Atlas 2025 Review: Everything You Need to Know

Executive Summary

Atlas Broker offers zero commission accounts and competitive spreads as low as 1 pip for forex and CFD trading. This atlas review looks at what the broker offers based on available information and user feedback. The platform targets investors who want to trade forex and cryptocurrency, and it tries to be an easy option for regular traders.

Atlas works as a forex and CFD broker that focuses on low-cost trading solutions. The broker lets you trade various financial instruments including major forex pairs and cryptocurrencies. However, there are big gaps in public information about regulatory oversight and complete service details.

The platform's main selling points include zero commission trading and tight spreads, which could appeal to traders who care about costs. Still, potential users should carefully think about the limited transparency regarding regulatory compliance and operational details before making any investment decisions.

Important Notice

Regulatory Considerations: Atlas Broker's regulatory status remains unclear based on available information, with some sources indicating "Non-Regulation" status. Investors must check the broker's compliance status in their own areas before using the platform.

Review Methodology: This evaluation uses publicly available information and limited user feedback. The assessment may not capture all aspects of the user experience because of restricted data availability. Potential clients should do thorough research before opening accounts.

Rating Framework

Broker Overview

Atlas Broker works in the competitive forex and CFD trading space. Specific details about when it started and its corporate background are limited in available sources. The broker seems to focus mainly on providing cost-effective trading solutions through zero commission accounts and competitive spread offerings.

The platform's business model centers around forex and CFD trading, with special focus on cryptocurrency trading instruments including Bitcoin, Ethereum, and Ripple. This atlas review finds that the broker targets retail traders who want low-cost access to financial markets, though the scope of services appears more limited compared to established industry players.

Available information suggests Atlas works with a simple approach to trading services. It prioritizes easy account creation and straightforward trading processes. However, the lack of complete corporate information and regulatory transparency raises questions about the broker's long-term viability and operational standards in the highly regulated forex industry.

Regulatory Status: Current available information shows Atlas Broker operates under "Non-Regulation" status. This represents a significant concern for potential clients seeking regulated trading environments.

