Emporium Capital 2025 Review: Everything You Need to Know

Executive Summary

Emporium Capital presents itself as a CySEC-regulated forex and CFD broker operating from Cyprus. The company offers traders access to the MetaTrader 5 platform and multiple asset classes through its comprehensive trading environment. This emporium capital review provides a neutral assessment of the broker, acknowledging its regulatory compliance while noting the limited availability of specific trading condition information that potential clients may require. The broker utilizes a genuine STP execution model and provides trading opportunities across forex, CFDs, commodities, indices, and cryptocurrencies.

Based on available information, Emporium Capital appears positioned for investors seeking multi-asset trading through an STP execution framework. However, the lack of detailed trading conditions and limited user feedback data requires potential clients to conduct additional due diligence before making investment decisions. The broker's regulatory status under CySEC provides a foundation of legitimacy. Comprehensive evaluation remains challenging due to information gaps regarding account specifics, fee structures, and customer service quality metrics.

Important Notice

Due to Emporium Capital's registration in Cyprus and CySEC regulation, the broker may be subject to different regional legal requirements and restrictions. These regulatory frameworks could affect service availability across various jurisdictions where the broker operates. According to available regulatory information, between 74-89% of retail investor accounts lose money when trading CFDs with this provider. This statistic highlights the inherent risks associated with leveraged trading products that all potential clients should carefully consider.

This review is based on available public information, regulatory filings, and limited user feedback data. Potential clients should verify current terms, conditions, and service offerings directly with the broker before making any trading decisions or financial commitments.

Rating Framework

Broker Overview

Emporium Capital K.A. Limited operates as an online financial services provider headquartered in Nicosia, Cyprus. The company focuses on multi-asset trading opportunities for retail and institutional clients seeking diverse investment options. The company positions itself as a prime STP broker, emphasizing its commitment to transparent and reliable brokerage services through advanced technology infrastructure and strategic industry partnerships that enhance trading execution quality.

According to company information, Emporium Capital has established a secure trading network designed to facilitate efficient order execution. The network maintains regulatory compliance standards while providing competitive trading conditions for its client base. The firm operates as a Cypriot Investment Firm under CySEC licensing, providing both Forex trading and Contract for Difference trading services across various financial instruments. These instruments include stocks and equity indices that appeal to diverse trading strategies.

The broker's business model centers on the STP execution framework, which theoretically allows for direct market access without dealing desk intervention. This emporium capital review notes that while the STP model can offer advantages in terms of execution transparency, the actual implementation quality depends on several factors. The broker's liquidity partnerships and technology infrastructure determine execution quality, though details of these arrangements remain limited in available public information.

Regulatory Status: Emporium Capital operates under CySEC regulation, providing a European regulatory framework for client protection and operational standards.

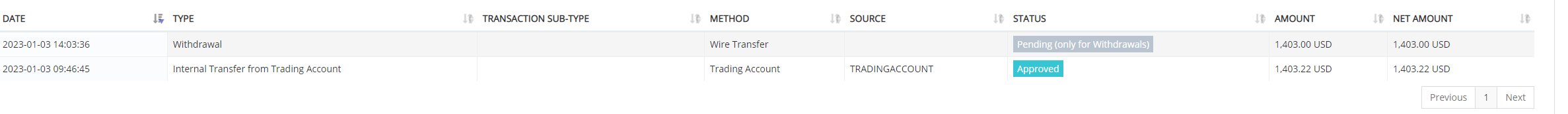

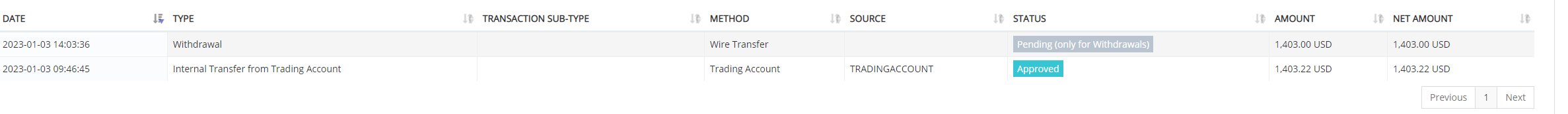

Deposit and Withdrawal Methods: Specific information regarding available payment methods, processing times, and associated fees is not detailed in available sources. Potential clients should verify these details directly with the broker before opening accounts.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in available documentation. These requirements should be confirmed directly with the broker to ensure accurate planning.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not detailed in accessible sources.

Tradable Assets: The broker provides access to multiple asset classes including forex currency pairs, CFDs on stocks, commodities, indices, and cryptocurrency instruments. This selection offers diversified trading opportunities for various investment strategies.

