Regarding the legitimacy of moomoo forex brokers, it provides MAS and WikiBit, (also has a graphic survey regarding security).

Is moomoo safe?

Pros

Cons

Is moomoo markets regulated?

The regulatory license is the strongest proof.

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

MOOMOO FINANCIAL SINGAPORE PTE. LTD.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.moomoo.com/sgExpiration Time:

--Address of Licensed Institution:

10 MARINA BOULEVARD MBFC TOWER 2 #31-01 018983Phone Number of Licensed Institution:

+65 64391100Licensed Institution Certified Documents:

Is Moomoo A Scam?

Introduction

Moomoo is a digital trading platform that has rapidly gained popularity among retail investors since its inception in 2018. Headquartered in Palo Alto, California, it is a subsidiary of Futu Holdings, a company listed on the NASDAQ. Moomoo positions itself as a user-friendly platform for trading U.S. and international stocks, ETFs, and options, offering commission-free trading and advanced analytical tools. However, as with any financial service, it is crucial for traders to thoroughly evaluate the legitimacy and reliability of the broker they choose. The foreign exchange market is particularly susceptible to scams and fraudulent activities, making it imperative for traders to perform due diligence before committing their funds. This article aims to provide a comprehensive analysis of Moomoo, examining its regulatory status, company background, trading conditions, customer experience, and overall safety measures. The evaluation is based on a review of multiple credible sources, user feedback, and regulatory information to offer a balanced perspective on whether Moomoo is a safe and legitimate trading platform.

Regulation and Legitimacy

Moomoo operates under the regulatory oversight of several prestigious financial authorities, which adds a layer of credibility to its operations. Regulatory compliance is essential in the financial industry, as it ensures that brokers adhere to strict standards designed to protect investors. Moomoo is registered with the U.S. Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). The following table summarizes Moomoo's key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SEC | 8-69739 | United States | Verified |

| FINRA | 283078 | United States | Verified |

| SIPC | N/A | United States | Verified |

| ASIC | 224663 | Australia | Verified |

| MAS | CMS 101000 | Singapore | Verified |

The SEC and FINRA are two of the most respected regulatory bodies in the U.S., ensuring that Moomoo adheres to industry standards for financial practices. The SIPC provides insurance coverage for investors' securities up to $500,000, which includes a cash limit of $250,000, offering additional peace of mind to users. Moomoos compliance with these regulatory agencies demonstrates its commitment to maintaining a secure trading environment. Furthermore, Moomoo has a history of compliance with regulatory requirements, with no significant violations reported, further solidifying its reputation as a legitimate broker.

Company Background Investigation

Moomoo was founded in 2018 by Leaf Hua Li with the goal of simplifying the investment process for everyday traders. The company has experienced rapid growth and expansion into international markets, including Singapore, Australia, Japan, Malaysia, and Canada. This expansion reflects Moomoo's ambition to provide global access to financial markets while offering a robust trading experience.

The ownership structure of Moomoo is linked to Futu Holdings, which is publicly traded and has garnered significant investment from Tencent, a major player in the technology sector. This backing provides Moomoo with substantial financial resources and technological expertise, enhancing its platform capabilities. The management team at Moomoo comprises experienced professionals from various backgrounds in finance and technology, further strengthening the companys operational integrity.

Moomoo emphasizes transparency in its operations, with detailed disclosures regarding its services, fees, and account types readily available on its website. This level of transparency is crucial in building trust with users, as it allows potential clients to make informed decisions about their investments. Overall, Moomoo's strong company background and commitment to transparency position it as a credible option for traders seeking a reliable platform.

Trading Conditions Analysis

Moomoo's trading conditions are designed to cater to both novice and experienced traders. One of the most appealing aspects of Moomoo is its commission-free trading model for U.S. stocks, ETFs, and options. This model allows traders to execute trades without incurring traditional brokerage fees, which can significantly reduce overall trading costs. The following table outlines Moomoo's core trading costs compared to industry averages:

| Fee Type | Moomoo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | $0.00 | $0.01 - $0.03 |

| Commission Model | $0 for stocks | $0.01 - $0.05 |

| Overnight Interest Range | 6.8% | 10%+ |

While Moomoo offers competitive trading conditions, it is essential to note that there are other fees that traders may encounter. For instance, Moomoo charges a $75 fee for transferring stocks out of the account, which is relatively high compared to other brokers. Additionally, while trading options is commission-free, index options incur a fee of $0.50 per contract. Such fees can be a deterrent for traders looking to move their assets freely or engage in extensive options trading.

Moreover, Moomoo does not offer mutual funds or bonds, which may limit investment options for those seeking diversification through traditional investment vehicles. Overall, while Moomoo's trading conditions are favorable for active traders, potential users should be aware of the associated fees and limitations.

