Regarding the legitimacy of B2BROKER forex brokers, it provides CYSEC, LFSA, FSCA, DFSA, FSA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is B2BROKER safe?

Business

Risk Control

Is B2BROKER markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM) 15

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

B2B Prime Services EU Ltd

Effective Date:

2018-11-05Email Address of Licensed Institution:

info@b2prime.comSharing Status:

Website of Licensed Institution:

www.menasecurities.com, www.b2prime.comExpiration Time:

--Address of Licensed Institution:

Georgiou Kaningos, Pamelva Court, Office 104, Limassol, CY 3105 CyprusPhone Number of Licensed Institution:

+357 25 582 192Licensed Institution Certified Documents:

LFSA Market Making License (MM)

Labuan Financial Services Authority

Labuan Financial Services Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

B2Broker Prime Investment Bank Ltd.

Effective Date:

--Email Address of Licensed Institution:

daisy.jack@b2b.capitalSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office Suite 628, Level 6(C), Main Office Tower, Financial Park Complex Labuan, Jalan Merdeka, 87000 Labuan F.T.Phone Number of Licensed Institution:

087-584 871Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

B2B PRIME SERVICES AFRICA (PTY) LTD

Effective Date:

2024-12-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

NORWICH PLACE WEST 2ND FLOORCNR 5TH & NORWICHSANDOWN SANDTON, GAUTENG2031Phone Number of Licensed Institution:

079 016 0619Licensed Institution Certified Documents:

DFSA Derivatives Trading License (MM)

Dubai Financial Services Authority

Dubai Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

B2B Prime Services MENA Limited

Effective Date:

2025-08-15Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit N1004, Emirates Financial Towers, DIFC, Dubai, UAEPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

B2B Prime Services SC Ltd

Effective Date:

--Email Address of Licensed Institution:

info@b2prime.comSharing Status:

No SharingWebsite of Licensed Institution:

https://b2prime.comExpiration Time:

--Address of Licensed Institution:

ABIS Centre (2) Office, Second Floor, Providence Estate, Mahe, SeychellesPhone Number of Licensed Institution:

4376048Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

GLOBAL POP LIQUIDITY SOLUTIONS LTD

Effective Date: Change Record

2023-04-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is B2Prime Safe or Scam?

Introduction

B2Prime is a multi-asset liquidity provider based in Cyprus, specializing in forex and contracts for difference (CFDs). As a participant in the highly competitive forex market, B2Prime aims to serve institutional and professional clients with a range of trading services. Given the complexities and risks associated with forex trading, it is crucial for traders to carefully evaluate the credibility and reliability of brokers like B2Prime. This article seeks to investigate whether B2Prime is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund security, customer experience, and risk factors. The evaluation will be based on a thorough analysis of available data from credible sources, including regulatory bodies and user reviews.

Regulation and Legitimacy

Understanding a broker's regulatory status is essential for assessing its legitimacy. B2Prime operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent regulatory framework. This oversight is crucial as it ensures that B2Prime adheres to high standards of financial conduct, including capital adequacy requirements and client fund segregation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 392/20 | Cyprus | Verified |

The importance of regulation cannot be overstated, as it provides a layer of protection for traders. CySEC's rigorous requirements include regular audits and compliance checks, which enhance transparency. While B2Prime has maintained its regulatory status, it is essential to monitor its history of compliance. There have been no significant regulatory infractions reported against B2Prime, which adds to its credibility. However, traders should remain vigilant and conduct ongoing assessments of the brokers regulatory standing.

Company Background Investigation

B2Prime was established in 2018 and has quickly gained a reputation as a reliable liquidity provider in the forex and CFD markets. The company is part of the B2Broker group, which has a solid presence in the financial services industry. The ownership structure of B2Prime is transparent, with key figures such as Artur Azizov and Evgeniya Mykulyak at the helm, both of whom have extensive experience in financial markets.

The management team‘s background is a significant factor in determining the company's reliability. Both Azizov and Mykulyak have been recognized for their contributions to the fintech and liquidity provision sectors. Their expertise lends credibility to B2Prime’s operations. Furthermore, the company maintains a commitment to transparency, regularly updating its clients about changes in regulations, trading conditions, and other operational matters.

