Everbright Futures 2025 Review: Everything You Need to Know

Executive Summary

Everbright Futures Co. stands as a veteran player in the Chinese financial markets. The company has been around since 1993, building its reputation over more than three decades. This everbright futures review presents a comprehensive analysis of a broker that has evolved from its origins as Nandu Futures into a regulated entity under the China Securities Regulatory Commission. With over thirty years of operational history, the company offers a solid choice for traders seeking diversified investment opportunities.

The broker's key features include zero spread costs and access to multiple asset classes through their proprietary Futures Trader Pro platform. According to available data, Everbright Futures maintains an average trading speed of 0ms, which puts them ahead of many competitors in terms of execution performance. The platform supports trading across bonds, stocks, futures contracts, forex, and insurance products. This makes it particularly attractive for investors seeking portfolio diversification.

The primary target demographic consists of small to medium-sized investors operating within the Chinese market framework. The broker's regulatory standing under the China Securities Regulatory Commission provides a foundation of legitimacy. However, traders should note that services may be primarily oriented toward domestic Chinese markets. With a user rating of 6 out of 10, the broker maintains a moderate satisfaction level among its client base. This indicates room for improvement in service delivery and user experience.

Important Disclaimers

Regional Entity Differences: Everbright Futures operates primarily within the Chinese regulatory framework under the China Securities Regulatory Commission. International investors should be aware that services, features, and regulatory protections may not extend beyond Chinese jurisdiction, which could limit their access to certain benefits. The broker's offerings and compliance standards are specifically designed for the domestic Chinese market. This may limit accessibility and suitability for traders in other regions.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and aggregated user feedback. Our assessment methodology incorporates multiple data sources to provide a balanced perspective on the broker's performance and reliability. However, some operational details remain limited due to the broker's regional focus and information disclosure practices.

Overall Rating Framework

Broker Overview

Company Foundation and Background

Everbright Futures Co. traces its origins to 1993 when it was established as Nandu Futures. This marks over three decades of presence in China's evolving financial landscape, giving them significant experience in navigating market changes. Headquartered in China, the company has positioned itself as a comprehensive financial services provider, focusing on creating what it describes as a "first-class trading platform" for diverse investment needs. The broker's evolution from its original incarnation demonstrates adaptability to changing market conditions and regulatory requirements within the Chinese financial sector.

The company's business model centers on providing access to multiple asset classes through advanced technology infrastructure. Everbright Futures implements the CTP trading system, which serves as the backbone for order processing and execution across all their trading platforms. Their approach emphasizes strict margin management protocols, reflecting a risk-conscious operational philosophy designed to protect both the firm and its clients from excessive market exposure.

Platform and Asset Coverage

The broker's primary trading interface, Futures Trader Pro, serves as an online futures trading platform that extends beyond traditional futures to encompass a broader spectrum of financial instruments. This everbright futures review finds that the platform supports trading in bonds, stocks, futures contracts, foreign exchange, and insurance products. This provides clients with comprehensive market access under a single technological framework.

Operating under the regulatory oversight of the China Securities Regulatory Commission, Everbright Futures maintains compliance with domestic financial regulations while serving its target market of Chinese investors. The broker's regulatory status provides a foundation of legitimacy and operational transparency. However, specific details about international service availability remain limited in publicly available documentation.

Regulatory Framework and Compliance

Everbright Futures operates under the supervision of the China Securities Regulatory Commission. This regulatory body provides oversight for securities and futures markets within China, ensuring that brokers meet strict operational standards. This regulatory relationship ensures compliance with domestic financial laws and provides clients with standard protections available under Chinese financial regulations.

Deposit and Withdrawal Systems

Specific information regarding deposit and withdrawal methods is not detailed in available documentation. Prospective clients should contact the broker directly to understand available funding options and any associated processing requirements or limitations that may apply to their specific situation.

Minimum Account Requirements

The broker's minimum deposit requirements are not specified in publicly available information. This everbright futures review notes that potential clients will need to inquire directly with Everbright Futures to understand initial funding requirements and account opening procedures that may vary based on account type and trading preferences.

