UBK Markets 2025 Review: Everything You Need to Know

Executive Summary

UBK Markets is a regulated forex broker. It operates under the supervision of the Cyprus Securities and Exchange Commission, which is known as CYSEC. This comprehensive ubk markets review reveals a company that offers brokerage and social trading services with competitive trading conditions. The broker provides spreads starting from 0 pips and ECN-standard trade execution. UBK Markets targets investors interested in forex and CFD trading. It especially focuses on those who prioritize cost-effective trading solutions.

Despite being regulated and offering attractive trading conditions, user feedback suggests mixed experiences with the platform. Some traders appreciate the competitive spreads and ECN execution standards. However, concerns have been raised about the broker's overall reliability. The company operates through the iPro Marketplace platform. It provides access to multiple asset classes including forex and CFDs. For traders considering UBK Markets, it's essential to weigh the competitive trading costs against the reported user concerns. This helps make an informed decision.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. UBK Markets operates under CYSEC regulation. However, regulatory frameworks may differ across jurisdictions where the broker operates. Traders should verify the applicable legal and regulatory environment in their specific region before opening an account.

Our evaluation methodology incorporates multiple assessment criteria. These include account conditions, trading tools, customer support quality, trading experience, trustworthiness, and overall user satisfaction. All information presented reflects the most current data available at the time of publication. The data comes from regulatory databases, user reviews, and official broker communications.

Rating Framework

Broker Overview

UBK Markets was established in 2011 as a Cyprus-based forex broker. The company specializes in innovative solutions for capital management and financial market analysis. UBK Markets has positioned itself as a provider of comprehensive trading services. It focuses on delivering competitive spreads and professional-grade execution standards to retail and institutional clients.

The broker operates primarily through its proprietary iPro Marketplace platform. This platform offers access to forex markets and CFD trading across multiple asset classes. According to forex-broker-rating.com, UBK Markets maintains its regulatory standing through CYSEC oversight. This provides a framework for client fund protection and operational transparency. This ubk markets review examines how the broker's decade-plus experience in the market translates into practical benefits. These benefits help traders seeking reliable execution and competitive trading conditions.

Regulatory Jurisdiction: UBK Markets operates under the regulatory oversight of the Cyprus Securities and Exchange Commission. CYSEC provides a European regulatory framework for its operations.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in available documentation. Traders need to contact the broker directly for comprehensive payment method details.

Minimum Deposit Requirements: The exact minimum deposit amount for account opening is not specified in current available materials.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not detailed in accessible broker information.

Tradeable Assets: The platform provides access to forex pairs and CFDs across various asset classes. However, specific instrument counts are not detailed in available resources.

Cost Structure: According to available information, UBK Markets offers spreads starting from 0 pips. The commission rates are $9 per $100,000 traded volume. This represents competitive pricing in the ECN broker category.

Leverage Options: Maximum leverage is available up to 1:30. This complies with European regulatory standards.

