Summary: Corporate Brokers Limited presents itself as a regulated financial institution operating in Hong Kong, offering a range of trading services. However, user experiences and expert opinions reveal significant concerns regarding its legitimacy, customer support, and operational transparency.

Note: It is important to consider that Corporate Brokers Limited may operate under different entities across regions, which can affect its regulatory status. This review aims to provide a fair and accurate assessment based on the latest available information.

Rating Overview

We rate brokers based on a combination of user feedback, expert analysis, and factual data from regulatory sources.

Broker Overview

Founded in 1982, Corporate Brokers Limited is a financial institution based in Hong Kong, regulated by the Securities and Futures Commission (SFC). The broker primarily offers access to Hong Kong securities, futures, and trading platforms like the Concord Securities trading platform. However, the broker has been flagged for exceeding its regulatory scope, raising questions about its operational practices.

Detailed Breakdown

Regulatory Status

Corporate Brokers Limited is regulated in Hong Kong by the SFC, which provides a level of assurance regarding investor protection. However, reports indicate that the broker operates beyond its licensed activities, specifically in dealing with securities and futures, without proper forex regulation (license number: AAC 806). This has led to concerns about its credibility and the potential risks for investors.

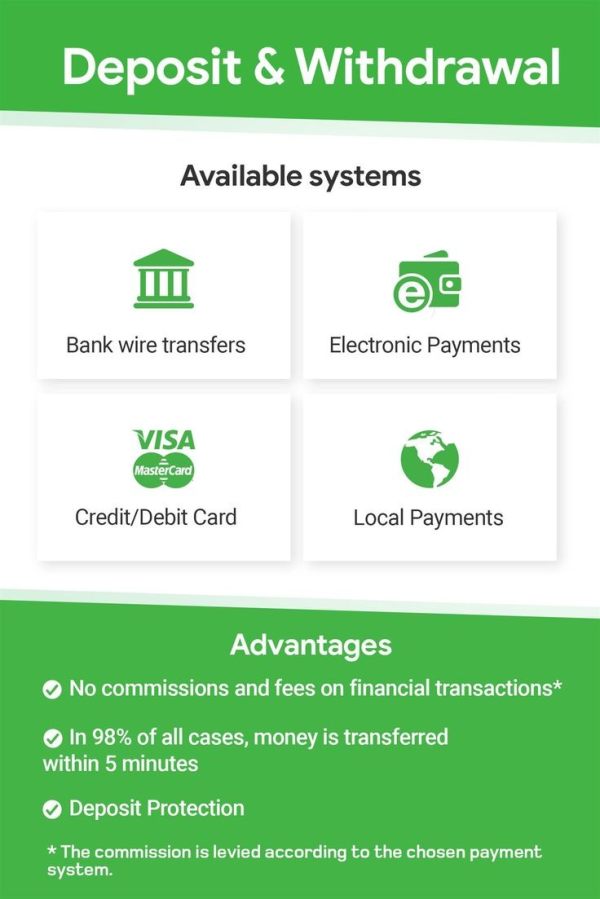

Deposit and Withdrawal Options

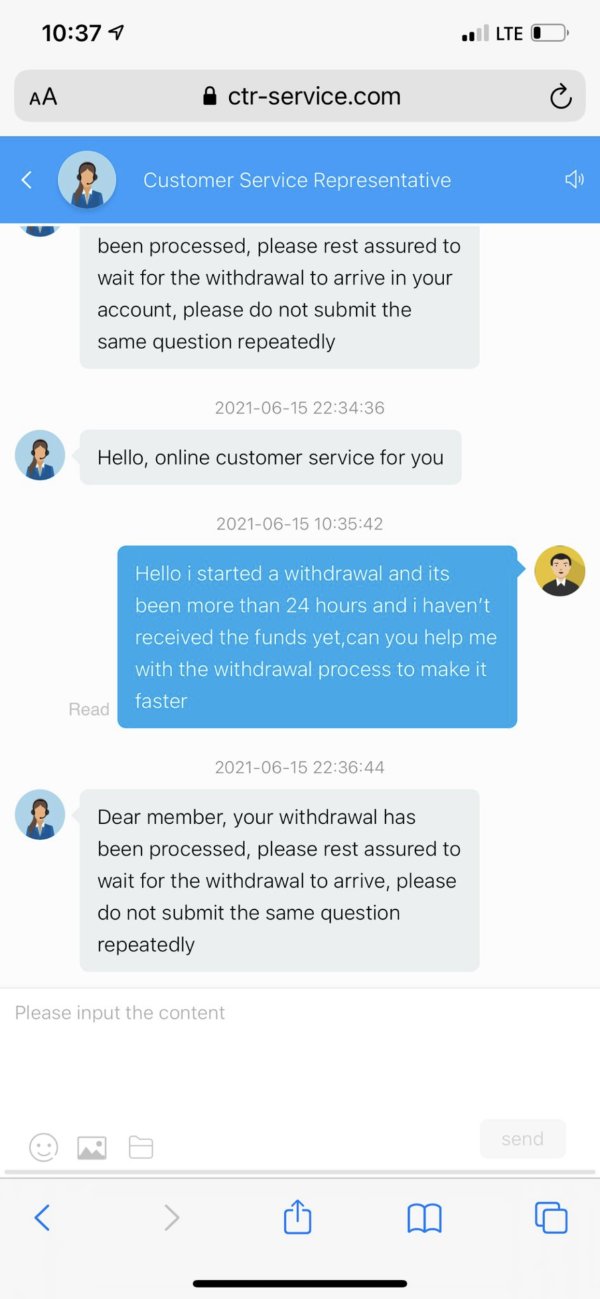

Corporate Brokers Limited allows deposits through various means, including bank transfers from major institutions such as Bank of China and HSBC. However, the lack of clear information regarding withdrawal processes has been a common complaint among users, with reports of delays and difficulties in accessing funds.

Minimum Deposit and Fees

While specific minimum deposit requirements were not clearly stated, users have reported that the platform may require significant initial investments. Costs associated with trading vary by product, with minimum charges for Hong Kong stocks starting at HK$100 for traditional orders and HK$50 for online transactions.

