Founded in 2017 and headquartered in Saint Vincent and the Grenadines, Traders Domain operates without the safeguard of a reputable regulatory framework. This lack of oversight has resulted in red flags being raised within the trading community, particularly concerning fund safety and operational transparency. Traders Domain presents itself as a versatile trading platform built by traders for traders, aimed at attracting a diverse user base.

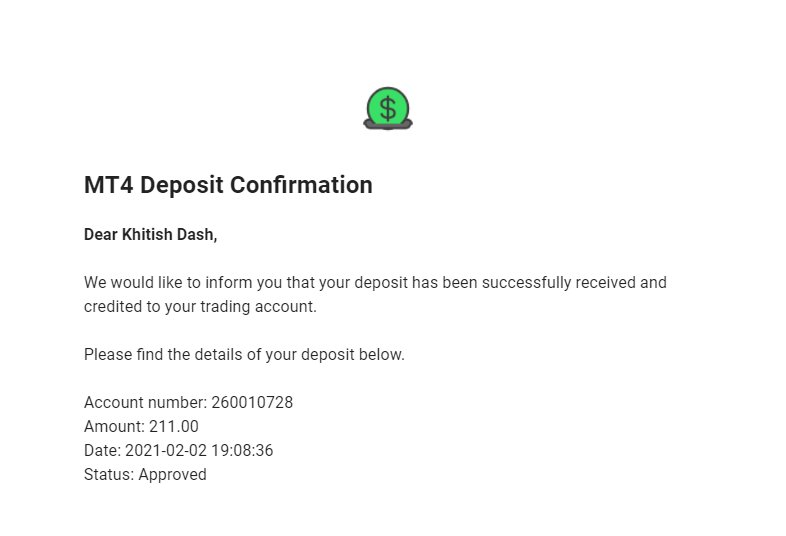

Traders Domain provides access to forex, commodities, indices, and cryptocurrencies with promises of competitive trading conditions. They claim to support popular trading platforms, including MetaTrader 4 and MetaTrader 5, appealing to both novice and experienced traders alike. However, the absence of a robust regulatory authority to ensure accountability creates substantial risks for their user base, which must be carefully evaluated before moving forward.

Traders Domain operates under the auspices of the Financial Services Authority of Saint Vincent and the Grenadines, a jurisdiction notorious for lack of regulatory scrutiny in the forex industry. Various reviews from user testimonials suggest that this regulatory status is insufficient, and that the absence of significant governing bodies like the FCA or ASIC compounds the risks associated with fund safety.

- Visit the NFA's BASIC database: Check for any records under Traders Domain‘s name.

- Search for reviews: Use platforms like Trustpilot to analyze user ratings and comments.

- Consult community feedback: Engage in forums like Forex Peace Army to see live experiences shared by traders.

- Test withdrawals: Create a minimum account and process a withdrawal to evaluate their claims.

- Research online updates: Stay informed with the broker’s operational status through online news and financial updates.

Industry Reputation and Summary

"The Traders Domain appears to be an unreliable investment company and should be verified before making any investment."

The combination of poor regulatory oversight and negative user feedback suggests that this brokerage poses a higher risk to individual traders.

Trading Costs Analysis

Advantages in Commissions

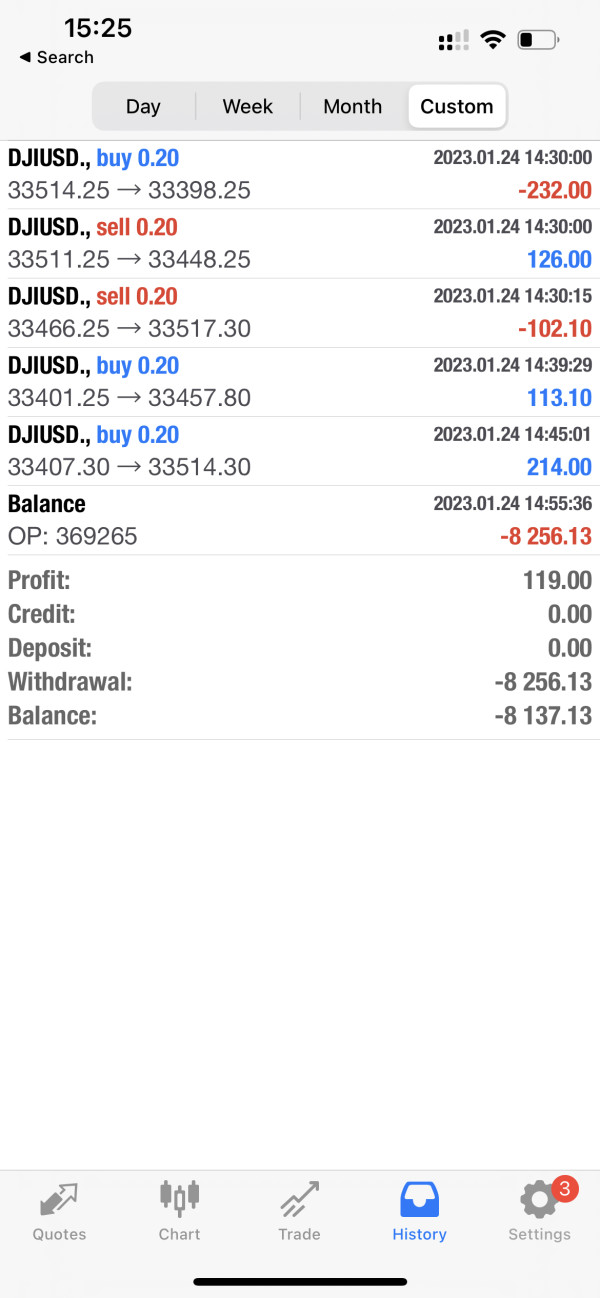

Traders Domain claims a commission policy attractive to high-volume traders, where no commission means trading fees are primarily through spread, which starts from competitive rates as low as 1 pip, depending on account type.