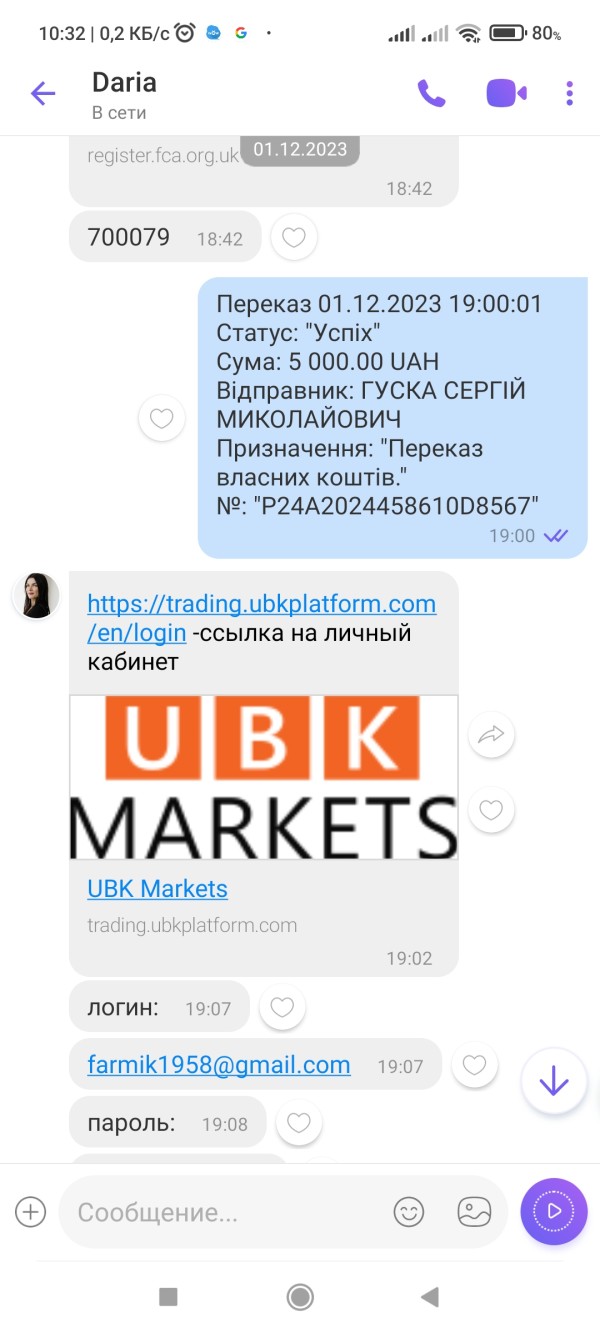

Trading Platform: The primary trading platform is iPro Marketplace. It serves as the main interface for trade execution and account management.

Geographic Restrictions: Specific regional limitations are not detailed in current available documentation.

Customer Support Languages: Multilingual support capabilities are not specifically outlined in accessible materials. This ubk markets review notes that traders should verify language support availability based on their specific needs.

Account Conditions Analysis

UBK Markets' account structure reflects industry-standard practices with ECN execution capabilities. However, specific account type variations are not detailed in available documentation. The broker's commission structure of $9 per $100,000 traded volume positions it competitively within the ECN broker segment. This is particularly true when combined with spreads starting from 0 pips.

The minimum lot size of 0.0001 lots provides flexibility for traders with varying capital levels. It enables micro-lot trading for position sizing precision. However, the lack of detailed information about different account tiers or premium account features limits our ability to fully assess the account condition landscape.

Account opening procedures and verification requirements are not specifically outlined in available materials. However, regulatory compliance under CYSEC suggests standard KYC and AML procedures apply. The absence of detailed minimum deposit information makes it challenging for potential clients to plan their initial investment requirements. This ubk markets review recommends direct contact with the broker for comprehensive account condition details before making trading decisions.

The trading tools and resources offered by UBK Markets appear limited based on available information. The broker provides access to forex and CFD trading through the iPro Marketplace platform. However, specific details about analytical tools, charting capabilities, or market research resources are not comprehensively documented.

Educational resources and training materials are not specifically mentioned in accessible broker information. This may impact the platform's appeal to novice traders seeking learning support. The absence of detailed information about automated trading capabilities, expert advisors, or API access suggests these features may be limited. Traders may need to contact the broker directly for more information.

Research and analysis resources are not outlined in current documentation. These would include market commentary, economic calendars, or fundamental analysis tools. This limitation may affect traders who rely on comprehensive market analysis for their trading decisions. The platform's focus appears to be primarily on execution rather than comprehensive analytical support. This may suit experienced traders but could limit appeal for those seeking extensive research resources.

Customer Service and Support Analysis

Customer service quality at UBK Markets shows mixed performance based on available user feedback. Response times appear inconsistent. Some users report satisfactory support experiences while others indicate delays in receiving assistance. The lack of detailed information about available support channels limits our assessment of accessibility options.

