Regarding the legitimacy of FINEX forex brokers, it provides BAPPEBTI, JFX and WikiBit, (also has a graphic survey regarding security).

Is FINEX safe?

Pros

Cons

Is FINEX markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. Finex Bisnis Solusi Futures

Effective Date:

--Email Address of Licensed Institution:

customer@finex.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.finex.co.idExpiration Time:

--Address of Licensed Institution:

SOHO Pancoran Tower Splendor lantai 30 Unit 3005, Jl. M.T Haryono kavling 2 - 3, Tebet, Jakarta Selatan - 12810 TEBET BARAT TEBET JAKARTA SELATAN DKI JAKARTA 12810Phone Number of Licensed Institution:

021 - 50101569Licensed Institution Certified Documents:

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Finex Bisnis Solusi Futures

Effective Date:

--Email Address of Licensed Institution:

corporate@finex.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.finex.co.idExpiration Time:

--Address of Licensed Institution:

Soho Pancoran Tower Splendor Lt 30 Unit 3005, Jl M.T Haryono Kav 2-3, Kel. Tebet, Jakarta Selatan 12810Phone Number of Licensed Institution:

021-50101569Licensed Institution Certified Documents:

Is Finex A Scam?

Introduction

Finex is a broker that has gained attention in the forex market, particularly among traders looking for opportunities in foreign exchange and commodities. Established in Indonesia, Finex claims to offer a variety of trading services, including forex, commodities, and indices. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with a broker. The forex market is rife with scams and unregulated entities, making it essential for traders to assess the credibility and reliability of their chosen broker. This article investigates the legitimacy of Finex by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The analysis draws from various online sources, reviews, and regulatory databases to provide a comprehensive overview of Finex's standing in the forex industry.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and reliability. Regulation serves as a safeguard for traders, ensuring that brokers adhere to stringent standards designed to protect client funds and promote fair trading practices. In the case of Finex, it is regulated by the Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI), the Indonesian Commodity Futures Trading Regulatory Agency. However, the effectiveness of this regulation can vary compared to more stringent regulatory bodies found in other jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BAPPEBTI | 47/BAPPEBTI/SI/04/2013 | Indonesia | Verified |

Despite being regulated by BAPPEBTI, many reviews indicate that this regulatory body does not offer the same level of investor protection as top-tier regulators such as the FCA in the UK or the SEC in the U.S. Moreover, there are claims that BAPPEBTI does not effectively oversee forex trading operations, raising concerns about the overall safety of funds deposited with Finex. Furthermore, there have been multiple warnings issued by various financial authorities regarding the legitimacy of brokers operating under less stringent regulations, which adds an additional layer of risk for potential clients.

Company Background Investigation

Finex, formally known as PT Finex Bisnis Solusi Futures, was established in 2012 and has positioned itself as a provider of trading services in Indonesia. The company operates under Indonesian law and is a member of the Jakarta Futures Exchange. However, there is limited information available regarding its ownership structure and management team, which raises questions about transparency and accountability.

The lack of detailed disclosures about the company's management and operational history can be a red flag for potential investors. A transparent company typically provides information about its founders, key executives, and their relevant experience in the financial industry. In the case of Finex, the absence of such information could indicate a lack of commitment to transparency, which is essential for building trust with clients. Additionally, the companys website does not provide clear contact information or a physical address, further diminishing its credibility.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is crucial. Finex offers a variety of trading instruments, including forex, commodities, and indices, with a minimum deposit requirement that is relatively low compared to other brokers. However, the overall cost structure and any unusual fees should be carefully considered.

| Fee Type | Finex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.5 pips | From 0.1 pips |

| Commission Model | $1 per lot | $2 per lot |

| Overnight Interest Range | Variable | Variable |

While the spreads offered by Finex appear competitive, the commission structure may not be as favorable when compared to other brokers that offer lower or no commissions. Additionally, the variable overnight interest rates can lead to unexpected costs for traders who hold positions overnight. Transparency regarding these fees is essential, and any hidden charges could significantly impact a trader's profitability.

