GMO Gaika 2025 Review: Everything You Need to Know

Summary

This comprehensive gmo gaika review examines a Japanese forex broker that has been operating since 2007 under the regulation of Japan's Financial Services Authority. GMO Gaika positions itself as a transparent trading provider offering commission-free forex and CFD trading through its proprietary "Gaitame-EX" platform. The broker demonstrates a neutral overall performance with competitive trading conditions. These conditions appeal to both novice and intermediate traders.

Two key features distinguish GMO Gaika in the competitive forex market. First, it offers zero-commission trading structure across major currency pairs. Second, it provides a self-developed trading platform that delivers localized services primarily for the Japanese market. The broker's focus on transparency and regulatory compliance creates a reliable trading environment. However, its services are primarily designed for Japanese-speaking clients.

The broker targets beginning and intermediate traders who value regulatory security and straightforward trading conditions. With a relatively low minimum deposit requirement of approximately 2,000 JPY, GMO Gaika makes forex trading accessible to retail traders entering the market. International users should carefully consider the language limitations and regional service restrictions before opening an account.

Important Disclaimers

GMO Gaika primarily serves Japanese domestic clients. International users may encounter significant service limitations including language barriers and restricted access to certain features. The broker's customer support operates exclusively in Japanese. This may create challenges for non-Japanese speaking traders seeking assistance or account management support.

This review is based on publicly available information and user feedback accessible through various financial information platforms. Our analysis aims to provide comprehensive broker evaluation while acknowledging that specific details about certain services remain limited in available documentation. All regulatory information has been verified through Japan's Financial Services Authority database to ensure accuracy.

Rating Framework

Broker Overview

GMO Gaika emerged in 2007 as a specialized forex and CFD broker headquartered in Japan. The company focuses on delivering transparent and efficient trading experiences to retail and institutional clients. It operates under the strict regulatory framework of Japan's Financial Services Authority. This ensures compliance with domestic financial regulations while maintaining high standards of client fund protection and operational transparency.

The broker's business model centers on providing commission-free trading across major currency pairs while generating revenue through competitive spread structures. This approach appeals to cost-conscious traders who prioritize transparent pricing without hidden fees or complex commission calculations. GMO Gaika's commitment to regulatory compliance and operational transparency has established its position within Japan's competitive forex brokerage landscape.

This gmo gaika review reveals that the broker utilizes its proprietary "Gaitame-EX" trading platform. The platform offers comprehensive functionality for forex and CFD trading across desktop and mobile environments. It supports multiple currency pairs and provides essential trading tools. However, specific advanced features and analytical resources require further investigation based on available documentation.

The broker's asset coverage includes major, minor, and exotic forex pairs alongside CFD instruments. The exact number of tradeable instruments varies according to account type and client location. FSA regulation provides the primary regulatory oversight. This ensures client funds are segregated and protected according to Japanese financial regulations.

Regulatory Coverage: GMO Gaika operates under Japan's Financial Services Authority regulation. This provides robust client protection through segregated account requirements and strict operational oversight. The regulatory framework ensures compliance with Japanese financial standards while maintaining transparency in business operations.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available documentation. Japanese brokers typically support domestic bank transfers and local payment systems for domestic clients.

Minimum Deposit Requirements: The broker maintains an accessible minimum deposit of approximately 2,000 JPY. This makes it suitable for beginning traders who want to start with limited capital investment.

Bonus and Promotions: Available documentation does not specify current bonus offerings or promotional campaigns. This suggests the broker may focus on competitive trading conditions rather than incentive programs.

Tradeable Assets: GMO Gaika provides access to forex and CFD trading across multiple currency pairs. Specific instrument counts and exotic pair availability require verification through direct broker contact.

Cost Structure: The broker offers EUR/USD spreads starting from 3 pips with zero commission charges. This creates a straightforward cost structure that appeals to traders preferring transparent pricing without additional fees.

Leverage Options: Leverage information was not specified in available documentation. Japanese brokers typically operate under FSA leverage restrictions for retail clients.