Promotional Offerings

Current bonus programs or promotional incentives are not detailed in available broker documentation. Traders interested in potential promotional offerings should verify directly with the broker regarding any available incentives or special programs that might be available to new or existing clients.

Trading Assets and Markets

Everbright Futures provides access to multiple asset categories including bonds, stocks, futures contracts, foreign exchange instruments, and insurance products. This diversified offering allows traders to construct varied portfolios across different market sectors and risk profiles. The platform supports both hedging and speculative trading strategies across these various asset classes.

Cost Structure Analysis

Available data indicates zero spread costs, which represents a competitive advantage in terms of trading expenses for active traders. However, detailed commission structures, overnight financing charges, and other potential fees are not specified in publicly available information. This limits comprehensive cost analysis for potential clients evaluating the true cost of trading.

Leverage and Margin Requirements

Specific leverage ratios and margin requirements are not detailed in available documentation. The broker mentions implementing strict margin management, but precise leverage offerings across different asset classes require direct inquiry with the firm to understand what options are available for different trading strategies.

Platform Technology

The Futures Trader Pro platform serves as the primary trading interface, offering online access to the broker's full range of tradeable instruments. Platform-specific features, mobile accessibility, and advanced trading tools require further investigation through direct platform demonstration or trial access to fully understand the technological capabilities available to clients.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 6/10)

Everbright Futures presents a mixed picture regarding account conditions, with some competitive elements offset by limited transparency in key areas. The broker's zero spread cost structure represents a significant advantage for traders focused on minimizing transaction expenses. This is particularly beneficial for high-frequency trading strategies or cost-sensitive portfolio management approaches.

However, this everbright futures review identifies substantial information gaps that impact the overall assessment of account conditions. The absence of clearly stated minimum deposit requirements creates uncertainty for prospective clients attempting to evaluate accessibility and initial investment commitments, which can be frustrating for those trying to plan their trading budget. Similarly, the lack of detailed information about account types, their respective features, and any special account functionalities limits traders' ability to select appropriate account structures for their specific needs.

The account opening process details are not comprehensively documented in available materials, which may create barriers for new clients seeking to understand onboarding requirements. This includes documentation needs, timeline expectations, and verification procedures that potential clients need to complete. This lack of transparency in fundamental account information contributes to the moderate scoring in this category, despite the attractive zero spread offering.

The broker's tool and resource offering centers around the Futures Trader Pro platform, which provides access to multiple asset classes and appears to offer competent basic trading functionality. The platform's support for bonds, stocks, futures contracts, forex, and insurance products demonstrates technological capability to handle diverse trading requirements across different market sectors, which is impressive for a single platform solution.

However, detailed information about specific trading tools, analytical resources, and educational materials remains limited in publicly available documentation. The absence of information regarding research capabilities, market analysis tools, charting functionality, and automated trading support represents a significant knowledge gap. This affects the comprehensive evaluation of the broker's technological offerings and makes it difficult for traders to understand what analytical support they can expect.

Educational resources, which are increasingly important for broker differentiation and client development, are not detailed in available materials. The lack of information about webinars, tutorials, market commentary, or educational content suggests either limited offerings in this area or insufficient communication about available resources to potential clients. This limitation impacts the overall assessment of the broker's commitment to client education and development.

