Trive 2025 Review: Everything You Need to Know

Executive Summary

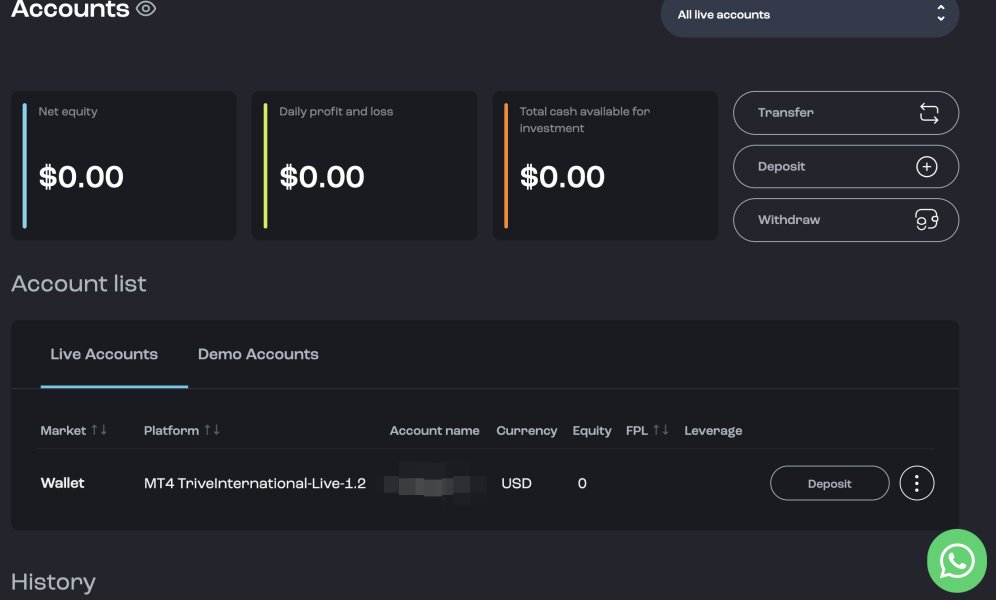

This trive review gives you a complete look at Trive, a newer online CFD broker that wants to help both new and experienced traders. Trive offers a mixed bag of services in the busy CFD trading world, with some good points and some concerns that traders should know about. The broker started in 2016 and has its main office in the Netherlands. It follows rules set by ASIC (Australian Securities and Investments Commission) and is registered in Malta.

