iFOREX 2025 Review: Everything You Need to Know

Executive Summary

iFOREX is a well-known forex and CFD broker that has served traders since 1996. The company brings over 25 years of experience to the financial markets, making it one of the more established players in the industry. This iforex review shows a broker that mainly helps experienced professional clients. The platform offers many trading tools and good leverage ratios for qualified users.

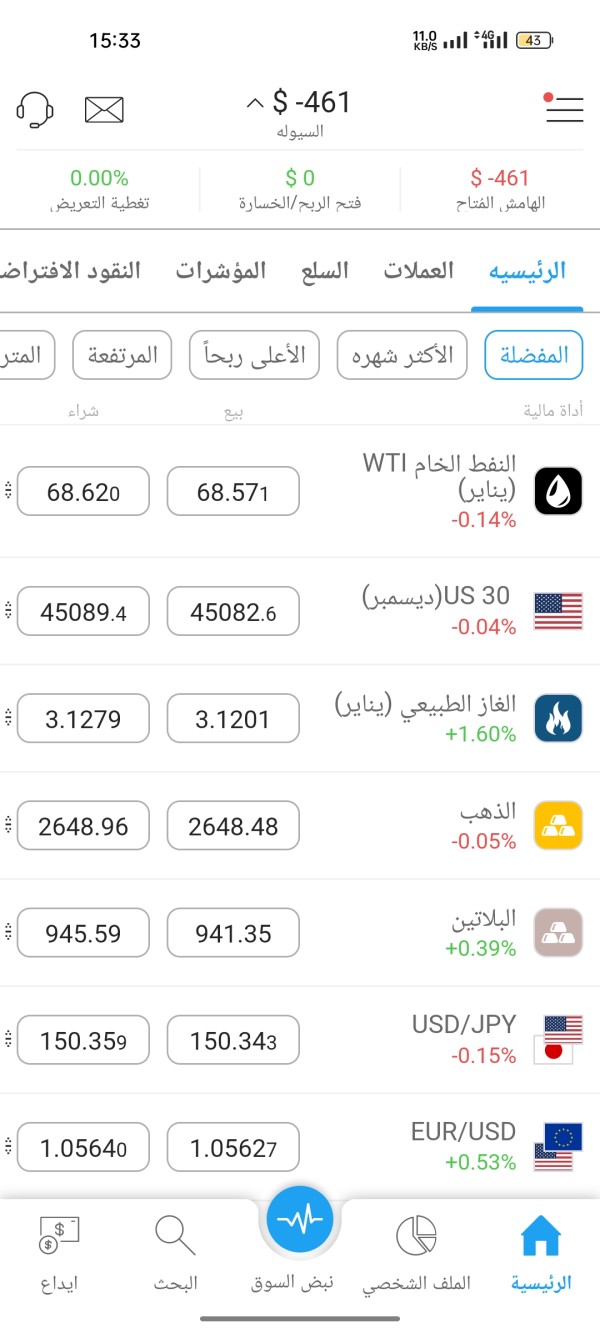

The broker stands out because it offers over 750 financial instruments. These include forex pairs, CFDs, and binary options, giving traders many choices for their investment strategies. Professional clients can get leverage up to 400:1. This high leverage makes the platform very appealing for experienced traders who want more market exposure and understand the risks involved.

iFOREX works under the watch of the Cyprus Securities and Exchange Commission (CySEC) with license number 143/11. This regulatory oversight gives the broker a solid foundation of compliance and helps protect client interests. The broker has earned a Trust Score of 80/100, which shows it has built a good reputation as a reliable trading partner in the forex industry.

The company cares about trader education. It provides detailed training materials and offers live trading services that run 24 hours a day. The platform focuses on professional clients, which shows it wants to serve traders who have the knowledge and experience to handle complex financial markets well.

Important Notice

iFOREX operates in multiple countries and may offer different services based on local rules. The features, leverage ratios, and trading tools available may change depending on where you live and what your local laws require. Some services might not be available in certain regions due to regulatory restrictions.

This review uses publicly available information and user feedback analysis. Trading conditions, regulatory status, and services may change over time, so it's important to stay updated. Potential clients should check current terms and conditions directly with iFOREX before making any trading decisions or opening accounts.

