RLC 2025 Review: Everything You Need to Know

Summary: The RLC forex broker has garnered mixed reviews, with some traders praising its regulatory compliance and trading platform, while others express concerns over withdrawal issues and customer service experiences. Key features include its regulation by the Chinese Gold and Silver Exchange Society and the use of the popular MT4 trading platform.

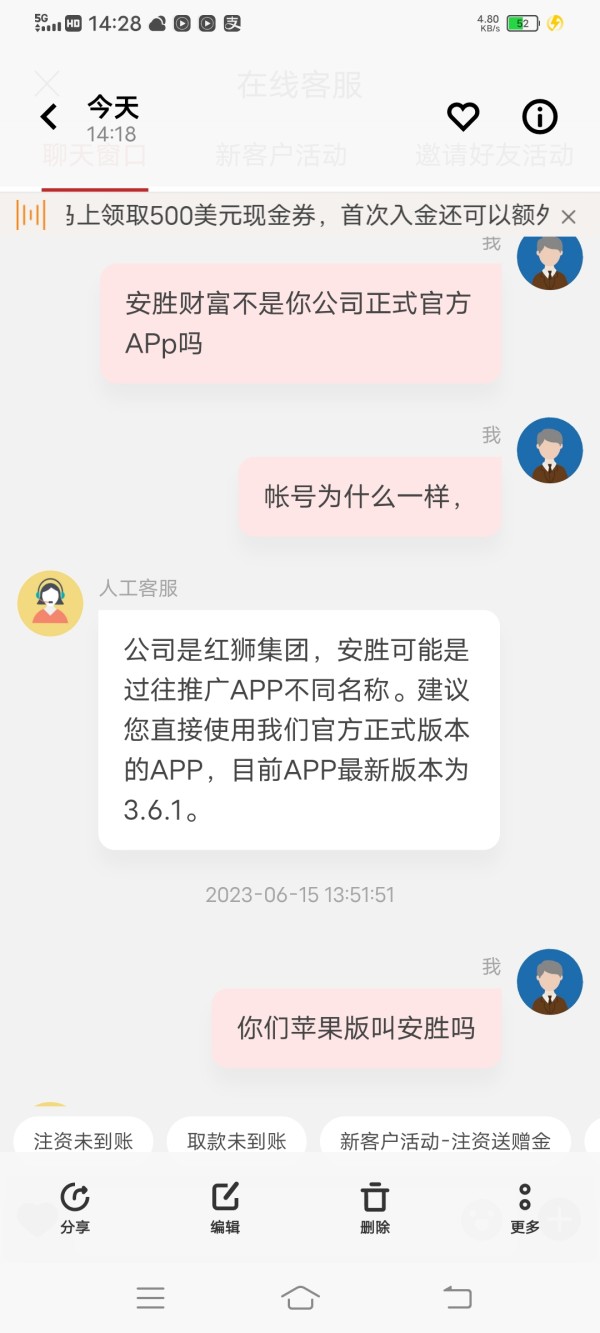

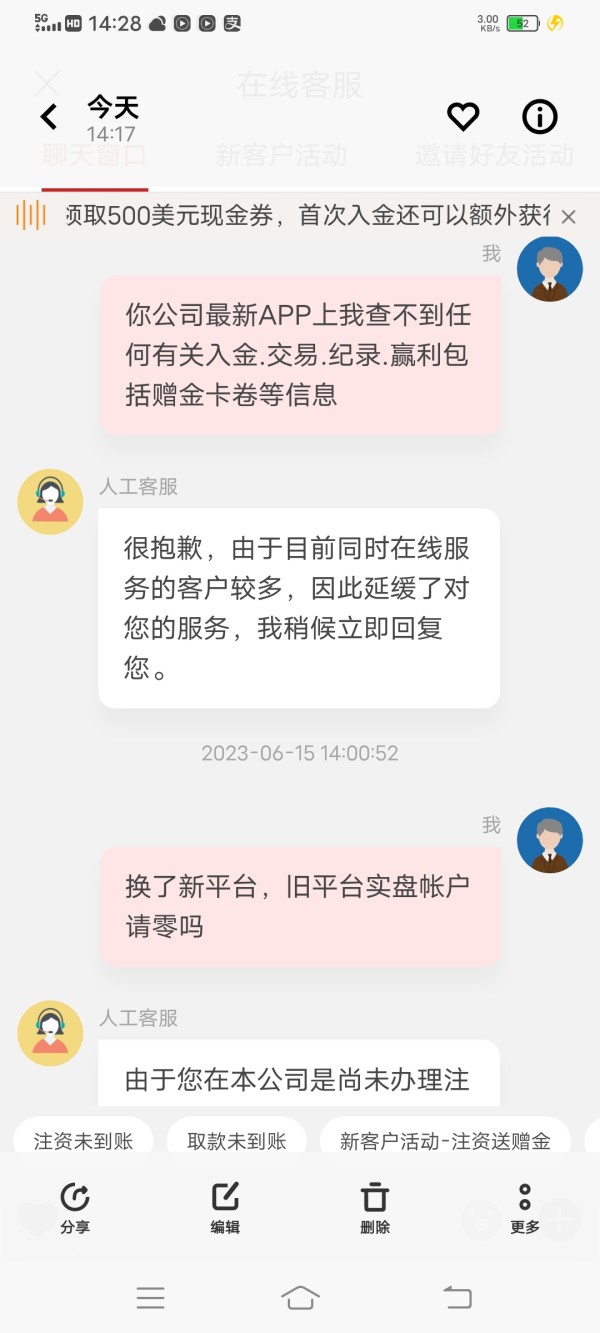

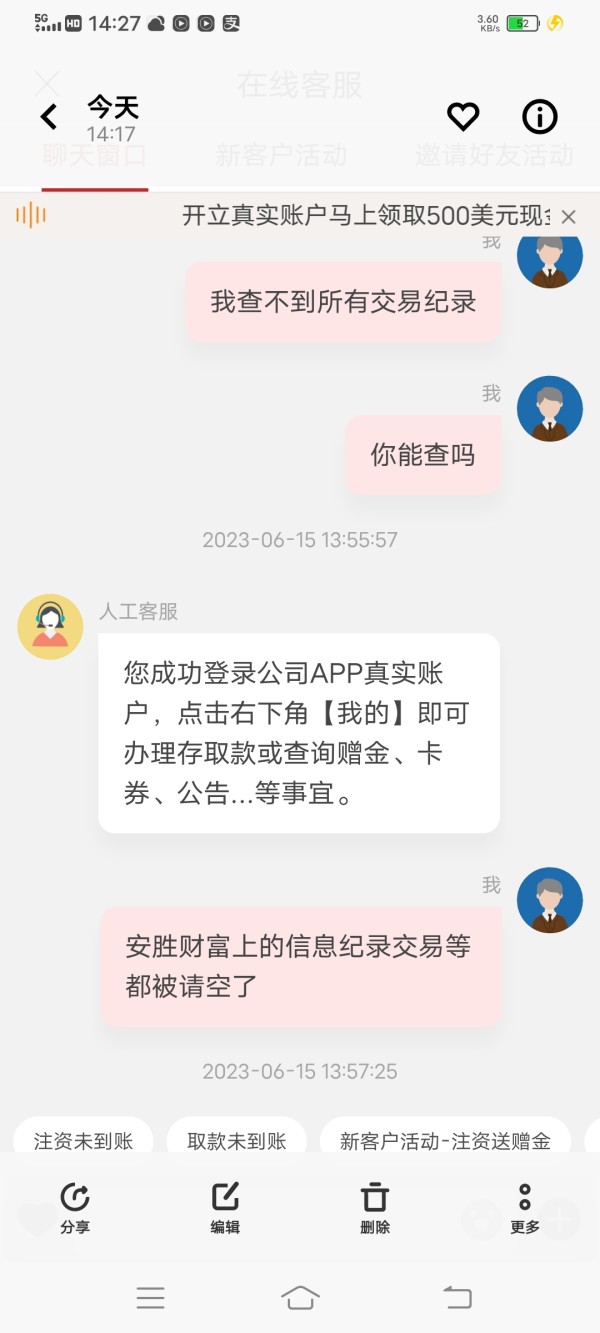

Note: It's important to be aware that the RLC broker operates under different entities across regions, which can affect user experiences and regulatory oversight. This review aims for fairness and accuracy by considering various perspectives.