Customer Funds Safety

The safety of customer funds is a critical aspect of any trading platform. Moomoo employs several measures to ensure the security of its users' investments. As a member of the SIPC, Moomoo provides insurance for securities customers, protecting them up to $500,000, including a cash limit of $250,000. This coverage is crucial in the event of broker insolvency, although it does not protect against losses due to market fluctuations.

Moomoo also implements strict security protocols, including the segregation of client funds from corporate assets. This practice ensures that customers' funds are not used for the company's operational expenses. Additionally, Moomoo employs multi-factor authentication and encryption technologies to safeguard user accounts, further enhancing the security of sensitive information.

Despite these measures, it is essential for traders to remain vigilant and monitor their investments regularly. There have been no significant reports of security breaches or fund mismanagement associated with Moomoo, which is a positive indicator of its commitment to protecting customer assets. However, as with any financial platform, users should exercise caution and practice safe online habits to mitigate potential risks.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a trading platform's reliability and service quality. Moomoo has received a mix of reviews from users, with many praising its user-friendly interface, advanced trading tools, and commission-free trading options. However, some common complaints have emerged, particularly concerning customer support and withdrawal processes.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

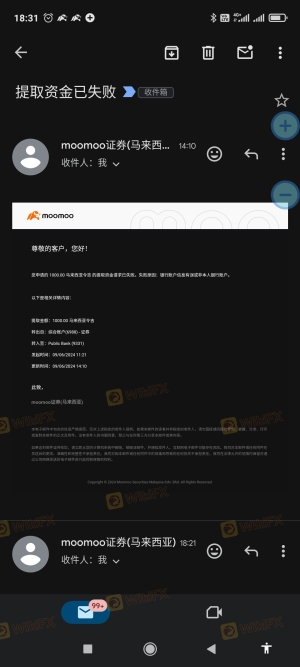

| Withdrawal Delays | Moderate | Slow to respond |

| Customer Support Accessibility | High | Limited options |

| Platform Stability | Low | Generally stable |

One notable case involved users experiencing delays in fund withdrawals, leading to frustration among clients who expected quicker access to their capital. While Moomoo has a responsive customer support team, the lack of direct phone support has been a drawback for some users. Instead, customers must rely on email communication, which can lead to longer response times.

Overall, while Moomoo provides a generally positive trading experience, the company should address the concerns raised by users to enhance its service quality and maintain a strong reputation in the competitive brokerage landscape.

Platform and Trade Execution

Moomoo's trading platform is designed to deliver a seamless user experience, combining advanced features with an intuitive interface. Both the mobile and desktop versions of the platform offer robust trading tools, including real-time market data, customizable charts, and a variety of order types. Users can access level 2 market data, which provides deeper insights into market activity, a feature that is typically reserved for professional traders.

When it comes to order execution, Moomoo claims to execute a high percentage of trades at the national best bid and offer (NBBO) price or better. However, some users have reported instances of slippage and order rejections during periods of high market volatility. These issues can impact the overall trading experience, particularly for active traders who rely on precise execution.

The platform has not been associated with any significant manipulation or unethical practices, which is a positive sign for potential users. Moomoo's commitment to transparency and fair trading practices is evident in its operational policies and user agreements.

Risk Assessment

Using Moomoo as a trading platform comes with inherent risks, as is the case with any online brokerage. The following risk assessment summarizes key risk areas associated with Moomoo:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight from SEC and FINRA. |

| Market Risk | High | Exposure to market volatility and potential losses. |

| Operational Risk | Medium | Occasional platform issues and withdrawal delays. |

| Customer Support Risk | Medium | Limited support options may lead to user frustration. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and remain informed about market conditions. Additionally, users should familiarize themselves with the platform's features and limitations before engaging in trading activities.

Conclusion and Recommendations

In conclusion, Moomoo presents itself as a legitimate and competitive trading platform, offering commission-free trading, advanced analytical tools, and a user-friendly interface. The regulatory oversight from respected authorities such as the SEC and FINRA, combined with SIPC protection for customer funds, reinforces its credibility as a safe option for traders.

However, potential users should be aware of the platform's limitations, including the lack of mutual funds and retirement account options, as well as higher fees for transferring assets out of the platform. While Moomoo is well-suited for active traders seeking low-cost trading options, those looking for a more comprehensive investment experience may need to explore alternatives.

For traders seeking a reliable platform, consider options like Charles Schwab or Fidelity, which offer a broader range of investment products and account types. Overall, Moomoo is not a scam, but it is essential for traders to assess their individual needs and preferences before committing to any trading platform.

Is moomoo a scam, or is it legit?

The latest exposure and evaluation content of moomoo brokers.

moomoo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

moomoo latest industry rating score is 3.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.