Finex 2025 Review: Everything You Need to Know

Summary

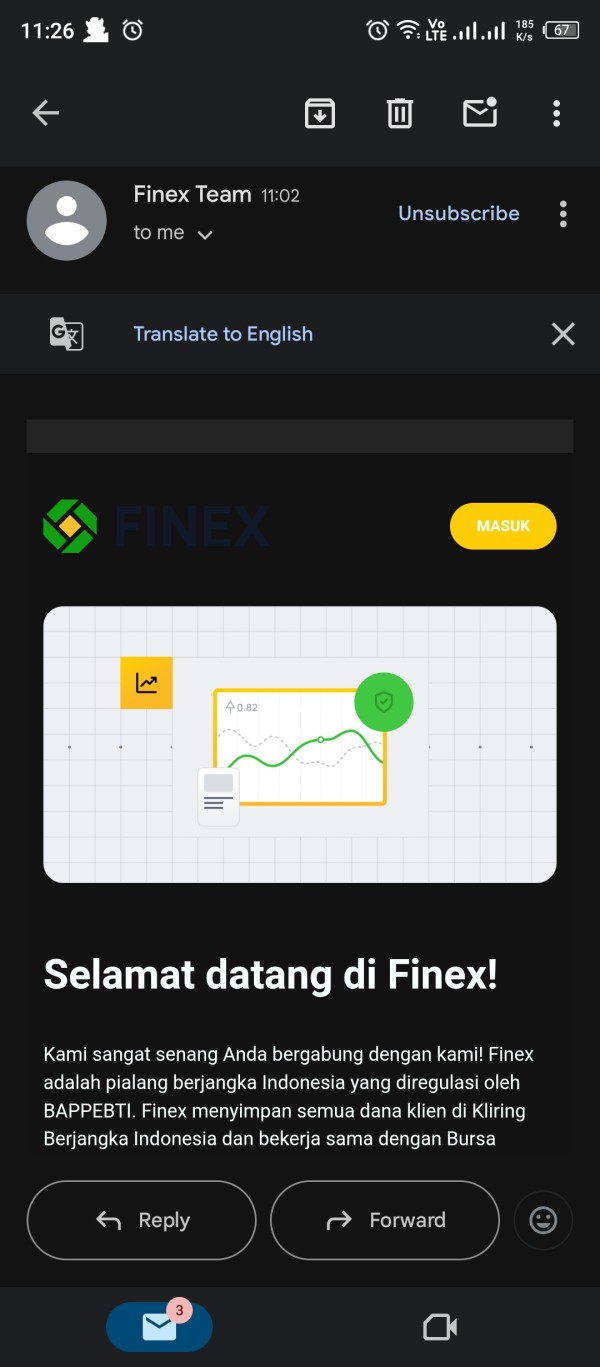

Finex is a notable broker in the competitive forex and CFD trading world. The company has been around since 2012 and works as a reliable trading partner for investors who want access to different markets. This detailed finex review looks at what the broker offers, its regulatory status, and the overall trading experience to help potential clients make informed decisions.