Ratings Overview

How We Rate Brokers: Our ratings are based on a combination of user feedback, expert analysis, and factual data regarding the broker's offerings.

Broker Overview

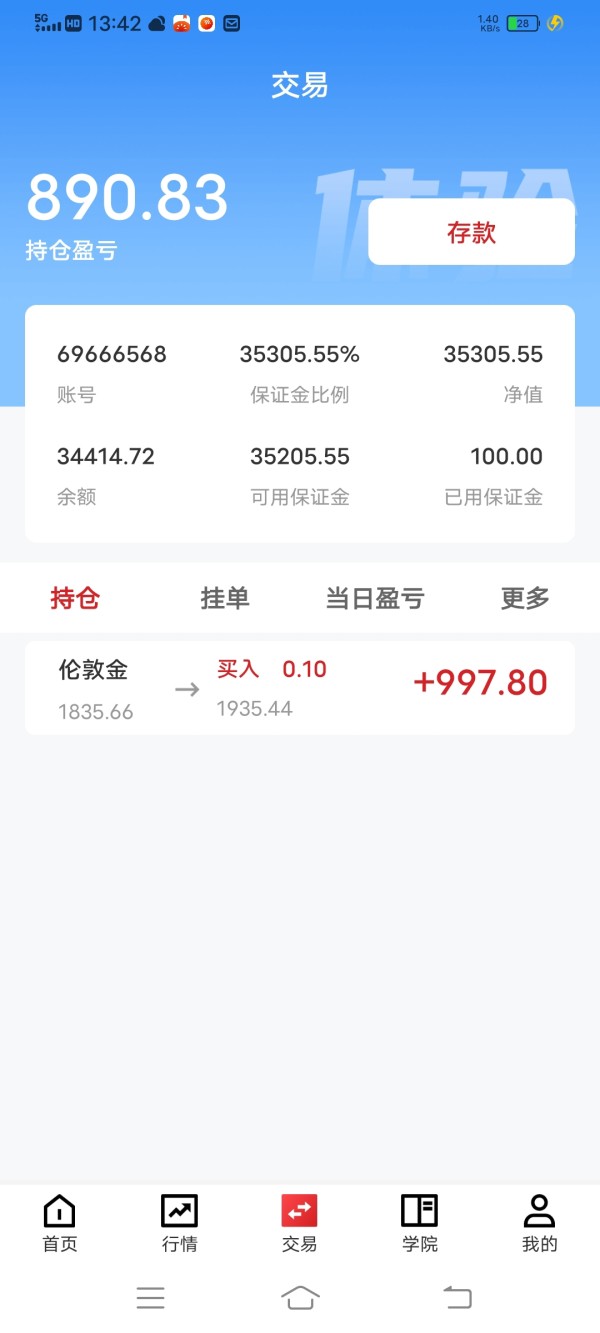

Founded in 2021, RLC (Real Life Capital) is a Hong Kong-based forex broker regulated by the Chinese Gold and Silver Exchange Society (CGSE). The broker primarily offers trading in precious metals, specifically London gold and silver. RLC utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and extensive trading tools.

RLC provides access to various trading instruments, allowing traders to speculate on the price movements of precious metals. Although it has received some positive feedback regarding its regulatory status, there are notable concerns regarding customer service and withdrawal issues.

Detailed Breakdown

Regulatory and Geographical Presence

RLC is regulated in Hong Kong under the CGSE, which is recognized as the sole exchange for trading physical gold and silver in the region. However, it is crucial to note that regulatory scrutiny can vary significantly between different jurisdictions, affecting user trust and security.

