Regarding the legitimacy of Vantage forex brokers, it provides ASIC, FSCA, CIMA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is Vantage safe?

Pros

Cons

Is Vantage markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

VANTAGE GLOBAL PRIME PTY LTD

Effective Date: Change Record

2012-12-21Email Address of Licensed Institution:

compliance@vantagemarkets.com.auSharing Status:

Website of Licensed Institution:

https://www.vantagemarkets.com/en-au/Expiration Time:

--Address of Licensed Institution:

L 12 15 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

+6594567234Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

VANTAGE MARKETS (PTY) LTD

Effective Date: Change Record

2021-04-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

18 CAVENDISH ROAD CLAREMONT CAPE TOWN 7708Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Vantage International Group Limited

Effective Date:

2018-05-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Vantage Global Limited

Effective Date:

2023-08-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Vantage A Scam?

Introduction

Vantage, established in 2009, has carved a niche for itself in the forex market as a multi-asset broker offering a variety of trading instruments, including forex, CFDs, commodities, and indices. With its headquarters in Sydney, Australia, Vantage has expanded its operations globally, providing services to traders in various regions. However, as the online trading landscape grows, so does the need for traders to exercise caution when selecting a broker. The potential for scams and fraudulent activities in the forex market necessitates a thorough evaluation of any trading platform before committing funds.

In this article, we will investigate whether Vantage is a scam or a legitimate trading broker. Our analysis will rely on information sourced from various reputable platforms, including regulatory disclosures, customer reviews, and industry reports. We will assess Vantage's regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk profile to provide a comprehensive evaluation of its credibility in the forex market.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the trustworthiness of a forex broker. Vantage is regulated by several reputable authorities, which adds a layer of security for traders. The presence of regulatory bodies ensures that brokers adhere to strict operational standards, safeguarding client funds and promoting transparency.

Heres a summary of Vantage's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | 428901 | Australia | Verified |

| Financial Conduct Authority (FCA) | 590299 | United Kingdom | Verified |

| Cayman Islands Monetary Authority (CIMA) | 1383491 | Cayman Islands | Verified |

| Vanuatu Financial Services Commission (VFSC) | 700271 | Vanuatu | Verified |

Vantage holds licenses from both ASIC and FCA, which are considered tier-1 regulators. This high level of regulation indicates that Vantage is subject to rigorous compliance checks and must maintain a high standard of financial integrity. The regulatory history of Vantage shows no significant violations, which further supports its legitimacy. However, it is important to note that the company also operates under tier-3 regulators, which may not offer the same level of protection. Overall, Vantage's regulatory status is a positive indicator of its reliability as a trading platform.

Company Background Investigation

Vantage was founded in 2009 and has since grown to become a significant player in the forex and CFD trading industry. The company is structured as Vantage Global Prime Pty Ltd, operating under the regulatory frameworks of multiple jurisdictions. Its ownership is transparent, with a management team comprising professionals with extensive experience in the financial services sector.

The management team at Vantage is composed of individuals with backgrounds in finance, trading, and technology, which enhances the broker's ability to provide a robust trading platform. The company emphasizes transparency and regularly publishes financial reports, ensuring that clients can access information about its operations and financial health.

Vantage's commitment to transparency is evident in its clear communication regarding fees, trading conditions, and regulatory compliance. The broker maintains a user-friendly website where potential clients can easily find information about its services, account types, and regulatory status. The availability of comprehensive educational resources also reflects Vantage's dedication to fostering a knowledgeable trading community.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Vantage offers a competitive fee structure, which is crucial for traders looking to maximize their profits. The broker provides three main account types: Standard STP, Raw ECN, and Pro ECN, each catering to different trading styles and preferences.

Heres a comparison of Vantage's core trading costs:

| Fee Type | Vantage | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips (Standard) / 0.0 pips (Raw ECN) | 1.2 pips |

| Commission Model | $0 (Standard) / $3 per lot (Raw ECN) | $6 per lot |

| Overnight Interest Range | Varies by asset | Varies by asset |

Vantage's spreads are competitive, particularly for the Raw ECN account, which offers spreads starting from 0.0 pips. This is attractive for high-frequency traders and those looking to capitalize on small market movements. However, the commission model on the Raw ECN account may deter some traders, as the cost can accumulate quickly with frequent trading.

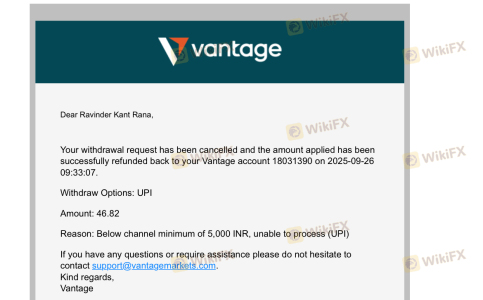

Additionally, Vantage does not charge deposit or withdrawal fees, which is a significant advantage compared to many competitors. However, traders should be aware of potential third-party fees associated with banking methods. Overall, Vantage's trading conditions are favorable, but traders should assess their trading volume and style to determine the most suitable account type.

