B2Prime 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive b2prime review examines a CySEC-regulated forex broker that presents a mixed picture for potential clients. B2Prime demonstrates notable strengths in providing high liquidity trading environments. User feedback particularly praises its ability to efficiently match buyers and sellers. However, concerning aspects emerge regarding its regulatory transparency and automated trading software performance.

B2Prime operates under Cyprus Securities and Exchange Commission oversight, which provides a foundation of regulatory compliance. The broker's primary strength lies in its liquidity provision capabilities. This makes it potentially suitable for traders who prioritize market depth and execution efficiency. Nevertheless, negative user experiences with automated trading systems and questions about regulatory clarity suggest traders should approach with caution.

The broker appears most appropriate for experienced traders seeking high-liquidity trading environments who can navigate potential risks independently. However, those relying heavily on automated trading solutions or requiring extensive educational resources may find B2Prime's offerings insufficient for their needs.

Important Notice

Regional Entity Variations: Available information suggests B2Prime may operate as an unregulated entity in certain jurisdictions. This significantly increases the risk of fund misappropriation. Traders should carefully verify the regulatory status applicable to their specific region before engaging with this broker.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, regulatory information, and available public data. Due to limited transparency in certain operational aspects, some assessments rely on user-reported experiences rather than verified company disclosures.

Rating Framework

Broker Overview

B2Prime operates as a forex brokerage firm under the regulatory oversight of the Cyprus Securities and Exchange Commission. The company positions itself within the competitive forex market by emphasizing liquidity provision and trading execution capabilities. While specific founding details remain unclear in available documentation, the broker has established a presence in the international forex trading community.

The brokerage focuses primarily on foreign exchange trading services. It targets traders who require efficient market access and execution. B2Prime's business model centers on providing trading infrastructure that connects clients to forex markets, with particular emphasis on maintaining high liquidity levels that facilitate smooth order execution.

Operating under CySEC regulation provides B2Prime with a framework for compliance with European financial market standards. This regulatory foundation requires adherence to client fund protection measures and operational transparency standards. However, the practical implementation of these requirements varies based on specific jurisdictional applications. The broker's regulatory status represents both an asset and a point of concern, given conflicting information about its regulatory standing in different regions.

This b2prime review reveals that while the company maintains regulatory credentials, the lack of comprehensive public information about its operations creates uncertainty. The absence of details about management structure and detailed service offerings makes thorough due diligence challenging for potential clients.

Regulatory Coverage: B2Prime operates under Cyprus Securities and Exchange Commission supervision, providing European regulatory framework compliance. However, regulatory status may vary significantly across different operational jurisdictions.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in accessible documentation. This requires direct inquiry with the broker for comprehensive payment method details.

Minimum Deposit Requirements: Concrete minimum deposit thresholds are not specified in available materials. This suggests potential variation based on account types or regional offerings.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not clearly outlined in public information. This indicates either absence of such programs or limited marketing disclosure.