Deposit/Withdrawal Methods

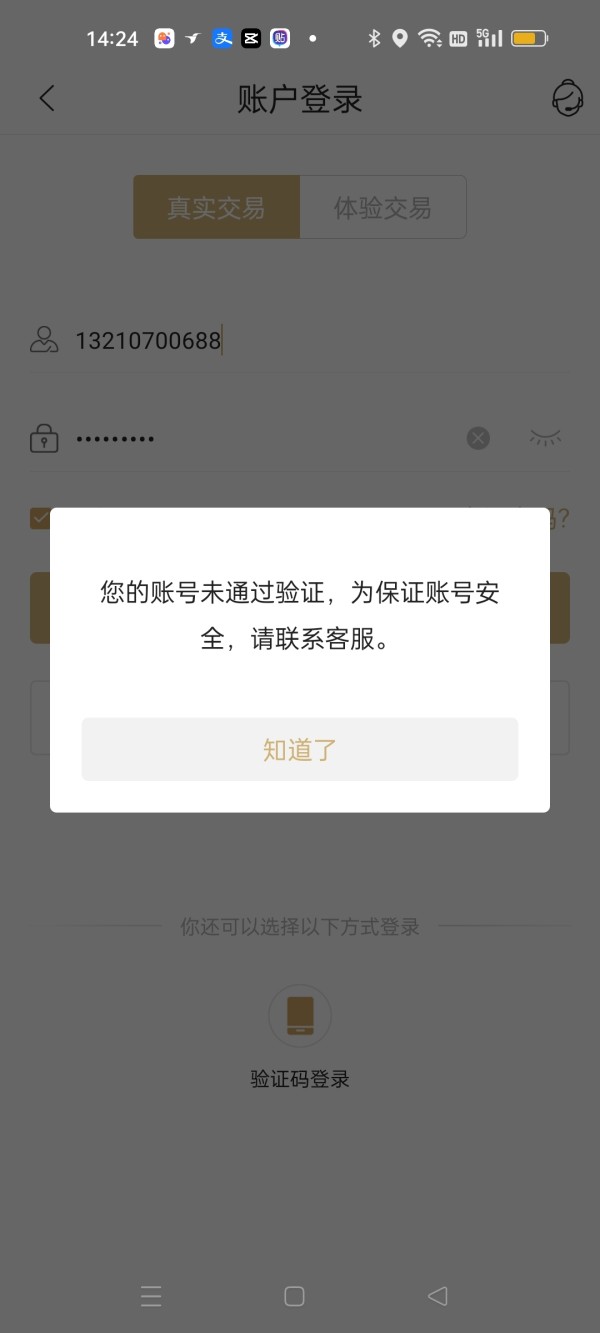

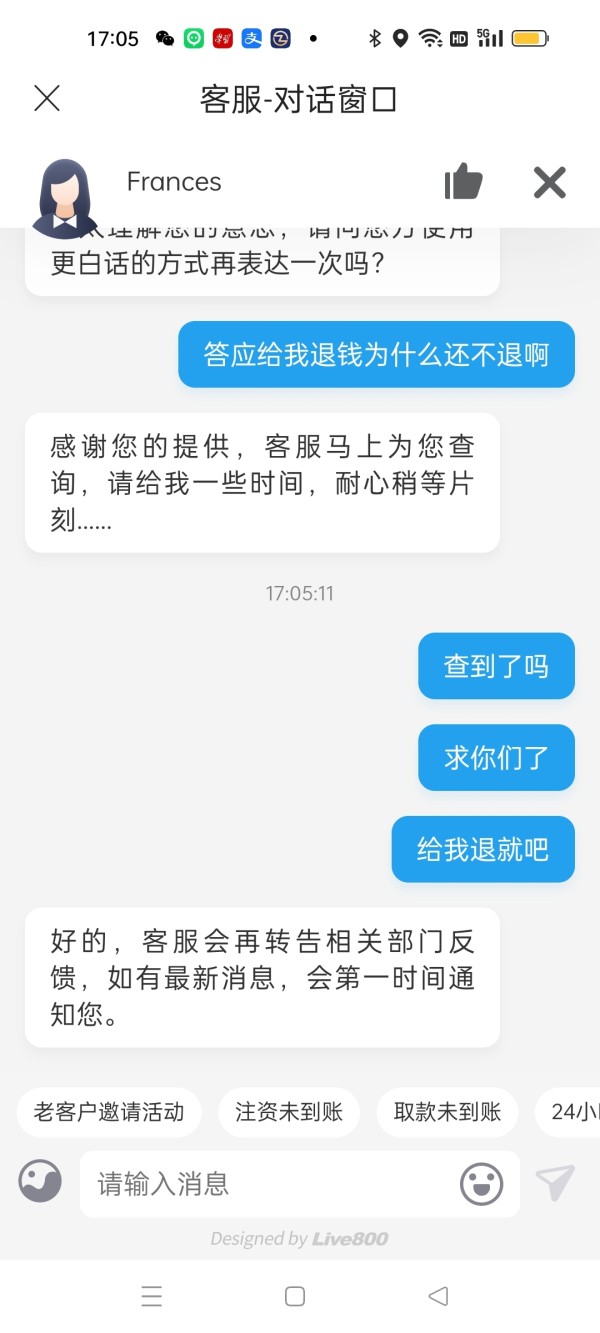

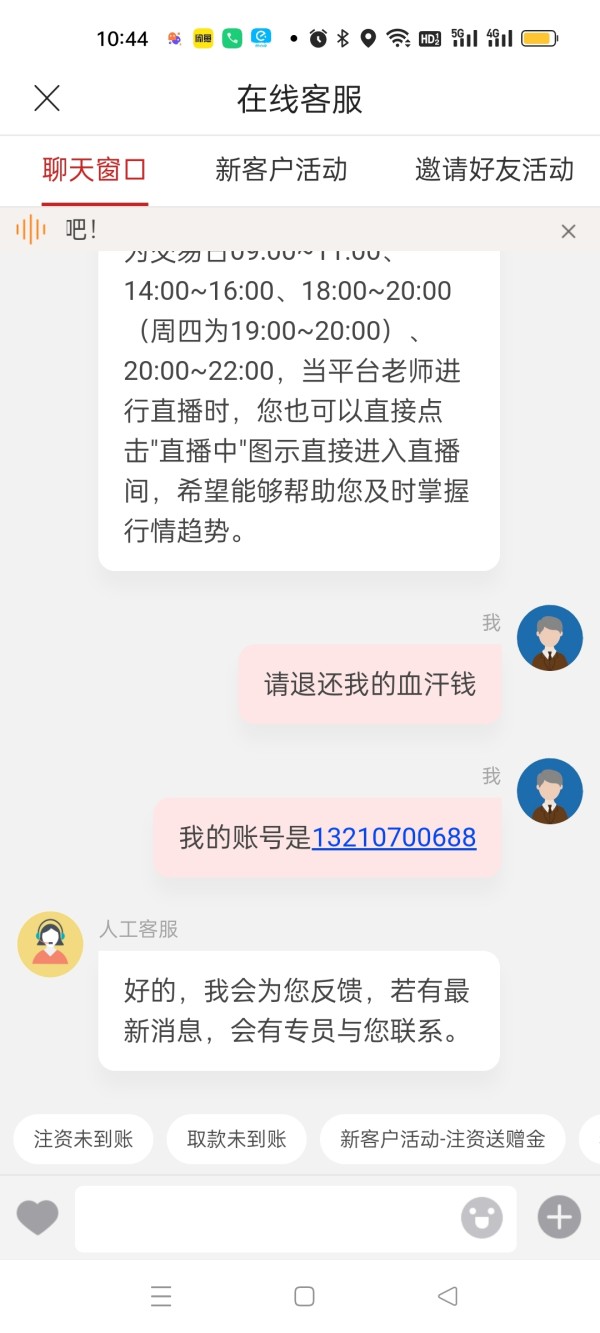

RLC accepts deposits in multiple currencies, but specific details on supported cryptocurrencies were not explicitly mentioned. The minimum deposit required to open an account is reportedly around $250, which is relatively standard in the industry. However, users have raised concerns regarding the withdrawal process, with several complaints about difficulties in accessing their funds.

There are no significant bonuses or promotional offers highlighted for RLC, which is common among regulated brokers aiming for compliance with industry standards.

Tradable Asset Classes

RLC specializes in trading precious metals, specifically London gold and silver. This focus offers traders opportunities to engage with these commodities, which are often viewed as safe-haven assets.

