Trans X Market 2025 Review: Everything You Need to Know

Executive Summary

Trans X Market is a new online forex and CFD broker. This company has raised major concerns in the trading community. This trans x market review shows that the company operates without clear regulatory approval and presents serious fraud risks for potential investors.

Trans X Market Limited was founded in June 2023. The company claims to offer various financial instruments including forex, commodities, indices, and cryptocurrencies. They target both beginner and experienced traders.

Our investigation shows that the company lacks proper licensing for forex trading brokerage activities. Trans X Market presents itself as a complete trading platform, but the absence of legitimate regulatory oversight creates major risks for traders. The broker's registration with Saint Lucia's International Financial Centre does not provide the necessary authorization for forex trading operations.

This makes it a potentially dangerous choice for investors seeking reliable trading services. The platform mainly targets individuals looking to explore forex and other financial instruments. However, the significant regulatory gaps and emerging negative feedback suggest that traders should exercise extreme caution before engaging with this broker.

Important Notice

Regional Entity Differences: Trans X Market operates across different jurisdictions. This significantly impacts its regulatory status and user experiences. The company's registration in Saint Lucia through the International Financial Centre does not constitute proper licensing for forex trading activities.

This creates varying levels of risk exposure for users in different regions. Review Methodology: This evaluation is based on comprehensive analysis of publicly available information, regulatory databases, user feedback, and industry reports. We aim to provide an accurate assessment of Trans X Market's services and reliability.

Rating Framework

Broker Overview

Trans X Market was founded in June 2023. The company presents itself as a modern online trading platform designed to serve the global forex and CFD trading community. The company operates under Trans X Market Limited, which is incorporated in Saint Lucia.

Despite its recent establishment, the broker has quickly gained attention in the trading community. However, much of this attention stems from concerns about its legitimacy and regulatory compliance rather than positive recognition. The company positions itself as a comprehensive trading solution, offering access to multiple asset classes and claiming to serve both novice and experienced traders.

Trans X Market's business model centers around providing online forex and CFD brokerage services. The specific details of their operational framework remain largely unclear due to limited transparency in their public communications. According to available information, Trans X Market offers trading access to various financial instruments including foreign exchange pairs, commodities, stock indices, and cryptocurrencies.

However, the platform lacks proper licensing for forex trading brokerage activities, as confirmed by regulatory investigations. The company's registration with Saint Lucia's International Financial Centre serves as an International Business Companies Registry but does not authorize forex trading operations. This creates a significant regulatory gap that poses risks to potential clients.

Regulatory Jurisdiction: Trans X Market Limited is registered in Saint Lucia through the International Financial Centre. This registration does not provide licensing for forex trading brokerage activities, creating substantial regulatory concerns.