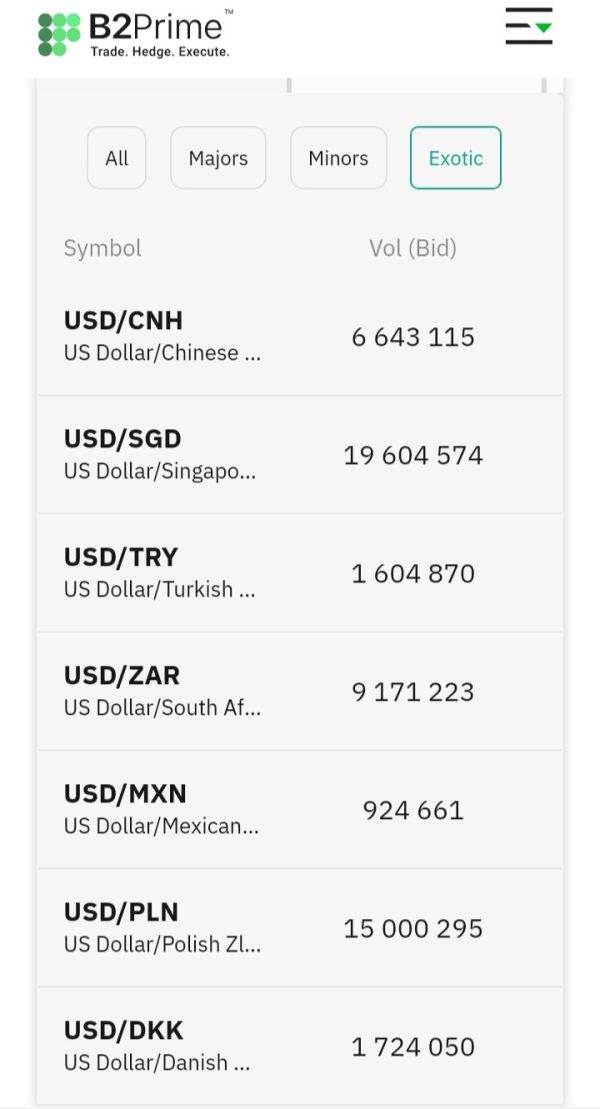

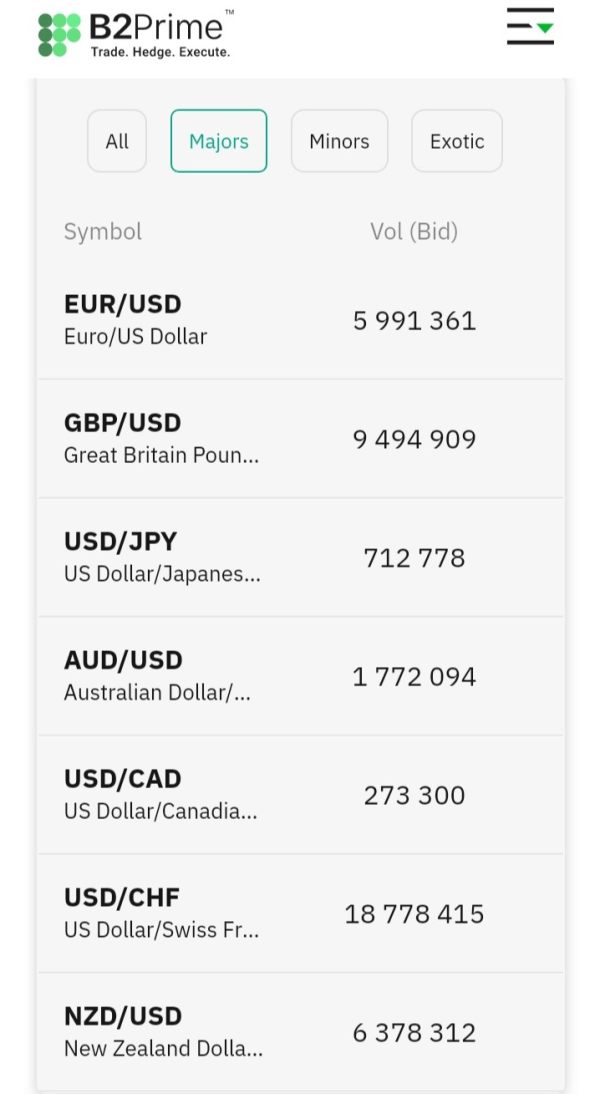

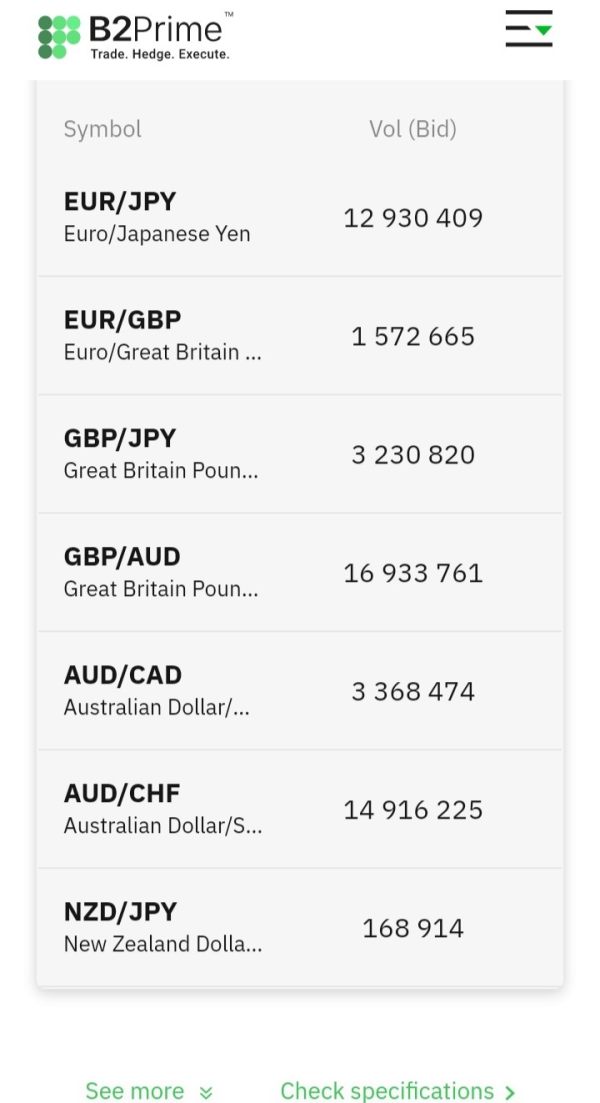

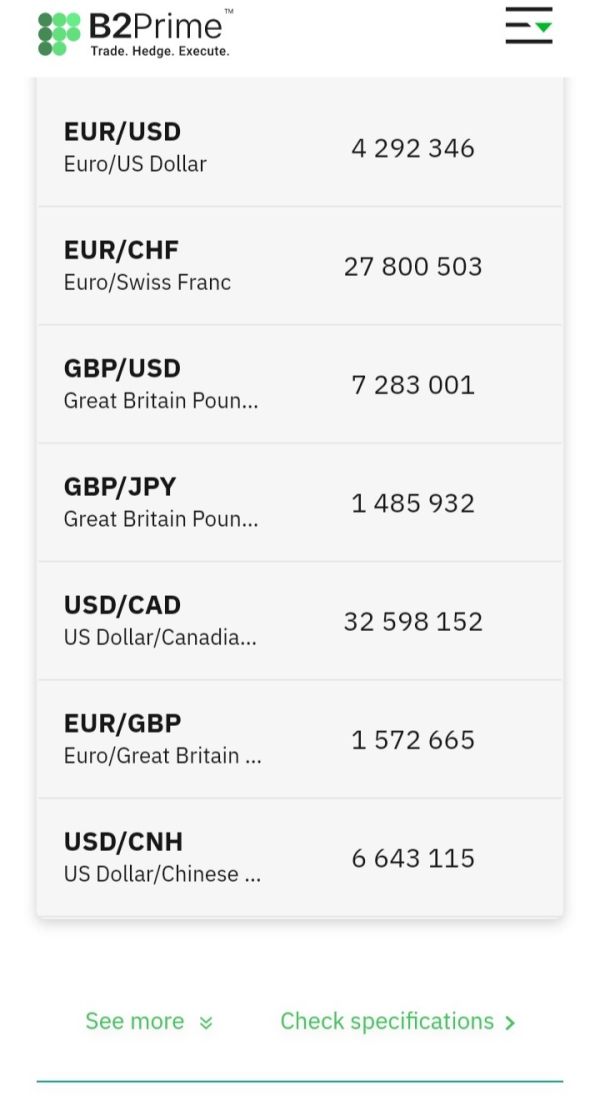

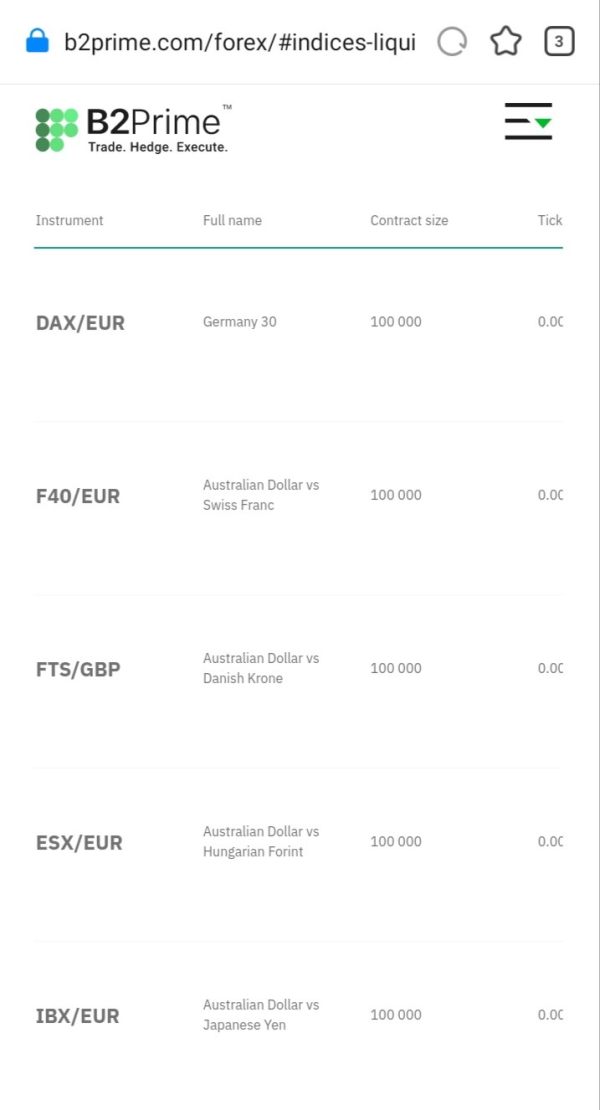

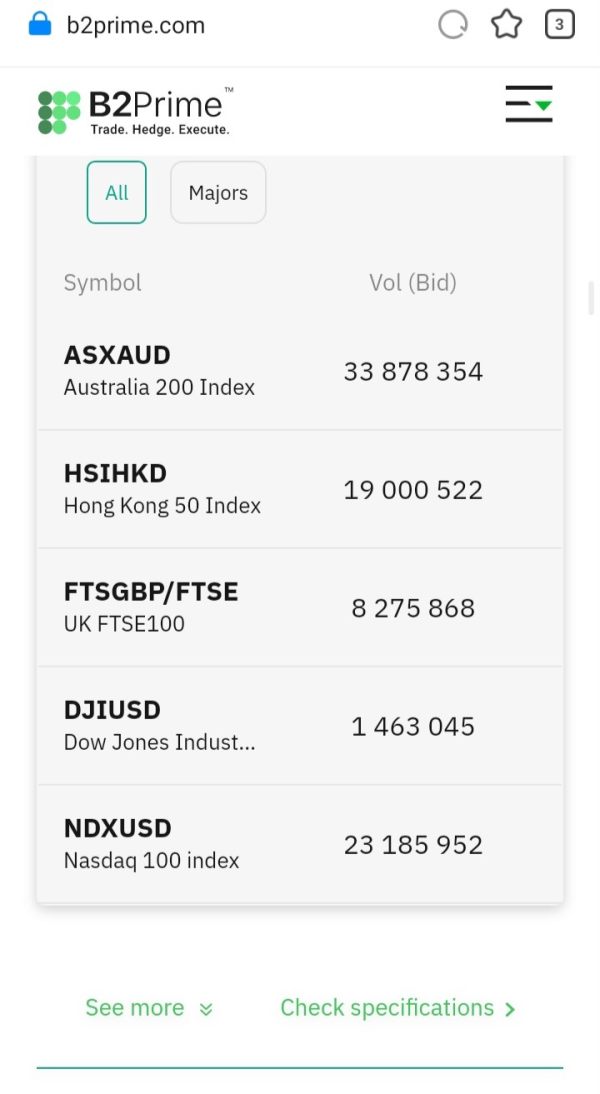

Tradeable Assets: Primary focus appears concentrated on forex trading. However, specific currency pair availability and additional asset classes require further investigation through direct broker contact.

Cost Structure: Detailed information regarding spreads, commissions, and additional trading costs is not readily available in public documentation. This represents a significant transparency gap for potential clients.

Leverage Ratios: Specific leverage offerings are not detailed in accessible information. However, CySEC regulation typically imposes maximum leverage limits for retail clients.

