Regarding the legitimacy of TradeFW forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is TradeFW safe?

Pros

Cons

Is TradeFW markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

iTrade Global (CY) Ltd

Effective Date:

2016-04-28Email Address of Licensed Institution:

compliancefw@tradefw.comSharing Status:

Website of Licensed Institution:

www.investfw.com, www.tradedwell.comExpiration Time:

--Address of Licensed Institution:

Gladstonos 99, Elnor Building, 3rd Floor, 3032 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 262 126Licensed Institution Certified Documents:

Is TradeFW A Scam?

Introduction

TradeFW is an online brokerage firm that primarily operates in the forex and CFD markets. Established in 2018 and regulated by the Cyprus Securities and Exchange Commission (CySEC), TradeFW aims to provide a trading platform for both novice and experienced traders. However, as with any financial service, it is crucial for traders to carefully evaluate the legitimacy and reliability of a broker before committing their funds. The forex market, while offering significant opportunities for profit, also harbors risks, including the potential for fraud. This article aims to investigate whether TradeFW is a safe broker or if it exhibits characteristics of a scam. The assessment is based on a comprehensive review of its regulatory status, company background, trading conditions, client fund security measures, and customer experiences.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy. TradeFW is regulated by CySEC, a well-known authority in the financial sector. Regulation by a reputable body like CySEC implies that the broker must adhere to strict guidelines designed to protect investors and ensure fair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 298/16 | Cyprus | Verified |

CySEC's oversight includes requirements for capital adequacy, regular audits, and the segregation of client funds from the broker's operational funds. This regulatory framework is essential as it offers a layer of protection for traders, ensuring that their deposits are kept safe and are accessible even in the event of the broker's insolvency. However, it is important to note that not all regulatory bodies are created equal; while CySEC is reputable, some traders express concerns regarding the effectiveness of oversight in Cyprus compared to other jurisdictions like the UK or the US.

Company Background Investigation

TradeFW operates under the parent company Itrade Global (Cy) Ltd, which is based in Limassol, Cyprus. The company was established in 2018, and while relatively new, it has made strides to position itself as a competitive player in the forex market. The management team consists of professionals with backgrounds in finance and trading, which adds to the broker's credibility.

However, transparency regarding the company's ownership and operational history is somewhat limited. There have been reports linking TradeFW to other brokers, some of which have faced regulatory scrutiny, raising questions about the overall trustworthiness of the brand. The broker's website claims to prioritize transparency, but the lack of detailed information regarding its ownership structure and management team can be a red flag for potential investors.

Trading Conditions Analysis

When assessing a broker's reliability, the trading conditions it offers are of utmost importance. TradeFW has a minimum deposit requirement of $250, which is relatively standard for the industry. However, the broker's fee structure has raised some eyebrows among traders.

| Fee Type | TradeFW | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.7 - 3.2 pips | 1.5 - 2.0 pips |

| Commission Structure | None on forex, 0.1% on stocks | Varies, often lower |

| Overnight Interest Range | Varies | Varies |

The spreads offered by TradeFW, starting from 1.7 pips, are on the higher side compared to industry averages. This could indicate potential liquidity issues or a reliance on less competitive pricing from liquidity providers. Additionally, the commission for stock trading, while not uncommon, adds to the overall cost of trading with this broker. Such high trading costs can significantly affect profitability, particularly for high-frequency traders.

Client Fund Security

Client fund security is a major concern for any trader. TradeFW claims to implement several measures to ensure the safety of its clients' funds. These include maintaining segregated accounts, which means that client funds are kept separate from the broker's operational funds. This is a standard practice among regulated brokers and is crucial for protecting traders' investments.

Moreover, TradeFW is a member of the Investor Compensation Fund (ICF), which provides additional protection to clients in case the broker fails. This means that clients may be entitled to compensation up to a certain limit, further enhancing the security of their funds. However, there have been no significant historical incidents reported regarding fund safety at TradeFW, which is a positive indicator.

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing the overall reliability of a broker. TradeFW has received mixed reviews from users, with some praising its user-friendly platform and responsive customer support, while others have reported issues with withdrawal processes and high-pressure sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| High-Pressure Sales | Medium | Inconsistent follow-up |

| Lack of Transparency | High | Limited information provided |

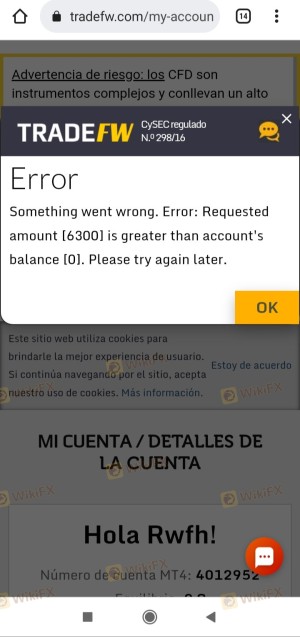

Common complaints include difficulties in withdrawing funds, with some users alleging that their requests were met with excessive demands for documentation. This can be a troubling sign, as it may indicate a strategy to delay or deny withdrawals, a tactic often employed by less reputable brokers. Overall, while there are positive testimonials, the negative feedback raises concerns about the broker's practices.

Platform and Trade Execution

TradeFW utilizes the MetaTrader 4 (MT4) platform, which is widely regarded as one of the best trading platforms available. MT4 provides a robust set of tools for technical analysis and automated trading, making it suitable for both novice and experienced traders. However, there have been reports of execution issues, such as slippage and order rejections, which can negatively impact trading performance.

The platform's stability and user experience are generally rated positively, but any signs of manipulation or execution delays should be monitored closely. Traders should ensure they are comfortable with the platform's functionality and performance before committing significant capital.

Risk Assessment

When trading with TradeFW, various risks should be considered. The broker's relatively high spreads and commission structure can lead to increased trading costs, which may not be suitable for all traders. Furthermore, the mixed reviews regarding customer service and withdrawal processes suggest that there may be underlying issues that could pose risks to traders' investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | CySEC regulation provides some protection, but not as robust as other jurisdictions. |

| Financial Risk | High | High spreads and commission can erode profits. |

| Operational Risk | Medium | Customer service issues may affect trading experience. |

To mitigate these risks, traders should consider starting with a smaller investment and thoroughly test the platform before scaling up their trading activities.

Conclusion and Recommendations

Based on the evidence gathered, TradeFW presents a mixed picture. While it is regulated by CySEC, which provides a degree of legitimacy, there are several concerning aspects, including high trading costs, mixed customer reviews, and reports of withdrawal difficulties.

In conclusion, while TradeFW may not be an outright scam, traders should approach with caution. It is advisable to conduct thorough research, start with a small investment, and consider alternative brokers that may offer better trading conditions and customer support. Reputable alternatives include brokers like eToro or IG, which have established track records and offer more favorable trading environments. Ultimately, ensuring a broker's safety and reliability is paramount for a successful trading experience.

In summary, is TradeFW safe? While it operates under regulation, potential traders should remain vigilant and informed about the risks involved.

Is TradeFW a scam, or is it legit?

The latest exposure and evaluation content of TradeFW brokers.

TradeFW Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeFW latest industry rating score is 2.69, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.69 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.