DE NOVO Review 1

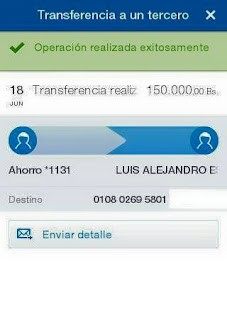

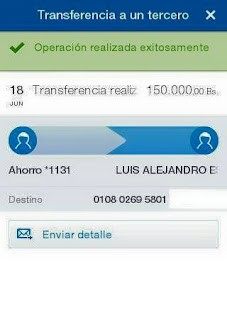

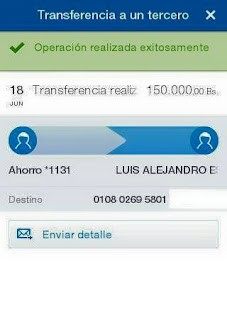

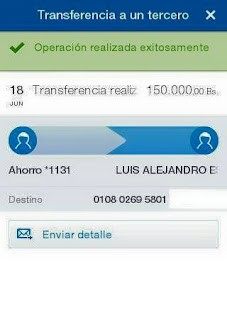

I deposited $150 under the guidance of the agent. After that, he blocked me and disappeared.

DE NOVO Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I deposited $150 under the guidance of the agent. After that, he blocked me and disappeared.

This de novo review presents a comprehensive analysis of De Novo Capital LLC. The investment management firm operates from Granite Bay, California. Based on available information, the company distinguishes itself through its leadership by a former attorney who emphasizes independent research, discipline, and common sense as core investment principles. However, our evaluation reveals significant information gaps regarding traditional forex trading services, regulatory oversight, and specific trading conditions that are typically expected from retail forex brokers.

The firm appears to target investors who value independent research methodologies and disciplined investment approaches rather than conventional retail forex traders. While the company's professional background and California-based operations suggest legitimacy, the absence of detailed trading specifications, user feedback, and regulatory information in available materials makes it challenging to provide a definitive assessment for forex trading purposes. This de novo review aims to present all available information while highlighting areas where additional due diligence would be necessary for potential clients.

The information presented in this review is based on limited publicly available data about De Novo Capital LLC. No specific regulatory information was found in the source materials, which may impact user confidence, particularly for international clients seeking regulated forex trading services. This evaluation methodology relies heavily on company-provided information and lacks comprehensive user reviews or independent market feedback that would typically inform a complete broker assessment.

Potential users should note that the absence of detailed regulatory disclosures in available materials may indicate different operational structures across various jurisdictions. Independent verification of licensing and regulatory status is strongly recommended before engaging with any investment services.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | No specific account types, minimum deposits, or trading conditions mentioned in available materials |

| Tools and Resources | N/A | Trading platforms, analytical tools, and educational resources not detailed in source information |

| Customer Service | N/A | Support channels, response times, and service quality metrics not available |

| Trading Experience | N/A | Platform performance, execution quality, and user interface details not provided |

| Trust and Regulation | N/A | Regulatory status and compliance information not specified in available materials |

| User Experience | N/A | Client testimonials and satisfaction metrics not available for assessment |

De Novo Capital LLC operates as an investment management company headquartered in Granite Bay, California. The firm's leadership structure features a former attorney at the helm, bringing legal expertise to investment management operations. This unique background potentially offers clients a perspective that combines legal skills with financial market knowledge, though specific founding dates and company history details were not available in the reviewed materials.

The company's investment philosophy centers on three core principles: independent research, disciplined approach, and common sense application to investment decisions. This methodology suggests a focus on fundamental analysis and risk management rather than speculative trading strategies. However, the absence of information about specific trading platforms, asset classes offered, or regulatory oversight in the available materials makes it difficult to categorize this entity within the traditional forex broker landscape that this de novo review typically covers.

Regulatory Jurisdiction: No specific regulatory information was mentioned in available source materials. This represents a significant information gap for potential clients seeking regulated trading services.

Deposit and Withdrawal Methods: Payment processing options and funding mechanisms were not detailed in the company information reviewed for this assessment.

Minimum Deposit Requirements: Entry-level investment thresholds and account funding minimums were not specified in available materials.

Promotional Offers: No information about welcome bonuses, trading incentives, or promotional programs was found in the source documentation.

Available Assets: The range of tradeable instruments, including forex pairs, commodities, indices, or other financial products, was not detailed in available company information.

Fee Structure: Comprehensive pricing information, including spreads, commissions, overnight fees, and other trading costs, was not provided in the materials reviewed for this de novo review.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in available documentation.

Platform Choices: Trading software options, mobile applications, and platform features were not mentioned in the source materials.

Geographic Restrictions: Service availability by region and country-specific limitations were not addressed in available information.

Customer Support Languages: Multi-language support options were not specified in the reviewed materials.

The evaluation of account conditions for De Novo Capital LLC faces significant limitations due to the absence of specific information in available materials. Traditional forex brokers typically offer multiple account tiers with varying features, minimum deposit requirements, and trading conditions, but no such details were found in the company's available documentation. This information gap makes it impossible to assess whether the firm provides retail forex accounts, professional trading accounts, or Islamic-compliant options that are standard in the industry.