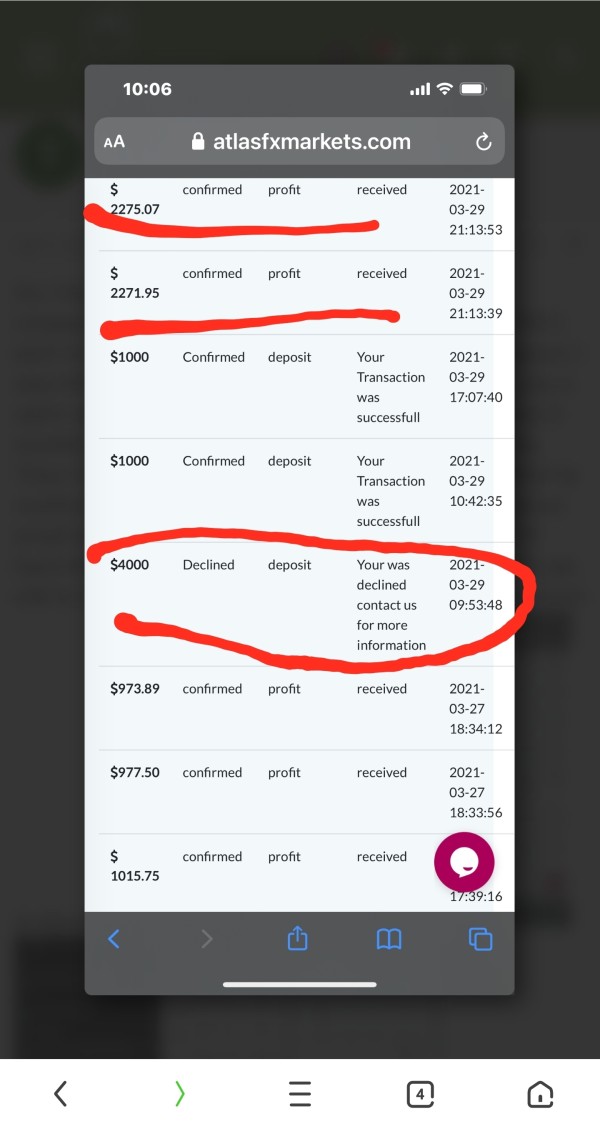

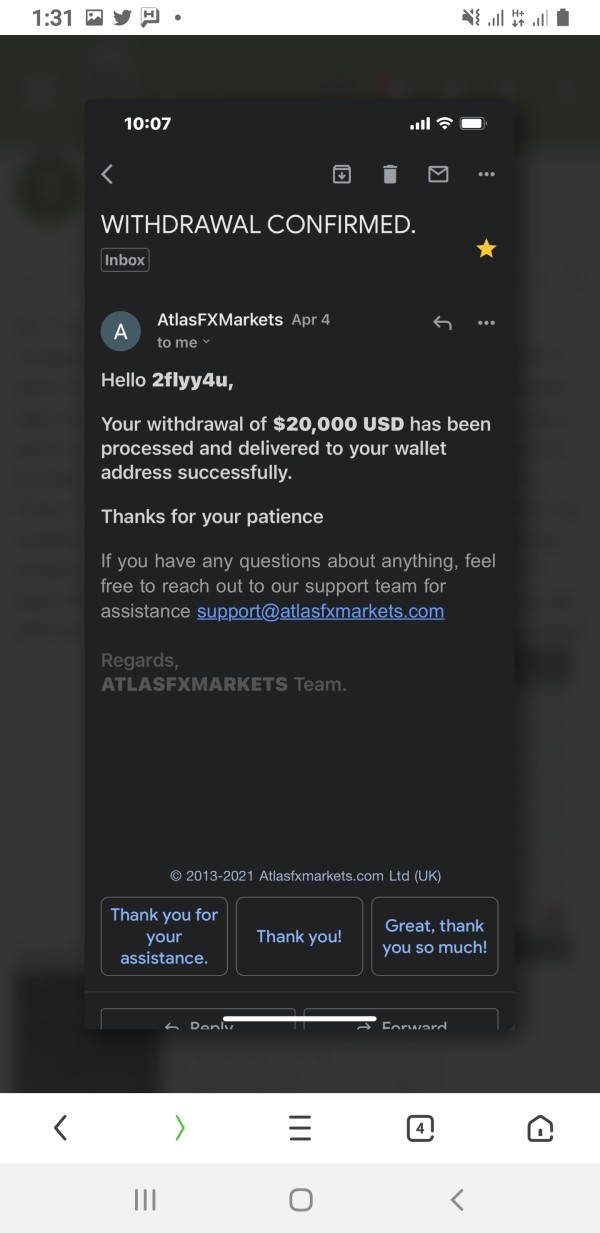

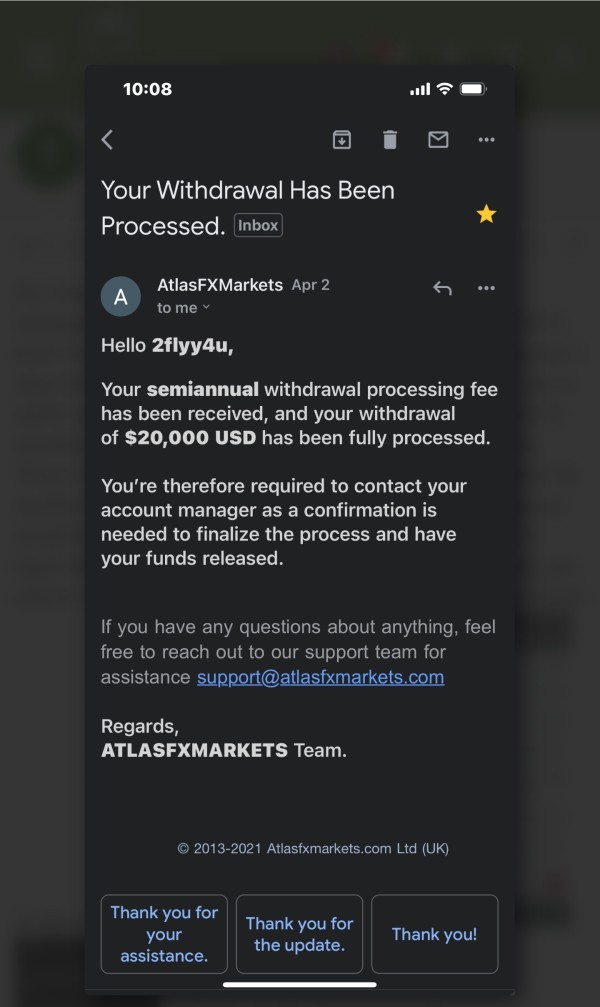

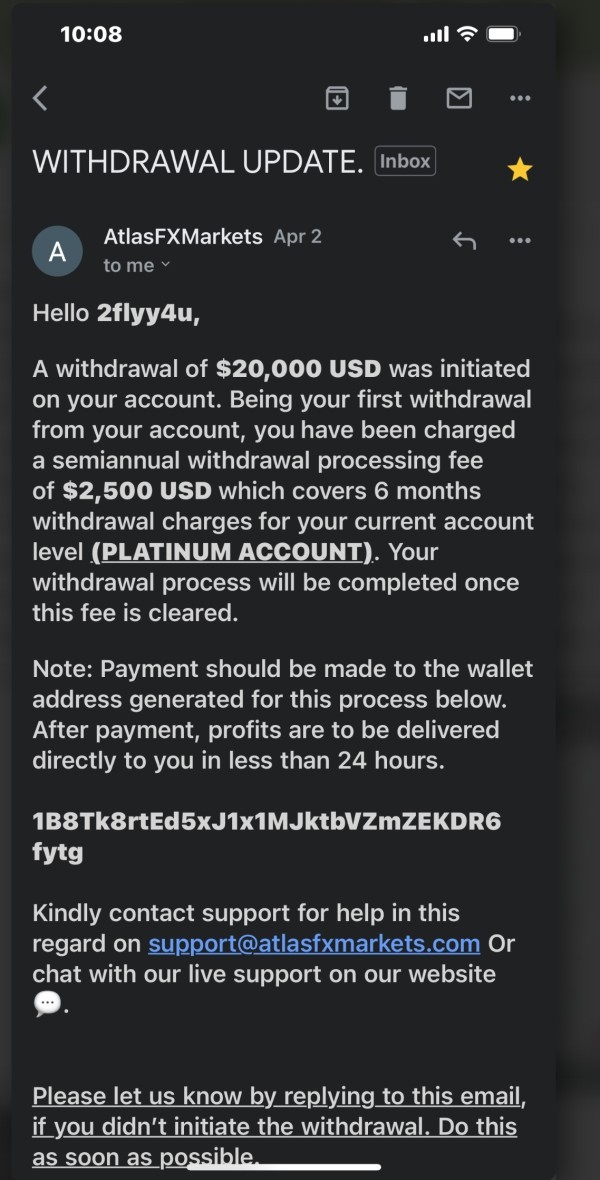

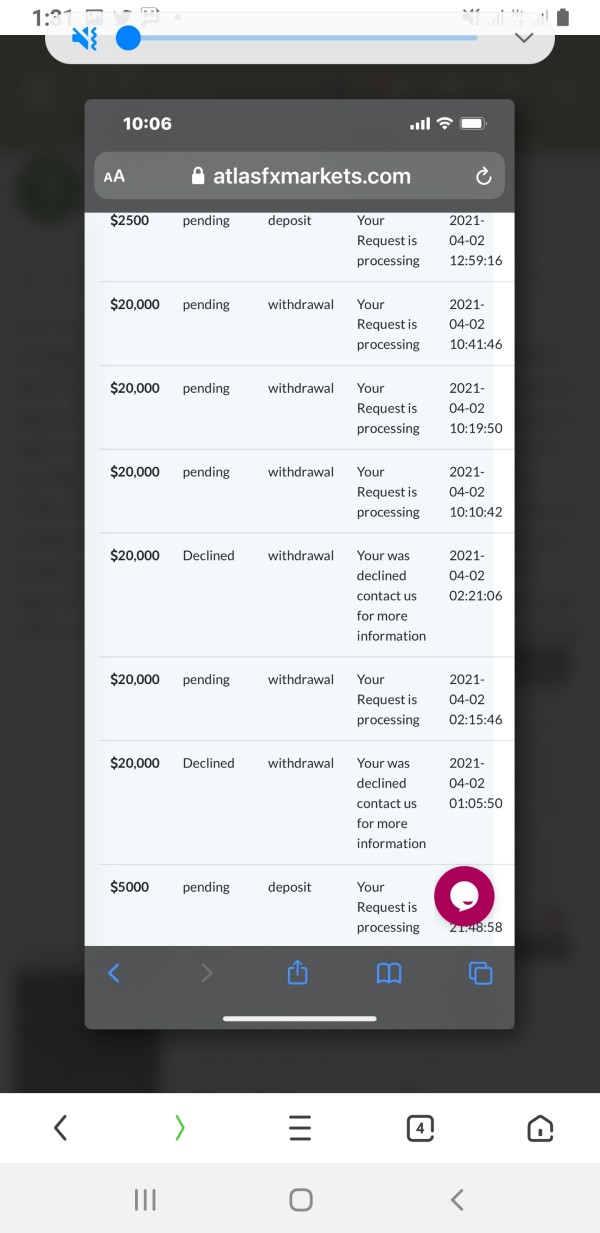

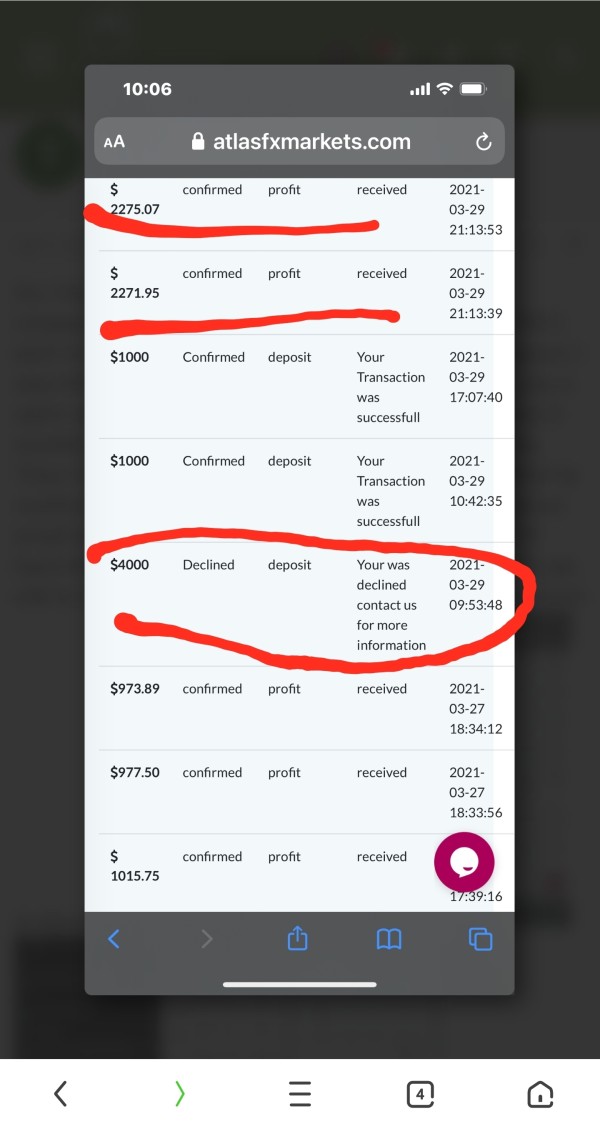

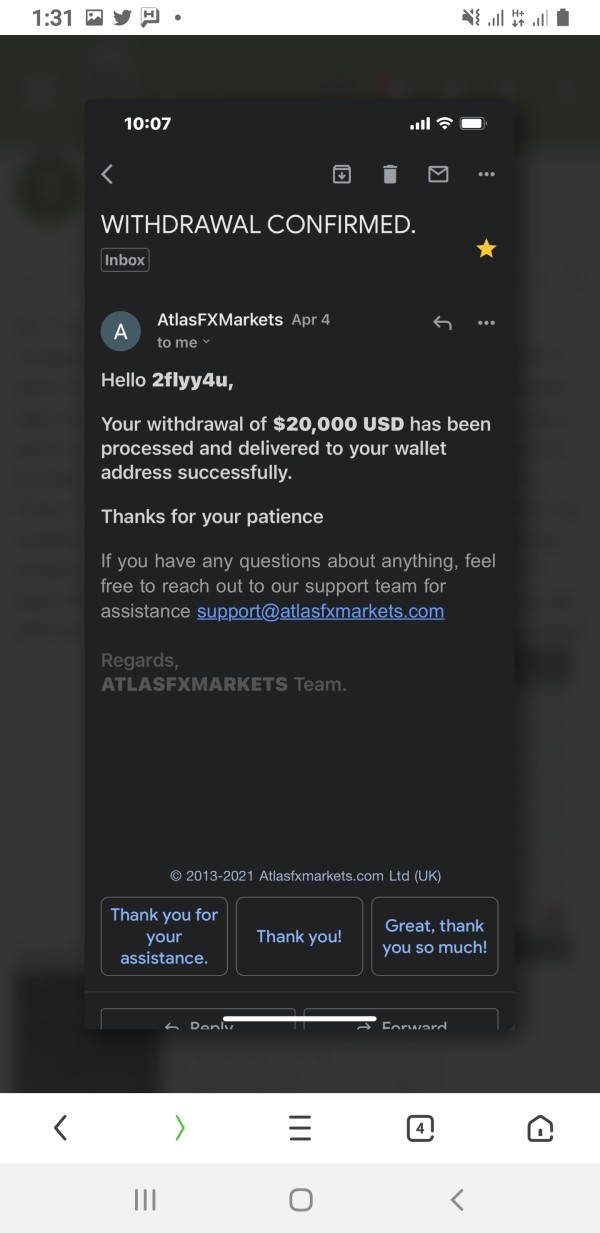

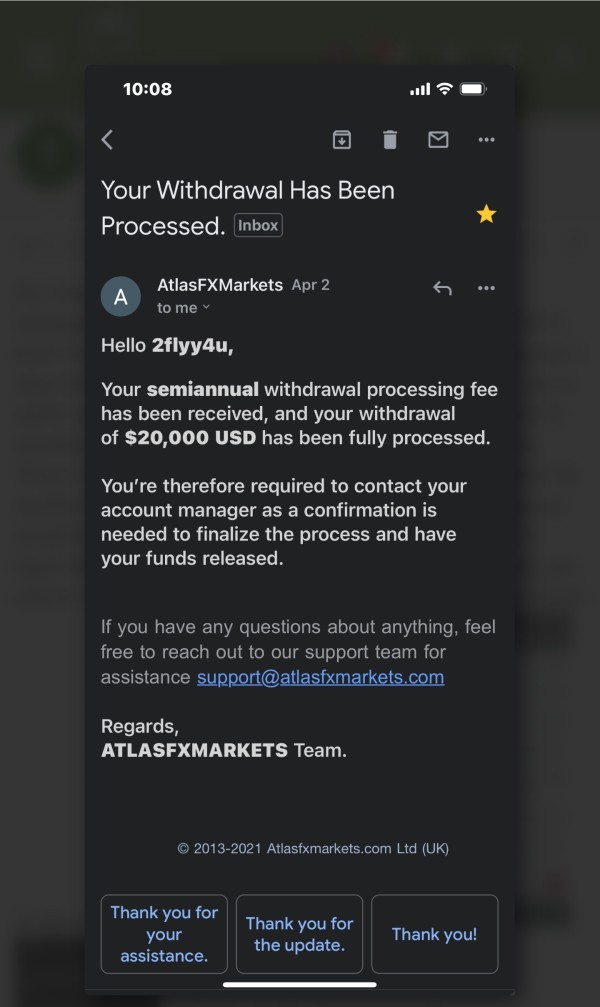

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available sources. You need to ask the broker directly.

Minimum Deposit Requirements: The minimum deposit threshold for opening accounts with Atlas Broker is not specified in accessible documentation.

Promotional Offers: Details about bonus programs or promotional incentives are not mentioned in current available materials.