Customer Fund Security

The security of customer funds is paramount when choosing a broker. Finex claims to implement several measures to protect client funds, including segregated accounts and adherence to local regulations. However, the effectiveness of these measures is often questioned, particularly in regions with less stringent regulatory oversight.

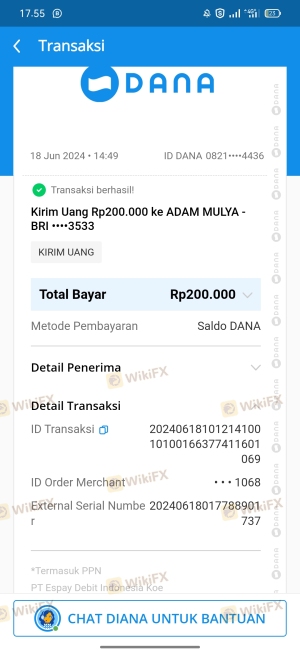

The absence of robust investor protection mechanisms, such as compensation funds, raises concerns about the safety of funds deposited with Finex. Moreover, there have been reports of previous fund security issues involving other brokers operating in similar jurisdictions, which could pose a risk for traders considering Finex. Historical controversies regarding fund management and withdrawal issues can further exacerbate these concerns.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability and service quality. An analysis of customer reviews reveals a mixed bag of experiences with Finex. While some users praise the broker for its user-friendly platform and responsive customer service, others have reported significant issues, including withdrawal delays and poor communication regarding account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Average response |

Case studies from users highlight instances where traders faced challenges in withdrawing their funds, leading to frustration and distrust. In some cases, clients reported that their withdrawal requests took longer than expected to process, raising concerns about the broker's operational efficiency.

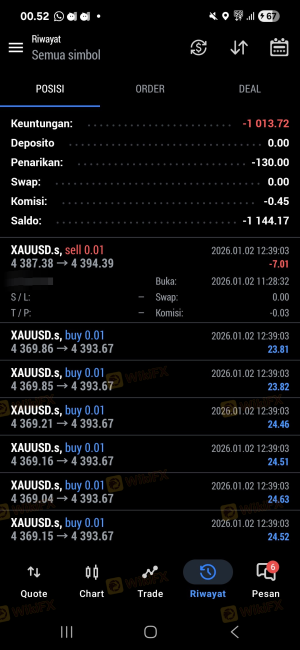

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Finex utilizes the popular MetaTrader 5 (MT5) platform, which is known for its advanced trading features and user-friendly interface. However, user reviews suggest that there may be issues related to execution quality, including slippage and occasional order rejections.

Traders have reported experiencing delays in order execution during high volatility periods, which can be detrimental to trading strategies. Furthermore, any signs of platform manipulation, such as sudden price spikes or unexplainable changes in spreads, can severely impact a trader's confidence in the broker.

Risk Assessment

Engaging with Finex carries several risks that potential clients should be aware of. The lack of transparency regarding regulatory oversight, combined with historical complaints and mixed user experiences, suggests a medium to high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited investor protection and oversight. |

| Fund Security Risk | High | Concerns over fund safety and withdrawal issues. |

| Execution Risk | Medium | Potential for slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and maintain a diversified trading strategy.

Conclusion and Recommendations

In conclusion, the investigation into Finex raises several red flags regarding its legitimacy and reliability as a forex broker. While it is regulated by BAPPEBTI, the effectiveness of this regulation is questionable compared to more established regulatory authorities. The company's lack of transparency regarding its management and operational history further complicates the assessment of its trustworthiness.

Given the potential risks associated with trading through Finex, traders should exercise caution. It is recommended that individuals consider alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Reliable options may include brokers regulated by top-tier authorities like the FCA or ASIC, which provide enhanced security and investor protection. Ultimately, conducting thorough research and seeking out well-regulated brokers is essential for a safe trading experience in the volatile forex market.

Is FINEX a scam, or is it legit?

The latest exposure and evaluation content of FINEX brokers.

FINEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FINEX latest industry rating score is 7.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.