Platform Selection: Traders access markets through GMO Gaika's proprietary "Gaitame-EX" platform. The platform supports both desktop and mobile trading environments with localized functionality for Japanese users.

Regional Restrictions: The broker primarily targets Japanese domestic markets. There are potential limitations for international clients regarding service access and support availability.

Customer Service Languages: Support services operate exclusively in Japanese. This may limit accessibility for international traders requiring assistance in other languages.

This comprehensive gmo gaika review indicates that while the broker offers competitive basic trading conditions, international users should carefully evaluate service limitations before account opening.

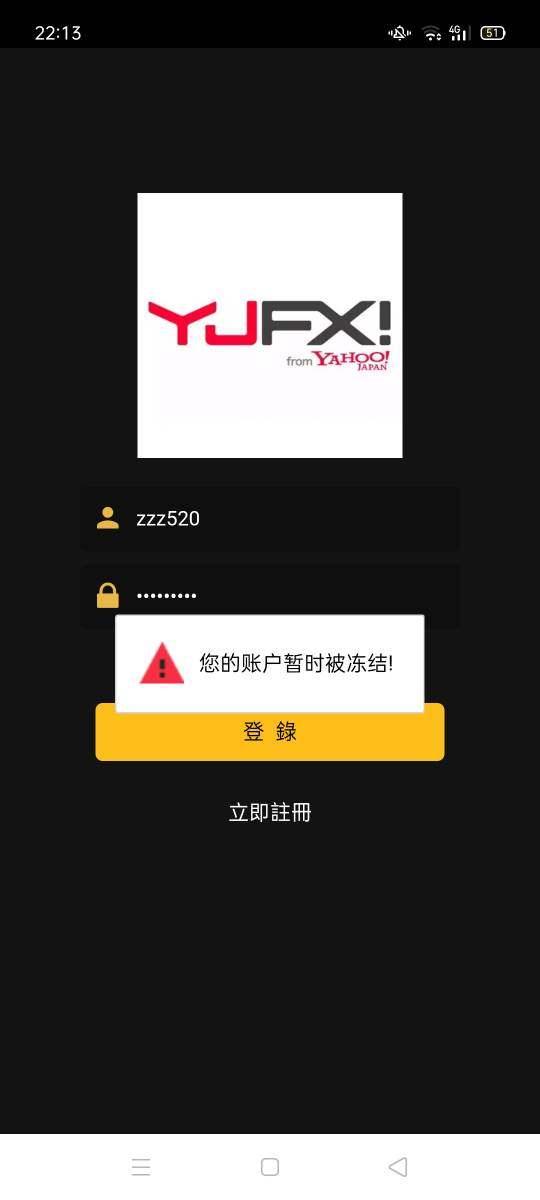

Account Conditions Analysis

GMO Gaika's account structure focuses on simplicity and accessibility. It offers standard trading accounts suitable for various trader experience levels. The broker's approach emphasizes straightforward account types without complex tier systems or premium account requirements that might confuse beginning traders. This streamlined structure allows clients to focus on trading rather than navigating complicated account hierarchies.

The minimum deposit requirement of approximately 2,000 JPY represents one of the more accessible entry points in the Japanese forex market. This enables beginning traders to start with limited capital while experiencing professional trading conditions. The low barrier to entry aligns with the broker's focus on retail trader accessibility and market education.

Account opening procedures were not detailed in available documentation. Japanese brokers typically require standard identification verification and compliance documentation according to FSA requirements. The specific timeline and documentation requirements for international clients may differ from domestic Japanese procedures.

Information regarding specialized account types such as Islamic accounts or professional trader accounts was not available in current documentation. Potential clients requiring specific account features should contact the broker directly for detailed information about available options and eligibility requirements.

This gmo gaika review assessment of account conditions reveals competitive accessibility for beginning traders. More detailed information about account features and opening procedures would enhance transparency for potential clients considering the broker's services.