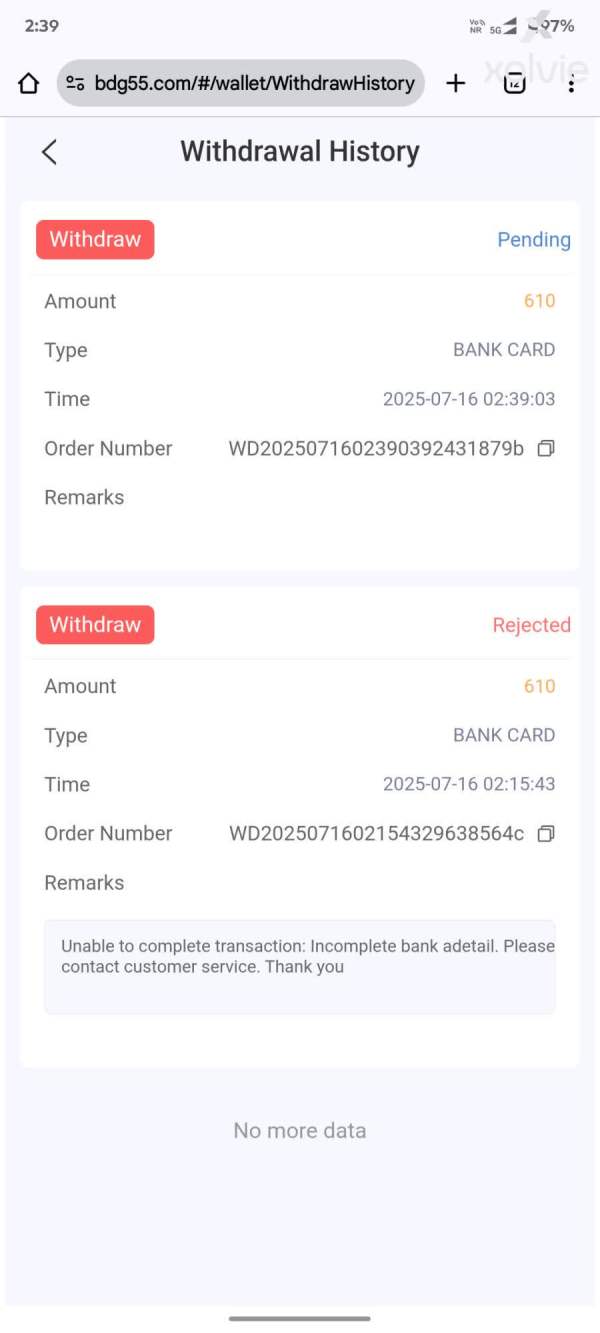

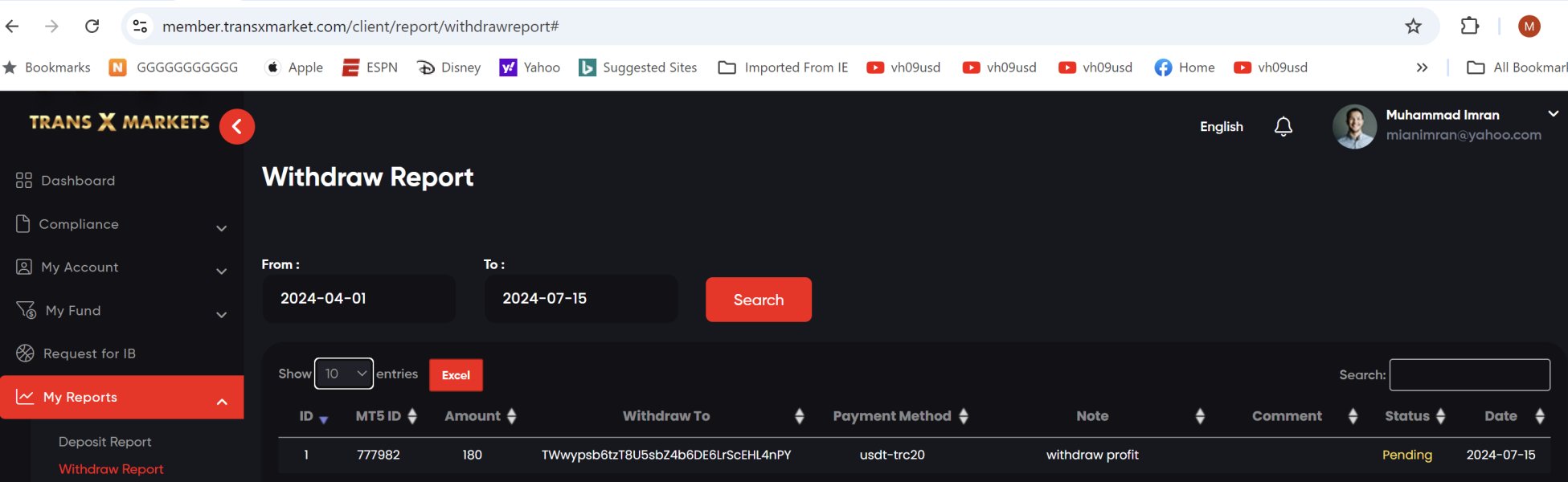

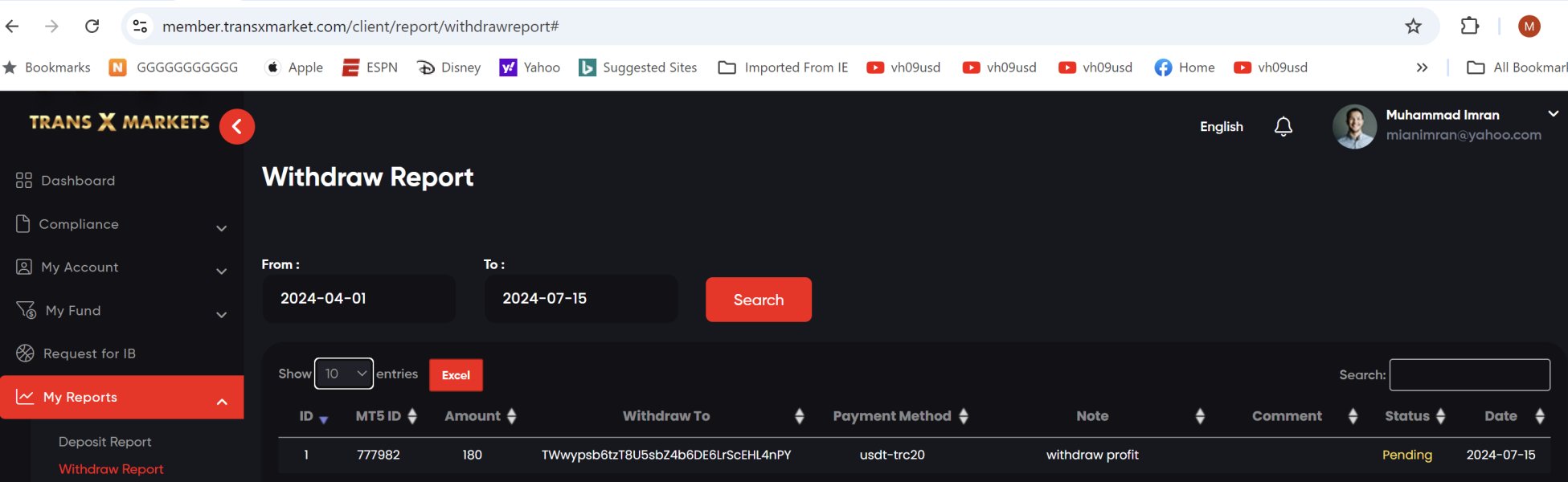

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available documentation. This raises transparency concerns for potential clients.

Minimum Deposit Requirements: The minimum deposit requirements are not clearly specified in available materials. This indicates a lack of comprehensive public disclosure.

Bonus and Promotions: Details about promotional offers and bonus structures are not mentioned in available documentation.

Tradeable Assets: The platform claims to offer access to forex pairs, commodities, stock indices, and cryptocurrencies. This provides a diverse range of financial instruments for trading activities.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in available materials. This significantly impacts transparency and client decision-making.

