Is TRUEFIRE safe?

Pros

Cons

Is Truefire Safe or Scam?

Introduction

Truefire is a forex broker that emerged in the trading landscape in 2018, primarily catering to clients in Australia and China. As with any financial service provider, particularly in the volatile forex market, traders must exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is rife with opportunities, but it also harbors risks, including potential scams. This article aims to assess the legitimacy of Truefire, focusing on its regulatory compliance, company background, trading conditions, customer experience, and overall safety. The evaluation is based on a comprehensive analysis of various online sources, including user reviews and expert assessments.

Regulation and Legitimacy

The regulatory environment is a crucial aspect of evaluating any forex broker, as it directly impacts the safety of traders' funds and the broker's operational integrity. Truefire is reported to be unregulated by any recognized financial authority, which raises significant concerns about its legitimacy. Below is a summary of the regulatory status of Truefire:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Australia | Unverified |

The absence of regulation means that Truefire is not subject to oversight by any financial authority, which typically enforces rules and standards designed to protect investors. Without these protections, traders are at a higher risk of losing their funds in case of mismanagement or fraud. Although Truefire has not been linked to any significant regulatory breaches, the lack of oversight is a red flag for potential investors. In the forex industry, regulated brokers are required to maintain certain standards, including segregating client funds and adhering to fair trading practices. Therefore, it is essential to consider whether Truefire is safe given its unregulated status.

Company Background Investigation

Truefire is operated by Truefire Trade Markets Ltd, which was established in 2018. The company is based in Australia, and while it claims to offer a range of financial products, its operational transparency is questionable. A thorough background check reveals that Truefire has limited information available regarding its ownership structure and management team. The absence of detailed disclosures about the company's leadership raises concerns about accountability and trustworthiness.

The management team‘s experience is a critical factor in assessing the broker's reliability. Unfortunately, there is little publicly available information on the qualifications or backgrounds of those at the helm of Truefire. This lack of transparency can be alarming for potential traders, as it is often indicative of a broker that may not prioritize investor protection. Furthermore, the company’s limited operational history means it has not yet established a long-term track record of compliance or performance in the forex market. Thus, the question remains: Is Truefire safe for traders seeking reliable and trustworthy services?

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Truefire utilizes the MetaTrader 4 (MT4) platform, which is widely recognized for its user-friendly interface and robust trading tools. However, the overall fee structure and trading conditions provided by Truefire are crucial to assess.

Truefire's fee structure appears to lack transparency, which can be concerning for traders. Below is a comparison of Truefire's trading costs against industry averages:

| Fee Type | Truefire | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not specified | Variable |

| Overnight Interest Range | Not specified | 0.5% - 1.5% |

The lack of disclosed fees and commissions can lead to unexpected costs for traders, which may significantly affect their profitability. Furthermore, the absence of clear information about overnight interest rates raises concerns about potential hidden charges. Traders should be wary of any broker that does not provide comprehensive details about its fee structure, as this can lead to financial surprises down the line. In this context, one must ask: Is Truefire safe in terms of its trading conditions?

Client Funds Security

The safety of client funds is paramount when considering a forex broker. Truefire has not provided sufficient information about its security measures for client deposits. A reliable broker typically ensures that client funds are kept in segregated accounts, offering a layer of protection in case of financial difficulties. However, the absence of such disclosures from Truefire raises questions about its commitment to safeguarding client assets.

Additionally, it is crucial to evaluate whether Truefire offers investor protection schemes, which can provide some level of assurance to traders in the event of insolvency. Unfortunately, Truefire has not been found to offer any such protections, which further heightens the risk associated with trading through this broker. Historical issues related to fund security have also emerged, with reports of complaints regarding fund withdrawals and alleged fraud. Given these factors, potential clients must critically assess whether Truefire is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Truefire has received mixed reviews from users, with several complaints highlighting issues related to withdrawal processes and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresponsive |

| Induced Fraud Claims | High | No resolution |

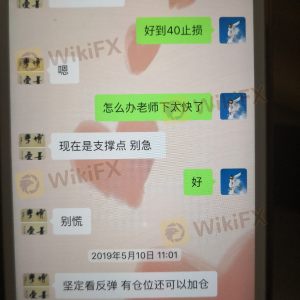

One notable case involved allegations of fraud, where users reported being misled about the broker's services and faced difficulties in reclaiming their funds. Such complaints underscore the importance of evaluating a broker's customer service capabilities and responsiveness to issues. The overall sentiment among users suggests a lack of trust in Truefire's operational practices. Therefore, potential traders should carefully consider whether Truefire is safe based on the experiences of others.

Platform and Execution

The trading platform's performance is another critical aspect of evaluating a broker. Truefire offers the widely used MT4 platform, which is known for its reliability and extensive features. However, users have reported issues with platform stability, order execution quality, and instances of slippage.

Traders expect timely execution of their orders, particularly in the fast-paced forex market. Reports of rejected orders and poor execution can significantly impact a trader's strategy and profitability. Furthermore, any signs of platform manipulation or unfair practices must be scrutinized, as they can indicate deeper issues within the broker's operational integrity. Given these concerns, it is essential to question whether Truefire is safe regarding its trading platform and execution quality.

Risk Assessment

Engaging with any forex broker entails inherent risks, and Truefire is no exception. Below is a summary of the key risk areas associated with trading with Truefire:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated by any authority |

| Financial Risk | High | Lack of fund protection |

| Customer Service Risk | Medium | Poor responsiveness |

| Platform Risk | Medium | Stability and execution issues |

To mitigate these risks, traders should consider implementing strict risk management strategies, such as setting stop-loss orders and limiting their exposure to any single broker. Additionally, it may be prudent to diversify trading accounts across multiple regulated brokers to enhance overall safety. The overarching question remains: Is Truefire safe in light of these identified risks?

Conclusion and Recommendations

In conclusion, the analysis of Truefire reveals several concerning factors that potential traders should carefully consider. The absence of regulation, coupled with a lack of transparency regarding fees, client fund security, and customer service, raises significant red flags. While Truefire may offer a functional trading platform, the overall risk profile suggests that traders should exercise caution.

For those seeking reliable and trustworthy trading environments, it may be advisable to consider alternative brokers that are regulated and have established a positive reputation in the industry. Some recommended alternatives include brokers like IG, OANDA, and Forex.com, which are known for their regulatory compliance and robust customer support. Ultimately, the decision to engage with Truefire should be made with a clear understanding of the associated risks and a critical evaluation of whether Truefire is safe for trading activities.

Is TRUEFIRE a scam, or is it legit?

The latest exposure and evaluation content of TRUEFIRE brokers.

TRUEFIRE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRUEFIRE latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.