Crib Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive crib markets review examines a forex and CFD broker that has generated significant attention within the online trading community. Most of this attention has been for concerning reasons. Crib Markets, also known as CRIB MARKETS LTD, presents itself as a global trading platform offering diverse market instruments including forex, metals, energy, indices, stocks, commodities, cryptocurrencies, and bonds.

Our analysis reveals substantial red flags regarding the broker's legitimacy and reliability. The broker's regulatory status remains highly questionable, with registration in Saint Vincent and the Grenadines while operating from Dubai. This structure raises immediate concerns about regulatory oversight and trader protection.

User feedback across multiple review platforms consistently highlights negative experiences. These reviews emphasize trustworthiness issues and poor service quality. While Crib Markets does offer a diverse range of trading instruments that could appeal to traders seeking variety, these potential benefits are significantly overshadowed by fundamental concerns about the broker's credibility and operational transparency.

Our evaluation suggests this broker is primarily suitable for traders who prioritize instrument diversity. However, we strongly advise extreme caution given the numerous legitimacy concerns identified throughout our research.

Important Notice

Regional Entity Differences: Crib Markets operates under a complex structure with registration in Saint Vincent and the Grenadines while maintaining operational headquarters in Dubai. Traders should be aware that this arrangement may result in varying legal protections and regulatory oversight depending on their jurisdiction.

The lack of robust regulatory supervision in the primary registration jurisdiction presents additional risks that traders must carefully consider. Review Methodology: This evaluation is based on comprehensive analysis of available user feedback, market intelligence, publicly accessible regulatory information, and industry reports.

Given the limited transparency from the broker itself, our assessment relies heavily on third-party sources and user experiences reported across various platforms and review sites.

Rating Framework

Broker Overview

Crib Markets was established in 2021. The company operates as CRIB MARKETS LTD with a complex international structure that immediately raises questions about regulatory oversight and trader protection.

The company maintains registration in Saint Vincent and the Grenadines while conducting primary operations from Dubai. This creates a jurisdictional arrangement that provides minimal regulatory supervision for traders. This offshore registration strategy is commonly employed by brokers seeking to avoid stringent regulatory requirements that protect traders in major financial centers.

The broker positions itself as a global forex and CFD trading provider. It targets international markets with promises of diverse trading opportunities. However, the company's relatively recent establishment combined with its offshore regulatory approach suggests a business model that prioritizes operational flexibility over trader protection and regulatory compliance.

Crib Markets offers access to multiple asset classes including forex pairs, precious metals, energy commodities, global indices, individual stocks, various commodities, cryptocurrencies, and government bonds. While this diversity appears attractive on paper, the lack of detailed information about trading conditions, platform specifications, and regulatory protections raises significant concerns.

The broker's marketing materials and available information lack the transparency typically expected from legitimate, well-regulated trading platforms. This makes it difficult for potential clients to make informed decisions about the actual trading environment and associated risks. This crib markets review must emphasize that the broker's operational structure and limited regulatory oversight create an environment where trader protections are minimal and dispute resolution mechanisms may be inadequate.

Regulatory Jurisdiction: Crib Markets operates under registration in Saint Vincent and the Grenadines while maintaining operational headquarters in Dubai. This offshore regulatory approach provides minimal trader protection compared to major financial centers.

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in available sources. This indicates a lack of transparency in financial operations. Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts across different account types.

This makes it difficult for potential traders to understand entry requirements. Bonus and Promotional Offers: No specific information about welcome bonuses, promotional campaigns, or trading incentives is available in reviewed sources.

Tradeable Assets: The broker offers access to forex currency pairs, precious metals (gold, silver), energy commodities (oil, gas), global stock indices, individual company stocks, agricultural and industrial commodities, major cryptocurrencies, and government bonds across multiple markets. Cost Structure: Critical information about spreads, commission rates, overnight financing charges, and other trading costs remains undisclosed in available materials.

This raises transparency concerns about the true cost of trading. Leverage Ratios: Specific leverage offerings for different asset classes and account types are not clearly specified in available documentation.

Trading Platform Options: The review sources do not provide clear information about whether the broker offers MetaTrader 4, MetaTrader 5, or proprietary trading platforms. Geographic Restrictions: Specific information about restricted countries or regions is not detailed in available sources.

Customer Support Languages: Available customer service languages are not specified in the reviewed materials. This crib markets review notes the general lack of detailed service information.

Detailed Rating Analysis

Account Conditions Analysis (Rating: 3/10)

The account conditions offered by Crib Markets present significant transparency issues that substantially impact our evaluation. The broker fails to provide clear, accessible information about fundamental trading parameters that informed traders require for decision-making.

