APP Securities Review 1

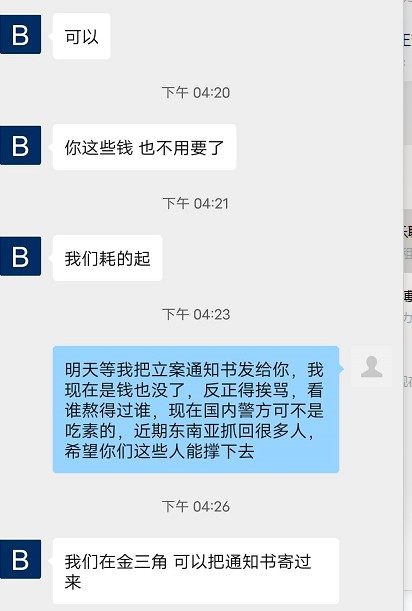

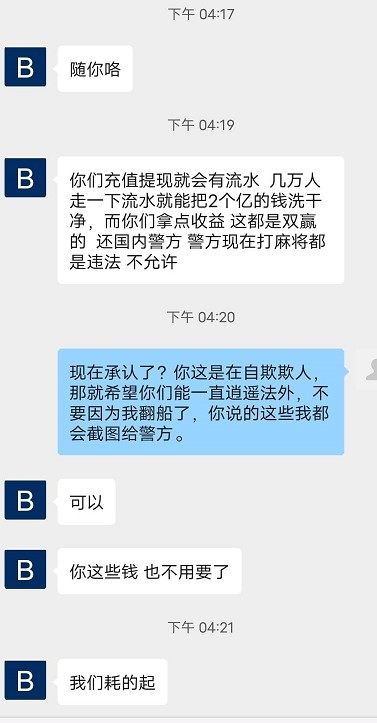

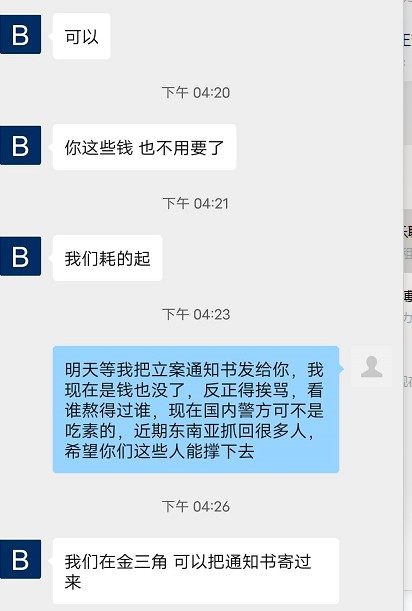

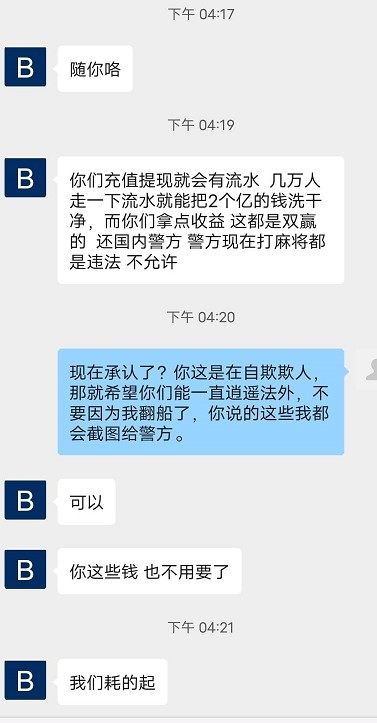

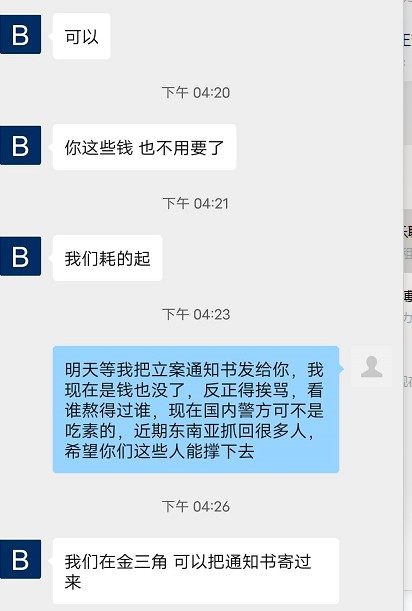

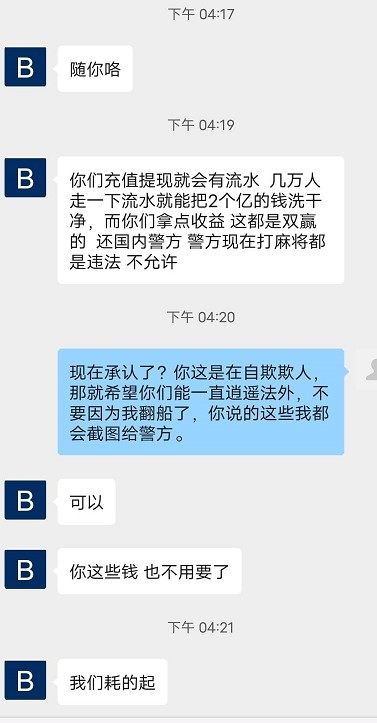

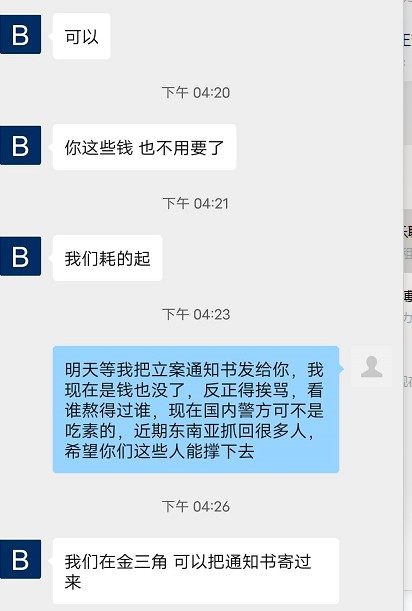

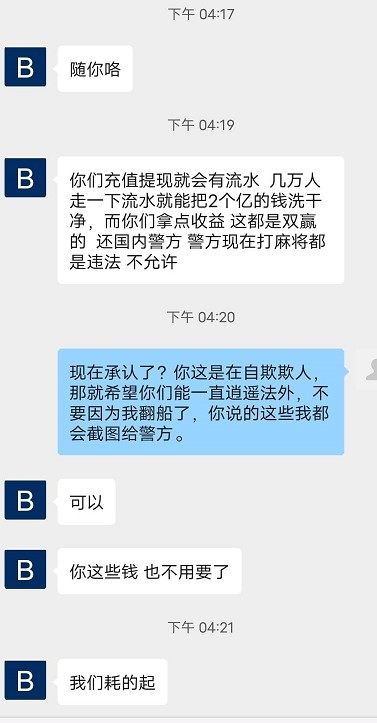

Induce to trade with rebates but in fact, it’s a fraud platform. They work overseas so they are arrogant. The victims should get together to call the police.

APP Securities Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Induce to trade with rebates but in fact, it’s a fraud platform. They work overseas so they are arrogant. The victims should get together to call the police.

APP Securities is an Australian-based brokerage firm that claims to offer a comprehensive range of trading services across financial instruments such as forex, contracts for difference (CFDs), commodities, and indices. While the allure of diverse trading options may attract experienced traders who understand the complex dynamics of unregulated environments, potential investors must tread carefully. The absence of regulatory oversight raises substantial concerns regarding fund safety, withdrawal procedures, and the possibility of hidden fees. As a result, APP Securities mainly appeals to seasoned traders prepared to assume higher risks, leaving novice and risk-averse investors in search of safer, regulated platforms. This review aims to shed light on both the opportunities and pitfalls associated with APP Securities, helping investors make informed decisions.