Cost Structure: While the broker mentions competitive pricing, specific details regarding spreads, commissions, overnight financing rates, and other trading costs require further verification. Potential clients should request detailed fee schedules through direct inquiry.

Leverage Ratios: The broker advertises competitive leverage options, though specific maximum leverage ratios for different asset classes are not explicitly stated. These ratios may vary based on regulatory requirements and account types.

Platform Options: Emporium Capital provides the MetaTrader 5 trading platform, offering comprehensive charting tools, automated trading capabilities, and market analysis features.

Regional Restrictions: Specific geographical limitations or restricted jurisdictions are not clearly outlined in available information.

Customer Support Languages: The range of supported languages for customer service communication is not specified in accessible sources.

This emporium capital review emphasizes the need for potential clients to verify these details directly with the broker. Direct verification ensures accurate and current information for informed decision-making.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The evaluation of Emporium Capital's account conditions reveals significant information gaps that impact the overall assessment. Available sources do not provide clear details regarding the variety of account types offered, their specific features, or the associated requirements for each tier of service. This lack of transparency makes it challenging for potential clients to understand what options are available. It also prevents them from determining which account type might best suit their individual trading needs and investment goals.

Minimum deposit requirements, a crucial factor for many traders, are not specified in accessible documentation. This omission prevents effective comparison with industry standards and competitor offerings in the forex and CFD trading space. Additionally, the absence of detailed information about account opening procedures, required documentation, and verification timelines creates uncertainty for prospective clients who want to plan their onboarding process.

The broker does not clearly outline special account features such as Islamic accounts for clients requiring Sharia-compliant trading conditions. VIP account benefits and institutional account services are also not detailed in available materials. According to available user ratings showing a 3.0 satisfaction level, there appears to be room for improvement in account condition transparency and communication with existing and potential clients.

This emporium capital review notes that while the broker operates under CySEC regulation, which provides certain standardized protections, the lack of readily available account condition details may deter potential clients. Many traders prefer comprehensive information before making financial commitments to any brokerage platform.

Emporium Capital's offering of the MetaTrader 5 platform represents a significant strength in their service portfolio. MT5 provides traders with advanced charting capabilities, comprehensive technical analysis tools, automated trading through Expert Advisors, and multi-asset trading functionality that appeals to diverse trading styles. The platform's reputation for stability and feature richness contributes positively to the overall trading environment that clients can expect.

The broker's multi-asset approach, covering forex, CFDs, commodities, indices, and cryptocurrencies, offers traders diversification opportunities within a single platform. This breadth of available instruments can appeal to traders seeking to implement varied strategies across different market sectors and economic conditions. The integration of multiple asset classes allows for portfolio diversification and risk management strategies.

However, available information does not detail additional research and analysis resources that might be provided to clients beyond the standard MT5 features. Educational materials, market commentary, economic calendars, and trading webinars are not specifically mentioned in accessible sources that could enhance the trading experience. The absence of information about proprietary trading tools, market analysis, or educational support programs limits the overall assessment of the broker's resource offerings.

While the MT5 platform provides substantial built-in functionality, the lack of clarity regarding additional broker-provided resources and support materials prevents a higher rating in this category. Many competitive brokers offer supplementary tools and educational resources that enhance the overall value proposition.

Customer Service and Support Analysis (5/10)

