TradeFW 2025 Review: Everything You Need to Know

Summary

TradeFW stands out as a reliable and user-friendly trading platform. The broker has gained significant recognition among traders who seek diverse investment opportunities. This tradefw review reveals a broker that prioritizes customer satisfaction while offering comprehensive trading solutions across multiple asset classes.

The platform's most compelling features include access to over 250 trading instruments. These instruments span forex, CFDs, commodities, stocks, indices, precious metals, and cryptocurrencies. According to user feedback, TradeFW's customer support excellence sets it apart from competitors. Traders consistently praise the responsiveness and professionalism of the support team.

Based on available data from Trustpilot, TradeFW maintains a 3.66 TrustScore with 354 customer reviews. This indicates generally positive user experiences. The platform particularly appeals to traders who value diversified trading options combined with reliable customer service.

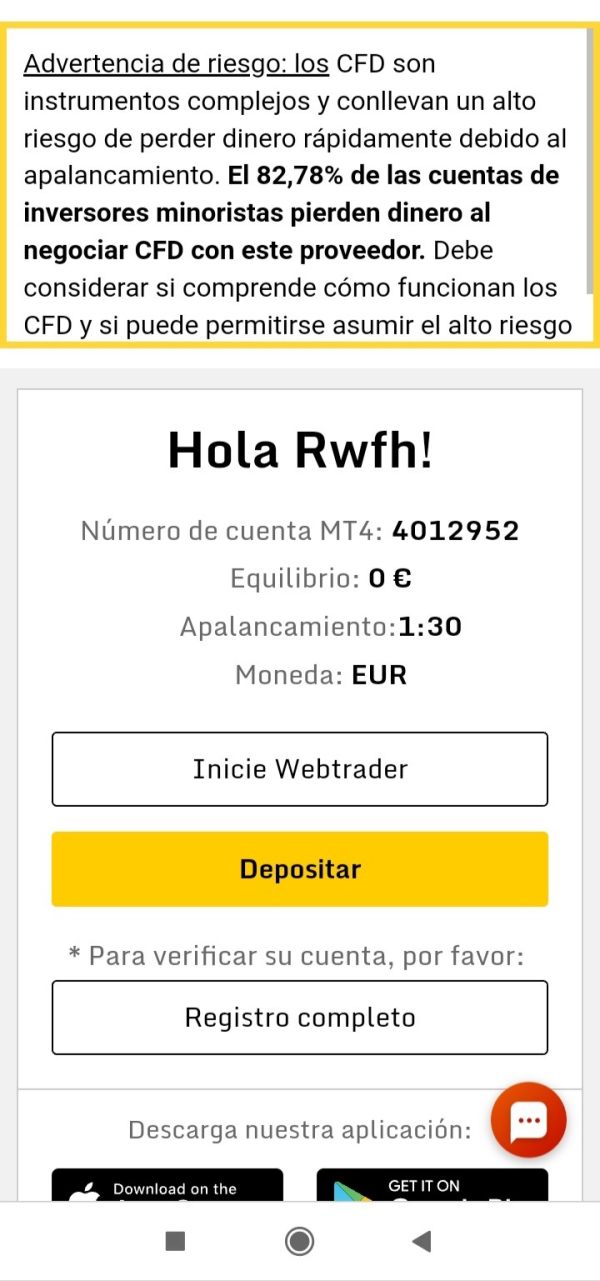

Whether you're interested in traditional forex trading or exploring newer markets like cryptocurrencies, TradeFW provides the infrastructure and support necessary for effective trading operations. The broker's regulatory compliance under the Cyprus Securities and Exchange Commission adds an important layer of credibility. However, traders should always verify current regulatory status before opening accounts.

Important Notice

TradeFW operates under the regulatory oversight of the Cyprus Securities and Exchange Commission. This provides European Union-level investor protections. However, traders should be aware that regulatory frameworks and available services may vary significantly across different jurisdictions.

Users outside the EU may experience different terms, conditions, and protections. This comprehensive review is based on publicly available information, user feedback from verified review platforms, and official broker documentation. All assessments reflect conditions as of 2025.

Traders are advised to verify current terms and offerings directly with TradeFW before making investment decisions.

Rating Framework

Broker Overview

TradeFW emerged in the competitive online trading landscape as a Cyprus-based financial services provider. The company established its headquarters in Limassol. TradeFW has positioned itself as a comprehensive trading solution provider, focusing on delivering quality trading experiences across diverse financial markets.