Before engaging with APP Securities, it is imperative that prospective clients acknowledge the inherent risks of trading with an unregulated broker. The lack of regulatory oversight may lead to potential harms, including the loss of invested funds due to mismanagement or fraud. Steps to verify the legitimacy of APP Securities include:

Stay vigilant and make sure to protect your investment before proceeding.

| Criteria | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Lack of regulation and warnings from multiple sources raise serious concerns about fund safety. |

| Trading Costs | 4 | Competitive commission structures, though users report potential hidden fees. |

| Platforms & Tools | 3 | Average platform offerings, not utilizing popular trading software such as MT4 or MT5. |

| User Experience | 2 | Mixed reviews from users highlight shortcomings in customer service and platform usability. |

| Customer Support | 2 | Reports of slow response times and inadequate resolution of user issues. |

| Account Conditions | 2 | No client insurance, limited information about account types, and unclear withdrawal processes. |

Established in 1991 and headquartered at Level 41, 259 George Street, Sydney, NSW 2000, APP Securities finds its place within the competitive Australian brokerage landscape. The firm is owned by AIMS Financial Group, which has a notable history involving diversified financial services and investments. Despite its extensive experience and offerings in retail broking, institutional sales, and corporate advisory services, APP Securities is widely described as being unregulated, which may deter risk-sensitive investors.

APP Securities offers a variety of trading instruments, primarily focusing on forex and CFD markets. However, despite the expansive choice for traders, the absence of proper regulation makes the trading environment perilous. Investors engaging with APP Securities should be prepared for the complexities and risks of trading without a safety net of regulatory oversight or guaranteed client protection.

| Feature | Details |

|---|---|

| Regulation | Unregulated |

| Minimum Deposit | N/A |

| Leverage | Varies, typically up to 1:500 |

| Major Fees | 0-2% on trades suspected |

Regulatory shortcomings are the cornerstone of trust issues associated with APP Securities. Users have consistently flagged the broker for lacking transparency in its financial operations. This absence of regulatory backing not only jeopardizes clients' fund safety but also raises questions about the withdrawal process.

To verify the regulatory status, users should:

User experiences emphasize considerable concerns about fund safety, with one user sharing:

"After trying to withdraw my funds, I faced unexplained delays and poor communication from customer service."

While APP Securities may appear to offer low commission rates that might seem appealing, potential hidden fees can negate trading advantages. The broker reportedly imposes various non-trading fees, as highlighted by customer complaints:

"I was surprised by the sudden account maintenance charges that weren't clearly disclosed when I signed up."

This duality in trading costs, where low commissions attract traders, but hidden fees act as a double-edged sword, contributes to a layered understanding of the broker's cost structure.

APP Securities does not support major trading platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are industry standards renowned for their advanced trading tools. The limited platform options hinder traders looking for features like expert advisors, backtesting, and comprehensive charting.

Additionally, user feedback indicates a gap in educational resources and sophisticated trading tools, resulting in mediocre user experiences. As summarized in user feedback:

"The platform feels outdated and lacks the intuitive UI of major competitors."

The overall user experience at APP Securities has received mixed reviews, reflecting challenges in customer interactions and platform navigation. Reports suggest that users often encounter delays in support responses and a lack of streamlined processes to manage trades or inquiries effectively, making it less suited for inexperienced traders.

Customer support at APP Securities has been criticized for its inefficiencies. Users frequently mention difficulties in obtaining assistance or timely resolutions to issues faced during trading. Feedback from users showcases this concern:

"Every time I needed help, it took ages to get a response from customer service."

Account conditions at APP Securities do not provide clients with crucial aspects such as insurance coverage. This absence exacerbates concerns around fund safety as no buffer exists to protect clients in cases of broker insolvency or mismanagement. Additionally, vague withdrawal conditions further deepen the lack of clarity regarding users' ability to access their funds when requested.

Navigating the investment landscape with APP Securities prompts serious consideration of the highlighted risks. While the allure of diverse trading options exists, the notable absence of regulations, questionable customer support, and the potential for hidden fees create a precarious trading environment, particularly for inexperienced investors. Understanding these facets is essential for those contemplating whether to engage with APP Securities, emphasizing the value of conducting thorough due diligence before making critical financial decisions.

FX Broker Capital Trading Markets Review