Rating Framework

Broker Overview

iFOREX started in 1996, making it one of the more experienced companies in online trading. The company has over 25 years of market presence and has grown into a full-service forex and CFD trading provider. The broker's long history in the competitive financial services sector shows it can adapt to changing market conditions and regulatory requirements while staying stable.

The company's business model focuses on giving access to global financial markets through forex, CFD, and binary options trading services. iFOREX supports multiple payment methods to meet different client needs, though the specific payment options are not detailed in available documents. This iforex review shows that the broker has built its reputation by serving clients who have substantial trading experience and want access to professional-grade trading conditions.

iFOREX offers an impressive collection of over 750 financial instruments. These include major and minor forex pairs, commodity CFDs, stock indices, and individual equity CFDs, giving traders many options for diversification. The broker operates under the regulatory supervision of the Cyprus Securities and Exchange Commission (CySEC) and holds license number 143/11. This regulatory framework ensures compliance with European Union financial services rules and provides client protection measures that are standard within the EU regulatory environment.

Regulatory Jurisdiction: iFOREX operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). This ensures compliance with EU financial services regulations and maintains operational standards required for European market participation.

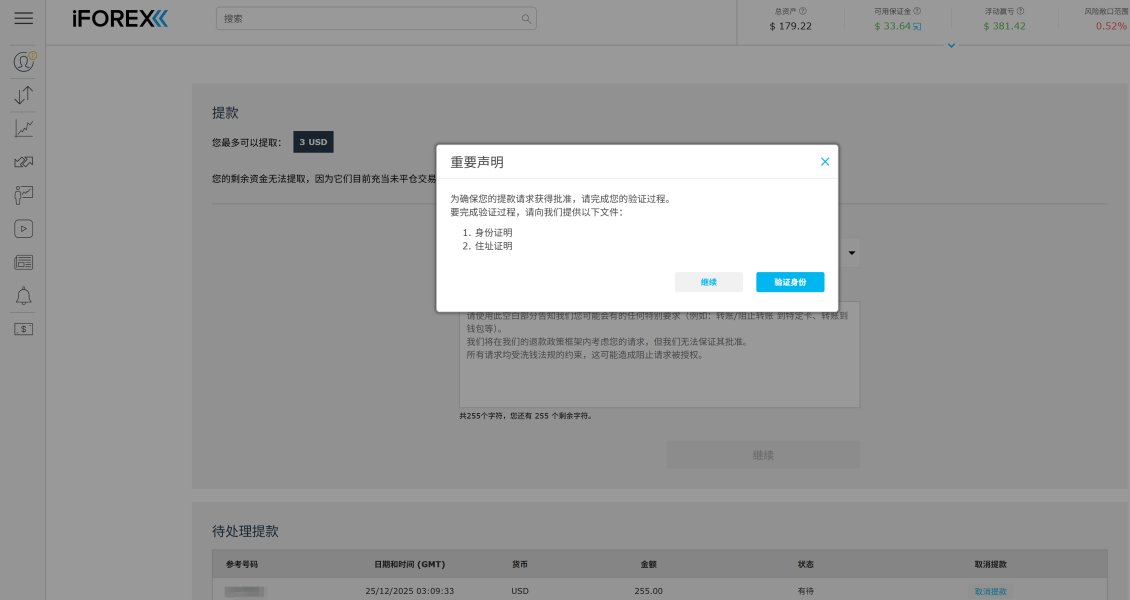

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. Potential clients should verify these details directly with the broker to understand their options.

Minimum Deposit Requirements: Minimum deposit amounts are not specified in current available materials. Interested traders should confirm these requirements directly with iFOREX representatives before opening an account.

Bonus and Promotional Offers: Information about current bonus structures or promotional campaigns is not available in reviewed documentation. Traders should contact the broker directly to learn about any current offers or incentives.

Tradeable Assets: The broker provides access to over 750 financial instruments across multiple asset classes. These include forex currency pairs, CFDs on commodities, stock indices, individual stocks, and binary options trading opportunities, offering extensive market coverage.