Trading Assets

The broker offers a diverse range of trading instruments, including Hong Kong securities, futures contracts, and access to the Hong Kong Stock Connect program. However, the absence of a demo account limits the ability of new traders to familiarize themselves with the platform before committing real funds.

Trading Costs

Trading costs, including spreads and commissions, are not transparently disclosed, which can pose challenges for traders seeking to understand the total cost of their trading activities. This lack of clarity has raised concerns among potential clients regarding hidden fees and overall transparency.

Corporate Brokers Limited provides leverage of up to 1:100, allowing traders to maximize their exposure. However, the trading platform, Concord Securities, lacks the advanced features found in industry-leading platforms like MT4 or MT5, which may limit the trading experience for more experienced traders.

Restricted Areas and Language Support

The broker primarily operates in Chinese, which may deter non-Chinese speaking clients. Additionally, there are indications that the broker may have restrictions on servicing clients from certain regions, raising further concerns about accessibility.

Rating Recap

Detailed Analysis

Account Conditions

Corporate Brokers Limited's account conditions are somewhat opaque, with no clear information regarding minimum deposit requirements. The varying trading costs and lack of transparency around fees have raised concerns among potential clients. Users have reported that the absence of demo accounts limits their ability to familiarize themselves with the platform, which is particularly critical for novice traders.

The broker provides access to the Concord Securities trading platform, which, while functional, lacks the advanced features and user-friendliness of more established platforms like MT4 and MT5. This can hinder the trading experience for users looking for robust analytical tools and customizable interfaces. Additionally, the absence of educational resources and research tools may leave traders underprepared to make informed decisions.