Tradeable Assets: The broker offers access to major cryptocurrencies including Bitcoin, Ethereum, and Ripple, alongside traditional forex and CFD instruments. The complete asset list requires verification.

Cost Structure: Atlas Broker advertises zero commission trading with spreads starting from 1 pip. This positions it as a low-cost trading solution in the competitive forex market.

Leverage Options: Information about maximum leverage ratios and margin requirements is not specified in available sources.

Platform Options: Specific details about trading platforms are not mentioned in accessible materials. This includes whether they use proprietary or third-party solutions like MetaTrader.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in current documentation.

Customer Support Languages: The range of supported languages for customer service is not detailed in available information.

This atlas review highlights significant information gaps that potential clients should address through direct communication with the broker before making trading decisions.

Account Conditions Analysis

Atlas Broker's account structure centers around its zero commission offering. This represents a competitive advantage in the cost-conscious trading environment. The advertised spreads starting from 1 pip suggest reasonable trading costs for major currency pairs, though specific details about spread variations across different instruments remain unclear.

The account opening process appears streamlined based on limited user feedback suggesting simplicity in account creation. However, complete details about account tiers, minimum balance requirements, and specific features for different account types are not readily available in public sources.

The broker's focus on zero commission trading could appeal to high-frequency traders and those prioritizing cost efficiency. Still, traders should verify whether additional fees apply to deposits, withdrawals, or other services that might offset the commission-free structure.

Account verification procedures, documentation requirements, and timeframes for account activation are not detailed in available materials. This atlas review notes that potential clients should ask directly about these operational aspects before committing to the platform.