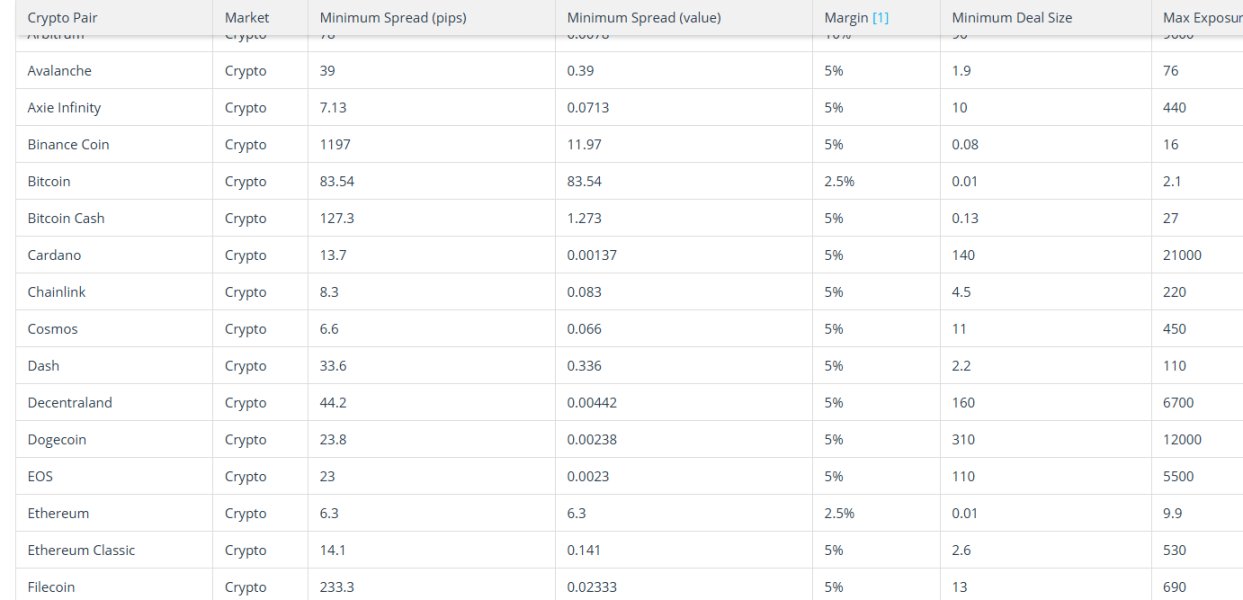

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in available materials. Traders should inquire directly with the broker to understand the complete fee structure before trading.

Leverage Ratios: Professional clients can access maximum leverage of 400:1. This provides significant market exposure capabilities for qualified traders who meet professional client criteria under regulatory guidelines.

Platform Options: Specific trading platform names and technical specifications are not detailed in current documentation. Interested clients should request platform demonstrations or trials to evaluate the trading environment.

Geographic Restrictions: Regional availability and potential geographic restrictions are not specified in available materials. Traders should verify service availability in their location before attempting to open an account.

Customer Service Languages: The range of supported languages for customer service is not detailed in reviewed documentation. Multilingual support availability should be confirmed directly with the broker.

This iforex review highlights the need for potential clients to conduct direct inquiries about specific service details not covered in public documentation.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

iFOREX's account conditions show its focus on serving professional clients. The standout feature is the availability of leverage up to 400:1 for qualified professional traders, which is quite competitive in the industry. This leverage ratio positions the broker well within the professional trading segment, though it's important to note that such high leverage is typically only available to clients who meet specific professional criteria under regulatory guidelines.