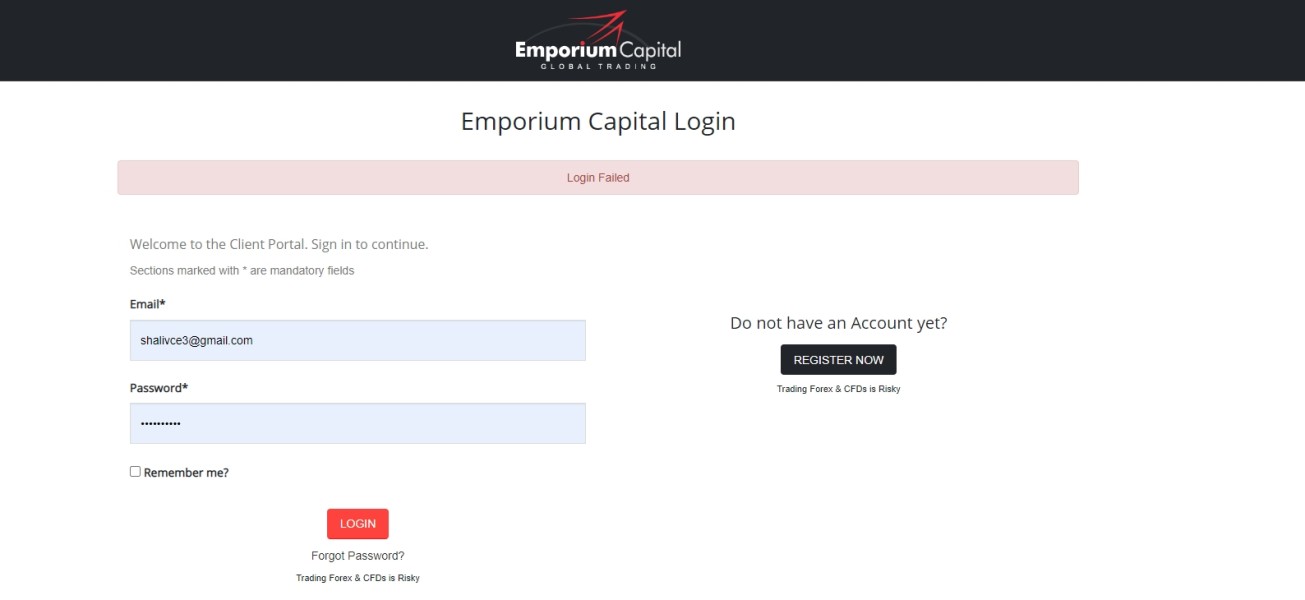

The assessment of Emporium Capital's customer service capabilities is hampered by limited available information regarding support channels, response times, and service quality metrics. Available sources do not specify the methods through which clients can contact support, whether through phone, email, live chat, or other communication channels that modern traders expect. This lack of clarity creates uncertainty about the accessibility of support when clients encounter issues or have questions.

Operating hours for customer support, crucial for international traders across different time zones, are not clearly outlined in accessible documentation. The availability of multilingual support, important for a Cyprus-based broker serving international clients, remains unspecified in available materials that could help potential clients understand service accessibility. Global trading requires round-the-clock support capabilities that many traders consider essential.

Response time expectations and service level agreements are not detailed in public information, making it difficult to assess the broker's commitment to timely issue resolution. The user rating of 3.0 suggests that customer satisfaction levels may be moderate, potentially indicating areas where service improvements could be beneficial for client retention. Without specific user testimonials, complaint resolution case studies, or detailed service protocols, this emporium capital review cannot provide a comprehensive evaluation of the customer support experience.

Potential clients should inquire directly about support availability and service standards before committing to the platform. Understanding support capabilities is crucial for traders who may need assistance during volatile market conditions.

Trading Experience Analysis (6/10)

Emporium Capital's implementation of the STP execution model theoretically provides advantages in terms of order processing transparency and potential price improvement opportunities. STP execution can offer faster order processing and reduced conflicts of interest compared to dealing desk models, though the actual quality depends on several operational factors. The broker's liquidity provider relationships and technology infrastructure determine the effectiveness of this execution model.

The MetaTrader 5 platform contributes positively to the trading experience through its comprehensive functionality, including advanced order types, one-click trading, and extensive charting capabilities. The platform's support for automated trading strategies through Expert Advisors provides flexibility for both manual and algorithmic traders seeking diverse approaches. This versatility appeals to traders with varying experience levels and strategy preferences.

However, specific performance metrics such as average execution speeds, slippage statistics, or uptime reliability data are not available in accessible sources. Mobile trading experience details, crucial for modern traders requiring on-the-go access, are not specifically addressed in available information that could help assess platform accessibility. The lack of detailed user feedback regarding actual trading conditions, platform stability during high-volatility periods, or execution quality during different market sessions limits comprehensive assessment.

This emporium capital review notes that while the technical foundation appears solid, verification of real-world performance requires additional investigation. Traders should consider requesting demo accounts or trial periods to evaluate execution quality before committing significant capital.

Trust and Security Analysis (6/10)

Emporium Capital's regulation under CySEC provides a foundational level of trust and regulatory oversight that meets European standards. CySEC regulation includes requirements for client fund segregation, capital adequacy, and operational standards that contribute to overall security and client protection. The European regulatory framework offers certain protections and recourse mechanisms for clients who may encounter disputes or issues.

However, available information does not detail additional security measures that the broker may have implemented beyond regulatory requirements. Information about client fund protection schemes, insurance coverage, negative balance protection, or additional safeguards is not readily accessible in public sources that could enhance client confidence. The warning that 74-89% of retail investor accounts lose money when trading CFDs highlights the inherent risks of leveraged trading products. This statistic emphasizes the importance of risk management and the volatile nature of CFD trading.

Company transparency regarding ownership structure, financial reporting, or industry certifications is not comprehensively detailed in available materials. Additional transparency measures could enhance trust and provide clients with better understanding of the company's financial stability and operational practices. Without detailed information about security protocols, fund protection measures, or transparency initiatives, the trust assessment relies primarily on regulatory status.