Platform Options: Trading platform specifications and availability are not comprehensively detailed in available materials.

Geographic Restrictions: Specific regional limitations and service availability are not clearly documented in accessible information.

Customer Support Languages: Supported languages for customer service are not specified in available documentation.

This b2prime review highlights significant information gaps. Potential clients should address these through direct broker communication before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

B2Prime's account conditions receive a below-average rating due to significant transparency limitations in available documentation. The absence of clearly specified account types, minimum deposit requirements, and detailed fee structures creates substantial uncertainty for potential clients. These clients are attempting to evaluate suitability but lack essential information.

Without accessible information about different account tiers, traders cannot effectively assess which offering might align with their trading capital and strategy requirements. The lack of published minimum deposit thresholds particularly impacts newer traders. These traders need to understand entry barriers before committing to the platform.

Account opening procedures are not detailed in available materials. This leaves questions about verification requirements, documentation needs, and approval timeframes. This opacity contrasts unfavorably with industry standards where brokers typically provide comprehensive account information to facilitate informed decision-making.

The absence of information about specialized account features, such as Islamic accounts for Sharia-compliant trading, further limits the broker's appeal to diverse trader populations. Additionally, without clear details about account maintenance fees, inactivity charges, or other ongoing costs, traders cannot accurately calculate the total cost of maintaining a relationship with B2Prime.

This b2prime review emphasizes that the lack of transparent account condition information significantly hampers trader ability to make informed choices. This contributes to the below-average rating in this crucial evaluation dimension.

B2Prime's tools and resources receive an average rating, reflecting mixed performance in providing comprehensive trading support infrastructure. While the broker demonstrates strength in liquidity provision, the overall toolkit appears limited compared to full-service competitors.