The trading tools and resource offerings at Atlas Broker appear limited based on available information. While the platform provides access to various financial instruments including cryptocurrencies, specific details about analytical tools, charting capabilities, and research resources are not mentioned in accessible sources.

Educational resources, market analysis, and trading guides that are typically expected from modern forex brokers are not documented in current materials. This absence could indicate either limited offerings or poor communication of available resources to potential clients.

Automated trading support, expert advisors, and algorithmic trading capabilities remain unspecified. For traders relying on sophisticated trading tools and complete market analysis, the apparent lack of detailed resource information may be concerning.

The platform's technological infrastructure, including mobile trading capabilities and advanced order types, requires direct verification with the broker as these details are not available in public documentation.

Customer Service and Support Analysis

Customer service quality and availability represent significant unknowns in this Atlas Broker evaluation. Available sources do not provide specific information about support channels, response times, or service quality metrics that would allow for complete assessment.

The absence of detailed customer service information creates uncertainty about the broker's commitment to client support. This includes available contact methods, operating hours, and language support. Professional forex brokers typically maintain 24/5 support with multiple contact options.

User feedback regarding customer service experiences is limited in available sources. This prevents accurate assessment of actual service quality and problem resolution capabilities. The lack of transparency about support services raises concerns about the broker's operational standards.

Multilingual support capabilities, educational assistance, and technical support quality remain unverified aspects that potential clients should investigate before opening accounts with Atlas Broker.

Trading Experience Analysis

The trading experience at Atlas Broker appears focused on simplicity and ease of use. This is based on limited user feedback suggesting straightforward trading processes. The zero commission structure and competitive spreads could contribute to a positive cost-effective trading environment.

Platform stability, execution speed, and order fulfillment quality are not documented in available sources. This makes it difficult to assess the technical trading experience. These factors are crucial for active traders who require reliable and fast execution.

The availability of advanced order types, risk management tools, and trading features typically expected from modern forex platforms requires verification. The atlas review process reveals limited information about sophisticated trading capabilities.

Mobile trading functionality, cross-platform synchronization, and offline trading capabilities are not detailed in accessible materials. For traders requiring flexible trading access, these omissions represent important considerations in platform selection.

Trust Factor Analysis

The trust factor represents Atlas Broker's most significant challenge based on available information. The indication of "Non-Regulation" status raises serious concerns about client protection, fund security, and operational oversight that regulated brokers typically provide.

Regulatory compliance forms the foundation of trust in the forex industry. The absence of clear regulatory authorization creates uncertainty about the broker's legitimacy and client fund protection measures. Established regulatory bodies provide essential oversight and dispute resolution mechanisms.

Corporate transparency appears limited in public sources. This includes company registration details, management information, and operational history. The lack of transparency contrasts with industry standards where reputable brokers maintain complete corporate disclosure.

Fund segregation policies, insurance coverage, and client protection measures are not detailed in available information. This leaves potential clients without assurance about their capital security in case of operational difficulties.

User Experience Analysis

User experience feedback for Atlas Broker remains limited. Available comments suggest a relatively straightforward platform interface and simple account creation process. The emphasis on ease of use could appeal to novice traders seeking uncomplicated trading environments.

The platform's design philosophy appears to prioritize simplicity over complete functionality. This may suit traders with basic requirements but could disappoint those seeking advanced features and sophisticated trading tools.

Registration and verification processes are described as simple, though specific timeframes and documentation requirements are not detailed. User onboarding experience quality requires direct verification through the actual account opening process.

Common user complaints or recurring issues are not documented in available sources. This prevents identification of potential problem areas. This atlas review emphasizes the need for prospective clients to seek additional user feedback before making platform decisions.

The target user profile appears to be retail traders interested in forex and cryptocurrency trading who prioritize cost efficiency over complete service offerings. However, the limited service transparency may not meet the expectations of experienced traders requiring detailed operational information.

Conclusion

Atlas Broker presents a mixed proposition in the competitive forex trading landscape. While the zero commission structure and competitive spreads offer potential cost advantages, significant concerns about regulatory status and operational transparency limit its appeal to security-conscious traders.

The broker appears most suitable for cost-focused traders willing to accept higher risk in exchange for potentially lower trading costs. However, the lack of regulatory oversight makes it inappropriate for traders prioritizing fund security and regulatory protection.

Key advantages include zero commission trading and competitive spreads, while major disadvantages include unclear regulatory status and limited operational transparency. Potential clients should conduct thorough research and consider regulated alternatives before making trading decisions with Atlas Broker.