Is COINEXX safe?

Pros

Cons

Is Coinexx A Scam?

Introduction

Coinexx is an online trading platform that has made a name for itself in the forex and cryptocurrency markets since its establishment in 2017. Positioned as an offshore broker, Coinexx offers a wide range of trading instruments, including over 60 currency pairs, cryptocurrencies, commodities, and indices. However, the lack of regulation and transparency surrounding its operations raises significant concerns for potential traders. In the highly volatile and competitive realm of forex trading, it is crucial for traders to carefully evaluate the brokers they choose to ensure their investments are safe and their trading experience is secure.

This article aims to provide an in-depth analysis of Coinexx, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The information is gathered from various reputable sources, including trader reviews, regulatory databases, and financial news outlets, ensuring a comprehensive understanding of the broker's standing in the market.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors to consider when assessing its legitimacy. Coinexx operates without regulation from any major financial authority, which poses inherent risks for traders. The absence of oversight means that clients have limited recourse in the event of disputes or issues with fund withdrawals.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation is a significant red flag, as regulated brokers are subject to strict guidelines that protect clients' funds and ensure fair trading practices. Regulatory bodies such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus) enforce measures such as segregated client accounts, investor compensation schemes, and regular audits. Coinexx's unregulated status means it is not held accountable to any of these standards, making it more susceptible to operational risks and potential fraudulent activities.

Historically, unregulated brokers have been associated with various compliance issues, including misappropriation of client funds and failure to honor withdrawal requests. This lack of regulatory oversight highlights the importance of exercising caution when considering Coinexx as a trading option.

Company Background Investigation

Coinexx was founded in 2017 and claims to have its headquarters in Seychelles, a jurisdiction known for its lenient regulatory framework. The company presents itself as a client-centric broker that leverages cryptocurrency for fast and efficient trading. However, details regarding its ownership structure and management team remain vague, raising concerns about transparency.

The absence of publicly available information about the company's management and operational history can be problematic. A reputable broker typically provides insights into its leadership, including their qualifications and experience in the financial industry. Coinexx's lack of such disclosures may indicate a desire to operate without scrutiny, which can be a warning sign for potential traders.

Furthermore, the company's website does not provide adequate information about its operational practices, which further complicates the assessment of its legitimacy. Transparency in operations is crucial for building trust with clients, and Coinexx appears to fall short in this regard.

Trading Conditions Analysis

Coinexx offers a variety of trading conditions that are competitive in some aspects but also raise concerns. The broker provides a single account type known as the Pro ECN account, which features tight spreads, high leverage, and low commissions. However, the overall cost structure and fee policies require careful scrutiny.

| Fee Type | Coinexx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0.0 pips | 1.0-1.5 pips |

| Commission Model | $2 per lot | $3-5 per lot |

| Overnight Interest Range | Variable | 0.5-2% |

While Coinexx's claim of spreads starting from 0.0 pips is appealing, it is essential to consider that such low spreads may not always be available, especially during high volatility periods. Additionally, the commission structure, while lower than many competitors, may not be as straightforward as it appears. Traders should be wary of hidden fees or unexpected charges that could erode profitability.

Moreover, the broker's overnight interest rates can vary significantly, and traders may find themselves facing higher costs than anticipated if they hold positions overnight. This variability in trading costs can complicate trading strategies and affect overall profitability.

Customer Fund Security

The security of customer funds is paramount in the trading industry. Coinexx claims to implement various security measures, including SSL encryption and two-factor authentication for account access. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Coinexx does not provide investor protection schemes, which means that in the event of insolvency or operational issues, clients may not recover their funds. The absence of segregated accounts further exacerbates this risk, as client funds could potentially be used for the broker's operational expenses.

Historically, unregulated brokers like Coinexx have faced allegations of mishandling client funds, leading to significant financial losses for traders. The lack of transparency regarding fund management practices and the absence of a robust regulatory framework make it difficult to ascertain the true safety of clients' investments with Coinexx.

