KCM Trade 2025 Review: Everything You Need to Know

Executive Summary

KCM Trade is a trusted global forex and CFD broker established in 2014. Operating under reputable regulatory frameworks such as the FSC, IFSC, and ASIC, the company continues to expand its international presence by offering safe, transparent, and user-friendly trading solutions.

This KCM Trade review highlights a broker that serves both retail and institutional clients with competitive trading conditions, a low minimum deposit of $50, and leverage up to 1:500 for those seeking enhanced trading opportunities.

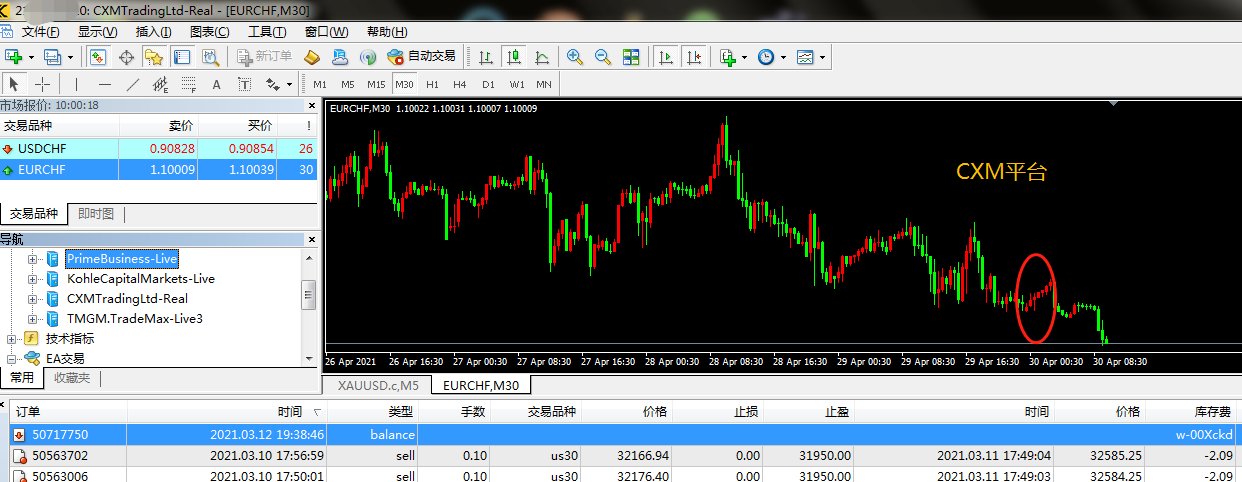

The broker supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), ensuring traders access world-class tools, analysis features, and automated trading capabilities. Its diverse asset selection—covering forex pairs, commodities, indices, and cryptocurrencies—provides flexibility for various trading strategies.

Multiple payment options such as bank transfers, credit/debit cards, Skrill, Neteller, and PayPal make transactions fast and convenient.

With its multi-jurisdictional regulation, segregated fund policies, and third-party auditing, KCM Trade demonstrates strong transparency and accountability—solidifying its position as a reliable broker for 2025.

Important Disclaimer

KCM Trade operates under several regulatory jurisdictions. Trading conditions, account structures, and investor protections may vary depending on a clients region.

Traders should review the applicable regulatory entity (FSC, IFSC, or ASIC) before opening an account to understand the scope of protection.

This review summarizes information gathered from reputable public sources and professional evaluations. Forex and CFD trading involves leverage and market risk; traders are encouraged to manage their exposure responsibly and assess personal financial suitability before live trading.

Rating Framework

Broker Overview

Founded in 2014, KCM Trade has evolved into a multi-asset brokerage serving clients across continents. The companys business model emphasizes transparent pricing, competitive spreads, and regulatory compliance.

Its partnership with independent auditing firms ensures real-time verification of trading volumes and client asset reporting, reflecting a commitment to financial integrity.

From beginners exploring live markets with small capital to professionals managing larger portfolios, KCM Trades structure supports diverse trader profiles.

The brokers ecosystem is built on MetaTrader 4 and MetaTrader 5, offering comprehensive charting, analytical tools, and automation features.

With access to forex, indices, commodities, and cryptocurrencies, KCM Trade enables portfolio diversification and flexible strategy execution within a regulated framework.

Detailed Information Analysis

Regulatory Oversight

KCM Trade operates under a multi-jurisdictional regulatory structure, combining the strengths of:

- FSC (Mauritius)

- IFSC (Belize)

- ASIC (Australia)

This layered approach ensures adherence to global financial standards and provides clients with compliance assurance and operational transparency.

