Thornbridge 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Thornbridge review reveals a unique situation in the financial services landscape. Based on available information, Thornbridge appears to be primarily known as Thornbridge Brewery, a craft beer company located at Thornbridge Hall, rather than a traditional forex broker. The company emphasizes innovation and experimental approaches. Their "Never Ordinary" tagline reflects their forward-thinking philosophy. Their Halcyon series has gained significant recognition among beer enthusiasts, showcasing the company's commitment to quality and creativity. However, for traders seeking forex services, this Thornbridge review must highlight the absence of crucial trading-related information. This includes regulatory status, trading platforms, and financial instruments. The evaluation remains neutral due to insufficient data regarding forex trading capabilities, account conditions, and regulatory compliance. These elements would typically define a financial services provider.

Important Notice

This Thornbridge review is based on available public information and research findings. The information summary does not mention different regional entities or variations in service offerings across jurisdictions. Our evaluation methodology relies on accessible data sources. However, comprehensive user reviews and detailed regulatory information were not available in the source materials. Potential clients should conduct independent verification of all trading conditions, regulatory status, and service offerings before making any financial commitments. The absence of detailed forex-related information in our research suggests that Thornbridge may not operate as a traditional financial services provider.

Rating Framework

Based on available information, here are the ratings for six key dimensions:

Broker Overview

Thornbridge operates from Thornbridge Hall. It has established itself primarily as a brewery specializing in craft beer production and sales. The company's core business model centers around innovative and experimental brewing techniques. They maintain a strong emphasis on quality and creativity. Their approach is captured in their "Never Ordinary" philosophy, which drives their product development and brand positioning. The Halcyon series represents one of their flagship offerings. This demonstrates their commitment to excellence in brewing craftsmanship.

The company's operational focus appears to be entirely concentrated on the beverage industry rather than financial services. This Thornbridge review finds no mention of trading platforms, financial instruments, or regulatory oversight typical of forex brokers. The absence of traditional broker characteristics such as MetaTrader platforms, regulatory licenses from bodies like FCA or CySEC, or typical financial service offerings suggests something important. Thornbridge operates in a completely different sector than expected for a forex review.

Regulatory Jurisdictions: The information summary does not mention any financial regulatory oversight. It lacks licensing from recognized authorities such as FCA, CySEC, or other international financial regulators.

Deposit and Withdrawal Methods: Specific information regarding financial transaction methods for trading purposes is not available in the provided summary.

Minimum Deposit Requirements: The summary contains no details about minimum deposit thresholds. It also lacks account funding requirements typical of forex brokers.

Bonuses and Promotions: No trading-related promotional offers or bonus structures are mentioned in the available information.

Tradeable Assets: The summary does not specify forex pairs, commodities, indices, or other financial instruments. These are typically offered by trading platforms.

Cost Structure: Details about spreads, commissions, overnight fees, or other trading costs are not provided in the information summary. This Thornbridge review cannot assess the competitiveness of trading costs due to information unavailability.

Leverage Ratios: Maximum leverage offerings and margin requirements are not detailed in the available materials.

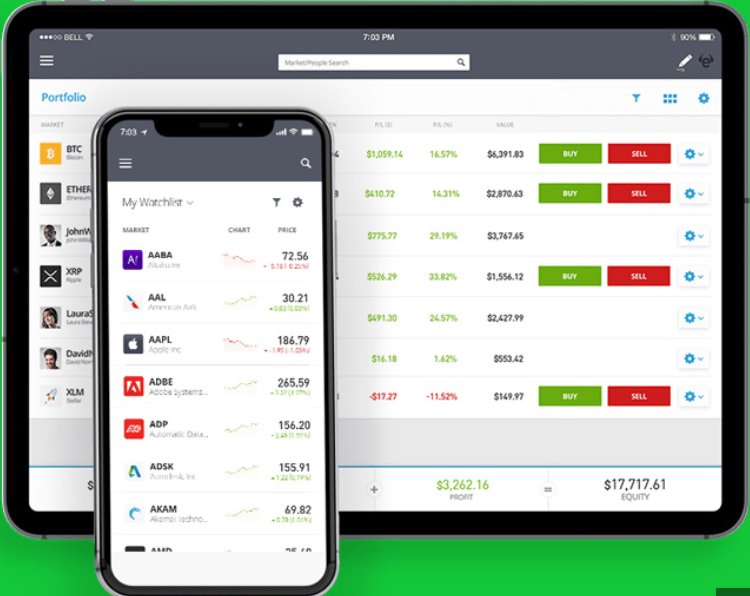

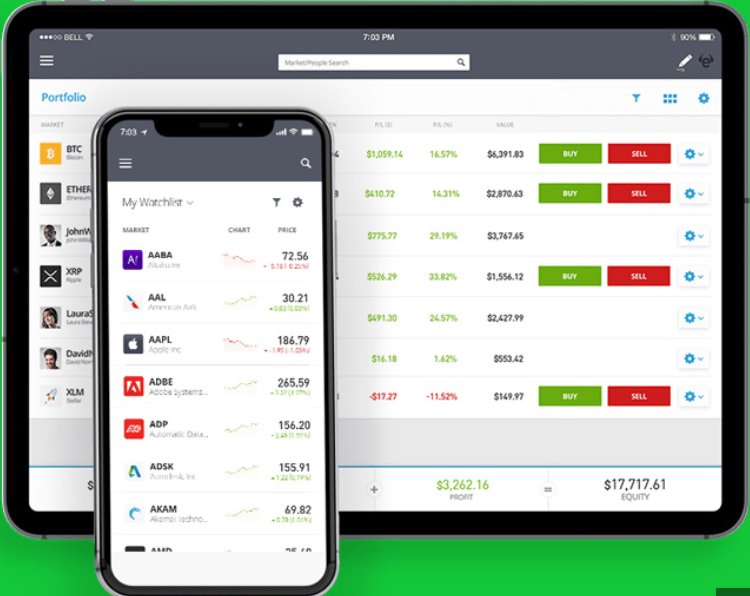

Platform Options: Information about trading platform availability is not mentioned in the summary. This includes mobile applications or web-based trading interfaces.