Since its inception, TradeFW has built its reputation on combining technological innovation with customer-centric service delivery. The broker operates under a business model that emphasizes accessibility and variety. This approach caters to both novice and experienced traders through its multi-platform approach.

TradeFW's commitment to regulatory compliance and customer satisfaction has helped establish its presence in the European trading community. However, specific founding details require verification through official sources. TradeFW supports multiple trading platforms including the industry-standard MetaTrader 4.

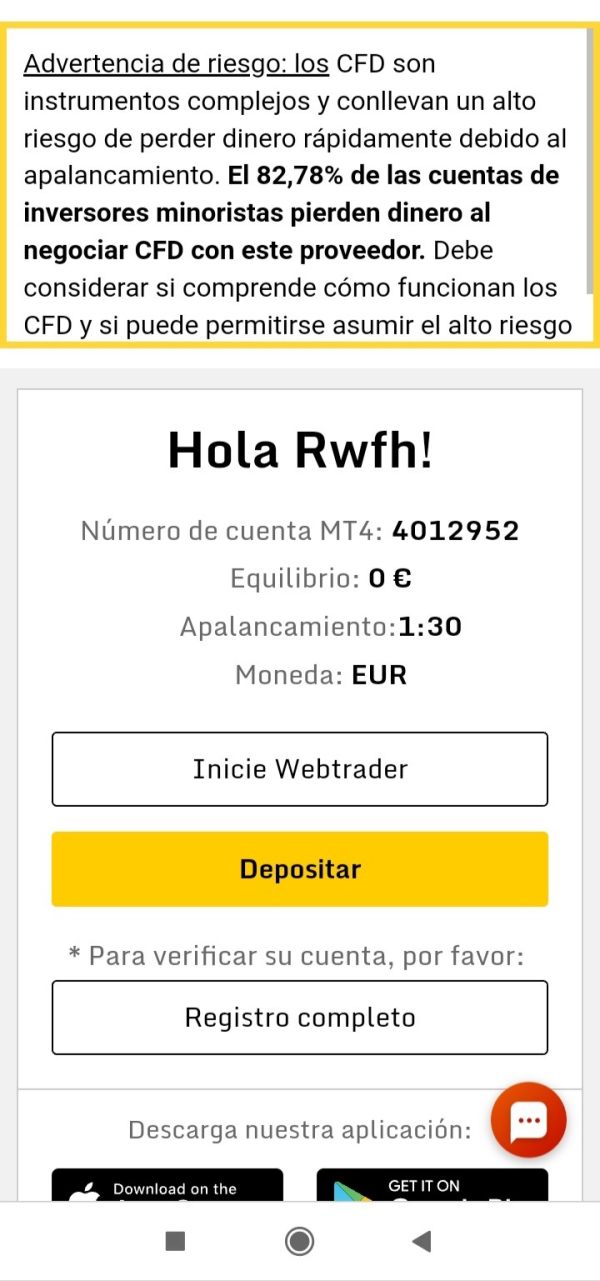

The platform also offers MT4 Mobile for on-the-go trading and a proprietary Webtrader platform. The asset coverage spans seven major categories: forex currency pairs, Contracts for Difference, commodities, individual stocks, market indices, precious metals, and cryptocurrencies. This tradefw review confirms that regulatory oversight comes from the Cyprus Securities and Exchange Commission, providing European regulatory framework protections for eligible traders.

Regulatory Jurisdiction: TradeFW operates under Cyprus Securities and Exchange Commission supervision. This provides EU-level regulatory protections and compliance standards for European traders.