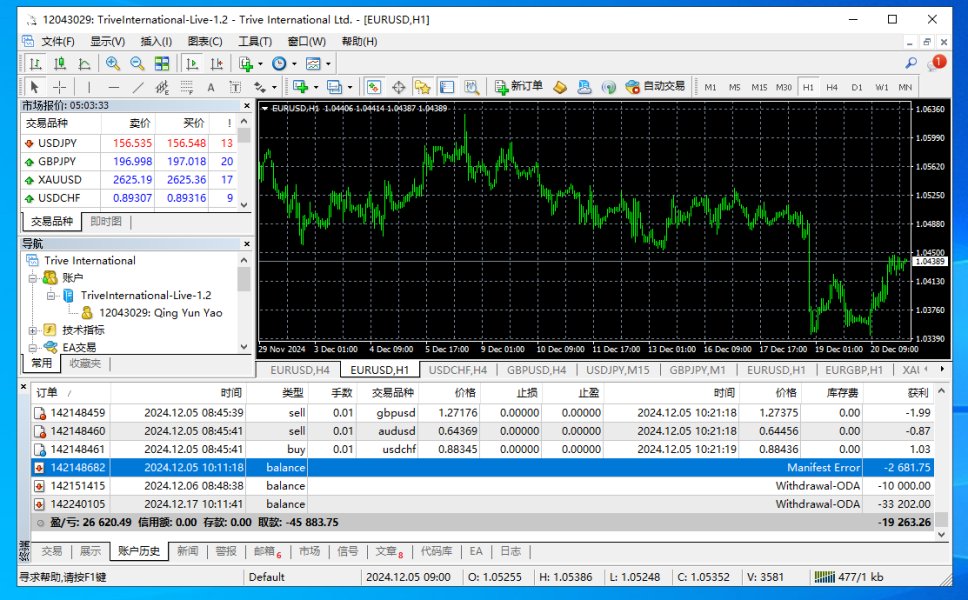

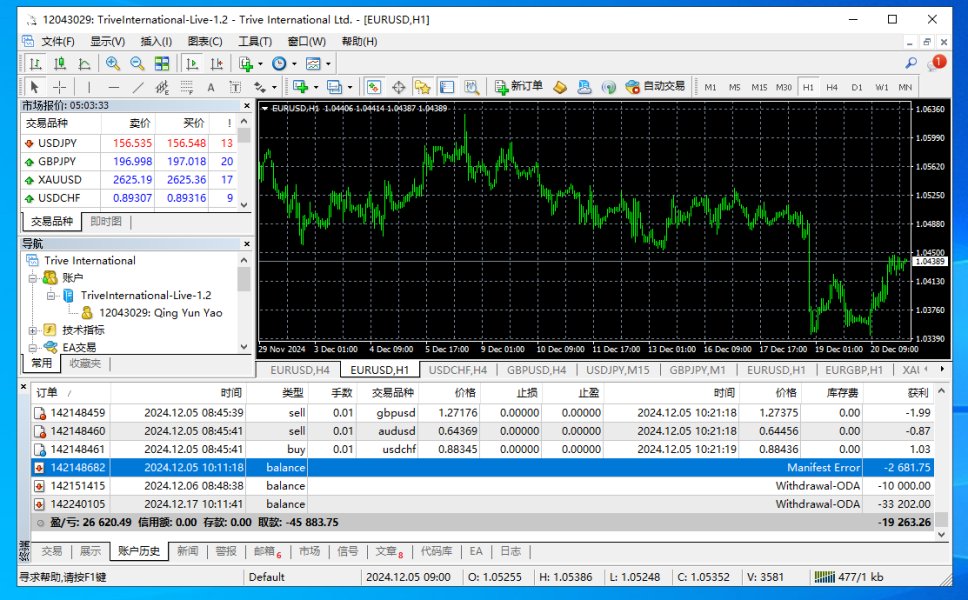

Trive's best features include more than 30 forex currency pairs that you can trade and support for both MetaTrader 4 and MetaTrader 5 platforms. These platforms give traders tools they already know how to use and strong trading environments that work well. The broker lets you trade different types of assets like forex, stocks, ETFs, cryptocurrencies, and commodities, which makes it good for traders who want to spread their investments around.

But there's a big problem that might stop many people from using Trive. You need to put down at least 15,000 EUR to open a Prime Plus account, which is way too much money for most regular traders. The broker only lets you use up to 1:30 leverage, which follows European rules, and charges 5 EUR for each lot you trade. Here's something important to know: 68% of regular people lose money when they trade CFDs with Trive, which shows how risky this kind of trading can be.

This review is mainly for traders who have a lot of money to invest and want to trade CFDs across many different types of assets. But you need to think carefully about the high costs to get started and the risks involved.

Important Notice

Trive works in different countries, and what services you can get might change depending on where you live and what rules apply there. The broker follows different regulations and offers different services in different places, especially when it comes to how much leverage you can use, what assets you can trade, and how your money is protected. People who might want to open an account should check what rules apply in their country before they start.

This review uses information that anyone can find and feedback from users as of 2025. The goal is to help people who might want to use Trive understand what the broker offers, but everyone's experience might be different. Trading CFDs is very risky, and you should really think about the fact that 68% of people lose money with this broker. This review is not financial advice, and you should do your own research before you decide to invest any money.

All the information here comes from official sources and reports from users. Some details might change as the broker keeps working on its services.

Rating Framework

Broker Overview

Trive started in 2016 in the busy world of CFD brokers. The company is based in the Netherlands and focuses on giving complete trading solutions to people around the world. Trive has set itself up as a broker that handles many different types of assets, trying to attract both regular people and big institutions that want to trade different financial products using advanced trading platforms.