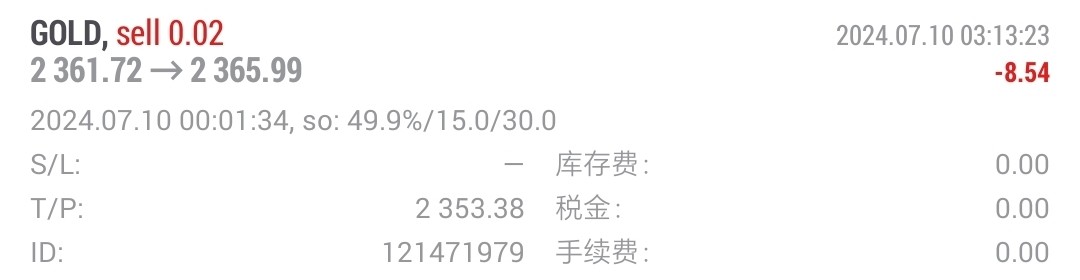

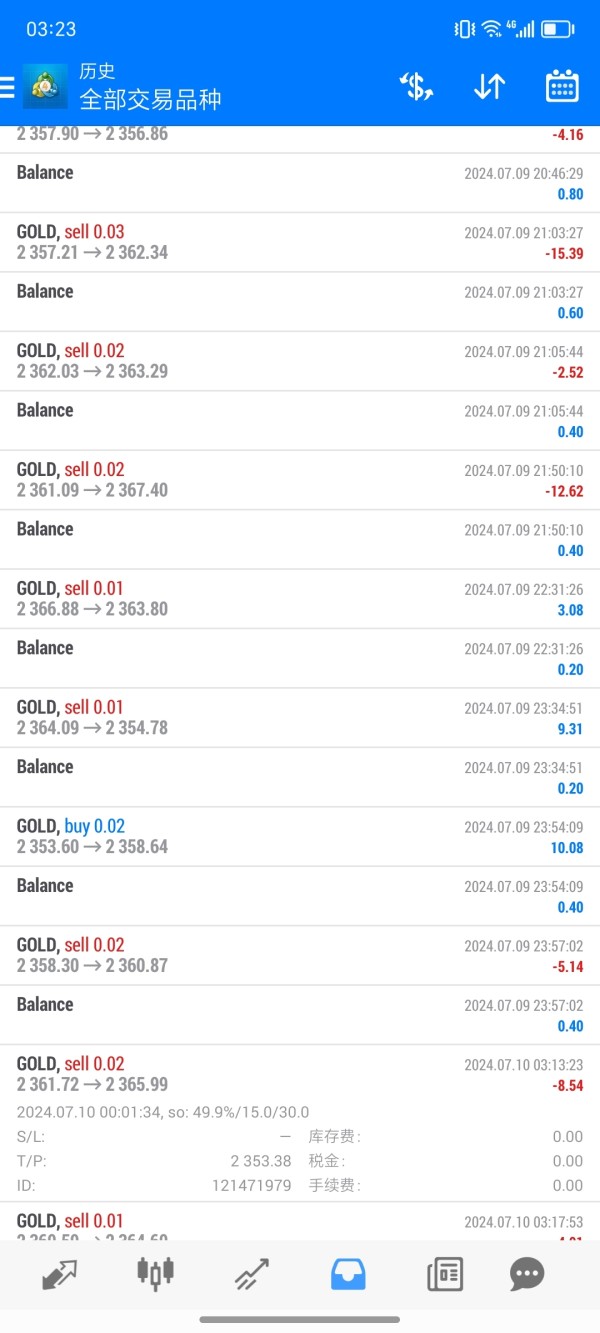

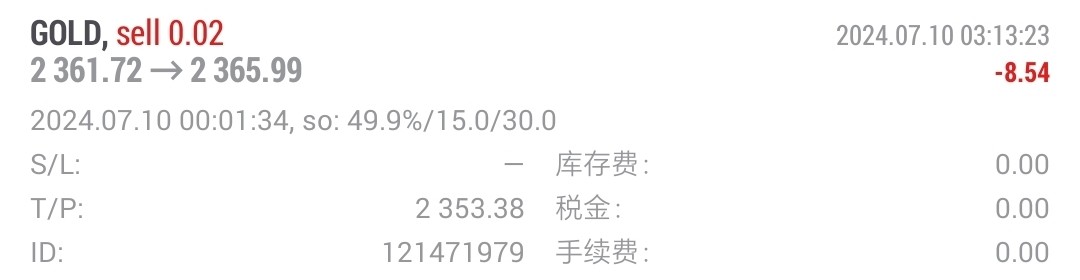

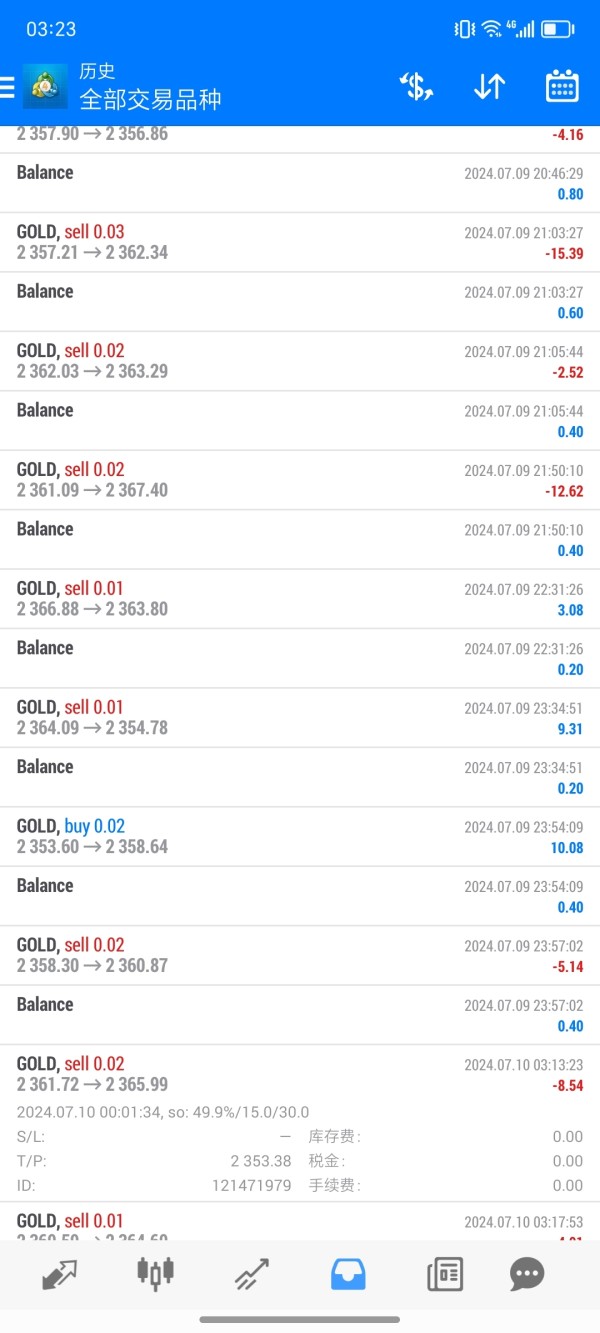

Costs (Spreads, Fees, Commissions)

The spreads at RLC are reported to be higher than average, with some users noting spreads as high as 0.5 pips. This can impact trading profitability, especially for those engaging in high-frequency trading strategies. Additionally, there are concerns regarding hidden fees that may not be clearly disclosed upfront.

Leverage

RLC offers leverage that can go up to 1:500, which is significantly higher than many other brokers. While high leverage can amplify profits, it also poses considerable risks, especially for inexperienced traders.

The primary trading platform offered by RLC is MetaTrader 4 (MT4). This platform is well-regarded in the trading community for its robust features, including automated trading capabilities through Expert Advisors (EAs).

Restricted Regions

RLC does not provide services to residents of certain jurisdictions, including the United States, Canada, and several other countries. This limitation is important for potential clients to consider before registration.

Available Customer Service Languages

RLC primarily offers customer support in Chinese (Simplified). However, the absence of multilingual support may pose challenges for non-Chinese speaking clients who require assistance.

Repeated Ratings Overview

Detailed Analysis

Account Conditions

The account conditions at RLC are fairly standard, with a minimum deposit of $250 and a focus on precious metals trading. However, the higher spreads and potential hidden fees have raised concerns among users, leading to a rating of 6 out of 10.

While RLC provides the MT4 platform, which is rich in features, the lack of educational resources and limited tools for market analysis have been noted as drawbacks. This has resulted in a rating of 5 out of 10 for tools and resources.

