Regarding the legitimacy of ACCM forex brokers, it provides ASIC, FSCA, VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is ACCM safe?

Pros

Cons

Is ACCM markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

ACCM PRIME PTY LTD

Effective Date: Change Record

2007-04-18Email Address of Licensed Institution:

jason@accmfx.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.acmarkets.com.au/Expiration Time:

--Address of Licensed Institution:

L 12 465 VICTORIA AVE CHATSWOOD NSW 2067Phone Number of Licensed Institution:

61455455885Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ACCM GLOBAL (PTY) LTD

Effective Date:

2024-09-27Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

34 WHITELEY ROADMELROSE ARCH,JOHANNESBURG2196Phone Number of Licensed Institution:

010 020 2176Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

AC CAPITAL MARKET (V) LTD

Effective Date:

2022-08-26Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AC Capital Market (S) LTD

Effective Date:

--Email Address of Licensed Institution:

cs@accapital.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.accapital-syc.comExpiration Time:

--Address of Licensed Institution:

ABIS Centre (2) Office No. 7, Denis Island, Second Floor, Providence Estate, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373224Licensed Institution Certified Documents:

Is AC Capital Safe or Scam?

Introduction

AC Capital is a forex and CFD broker that has positioned itself as a player in the global trading market since its establishment in 2007. Operating under the name AC Capital Market, the broker offers a range of financial instruments including forex, commodities, indices, and precious metals. As the forex market continues to grow, traders are increasingly drawn to the potential for profit but must also navigate the risks associated with unregulated or poorly regulated brokers. This article aims to provide an objective analysis of AC Capital, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it can be considered a safe trading platform or a potential scam.

To conduct this investigation, we analyzed various online sources, including reviews, regulatory filings, and customer feedback, focusing on key criteria such as regulation, company history, trading conditions, client fund safety, and user experiences. This comprehensive framework allows for a balanced view of AC Capitals credibility in the forex market.

Regulation and Legitimacy

The regulatory status of a broker is crucial for ensuring the safety of client funds and the integrity of trading practices. AC Capital claims to be regulated by two authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). While ASIC is regarded as a tier-1 regulator with strict compliance standards, the VFSC is often criticized for its lenient oversight, classifying it as a tier-3 regulator.

| Regulatory Body | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| ASIC | 308159 | Australia | Verified |

| VFSC | 700597 | Vanuatu | Verified |

The presence of ASIC regulation is a positive aspect of AC Capital, suggesting that it adheres to stringent financial standards. However, the VFSC's reputation raises concerns about the level of investor protection offered. The broker's compliance history indicates no major violations reported under ASIC, but the lack of a robust regulatory framework in Vanuatu can lead to a perception of increased risk for traders.

Company Background Investigation

AC Capital Market was founded in 2007 and has since expanded its operations to cater to a global clientele. The broker operates from two offices, one in Australia and the other in Vanuatu. However, the ownership structure remains somewhat opaque, with limited information available about the individuals behind the company. This lack of transparency can be a red flag for potential investors.

The management team‘s background is not extensively detailed on the broker’s website, which may raise questions regarding their expertise and experience in the financial markets. While AC Capital claims to have a dedicated team of professionals, the absence of publicly available profiles or professional histories can contribute to a lack of trust among potential clients. Overall, while AC Capital has been in operation for several years, the limited transparency regarding its ownership and management can be a cause for concern.

Trading Conditions Analysis

AC Capital offers a minimum deposit requirement of $500, which is relatively high compared to many other brokers in the market. The broker provides access to various trading instruments, including over 40 currency pairs, commodities, and indices. However, the overall fee structure and trading conditions warrant closer scrutiny.

| Fee Type | AC Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 - 0.5 pips | 0.1 - 0.3 pips |

| Commission Model | $6 per lot (ECN) | $3 - $6 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads offered are competitive, especially on the ECN account, the high minimum deposit and the commission structure may deter some traders. Additionally, there are reports of hidden fees and unclear terms regarding bonuses, which can lead to unexpected costs for traders. Therefore, it is essential for potential clients to read the fine print and understand the fee structure before committing to this broker.