Multilingual support capabilities are not specifically documented. This may present challenges for non-English speaking clients. Operating hours and timezone coverage for customer support are not outlined in available materials. This makes it difficult to assess global support availability.

The professional competency of support staff and their ability to resolve technical or account-related issues efficiently is not well-documented in available user feedback. This gap in information suggests potential clients should test support responsiveness during the account evaluation phase. Problem resolution procedures and escalation processes are not detailed in accessible documentation. This indicates a need for direct inquiry about support protocols.

Trading Experience Analysis

The trading experience at UBK Markets centers around the iPro Marketplace platform. Users generally report this platform as stable and reliable for order execution. The ECN execution standards provide competitive trade processing. Users appreciate the professional-grade execution quality that minimizes slippage and improves fill rates.

Platform functionality appears adequate for standard trading operations. However, specific features like advanced charting tools, technical indicators, or customization options are not detailed in available documentation. Mobile trading capabilities and cross-device synchronization features are not specifically outlined. This may impact traders who require flexible access options.

Order execution quality benefits from the ECN model. This provides direct market access and transparent pricing. Spread stability and liquidity access appear satisfactory based on user feedback. However, detailed performance metrics are not publicly available. The trading environment supports the advertised spreads starting from 0 pips. Actual spreads may vary based on market conditions and trading volume. This ubk markets review notes that execution quality represents one of the broker's stronger performance areas.