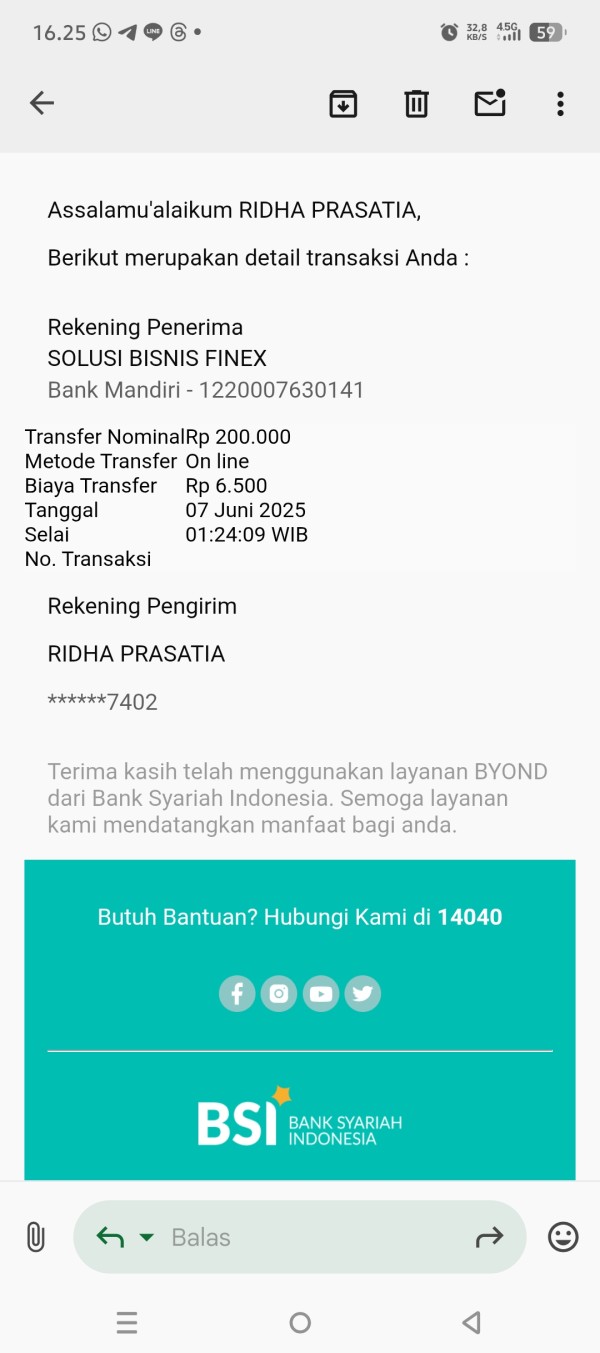

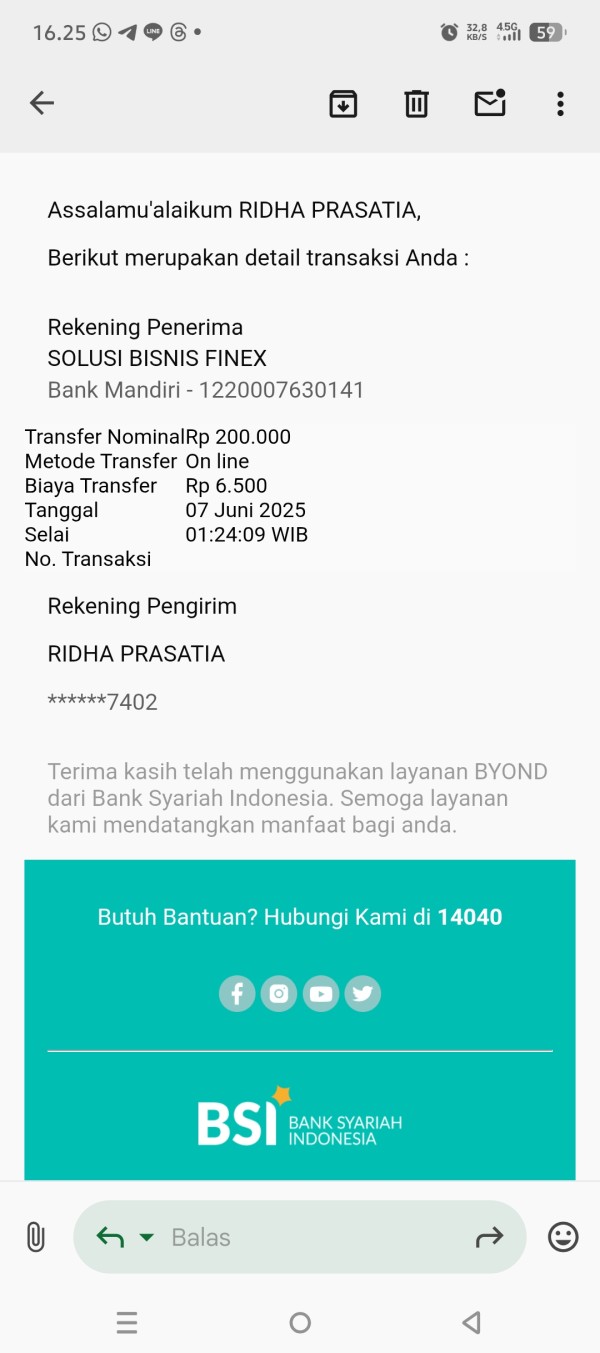

The broker stands out through its own Finex Trading app and wide asset coverage that includes forex, metals, energy, indices, stocks, and CFDs. It operates under BAPPEBTI regulation in Indonesia while also being registered in Saint Vincent and the Grenadines. Finex targets investors who want easy access to forex and CFD trading solutions with a focus on user experience and platform reliability.

Most traders think Finex is a legitimate company that provides good trading experiences, based on available user feedback and regulatory information. However, potential clients should carefully check if the broker's offerings match their specific trading needs and risk tolerance levels before using the platform, just like with any financial service provider.

Important Notice

This review uses available user feedback, regulatory information, and public data about Finex. Future traders should know that regulatory rules and operational standards may be different across the various places where Finex operates. The broker's registration in Saint Vincent and the Grenadines and regulation by Indonesia's BAPPEBTI may offer different levels of investor protection depending on where you live.

Our review method mainly uses existing user reviews, regulatory filings, and platform analysis. This assessment might not cover all parts of the user experience, and individual trading results may vary a lot based on market conditions, trading strategies, and personal risk management practices.