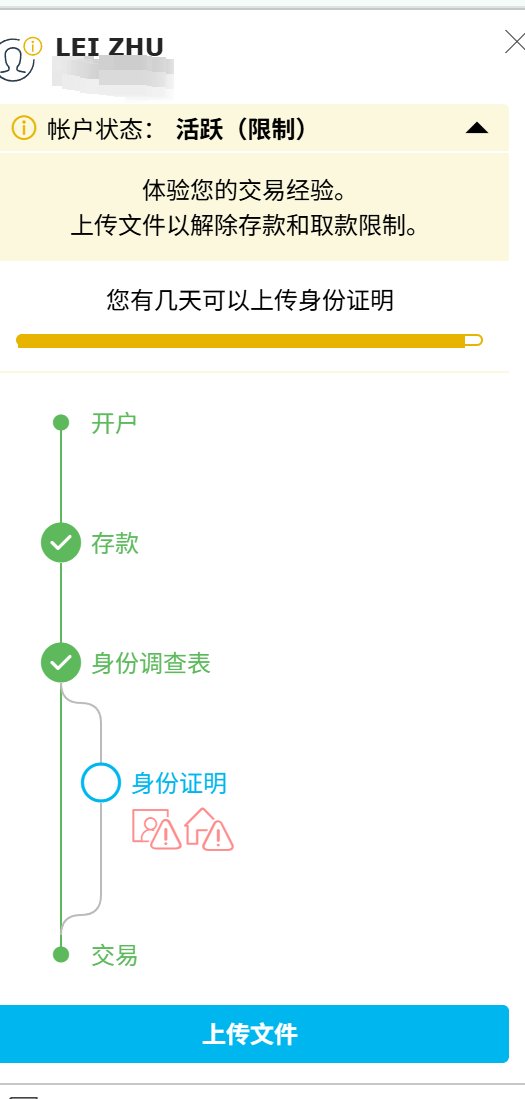

The lack of detailed information about account types and minimum deposit requirements in available documentation presents a limitation for this iforex review. While the high leverage offering suggests competitive account conditions, the lack of transparency about entry-level requirements and account tier structures makes it hard to assess accessibility for different trader segments. Potential clients need to contact the broker directly to get this important information.

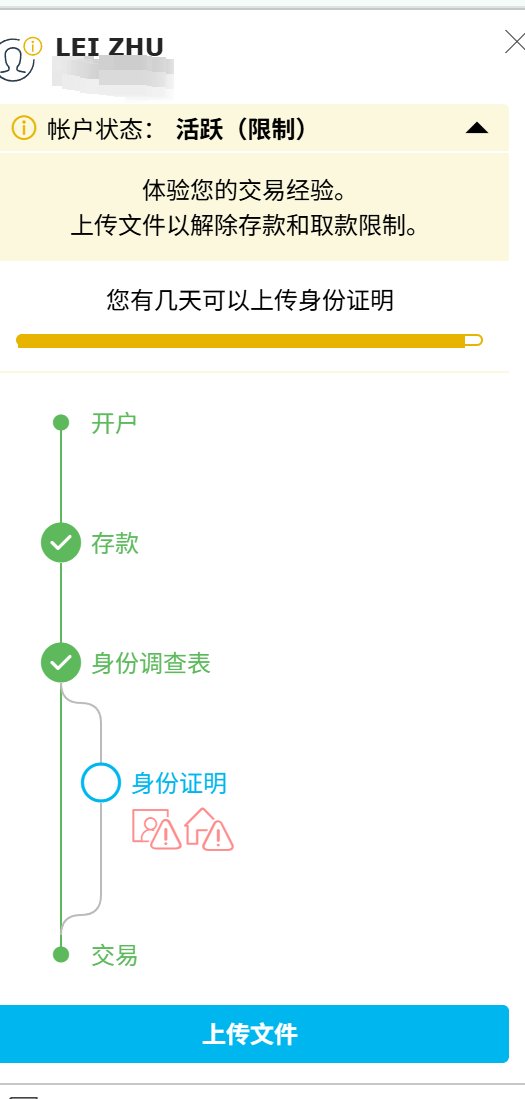

Account opening procedures and verification processes are not extensively documented in available materials. This may impact the user experience for prospective clients who want detailed information before starting the registration process, as they won't know what to expect. The broker would benefit from providing more comprehensive public information about account structures and opening requirements to help potential clients make informed decisions.

Despite these information gaps, the availability of professional-grade leverage ratios shows that iFOREX maintains account conditions designed to meet the needs of experienced traders. These traders can effectively use enhanced market exposure capabilities and understand the associated risks.

