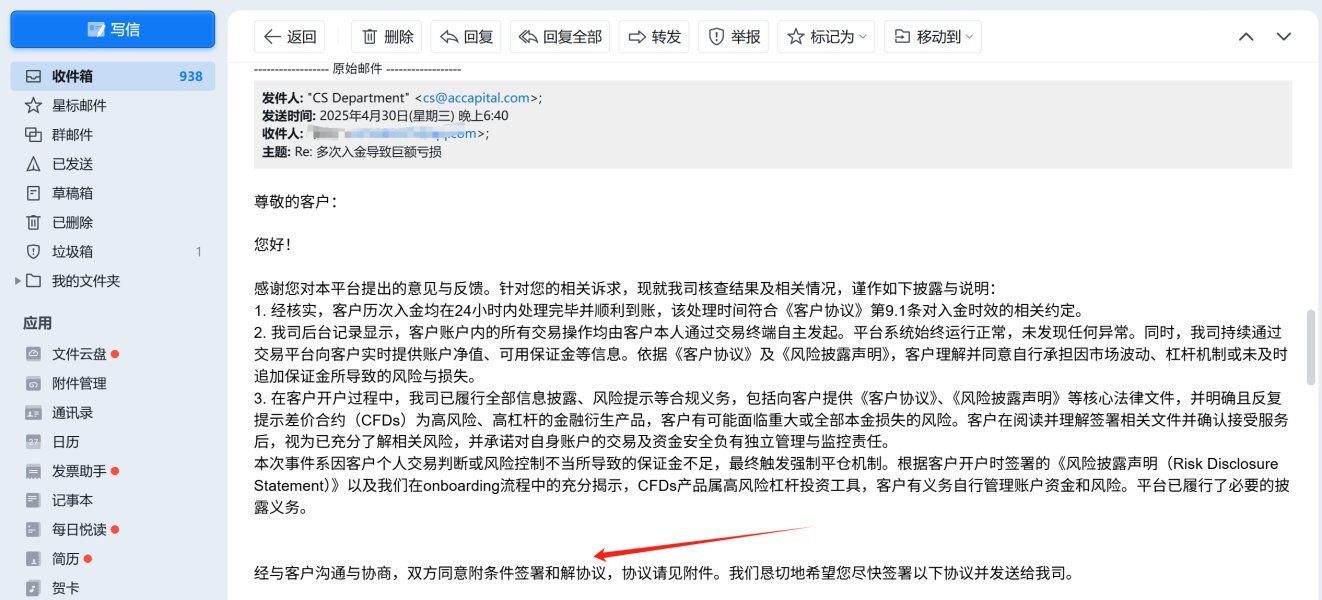

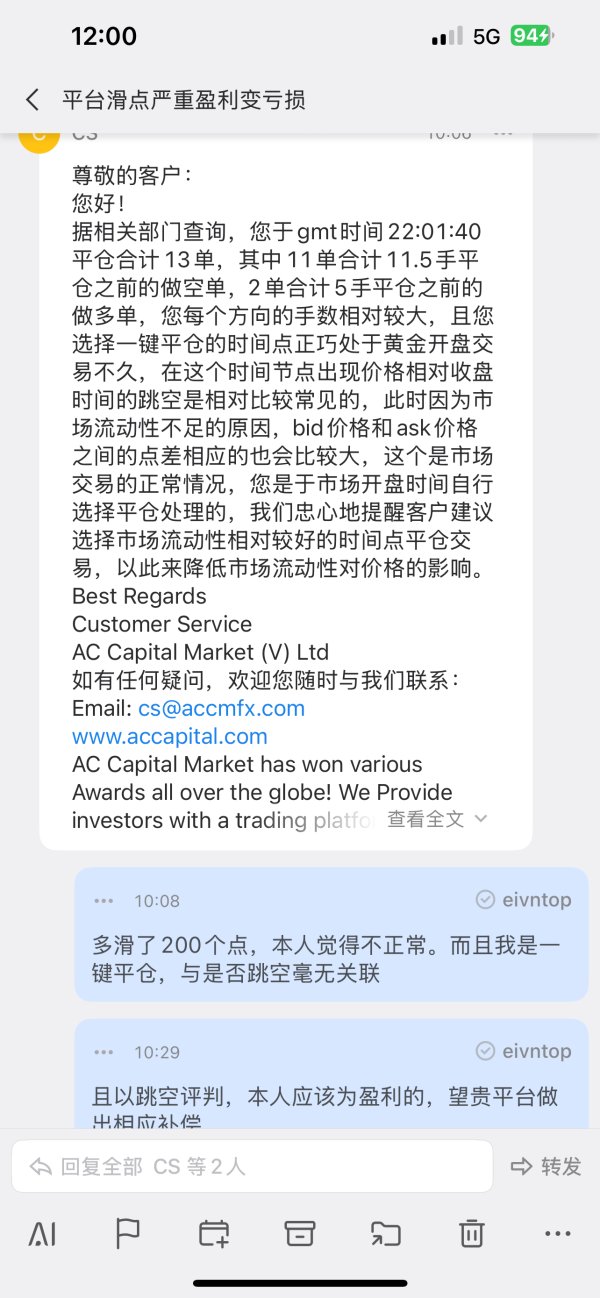

The customer service evaluation for AC Capital Market is significantly limited by the absence of detailed support information in available sources. Critical service elements including contact methods, response times, availability hours, and multilingual support capabilities remain unspecified. This lack of transparency about customer service infrastructure raises concerns about the broker's commitment to client support accessibility.

Without user feedback data or service quality metrics, this assessment cannot determine actual support effectiveness or client satisfaction levels. The absence of information about dedicated account management, technical support channels, or complaint resolution procedures creates uncertainty for potential clients who prioritize responsive customer service.

