Regarding the legitimacy of Trive forex brokers, it provides ASIC, MFSA, FSCA, FSC, FCA, BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is Trive safe?

Pros

Cons

Is Trive markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD

Effective Date: Change Record

2012-07-24Email Address of Licensed Institution:

horatio.wheeler@trive.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 26 1-7 BLIGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

61288233544Licensed Institution Certified Documents:

MFSA Market Making License (MM) 4

Malta Financial Services Authority

Malta Financial Services Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

TRIVE FINANCIAL SERVICES EUROPE LTD.

Effective Date: Change Record

2013-06-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://trive.comExpiration Time:

--Address of Licensed Institution:

FLOOR 5, THE PENTHOUSE, LIFESTAR, TESTAFERRATA STREET, TA XBIEX MALTA XBX1403Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

TRIVE SOUTH AFRICA (PTY) LTD

Effective Date:

2007-08-15Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4 KAREN STREET OFFICE PARK LYME PARK BRYANSTON SANDTON JOHANNESBURG 2195Phone Number of Licensed Institution:

0000 000000000Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trive International Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Market Making (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Inst Market Making (MM)

Licensed Entity:

Trive Financial Services UK Limited

Effective Date:

2010-02-15Email Address of Licensed Institution:

support.uk@trive.comSharing Status:

No SharingWebsite of Licensed Institution:

www.trivepro.co.ukExpiration Time:

2024-06-14Address of Licensed Institution:

Level39 One Canada Square London E14 5AB ENGLANDPhone Number of Licensed Institution:

+442071861212Licensed Institution Certified Documents:

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT Trive Invest Futures

Effective Date:

--Email Address of Licensed Institution:

info@triveinvest.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.triveinvest.co.idExpiration Time:

--Address of Licensed Institution:

Multivision Tower Lantai 20, Jl. Kuningan Mulia Lot 9B, Kuningan Persada Complex, Jakarta Selatan 12980Phone Number of Licensed Institution:

(021) 22837975Licensed Institution Certified Documents:

Is Trive A Scam?

Introduction

Trive is a forex and CFD broker operating in the global financial markets, known for offering a range of trading instruments including currency pairs, commodities, and indices. Established in Malta, Trive positions itself as a competitive player in the forex trading landscape, appealing to both novice and experienced traders. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and conduct thorough evaluations before entrusting their funds to any broker. The importance of assessing a broker's credibility cannot be overstated, as traders risk not only their capital but also their financial security. In this article, we will explore Trive's regulatory status, company background, trading conditions, customer fund safety measures, client experiences, and overall risk profile to determine whether Trive is a legitimate broker or a potential scam.

Regulation and Legitimacy

Regulation is one of the key indicators of a broker's legitimacy and reliability. Brokers that are regulated by reputable authorities are subject to strict compliance standards, which helps protect traders from potential fraud and malpractice. Trive is regulated by several financial authorities, including the Malta Financial Services Authority (MFSA) and the Financial Conduct Authority (FCA) in the UK. Below is a summary of Trive's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MFSA | C60473 | Malta | Verified |

| FCA | 501320 | United Kingdom | Verified |

| ASIC | 424122 | Australia | Verified |

| BVI FSC | GB21026295 | British Virgin Islands | Verified |

| Bappebti | 824/Bappebti | Indonesia | Verified |

The presence of multiple regulatory licenses indicates that Trive operates under stringent oversight. The MFSA and FCA are considered tier-1 regulators, known for enforcing high standards of conduct among financial firms. Trive's compliance history appears to be clean, with no significant regulatory sanctions reported, which enhances its credibility. However, it is essential to note that while regulation provides a level of security, it does not eliminate all risks associated with trading.

Company Background Investigation

Trive Financial Services Malta Limited, the parent company of Trive, was established in 2013 and has since expanded its operations to serve clients globally. The company is headquartered in Malta, a jurisdiction known for its robust regulatory framework in financial services. The ownership structure of Trive includes various subsidiaries across different regions, including the UK, Australia, and South Africa, which allows it to cater to a diverse clientele.

The management team at Trive consists of experienced professionals with backgrounds in finance and trading, which adds to the company's credibility. The firm emphasizes transparency, providing clear information about its services and fees on its website. However, the depth of information available regarding the company's operational history and specific management profiles is somewhat limited, which may raise questions about its overall transparency.