GMO Gaika's proprietary "Gaitame-EX" trading platform serves as the primary tool for client trading activities. It offers essential functionality for forex and CFD execution across desktop and mobile environments. The platform's development specifically for the Japanese market provides localized features and interface elements that cater to domestic user preferences and trading habits.

The quality and scope of research and analytical resources were not detailed in available documentation. This leaves questions about market analysis, economic calendars, and trading signals that many traders consider essential for informed decision-making. The information gap represents a significant limitation for traders evaluating the broker's analytical support capabilities.

Educational resources and training materials were similarly not specified in current documentation. Many Japanese brokers provide comprehensive educational content for beginning traders. The availability and quality of such resources could significantly impact the broker's suitability for novice traders seeking market education alongside trading access.

Automated trading support and algorithmic trading capabilities were not mentioned in available information. This may concern advanced traders who rely on expert advisors or custom trading algorithms for their strategies. The platform's compatibility with third-party tools and automated systems requires direct verification with the broker.

The overall assessment suggests that while GMO Gaika provides essential trading functionality through its proprietary platform, the limited information about advanced tools and resources creates uncertainty about the broker's suitability for traders requiring comprehensive analytical and educational support.

Customer Service and Support Analysis

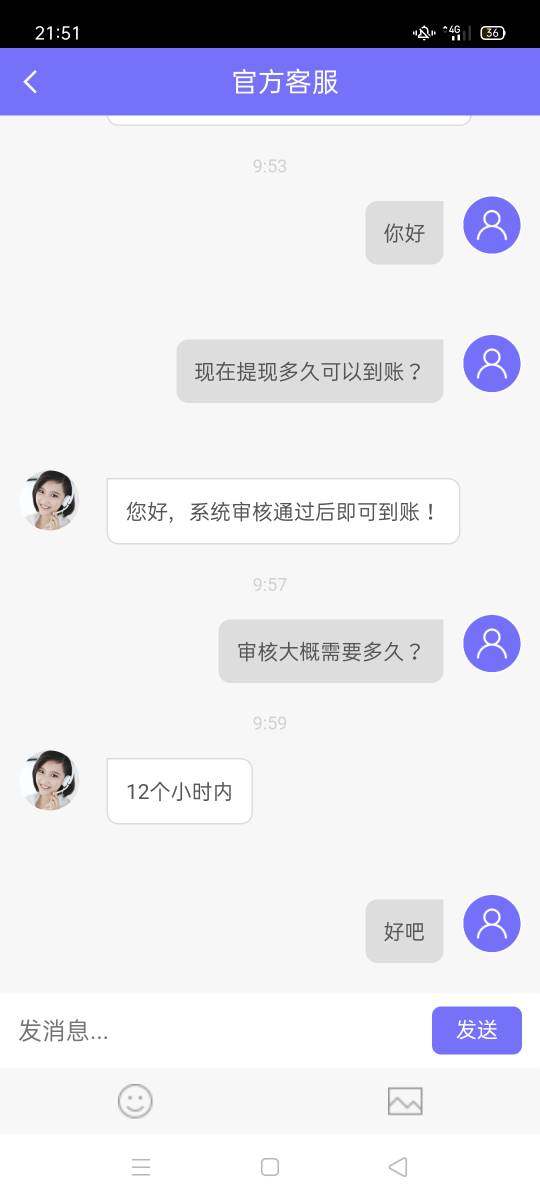

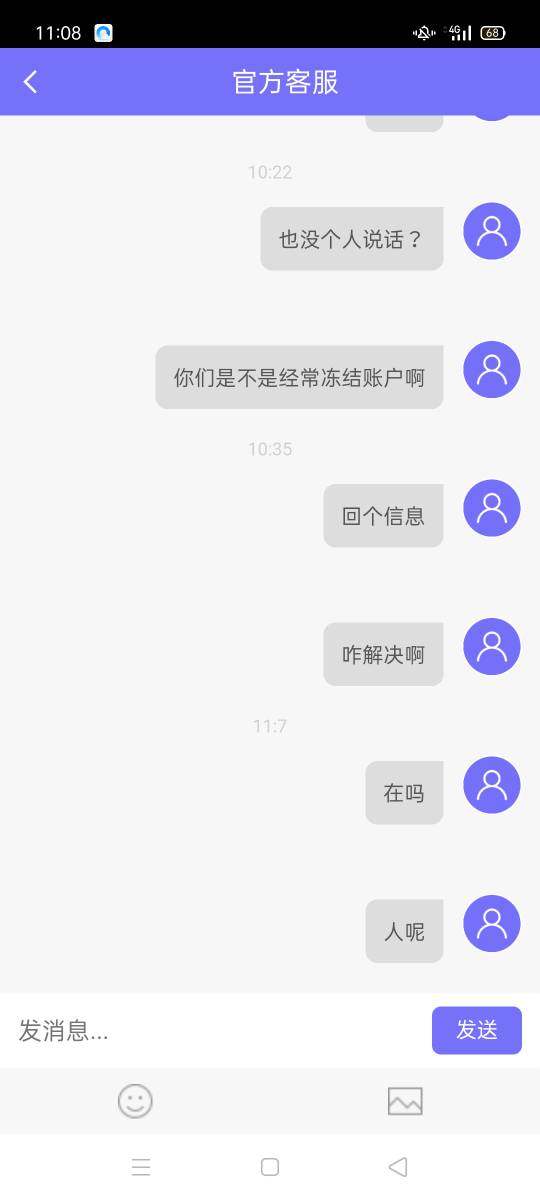

GMO Gaika's customer service operates exclusively in Japanese. This creates a significant limitation for international traders seeking support for account management, technical issues, or trading inquiries. The language restriction effectively limits the broker's accessibility to Japanese-speaking clients or those comfortable navigating support interactions in Japanese.

The available support channels include telephone and online assistance. Specific response times and service quality metrics were not detailed in accessible documentation. Without concrete data about support responsiveness and problem resolution efficiency, potential clients cannot adequately assess the broker's service quality compared to international competitors.