For traders considering AC Capital Market, the limited customer service information represents a significant evaluation gap. International clients particularly need clarity on language support and regional service availability, information that was not available in the reviewed materials. The broker's global service claims cannot be verified without complete support infrastructure documentation.

Trading Experience Analysis (Score: 6/10)

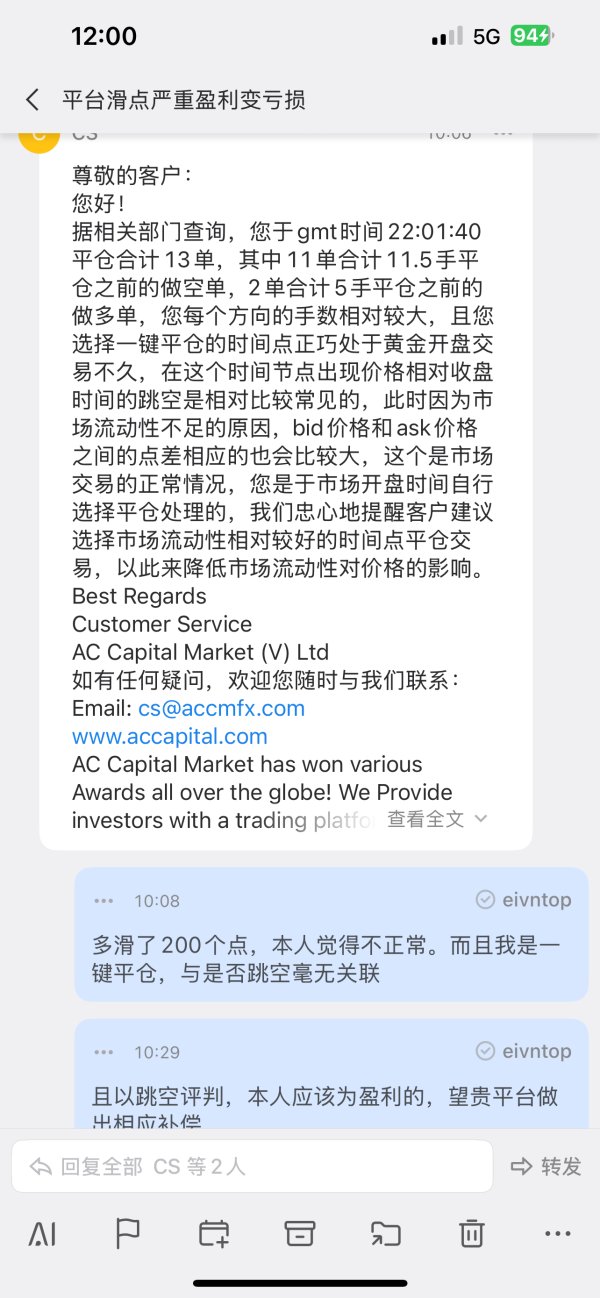

AC Capital Market's trading experience centers on its high leverage offering of up to 800:1. This appeals to experienced traders seeking amplified market exposure. The broker's diverse asset selection across forex, metals, commodities, and cryptocurrencies provides substantial trading opportunities for various market strategies. However, this ac capital review finds limited information about platform stability, execution quality, and trading environment specifics.