Client Fund Safety

The safety of client funds is paramount in forex trading. AC Capital claims to implement several measures to protect client deposits, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the brokers operational funds, which is a standard practice among reputable brokers.

However, the absence of an investor compensation fund, especially under VFSC regulation, poses a risk. In the event of insolvency, clients may not receive adequate compensation for their losses. Historical issues with fund safety have been reported, with some users expressing concerns about difficulties in withdrawing their funds and the overall transparency of the withdrawal process. Thus, while AC Capital has some protective measures in place, the lack of a robust compensation scheme raises questions about the security of client investments.

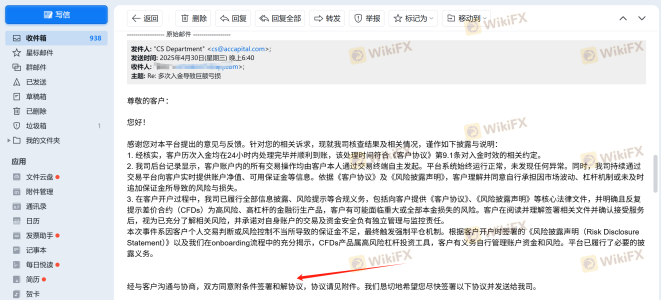

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of AC Capital reveal a mixed bag of experiences. While some traders report satisfactory execution and customer service, others express frustration over withdrawal issues and unresponsive support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Often slow |

| Account Verification | Medium | Inconsistent |

| Customer Support Quality | Medium | Varies |

Common complaints include difficulties in withdrawing funds and lengthy account verification processes. Some users have reported being unable to access their accounts or withdraw their earnings, raising red flags about the broker's operational integrity. For instance, several traders have claimed that their withdrawal requests were delayed or denied without clear explanations, leading to suspicions of potential scams.

Platform and Execution

AC Capital provides access to popular trading platforms such as MetaTrader 5 (MT5) and its proprietary mobile app. User reviews indicate that the platforms are generally stable and user-friendly, allowing for efficient trade execution. However, there are concerns about execution quality, particularly regarding slippage and order rejections during volatile market conditions.

The broker's trading execution speed is reportedly satisfactory, yet some users have noted instances of slippage, particularly during high-impact news events. These issues can significantly affect trading outcomes, especially for scalpers and high-frequency traders. Therefore, potential clients should consider their trading strategies and how they may be impacted by the broker's execution quality.

Risk Assessment

Using AC Capital involves several risks that traders should be aware of. The regulatory environment, potential withdrawal issues, and lack of transparency contribute to an overall risk profile that could be concerning for many traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited protection under VFSC. |

| Withdrawal Risk | Medium | Reports of delays and issues accessing funds. |

| Transparency Risk | Medium | Opaque ownership structure and management background. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions before committing real funds. Furthermore, it is advisable to maintain a cautious approach regarding deposit amounts and to stay informed about the broker's regulatory status and any changes in its operations.

Conclusion and Recommendations

In conclusion, while AC Capital has established itself as a player in the forex market, the evidence suggests that potential traders should exercise caution. The broker is regulated by ASIC, which offers a level of credibility, but its secondary regulation by the VFSC raises concerns about investor protection. Additionally, issues related to withdrawal delays and a lack of transparency regarding the company's ownership and management can be red flags for traders.

For those considering trading with AC Capital, it is recommended to thoroughly research and understand the associated risks, particularly regarding fund withdrawals and regulatory protections. Potential traders may also want to explore alternative brokers with stronger regulatory oversight and better customer feedback, such as those regulated by tier-1 authorities like the FCA or ASIC without the additional offshore layer of regulation.

In summary, while AC Capital is not outright a scam, the combination of regulatory weaknesses and customer complaints warrants a careful approach for any potential investor.

Is ACCM a scam, or is it legit?

The latest exposure and evaluation content of ACCM brokers.

ACCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACCM latest industry rating score is 7.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.