Leverage Ratios: Leverage information is not specified in available documentation. This creates uncertainty about trading conditions.

Platform Options: Specific trading platform details are not mentioned in available materials. This leaves questions about the technological infrastructure.

This comprehensive trans x market review reveals significant gaps in publicly available information. This itself raises concerns about the broker's transparency and commitment to client disclosure.

Detailed Rating Analysis

Account Conditions Analysis

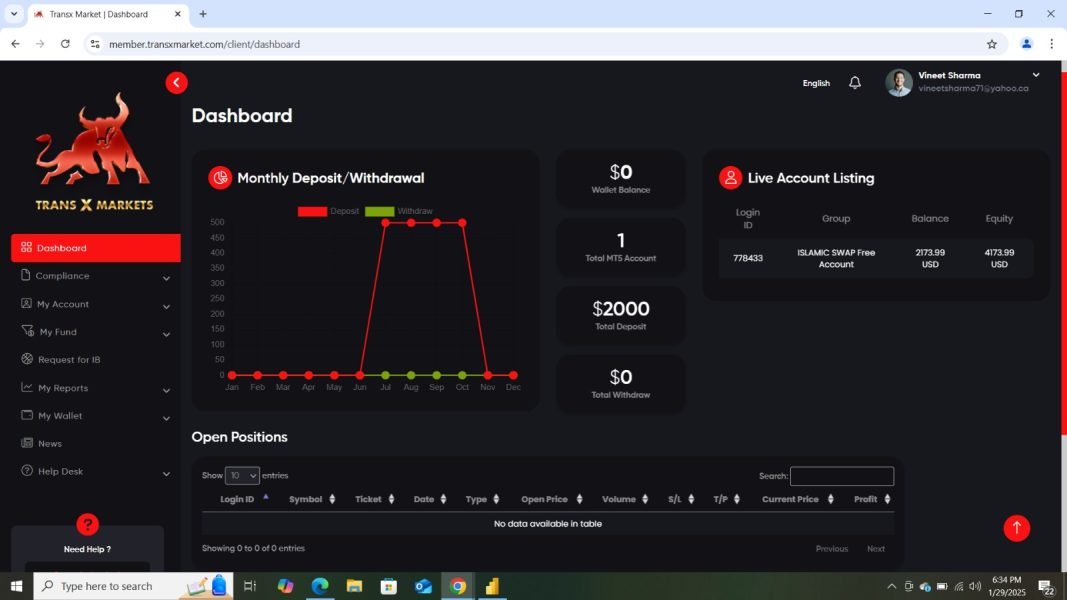

Trans X Market's account conditions receive a poor rating due to the significant lack of transparency and detailed information available to potential clients. The broker fails to provide clear specifications about account types, minimum deposit requirements, or the account opening process. These are fundamental elements that traders need to make informed decisions.