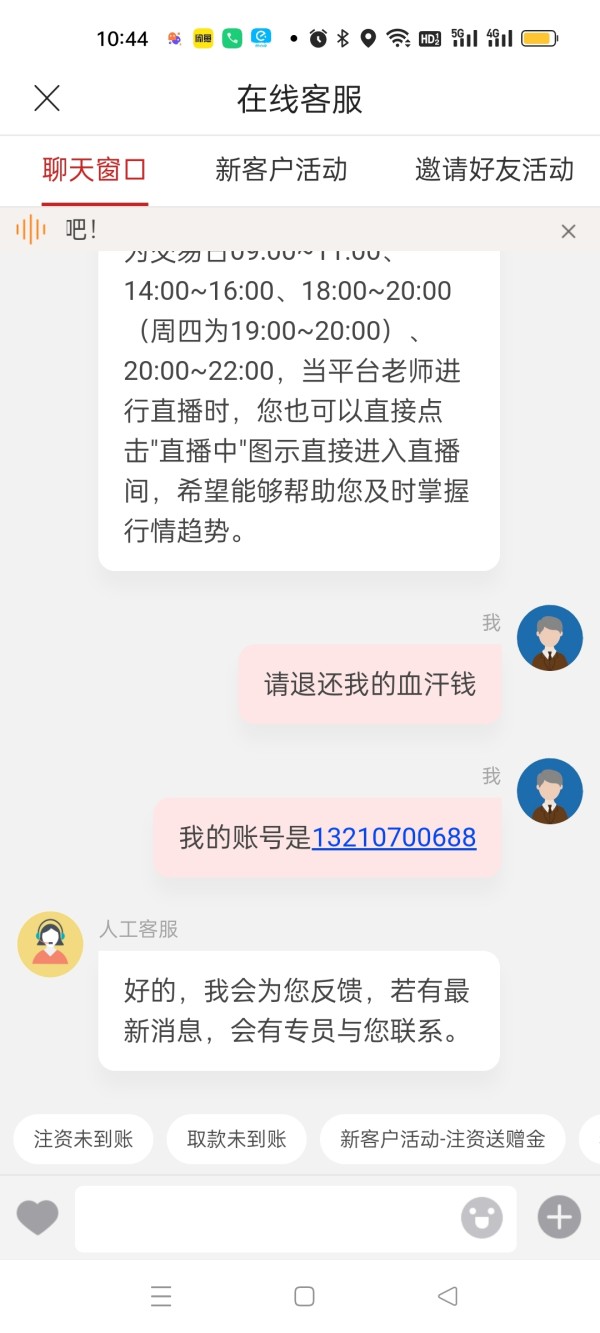

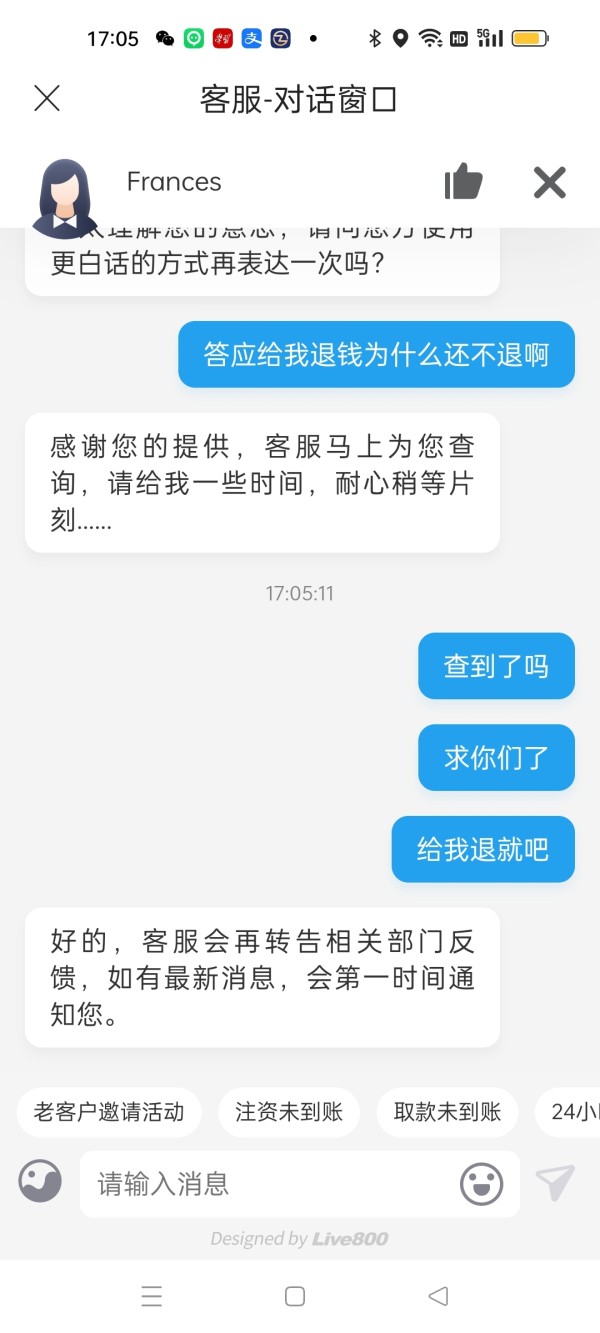

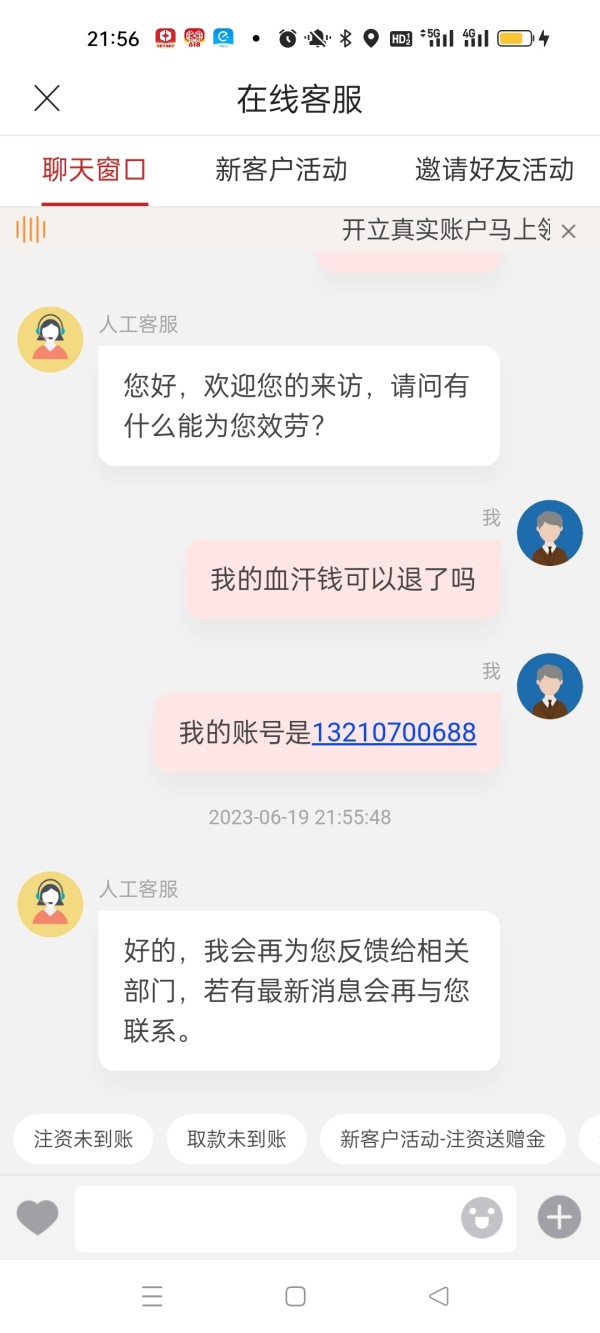

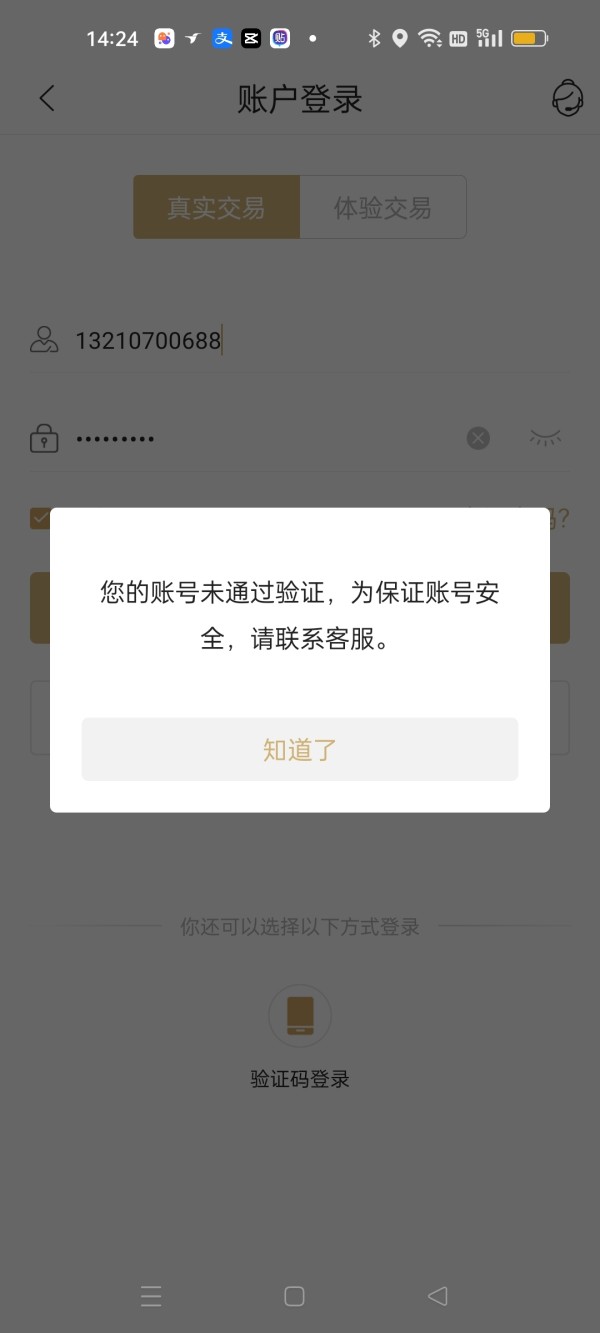

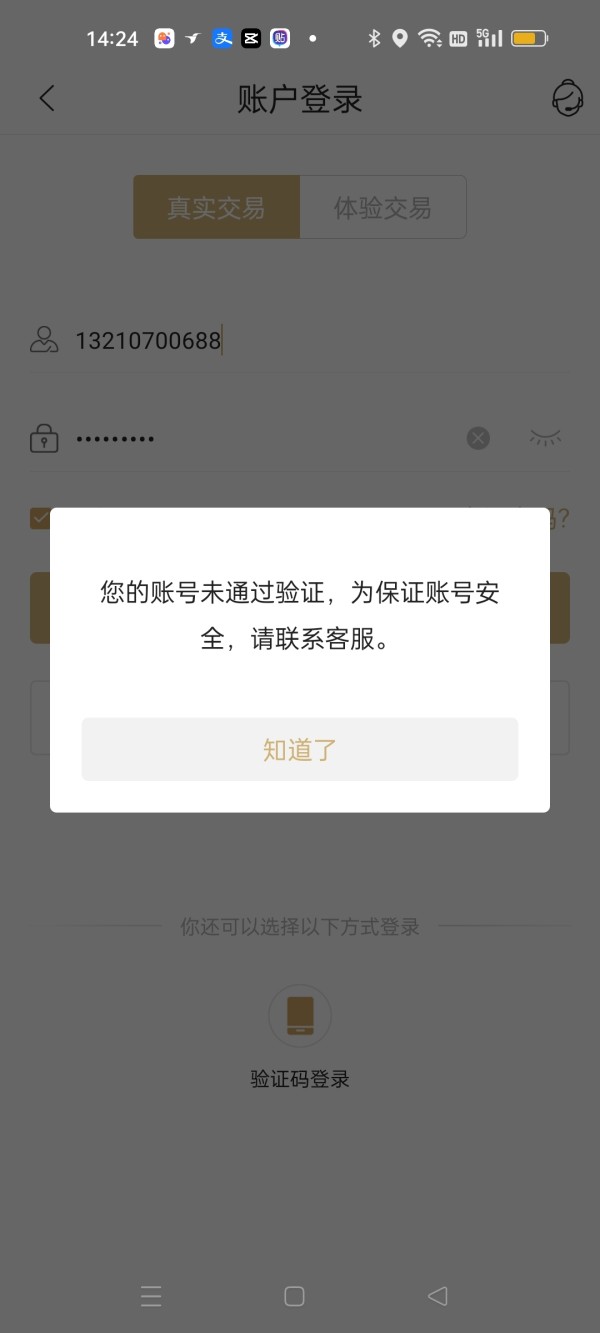

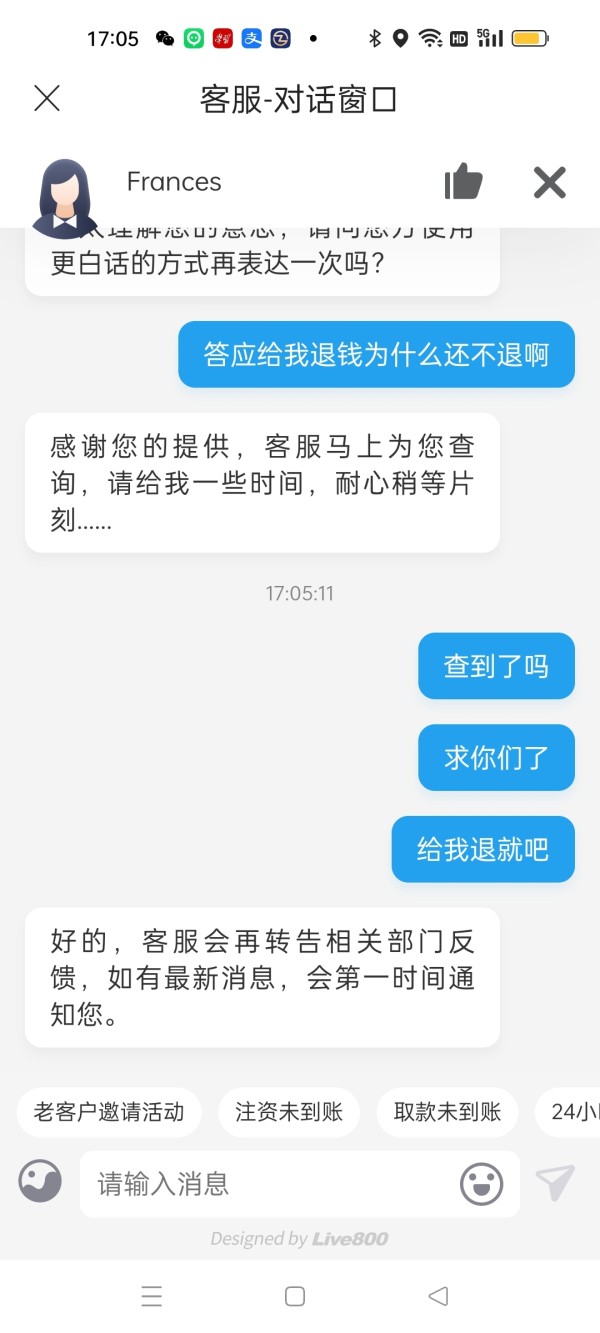

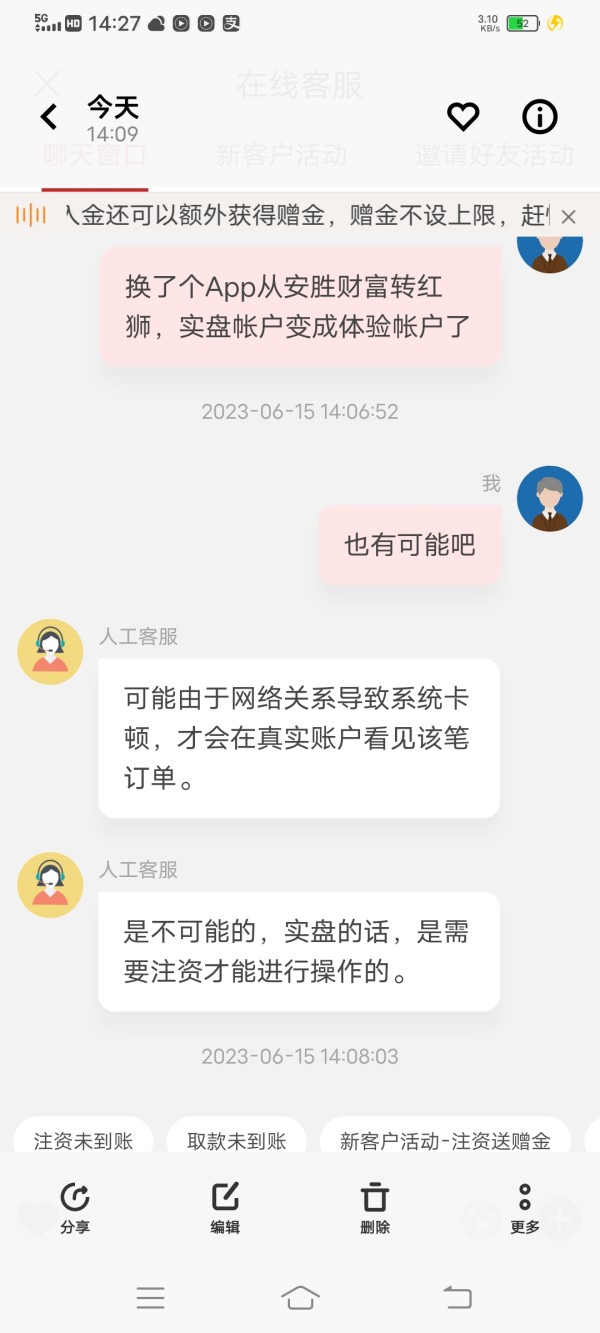

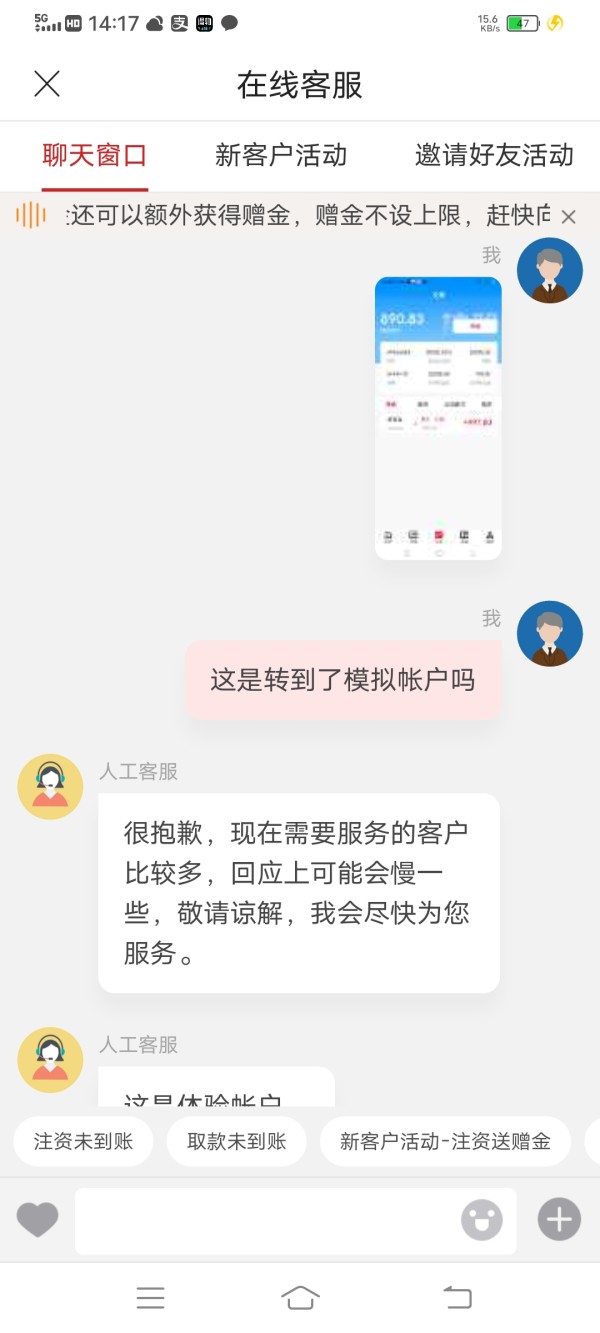

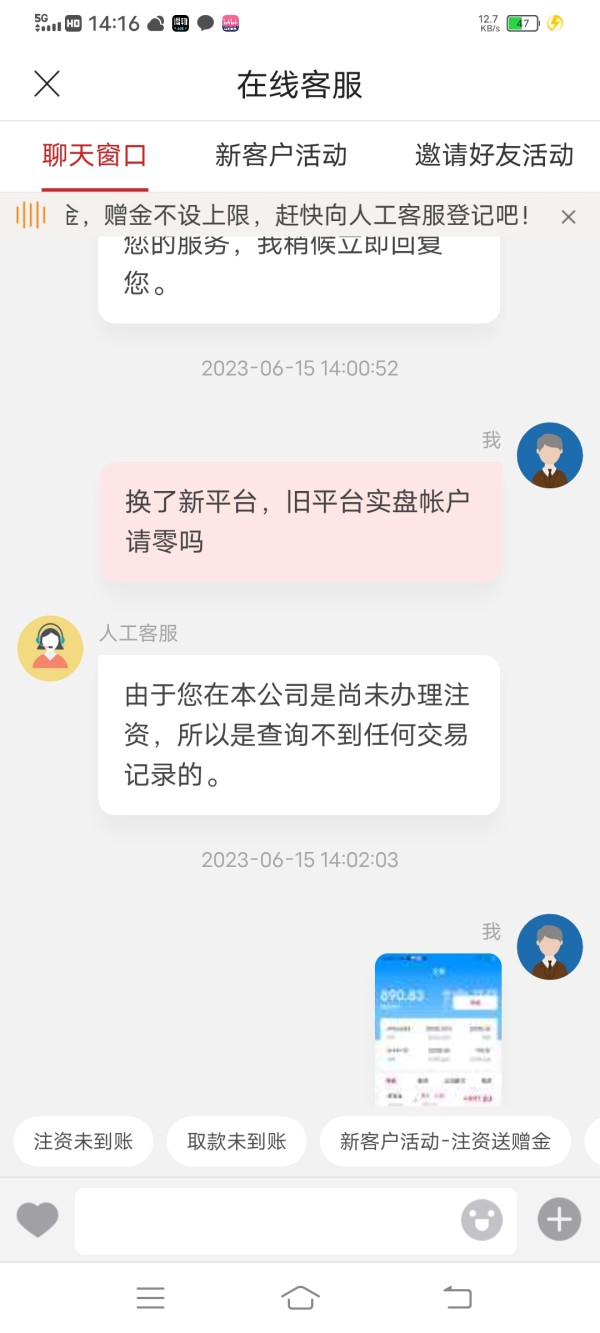

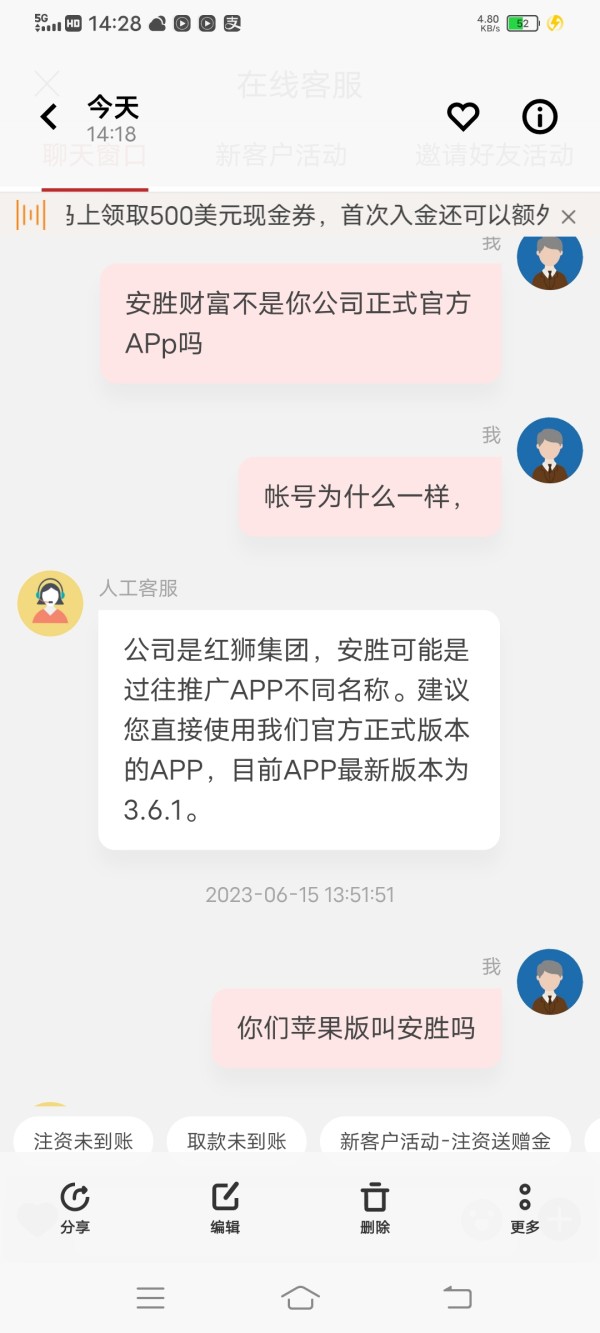