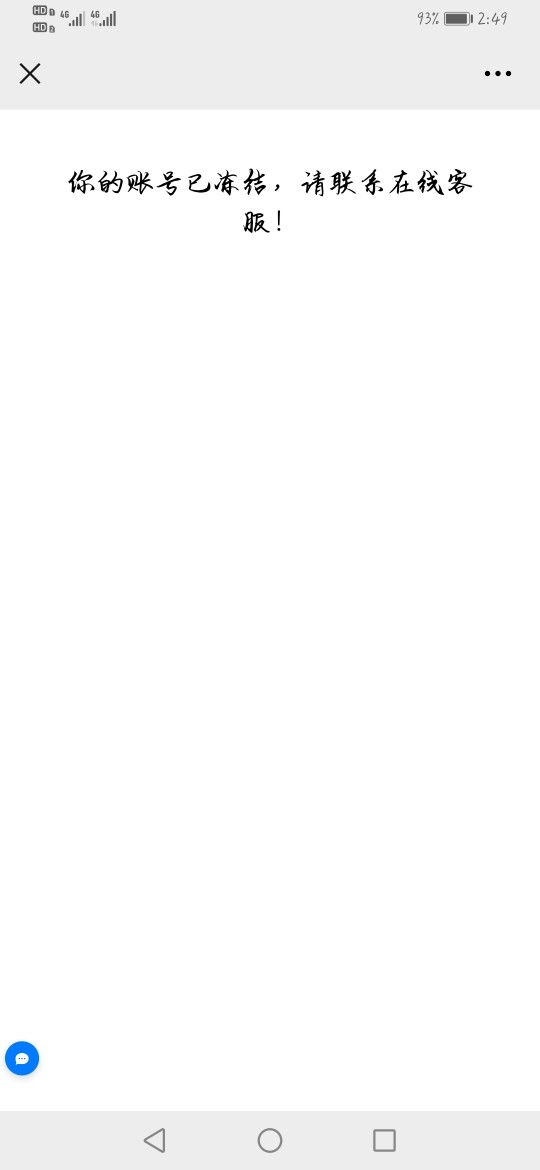

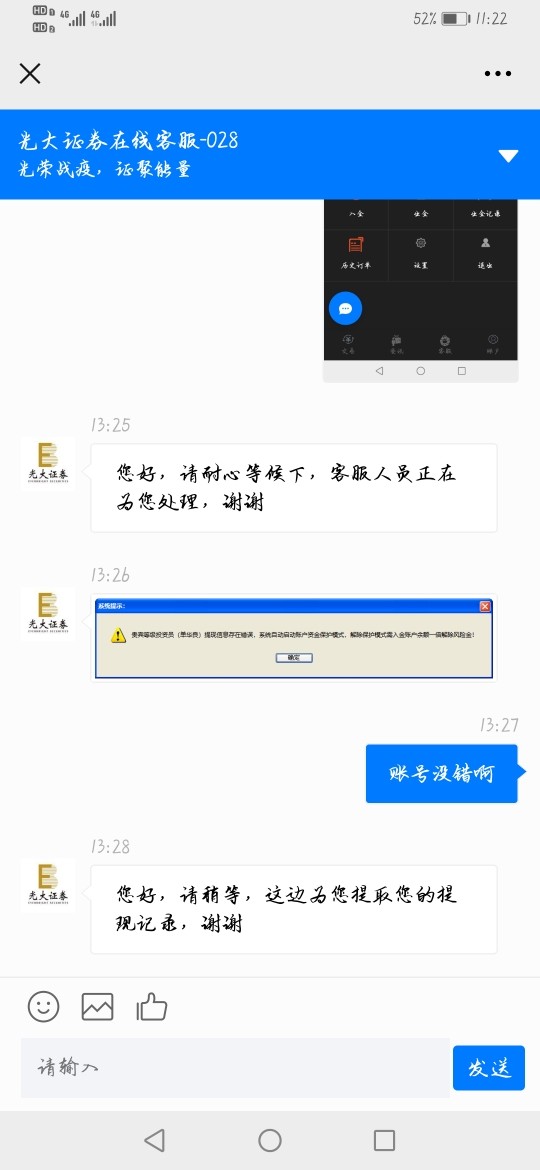

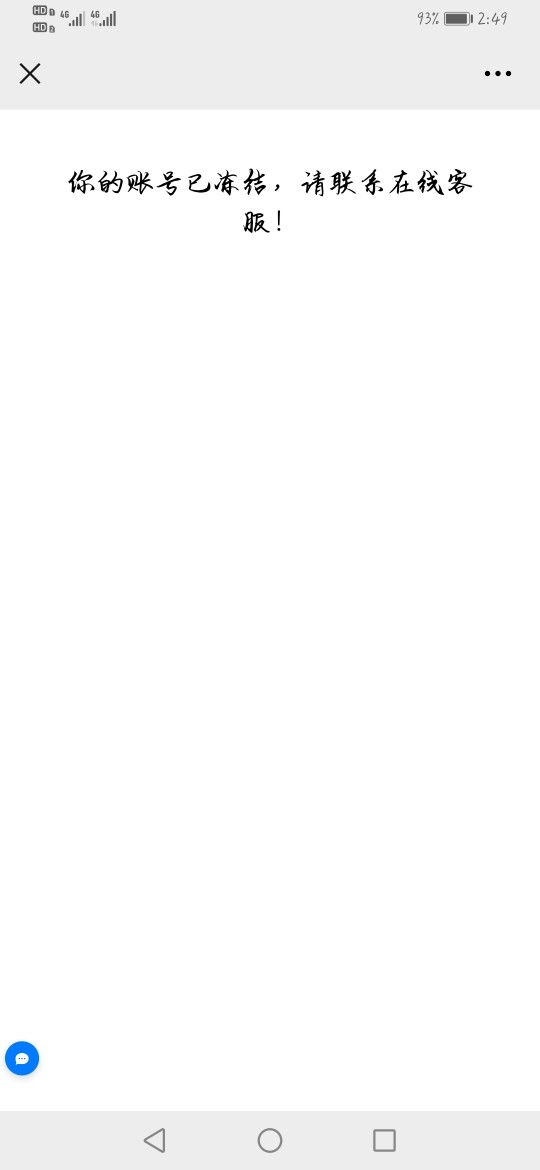

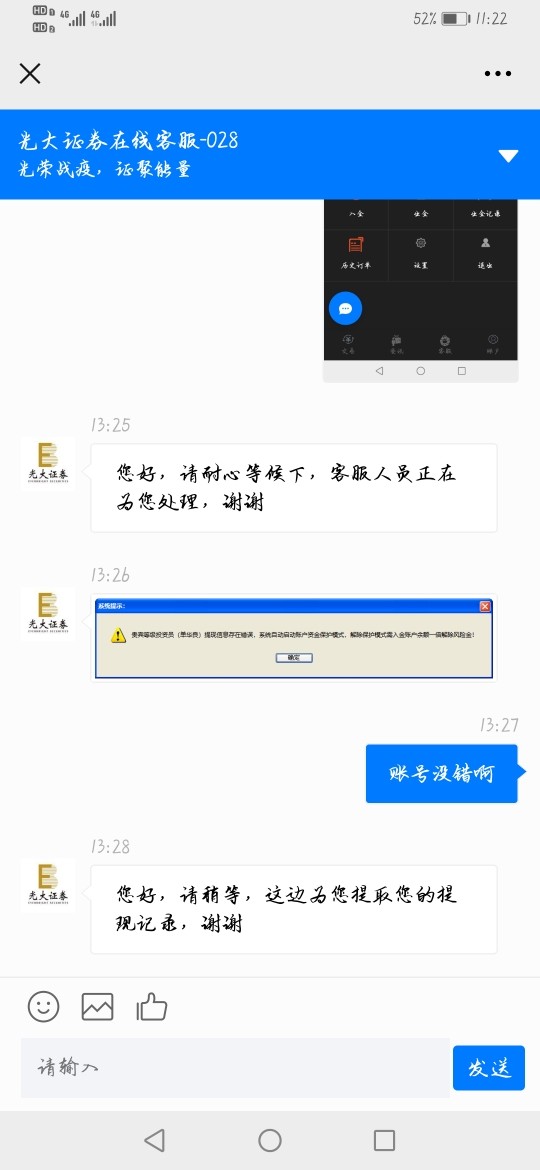

Customer Service and Support Analysis (Score: 6/10)

Customer service evaluation proves challenging due to limited publicly available information about support channels, availability, and service quality metrics. The absence of detailed information about customer service phone lines, email support, live chat functionality, or other communication channels creates uncertainty about the broker's commitment to client support. This makes it difficult for potential clients to understand how they can get help when needed.

Response time metrics, service quality indicators, and client satisfaction measures for customer support are not documented in available materials. This lack of transparency makes it difficult for prospective clients to evaluate the level of support they can expect when encountering technical issues, account questions, or trading-related concerns that inevitably arise during active trading.

