Regarding the legitimacy of Axi forex brokers, it provides ASIC, FCA, FMA, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Axi safe?

Pros

Cons

Is Axi markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AXICORP FINANCIAL SERVICES PTY LTD

Effective Date: Change Record

2007-12-21Email Address of Licensed Institution:

Compliance.Emails@axi.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.axi.com/auExpiration Time:

--Address of Licensed Institution:

L 13 73 MILLER ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

1300888936Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Axi Financial Services (UK) Limited

Effective Date:

2007-08-16Email Address of Licensed Institution:

compliance.uk@axi.com, katie.leroux@axi.comSharing Status:

No SharingWebsite of Licensed Institution:

www.axi.com/ukExpiration Time:

--Address of Licensed Institution:

Axi Financial Services (UK) Ltd 1 Finsbury Market London EC2A 2BN UNITED KINGDOMPhone Number of Licensed Institution:

+442038572000Licensed Institution Certified Documents:

FMA Derivatives Trading License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

AXICORP FINANCIAL SERVICES PTY LTD

Effective Date:

2018-06-01Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 4, 4 Graham St, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+6121621182Licensed Institution Certified Documents:

CYSEC Derivatives Trading License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Solaris EMEA Limited

Effective Date:

2023-07-10Email Address of Licensed Institution:

enquiries@solarisemea.comSharing Status:

No SharingWebsite of Licensed Institution:

www.axi.com/euExpiration Time:

--Address of Licensed Institution:

78 Spyrou Kyprianou, Magnum Business Centre, Office 1B, 3076, LimassolPhone Number of Licensed Institution:

+357 25 281 705Licensed Institution Certified Documents:

Is Axi A Scam?

Introduction

Axi, formerly known as AxiTrader, is a prominent online forex and CFD broker headquartered in Sydney, Australia. Established in 2007, Axi has positioned itself as a global player in the trading industry, catering to over 60,000 clients across more than 100 countries. As with any financial service, especially in the forex market, traders must exercise caution and conduct thorough evaluations of brokers before committing their capital. The potential for scams in the trading world necessitates a careful assessment of a broker's legitimacy, regulatory compliance, and overall reputation.

This article aims to provide a comprehensive analysis of Axi, focusing on its regulatory status, company background, trading conditions, customer funds security, user experience, and overall risk assessment. The evaluation is based on a review of multiple credible sources, including industry reports, user testimonials, and regulatory filings, ensuring a well-rounded perspective on Axi's operations.

Regulation and Legitimacy

Axi operates under the oversight of several regulatory authorities, which is a crucial factor in determining its legitimacy and safety for traders. Regulation ensures that brokers adhere to strict financial standards, providing a level of protection for client funds. Axi is regulated by the following entities:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 509746 | United Kingdom | Verified |

| ASIC | 318232 | Australia | Verified |

| DFSA | N/A | Dubai | Verified |

| SVG FSA | 25417 BC 2019 | St. Vincent and the Grenadines | Verified |

The Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) are both tier-1 regulators, meaning they impose high standards of compliance and consumer protection. The presence of these regulatory licenses indicates that Axi is subject to strict oversight, which is vital for ensuring the safety of client funds.

Historically, Axi has maintained a clean compliance record, with no significant regulatory infractions reported. This level of oversight not only enhances the broker's credibility but also provides traders with peace of mind knowing their funds are protected under regulatory frameworks. Overall, Axi's regulatory standing is a strong indicator of its legitimacy and reliability in the forex market.

Company Background Investigation

Axi was founded in 2007 as AxiTrader, evolving into a well-established broker with a focus on providing quality trading services. The company has undergone significant growth since its inception, expanding its reach to various international markets. Axi is owned by Axicorp Financial Services Pty Ltd, which is a reputable entity in the financial services sector.

The management team at Axi comprises industry veterans with extensive experience in forex trading and financial services. This expertise contributes to the broker's operational efficiency and customer service quality. Axi's commitment to transparency is evident in its regular publication of financial statements and operational updates, which are independently audited by reputable firms.

The company's information disclosure practices are commendable, as they provide potential and existing clients with access to critical information regarding trading conditions, fees, and company policies. This level of transparency is essential for building trust with clients and establishing Axi as a credible player in the forex industry.

Trading Conditions Analysis

Axi offers competitive trading conditions, which are a significant factor for traders when choosing a broker. The broker's fee structure is primarily based on spreads and commissions, which vary depending on the account type. Below is a comparison of Axis core trading costs:

| Cost Type | Axi | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.4 pips | 1.0 pips |

| Commission Model | $7 round trip (Pro) | $7 round trip |

| Overnight Interest Range | Varies by asset | Varies widely |

Axi's spreads start from 0.4 pips on standard accounts and can go as low as 0.0 pips on pro accounts, making it competitive compared to industry averages. The commission structure is straightforward, with a $7 charge for pro accounts, which is standard for brokers offering tight spreads.

