Daiwa 2025 Review: Everything You Need to Know

Executive Summary

Daiwa Securities Group Inc stands as Japan's second-largest securities brokerage company. It trails only behind Nomura Securities in market presence. This comprehensive daiwa review reveals a well-established financial institution that has built its reputation on regulatory compliance and diverse investment opportunities. Founded in 2007, Daiwa operates under the strict oversight of Japan's Financial Services Authority. The FSA provides traders with confidence in their regulatory framework.

The broker distinguishes itself through its comprehensive asset offerings. These include domestic and international stocks, Chinese equities, IPOs, investment trusts, bonds, and foreign exchange products. This diverse portfolio makes Daiwa particularly attractive to traders seeking multi-asset exposure across Japanese and international markets. The company's strong institutional background and regulatory standing position it as a reliable choice for investors prioritizing security and legitimacy in their trading activities.

Daiwa's primary target audience consists of traders and investors who value regulatory security. They seek diversified investment opportunities across multiple asset classes. The broker's emphasis on both domestic Japanese markets and international exposure creates an appealing proposition for those looking to build comprehensive investment portfolios.

Important Disclaimer

This review is based on publicly available information and market research conducted through various sources. Readers should note that Daiwa may operate different entities across various jurisdictions. This could result in varying service offerings, product availability, and regulatory frameworks depending on the trader's location. The information presented here reflects general market understanding and should not be considered as personalized investment advice.

This evaluation methodology relies on publicly accessible data, regulatory filings, and market analysis rather than direct user testimonials or proprietary research. Potential clients are encouraged to conduct their own due diligence and verify current terms and conditions directly with Daiwa before making any investment decisions.

Rating Framework

Broker Overview

Daiwa Securities Group Inc emerged as a significant player in Japan's financial landscape following its establishment in 2007. As the country's second-largest securities brokerage firm, Daiwa has built its foundation on providing comprehensive online trading services to both individual and institutional clients. The company's business model centers on delivering multi-asset trading capabilities through digital platforms. It positions itself as a bridge between traditional Japanese finance and modern trading technology.

The broker's operational framework emphasizes regulatory compliance and market diversity. This reflects Japan's sophisticated financial regulatory environment. Daiwa's approach to client service integrates traditional Japanese business values with contemporary trading demands, creating a unique market position that appeals to both domestic and international traders seeking exposure to Asian markets.

This daiwa review highlights the broker's commitment to maintaining high operational standards while expanding its service offerings across multiple asset classes. The company's strategic focus on combining domestic market expertise with international trading opportunities demonstrates its understanding of modern portfolio diversification needs. Daiwa's platform architecture supports various trading instruments. However, specific technical details about platform types such as MT4 or MT5 integration are not detailed in available public information.

The broker operates under Japan's Financial Services Authority supervision. This ensures adherence to strict regulatory standards that govern client fund protection, operational transparency, and market conduct. This regulatory framework provides traders with institutional-level security measures typically associated with established financial institutions.

Regulatory Jurisdiction: Daiwa operates under the comprehensive supervision of Japan's Financial Services Authority. The FSA is one of Asia's most stringent financial regulatory bodies. This oversight ensures compliance with international banking standards and provides robust client protection measures.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in current available sources. Potential clients should verify current payment processing options directly with the broker.

Minimum Deposit Requirements: Current minimum deposit requirements are not specified in available public information sources.

Bonus and Promotional Offers: No specific bonus or promotional programs are mentioned in current available information sources.