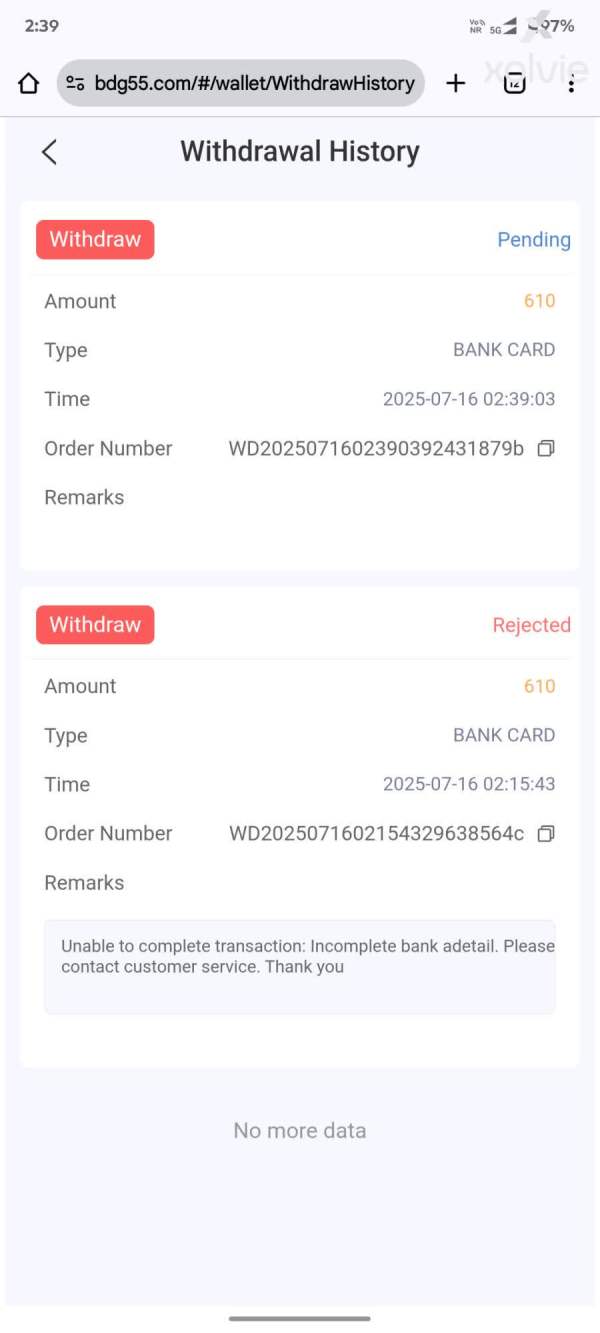

The absence of detailed information about account features creates uncertainty for potential clients. For example, it's unclear whether Islamic accounts are available or what specific benefits different account tiers might offer. This lack of transparency is particularly concerning given that legitimate brokers typically provide comprehensive account information as part of their standard client disclosure practices.

The account opening process appears to lack the robust verification procedures typically associated with properly regulated brokers. The regulatory gaps identified in this trans x market review suggest that the account conditions may not meet industry standards for client protection and compliance requirements. The limited information available about account management, maintenance fees, or inactivity charges further compounds concerns about the broker's transparency.

Professional traders and institutions typically require detailed account specifications to assess whether a broker meets their operational requirements. Trans X Market's lack of comprehensive disclosure significantly hampers such evaluations.

Trans X Market claims to offer access to multiple asset classes including forex, commodities, indices, and cryptocurrencies. This provides some diversity in trading opportunities. However, the actual quality and reliability of these instruments remain questionable due to the broker's regulatory status and limited operational transparency.

The platform's range of financial instruments appears competitive on the surface, potentially catering to different trading strategies and preferences. The inclusion of cryptocurrency trading alongside traditional forex and commodity markets suggests an attempt to appeal to modern traders seeking diverse investment opportunities. However, the lack of detailed information about research and analysis resources significantly limits the platform's value proposition.

Professional traders typically rely on comprehensive market analysis, economic calendars, and technical analysis tools. None of these are clearly described in available documentation about Trans X Market's services. Educational resources, which are crucial for beginner traders, are not mentioned in available materials.

This absence is particularly concerning given that the broker claims to target both novice and experienced traders. Legitimate brokers typically invest heavily in educational content to support client success and demonstrate their commitment to responsible trading practices.