Trading Conditions Analysis

Trive offers a variety of trading accounts, each designed to meet the needs of different types of traders. The broker's fee structure is competitive, with no minimum deposit required for certain account types. However, it is essential to analyze the overall cost of trading, including spreads and commissions. Below is a comparison of core trading costs:

| Fee Type | Trive | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | $0 for standard accounts | $6 for standard accounts |

| Overnight Interest Range | 0.5% - 1.0% | 0.5% - 1.5% |

Trive's spreads are slightly above the industry average for major currency pairs, which may impact profitability for day traders and scalpers. The absence of commissions on standard accounts is a positive aspect; however, traders should be aware of potential hidden fees in other areas, such as withdrawal fees or inactivity fees.

Client Fund Safety

The safety of client funds is paramount in the trading industry. Trive employs several measures to ensure the security of its clients' funds, including segregating client deposits from operational funds. This practice is crucial because it protects traders capital in the event of the broker's insolvency. Additionally, Trive participates in investor protection schemes, which provide further security for client funds.

Trive also offers negative balance protection, ensuring that traders cannot lose more money than they have deposited in their accounts. This feature is particularly important for retail traders who may be exposed to high volatility in the forex market. However, historical data regarding any past security issues or disputes involving Trive is limited, which may lead some traders to question the broker's overall safety.

Customer Experience and Complaints

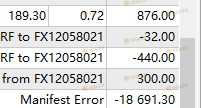

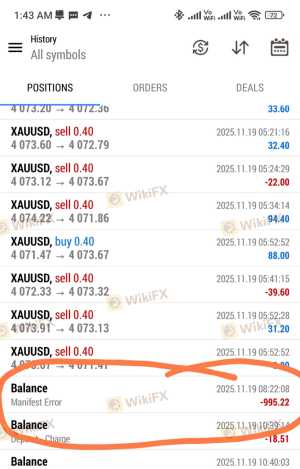

Customer feedback is a vital component in assessing a broker's reliability. Trive has received a mix of reviews from clients, with some praising its trading conditions and customer support, while others have raised concerns about withdrawal processes and response times. Common complaint patterns include difficulties in fund withdrawals and delays in customer service responses. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Generally responsive, but issues reported |

| Customer Support Quality | Medium | Mixed experiences; improvement needed |

| Account Verification Issues | Medium | Some delays reported |

A couple of notable cases involve clients reporting extended delays in receiving their funds after withdrawal requests. While Trive has addressed these issues in most instances, the frequency of such complaints could be a red flag for potential clients.

Platform and Trade Execution

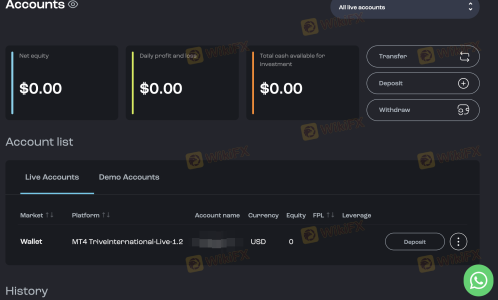

Trive utilizes the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which are known for their user-friendly interfaces and robust trading capabilities. The platforms offer a range of features, including advanced charting tools, automated trading options, and a variety of order types. In terms of order execution, Trive generally meets industry standards, with average execution speeds reported at around 60 milliseconds.

However, there have been reports of slippage during high volatility periods, which can affect trade outcomes. Additionally, there are no indications of platform manipulation, but traders should remain vigilant and monitor their trades closely, especially during significant market events.

Risk Assessment

Trading with Trive presents a range of risks that potential clients should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple regulations, but some are tier-2 or tier-3. |

| Fund Safety Risk | Low | Strong measures in place, including fund segregation and negative balance protection. |

| Customer Service Risk | Medium | Mixed reviews on responsiveness and effectiveness. |

| Trading Conditions Risk | Medium | Slightly higher spreads may affect profitability. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and consider starting with a demo account to familiarize themselves with the platform and trading conditions.

Conclusion and Recommendations

Based on the evidence presented, Trive does not exhibit clear signs of being a scam. It operates under reputable regulatory frameworks and offers a range of trading instruments with competitive conditions. However, potential clients should remain cautious due to mixed customer feedback, particularly regarding withdrawal processes and customer support responsiveness.

For traders seeking reliability, it is advisable to consider alternative brokers with a proven track record of excellent customer service and lower complaint rates. Some recommended alternatives include brokers regulated by top-tier authorities, such as the FCA or ASIC, which consistently receive positive reviews from their client base. Overall, while Trive may be a viable option for some traders, thorough due diligence is essential before making any financial commitments.

Is Trive a scam, or is it legit?

The latest exposure and evaluation content of Trive brokers.

Trive Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trive latest industry rating score is 7.84, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.84 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.