The absence of detailed platform information, including software specifications, mobile trading capabilities, and advanced order types, restricts complete trading experience assessment. Without user feedback about execution speeds, slippage rates, or platform reliability, potential clients cannot evaluate actual trading conditions. The broker's emphasis on technological innovation suggests platform development focus, but concrete performance metrics remain unavailable.

For active traders, the combination of high leverage and diverse instruments presents attractive opportunities. However, the lack of detailed trading environment information creates evaluation challenges. Platform demonstrations or trial accounts may be necessary to assess actual trading experience quality before committing to live trading.

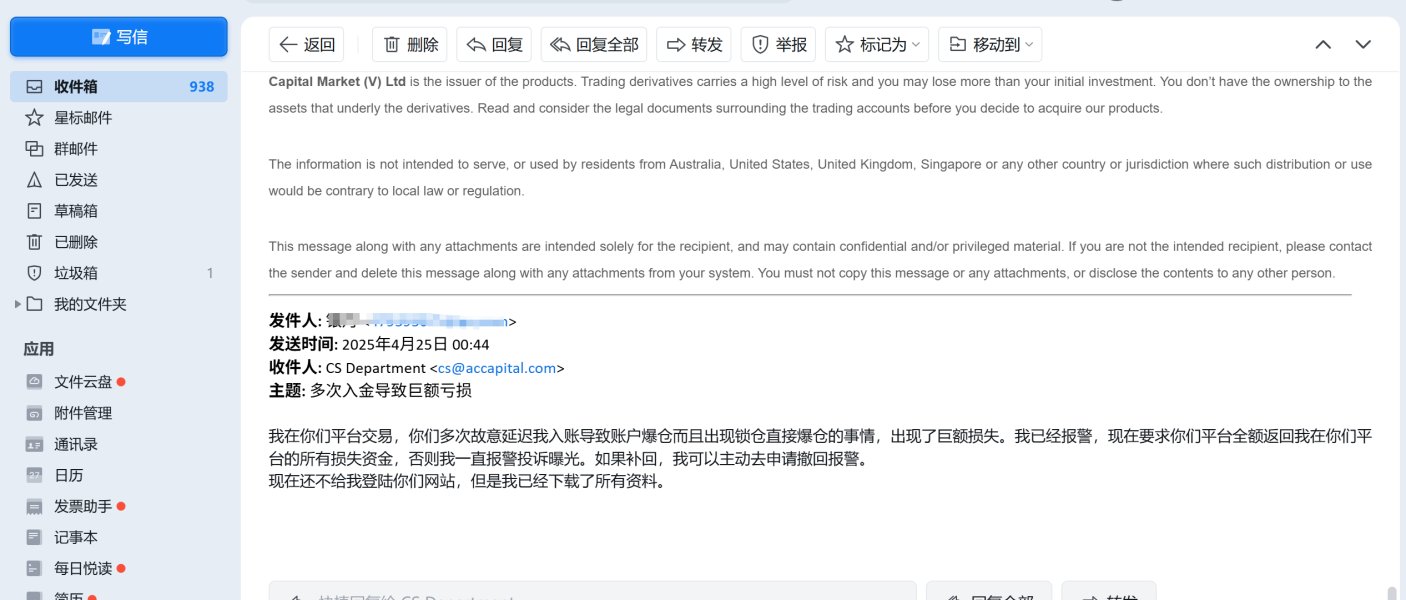

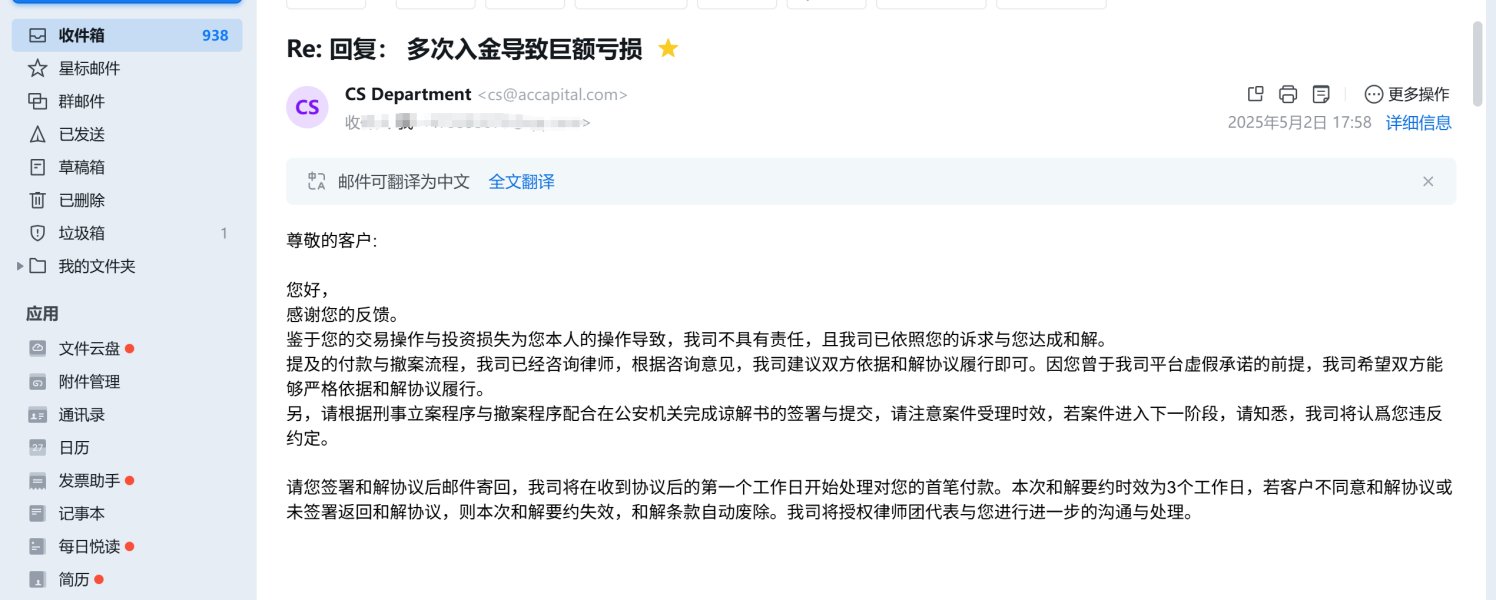

Trust and Safety Analysis (Score: 4/10)

AC Capital Market's trust assessment is significantly impacted by its Vanuatu regulatory status. Vanuatu provides limited investor protection compared to tier-1 financial jurisdictions. While Vanuatu regulation offers some oversight, it lacks the complete safeguards and compensation schemes available through major regulatory bodies like the FCA, ASIC, or CySEC.

The absence of detailed information about client fund segregation, insurance coverage, or financial transparency measures raises additional trust concerns. Without clear disclosure of the broker's financial backing, audit procedures, or regulatory compliance history, potential clients cannot thoroughly assess operational security. The limited regulatory framework may not provide adequate recourse mechanisms in case of disputes or operational issues.

For risk-conscious traders, the combination of offshore regulation and limited transparency information presents significant trust challenges. While the broker operates legally under Vanuatu jurisdiction, the regulatory environment may not meet the protection standards expected by traders accustomed to major financial centers' oversight.

User Experience Analysis (Score: 5/10)

