Regarding the legitimacy of APP Securities forex brokers, it provides ASIC and WikiBit, .

Is APP Securities safe?

Pros

Cons

Is APP Securities markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

APP Securities Pty Ltd

Effective Date:

2007-04-24Email Address of Licensed Institution:

steven.larkins@appsecurities.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://www.appsecurities.com.au/Expiration Time:

--Address of Licensed Institution:

STEVEN LARKINS, Level 41, 259 George Street SYDNEY NSW 2000, Level 41, 259 George Street Sydney, NSW 2000 AustraliaPhone Number of Licensed Institution:

02 9226 0087, 0416420482Licensed Institution Certified Documents:

Is APP Securities Safe or Scam?

Introduction

APP Securities is an Australian-based brokerage firm that positions itself as a provider of a wide range of financial services across the Asia-Pacific region. Established in 1991, the firm claims to offer various investment options, including forex trading, contracts for difference (CFDs), and equities. However, with the increasing number of scams in the forex market, traders must exercise caution when evaluating brokers. The need for due diligence is paramount, as the safety of investments can greatly depend on the regulatory oversight and operational integrity of the brokerage firm in question.

In this article, we will investigate the safety of APP Securities by examining its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our evaluation will be based on data gathered from multiple credible sources, including regulatory bodies, financial reviews, and user feedback. By employing a structured framework, we aim to provide a comprehensive analysis that helps traders determine whether APP Securities is a legitimate broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in assessing its safety. APP Securities claims to operate under the oversight of the Australian Securities and Investments Commission (ASIC). However, there are conflicting reports regarding its regulatory compliance. Some sources indicate that APP Securities is unregulated or lacks proper licenses, raising questions about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 307 706 | Australia | Verified |

The importance of regulation cannot be overstated. A regulated broker is required to adhere to strict guidelines that protect investors, including maintaining segregated accounts for client funds and providing transparency in operations. In the case of APP Securities, while it claims to be regulated by ASIC, the lack of clarity regarding its compliance history and operational practices raises concerns. A broker without robust regulatory oversight may expose traders to higher risks, including the potential for fraud or mismanagement of funds.

Company Background Investigation

APP Securities has a long history in the financial services sector, initially operating as BBY Group before its acquisition by AIMS Financial Group in 2015. This transition aimed to bolster its position in the investment banking and stockbroking landscape across Australia and Asia. The company is headquartered in Sydney, Australia, and claims to have a substantial presence in the Asia-Pacific region.

The management team at APP Securities comprises experienced professionals with backgrounds in finance and investment banking. However, the transparency regarding the team's qualifications and their track record in managing client funds remains limited. An essential aspect of evaluating a broker's credibility is understanding its ownership structure and the experience of its leadership. APP Securities, being a subsidiary of AIMS Financial Group, has access to a broader financial network, yet the historical performance and regulatory compliance of the parent company are essential factors to consider.

Trading Conditions Analysis

When assessing whether APP Securities is safe, it is crucial to analyze its trading conditions and fee structure. The broker offers various trading instruments, including forex, commodities, and indices. However, reports suggest that APP Securities may have an unusual fee structure that could be detrimental to traders.

| Fee Type | APP Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | 0.1-0.5% |

| Overnight Interest Range | High | Moderate |

While the absence of commissions may seem attractive, the variable spreads and potential hidden fees could significantly impact trading profitability. Traders should be cautious of brokers that offer low commissions but compensate with high spreads or other charges. A lack of clarity in fee structures can indicate potential issues with transparency and fairness, further questioning whether APP Securities is a safe choice.

Customer Fund Security

The safety of customer funds is a critical concern for any trader. APP Securities claims to implement various measures to protect client funds, including the segregation of accounts and adherence to anti-money laundering regulations. However, the effectiveness of these measures is challenging to verify without independent audits or transparent reporting.

The absence of investor protection schemes, such as those provided by the Financial Services Compensation Scheme (FSCS) in the UK or similar entities, raises further concerns. If a broker does not have adequate safeguards in place, clients could face significant risks in the event of financial difficulties or insolvency. Historical data on APP Securities does not indicate any major incidents involving fund mismanagement, but the lack of comprehensive information leaves potential investors in a precarious position.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability. Reviews of APP Securities reveal mixed experiences among users. While some clients report satisfactory service and support, others express concerns regarding responsiveness and complaint resolution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management | Medium | Average response |

| Fee Transparency | High | Lack of clarity |

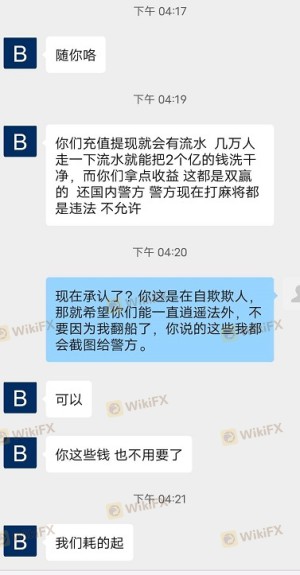

Common complaints include difficulties in withdrawing funds and a perceived lack of transparency regarding fees. These issues can significantly affect a trader's experience and raise concerns about the broker's operational integrity. For instance, a user reported a delayed withdrawal request, which took several weeks to resolve, highlighting potential inefficiencies in customer service.

Platform and Trade Execution

The trading platform offered by APP Securities is another critical factor in determining its safety. A robust and reliable platform is essential for executing trades efficiently. While APP Securities claims to provide a user-friendly interface, reviews suggest that the platform may experience occasional outages and lag during peak trading hours.

The quality of order execution is also vital. Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. Any signs of manipulation or unfair practices could indicate deeper issues within the broker's operations. Therefore, assessing the platform's performance is integral to determining whether APP Securities is a safe option for traders.

Risk Assessment

Using APP Securities involves several risks that potential clients should consider. The lack of regulatory clarity, mixed customer feedback, and potential issues with fund security contribute to an overall risk profile that may be concerning for some traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unclear regulatory status raises concerns. |

| Fund Security | Medium | Limited investor protection measures. |

| Customer Service | High | Reports of slow responses to complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with APP Securities. It is advisable to start with a demo account to assess the platform's performance and customer service quality before committing significant funds.

Conclusion and Recommendations

In conclusion, while APP Securities presents itself as a legitimate brokerage firm, several factors warrant caution. The lack of clear regulatory oversight, mixed user experiences, and potential issues with fund security raise red flags. Therefore, traders should approach APP Securities with a degree of skepticism.

For those considering trading with APP Securities, it is crucial to conduct extensive research and perhaps explore alternative brokers with stronger regulatory frameworks and better customer feedback. Reputable options include brokers regulated by top-tier authorities, offering robust investor protection and transparent trading conditions. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is APP Securities a scam, or is it legit?

The latest exposure and evaluation content of APP Securities brokers.

APP Securities Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APP Securities latest industry rating score is 5.11, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.11 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.