Customer Experience and Complaints

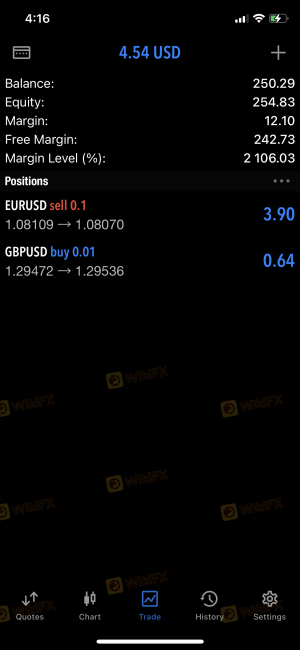

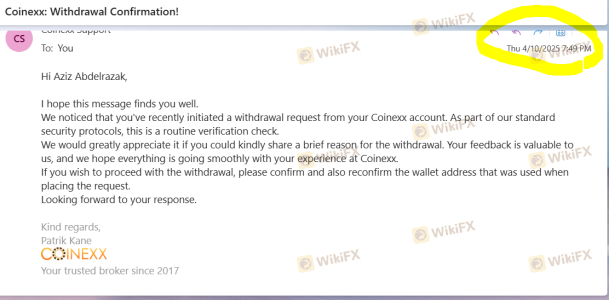

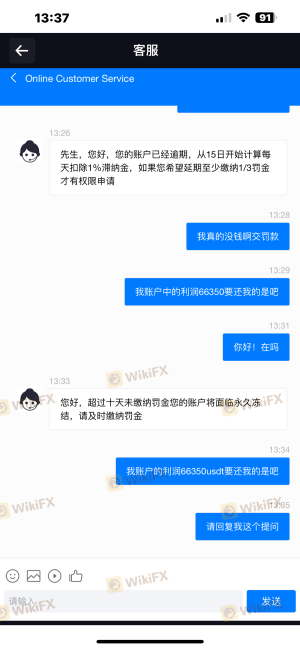

Customer feedback regarding Coinexx is mixed, with numerous reports of negative experiences. Common complaints include difficulties with fund withdrawals, poor customer service, and issues with trade execution.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Generally unresponsive |

| Poor Customer Support | Medium | Slow response times |

| Execution Issues | High | Denial of issues |

Many users report facing significant delays in withdrawal processing, with some claiming that their requests were denied without clear explanations. Additionally, the quality of customer support has been criticized, with traders often experiencing long wait times for assistance.

Two notable case studies highlight these issues. One trader reported being unable to withdraw their funds after repeated attempts, leading to frustration and distrust. Another user mentioned that their account was suddenly flagged for review, resulting in the removal of their profits without justification. These incidents underscore the potential risks associated with trading with Coinexx.

Platform and Execution Quality

The trading platforms offered by Coinexx, namely MetaTrader 4 and MetaTrader 5, are well-regarded in the industry for their functionality and user-friendliness. However, the execution quality has come under scrutiny, with reports of slippage and rejected orders.

Traders have noted instances of negative slippage, where trades are executed at worse prices than expected. This practice can significantly impact profitability, especially for high-frequency traders who rely on precise execution. Additionally, some users have reported that their orders were not executed at all, raising concerns about the broker's reliability.

Risk Assessment

Using Coinexx as a trading platform comes with inherent risks that potential traders should carefully evaluate.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of investor protection |

| Execution Risk | Medium | Reports of slippage and rejections |

| Customer Support Risk | Medium | Slow response times |

To mitigate these risks, traders are advised to conduct thorough research before investing and consider diversifying their trading activities across multiple regulated brokers. Additionally, maintaining a cautious approach to fund management and utilizing risk management strategies can help minimize potential losses.

Conclusion and Recommendations

In conclusion, while Coinexx offers competitive trading conditions and a range of instruments, the lack of regulation and transparency raises significant concerns about its legitimacy. The numerous complaints regarding fund withdrawals, poor customer support, and execution issues suggest that traders should approach this broker with caution.

For those seeking a reliable trading experience, it is advisable to consider regulated alternatives that offer robust investor protection and transparent operations. Brokers like eToro, IG, and OANDA provide a higher level of security and regulatory oversight, making them more trustworthy options for traders.

Ultimately, while Coinexx may appeal to some traders due to its high leverage and low costs, the associated risks and negative feedback warrant a careful evaluation before committing funds.

Is COINEXX a scam, or is it legit?

The latest exposure and evaluation content of COINEXX brokers.

COINEXX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

COINEXX latest industry rating score is 2.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.