Multi-language support capabilities and service hours are not specified, which may be particularly relevant for international clients or those operating across different time zones. The limited information available about customer service infrastructure and capabilities contributes to the moderate scoring in this evaluation category and suggests an area where the broker could improve transparency.

Trading Experience Analysis (Score: 7/10)

The broker's trading experience shows promise with reported average trading speeds of 0ms, suggesting efficient order processing and execution capabilities. This performance metric indicates competitive technological infrastructure that should support responsive trading operations across the platform's supported asset classes, which is crucial for active traders who need fast execution.

However, this everbright futures review notes the absence of crucial execution quality metrics including slippage data, requote frequency, and order rejection rates. These factors significantly impact actual trading costs and experience quality beyond just execution speed. Their absence represents a notable limitation in comprehensively evaluating trading conditions that traders actually experience in live market conditions.

Platform stability information, mobile trading capabilities, and advanced order types are not detailed in available documentation. The lack of information about platform downtime, system reliability during high-volatility periods, or mobile application functionality limits traders' ability to assess the complete trading environment they would be working with. While the zero-millisecond execution speed suggests strong technical capabilities, the overall trading experience evaluation requires additional transparency in execution quality metrics.

Trust and Reliability Analysis (Score: 8/10)

Everbright Futures demonstrates strong foundational trustworthiness through its regulatory relationship with the China Securities Regulatory Commission and its extensive operational history dating back to 1993. This three-decade presence in the Chinese financial markets provides evidence of institutional stability and regulatory compliance over multiple market cycles. The company has weathered various regulatory changes and market conditions, which speaks to its operational resilience.

The broker's regulatory status under CSRC supervision provides standard protections and oversight consistent with Chinese financial regulations. This regulatory framework offers clients recourse mechanisms and operational transparency requirements that enhance overall trust and reliability compared to unregulated alternatives, giving traders confidence in the broker's legitimacy and operational standards.

However, specific information about client fund protection measures, segregated account policies, and financial transparency reporting is not detailed in publicly available materials. The absence of information about negative balance protection, deposit insurance coverage, or third-party fund custody arrangements represents gaps in the complete trust assessment. Despite these information gaps, the regulatory foundation provides substantial credibility for the broker's operations.

User Experience Analysis (Score: 6/10)

User satisfaction metrics indicate moderate performance with a reported user rating of 6 out of 10, suggesting adequate but improvable service delivery across the broker's operations. This rating reflects a neutral user sentiment that indicates basic functionality without exceptional service quality or significant operational problems that would drive users away.

The absence of detailed user feedback about platform interface design, navigation efficiency, and overall usability limits comprehensive user experience evaluation. Information about registration processes, account verification procedures, and onboarding experiences is not available in current documentation. This makes it difficult to assess the complete client journey from initial interest through active trading.

Common user complaints, positive feedback themes, and specific areas of user satisfaction or dissatisfaction are not documented in available materials. This limitation prevents identification of specific strengths and weaknesses in the user experience. It contributes to the moderate scoring in this evaluation category despite the potential for higher performance in specific operational areas that users might actually appreciate.

Conclusion

Everbright Futures presents a moderately positioned option within the Chinese financial services landscape, offering over three decades of operational experience under regulatory supervision. This everbright futures review concludes that the broker provides adequate services for its target market, with particular strengths in regulatory compliance and multi-asset platform access that serve the needs of many Chinese investors. However, significant information gaps limit comprehensive evaluation of all aspects of their service offering.

The broker appears most suitable for small to medium-sized investors seeking diversified investment opportunities within the Chinese regulatory framework. The zero spread cost structure and multiple asset class access represent clear advantages for cost-conscious traders. The Futures Trader Pro platform provides a technological foundation for varied trading strategies across different market sectors.

Primary advantages include the competitive pricing structure with zero spreads, regulatory oversight providing institutional credibility, and comprehensive asset class coverage supporting portfolio diversification strategies. However, limitations include insufficient transparency regarding customer service capabilities, incomplete information about trading conditions beyond execution speed, and limited documentation of educational and analytical resources. Modern traders increasingly expect comprehensive support tools and educational materials from their brokers, making these gaps notable areas for potential improvement.