Service availability hours and timezone coverage were not specified in current information. Japanese brokers typically align support hours with domestic market hours and local business practices. International clients in different timezones should verify support availability during their preferred trading hours.

The lack of multilingual support represents a considerable disadvantage for GMO Gaika in attracting international clients. This is particularly true when compared to global brokers offering comprehensive language support across multiple regions. The limitation effectively restricts the broker's market reach to domestic Japanese clients and Japanese-speaking international traders.

Overall customer service assessment reveals that while the broker may provide adequate support for its target Japanese market, the language limitations significantly impact its suitability for international traders requiring comprehensive multilingual assistance and support services.

Trading Experience Analysis

GMO Gaika demonstrates strong technical performance with zero millisecond average execution speeds. This indicates robust platform infrastructure and efficient order processing capabilities. The execution speed performance suggests the broker has invested in quality technology systems that can handle rapid order flow without significant delays that might impact trading outcomes.

The EUR/USD spread of 3 pips falls within competitive ranges for retail forex brokers. Specific spread behavior during volatile market conditions and off-hours trading was not detailed in available documentation. Consistent spread performance during various market conditions significantly impacts overall trading costs and experience quality.

Platform stability and functionality through the proprietary "Gaitame-EX" system appears adequate for standard trading requirements. Comprehensive feature analysis requires direct platform evaluation. The platform's ability to handle complex order types, advanced charting, and real-time market data processing affects overall trading efficiency.

Mobile trading experience details were not extensively covered in available documentation. Modern traders increasingly rely on mobile platforms for market monitoring and trade execution. The quality and functionality of mobile trading capabilities significantly impact overall user satisfaction and trading flexibility.

This gmo gaika review of trading experience reveals strong technical execution performance. More detailed information about platform features, spread consistency, and mobile functionality would provide better assessment of overall trading quality for potential clients.