This lack of transparency extends to account type specifications, with no detailed breakdown of different account tiers, their respective features, or targeted user segments. Minimum deposit requirements remain undisclosed across available sources, making it impossible for potential traders to understand the financial commitment required to begin trading.

This information gap is particularly concerning as it prevents traders from comparing Crib Markets with established, regulated brokers who typically provide comprehensive account specification details. The account opening process lacks detailed documentation, with no clear information about required verification procedures, document requirements, or processing timeframes.

Additionally, specialized account options such as Islamic accounts for Sharia-compliant trading are not mentioned in available materials. This suggests limited accommodation for diverse trader needs. User feedback regarding account conditions is notably absent from review sources, which itself raises concerns about the broker's transparency and client communication practices.

This crib markets review emphasizes that the lack of basic account information represents a significant red flag for potential traders considering this platform.

Crib Markets demonstrates its strongest performance in the tools and resources category. This is primarily due to the diverse range of market instruments available to traders. The broker provides access to comprehensive asset classes including major and minor forex pairs, precious metals for portfolio diversification, energy commodities for sector-specific trading opportunities, global indices for broad market exposure, individual stocks for equity trading, and cryptocurrency options for digital asset exposure.

This instrument diversity represents genuine value for traders seeking to implement diversified trading strategies or explore multiple market sectors from a single platform. The inclusion of both traditional assets like forex and metals alongside modern instruments like cryptocurrencies suggests an attempt to cater to evolving trader preferences and market trends.

However, the positive aspect of instrument diversity is significantly undermined by the complete absence of information about research and analysis resources. Legitimate brokers typically provide market analysis, economic calendars, technical analysis tools, and educational materials to support trader decision-making.

The lack of any mention of such resources in available materials raises questions about the broker's commitment to trader education and market insight provision. Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, remains unspecified. This information gap prevents traders from understanding whether the platform supports sophisticated trading strategies that many experienced traders require.

Customer Service and Support Analysis (Rating: 4/10)

Customer service represents a critical weakness in Crib Markets' offering. User feedback consistently highlights poor service quality and responsiveness issues. The broker fails to provide clear information about available customer support channels, leaving potential clients uncertain about how to access assistance when needed.

Response time expectations are not established in available materials. This creates uncertainty about service level commitments. Professional brokers typically guarantee specific response timeframes for different inquiry types, but Crib Markets provides no such assurances or service standards.

The quality of customer service, based on available user feedback, appears problematic with multiple reports suggesting inadequate support experiences. This pattern of negative feedback regarding customer service quality represents a significant operational concern for a financial services provider where timely, professional support is essential.

Multilingual support capabilities remain unspecified, potentially limiting accessibility for international traders who require assistance in their native languages. Additionally, customer service hours and availability across different time zones are not detailed, creating uncertainty about when traders can access support.

The absence of detailed customer service information, combined with negative user feedback about service quality, suggests that Crib Markets may not prioritize client support as a core operational function. This represents a significant disadvantage compared to established, regulated brokers.

Trading Experience Analysis (Rating: 5/10)