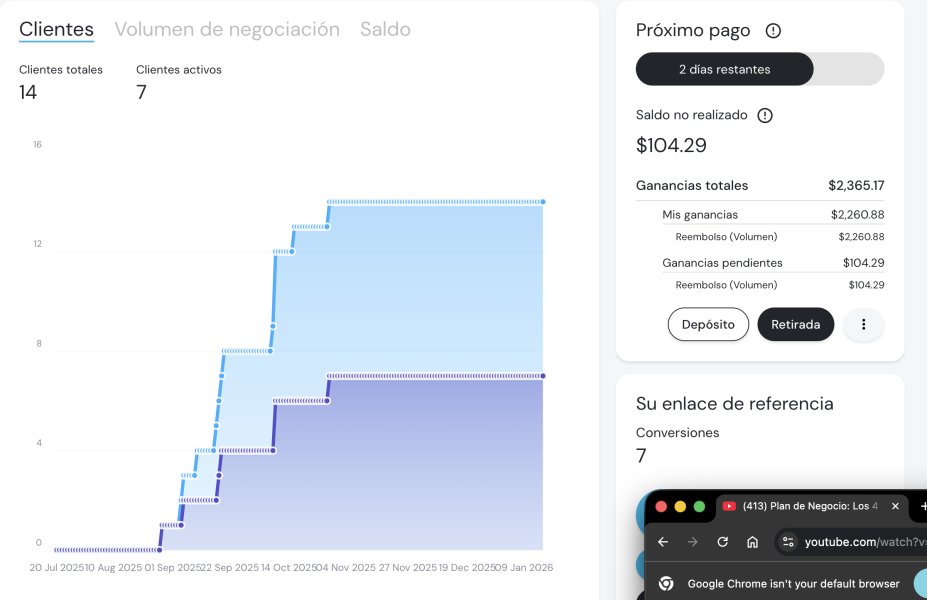

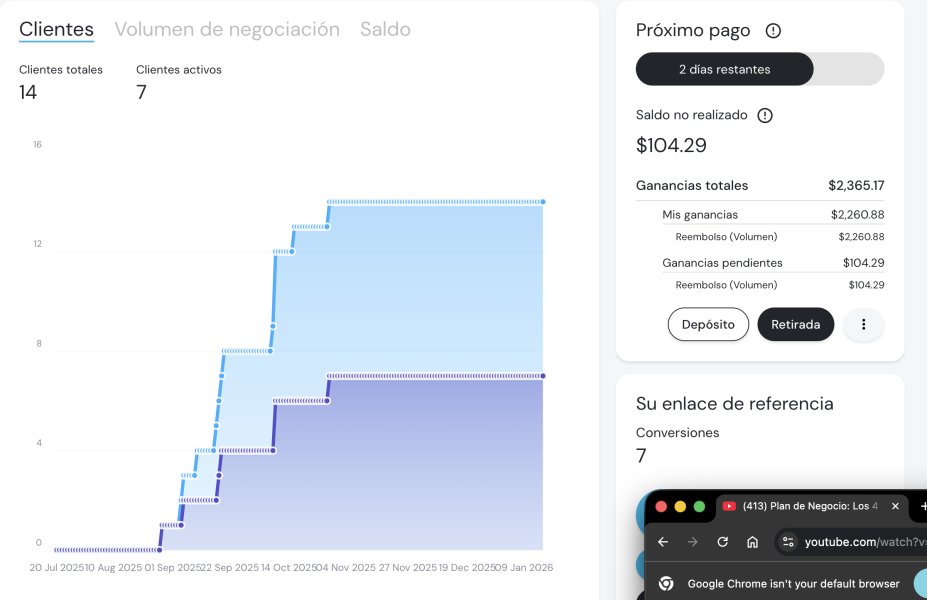

The broker makes money by letting people trade Contracts for Difference (CFDs) across many different types of assets. These include foreign exchange, stocks, exchange-traded funds, cryptocurrencies, and commodities. This trive review shows that the company charges clear commission fees for its premium accounts, which is different from many other brokers that only make money from spreads. Trive's approach shows they want to work with serious traders who are willing to pay clear commission fees to get better trading conditions.

Trive's technology supports MetaTrader 4 and MetaTrader 5 platforms, which are standard tools in the industry. These platforms give traders advanced charts, automatic trading features, and complete market analysis tools. The broker has also made its own mobile app, so people can trade on their phones and tablets. Having these platform choices shows that Trive wants to help traders who need professional tools and flexibility in how they trade.

Trive follows ASIC rules and is registered in Malta, so it meets legal requirements in important areas. But the exact services you can get might be different depending on where you live. The broker offers more than 30 forex currency pairs, including major, minor, and exotic combinations, plus stock CFDs, ETF trading chances, popular cryptocurrencies like Bitcoin, and commodity markets including precious metals and energy products.

Regulatory Jurisdiction: Trive follows rules set by ASIC (Australian Securities and Investments Commission) and is registered in Malta. This setup gives clients some protection and makes sure the broker follows international financial standards, but the exact protection you get might be different depending on where you live.

Deposit and Withdrawal Methods: The available information doesn't give details about how you can put money in or take money out of your account. People who might want to open an account should contact the broker directly to learn about funding options, how long it takes to process transactions, and any fees for moving money.

Minimum Deposit Requirements: The broker requires a lot of money to start - 15,000 EUR for Prime Plus accounts. This means Trive is mainly for people with a lot of money and big institutions, not for regular traders who don't have much capital.

Promotional Offers: The information available doesn't mention current promotions or bonus programs. Traders who want to know about possible incentives should ask Trive directly about any promotional programs they might have.

Tradeable Assets: Trive lets you trade many different financial products. These include over 30 forex currency pairs covering major economies and emerging markets, stock CFDs from various global exchanges, ETF trading opportunities, cryptocurrency CFDs including Bitcoin and other digital assets, and commodity markets with precious metals, energy products, and agricultural futures.

Cost Structure: The broker charges 5 EUR per lot traded as a commission. But specific information about spreads wasn't available in the materials we looked at. This trive review points out that without clear spread data, it's hard to know the total cost of trading, so potential clients need to test the platform or ask for detailed pricing information directly.

Leverage Options: The maximum leverage is 1:30, which follows European rules for regular clients. This leverage level gives moderate amplification of trading positions while following risk management rules that regulators require.

Platform Availability: Trive supports MetaTrader 4, MetaTrader 5, and its own mobile apps. This gives traders flexibility in choosing their preferred trading environment and makes sure they can access their accounts on desktop and mobile devices.

Geographic Restrictions: The available information doesn't detail specific geographic restrictions. But legal compliance requirements likely limit service availability in certain countries.