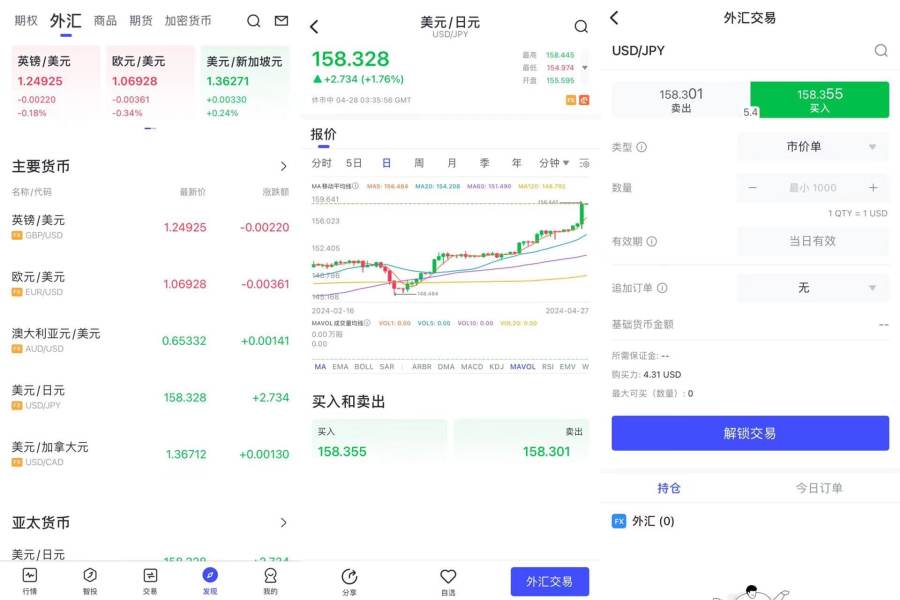

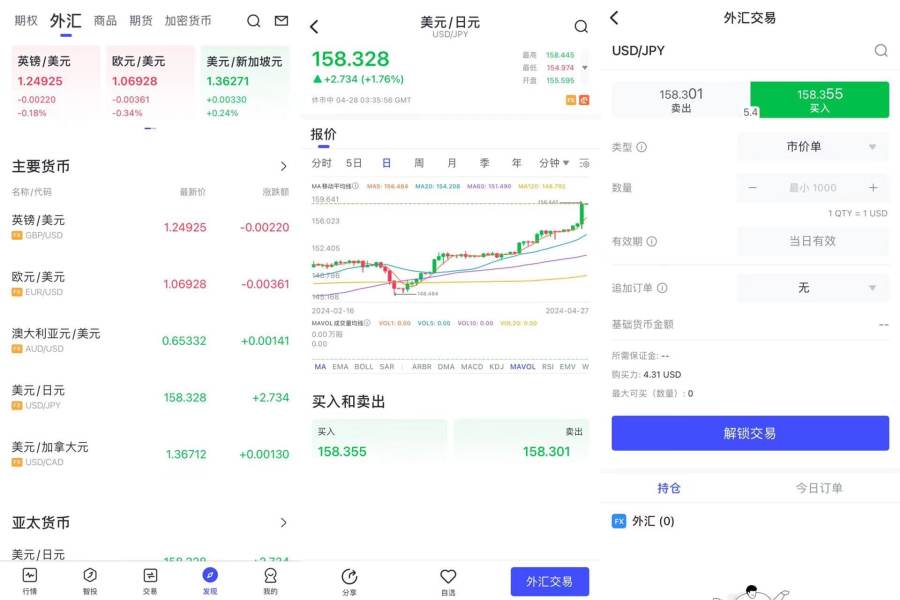

Tradeable Assets: Daiwa's asset portfolio encompasses domestic Japanese stocks, US equities, Chinese stock markets, Initial Public Offerings, investment trusts, government and corporate bonds, and foreign exchange products. This diverse range supports multi-asset portfolio strategies.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not available in current public sources. This daiwa review recommends contacting the broker directly for current pricing information.

Leverage Ratios: Specific leverage offerings are not detailed in available information sources.

Platform Options: Information about available trading platforms and their technical specifications is not provided in current sources.

Geographic Restrictions: Specific regional limitations are not detailed in available public information.

Customer Service Languages: Available customer support languages are not specified in current information sources.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Daiwa's account conditions faces limitations due to insufficient publicly available information regarding specific account types, minimum deposit requirements, and account opening procedures. Available sources do not detail whether the broker offers multiple account tiers. These might include basic, premium, or professional trading accounts, which are common industry standards.

Without access to specific account opening requirements, this daiwa review cannot assess the accessibility of Daiwa's services to different trader segments. The absence of information about special account features represents a significant information gap that potential clients should address through direct broker contact. These features might include Islamic accounts for Sharia-compliant trading.