Customer Service and Support

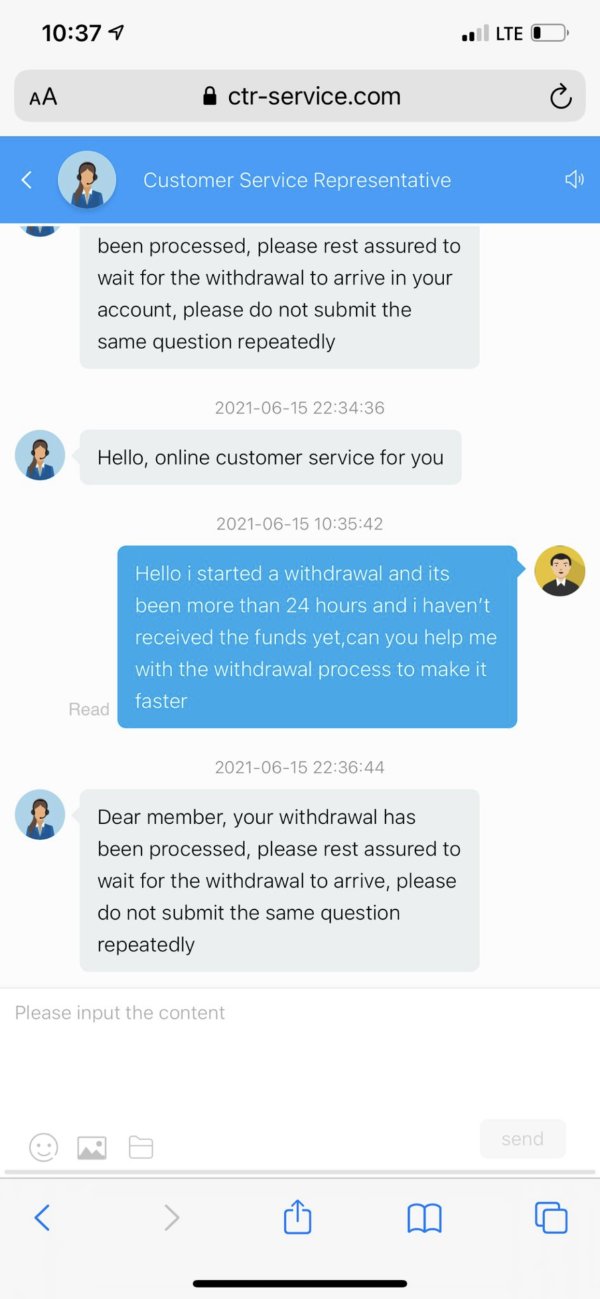

Customer service has been a significant point of contention among users, with many reporting difficulties in reaching support and receiving timely assistance. The lack of live chat support and limited communication channels can lead to frustration, especially for clients needing immediate help with their accounts.

Trading Setup (Experience)