Customer Support Languages: The information we reviewed doesn't specify what language options are available for customer service.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Trive's account setup creates a big problem for most regular traders. The Prime Plus account needs a huge 15,000 EUR minimum deposit, which effectively makes the broker only for institutional clients and people with lots of money, leaving out a large group of retail traders. The lack of detailed information about other account types in available materials suggests there aren't many options for traders with smaller amounts of money.

The commission structure of 5 EUR per lot shows a clear fee model that experienced traders often like better than spread-only pricing. This is because it usually means better price execution and fewer hidden costs. But without complete information about spread costs, the total trading expenses aren't clear, making it hard for potential clients to accurately judge if Trive's pricing is competitive.

The available materials don't detail account opening procedures. But standard industry practices typically involve online applications, identity verification, and compliance paperwork. The absence of specific information about Islamic accounts or other specialized account features limits understanding of how well the broker accommodates different client needs.

User feedback about the high minimum deposit requirement has been very critical. Many potential clients have expressed frustration at how the entry barrier excludes them. This trive review found that compared to industry standards where many good brokers offer accounts starting from $100-$500, Trive's 15,000 EUR requirement puts it among the most expensive brokers to access, significantly limiting its appeal in the market.

Trive does well in providing trading tools and technology resources. It supports both MetaTrader 4 and MetaTrader 5 platforms along with its own mobile apps. The MT4 and MT5 platforms offer complete technical analysis capabilities, including advanced charting tools, custom indicators, automated trading through Expert Advisors, and signal copying services that appeal to both manual and algorithmic traders.

The variety of available trading tools goes beyond basic platform functionality. It includes support for various order types, risk management features, and market analysis capabilities. The mobile trading apps make sure that clients can monitor and execute trades remotely, addressing modern traders' need for constant market access.

But the available materials didn't provide detailed information about proprietary research and analysis resources, educational content, or market commentary that many brokers offer to help clients make better trading decisions. The absence of information about webinars, trading courses, or market analysis reports suggests there might be gaps in value-added services.

User feedback has generally praised the platform variety and technical capabilities. Traders appreciate the familiar MetaTrader environment and the additional mobile trading options. The support for automated trading and signal services particularly appeals to more sophisticated traders who use algorithmic strategies or copy trading systems.