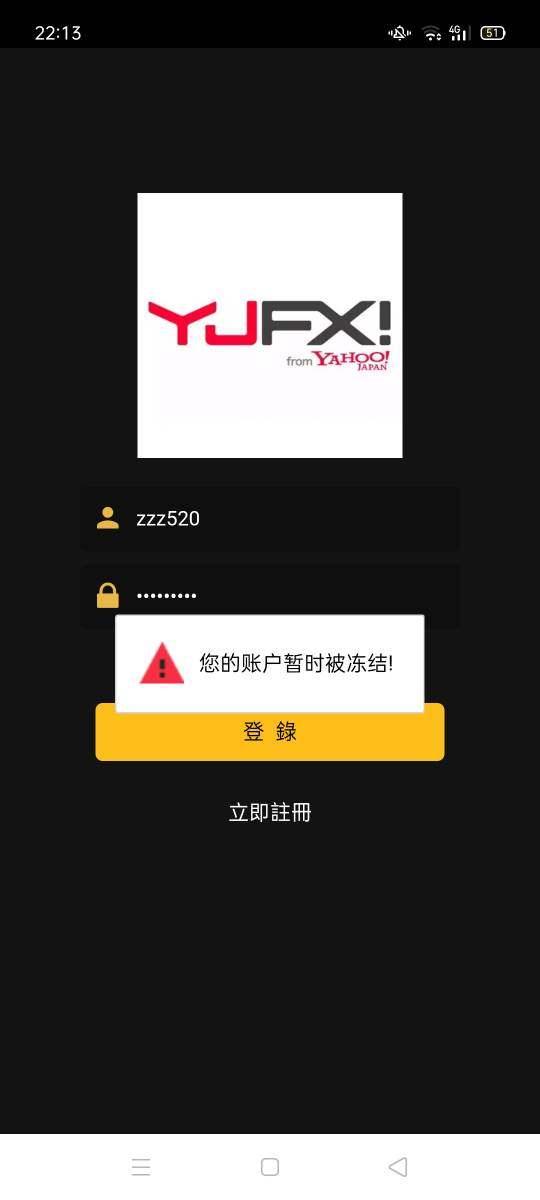

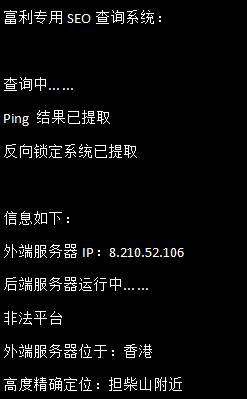

Trust and Reliability Analysis

GMO Gaika operates under Japan's Financial Services Authority regulation. This provides substantial regulatory oversight and client protection through established financial regulatory frameworks. FSA regulation ensures segregated client fund storage, operational transparency, and compliance with strict Japanese financial industry standards that protect trader interests.

Specific fund security measures beyond basic FSA requirements were not detailed in available documentation. Japanese regulatory standards typically include comprehensive client protection protocols. The absence of detailed security information limits assessment of additional protective measures the broker may implement beyond minimum regulatory requirements.

Company transparency regarding operational practices, financial reporting, and business performance was not extensively covered in accessible documentation. Enhanced transparency through regular financial reports, operational updates, and business performance metrics would strengthen client confidence and trust assessment.

Industry reputation and recognition through awards, certifications, or professional acknowledgments were not mentioned in current information. Such recognition often indicates peer and industry validation of service quality and operational excellence that supports trust evaluation.

The handling of negative events, client complaints, or regulatory issues was not addressed in available documentation. A broker's response to challenges and commitment to client satisfaction during difficult situations often reveals true reliability and trustworthiness beyond normal operational periods.

User Experience Analysis

Overall user satisfaction metrics and feedback data were not available in current documentation. This creates significant gaps in assessing actual client experience with GMO Gaika's services. Without concrete user feedback, potential clients cannot evaluate real-world service quality and satisfaction levels from existing users.