Rating Framework

Broker Overview

Company Background and Establishment

Finex started in the financial services market in 2012. The company positioned itself as a specialized provider of forex and CFD trading services. Over more than ten years of operation, the company has built its own trading infrastructure and expanded its asset offerings to serve a diverse client base that wants exposure to global financial markets.

The broker uses a business model focused on providing easy trading solutions through its custom-built Finex Trading application. This approach lets the company keep direct control over the trading experience while offering competitive access to multiple asset classes including traditional forex pairs, precious metals, energy commodities, global indices, individual stocks, and various CFD instruments.

Platform and Asset Coverage

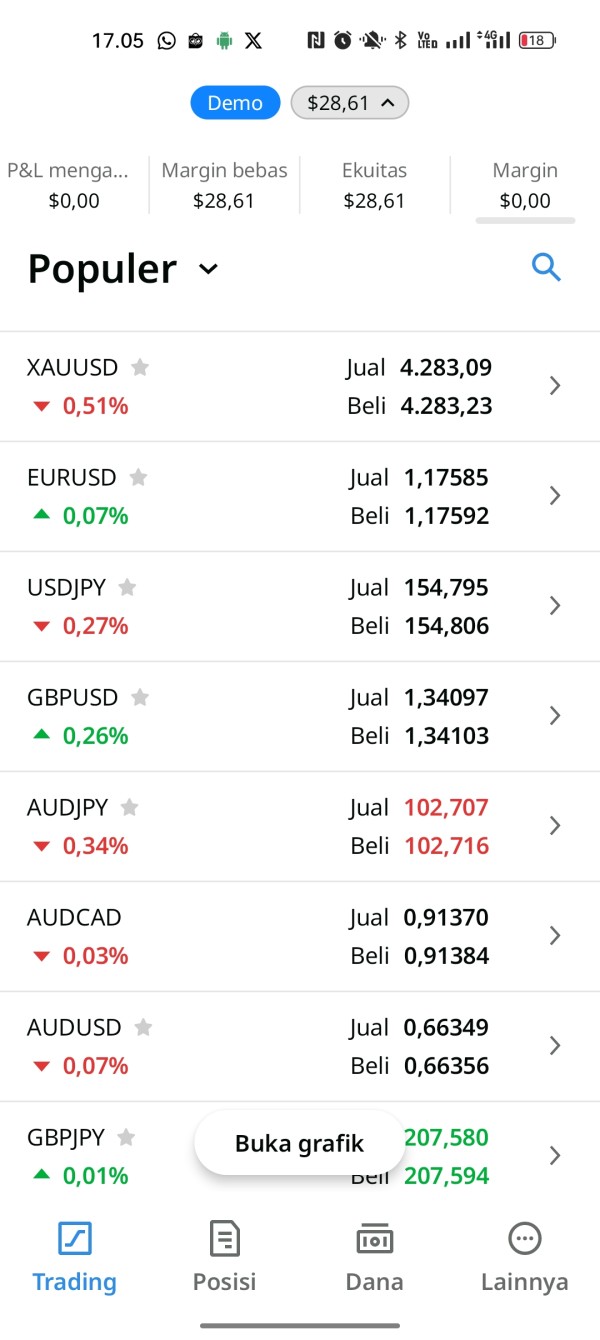

Finex uses its own Finex Trading application as the main platform for client trading activities. This finex review shows that the platform supports wide asset coverage including forex currency pairs, precious metals such as gold and silver, energy commodities including oil and gas, major global indices, individual stock CFDs, and specialized CFD instruments across various market sectors.

The broker's regulatory framework operates under Indonesia's BAPPEBTI (Commodity Futures Trading Regulatory Agency), which provides oversight for commodity futures and derivatives trading activities. This regulatory relationship shows the company's commitment to operating within established financial oversight frameworks while serving Indonesian and regional market participants.

Regulatory Jurisdictions: Finex is registered in Saint Vincent and the Grenadines while operating under BAPPEBTI regulation in Indonesia. This creates a dual-jurisdiction regulatory framework for its operations.