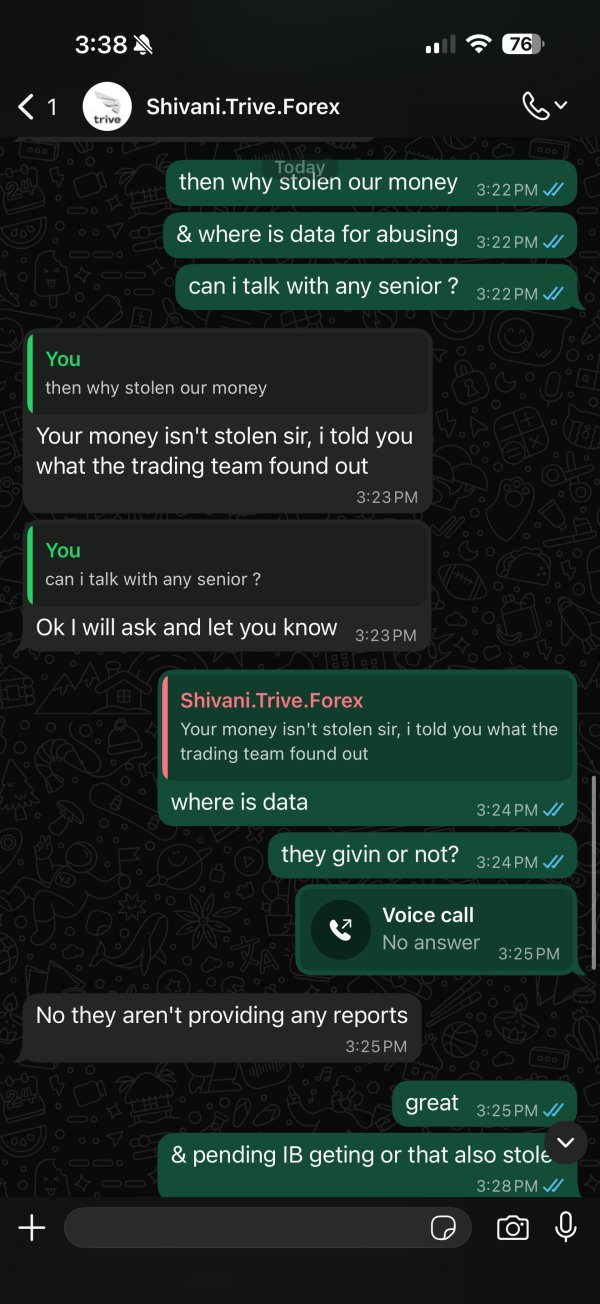

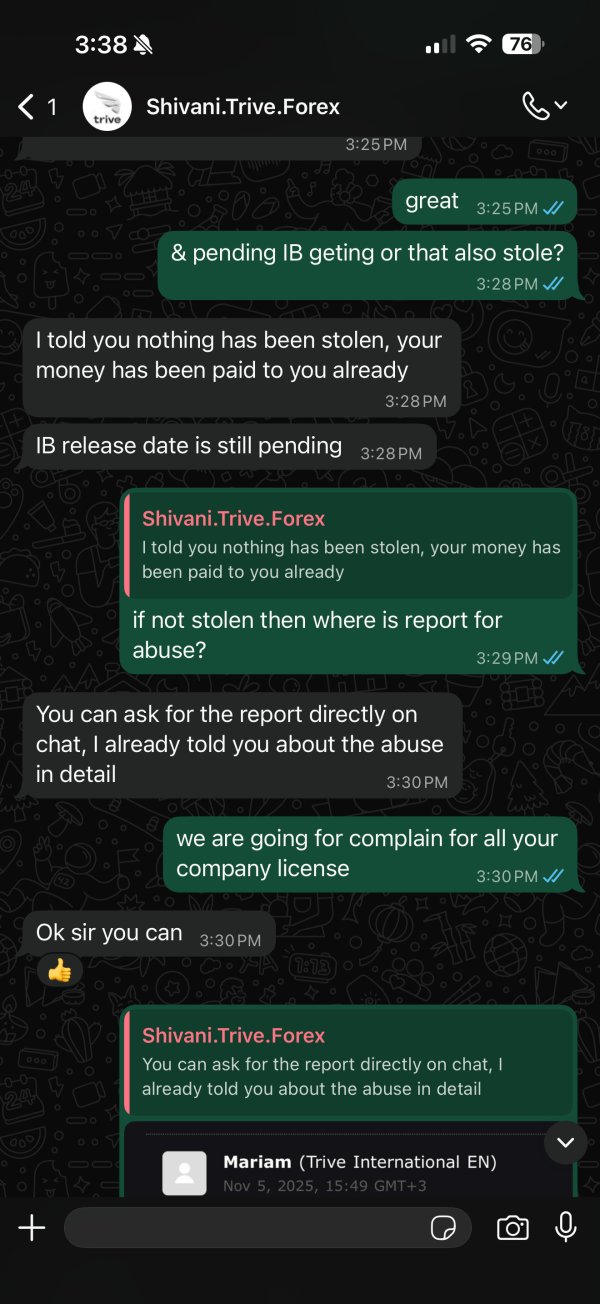

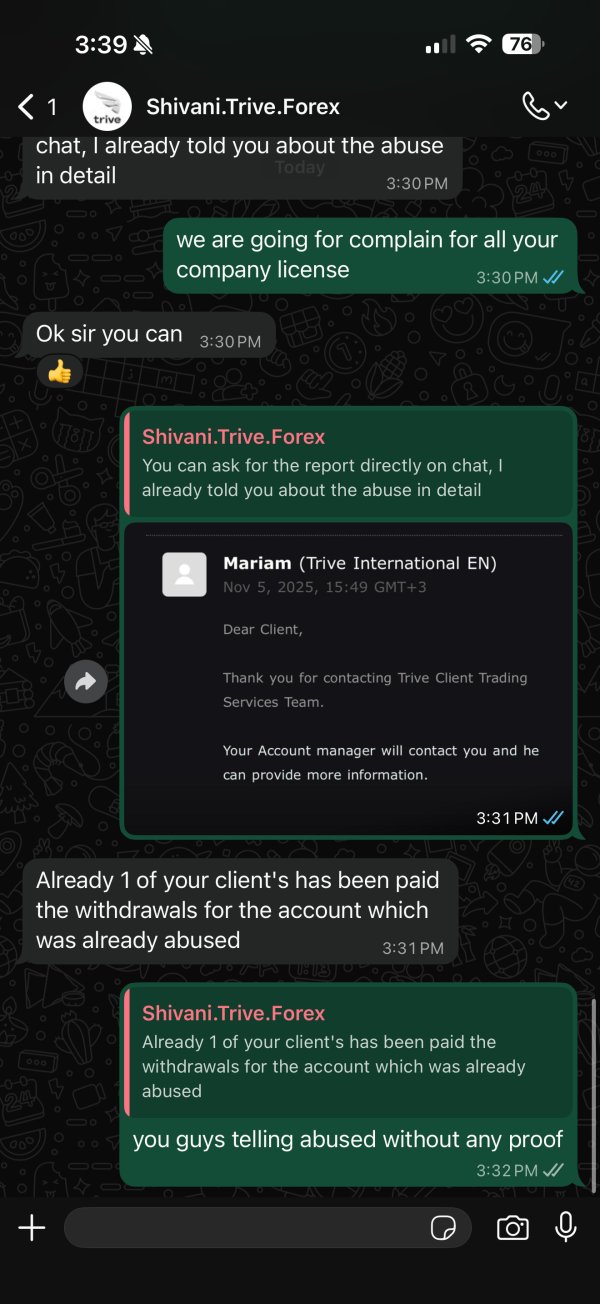

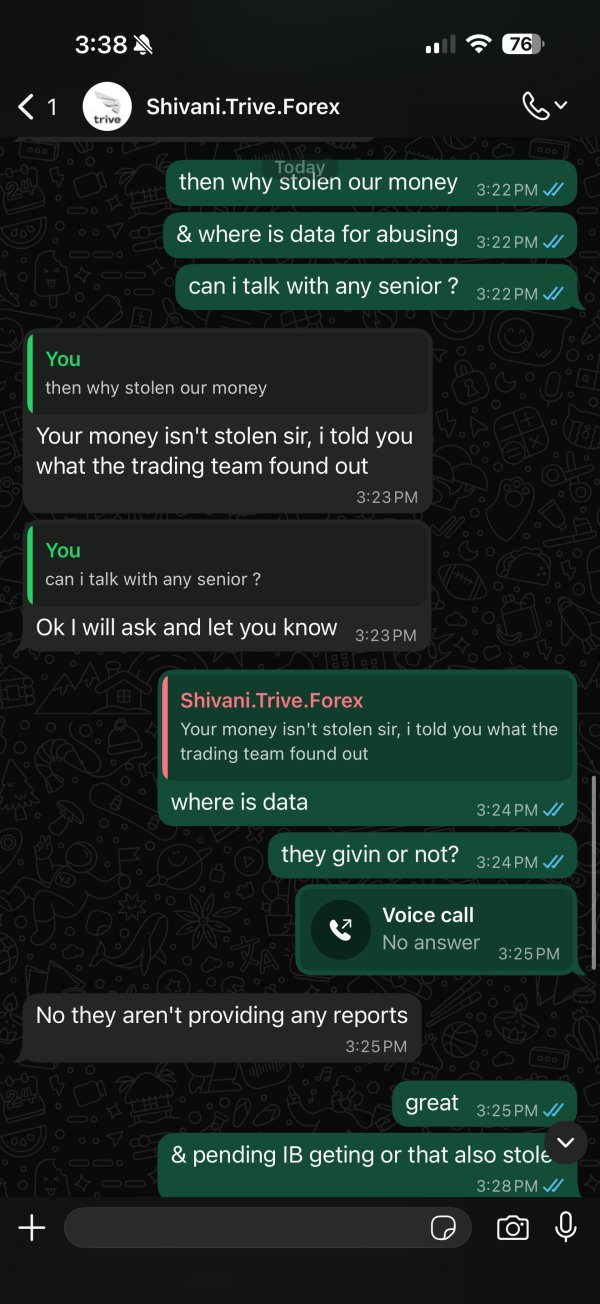

Customer Service and Support Analysis (Score: 5/10)

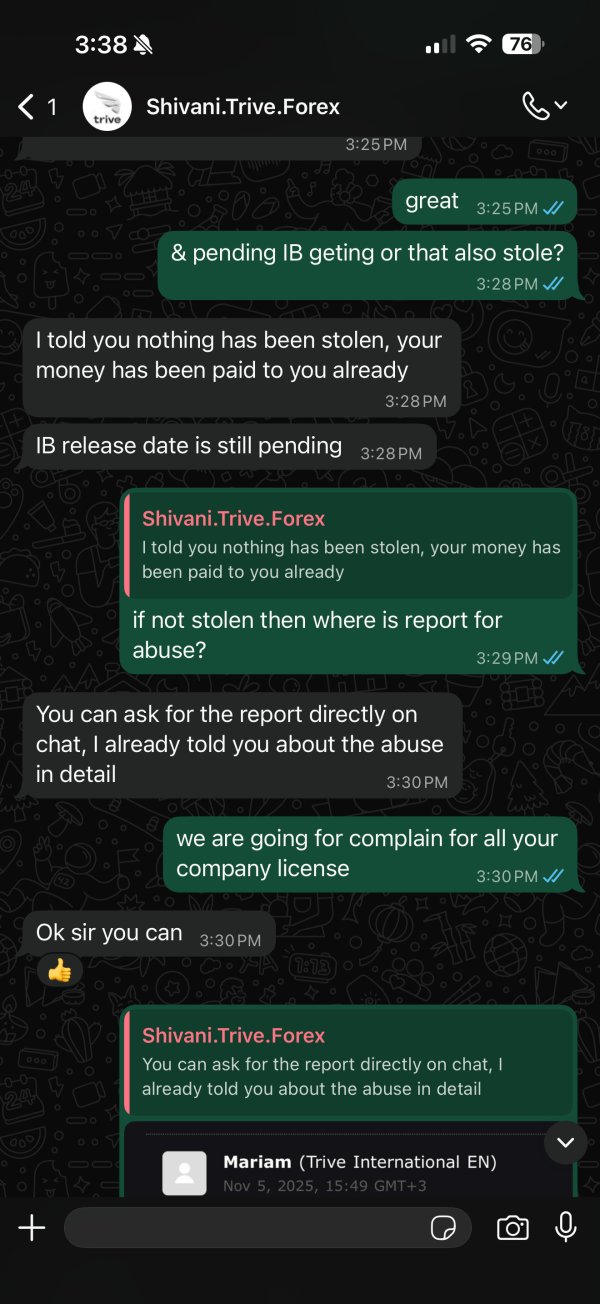

Customer service is a worrying area for Trive. Mixed user feedback highlights inconsistencies in support quality and how quickly they respond. The available information didn't specify how customer support is provided, leaving uncertainty about whether clients can get help through phone, email, live chat, or other ways to communicate.