The "Traps" of Non-Trading Fees

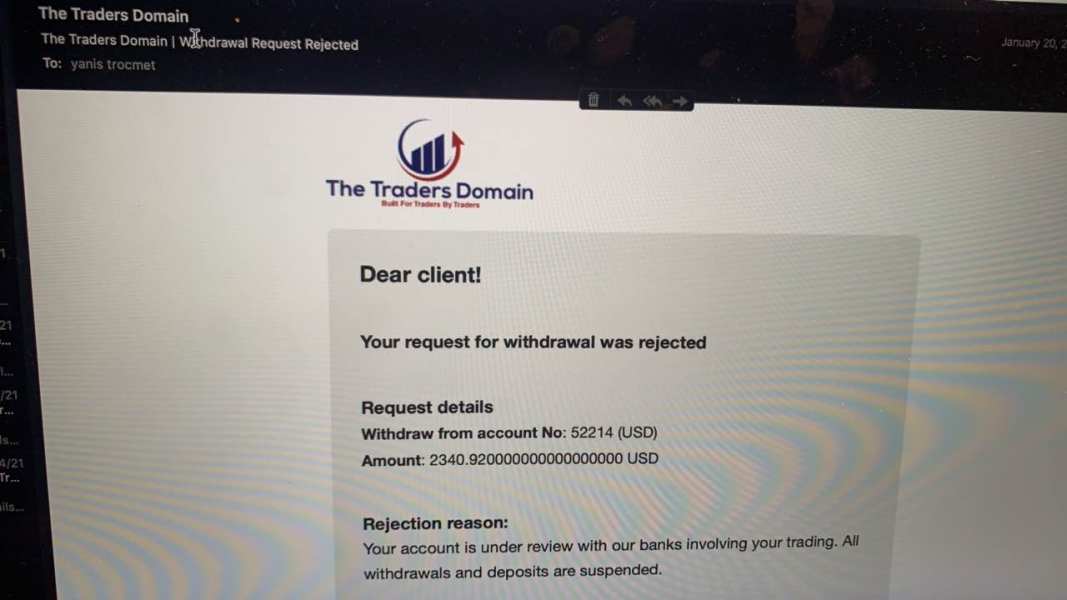

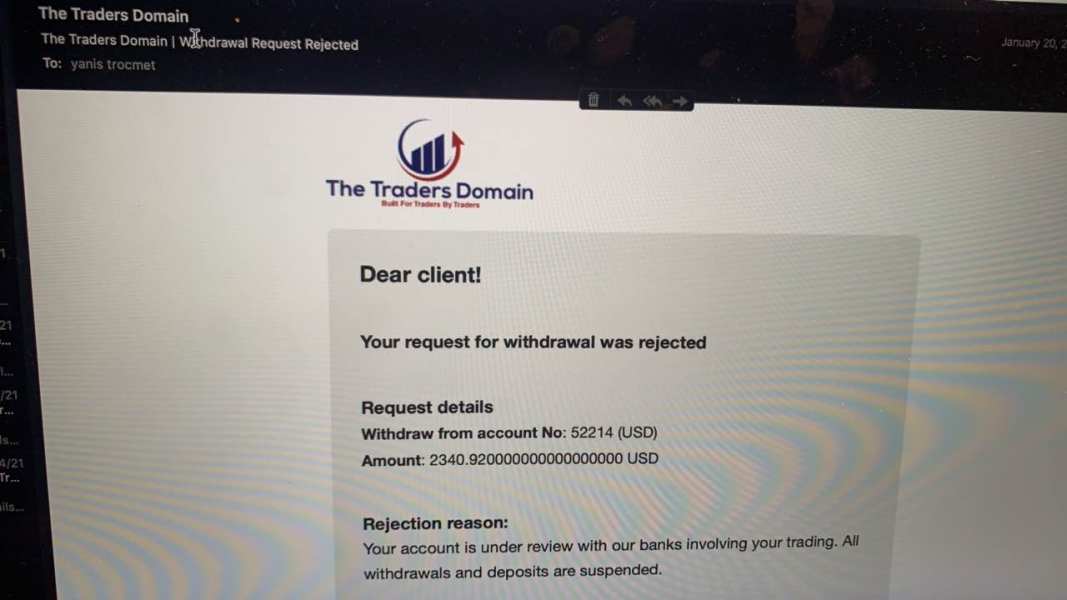

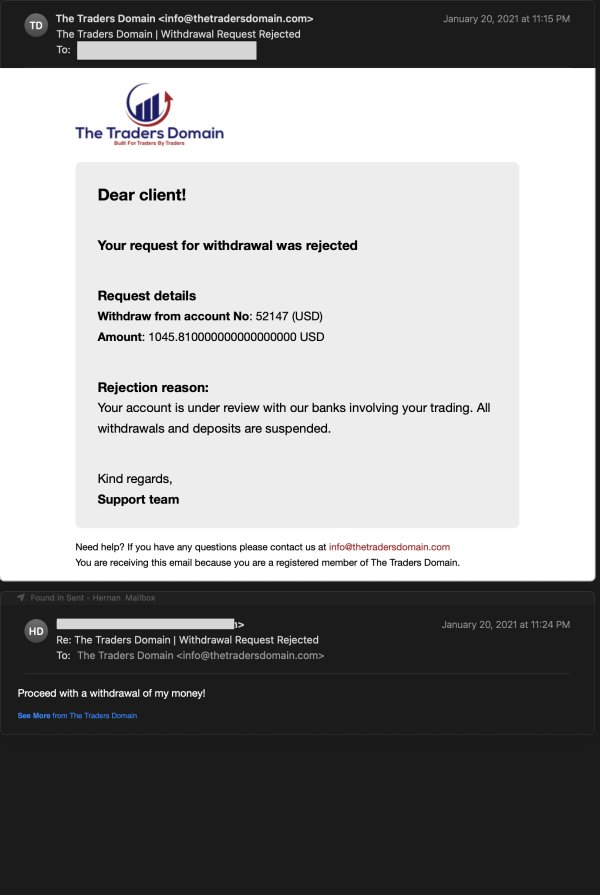

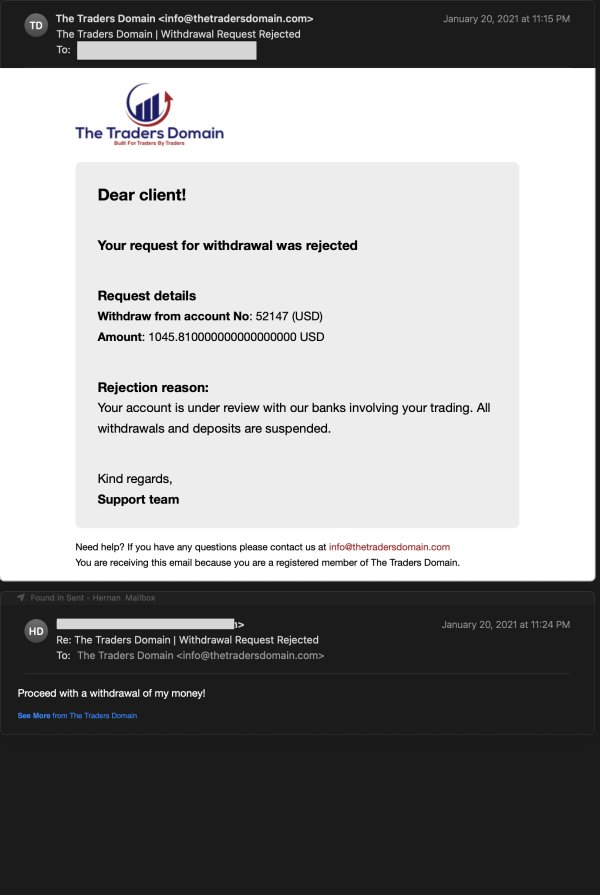

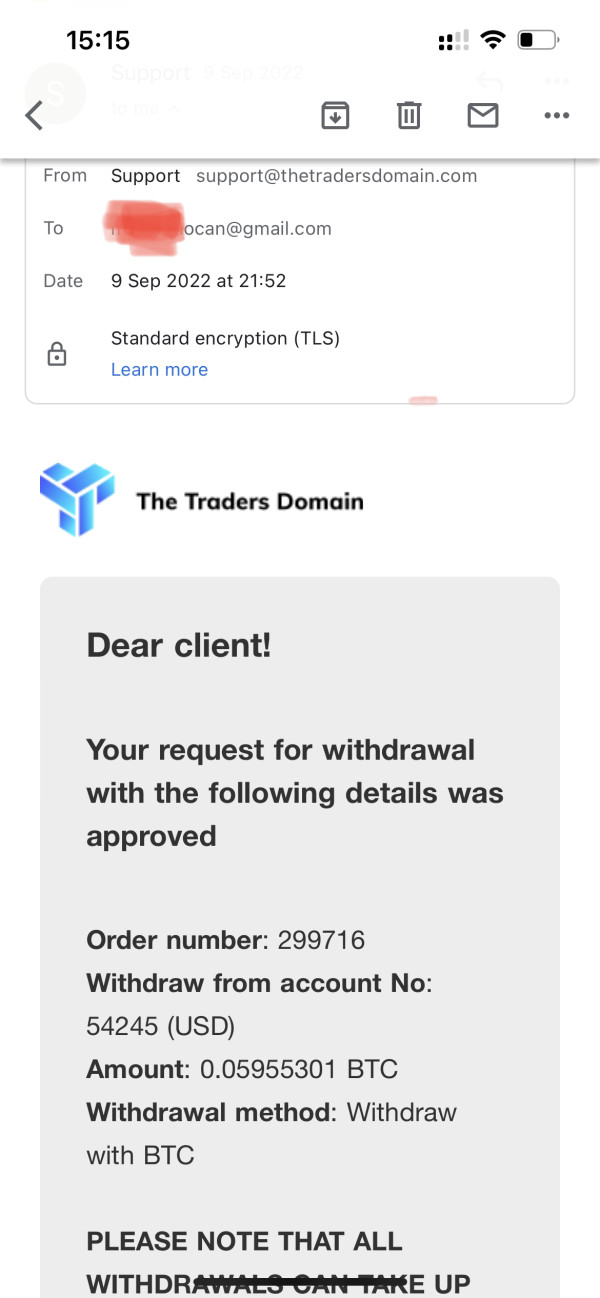

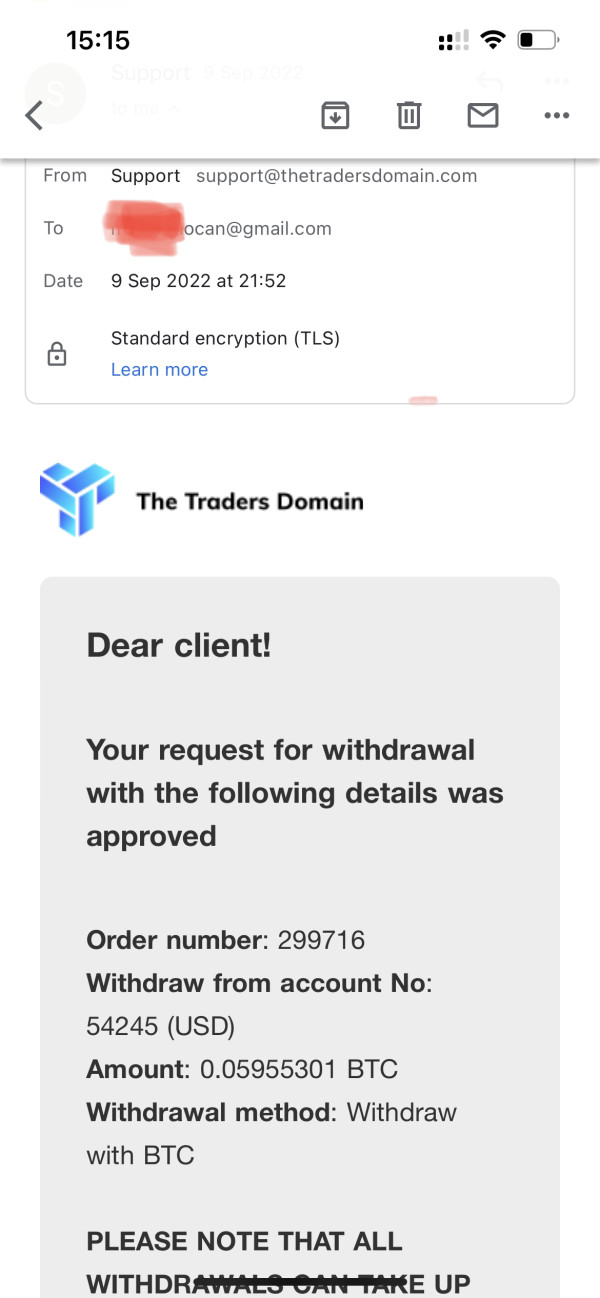

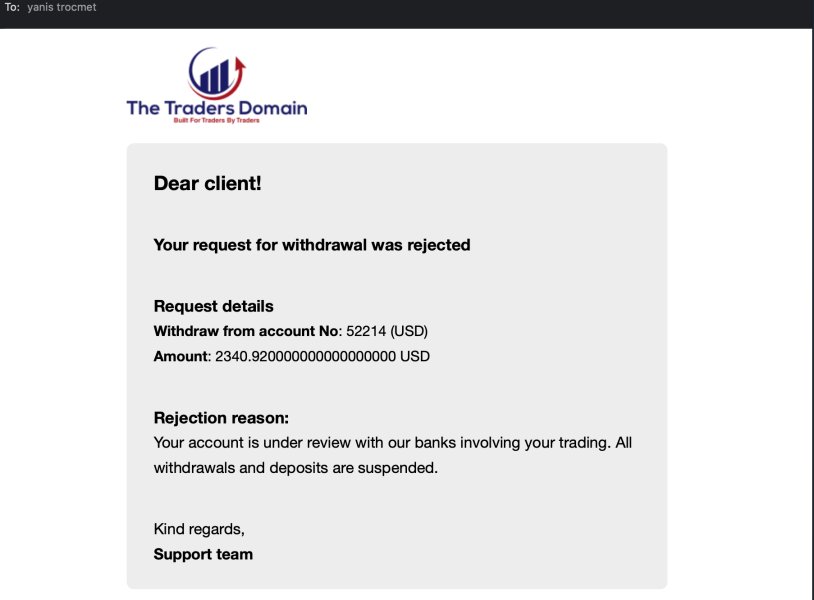