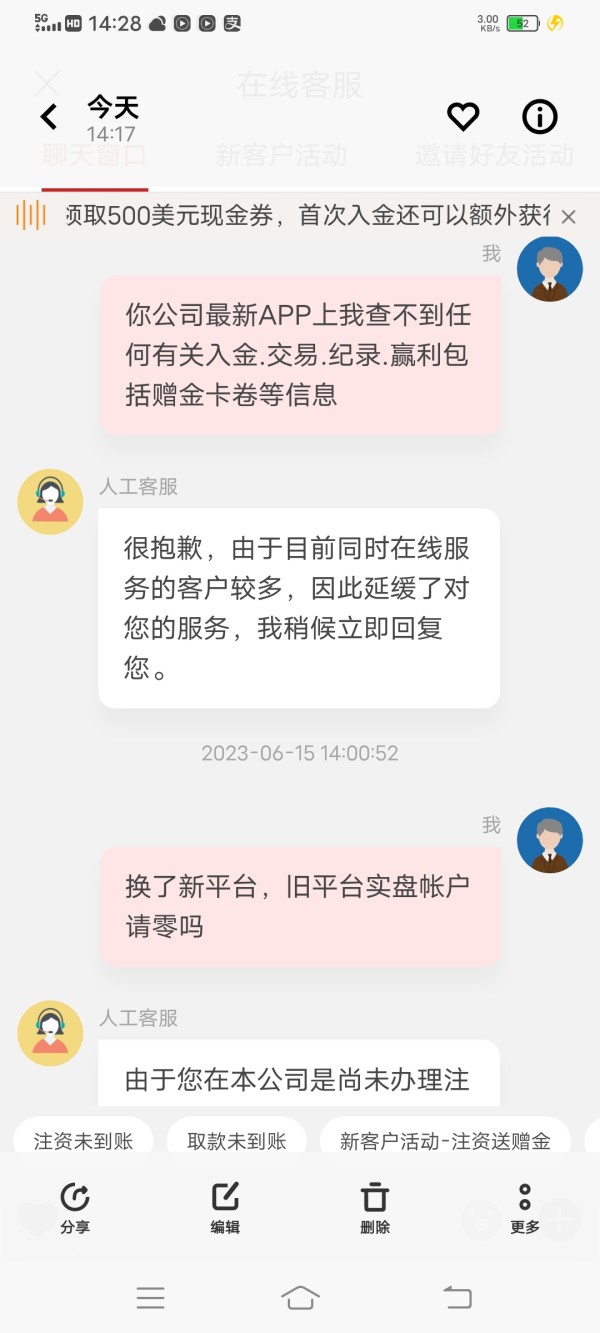

Customer Service and Support

Customer service has been a significant pain point for many users, with reports of long wait times and difficulties in resolving issues. This has led to a low rating of 4 out of 10 in this category.

Trading Setup (Experience)

The trading experience on the MT4 platform is generally positive, but issues related to execution speed and platform stability have been reported. This has resulted in a rating of 5 out of 10 for trading setup.

Trustworthiness

RLC's regulatory status provides some level of trust, but the numerous complaints regarding withdrawals and customer service have raised red flags. Thus, it receives a trust rating of 5 out of 10.

User Experience

Overall user experience has been mixed, with some traders appreciating the trading platform while others express dissatisfaction with customer support. This has led to a rating of 4 out of 10 in user experience.

In conclusion, while RLC offers a regulated environment for trading precious metals and utilizes a well-known trading platform, potential users should exercise caution due to reports of withdrawal issues and customer service challenges. It is advisable for traders to conduct thorough research and consider their options before engaging with RLC.