Customer Service and Support Analysis

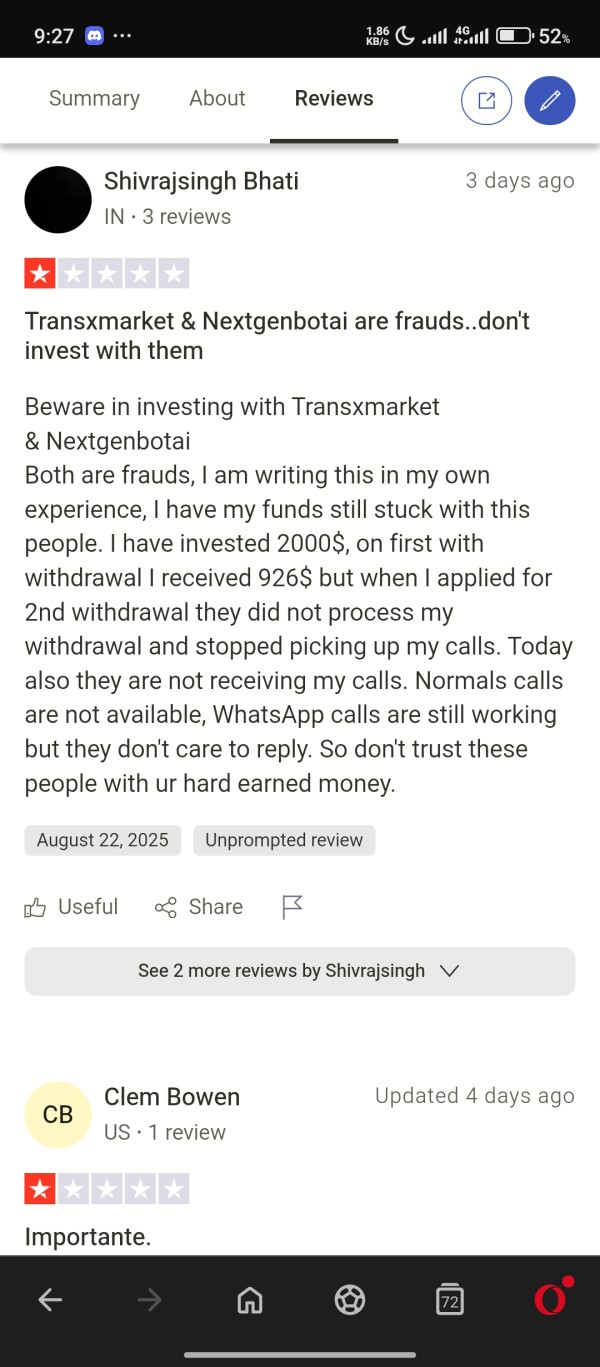

Customer service information for Trans X Market is notably limited. There are no clear details about available support channels, response times, or service quality standards. This lack of transparency about customer support infrastructure raises significant concerns about the broker's commitment to client service and problem resolution.

The absence of information about customer service availability creates uncertainty for potential clients. It's unclear whether support is provided 24/7 or what languages are supported, which is particularly problematic for clients in different time zones or non-English speaking regions. Professional trading environments require reliable customer support to address technical issues, account problems, or trading disputes promptly.

User feedback regarding customer service experiences is limited. However, the general concerns about the broker's legitimacy suggest that clients may face challenges in receiving adequate support when needed. The regulatory gaps identified in this analysis further compound concerns about recourse options for clients who experience problems with their accounts or trading activities.

The lack of detailed information about complaint resolution procedures or escalation processes indicates that Trans X Market may not have established the robust customer protection frameworks typically associated with legitimate, regulated brokers.

Trading Experience Analysis

The trading experience offered by Trans X Market remains largely unclear due to insufficient information about platform stability, execution quality, and technological infrastructure. Without detailed specifications about the trading platform used, order execution speeds, or system reliability, potential clients cannot adequately assess whether the broker can meet their trading requirements. Platform functionality details are not provided in available documentation.

This makes it impossible to evaluate whether the trading environment includes essential features such as advanced charting tools, technical indicators, or automated trading capabilities. These elements are crucial for serious traders who require sophisticated analytical and execution tools. Mobile trading capabilities, which are increasingly important in modern trading environments, are not specifically addressed in available materials.

The lack of information about mobile app features, compatibility, or functionality represents a significant gap in the broker's public disclosure. This trans x market review identifies substantial concerns about the overall trading environment, particularly given the regulatory issues that may impact order execution quality and client fund protection. The absence of detailed performance metrics or execution statistics further limits the ability to assess the actual trading experience quality.

Trust and Security Analysis

Trans X Market receives the lowest possible rating for trust and security due to fundamental regulatory compliance failures. The broker's lack of proper licensing for forex trading brokerage activities represents a critical security risk for potential clients. Investigation reveals that while the company is registered with Saint Lucia's International Financial Centre, this registration does not authorize forex trading operations.

The regulatory gap creates substantial risks regarding fund security. Clients may not have access to standard investor protection measures such as segregated client accounts, compensation schemes, or regulatory oversight of business practices. These protections are fundamental elements of legitimate forex brokerage operations and their absence significantly compromises client security.

