Is Emporium Capital safe?

Business

License

Is Emporium Capital A Scam?

Introduction

Emporium Capital is a forex broker that has positioned itself within the competitive landscape of online trading, offering a range of financial instruments, including forex, CFDs, commodities, and cryptocurrencies. Established in 2017, the broker claims to provide a secure trading environment, appealing to both novice and experienced traders. However, the forex market is rife with scams and unreliable brokers, making it essential for traders to thoroughly evaluate the legitimacy and safety of any trading platform before committing their funds. This article investigates whether Emporium Capital is a trustworthy broker or if it raises red flags for potential scams. The analysis is based on a comprehensive review of regulatory information, company background, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial in determining its legitimacy and the safety of its clients' funds. Emporium Capital claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 358/18. This regulatory status is significant as CySEC is known for its stringent oversight of financial firms, ensuring they adhere to high standards of conduct.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 358/18 | Cyprus | Verified |

Despite its claims, there are reports indicating that Emporium Capital has faced scrutiny from regulatory bodies, including warnings about its operations. CySEC issued a warning that the broker does not belong to an entity authorized to provide investment services, which raises concerns about its regulatory compliance. The quality of regulation is paramount; a broker with a solid regulatory background is less likely to engage in unethical practices, while those lacking proper oversight may pose a higher risk to investors. Thus, the regulatory status of Emporium Capital suggests a need for caution, as its legitimacy is questionable given the conflicting reports on its compliance history.

Company Background Investigation

Emporium Capital was founded in 2017 and operates under the umbrella of Emporium Capital K.A. Ltd, based in Cyprus. The company's ownership structure and management team are essential factors in assessing its reliability. However, detailed information about the ownership and backgrounds of key personnel is scarce, which can be a red flag for potential investors. The lack of transparency regarding the management team raises questions about the company's commitment to accountability and ethical trading practices.

Furthermore, the company's operational history is relatively short, which can be concerning in an industry where trust is built over time. A broker with a longer track record may have proven its reliability through consistent performance and customer satisfaction. The limited information available about Emporium Capital's management and ownership structure suggests a need for further scrutiny before engaging with the broker.

Trading Conditions Analysis

Emporium Capital offers a variety of trading conditions, including competitive spreads and leverage options. However, understanding the overall cost structure is vital for traders to make informed decisions. The broker's fee structure includes spreads, commissions, and overnight interest rates, which can significantly impact profitability.

| Fee Type | Emporium Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 1.5 pips | From 1.0 pips |

| Commission Structure | Variable | Typically fixed |

| Overnight Interest Range | Varies by instrument | Varies widely |

While Emporium Capital advertises competitive spreads starting from 1.5 pips, this is higher than the industry average for major currency pairs, which typically starts from 1.0 pips. Additionally, the variable commission structure may lead to unexpected costs for traders, especially those engaging in high-frequency trading. The lack of clarity regarding overnight interest rates also raises concerns, as traders need to be aware of potential hidden charges that could erode their profits. Overall, the trading conditions at Emporium Capital warrant careful consideration, particularly regarding their fee transparency.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a forex broker. Emporium Capital claims to implement various measures to protect client funds, including segregated accounts and partnerships with tier-1 banks. Segregating client funds ensures that they are kept separate from the broker's operational funds, providing an additional layer of security in the event of financial difficulties.

However, the level of investor protection offered by Emporium Capital remains uncertain. The broker's claims about using tier-1 banks for fund management are not independently verified, and the absence of clear information regarding investor compensation schemes raises concerns. Additionally, any historical issues related to fund security could indicate a pattern of negligence or mismanagement. Therefore, potential clients should exercise caution and conduct thorough due diligence regarding the safety of their funds with Emporium Capital.

Customer Experience and Complaints

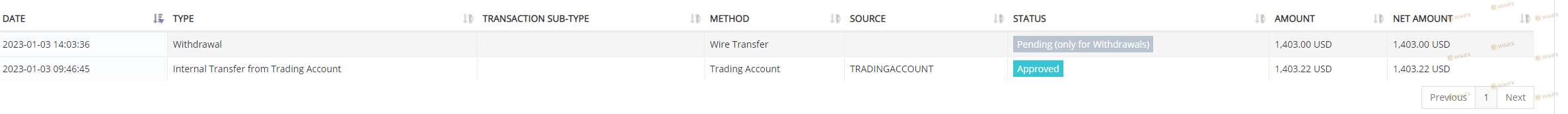

Customer feedback is a crucial aspect of assessing a broker's reputation. Reviews of Emporium Capital reveal a mixed bag of experiences, with some users praising the platform's features while others report significant issues. Common complaints include withdrawal difficulties, lack of responsive customer support, and unexpected fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Mixed reviews |

| Fee Transparency | High | Limited information |

One notable case involved a trader who reported being unable to withdraw funds for weeks, leading to frustration and distrust in the broker. This highlights the importance of reliable customer support and prompt resolution of issues. The overall sentiment among users suggests that while some traders may have had positive experiences, the prevalence of complaints raises red flags about the broker's reliability and customer service quality.

Platform and Trade Execution

The trading platform is a critical component of the trading experience, affecting execution speed and order reliability. Emporium Capital primarily uses the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage rates, is essential to evaluate.

Reports from users indicate mixed experiences with order execution, with some experiencing significant slippage during volatile market conditions. Additionally, concerns about potential platform manipulation have been raised, particularly regarding the handling of stop-loss orders. A reliable trading platform should provide transparent execution without any undue interference from the broker.

Risk Assessment

Using Emporium Capital involves various risks that potential traders should consider. The lack of comprehensive regulatory oversight, combined with customer complaints and concerns about fund safety, contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Questionable regulatory status |

| Fund Safety | Medium | Unclear investor protection measures |

| Customer Support | Medium | Mixed feedback on responsiveness |

To mitigate these risks, traders should engage in thorough research, use risk management strategies, and consider starting with a demo account before committing significant funds.

Conclusion and Recommendations

In conclusion, while Emporium Capital presents itself as a regulated forex broker with a diverse offering, significant concerns regarding its regulatory status, customer feedback, and overall transparency cannot be overlooked. The evidence suggests that traders should exercise caution when considering this broker for their trading activities.

For those seeking a reliable trading environment, it may be prudent to explore alternatives with stronger regulatory backing and a proven track record of customer satisfaction. Brokers with established reputations and transparent fee structures should be prioritized to ensure a safer trading experience. In light of the findings, is Emporium Capital safe? The answer remains uncertain, and potential clients are advised to proceed with caution.

Is Emporium Capital a scam, or is it legit?

The latest exposure and evaluation content of Emporium Capital brokers.

Emporium Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Emporium Capital latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.