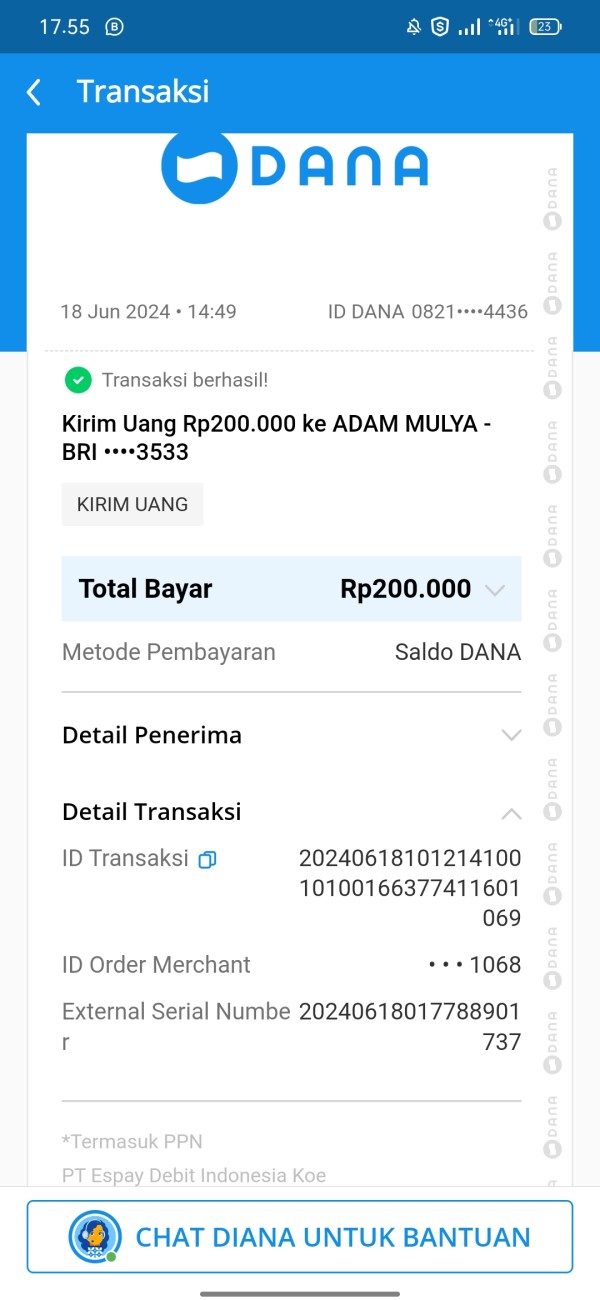

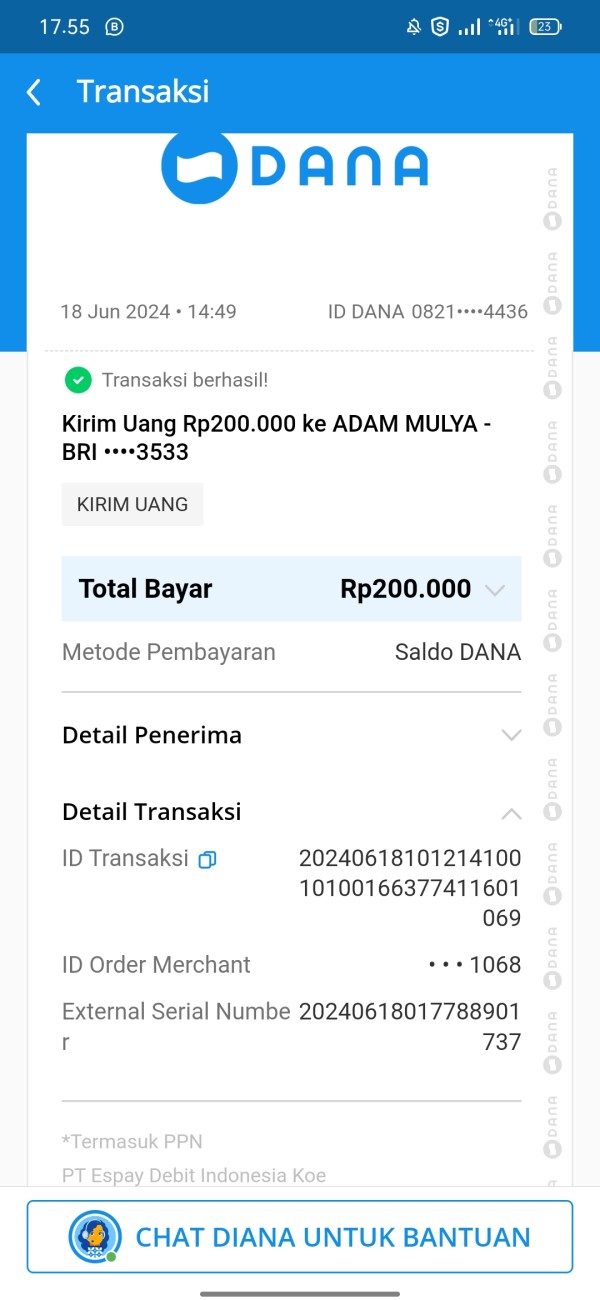

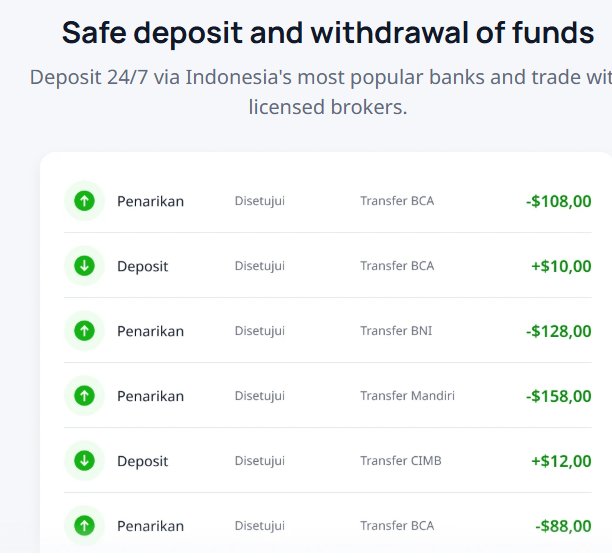

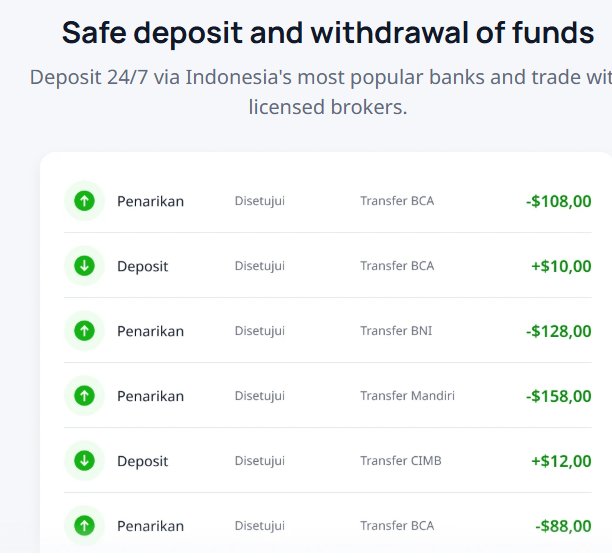

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available source materials.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in the accessible documentation.

Bonus and Promotional Offers: Details about promotional offers and bonus programs are not mentioned in the source materials.

Tradeable Assets: The platform supports comprehensive trading across forex pairs, precious metals, energy commodities, global indices, individual stocks, and CFD instruments across multiple market sectors.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in the available materials. You need to contact the broker directly for accurate pricing information.

Leverage Ratios: Leverage specifications are not mentioned in the source documentation and would need verification through direct broker contact.

