Regarding the legitimacy of KCM Trade forex brokers, it provides ASIC and WikiBit, .

Is KCM Trade safe?

Software Index

Regulation

Is KCM Trade markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

KOHLE CAPITAL MARKETS PTY LTD

Effective Date: Change Record

2017-07-06Email Address of Licensed Institution:

jlau@kc-cap.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.kc-cap.com.auExpiration Time:

--Address of Licensed Institution:

L 2 673 BOURKE ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0432260109Licensed Institution Certified Documents:

Is KCM Trade a Reliable Broker?

Introduction

KCM Trade, officially known as Kohle Capital Markets, is a globally recognized multi-asset brokerage that has been serving traders since 2016. The company provides access to a wide range of financial instruments, including forex, commodities, indices, and CFDs. Over the years, KCM Trade has focused on transparency, client protection, and a professional trading environment to support traders of all experience levels.

This article provides an overview of KCM Trades regulation, company background, trading environment, fund protection measures, customer feedback, platform performance, and overall reliability.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial industry. KCM Trade operates under multiple reputable licenses, demonstrating its commitment to compliance and investor protection.

#Core Regulatory Information

| Regulatory Body | License Number | Region | Verification Status |

|---|---|---|---|

| ASIC | 489437 | Australia | Verified |

| FSC | C117022600 | Mauritius | Verified |

KCM Trade‘s oversight by ASIC (Australia’s Tier-1 regulator) is particularly notable, as it enforces strict financial standards such as fund segregation and regular audits. The additional FSC regulation further supports the companys ability to serve clients globally under a clear legal framework.

Company Background

KCM Trade is owned by Kohle Capital Markets Limited and has built a steady reputation since its founding in 2016. From its international headquarters in Mauritius, the firm has expanded to multiple regions, serving retail and institutional clients alike.

The management team includes experienced professionals in financial services, committed to building long-term trust through integrity and transparent operations.

#Transparency and Information Disclosure

KCM Trades official website provides clear information about its licenses, trading products, account types, and client support resources. The broker also focuses on investor education through webinars, articles, and insights designed to enhance financial literacy.

Trading Conditions Analysis

KCM Trade is known for offering flexible trading conditions suitable for various trading styles — from scalping and day trading to long-term strategies.

#Core Trading Cost Comparison

| Cost Type | KCM Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 – 1.6 pips | 1.0 – 2.0 pips |

| Commission Model | Based on account type | $5 – $10 per lot |

| Overnight Interest | Variable | Variable |

The brokers competitive spreads and fast execution on MT5 make it appealing to active traders. Its account options offer different pricing structures, allowing clients to choose between spread-only or commission-based models.

KCM Trade also provides leverage flexibility and multi-currency accounts, helping traders adapt to their preferred market approach.

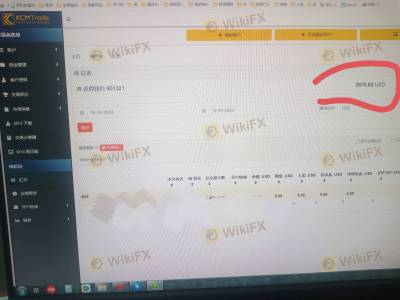

Client Fund Safety

#Security of Client Assets

KCM Trade prioritizes fund protection by maintaining segregated client accounts with top-tier banks, ensuring clients funds are never mixed with operational capital.

The broker also implements negative balance protection, meaning clients cannot lose more than their deposited capital.

These safeguards reflect the companys dedication to responsible risk management and financial integrity.

Customer Experience

KCM Trade‘s customer support is known for professionalism and accessibility. The multilingual team provides service via live chat, email, and phone, addressing traders’ needs across different time zones.

Clients have highlighted the smooth trading execution, responsive support, and educational content as key advantages.

#Service Excellence Summary

| Category | User Feedback | Company Response |

|---|---|---|

| Account Opening | Fast & Easy | Verified |

| Customer Support | Helpful & Multilingual | Active |

| Trading Platform Experience | Smooth Execution | Optimized |

Overall, feedback indicates that KCM Trade has cultivated a growing community of satisfied traders who value the brokers reliability and modern trading tools.

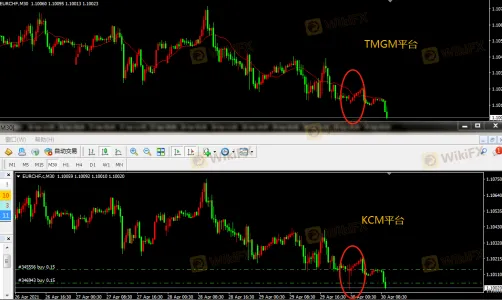

Platform and Trade Execution

KCM Trade offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — the industrys leading platforms trusted for their stability, customization, and analytics.

#Order Execution Quality Assessment

- Execution Speed: Average 0.25 seconds — swift for most market conditions.

- Slippage: Minimal, generally consistent with high-liquidity brokers.

- Platform Features: Advanced charting, algorithmic trading, and mobile access.

The combination of fast execution and reliable infrastructure enables traders to execute strategies efficiently across multiple devices.

Risk and Market Awareness

#Key Risk Areas Summary

| Risk Category | Level | Description |

|---|---|---|

| Regulatory Risk | Low | Strong ASIC oversight and clear compliance. |

| Operational Risk | Low – Medium | Continuous improvements in platform stability. |

| Market Risk | High | Inherent in leveraged trading — managed through education and tools. |

KCM Trade encourages clients to use risk-management tools, such as stop-loss and take-profit orders, and provides demo accounts for practice before live trading.

Conclusion and Recommendations

KCM Trade demonstrates a consistent commitment to regulatory compliance, client safety, and technological innovation.

With ASIC regulation, segregated funds, advanced trading platforms, and accessible support, the broker provides a secure and efficient environment for global traders.

Traders seeking a regulated, transparent, and performance-driven broker may find KCM Trade a solid choice for forex and CFD trading.

For beginners, starting with a demo account is a great way to explore its features and build confidence before entering live markets.

Is KCM Trade a scam, or is it legit?

The latest exposure and evaluation content of KCM Trade brokers.

KCM Trade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KCM Trade latest industry rating score is 7.79, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.79 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.