Regional Restrictions: The summary does not address geographical limitations. It also lacks information about restricted territories for service access.

Customer Support Languages: Specific details about multilingual support options are not available in the provided information.

Account Conditions Analysis

The analysis of account conditions for this Thornbridge review encounters significant limitations. This is due to information unavailability. Traditional forex broker account types such as standard, premium, or VIP accounts are not mentioned in the source materials. The absence of minimum deposit requirements, account tier structures, or special features like Islamic accounts makes evaluation impossible. Users cannot assess the competitiveness of account offerings. Without details about account opening procedures, verification requirements, or documentation needs, potential users face uncertainty. They cannot assess the accessibility of services. The lack of information about special account functionalities, leverage options per account type, or exclusive benefits for higher-tier accounts further complicates this evaluation. This Thornbridge review must conclude that insufficient account condition information prevents a meaningful assessment. This crucial trading aspect cannot be properly evaluated.

Evaluating trading tools and resources proves challenging in this Thornbridge review. This is due to information gaps. Standard trading tools such as technical indicators, charting packages, or analytical software are not mentioned in the available summary. Research resources including market analysis, economic calendars, or trading signals that traders typically expect from brokers are absent. The information provided lacks these details. Educational materials such as webinars, tutorials, or trading guides that support trader development are not referenced in the source materials. Automated trading support through Expert Advisors, copy trading features, or algorithmic trading capabilities cannot be assessed. This is due to information unavailability. The absence of details about third-party tool integrations or proprietary trading software leaves significant questions about the technological infrastructure. This infrastructure should support trading activities.

Customer Service and Support Analysis

Customer service evaluation faces substantial limitations in this Thornbridge review. This is due to insufficient information. Available support channels such as live chat, telephone support, or email assistance are not detailed in the provided summary. Response time expectations, service quality metrics, or customer satisfaction indicators cannot be assessed from the available materials. Multilingual support capabilities, which are crucial for international traders, remain unspecified in the source information. Operating hours for customer support, including weekend availability or 24/7 service options, are not mentioned. The summary lacks this information. Without user feedback or testimonials about support experiences, this review cannot provide insights into problem resolution effectiveness. Overall service quality remains unclear. The absence of information about dedicated account managers or specialized support for different account types further limits the evaluation scope.

Trading Experience Analysis

The trading experience assessment in this Thornbridge review faces significant constraints. This is due to information limitations. Platform stability, execution speed, and system reliability metrics that are crucial for forex trading evaluation are not available in the source materials. Order execution quality, including slippage rates, requote frequency, or fill rates during volatile market conditions, cannot be assessed. The provided information lacks these details. Platform functionality completeness, such as one-click trading, advanced order types, or risk management tools, remains unspecified in the available summary. Mobile trading experience, including app functionality, feature parity with desktop platforms, or offline capabilities, is not addressed. The source materials lack this information. This Thornbridge review cannot evaluate the overall trading environment quality, user interface design, or the seamless integration between different platform components. This is due to insufficient technical information.

Trust and Regulation Analysis

Trust and regulatory assessment presents major challenges in this Thornbridge review. This is due to information scarcity. Regulatory qualifications from recognized financial authorities such as FCA, CySEC, ASIC, or other international regulators are not mentioned in the available summary. Fund safety measures including segregated client accounts, investor compensation schemes, or deposit protection programs cannot be evaluated. The provided materials lack this information. Company transparency regarding financial statements, regulatory compliance reports, or operational disclosures is not addressed in the source information. Industry reputation, peer recognition, or regulatory standing within the financial services sector remains unverified. This is due to information limitations. The absence of details about negative event handling, dispute resolution procedures, or regulatory sanctions history prevents a comprehensive trust evaluation. Without third-party regulatory verification or compliance documentation, this review cannot establish the credibility expected from financial service providers.

User Experience Analysis

User experience evaluation encounters substantial obstacles in this Thornbridge review. This is due to information constraints. Overall user satisfaction metrics, customer retention rates, or user feedback summaries are not available in the provided materials. Interface design quality, navigation intuitiveness, or platform usability assessments cannot be conducted. This is based on the available information. Registration and verification process efficiency, including KYC procedures, document requirements, or account approval timeframes, remain unspecified in the source summary. Fund operation experiences such as deposit processing times, withdrawal procedures, or payment method reliability are not detailed. The available materials lack this information. Common user complaints, frequently reported issues, or recurring service problems cannot be identified from the information provided. Without comprehensive user feedback data or experience testimonials, this review cannot offer meaningful insights. The practical aspects of service utilization remain unclear.

Conclusion

This comprehensive Thornbridge review concludes with a neutral evaluation. This is due to insufficient information regarding forex trading services. The available data suggests that Thornbridge operates primarily as a brewery rather than a financial services provider. This explains the absence of typical broker characteristics. Users seeking innovative and experimental brewing products might find interest in Thornbridge's offerings. Their acclaimed Halcyon series is particularly noteworthy. However, for forex trading purposes, the lack of regulatory information, trading conditions, platform details, and financial service capabilities represents significant limitations. Potential clients should seek additional verification and detailed service information before considering any financial commitments with this entity.