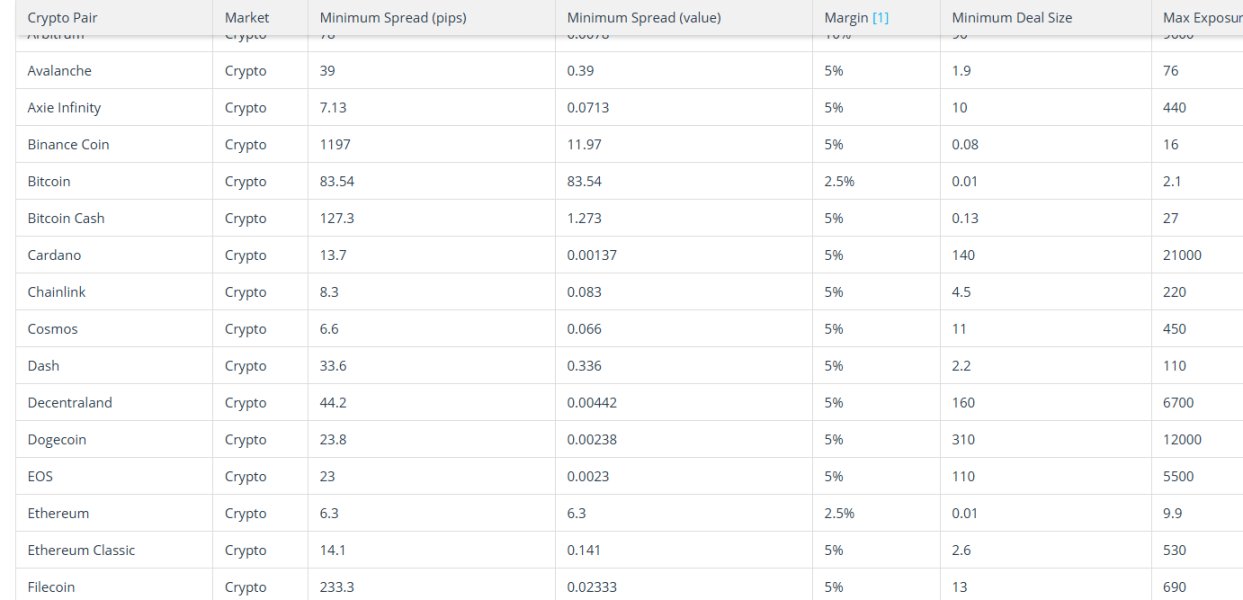

iFOREX excels in providing trading instruments, offering over 750 financial tools across multiple asset classes. This extensive range includes forex currency pairs, CFDs on various underlying assets including commodities and indices, individual stock CFDs, and binary options, giving traders many choices. The breadth of available instruments positions iFOREX favorably for traders seeking diversified market exposure through a single broker relationship.