Payment Methods and Banking

KCM Trade supports a wide range of secure funding and withdrawal methods:

- Bank transfers

- Credit and debit cards

- Skrill, Neteller, PayPal

This accessibility enhances convenience for traders worldwide, ensuring smooth and fast transactions.

Minimum Deposit Requirements

A minimum deposit of $50 makes KCM Trade highly accessible to new traders and those testing strategies with limited capital.

This entry-level requirement aligns with the companys goal of promoting financial inclusion and broad market participation.

Promotional Offerings

Promotional programs or bonus campaigns may vary by region. Traders can contact KCM Trades customer support directly for details on current offers and eligibility.

Trading Assets Portfolio

KCM Trades multi-asset environment includes:

- Forex pairs (major, minor, exotic)

- Indices and CFDs on equities

- Commodities such as gold, silver, and oil

- Cryptocurrency CFDs

This wide selection empowers traders to diversify and adapt to different market conditions seamlessly.

Cost Structure Analysis

KCM Trade maintains tight spreads across key instruments.

Its pricing model is structured to balance affordability and performance, appealing to both retail and professional traders seeking consistent execution quality.

Leverage Specifications

With leverage up to 1:500, traders can optimize their capital efficiency according to their strategies and experience levels.

Risk management remains essential, and KCM Trade provides tools like stop-loss and margin alerts to help clients trade responsibly.

Platform Technology

Supporting MT4 and MT5, KCM Trade ensures access to:

- Advanced technical indicators

- Multiple chart timeframes

- Automated trading via Expert Advisors (EAs)

- Mobile trading apps for iOS and Android

These platforms deliver institutional-grade functionality with an intuitive interface suitable for traders of all levels.

Geographic Accessibility

KCM Trade maintains global accessibility across multiple regions, complying with local regulations where applicable. This ensures clients benefit from both local service availability and international trading flexibility.

Customer Support and Languages

KCM Trade provides professional multilingual support, assisting clients through live chat, email, and phone.

Language coverage includes English, Chinese, Arabic, Spanish, and other major languages, enabling seamless global communication.

Account Conditions Analysis

KCM Trades account structure reflects inclusivity and flexibility:

- Minimum deposit: $50

- Leverage: Up to 1:500

- Multiple account types: Tailored for both beginners and advanced traders

- Execution: Fast and consistent

The simple onboarding process allows clients to open and verify accounts efficiently, supported by a dedicated service team.

Its inclusive approach appeals to traders in both developed and emerging markets.

Tools and Resources Analysis

KCM Trades MT4 and MT5 ecosystem offers:

- 30+ built-in indicators and customizable tools

- Advanced charting functions for scalping or swing trading

- Automated trading support (EAs)

- Cross-device synchronization for web, desktop, and mobile use

The broker also emphasizes continuous learning, offering periodic webinars and market updates to enhance trader competence and market awareness.

Customer Service and Support Analysis

KCM Trade maintains multi-channel support availability across time zones, ensuring client inquiries are handled efficiently.

Traders can expect timely responses for account setup, funding assistance, and technical support.

The brokers commitment to responsive service contributes to a smooth trading experience, reinforcing its reputation as a client-oriented platform.

Trading Experience Analysis

KCM Trades MetaTrader infrastructure delivers:

- Fast execution speed

- Minimal slippage

- Stable uptime and low latency

These factors create a seamless environment for day traders and algorithmic users alike.

The consistent performance of MT4/MT5 ensures reliable order handling during high-volatility events.

Trust and Security Analysis

KCM Trade builds trust through:

- Multi-jurisdictional regulation (FSC, IFSC, ASIC)

- Segregated client accounts held with reputable financial institutions

- External auditing by global accounting firms

- Data encryption and secure transaction protocols

Its multi-layered security framework reflects a proactive approach to compliance, transparency, and financial safety.

User Experience Analysis

Traders appreciate KCM Trades balance of simplicity and sophistication.

The user journey—from registration to live trading—is intuitive, with streamlined KYC verification and a clear interface.

The familiar MT4/MT5 environment supports a consistent experience for traders transitioning from other platforms.

Mobile compatibility, diverse payment channels, and responsive support collectively contribute to a user-friendly ecosystem designed for modern traders.

Conclusion

The KCM Trade 2025 Review showcases a broker that combines trust, technology, and accessibility in a single platform.

Its strengths include:

- Strong regulatory presence under FSC, IFSC, and ASIC

- Low $50 minimum deposit

- High leverage (up to 1:500)

- Advanced MT4/MT5 platforms

- Diverse payment and asset options

KCM Trade stands out as a reliable choice for both new and experienced traders, offering an optimal balance between performance, safety, and cost efficiency.

Whether starting small or trading professionally, clients benefit from a globally compliant, technologically advanced, and transparently managed trading environment.