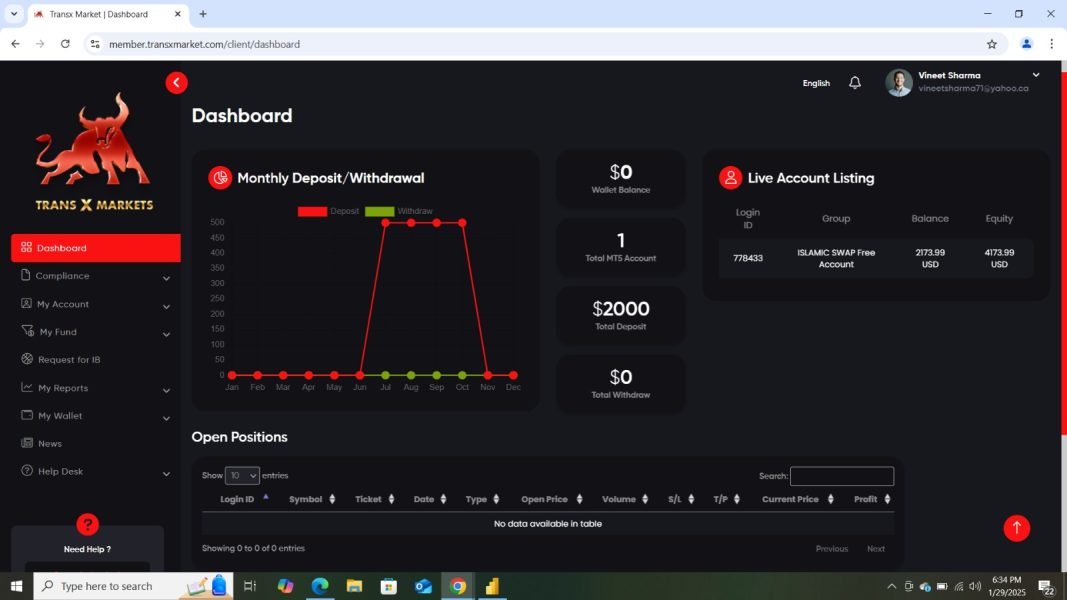

The company's operational transparency is severely limited, with minimal disclosure about fund handling procedures, risk management protocols, or compliance frameworks. This lack of transparency is particularly concerning given the regulatory deficiencies already identified, as it prevents potential clients from assessing the actual security measures in place. Industry reputation and third-party verification information is largely absent, and the available feedback suggests significant concerns about the broker's legitimacy.

The identification of potential fraud risks in regulatory assessments further undermines confidence in the platform's trustworthiness and security standards.