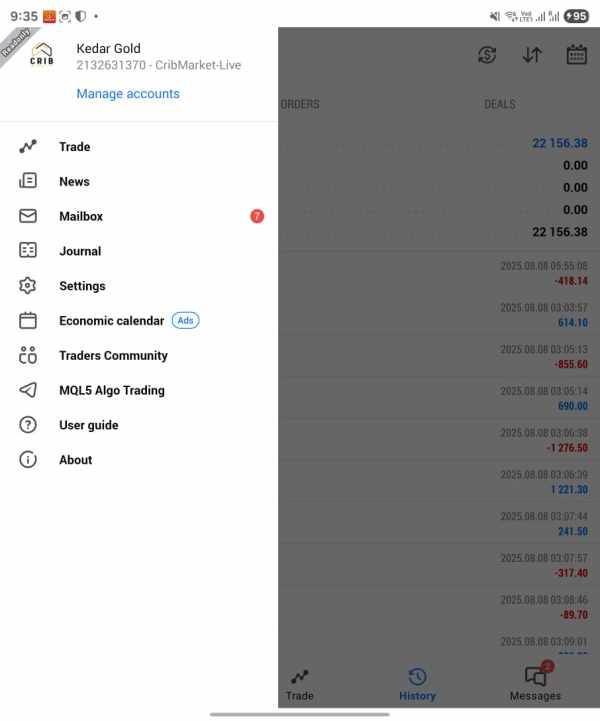

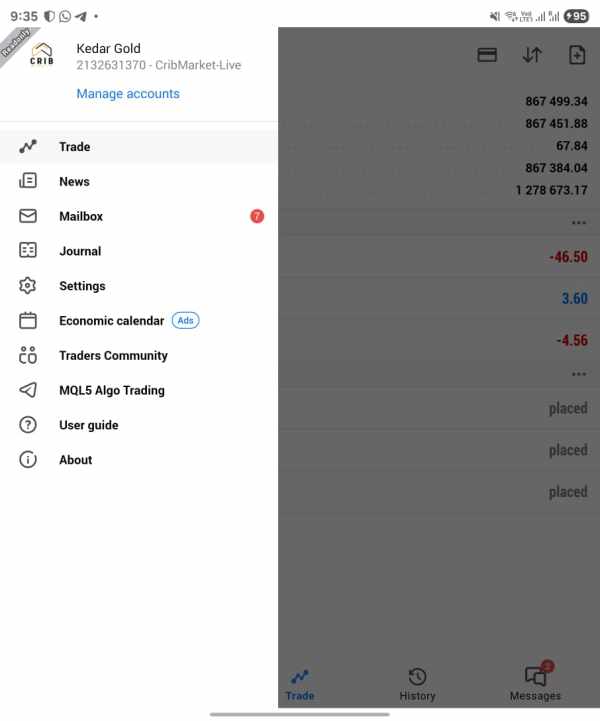

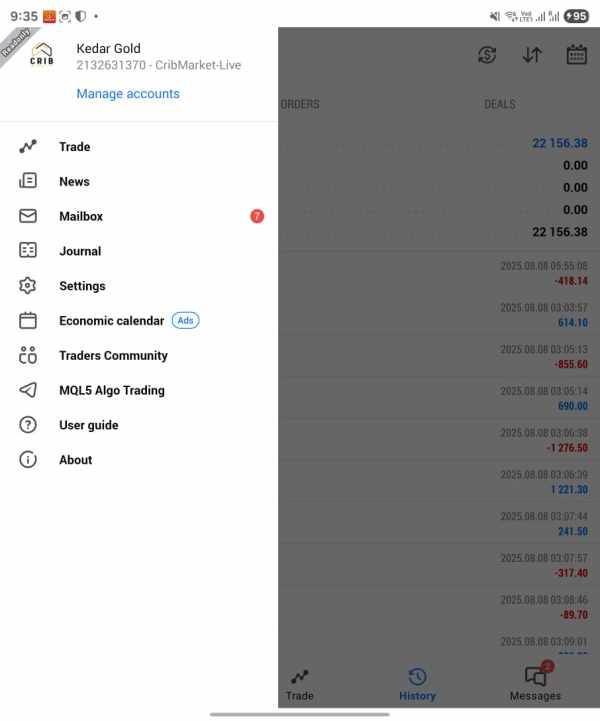

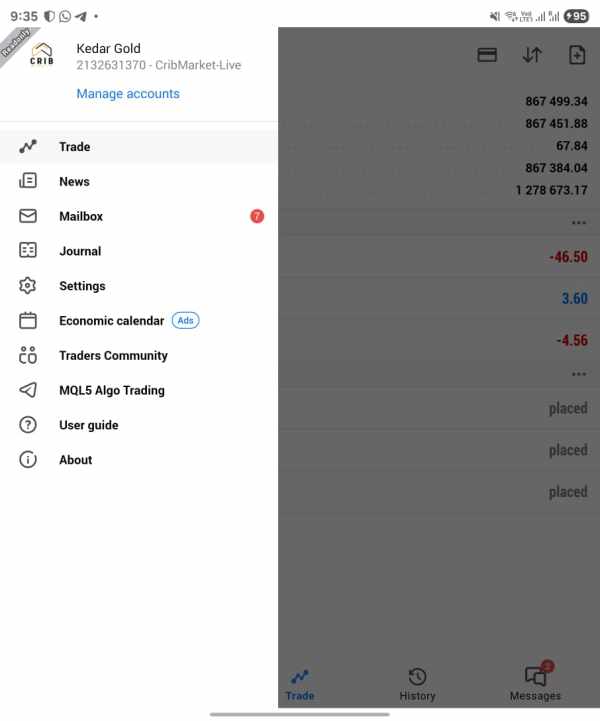

The trading experience evaluation for Crib Markets yields mixed results. This is primarily due to insufficient specific information about platform performance and execution quality. User feedback regarding trading experience varies, with some reports suggesting adequate functionality while others indicate concerns about platform reliability and execution standards.