Account opening procedures, verification requirements, and onboarding processes were not detailed in the source materials. This prevents a comprehensive evaluation of client accessibility. The lack of information about minimum deposit thresholds particularly impacts potential clients' ability to determine if the service aligns with their capital availability.

Without specific account feature comparisons or tier-based benefit structures, this de novo review cannot provide meaningful guidance on account selection strategies. The absence of detailed terms and conditions, account maintenance fees, or inactivity policies in available materials represents a significant transparency gap that potential clients would need to address through direct inquiry with the company.

Assessment of trading tools and analytical resources proves challenging due to limited information availability in source materials. Modern forex brokers typically provide comprehensive charting packages, technical analysis tools, economic calendars, and market research facilities, but no such offerings were detailed in the available De Novo Capital LLC documentation. The company's emphasis on independent research suggests potential analytical capabilities, but specific tool specifications remain unclear.

Educational resources, which are increasingly important for trader development, were not mentioned in available materials. This absence is particularly notable given the competitive forex market where brokers typically offer webinars, tutorials, market analysis, and educational content to support client success. The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities represents another evaluation gap.

Research provision quality cannot be assessed without access to sample reports, analyst credentials, or research methodology descriptions. The company's stated focus on independent research could represent a significant value proposition, but without concrete examples or detailed descriptions, potential clients cannot evaluate the practical utility of these resources.

Customer service evaluation faces substantial limitations due to the absence of specific support information in available materials. Essential service elements such as contact methods, availability hours, response time commitments, and support quality metrics were not detailed in the reviewed documentation. Modern forex trading requires reliable customer support given the 24-hour nature of currency markets, making this information gap particularly significant.

Multi-language support capabilities, which are crucial for international clients, were not specified in available materials. The lack of information about support channels—whether through phone, email, live chat, or other communication methods—prevents assessment of accessibility and convenience factors. Response time expectations and service level agreements, which are critical for time-sensitive trading issues, remain unspecified.

Problem resolution processes and escalation procedures were not detailed in available materials. This makes it impossible to evaluate the company's approach to client issue management. The absence of client testimonials or service quality feedback in reviewed materials further limits the ability to assess real-world support effectiveness in this de novo review.

Platform performance evaluation cannot be conducted due to the absence of specific trading platform information in available materials. Critical factors such as execution speed, platform stability, order types available, and system uptime statistics were not detailed in the reviewed documentation. These elements are fundamental to forex trading success, making their absence a significant evaluation limitation.

Order execution quality, including slippage rates, requote frequency, and execution speed metrics, could not be assessed from available information. Mobile trading capabilities, which are increasingly important for active traders, were not mentioned in source materials. The lack of platform feature descriptions prevents evaluation of charting capabilities, technical analysis tools, and overall user interface quality.

Trading environment details such as market depth information, liquidity provision, and execution model specifics were not available in reviewed materials. This de novo review cannot therefore provide meaningful guidance on the practical trading experience potential clients might expect from De Novo Capital LLC's services.

Regulatory assessment faces significant challenges due to the absence of specific licensing and oversight information in available materials. Forex brokers typically operate under strict regulatory frameworks, and the lack of detailed regulatory disclosures raises questions about the company's positioning within the traditional retail forex market. Client fund protection measures, segregated account policies, and deposit insurance coverage were not detailed in available documentation.

Company transparency levels cannot be fully evaluated without access to detailed financial disclosures, regulatory filings, or third-party audits. While the California-based location and professional leadership background suggest operational legitimacy, the absence of specific regulatory credentials in available materials represents a significant information gap for potential clients seeking regulated trading services.

Industry reputation and peer recognition could not be assessed due to limited third-party information in reviewed materials. The handling of any negative events or regulatory actions cannot be evaluated without access to comprehensive company history and regulatory records.

Overall user satisfaction assessment proves impossible due to the complete absence of client testimonials and user feedback in available materials. Interface design quality, navigation ease, and overall usability cannot be evaluated without access to platform demonstrations or user interface descriptions. Registration and account verification processes were not detailed in source materials, preventing assessment of onboarding efficiency.

Funding and withdrawal experience evaluation cannot be conducted without information about payment processing times, fee structures, and transaction procedures. Common user complaints and satisfaction patterns cannot be identified due to the lack of review data and client feedback in available materials.

User demographic analysis and client profile information were not available in reviewed sources. This makes it difficult to determine the target audience alignment with typical forex trading needs. Service improvement areas cannot be identified without comprehensive user feedback and satisfaction metrics.

This de novo review of De Novo Capital LLC reveals a significant information gap that prevents comprehensive evaluation using standard forex broker assessment criteria. While the company's California-based operations and professional leadership background suggest legitimacy, the absence of detailed trading conditions, regulatory information, and user feedback makes it challenging to recommend for traditional forex trading purposes.

The firm may be better suited for investors seeking investment management services with an emphasis on independent research rather than retail forex traders requiring comprehensive trading platforms and regulated environments. Potential clients should conduct additional due diligence to verify regulatory status, trading conditions, and service offerings before making any investment decisions.

FX Broker Capital Trading Markets Review