The lack of transparency regarding account conditions in publicly available sources suggests that Daiwa may provide this information primarily through direct client consultation rather than public marketing materials. This approach, while maintaining privacy, creates challenges for potential clients seeking preliminary account information before engagement.

Daiwa's tools and resources framework demonstrates strength in asset diversity. It offers access to multiple market segments including domestic Japanese equities, international stocks, and foreign exchange markets. The broker's institutional background suggests access to professional-grade research and analysis capabilities, though specific details about research quality and availability are not documented in current sources.

The company's position as Japan's second-largest securities firm implies access to comprehensive market data and analytical tools typically associated with major financial institutions. However, without specific information about educational resources, automated trading support, or advanced charting capabilities, a complete assessment of tool quality remains incomplete.

The absence of detailed information about research resources, market analysis offerings, and educational materials represents a significant evaluation limitation. Potential clients seeking comprehensive trading education and analysis tools should inquire directly about available resources and their accessibility levels.

Customer Service and Support Analysis

Customer service evaluation faces substantial information limitations. Current sources do not provide details about available support channels, response times, or service quality metrics. The absence of information about customer service hours, multilingual support capabilities, and problem resolution procedures creates significant evaluation gaps.

Without access to user feedback regarding customer service experiences, this analysis cannot assess the practical quality of Daiwa's support operations. The lack of information about available communication channels limits understanding of support accessibility. These channels might include phone, email, live chat, or in-person consultation.

The information gap regarding customer service represents a critical area where potential clients should conduct direct research through broker contact before account opening. Service quality often significantly impacts trading experience, making this information essential for informed decision-making.

Trading Experience Analysis

Trading experience evaluation encounters significant limitations due to the absence of specific information about platform stability, execution speed, and order processing quality. Without access to user feedback or technical performance data, assessing the practical trading environment becomes challenging.

Current sources do not provide information about platform functionality, mobile trading capabilities, or trading environment characteristics such as execution models or order types supported. This daiwa review cannot evaluate critical factors like slippage rates, requote frequency, or platform downtime statistics.

The lack of specific trading experience data suggests that potential clients should prioritize demo account testing or direct platform evaluation before committing to live trading. Trading experience quality often determines long-term client satisfaction and trading success.

Trustworthiness Analysis

Daiwa's trustworthiness rating reflects strong regulatory foundations through Japan's Financial Services Authority oversight. This provides comprehensive client protection and operational standards. The broker's position as Japan's second-largest securities company demonstrates established market credibility and institutional stability.

The FSA regulatory framework ensures adherence to strict capital adequacy requirements, client fund segregation protocols, and operational transparency standards. This regulatory environment provides traders with institutional-level protection typically associated with major financial institutions.

Daiwa's long-standing market presence and established reputation within Japan's financial sector contribute to overall trustworthiness assessment. However, the absence of specific information about fund protection measures, insurance coverage, or negative event handling procedures represents areas where additional transparency would strengthen confidence.

User Experience Analysis

User experience evaluation faces substantial limitations due to the absence of specific feedback regarding interface design, platform usability, and overall client satisfaction metrics. Without access to user testimonials or satisfaction surveys, assessing practical user experience becomes challenging.

Current information sources do not provide details about registration processes, account verification procedures, or fund operation efficiency. The lack of information about common user complaints or positive experience highlights prevents comprehensive user experience assessment.

The absence of user experience data suggests that potential clients should prioritize direct platform testing and consultation before account opening. User experience quality significantly impacts trading efficiency and long-term satisfaction with broker services.

Conclusion

This comprehensive evaluation reveals Daiwa as a regulatory-compliant broker with strong institutional backing and diverse asset offerings. The company's position as Japan's second-largest securities firm, combined with FSA regulatory oversight, establishes a foundation of trustworthiness and market credibility that appeals to security-conscious traders.

Daiwa appears most suitable for investors seeking diversified market exposure across Japanese and international assets. These investors particularly value regulatory compliance and institutional stability over cutting-edge trading features. The broker's multi-asset approach supports comprehensive portfolio strategies for traders comfortable with traditional brokerage models.

The primary advantages include strong regulatory protection, diverse asset availability, and established market reputation. However, significant information gaps regarding account conditions, trading costs, and user experience represent notable limitations that require direct broker consultation for complete evaluation.