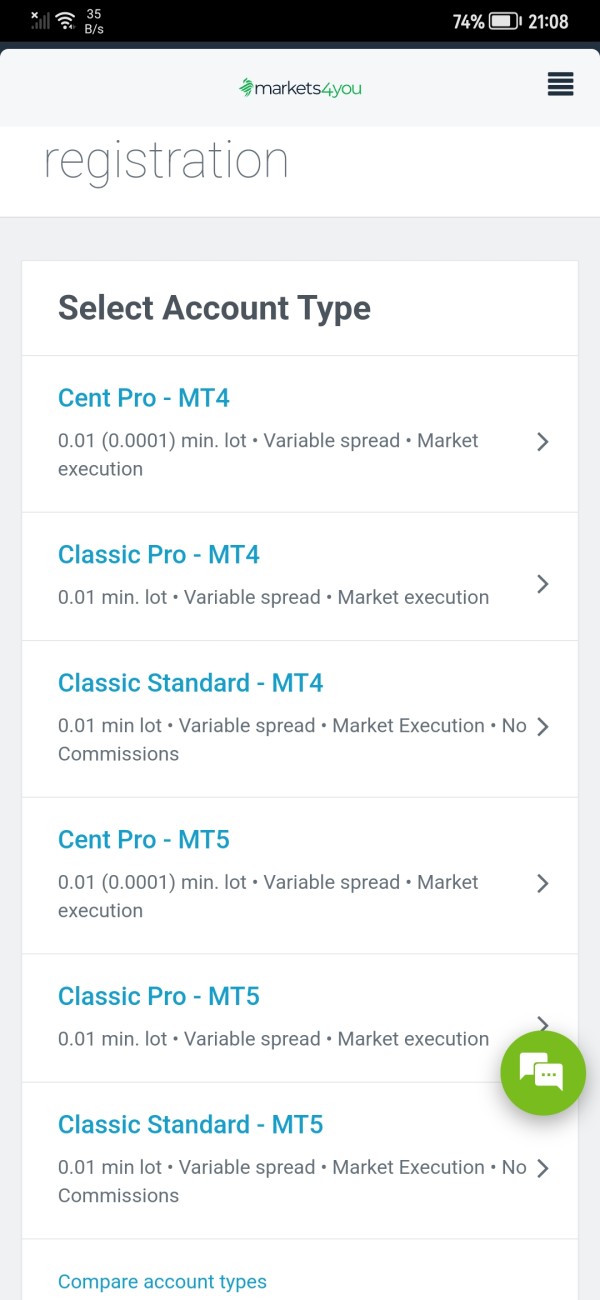

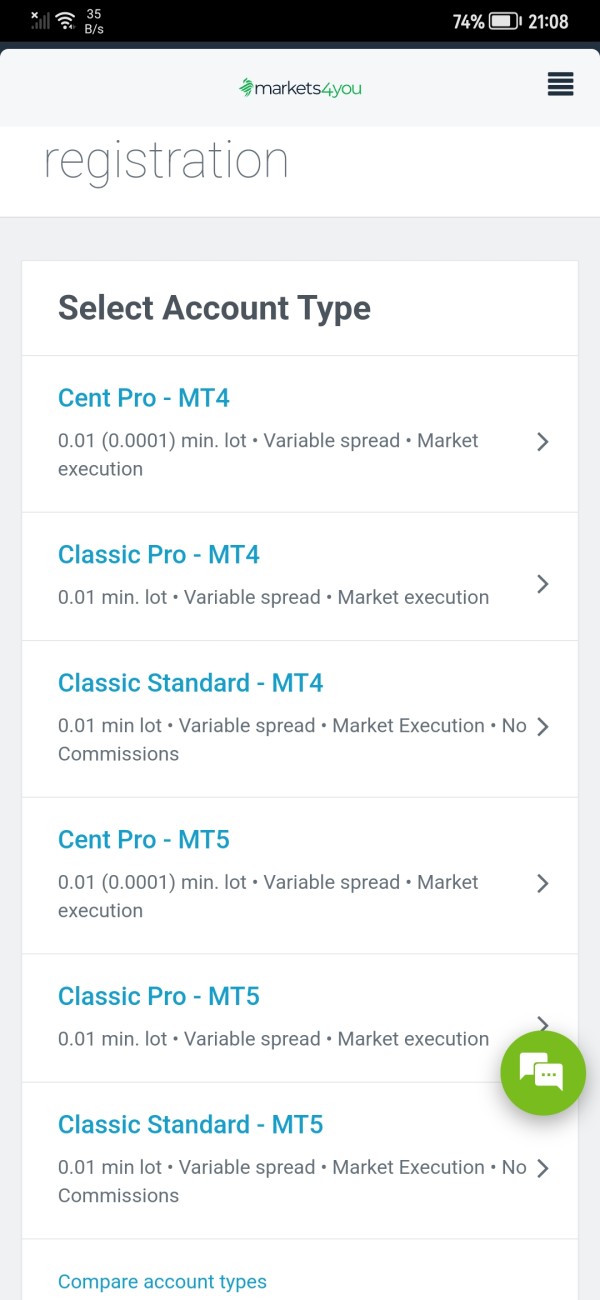

Platform Options: Finex provides its own Finex Trading application as the main trading interface for client activities.

Geographic Restrictions: Specific geographic limitations are not detailed in the available information.

Customer Support Languages: Supported languages for customer service are not specified in the source materials.

This finex review acknowledges that several important operational details require direct verification with the broker to ensure accuracy and current relevance.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Finex's account conditions faces limitations due to insufficient specific information in available source materials. While the broker clearly operates in the forex and CFD space with over ten years of market presence, detailed specifications about account types, minimum deposit requirements, and account-specific features are not fully documented in accessible reviews and regulatory filings.

Potential clients should directly contact Finex to get current information about available account structures, opening requirements, and any specialized account features that may align with their trading goals. The absence of detailed account information in this finex review shows the need for future traders to conduct direct research about account conditions that may impact their trading activities.

The broker's established presence since 2012 suggests developed account management systems. However, specific details about account tiers, benefits, and requirements would need verification through direct contact with the company's client services team.

Finex shows solid capabilities in the tools and resources area through its own Finex Trading application, which serves as the central platform for accessing multiple asset classes. The platform supports trading across forex, metals, energy, indices, stocks, and CFDs, showing comprehensive market coverage for diverse trading strategies.

The broker's decision to develop and maintain its own trading application rather than using third-party platforms suggests investment in creating a tailored user experience. This approach can provide advantages in terms of platform customization and direct control over trading functionality, though specific features and analytical tools within the application are not detailed in available source materials.

While the platform covers essential asset classes, information about advanced trading tools, research resources, educational materials, and automated trading support is not specified in accessible documentation. Traders who need sophisticated analytical tools or comprehensive market research should verify these capabilities directly with the broker to ensure the platform meets their specific requirements.