Platform stability and execution speed represent critical factors for successful trading, yet specific performance metrics and user experience data are notably limited in available sources. This information gap makes it difficult for potential traders to assess whether the platform can handle their trading volume and strategy requirements effectively.

Order execution quality, including fill rates, slippage statistics, and rejection rates, lacks documentation in available materials. Professional traders require this information to evaluate whether a broker can effectively implement their trading strategies without significant execution-related losses.

Platform functionality completeness, including charting tools, technical indicators, order types, and analytical capabilities, remains largely unspecified. Modern traders expect comprehensive platform features that support sophisticated analysis and strategy implementation, but Crib Markets provides insufficient information about these capabilities.

Mobile trading experience, increasingly important for active traders, is not detailed in available sources. The absence of mobile platform specifications raises questions about the broker's commitment to providing flexible, accessible trading solutions that meet contemporary trader expectations.

This crib markets review notes that the limited available information about trading experience, combined with mixed user feedback, creates uncertainty about platform reliability and suitability for serious trading activities.

Trustworthiness Analysis (Rating: 2/10)

Trustworthiness represents Crib Markets' most significant weakness. Multiple red flags raise serious concerns about the broker's legitimacy and reliability. The regulatory structure, involving registration in Saint Vincent and the Grenadines while operating from Dubai, creates a jurisdictional arrangement that provides minimal regulatory oversight and trader protection.

Saint Vincent and the Grenadines is known within the financial industry as an offshore jurisdiction with limited regulatory requirements and enforcement capabilities. This regulatory approach is commonly chosen by brokers seeking to avoid stringent compliance requirements that protect traders in major financial centers like the UK, EU, or Australia.

Fund security measures, including segregated client accounts, deposit insurance, and financial safeguards, are not detailed in available materials. Legitimate, regulated brokers typically provide comprehensive information about client fund protection measures, but Crib Markets offers no such transparency or assurances.

Company transparency remains problematic, with limited information about management team, financial statements, operational history, or corporate governance structures. This lack of transparency prevents traders from conducting proper due diligence about the organization handling their funds.

Industry reputation appears predominantly negative, with multiple review sources highlighting concerns about legitimacy and reliability. The pattern of negative feedback across different platforms suggests systemic issues rather than isolated complaints, indicating fundamental problems with the broker's operations and client treatment.

User Experience Analysis (Rating: 4/10)

User experience evaluation reveals predominantly negative feedback patterns that raise significant concerns about client satisfaction and platform reliability. Available user reviews consistently highlight various operational issues and service quality problems that impact the overall trading experience.

Overall user satisfaction appears low based on available feedback, with negative reviews substantially outnumbering positive experiences across multiple review platforms. This pattern suggests systematic issues with service delivery and client relationship management rather than isolated incidents.

Interface design and usability information is limited in available sources, making it difficult to assess whether the platform provides intuitive, efficient navigation for traders of different experience levels. Modern trading platforms require sophisticated yet user-friendly interfaces to support effective trading activities.

Registration and verification processes lack detailed documentation, creating uncertainty about account opening requirements and timeframes. Professional brokers typically provide clear, streamlined onboarding processes with transparent requirements and reasonable processing times.

Fund operation experiences, including deposit and withdrawal processes, are not well-documented in available sources. However, the general pattern of negative user feedback suggests potential issues with financial transaction processing and client fund management.

The target user profile appears to be traders seeking instrument diversity, but the numerous legitimacy concerns and negative feedback patterns suggest that even traders prioritizing variety should exercise extreme caution when considering this platform.

Conclusion

This comprehensive crib markets review reveals a broker with significant legitimacy and reliability concerns that substantially outweigh any potential benefits. While Crib Markets offers an attractive range of market instruments across multiple asset classes, the fundamental issues surrounding regulatory oversight, transparency, and user satisfaction create an unacceptable risk profile for most traders.

The broker's offshore regulatory structure provides minimal trader protection, while the consistent pattern of negative user feedback indicates systematic operational issues. The lack of transparency regarding trading conditions, costs, and platform specifications further compounds these concerns, making it impossible for traders to make fully informed decisions about the trading environment.

Crib Markets may theoretically appeal to traders seeking diverse market access, but the substantial risks associated with questionable regulatory status, poor user feedback, and limited transparency make this broker unsuitable for serious trading activities. Traders would be better served by choosing established, well-regulated brokers that provide transparent operations, robust regulatory protection, and demonstrated track records of reliable service delivery.