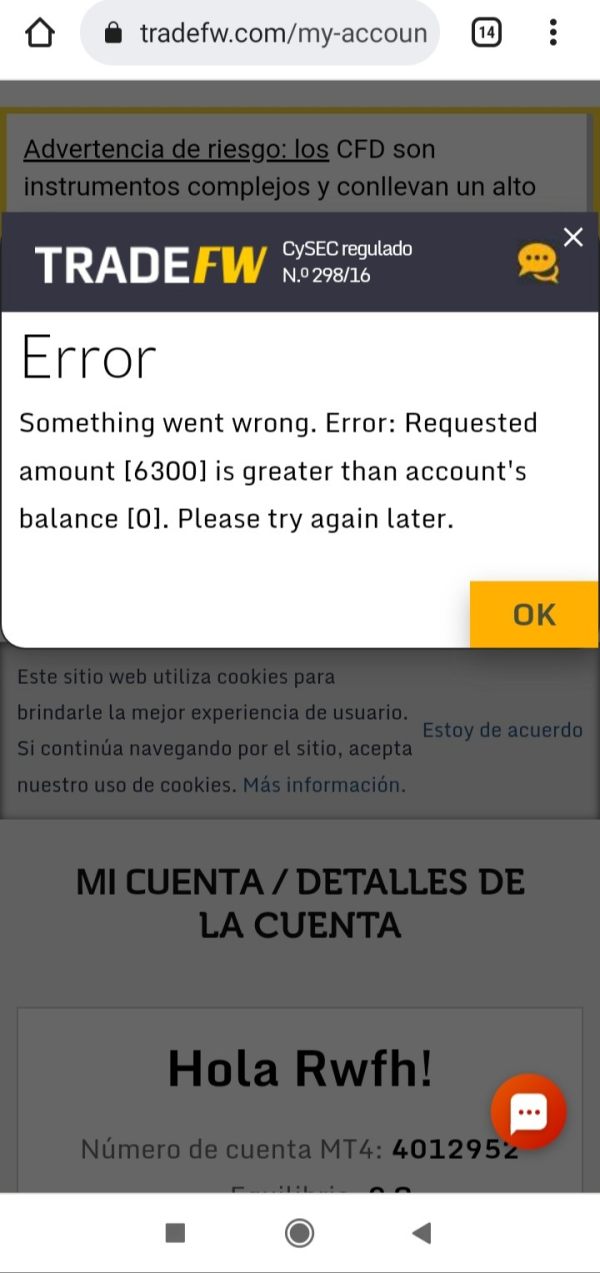

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in available public documentation.

Minimum Deposit Requirements: Current minimum deposit amounts for different account types are not specified in accessible broker information.

Bonus and Promotions: Details regarding welcome bonuses, trading incentives, or promotional offers are not mentioned in available sources.

Tradeable Assets: The platform provides access to over 250 trading instruments. These include major and minor forex pairs, commodity CFDs, individual stock CFDs, global indices, precious metals, and cryptocurrency CFDs.

Cost Structure: While specific spread ranges and commission structures are not publicly detailed, user feedback suggests competitive pricing. However, traders should verify current rates directly with the broker.

Leverage Ratios: Maximum leverage offerings and restrictions are not specified in available documentation. These likely vary by asset class and regulatory requirements.