How quickly they respond seems to vary based on user reports. Some clients have had satisfactory support while others report delays and inadequate help. The lack of detailed information about customer service hours, multilingual support options, and specialized support for different account types creates additional uncertainty about how easy it is to get service.

How competent the support staff is has received mixed reviews from users. This suggests there might be training or resource allocation issues within the customer service department. Some clients have reported difficulty resolving technical issues or getting adequate explanations for trading-related questions, showing there's room for improvement in staff expertise and problem-solving abilities.

The absence of complete information about customer service protocols, escalation procedures, or specialized support for different client segments suggests that Trive may need to improve transparency and structure in its support operations. Without clear service level agreements or published support standards, clients may face uncertainty about what level of help they can expect.

Trading Experience Analysis (Score: 7/10)

The trading experience with Trive generally gets positive feedback about platform stability and order execution quality. Users report reliable performance during normal market conditions. The MetaTrader platforms provide familiar environments for experienced traders while offering complete functionality for technical analysis and trade management.

Order execution quality seems to meet industry standards based on user feedback. But specific data about slippage rates, requote frequency, or execution speeds weren't available in the materials we reviewed. The absence of detailed performance metrics makes it hard to objectively assess execution quality compared to industry benchmarks.

Platform functionality gets strong marks for being complete. The MetaTrader environments provide extensive charting tools, technical indicators, and analytical capabilities that support sophisticated trading strategies. The availability of automated trading through Expert Advisors and signal copying services makes the platform more appealing to diverse trading approaches.

The mobile trading experience through Trive's own app needs more evaluation. Specific user feedback about mobile platform performance, functionality, and reliability was limited in available materials. How well the desktop and mobile platforms work together, along with synchronization of trading data and account information, represents important factors for modern traders who need flexibility.

This trive review notes that while overall trading experience feedback is generally positive, the lack of specific spread information and detailed execution statistics creates uncertainty about the true cost and quality of the trading environment. This requires potential clients to test the platform directly to make informed decisions.

Trust and Safety Analysis (Score: 6/10)

Trive's regulatory status under ASIC supervision provides a foundation for client trust. The Australian Securities and Investments Commission maintains rigorous oversight standards for financial services providers. The Malta registration adds another layer of regulatory compliance, though the specific client protection measures and compensation schemes available weren't detailed in available materials.

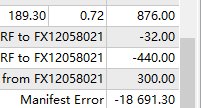

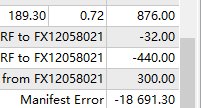

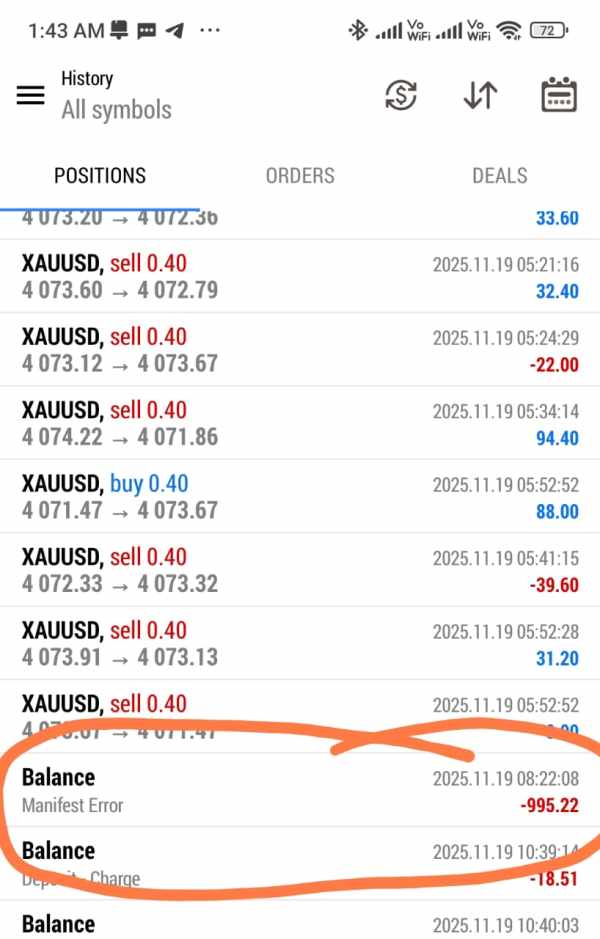

The concerning statistic that 68% of retail investors lose money when trading CFDs with Trive raises significant questions about client outcomes and risk management practices. While this figure is unfortunately common across the CFD industry, it represents a substantial risk factor that potential clients must carefully consider before investing.

