Regarding the legitimacy of Everbright Futures forex brokers, it provides CFFEX and WikiBit, .

Is Everbright Futures safe?

Risk Control

Software Index

Is Everbright Futures markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

光大期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Everbright Futures Safe or Scam?

Introduction

Everbright Futures is a brokerage firm based in Hong Kong, primarily focusing on futures and derivatives trading. Established in 2018, it has quickly positioned itself within the competitive foreign exchange market. As the trading landscape continues to evolve, traders must exercise caution and perform due diligence before selecting a broker. This is particularly important given the prevalence of scams and unregulated entities in the financial sector. In this article, we will systematically assess the legitimacy of Everbright Futures by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk factors. Our analysis is based on a comprehensive review of available information, including user reviews, regulatory filings, and industry reports.

Regulation and Legitimacy

The regulatory framework governing a brokerage is crucial for ensuring the safety of client funds and maintaining market integrity. Everbright Futures claims to be regulated by the China Financial Futures Exchange (CFFEX). Below, we summarize the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| China Financial Futures Exchange (CFFEX) | 0007 | China | Regulated |

While regulation by CFFEX is a positive indicator, it is essential to scrutinize the quality of oversight provided by this authority. Although Everbright Futures is licensed, some reviews indicate that the regulatory environment in China may not be as stringent as those in other regions, such as the UK or the US. Furthermore, recent complaints from users regarding withdrawal issues raise questions about the firms adherence to regulatory standards. Overall, while Everbright Futures is regulated, potential clients should be cautious and consider the implications of trading under a regulatory framework that may lack rigorous enforcement.

Company Background Investigation

Everbright Futures operates as a subsidiary of Everbright Securities, a well-established entity in the financial services industry. The parent company has been in operation since 1996 and has a robust infrastructure, including multiple branches across major Chinese cities. This affiliation lends some credibility to Everbright Futures; however, it is vital to examine the management team and their experience.

The management team at Everbright Futures comprises professionals with backgrounds in finance and trading, but specific details about their individual qualifications and track records are limited. Transparency regarding the company's operations and ownership structure is critical for establishing trust with clients. However, there seems to be a lack of comprehensive information available to the public regarding the company's governance and operational practices. This lack of transparency could be a red flag for potential investors.

Trading Conditions Analysis

When assessing whether Everbright Futures is safe, it is crucial to understand the trading conditions it offers. The overall fee structure can significantly influence a trader's profitability. Currently, the brokerage provides a standard fee model, but specific details about spreads and commissions are somewhat vague. Below is a comparison of core trading costs:

| Fee Type | Everbright Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of clear information about spreads and commissions raises concerns about the overall transparency of Everbright Futures. Traders should be wary of any hidden fees or unexpected costs that could erode their capital.

Client Fund Security

Client fund security is a paramount concern for any trader. Everbright Futures states that it employs measures to ensure the safety of client funds, including fund segregation and adherence to regulatory requirements. However, the effectiveness of these measures is questionable, especially in light of user complaints regarding withdrawal difficulties.

The absence of a clear investor protection scheme or negative balance protection policy further exacerbates concerns about fund safety. Historical issues related to fund withdrawals have been reported, which could indicate potential vulnerabilities in the firm's operational integrity. Therefore, it is essential for traders to thoroughly assess the security measures in place at Everbright Futures before committing their capital.

Customer Experience and Complaints

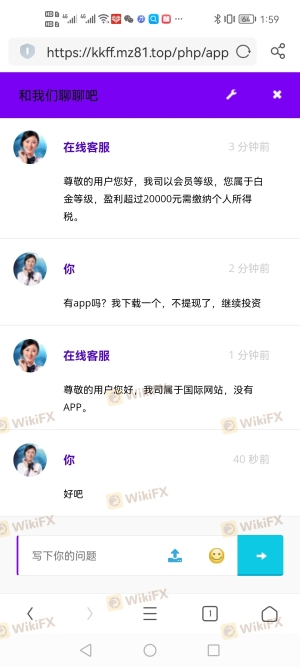

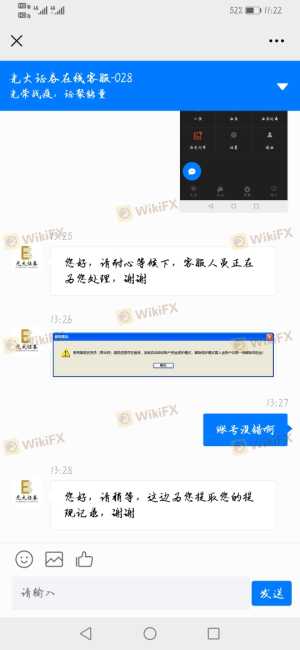

Analyzing customer feedback is vital in determining the reliability of a brokerage. Reviews of Everbright Futures reveal a mix of experiences, with several users expressing dissatisfaction over withdrawal processes. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delays | Medium | Average |

| Lack of Transparency | High | Poor |

Two typical cases illustrate these concerns. One user reported being unable to withdraw funds after multiple requests, leading to frustration and distrust. Another individual highlighted the slow response times from customer service, indicating a potential lack of support when issues arise. These complaints suggest a troubling trend that potential clients should take into account when evaluating whether Everbright Futures is safe.

Platform and Execution

The performance and stability of the trading platform are critical aspects that can affect a trader's experience. Everbright Futures offers a trading platform that is generally reported to be stable; however, specific details regarding order execution quality and slippage are not widely available.

Users have raised concerns about occasional slippage and order rejections, which can significantly impact trading outcomes. Additionally, there are no substantial indicators of platform manipulation, but the lack of comprehensive data makes it challenging to form a definitive conclusion.

Risk Assessment

Using Everbright Futures presents several risks that traders should consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory oversight may expose traders to risks. |

| Fund Security Risk | High | Historical issues with withdrawals raise concerns about fund safety. |

| Customer Support Risk | Medium | Slow response times can lead to unresolved issues for clients. |

To mitigate these risks, traders are advised to conduct thorough research, keep abreast of user reviews, and consider diversifying their trading across multiple platforms.

Conclusion and Recommendations

In conclusion, while Everbright Futures is regulated by CFFEX, there are several warning signs that potential clients should consider. Complaints regarding withdrawal issues, a lack of transparency, and insufficient customer support raise significant concerns about the firm's reliability. Therefore, it is essential for traders to approach Everbright Futures with caution.

For those seeking a safer trading environment, it may be prudent to explore alternative brokers that are regulated by more stringent authorities, have a proven track record, and offer robust customer support. Ultimately, the decision to trade with Everbright Futures should be made with careful consideration of the risks involved and the broker's overall reputation within the industry.

Is Everbright Futures a scam, or is it legit?

The latest exposure and evaluation content of Everbright Futures brokers.

Everbright Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Everbright Futures latest industry rating score is 7.73, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.73 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.