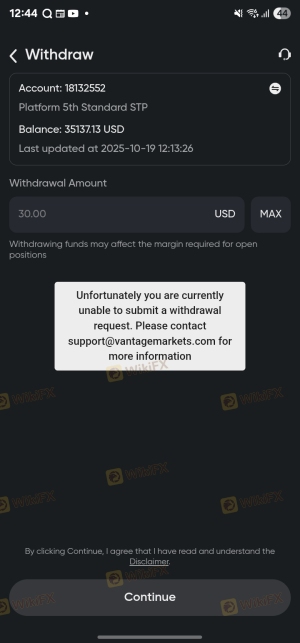

Customer Fund Safety

The safety of client funds is a primary concern for traders. Vantage employs several measures to ensure the security of its clients' capital. One of the key safety features is the segregation of client funds, which means that traders' money is held in separate accounts from the broker's operational funds. This practice protects client funds in the event of financial difficulties faced by the brokerage.

Additionally, Vantage offers negative balance protection, which ensures that traders cannot lose more than their account balance, even in volatile market conditions. This feature is particularly beneficial for inexperienced traders who may be more susceptible to market fluctuations.

Despite these safety measures, it is important to note that Vantage does not provide insurance for client funds, which is a common practice among some brokers. However, the broker's commitment to maintaining segregated accounts and providing negative balance protection demonstrates its dedication to safeguarding client interests.

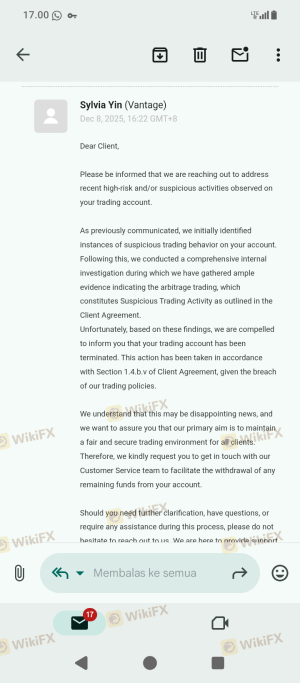

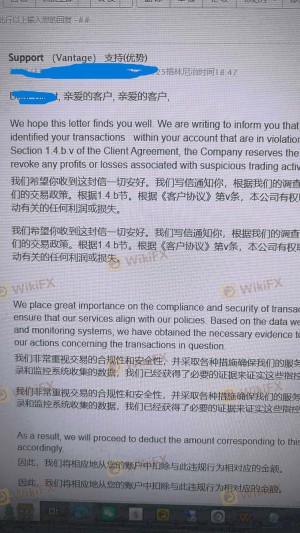

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Vantage generally receives positive reviews for its trading conditions, platform performance, and customer support. However, like many brokers, it has faced some complaints, particularly regarding withdrawal processes and customer service response times.

Heres an overview of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Addressed with follow-up support |

| Account Verification Issues | Low | Resolved with additional documentation |

| Execution Slippage | Moderate | Investigated on a case-by-case basis |

One notable case involved a trader who experienced delays in withdrawing funds, prompting concerns about the broker's reliability. Vantage responded by providing additional support and ensuring that the issue was resolved promptly. Overall, while there are some complaints, the majority of customer experiences with Vantage are positive, indicating a generally reliable service.

Platform and Trade Execution

The performance of a trading platform is critical for traders. Vantage offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary app. These platforms are known for their reliability and extensive features, catering to both novice and experienced traders.

In terms of order execution, Vantage claims to provide fast execution speeds with minimal slippage. However, some traders have reported instances of slippage, particularly during volatile market conditions. It is essential for potential clients to consider their trading strategies, as high-frequency trading may be affected by execution delays.

Risk Assessment

Using Vantage involves certain risks, as with any trading platform. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by tier-1 authorities |

| Operational Risk | Medium | Potential for withdrawal delays |

| Market Risk | High | Exposure to market volatility |

To mitigate these risks, traders should ensure they understand the trading environment and employ risk management strategies, such as setting stop-loss orders and not over-leveraging their accounts.

Conclusion and Recommendations

In conclusion, Vantage appears to be a legitimate broker with a solid regulatory framework and a commitment to client safety. While there are some concerns regarding withdrawal processes and customer service, the overall feedback from users is predominantly positive. Vantage's competitive trading conditions, combined with its robust platform offerings, make it a viable option for many traders.

However, potential clients should remain vigilant and conduct their own research before opening an account. For those seeking alternatives, brokers such as IG, Saxo Bank, or CMC Markets offer similar services with strong regulatory oversight. Ultimately, the choice of broker should align with individual trading goals and risk tolerance.

Is Vantage a scam, or is it legit?

The latest exposure and evaluation content of Vantage brokers.

Vantage Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vantage latest industry rating score is 8.70, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.70 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.