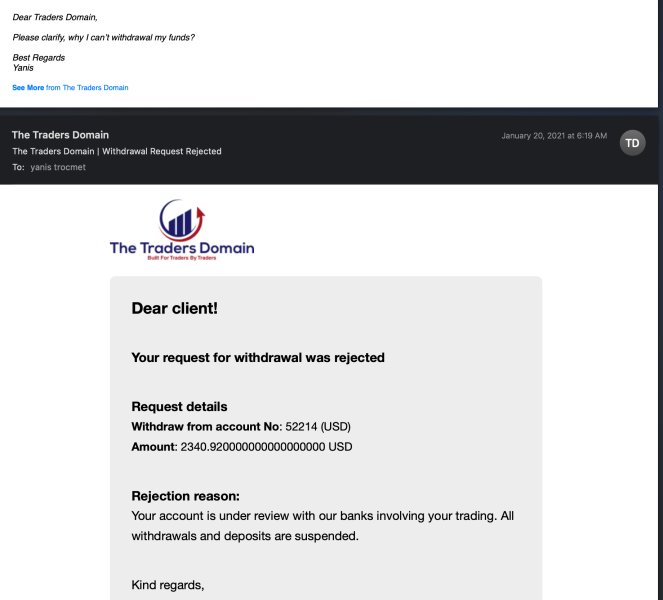

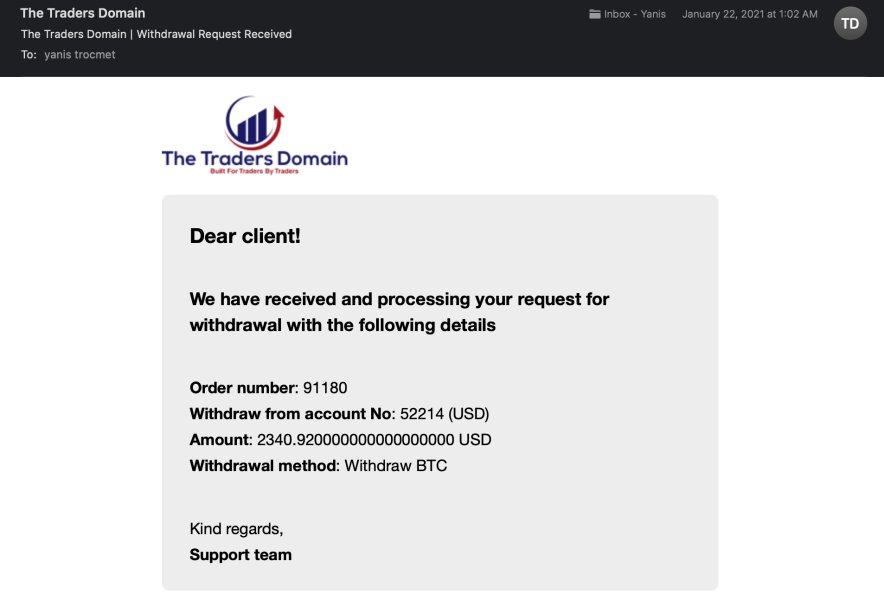

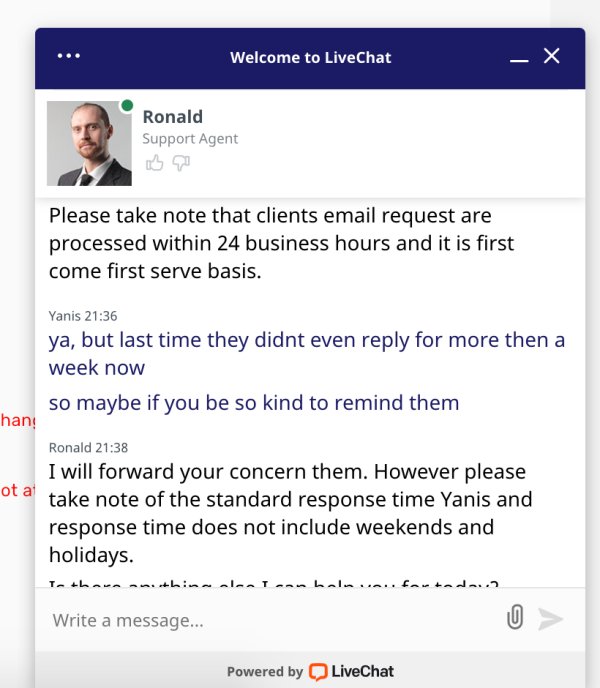

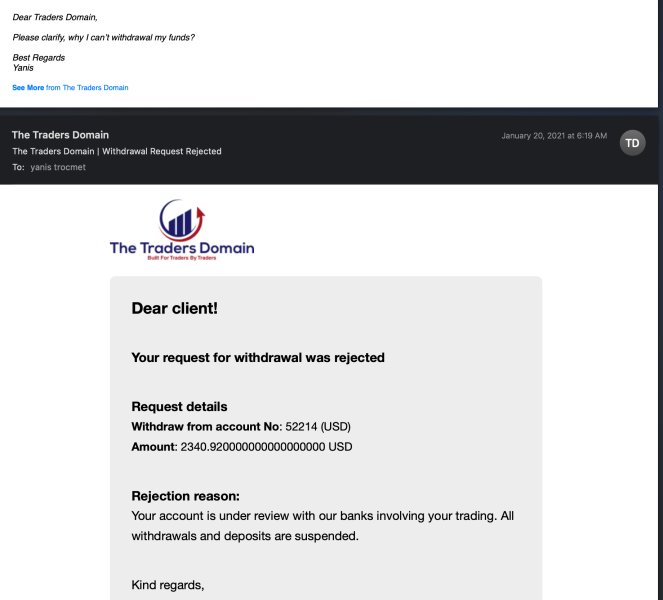

While spreads are appealing, Traders Domain has a notorious reputation for imposing withdrawal fees. For example, users have reported withdrawal processing fees of up to 15% for accounts with no trading activity, which cripples any potential profits made.

"I have made 2000 k profit and they simply disable my account and stole my money!"

Cost Structure Summary

In summary, while the commission structure is enticing, traders must remain vigilant against hidden fees, particularly concerning withdrawals which could severely impact profitability.

Offering both MetaTrader 4 and 5, Traders Domain positions itself to cater to various trading preferences. However, user reviews indicate mixed experiences with platform usability, suggesting potential issues with performance stability.