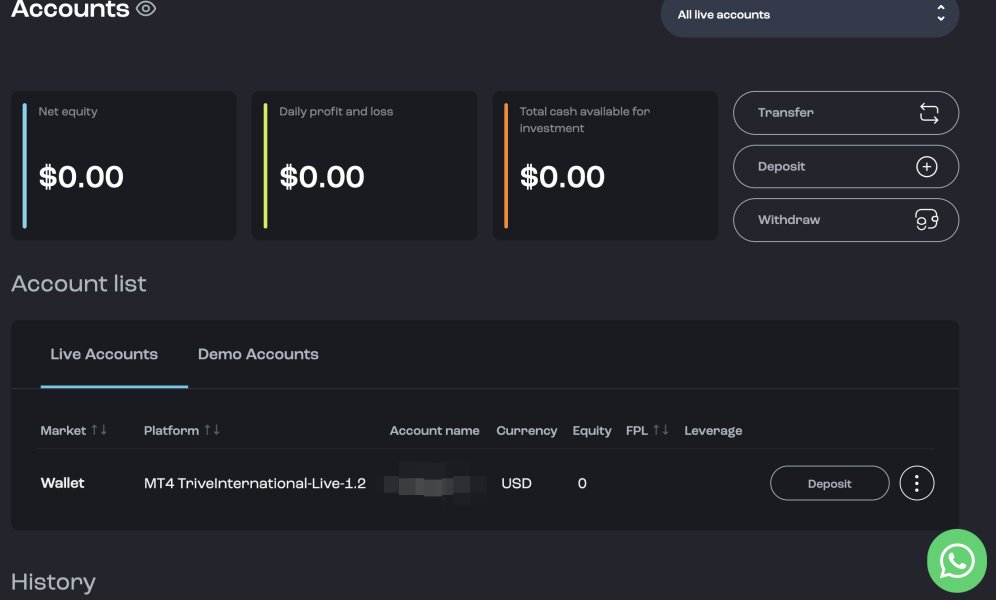

Fund safety measures weren't specifically detailed in available information. This includes segregated client accounts, insurance coverage, and regulatory capital requirements. The absence of clear information about how client funds are protected and what recourse exists in case of broker financial difficulties creates uncertainty about the safety of deposited capital.

Company transparency about financial reporting, management structure, and operational details appears limited based on available public information. Greater disclosure about company ownership, financial stability, and business operations would improve client confidence and show regulatory compliance better.

How they handle negative events, client complaints, or regulatory actions wasn't addressed in available materials. This makes it difficult to assess how Trive manages crisis situations or addresses client concerns when problems arise.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Trive presents a mixed picture. Feedback ranges from positive experiences with platform functionality to significant concerns about customer service and accessibility. The high minimum deposit requirement has generated substantial negative feedback from potential clients who feel excluded from the broker's services.

Interface design and usability get generally positive reviews for the MetaTrader platforms. But these are industry-standard solutions rather than new innovations. The mobile app's user experience needs more evaluation, as detailed feedback about navigation, functionality, and performance was limited in available materials.

Registration and account verification processes weren't specifically detailed in the information we reviewed. But user feedback suggests these procedures may involve standard industry practices including identity verification and compliance documentation. How efficient and user-friendly these processes are significantly impacts initial client experience.

Fund operation experiences weren't well covered in available materials. This includes deposit and withdrawal procedures, processing times, and fee structures. How convenient and reliable financial transactions are represents crucial factors in overall user satisfaction that need more investigation.

The most common user complaints center around the prohibitively high minimum deposit requirement and inconsistent customer service quality. The 68% retail loss rate also contributes to user concerns about whether the platform is really suitable for typical retail traders. Many question whether the broker's structure truly serves individual investor interests.

Conclusion

This comprehensive trive review reveals a broker with both strengths and significant limitations that potential clients must carefully weigh. Trive shows solid technical capabilities through its MetaTrader platform support and diverse asset offerings, making it potentially suitable for experienced traders seeking comprehensive CFD trading opportunities. The broker's regulatory oversight under ASIC provides a foundation of legitimacy and compliance with international standards.

But the extremely high minimum deposit requirement of 15,000 EUR effectively excludes most retail traders. This positions Trive as a niche service provider for high-net-worth individuals and institutional clients. Combined with mixed customer service feedback and the concerning 68% retail loss rate, these factors suggest that Trive may not be the best choice for typical individual traders seeking accessible and supportive CFD trading services.

The broker appears most suitable for well-capitalized traders who prioritize platform functionality and asset diversity over accessibility and customer support excellence. Prospective clients should carefully consider whether they meet the financial requirements and risk tolerance necessary for successful engagement with Trive's services. They should also explore alternative brokers that may offer more favorable conditions for their specific trading needs and experience level.