Regarding the legitimacy of UBK Markets forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is UBK Markets safe?

Business

Risk Control

Is UBK Markets markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

UBK Markets Ltd

Effective Date:

2012-12-14Email Address of Licensed Institution:

andigoni.themistocleous@ubkmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ubkmarkets.comExpiration Time:

--Address of Licensed Institution:

67, Spyrou Kyprianou Avenue, Kyriakides Business Center, 2nd Floor, CY-4003 LimassolPhone Number of Licensed Institution:

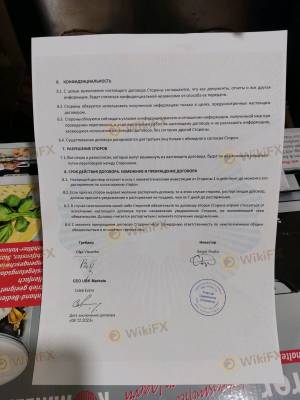

+357 25 353 630Licensed Institution Certified Documents:

Is UBK Markets Safe or a Scam?

Introduction

UBK Markets is a forex brokerage firm that has positioned itself within the competitive landscape of online trading. Established in 2011 and based in Limassol, Cyprus, UBK Markets offers a range of trading services, including forex and CFDs, to clients globally. As with any financial institution, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging in trading activities. The forex market is fraught with risks, and the integrity of a brokerage can significantly impact a trader's experience and financial safety. This article aims to provide an objective analysis of whether UBK Markets is safe or a potential scam by examining its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory environment in which a brokerage operates plays a vital role in ensuring the safety of client funds and the overall integrity of the trading platform. UBK Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent regulatory standards. Below is a summary of the core regulatory information related to UBK Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 186/12 | Cyprus | Verified |

The importance of regulation cannot be overstated; it provides a framework within which brokers must operate, ensuring transparency and accountability. CySEC is considered a reputable regulator, adhering to the Markets in Financial Instruments Directive (MiFID) of the European Union, which aims to protect investors and enhance the integrity of the financial markets. While UBK Markets has maintained a regulatory license since its inception, it is essential to note that regulatory oversight does not eliminate all risks associated with trading. Traders should remain vigilant and aware of the potential for issues, especially given that not all regulatory bodies enforce the same level of scrutiny.

Company Background Investigation

UBK Markets has been operating since 2011 and is part of a larger financial group that specializes in developing trading and analytical software solutions. The company is owned by UBK Markets Ltd., which operates under the CySEC license. The management team comprises professionals with experience in finance and technology, which is crucial for maintaining operational integrity and providing quality trading services.

The transparency of a brokerage is critical for building trust with clients. UBK Markets provides information about its ownership structure and management team on its website, although some users have reported challenges in accessing comprehensive details. The firm has made efforts to communicate its regulatory compliance and operational policies, which is a positive sign regarding its commitment to transparency. However, the level of information disclosure could be improved to enhance client confidence further.

Trading Conditions Analysis

UBK Markets offers a competitive trading environment with a low minimum deposit requirement of $25, making it accessible for new traders. However, the overall fee structure and trading conditions warrant careful examination. Below is a comparison of key trading costs associated with UBK Markets:

| Fee Type | UBK Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 0 pips | 1-2 pips |

| Commission Model | $9 per lot | $7-10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads start at 0 pips, which is attractive, the commission of $9 per trade may be considered high compared to industry standards. Additionally, the lack of clarity regarding overnight interest rates can be a concern for traders who hold positions longer than a day. Understanding these costs is essential for traders to assess the overall profitability of their trading strategies.

Client Fund Safety

The safety of client funds is paramount when evaluating a brokerage. UBK Markets implements several measures to protect client funds, including segregating client accounts from company funds. This practice is essential in the event of financial difficulties, ensuring that client assets are not at risk. Furthermore, UBK Markets is a member of the Investor Compensation Fund (ICF), which provides additional protection for clients in case the firm becomes insolvent.

Despite these measures, there have been reports of withdrawal issues from some clients, which raises concerns about the effectiveness of these safety protocols. Traders should be aware of the potential risks and consider these factors when determining if UBK Markets is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is a vital component of assessing the reliability of a broker. Reviews of UBK Markets reveal a mixed bag of experiences. While some clients have reported satisfactory trading conditions and responsive customer support, others have expressed frustrations regarding withdrawal processes. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Lack of Transparency | Medium | Limited information |

| Customer Support Delay | Medium | Response delays |

For instance, one user reported that their withdrawal request was delayed significantly, leading to frustration and a lack of trust in the platform. Another trader indicated that while the trading experience was generally positive, the customer service response times were longer than expected. These complaints highlight areas where UBK Markets could improve to enhance customer satisfaction and trust.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. UBK Markets utilizes its proprietary trading platform, known as the Ipro Marketplace. While some users have praised its user-friendly interface, others have noted concerns regarding execution quality and potential slippage during high volatility periods.

The platform's execution speed is generally acceptable, but reports of rejections on certain orders during peak trading times have raised red flags. Traders should be cautious, as any signs of platform manipulation or execution issues could indicate deeper problems within the brokerage.

Risk Assessment

Using UBK Markets comes with a set of inherent risks that traders should consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulatory oversight exists but varies in strictness. |

| Withdrawal Risk | High | Reports of difficulties in withdrawing funds. |

| Platform Reliability | Medium | Mixed reviews on execution quality and reliability. |

To mitigate these risks, traders are advised to start with a small investment to test the platform's reliability and customer support before committing larger sums. Additionally, maintaining a diversified trading portfolio can help reduce exposure to any single broker's issues.

Conclusion and Recommendations

In conclusion, while UBK Markets is regulated by CySEC and offers a range of trading services, potential traders should approach with caution. The mixed reviews regarding customer experiences, particularly concerning withdrawal issues, raise questions about the overall reliability of the broker. Is UBK Markets safe? The answer is nuanced; while it has regulatory oversight and implements safety measures, the reported withdrawal challenges and execution issues cannot be overlooked.

For traders seeking reliable alternatives, it may be prudent to consider brokers with a stronger reputation for customer service and a proven track record of timely withdrawals. Always conduct thorough research and consider your risk tolerance before engaging with any brokerage.

Is UBK Markets a scam, or is it legit?

The latest exposure and evaluation content of UBK Markets brokers.

UBK Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UBK Markets latest industry rating score is 4.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.