Customer Service and Support Analysis

Customer service and support capabilities represent an area where specific information is not available in the source materials for this review. The absence of detailed customer service information, including support channels, response times, service quality metrics, and multilingual support options, creates uncertainty about this crucial aspect of the broker's operations.

Effective customer support is essential for forex and CFD trading, particularly for resolving technical issues, addressing account questions, and providing assistance during volatile market conditions. Without specific information about Finex's customer service infrastructure, potential clients cannot properly assess whether the broker's support capabilities align with their expectations and requirements.

Future traders should directly evaluate Finex's customer service by testing response times, assessing available support channels, and verifying the quality of assistance provided before committing to the platform. The lack of detailed customer service information in available reviews suggests the need for direct verification of these capabilities.

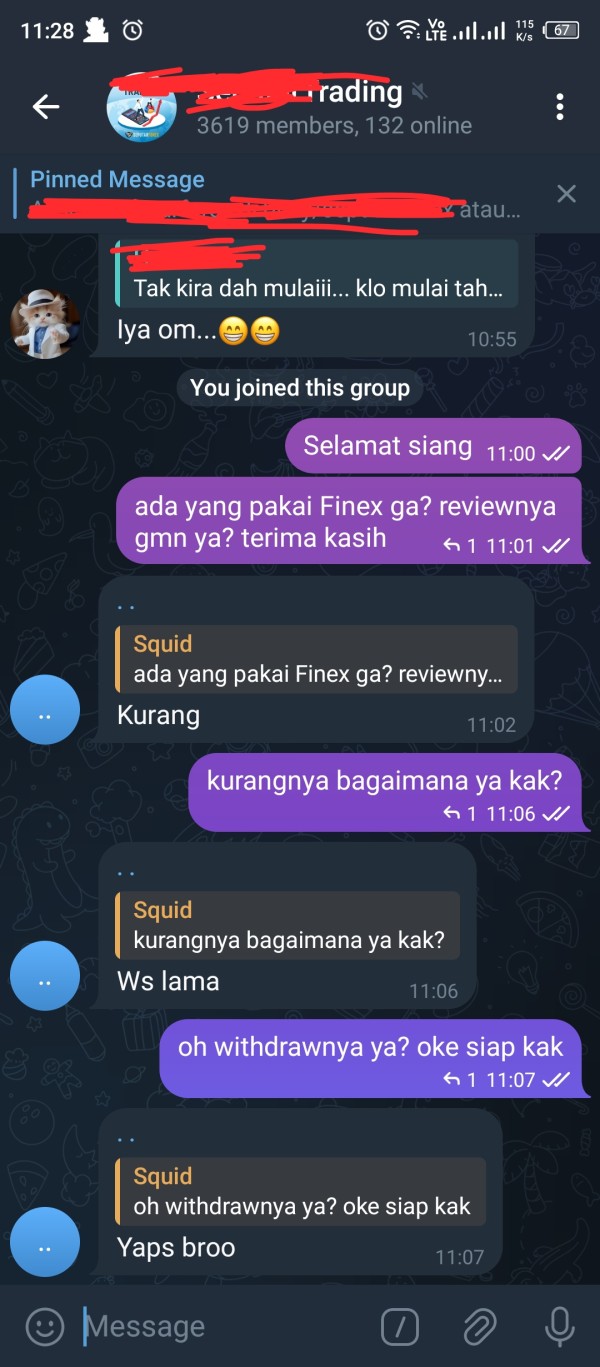

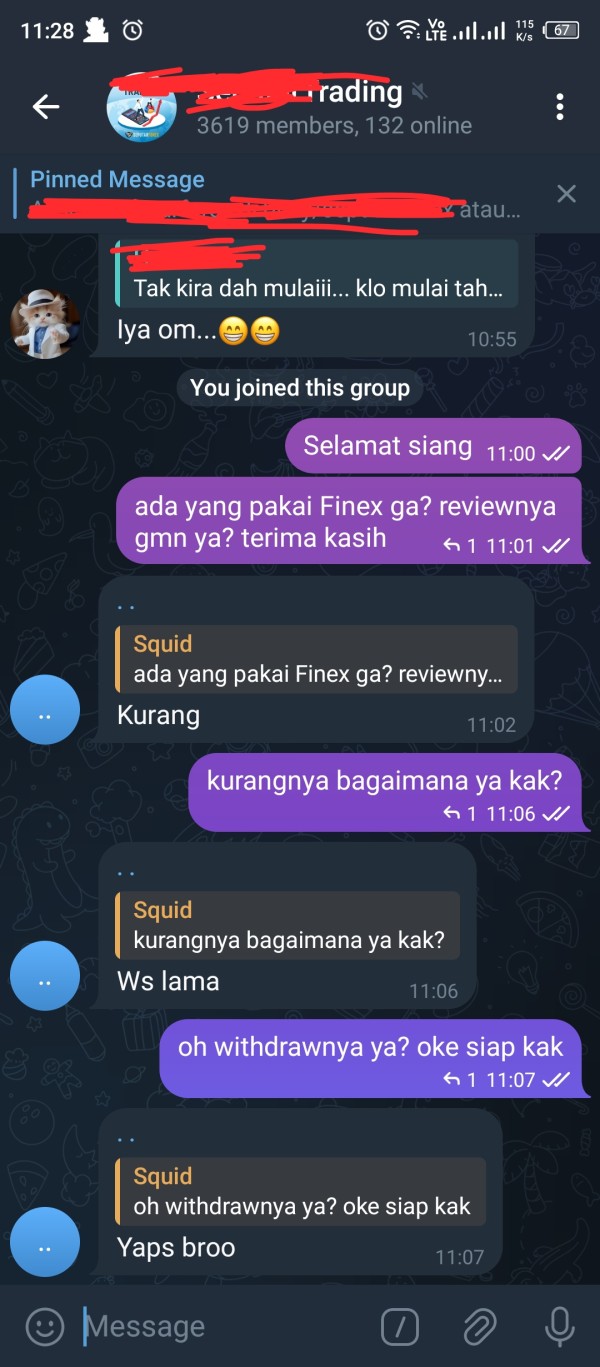

Trading Experience Analysis

User feedback shows that Finex generally provides a satisfactory trading experience, with most traders reporting positive interactions with the platform. The broker's own Finex Trading application appears to deliver stable performance, contributing to user satisfaction with the overall trading environment.

The finex review data suggests that traders appreciate the platform's reliability and functionality, though specific metrics about order execution speed, platform uptime, and technical performance are not detailed in available source materials. The positive user sentiment shows that the broker has successfully developed a trading infrastructure that meets basic user expectations for platform stability and functionality.

However, detailed information about order execution quality, slippage rates, platform responsiveness during high-volatility periods, and mobile trading experience specifics would require direct evaluation by potential clients. The generally positive user feedback provides a foundation for confidence, but traders with specific performance requirements should conduct their own platform testing before committing to live trading activities.

Trust and Reliability Analysis

Finex's trust profile reflects a mixed regulatory framework that requires careful consideration by potential clients. The broker operates under BAPPEBTI regulation in Indonesia, which provides legitimate regulatory oversight for commodity futures and derivatives trading activities. This regulatory relationship shows the company's commitment to operating within established financial oversight frameworks.