The user experience assessment for AC Capital Market faces substantial limitations because there is no client feedback data and detailed platform information. Without user testimonials, satisfaction surveys, or complaint records, this evaluation cannot determine actual client experience quality or identify common usage patterns.

The broker's focus on fintech innovation and mobile trading applications suggests attention to user interface development. However, specific usability features, registration processes, and platform navigation remain undocumented. The lack of information about account management tools, reporting capabilities, and customer portal functionality creates assessment gaps for potential users.

For traders who prioritize user-friendly platforms and streamlined account management, the limited available information makes experience evaluation challenging. The broker's global service claims and technological emphasis suggest user experience focus, but concrete evidence of interface quality and client satisfaction remains unavailable in reviewed materials.

Conclusion

This ac capital review reveals AC Capital Market as a Vanuatu-regulated CFD broker that offers diverse trading instruments with high leverage up to 800:1. The broker appeals primarily to experienced traders who want flexible trading conditions and access to multiple asset classes including forex, metals, commodities, and cryptocurrencies. However, significant information gaps about account conditions, platform specifics, and customer service infrastructure limit complete evaluation.

AC Capital Market appears suitable for intermediate to advanced traders who feel comfortable with offshore regulation and are willing to conduct additional research. The broker's strengths include diverse instrument selection and competitive leverage offerings, while weaknesses include limited regulatory protection and insufficient transparency about operational details.

Potential clients should carefully consider the trade-offs between high leverage opportunities and reduced regulatory oversight when evaluating AC Capital Market for their trading needs.