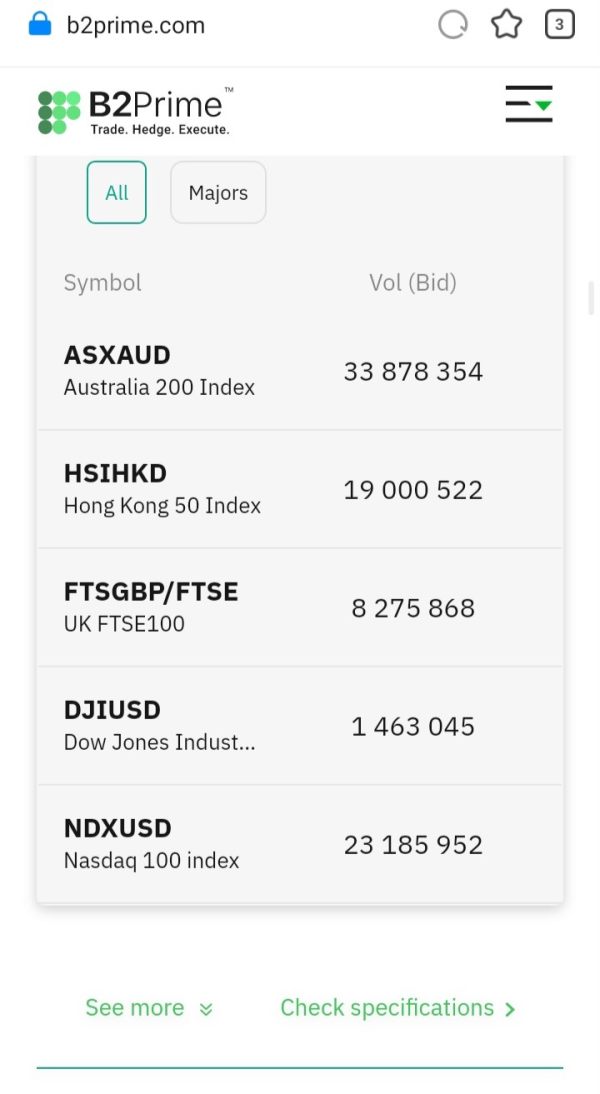

The platform's liquidity capabilities represent its strongest asset. User feedback specifically highlights efficient buyer-seller matching. This suggests robust underlying infrastructure that supports smooth order execution, particularly valuable for active traders requiring reliable market access.

However, significant gaps exist in educational resources and analytical tools. Available information does not indicate comprehensive market research provision, educational content libraries, or advanced analytical capabilities. Many traders expect these features from modern brokers. This limitation particularly impacts newer traders who rely on broker-provided education for skill development.

Concerning user feedback regarding automated trading software raises questions about the quality and reliability of algorithmic trading support. Negative experiences with automated systems suggest potential technical issues or inadequate software development. This could impact traders using expert advisors or copy trading strategies.

The absence of detailed information about charting capabilities, technical indicators, and advanced order types further limits the assessment of B2Prime's tool offerings. Without comprehensive platform demonstrations or detailed feature lists, traders cannot adequately evaluate whether the available tools meet their specific trading requirements.

Customer Service and Support Analysis (5/10)

Customer service and support receive a below-average rating due to limited available information about service quality, accessibility, and responsiveness. The absence of detailed customer support documentation creates uncertainty about the broker's commitment to client assistance.

Available materials do not specify customer service channels, operating hours, or response time commitments. This lack of transparency makes it difficult for potential clients to understand what level of support they can expect. They cannot assess assistance availability when encountering trading issues or requiring help with account management.

The absence of information about multilingual support capabilities further limits the broker's appeal to international clients. In today's global forex market, comprehensive language support often determines broker accessibility for diverse trader populations.

Without published information about support team expertise, escalation procedures, or specialized assistance for complex trading issues, traders cannot assess whether B2Prime provides adequate support for their specific needs. This is particularly concerning for traders requiring technical assistance. It also affects those dealing with significant account values.

The lack of user feedback specifically addressing customer service experiences in available materials prevents comprehensive evaluation of actual service quality. Without concrete user testimonials about support interactions, this assessment relies primarily on the transparency and accessibility of published support information.

Trading Experience Analysis (6/10)

B2Prime's trading experience receives an average rating, balancing positive liquidity feedback against concerns about platform reliability and feature completeness. User testimonials highlight the broker's strength in providing efficient market access. They particularly praise its ability to facilitate smooth buyer-seller matching.

The high liquidity environment appears to be B2Prime's primary competitive advantage. Users specifically note superior performance in finding counterparties for trades. This suggests robust connectivity to liquidity providers and efficient order routing that minimizes execution delays and improves fill rates.

However, platform stability and comprehensive functionality remain questionable due to limited available information about technical infrastructure and feature sets. Without detailed specifications about charting capabilities, order types, and analytical tools, traders cannot fully assess whether the platform meets modern trading requirements.