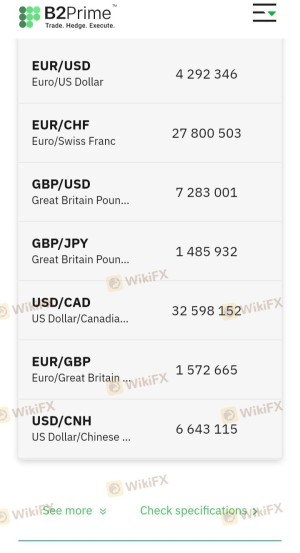

Trading Conditions Analysis

When evaluating the safety of a broker, understanding its trading conditions is critical. B2Prime offers a competitive fee structure that includes spreads, commissions, and overnight interest rates. However, it is essential to scrutinize any potential hidden fees that may not be immediately apparent to traders.

| Fee Type | B2Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 2.0% |

B2Primes spreads are competitive, particularly for major currency pairs, which can enhance trading profitability. However, traders should be aware of the variable commission model, which may lead to increased costs depending on trading volume. The overnight interest rates are within industry standards, but traders should always verify these rates before executing trades.

Customer Funds Security

The safety of customer funds is paramount in the forex industry. B2Prime implements several measures to ensure the security of client deposits. These include segregating client funds from company operating capital, which is a standard practice among regulated brokers. Additionally, B2Prime adheres to the investor protection schemes mandated by CySEC, which provide further security for client funds.

B2Primes commitment to fund security is reflected in its policies regarding negative balance protection, which prevents traders from losing more than their account balance. However, it is essential to note that while B2Prime has not faced any significant security breaches, traders should always exercise caution and ensure their funds are protected.

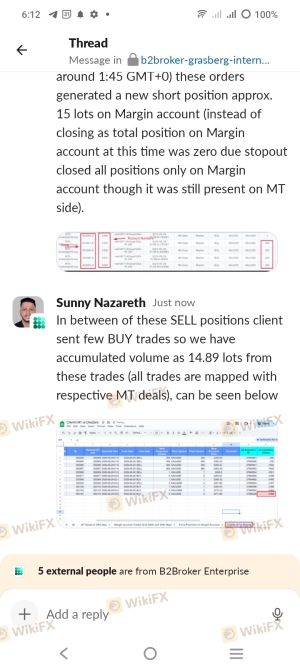

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. B2Prime has received mixed reviews from users, with some praising its liquidity and trading conditions, while others have raised concerns about withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Variable Quality |

| Trading Execution | Low | Generally Positive |

Typical complaints include delays in withdrawal processing, which can be a red flag for potential scams. However, B2Prime has made efforts to improve its customer support and address these issues. For instance, some users reported positive experiences with the trading platform's execution speed, indicating that the company does maintain a generally satisfactory trading environment.

Platform and Trade Execution

The performance of B2Primes trading platform is critical for user experience. B2Prime offers a robust trading platform with a user-friendly interface and advanced functionalities. The platform is designed to provide fast execution and low slippage, which are essential for successful trading.

However, there have been anecdotal reports of occasional slippage during volatile market conditions. Traders should remain aware of these potential issues and consider them when executing trades. Overall, B2Prime's platform appears to be reliable, but ongoing monitoring of execution quality is advisable.

Risk Assessment

Using B2Prime involves various risks, as is the case with any forex broker. Traders should be aware of the inherent risks associated with leveraged trading, market volatility, and the potential for loss.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Regulated by CySEC |

| Market Risk | High | Volatile market conditions |

| Operational Risk | Medium | Potential withdrawal issues |

To mitigate these risks, traders are advised to maintain a diversified portfolio, use risk management tools, and stay informed about market conditions. Engaging with educational resources can also enhance traders' understanding of the market and improve their trading strategies.

Conclusion and Recommendations

In summary, B2Prime appears to be a legitimate broker with a solid regulatory framework and a commitment to customer fund security. However, there are areas of concern, particularly regarding withdrawal processes and customer support responsiveness. While there are no significant indications of fraud, traders should remain vigilant and conduct their due diligence.

For traders considering B2Prime, it is advisable to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, traders may want to explore alternative brokers with a strong reputation for customer service and reliability, such as IG or OANDA. Overall, while B2Prime is not a scam, cautious assessment and informed decision-making are essential for a successful trading experience.

Is B2BROKER a scam, or is it legit?

The latest exposure and evaluation content of B2BROKER brokers.

B2BROKER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

B2BROKER latest industry rating score is 6.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.