However, traders should be aware of overnight financing costs, which can vary significantly depending on the asset class. While Axi does not charge deposit or withdrawal fees, there may be inactivity fees for accounts that remain dormant for extended periods. Overall, Axi's trading conditions are favorable for active traders, particularly those who prioritize low spreads and transparent commission structures.

Customer Funds Security

The safety of client funds is paramount in the trading industry, and Axi employs several measures to ensure the protection of its clients' investments. Axi segregates client funds in tier-1 bank accounts, which means that client assets are kept separate from the broker's operational funds. This practice is crucial in the event of financial difficulties faced by the broker, as it ensures that client funds remain protected.

Additionally, Axi offers negative balance protection, which prevents traders from losing more than their deposited amount. This feature is particularly beneficial for retail clients, as it mitigates the risks associated with leveraged trading.

While Axi has a solid reputation regarding fund safety, it is essential to note that clients trading under the St. Vincent and the Grenadines entity may not enjoy the same level of protections as those trading under FCA or ASIC regulations. Historically, Axi has not faced significant security issues or disputes regarding client funds, further reinforcing its reputation as a trustworthy broker.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability and service quality. Axi generally receives positive reviews from users, particularly regarding its customer support and trading platform. However, some common complaints have been noted:

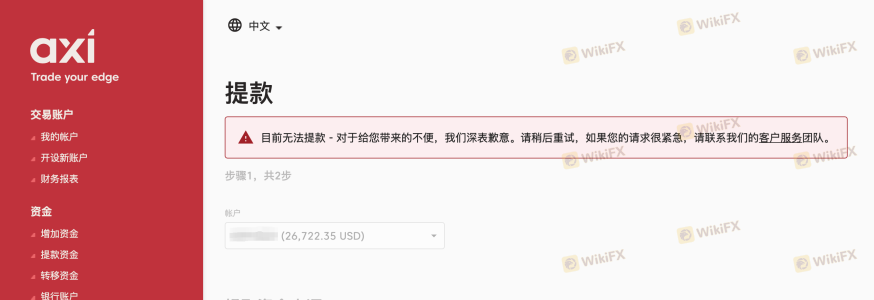

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive, but some users report delays |

| Account Verification Issues | Moderate | Support team assists, but process can be lengthy |

| Limited Research Tools | Low | Acknowledged, ongoing improvements in educational resources |

A typical case involves users experiencing delays in fund withdrawals, which they attribute to bank processing times rather than Axi's internal procedures. Another common complaint relates to the account verification process, which some users find cumbersome. However, Axi's customer support team has been praised for its willingness to assist and resolve issues promptly.

Overall, while there are some areas for improvement, Axi's customer experience is generally favorable, with many users appreciating the broker's commitment to service quality.

Platform and Trade Execution

Axi primarily utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its reliability and user-friendly interface. The broker also offers a proprietary trading platform for mobile devices, enhancing the trading experience for clients on the go.

In terms of order execution, Axi is noted for its speed and reliability. Users report minimal slippage and a low rate of order rejections, which is crucial for high-frequency traders and those employing automated trading strategies. The platform's stability is a significant advantage, especially during volatile market conditions.

However, some users have expressed concerns about the performance of the web-based trading platform compared to the desktop version. While the desktop application offers superior functionality, the web version may experience slower execution speeds during peak trading hours.

Risk Assessment

Using Axi as a trading platform comes with inherent risks that traders should be aware of. The following risk assessment summarizes the key risk areas associated with trading with Axi:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight from FCA and ASIC. |

| Operational Risk | Medium | Occasional delays in withdrawals; dependent on banking processes. |

| Market Risk | High | High leverage can amplify losses; traders should manage risk carefully. |

| Technology Risk | Medium | Potential for platform issues during high volatility. |

To mitigate these risks, traders should employ sound risk management strategies, such as setting stop-loss orders and avoiding over-leveraging their accounts. Additionally, it is advisable to stay informed about market conditions and to utilize demo accounts for practice before trading with real funds.

Conclusion and Recommendations

In conclusion, Axi is not a scam but a legitimate broker that operates under strict regulatory oversight from reputable authorities such as the FCA and ASIC. The broker's commitment to fund security, transparent trading conditions, and responsive customer support further enhances its credibility in the forex market.

While there are some areas for improvement, such as expanding research tools and addressing withdrawal delays, Axi generally provides a reliable trading environment for both novice and experienced traders.

For traders seeking a trustworthy broker with competitive pricing and robust trading platforms, Axi is a solid choice. However, those looking for a broader range of assets or advanced research tools may want to consider alternatives such as IC Markets or Pepperstone, which offer more comprehensive trading solutions. Overall, Axi stands out as a reputable option in the crowded forex brokerage landscape.

Is Axi a scam, or is it legit?

The latest exposure and evaluation content of Axi brokers.

Axi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Axi latest industry rating score is 8.12, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.12 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.