Mobile trading experience information is notably absent from available documentation. This represents a significant gap given the importance of mobile accessibility in contemporary trading. The lack of mobile platform details suggests either limited mobile offerings or insufficient marketing of existing capabilities.

Execution quality beyond liquidity provision lacks detailed documentation, with no specific information about slippage rates, requote frequency, or order execution statistics. These metrics are crucial for active traders who require predictable execution costs and minimal market impact.

This b2prime review indicates that while B2Prime demonstrates strength in core liquidity provision, the overall trading experience assessment is limited by insufficient transparency. The lack of information about platform capabilities and technical performance metrics hampers comprehensive evaluation.

Trust and Safety Analysis (4/10)

Trust and safety receive a poor rating due to conflicting regulatory information and concerning user feedback about fund security. While B2Prime claims CySEC regulation, contradictory information suggesting unregulated status in certain jurisdictions creates significant uncertainty about client protection.

The regulatory confusion represents a major red flag for potential clients. Clear regulatory standing is fundamental to broker trustworthiness. CySEC oversight typically provides strong client protections, including segregated account requirements and compensation schemes, but these protections may not apply if the broker operates as an unregulated entity in specific regions.

Fund security measures are not clearly detailed in available documentation. This leaves questions about client money protection, segregation practices, and insurance coverage. Without transparent information about how client funds are safeguarded, traders face elevated risks of capital loss beyond normal trading risks.

Company transparency falls short of industry standards. Limited public information exists about management structure, financial statements, or operational details. This opacity makes it difficult for clients to assess the broker's financial stability and operational integrity.

Negative user feedback regarding automated trading software raises additional concerns about the broker's technical reliability and commitment to client interests. When combined with regulatory uncertainty, these technical issues suggest potential systemic problems that could impact overall client safety.

User Experience Analysis (5/10)

User experience receives a below-average rating reflecting mixed client feedback and significant information gaps about platform usability and service quality. Available user testimonials present contrasting perspectives. This indicates inconsistent service delivery across different client segments.

Positive feedback emphasizes B2Prime's liquidity provision capabilities. Users appreciate efficient trade execution and market access. This suggests that the core trading functionality meets basic requirements for traders prioritizing execution efficiency over comprehensive service offerings.

However, negative feedback regarding automated trading software indicates serious usability issues. These could significantly impact traders relying on algorithmic strategies. These concerns suggest inadequate software development or insufficient testing of automated trading features.

The registration and account verification process lacks detailed documentation. This creates uncertainty about onboarding efficiency and user-friendliness. Without clear information about account opening procedures, potential clients cannot assess whether the initial experience meets their expectations for professional service.

Platform interface design and navigation capabilities are not detailed in available materials. This prevents assessment of user-friendliness and learning curve requirements. This information gap is particularly problematic for traders evaluating platform suitability before committing time and capital.

The absence of comprehensive user feedback addressing various aspects of the trading experience limits the ability to provide definitive user experience assessments. More extensive client testimonials would provide better insight into actual service quality and user satisfaction levels.

Conclusion

This b2prime review reveals a broker with notable strengths in liquidity provision but significant concerns regarding transparency and regulatory clarity. B2Prime appears most suitable for experienced traders who prioritize high-liquidity trading environments and can independently navigate potential regulatory and technical risks.

The broker's primary advantage lies in its ability to efficiently match buyers and sellers. This creates favorable conditions for active trading strategies. However, concerning gaps in information transparency, conflicting regulatory status, and negative feedback about automated trading systems suggest substantial risks that potential clients must carefully consider.

B2Prime may appeal to sophisticated traders seeking specific liquidity advantages. However, the lack of comprehensive service information and regulatory uncertainty make it unsuitable for traders requiring full-service broker relationships. It also does not suit those prioritizing maximum client protection and transparency.