However, the company's registration in Saint Vincent and the Grenadines introduces considerations about the level of investor protection and regulatory recourse available to clients. Saint Vincent and the Grenadines maintains a more limited regulatory framework compared to major financial centers, which may impact the breadth of investor protections available to traders.

The combination of BAPPEBTI oversight and Saint Vincent registration creates a dual-jurisdiction structure that potential clients should understand before engaging with the broker. While user feedback generally supports the broker's legitimacy, the regulatory framework requires individual assessment based on each trader's risk tolerance and jurisdiction-specific requirements for broker oversight and investor protection.

User Experience Analysis

Available information shows that most users consider Finex a legitimate and satisfactory trading partner, with general consensus supporting the broker's operational integrity and service delivery. This positive user sentiment suggests that the company has successfully developed systems and processes that meet basic client expectations for trading services.

The broker's longevity since 2012 and continued operation under regulatory oversight support the user assessment of legitimacy and reliability. However, specific details about interface design, platform usability, registration processes, fund management procedures, and common user concerns are not detailed in available source materials.

Potential clients should consider conducting their own evaluation of the user experience through demo accounts or initial small-scale trading activities to assess whether Finex's platform and services align with their specific requirements. The generally positive user feedback provides a foundation for confidence, but individual experience may vary based on trading style, technical requirements, and service expectations.

Conclusion

This comprehensive finex review reveals a broker with established market presence and generally positive user feedback. The company operates under legitimate regulatory oversight through Indonesia's BAPPEBTI while maintaining registration in Saint Vincent and the Grenadines. Finex appears well-suited for investors seeking access to diverse asset classes including forex, metals, energy, indices, stocks, and CFDs through a proprietary trading platform.

The broker's primary strengths include its decade-plus market presence, regulatory compliance, comprehensive asset coverage, and generally positive user experiences. However, potential clients should note the limitations in available detailed information about account conditions, customer service capabilities, and specific platform features that may impact their trading decisions.

Finex represents a viable option for traders comfortable with the dual-jurisdiction regulatory framework and seeking straightforward access to multiple asset classes. Future clients should conduct direct research to verify specific operational details that align with their individual trading requirements and risk management preferences.