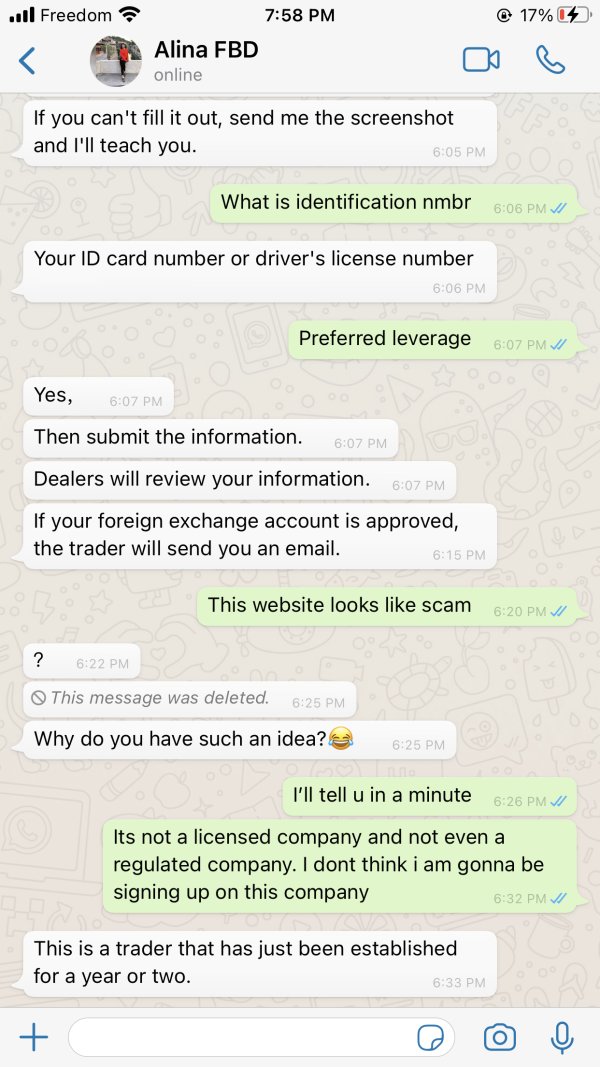

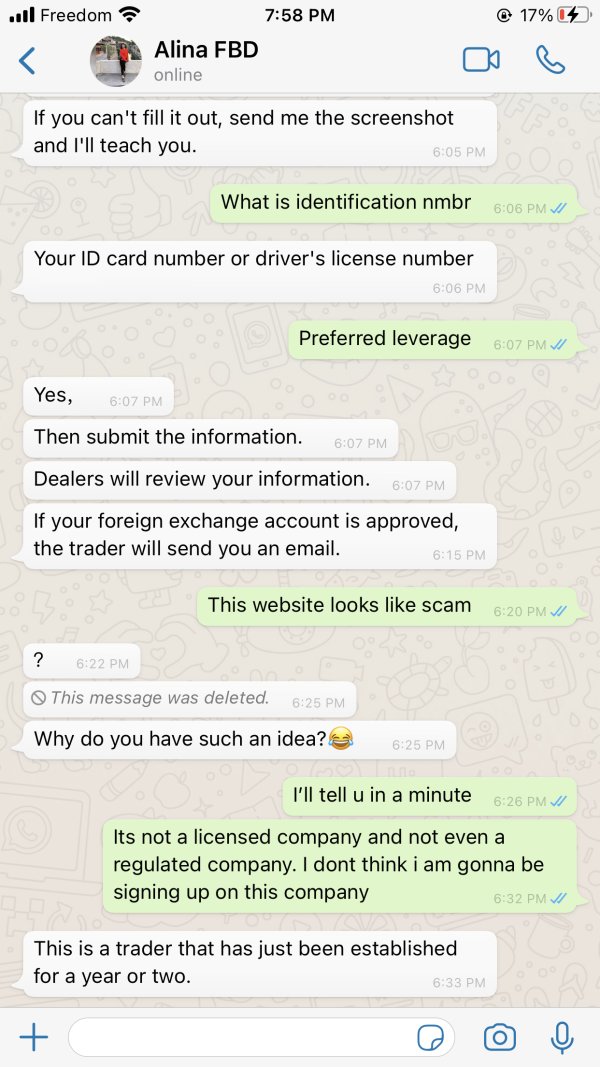

The overall trading experience on Corporate Brokers Limited is marred by the platform's limitations and regulatory concerns. Users have expressed dissatisfaction with the inability to withdraw funds promptly, alongside reports of high-pressure sales tactics and aggressive marketing strategies that raise red flags about the broker's legitimacy.

Trust Level

Trust in Corporate Brokers Limited is low, primarily due to its questionable regulatory compliance and the presence of scam reports associated with its operations. Users are advised to exercise caution and conduct thorough research before engaging with this broker, as the risks may outweigh the potential benefits.

User Experience

User experiences vary, with some clients highlighting the broker's range of services and regulatory backing, while others express dissatisfaction with the platform's limitations and customer support. Reports of withdrawal issues and concerns over transparency have led to a generally negative perception among users.

In conclusion, while Corporate Brokers Limited presents itself as a regulated entity in Hong Kong, the numerous concerns regarding its operational practices, customer service, and regulatory compliance warrant caution. Potential investors should carefully consider these factors before deciding to engage with this broker.