Traders Domain lacks comprehensive educational material, which can be a disadvantage for those entering the capital markets without substantial prior knowledge. There are no advanced resources like webinars or guided learning paths typically found through regulated brokers.

"A closer look at user reviews reveals mixed experiences regarding the platforms intuitiveness and ease of navigation."

Overall, while MT4 and MT5 are industry standards, the additional resources that enhance trading—such as tutorials, and market analysis tools—are lacking in this brokerage.

User Experience Analysis

Account Setup Process

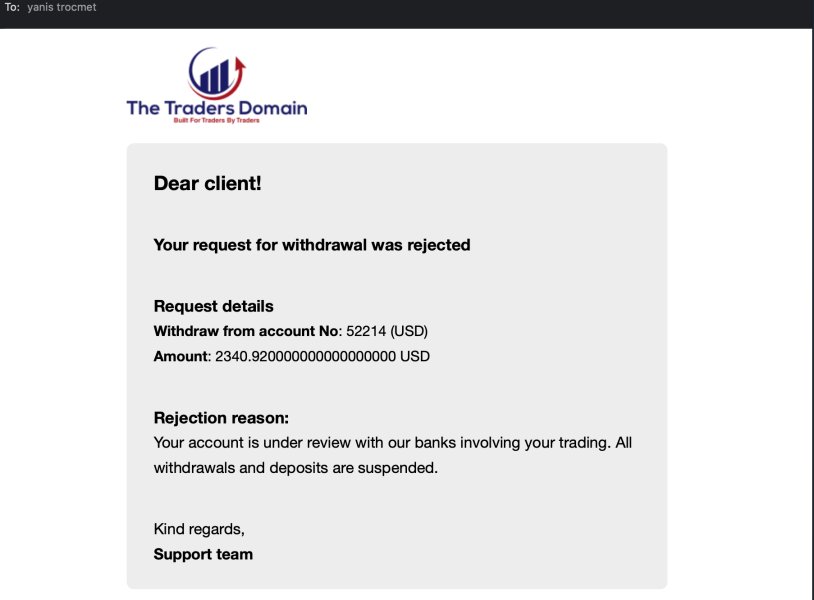

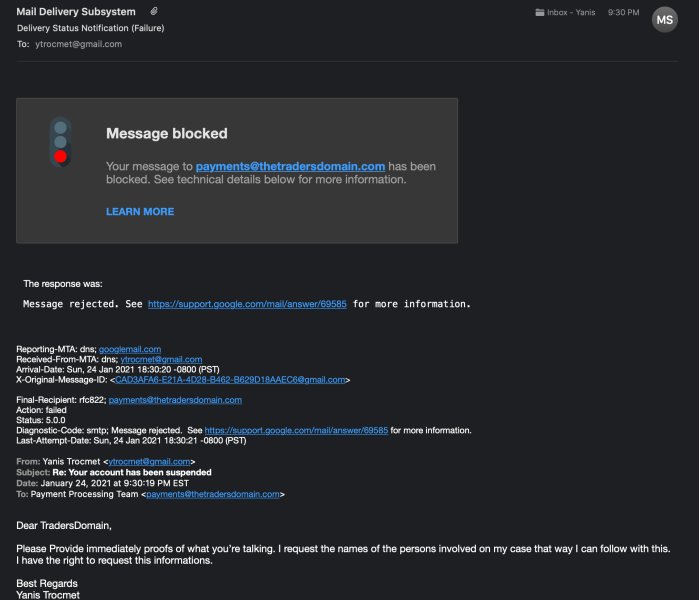

Registration processes have been reported as straightforward; however, the difficulty often arises during verification and withdrawal attempts, with many users encountering obstacles.

User Interface Evaluation

The interface, while based on MT4/MT5, has user complaints regarding intuitiveness. Many have cited frustrating navigation that impedes effective trading.

Overall User Experience Summary

Given user feedback, there seems to be a general sentiment of dissatisfaction regarding the overall interface and account management support, raising concerns about the usability.

Customer Support Analysis

Support Channels Offered

Traders Domain provides support via email, phone, and live chat. This range of channels can enhance accessibility for users needing assistance.