This reliance on regulatory compliance rather than comprehensive security evaluation limits the overall assessment in this category. Potential clients should inquire about additional security measures and fund protection policies.

User Experience Analysis (5/10)

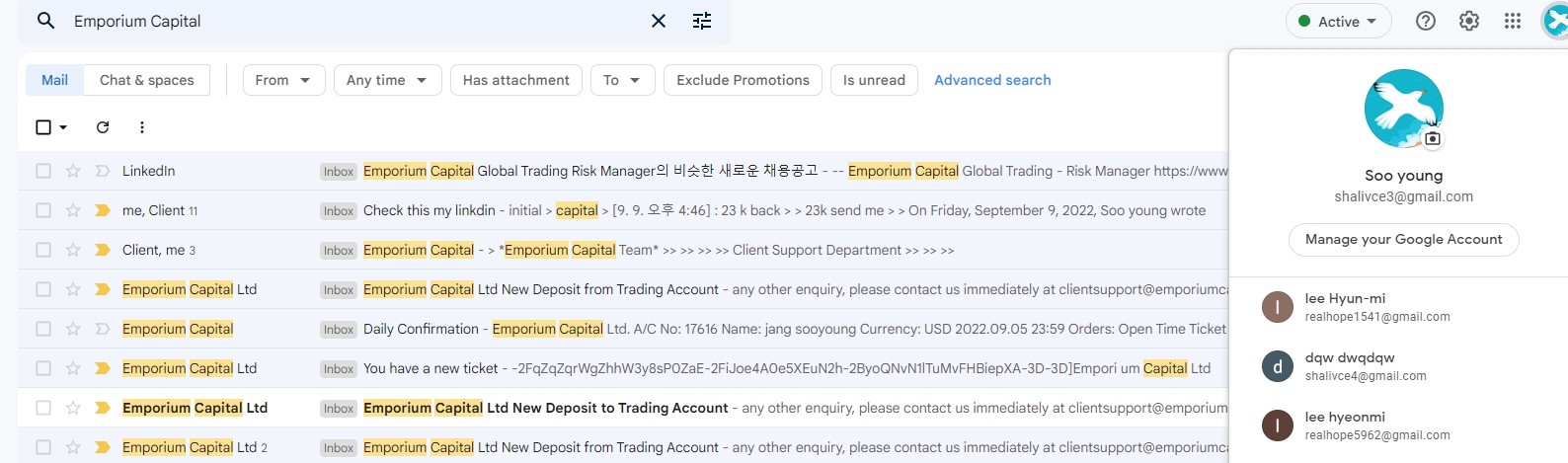

The available user rating of 3.0 indicates moderate satisfaction levels among Emporium Capital clients, suggesting that while the service is functional, there may be areas requiring improvement. This rating reflects the overall user experience across various aspects of the broker's services, from account opening to ongoing support. Moderate satisfaction levels suggest that the broker meets basic expectations but may lack exceptional service elements.

Specific feedback regarding website usability, account registration processes, or platform navigation is not detailed in accessible sources. The user onboarding experience, including account verification procedures and initial setup processes, lacks comprehensive documentation in available materials that could help potential clients understand what to expect. Clear onboarding processes are important for client satisfaction and retention.

Fund management experience, including deposit and withdrawal procedures, processing times, and associated fees, requires direct verification as this information is not clearly outlined in public sources. The absence of detailed user testimonials or case studies limits understanding of common user experiences or satisfaction drivers that could inform potential clients. Interface design quality, both for web-based access and mobile applications, is not specifically addressed in available information.

This emporium capital review notes that while the MT5 platform provides a solid trading foundation, the overall user experience encompasses broader service aspects. These aspects require further evaluation to provide a complete picture of client satisfaction and service quality.

Conclusion

This comprehensive emporium capital review presents a mixed assessment of the broker's offerings and service capabilities. While Emporium Capital demonstrates regulatory compliance through CySEC oversight and provides access to the robust MetaTrader 5 platform with multiple asset classes, significant information gaps limit the ability to provide a fully comprehensive evaluation. These gaps require potential clients to conduct additional research and verification before making investment decisions.

The broker appears most suitable for investors specifically seeking STP execution model trading with multi-asset capabilities. It may particularly appeal to those comfortable with conducting additional due diligence to verify specific trading conditions and service details before committing capital. The regulatory foundation provides legitimacy and basic client protections, though potential clients should verify current terms and conditions directly with the broker.

Primary advantages include regulatory compliance and diverse asset selection, while notable limitations involve the lack of detailed trading condition information and limited user feedback availability. Prospective clients should conduct thorough verification of account conditions, fees, and service levels before committing to the platform. Direct communication with the broker can help clarify important details that are not readily available in public sources.