Interface design and platform usability details were not extensively covered. User experience significantly depends on intuitive navigation, clear information presentation, and efficient workflow design. The proprietary platform's user-friendliness compared to industry standards requires direct evaluation.

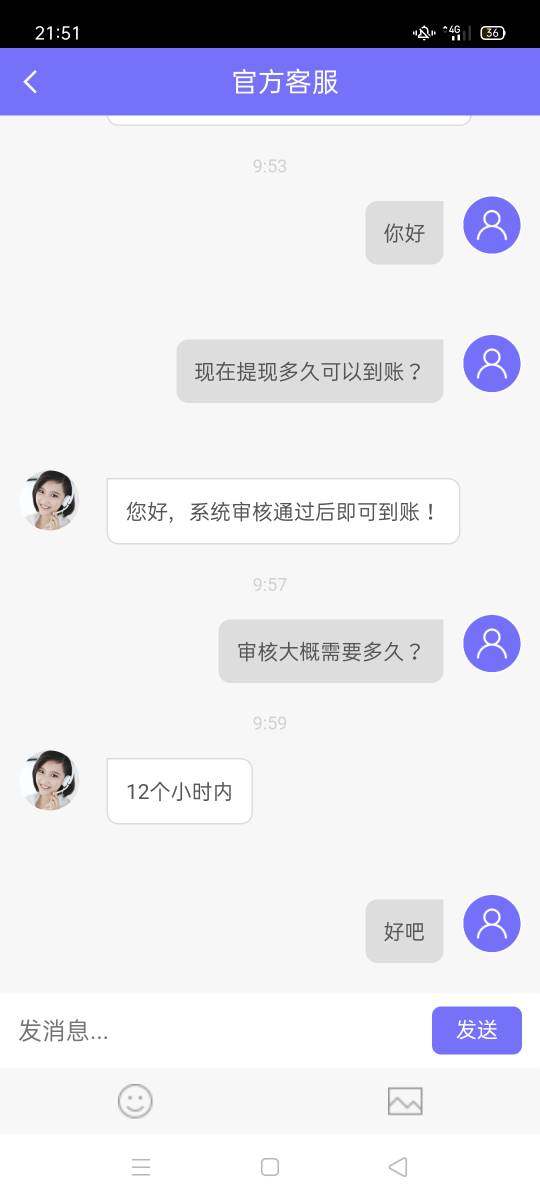

Registration and account verification processes were not detailed in available information. Streamlined onboarding significantly impacts initial user experience and satisfaction. Complex or lengthy verification procedures can create negative first impressions that affect overall service perception.

Fund operation experiences including deposit processing, withdrawal efficiency, and transaction transparency were not specified in current documentation. Smooth financial operations represent critical components of overall user satisfaction and broker reliability assessment.

Common user complaints or recurring issues were not identified in available information. This limits understanding of potential service weaknesses or areas requiring improvement. Such feedback typically reveals important service gaps that impact user satisfaction.

The broker appears suitable for beginning and intermediate traders seeking regulated forex access. Limited user feedback transparency restricts comprehensive experience assessment. Enhanced user review availability and satisfaction reporting would significantly improve service evaluation capabilities.

Conclusion

GMO Gaika presents a viable option for traders seeking regulated forex and CFD trading through a Japanese-licensed broker with competitive basic conditions. The combination of FSA regulation, commission-free trading, and fast execution speeds creates an appealing foundation for cost-conscious traders prioritizing regulatory security and transparent pricing structures.

The broker best serves Japanese-speaking users and international clients comfortable with Japanese-language support services. The low minimum deposit requirement and straightforward account structure make it particularly suitable for beginning traders entering the forex market with limited capital and experience.

Key advantages include zero-commission trading, fast execution performance, and robust regulatory oversight. Primary limitations involve language restrictions, limited international service transparency, and insufficient public feedback about user experiences. Potential clients should carefully weigh these factors against their specific trading requirements and support needs before making account decisions.