User Feedback on Support

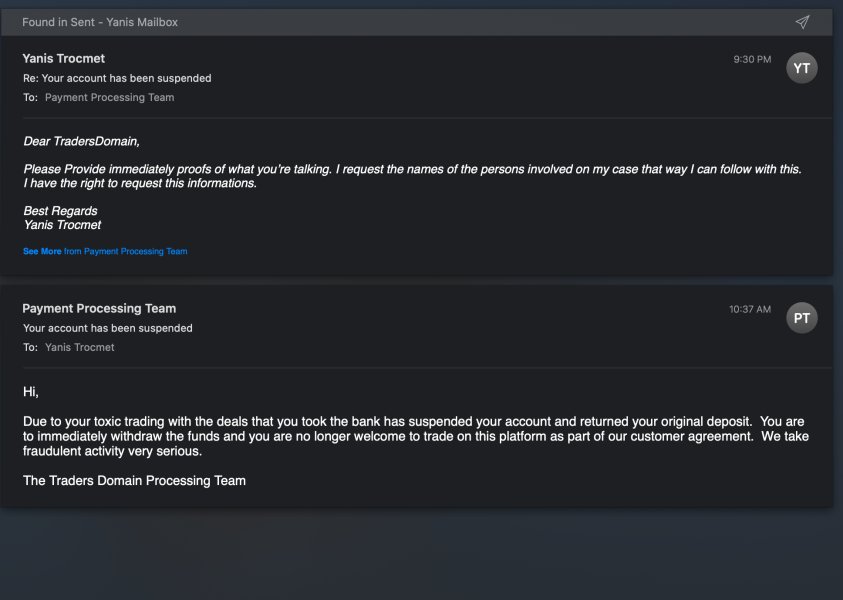

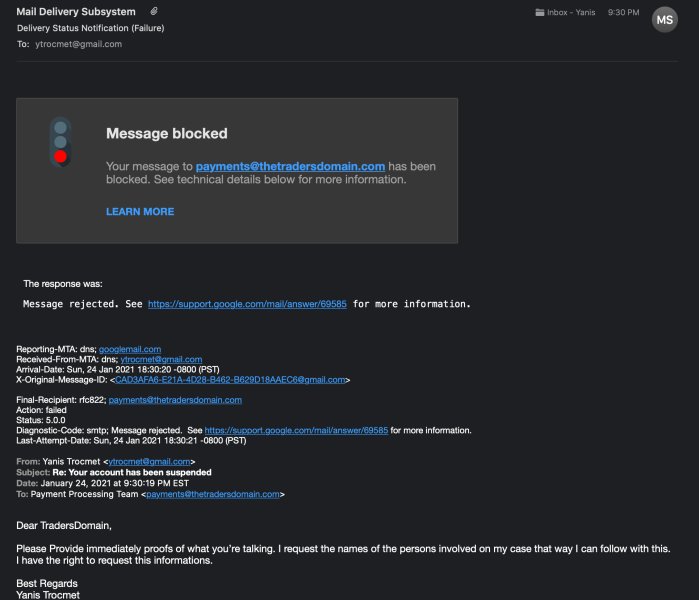

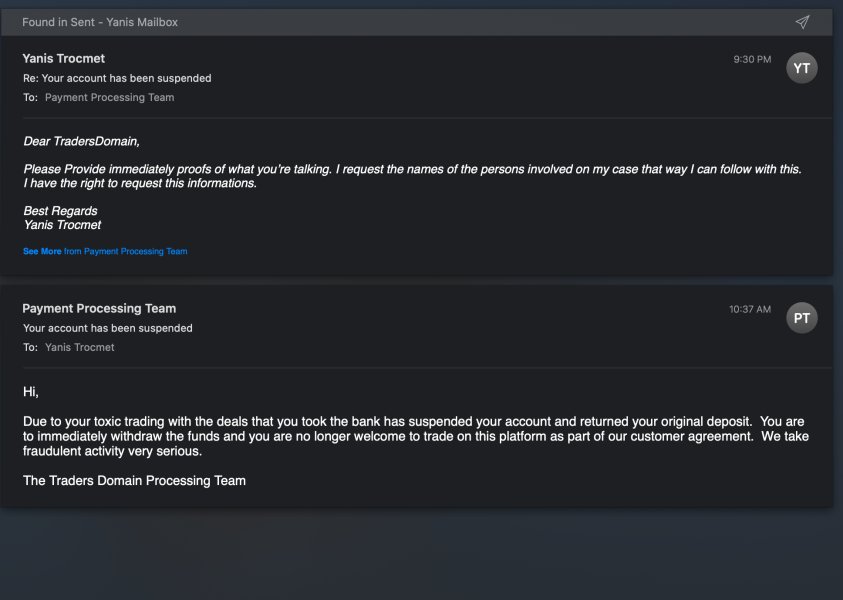

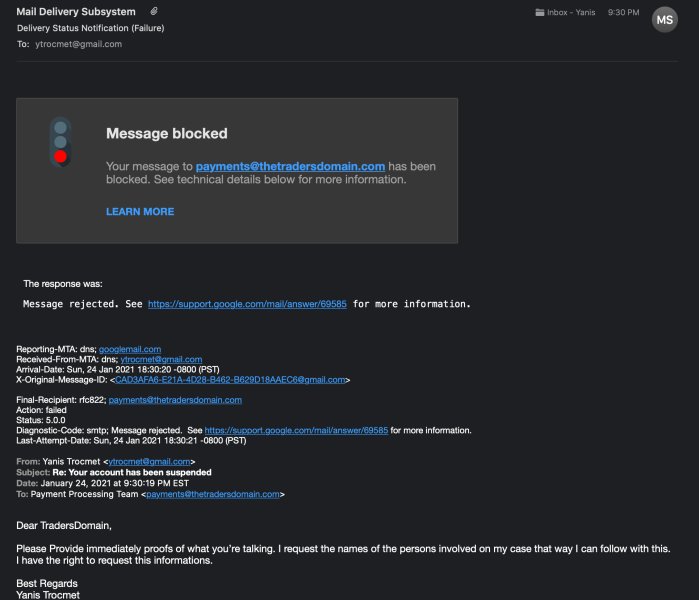

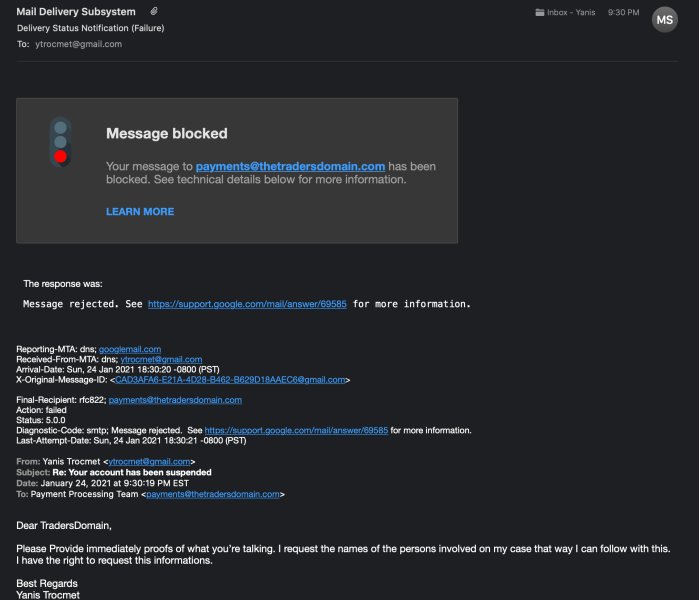

However, common user experiences indicate slow response times that could jeopardize trading success. Many users report waiting days for critical support queries.

Summary of Support Effectiveness

Overall, the feedback concerning customer support has been predominantly negative, suggesting a need for improvement in this crucial area.

Account Conditions Analysis

Account Types Available

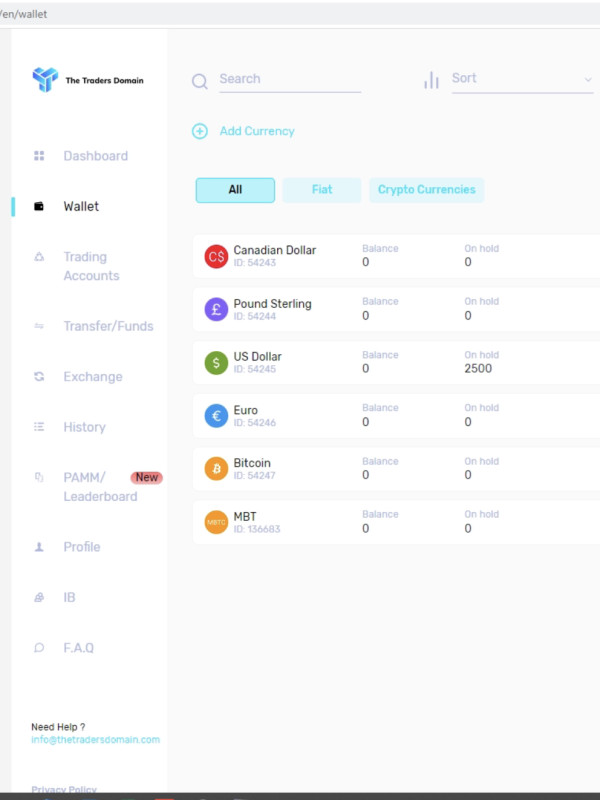

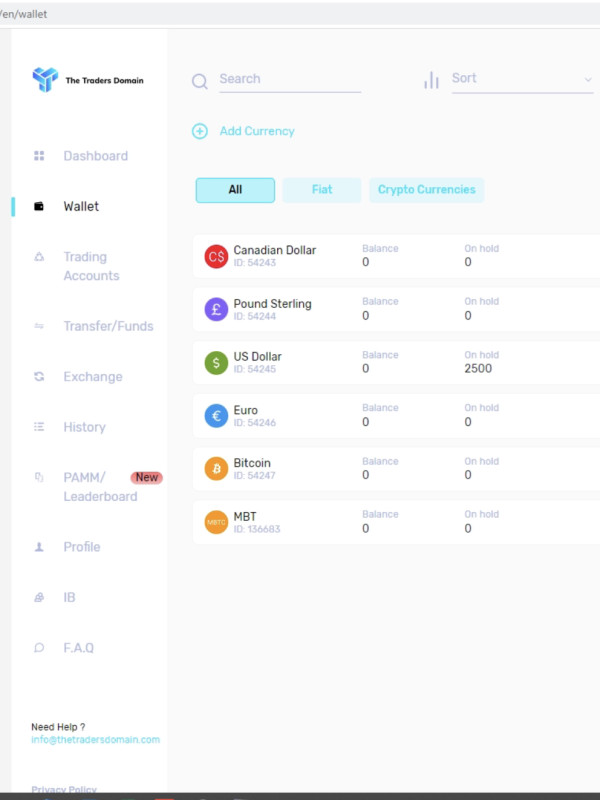

Traders Domain offers multiple account types, including Standard, ECN, Islamic, and Mini BTC, each tailored for different trading strategies and styles. This variety may cater to a broader audience.

Minimum Deposit and Leverage

With a minimum deposit of just $100, the platform is accessible to many traders, while offering leverage up to 1:500 presents both significant risk and reward potential.

Summary of Account Conditions

While the diversity in accounts is a plus, traders should scrutinize the implications of their choices, especially concerning unregulated trading environments and associated risks.

Conclusion

Traders Domain is characterized by its high-risk, high-reward nature, appealing primarily to those comfortable with the potential hazards of the unregulated offshore brokerage landscape. While it offers attractive trading conditions, the broker's numerous user complaints and withdrawal issues are serious deterrents. Prospective clients must prioritize safety over allure; thus, thorough research is recommended before engaging with these platforms. Always consider turning to regulated alternatives offering similar or even better trading conditions without compromising fund safety.