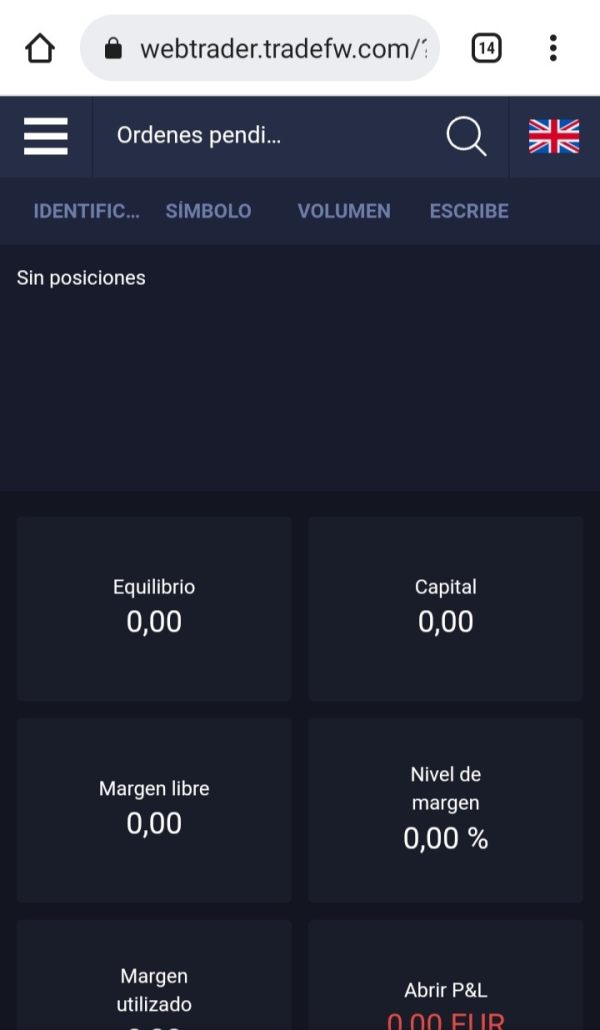

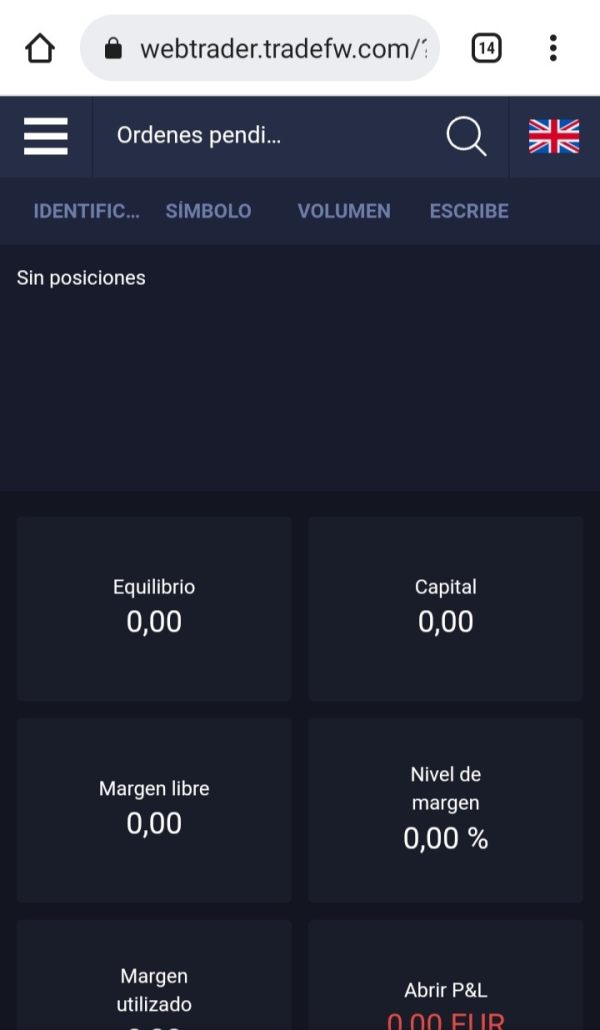

Platform Options: TradeFW supports MetaTrader 4 for desktop trading. The broker also offers MT4 Mobile for smartphone and tablet access, and a web-based trading interface for browser-based trading.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not detailed in current tradefw review materials.

Customer Service Languages: Available support languages are not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

TradeFW's account conditions present a mixed picture due to limited publicly available information about crucial trading terms. While the broker offers multiple account types to accommodate different trader profiles, specific details about minimum deposit requirements, spread ranges, and commission structures are not readily accessible through public channels. This lack of transparency impacts the overall assessment.

Traders typically require clear cost information before making broker selection decisions. The account opening process appears streamlined based on user feedback. However, specific verification requirements and timeframes are not detailed in available sources.

The absence of clearly published account tier structures makes it difficult for traders to understand what advantages higher-tier accounts might offer. This includes any potential VIP or premium account benefits. Additionally, information about specialized account types, such as Islamic accounts for Muslim traders, is not available in current documentation.

This tradefw review notes that while user satisfaction appears generally positive, the lack of detailed account condition information represents a significant transparency gap. Potential clients should address this through direct broker communication.

TradeFW excels in providing diverse trading opportunities through its extensive instrument selection of over 250 tradeable assets. The platform covers all major asset classes that modern traders expect. These include traditional forex pairs, commodity CFDs spanning energy and agricultural products, individual stock CFDs from major global exchanges, comprehensive index coverage, precious metals trading, and cryptocurrency CFDs for digital asset exposure.

The variety of trading platforms adds significant value. MetaTrader 4 provides robust technical analysis capabilities, automated trading support through Expert Advisors, and comprehensive charting tools. The addition of mobile trading through MT4 Mobile ensures traders can manage positions and monitor markets regardless of location.

The proprietary Webtrader platform offers browser-based access without software downloads. This appeals to traders who prefer web-based solutions. However, information about additional trading tools such as economic calendars, market research resources, educational materials, or advanced analytical tools is not detailed in available sources.

The absence of information about copy trading features, social trading capabilities, or advanced order types beyond standard market and limit orders represents potential areas for improvement. These features could enhance the platform's tool offering.

Customer Service and Support Analysis (9/10)

Customer support emerges as TradeFW's strongest competitive advantage based on consistently positive user feedback across review platforms. Traders frequently highlight the responsiveness, professionalism, and helpfulness of the support team. Many reviews specifically mention quick problem resolution and knowledgeable assistance.