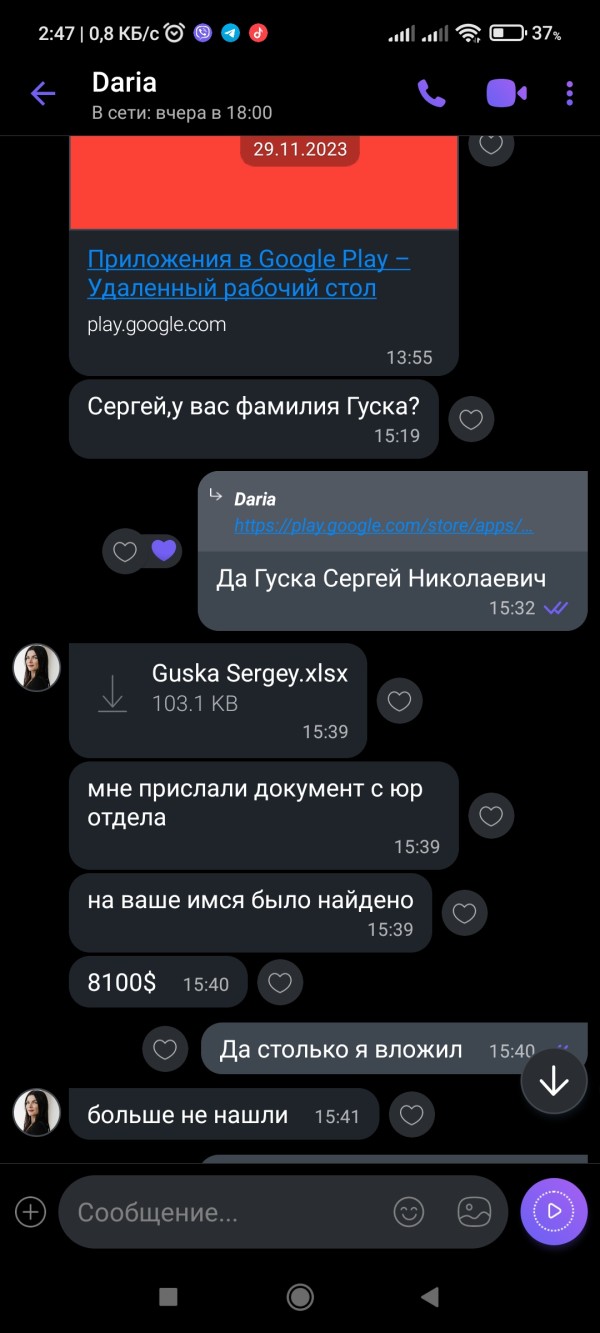

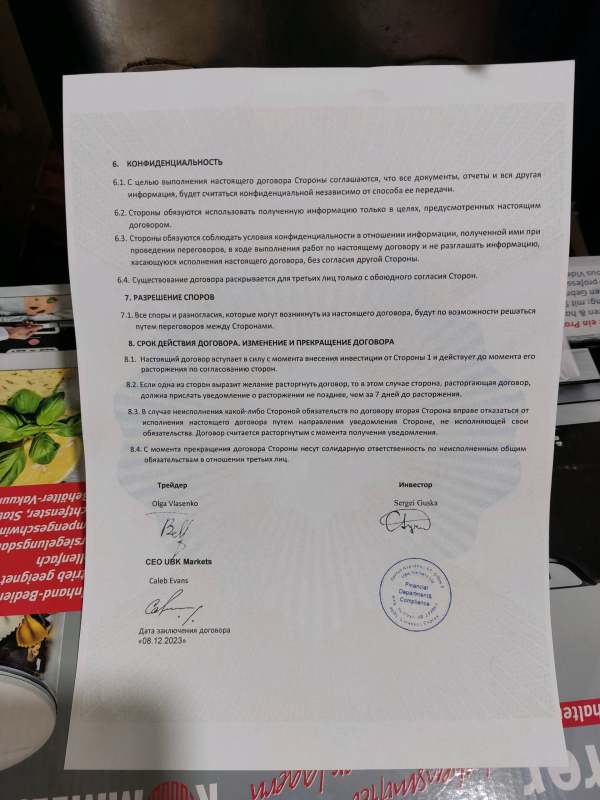

Trust and Safety Analysis

Trust and safety concerns represent a significant consideration for UBK Markets. User warnings about potential reliability issues impact the broker's reputation. The broker maintains CYSEC regulatory status, which provides basic operational oversight and client fund protection frameworks. However, user feedback suggests caution is warranted.

Regulatory compliance through CYSEC offers standard protections. These include segregated client funds and participation in investor compensation schemes. However, specific fund safety measures beyond regulatory requirements are not detailed. Financial transparency through regular reporting or third-party audits is not prominently featured in available documentation.

The company's operational transparency could be enhanced. Detailed information about management, financial statements, or corporate governance practices is not readily accessible. Industry reputation shows mixed signals. Regulatory standing provides some credibility while user concerns about reliability create uncertainty. Negative event handling procedures and dispute resolution mechanisms are not clearly outlined. This may impact client confidence in problem resolution capabilities.

User Experience Analysis

Overall user satisfaction with UBK Markets shows considerable variation. Experiences range from positive feedback about trading conditions to concerns about reliability and support quality. The platform interface design and usability are not extensively detailed in available feedback. This makes comprehensive user experience assessment challenging.

Registration and account verification processes are not specifically outlined. However, regulatory compliance suggests standard documentation requirements apply. The onboarding experience efficiency and user-friendliness remain unclear based on available information.

Funding operations are not well-documented in accessible user feedback. This includes deposit and withdrawal experiences. Common user complaints center around reliability concerns and support responsiveness. However, specific operational issues are not detailed. The target user profile appears to be traders focused on competitive spreads and ECN execution. This particularly applies to those with experience managing broker evaluation and due diligence independently.

Conclusion

UBK Markets presents a mixed proposition for forex and CFD traders. It offers competitive trading conditions including ECN execution standards and spreads starting from 0 pips. However, the broker faces user concerns about overall reliability. The broker's CYSEC regulation provides basic operational oversight. Trust factors require careful consideration.

The platform best suits experienced traders who prioritize cost-effective trading conditions and can independently assess broker reliability. Traders focused on comprehensive research tools, extensive educational resources, or premium customer support may find the offering limited. The main advantages include competitive spreads and professional execution standards. Significant drawbacks involve trust concerns and limited transparency about operational details.

Potential clients should conduct thorough due diligence before committing significant capital to UBK Markets. This includes direct platform testing and support evaluation.