User Experience Analysis

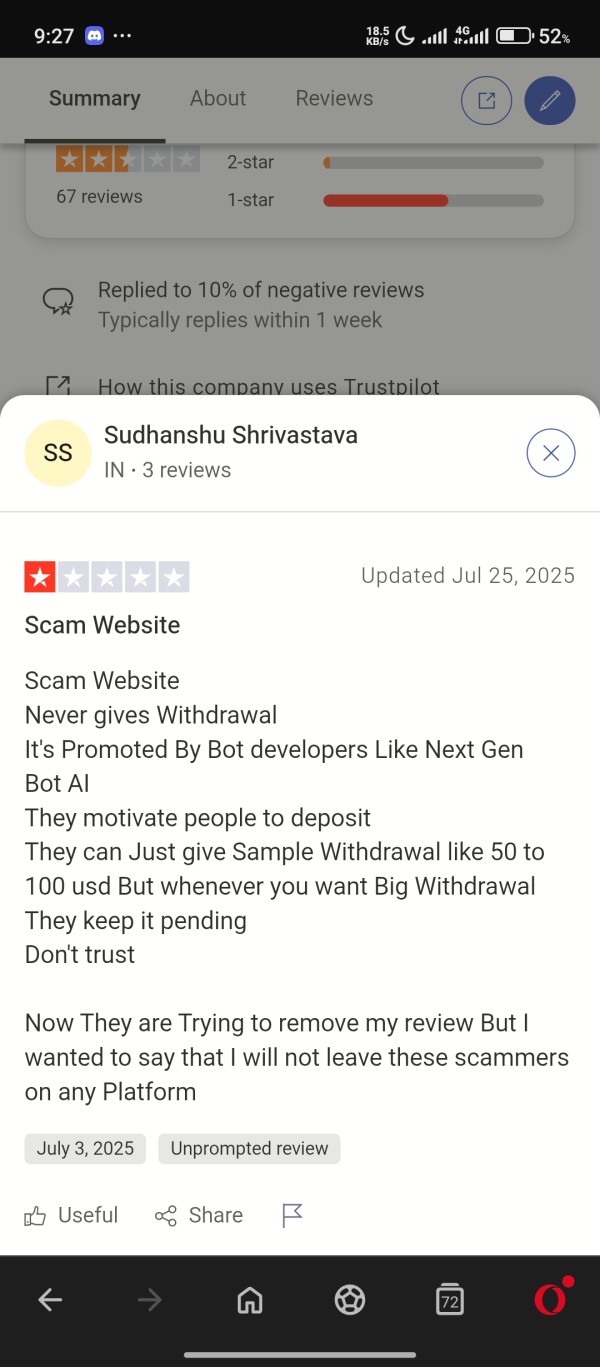

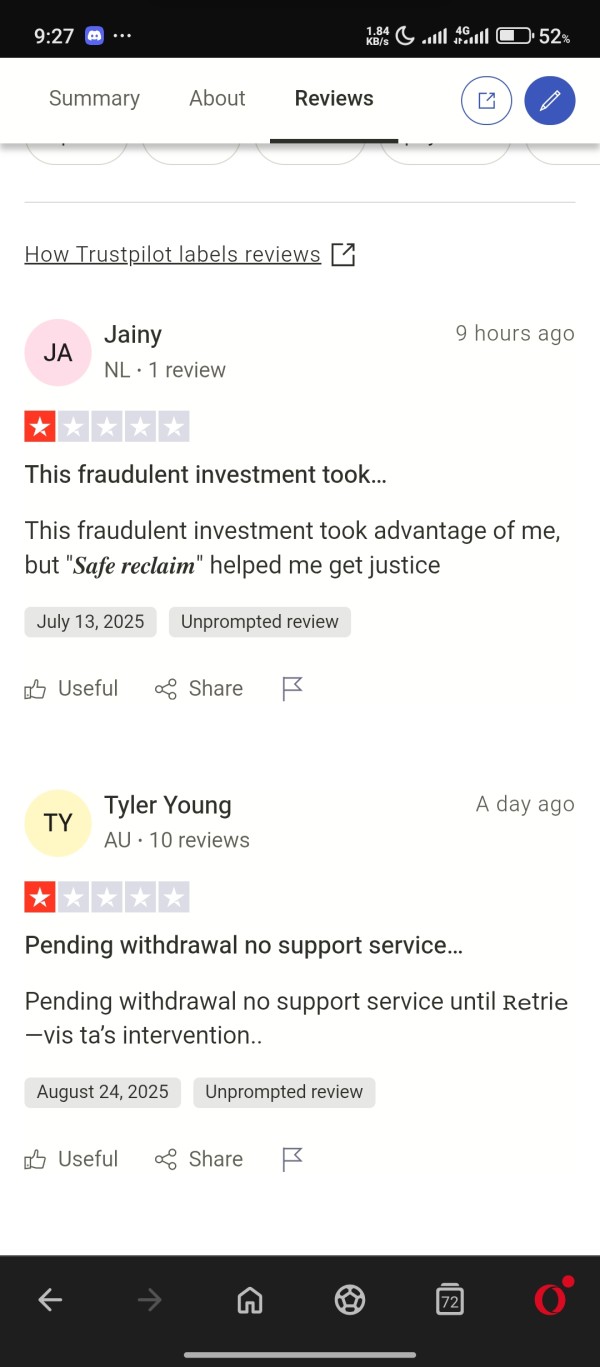

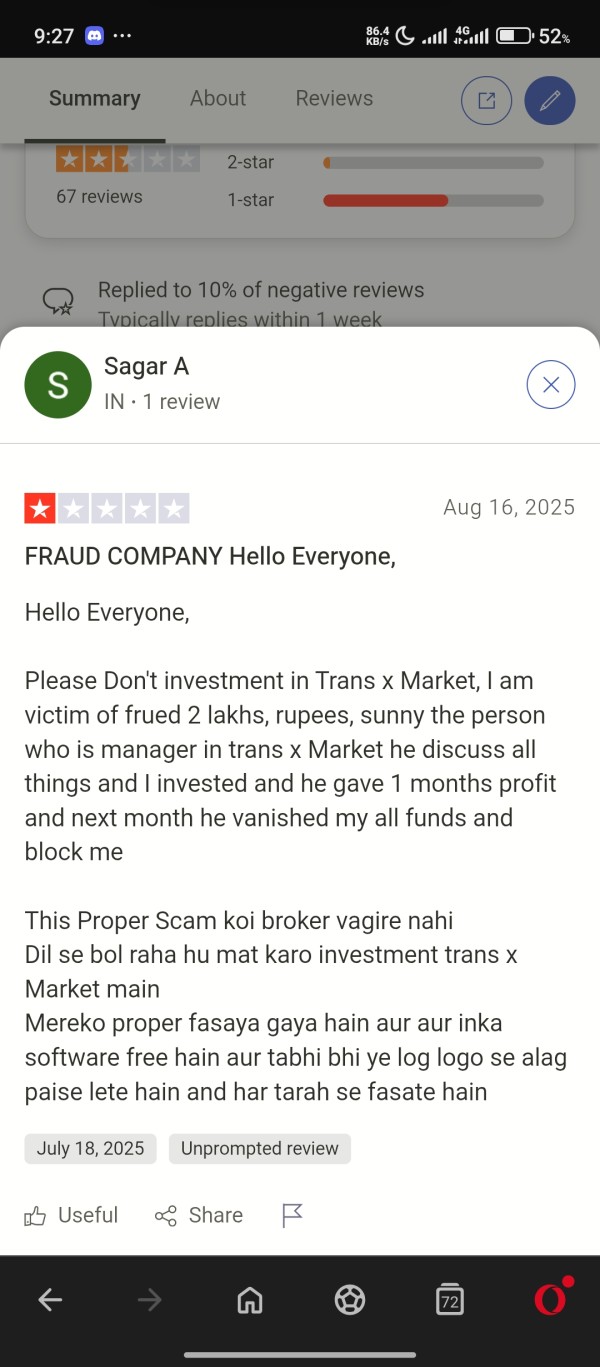

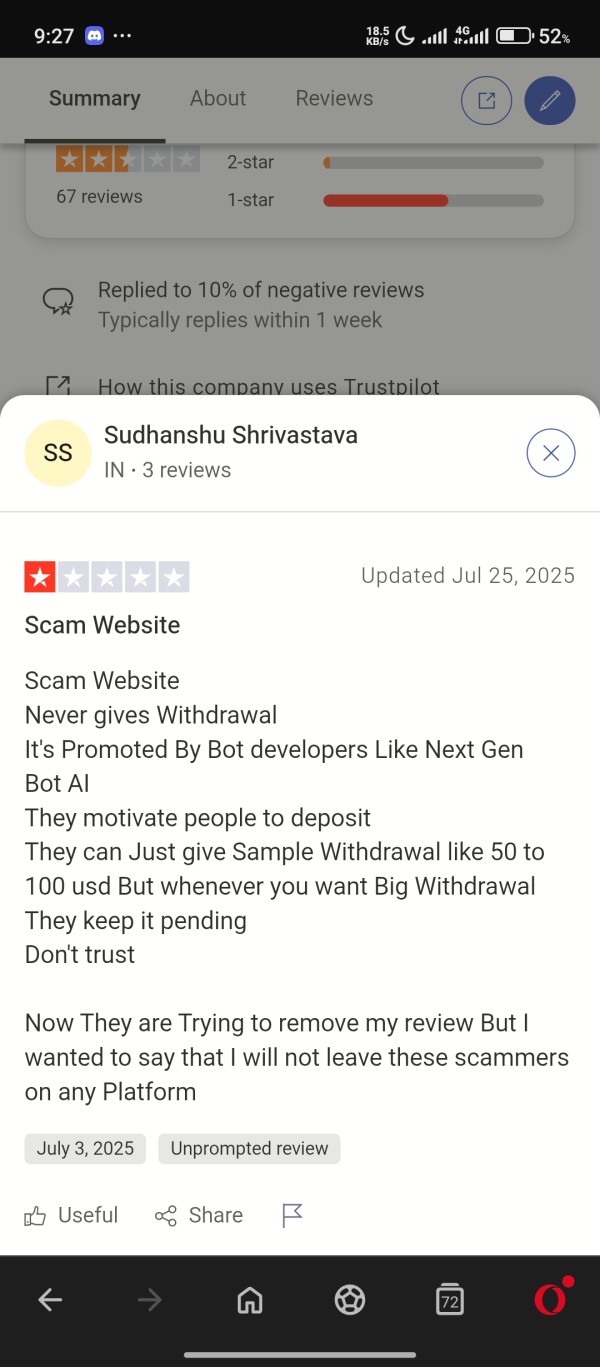

User experience assessment for Trans X Market is hampered by limited feedback and the broker's recent establishment. However, the available information suggests significant concerns about overall user satisfaction. These concerns are primarily driven by regulatory uncertainty and transparency issues rather than platform functionality problems.

The lack of detailed information about user interface design, registration processes, and account management features makes it difficult to assess the practical user experience. Professional traders typically require intuitive interfaces, efficient navigation, and comprehensive account management tools. None of these are adequately documented in available materials.

User feedback patterns suggest growing concerns about the broker's legitimacy and operational reliability. While specific user experience complaints about platform functionality are limited, the broader trust issues identified in this analysis significantly impact overall user satisfaction and confidence. The target user base of both beginners and experienced traders may find the lack of educational resources and comprehensive platform documentation particularly problematic.

The absence of detailed user guides, tutorial materials, or community support resources limits the platform's accessibility. This is especially true for novice traders who require additional guidance and support.

Conclusion

This comprehensive trans x market review reveals significant concerns about the broker's regulatory status, transparency, and overall reliability. Trans X Market's lack of proper licensing for forex trading activities, combined with limited operational disclosure, creates substantial risks. This makes it unsuitable for most traders, particularly beginners who require secure, well-regulated trading environments.

The broker's registration in Saint Lucia does not provide adequate regulatory oversight for forex operations. The absence of detailed information about trading conditions, customer service, and security measures further compounds these concerns. While the platform claims to offer diverse financial instruments, the regulatory gaps and transparency issues significantly outweigh any potential benefits.

We strongly recommend that traders, especially those new to forex trading, seek properly regulated alternatives. Look for brokers with clear licensing, comprehensive disclosure, and established track records of reliable service and client protection.