Regarding the legitimacy of RLC forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is RLC safe?

Pros

Cons

Is RLC markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

香港紅獅集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.rlc9000.comExpiration Time:

--Address of Licensed Institution:

九龍尖沙咀漆咸道南87-105號百利商業中心15字樓1511室Phone Number of Licensed Institution:

23927848Licensed Institution Certified Documents:

Is RLC Safe or Scam?

Introduction

RLC, also known as Red Lion Capital, is a forex broker based in Hong Kong that specializes in trading precious metals like London silver and London gold. Established in 2021, RLC aims to provide a platform for investors to engage in the global financial markets. However, as with any forex broker, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with potential risks, including the presence of unregulated brokers and scams that can lead to significant financial losses. In this article, we will investigate the legitimacy of RLC, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our findings are based on an analysis of multiple sources, including user reviews and regulatory databases, to provide a comprehensive assessment of whether "Is RLC safe?"

Regulation and Legitimacy

Understanding the regulatory framework surrounding a forex broker is crucial for assessing its legitimacy. RLC claims to be regulated by the Chinese Gold and Silver Exchange Society (CGSE), which is the sole exchange in Hong Kong trading physical gold and silver. The importance of regulation cannot be overstated, as it provides a layer of protection for traders, ensuring that the broker adheres to specific operational standards and ethical practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 081 | Hong Kong | Verified |

RLC operates under the auspices of CGSE, which is a recognized regulatory authority in Hong Kong. However, the quality and stringency of this regulation are often questioned. While CGSE is legitimate, it may not offer the same level of investor protection as more stringent regulators found in other regions, such as the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC). Furthermore, there have been reports of multiple complaints against RLC, which raise concerns about its compliance with regulatory standards.

Company Background Investigation

RLC was founded in 2021 and is operated by Hong Kong Red Lion Capital Limited. The company is relatively new in the forex trading industry, which raises questions about its long-term stability and reliability. The management teams background and experience are critical in assessing the broker's credibility. However, detailed information about the team is not readily available, which could indicate a lack of transparency.

The ownership structure of RLC is also somewhat opaque, as there is limited public information regarding its shareholders or key executives. This lack of transparency can be a red flag for potential investors, as it may imply that the company is not fully forthcoming about its operations or financial health. In terms of information disclosure, RLC's website provides basic details about its services but lacks comprehensive educational resources or insights into its operational practices.

Trading Conditions Analysis

The trading conditions offered by RLC are another crucial aspect to consider. The broker provides access to trading precious metals and utilizes the widely recognized MetaTrader 4 (MT4) platform. However, understanding the fee structure is essential for evaluating the overall cost of trading with RLC.

| Fee Type | RLC | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.5 pips | 1.0 pips |

| Commission Structure | Varies | Standard |

| Overnight Interest Range | 1% | 0.5% |

RLC's spreads appear to be competitive compared to industry averages, which may attract traders looking for cost-effective trading options. However, its essential to scrutinize any hidden fees or unusual policies, particularly regarding withdrawal fees or inactivity charges, which could significantly impact profitability.

Customer Funds Safety

The safety of customer funds is paramount in the forex industry. RLC claims to implement several measures to protect client funds, including segregating client accounts from the company's operational funds. This practice is essential for ensuring that client deposits are safeguarded in the event of financial difficulties faced by the broker.

Moreover, RLC does not provide explicit information regarding investor protection schemes, which are often offered by more reputable brokers. The absence of such protections can be concerning, as traders may find themselves without recourse in the event of a broker failure. Historical complaints about withdrawal issues and fund security raise additional red flags, indicating that potential investors should proceed with caution.

Customer Experience and Complaints

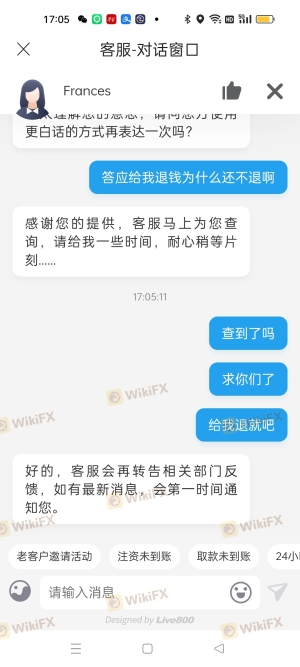

Customer feedback is a vital indicator of a broker's reliability and service quality. An analysis of user reviews reveals a mixed bag of experiences with RLC. Many users have reported difficulties in withdrawing funds, suggesting a potential issue with the broker's operational practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Slippage and Execution Issues | Medium | Unresolved |

| Customer Service Delays | Medium | Poor Communication |

Common complaints include slow withdrawal processes and poor customer service, which can significantly affect traders' experiences. In some cases, users have reported that their accounts were blocked or that they encountered unexpected slippage during trades. Such issues raise questions about the broker's operational integrity and customer support effectiveness.

Platform and Execution

The performance of the trading platform is critical for successful trading. RLC utilizes the MT4 platform, known for its user-friendly interface and robust features. However, user reviews indicate that the platform may experience occasional stability issues, which can lead to execution delays or order rejections.

Traders have also reported instances of slippage, particularly during volatile market conditions. Such occurrences can negatively impact trading results, leading to concerns about the broker's execution quality. Moreover, there are allegations of potential platform manipulation, which could further undermine trader confidence.

Risk Assessment

Engaging with RLC comes with inherent risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited investor protection |

| Operational Risk | High | History of withdrawal complaints |

| Execution Risk | Medium | Reports of slippage and order issues |

To mitigate these risks, traders should conduct thorough research and consider diversifying their investments across multiple brokers. Additionally, maintaining a cautious approach to leverage and position sizing can help manage potential losses.

Conclusion and Recommendations

In conclusion, while RLC presents itself as a regulated broker offering trading services in precious metals, several factors raise concerns about its overall safety and reliability. The mixed reviews, regulatory status, and history of customer complaints suggest that traders should exercise caution when considering RLC as their forex broker.

If you are contemplating trading with RLC, it is crucial to weigh the potential risks against your trading objectives. For those seeking more reputable alternatives, consider brokers regulated by stricter authorities like FCA or ASIC, which provide enhanced investor protections and a more transparent trading environment. Always remember to conduct thorough research and ensure that you are comfortable with the risks involved before proceeding with any trading activities. The question "Is RLC safe?" ultimately hinges on individual risk tolerance and the importance placed on regulatory oversight and customer feedback.

Is RLC a scam, or is it legit?

The latest exposure and evaluation content of RLC brokers.

RLC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RLC latest industry rating score is 6.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.