This positive reputation in customer service represents a significant asset in an industry where support quality often differentiates brokers. The high user satisfaction with customer service suggests that TradeFW has invested appropriately in training support staff and establishing effective communication protocols. Users report positive experiences when seeking assistance with account issues, trading questions, and technical problems.

This indicates comprehensive support coverage across different inquiry types. However, specific details about support availability including operating hours, available contact methods, average response times, and multilingual support capabilities are not detailed in accessible documentation. The lack of information about dedicated account managers for higher-tier accounts or specialized support for different trader categories represents areas where more transparency would benefit potential clients.

Trading Experience Analysis (6/10)

The trading experience at TradeFW centers around proven platform technology, particularly the MetaTrader 4 ecosystem. This provides familiar functionality for experienced traders. MT4's robust feature set includes advanced charting capabilities, technical indicator libraries, automated trading through Expert Advisors, and reliable order execution systems.

The mobile trading capability through MT4 Mobile ensures consistent functionality across devices. This allows traders to maintain market connectivity regardless of location. The Webtrader platform adds flexibility for traders who prefer browser-based trading without software installation requirements.

This multi-platform approach accommodates different trading styles and technical preferences. It serves everything from desktop-focused analytical trading to mobile-first quick execution strategies. The platform diversity suggests TradeFW understands varied trader needs and has invested in comprehensive technology solutions.

However, crucial performance metrics such as execution speeds, slippage rates, server uptime statistics, and order fill quality are not available in public documentation. Information about trading environment specifics, including whether the broker operates as a market maker or uses straight-through processing, is not detailed in this tradefw review. The absence of performance benchmarks makes it difficult to assess actual trading quality beyond platform availability.

Trust Factor Analysis (7/10)

TradeFW's regulatory status under the Cyprus Securities and Exchange Commission provides important credibility and legal framework compliance within the European Union regulatory environment. CySEC regulation includes investor protection measures, segregated client fund requirements, and operational oversight that adds security layers for eligible traders. This regulatory foundation represents a significant trust factor compared to unregulated alternatives.

The positive user review trend, evidenced by the 3.66 TrustScore on Trustpilot with 354 reviews, suggests generally satisfactory client experiences and dispute resolution. The volume of reviews indicates meaningful user engagement and feedback collection. The overall positive sentiment reflects operational reliability from the user perspective.

However, specific details about fund segregation policies, insurance coverage for client deposits, company financial transparency including published annual reports, and detailed regulatory license information are not available in accessible documentation. The absence of information about company ownership structure, parent company relationships, and detailed regulatory compliance history limits the depth of trust assessment possible in this review.

User Experience Analysis (8/10)

User experience at TradeFW appears generally positive based on the 3.66 TrustScore rating and favorable review content across platforms. Traders consistently mention the platform's user-friendly nature. This suggests intuitive interface design and logical workflow organization.

The combination of familiar MT4 functionality with proprietary web-based trading options accommodates different user preferences and technical comfort levels. The strong customer support reputation directly enhances user experience. Traders report confidence in receiving assistance when needed.

This support quality appears particularly valuable for newer traders who may require guidance during their initial trading activities. The diverse asset selection allows users to explore different markets and trading strategies within a single platform environment. The user base appears to include traders seeking diversified trading opportunities combined with reliable support services.

This suggests TradeFW successfully targets traders who value both variety and service quality. However, specific information about user onboarding processes, account verification procedures, common user complaints, and detailed demographic analysis of the trader base is not available in current documentation.

Conclusion

TradeFW establishes itself as a competent trading platform that prioritizes customer satisfaction while providing access to diverse financial markets. The broker's strongest assets include excellent customer support, extensive instrument selection with over 250 trading options, and solid regulatory foundation through CySEC oversight. These factors combine to create a trading environment suitable for traders who value service quality and market variety.

The platform particularly appeals to traders seeking comprehensive asset coverage spanning traditional forex, commodities, stocks, indices, precious metals, and cryptocurrencies. The multi-platform approach accommodating both MT4 enthusiasts and web-based trading preferences demonstrates flexibility in meeting different trader needs. However, the limited transparency regarding account conditions, pricing structures, and detailed operational information represents areas where improved disclosure would benefit potential clients.

Overall, TradeFW merits consideration for traders prioritizing customer support excellence and diverse trading opportunities. However, prospective clients should conduct direct broker communication to clarify specific terms and conditions before account opening.