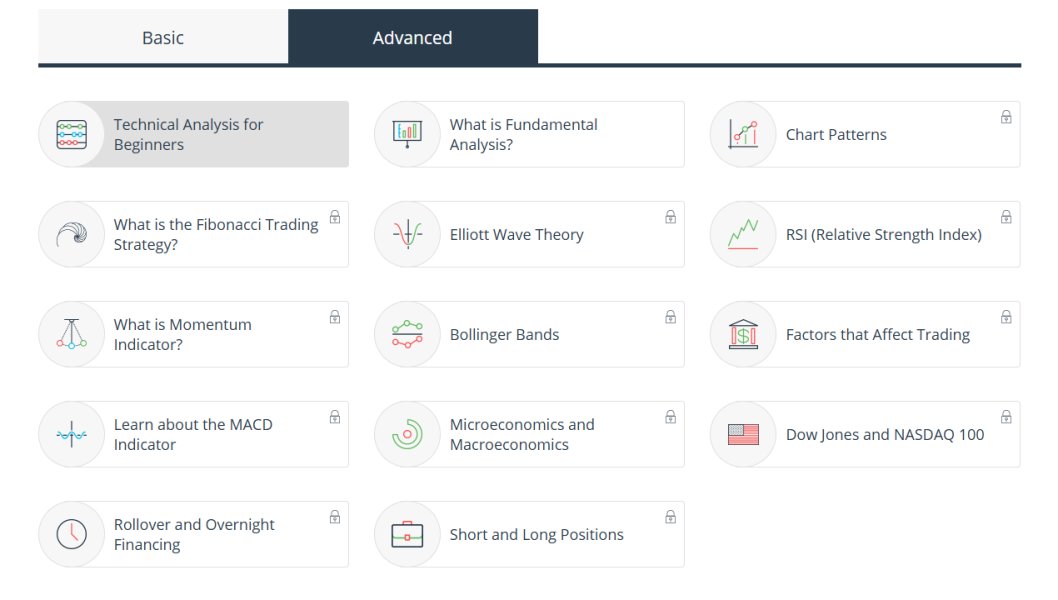

The broker's commitment to trader education is clear through its provision of comprehensive training materials. However, specific details about the scope and format of these educational resources are not extensively documented, which limits our ability to fully assess their quality. The availability of round-the-clock live trading services suggests robust infrastructure supporting continuous market access, which is valuable for traders in different time zones.

Research and analysis resources are not specifically detailed in available documentation. This represents an area where additional information would enhance the evaluation process and help traders understand what analytical support they can expect. Similarly, support for automated trading systems and algorithmic trading is not explicitly mentioned in reviewed materials, which could be important for advanced traders.

The quality and depth of available trading tools contribute significantly to iFOREX's strong rating in this category. The extensive instrument selection caters to diverse trading strategies and market preferences, making it suitable for traders with different approaches and risk tolerances.

Customer Service and Support Analysis (8/10)

iFOREX shows a strong commitment to client support through its provision of round-the-clock live trading services. This ensures that traders can access assistance during global market hours, which is particularly valuable for forex traders who operate across multiple time zones. The 24/7 availability means traders can get help when they need it most, regardless of when markets are active.

The broker's provision of comprehensive training materials indicates a dedication to client education and support. However, specific details about the format, depth, and accessibility of these materials are not extensively documented in available sources, which makes it hard to judge their effectiveness. The educational component suggests that iFOREX recognizes the importance of ongoing trader development and wants to help clients improve their skills.

Response times and service quality metrics are not specifically detailed in available documentation. This makes it difficult to assess the efficiency and effectiveness of the support infrastructure, which is important for traders who need quick help. Similarly, the range of available communication channels and multilingual support capabilities are not comprehensively documented, leaving questions about how clients can reach support.

User feedback generally indicates positive experiences with the broker's reliability and trustworthiness. However, specific testimonials about customer service interactions are not extensively available in reviewed materials, which limits our understanding of the actual support experience.

Trading Experience Analysis (7/10)

iFOREX's trading experience is supported by over 25 years of industry presence. This suggests platform stability and operational reliability developed through extensive market experience, which can give traders confidence in the broker's ability to handle various market conditions. However, specific information about trading platform names, technical specifications, and performance metrics is not detailed in available documentation.

Order execution quality, including details about slippage, requotes, and execution speeds, is not specifically addressed in reviewed materials. This information gap limits the ability to assess the technical quality of the trading environment, which is crucial for evaluating overall trading experience and can significantly impact trading results. Traders need to know they can rely on fast, accurate order execution.

Platform functionality, including charting capabilities, technical analysis tools, and order management features, requires additional verification through direct platform evaluation. Similarly, mobile trading capabilities and cross-platform synchronization are not extensively documented, which is important for traders who want to trade on the go. Modern traders expect seamless experiences across different devices.

The trading environment's stability and liquidity provision are supported by the broker's regulatory standing and industry experience. However, specific performance metrics would enhance the evaluation process and give traders better insight into what to expect. This iforex review indicates that while the broker's longevity suggests platform reliability, more detailed technical specifications would provide greater insight into the trading experience quality.

Trust and Security Analysis (8/10)

iFOREX operates under the regulatory supervision of the Cyprus Securities and Exchange Commission (CySEC), holding license number 143/11. This regulatory framework provides important client protections and ensures compliance with European Union financial services directives, including investor compensation schemes and segregated client fund requirements, which help keep client money safe. The CySEC regulation is well-respected in the industry and provides a good level of oversight.

The broker's Trust Score of 80/100 reflects generally positive industry perception and client feedback. This score indicates a solid reputation within the trading community and suggests that iFOREX maintains operational standards that meet client expectations and regulatory requirements. A score of 80/100 is quite good and shows the broker has earned trust over its years of operation.

Specific fund security measures, including details about client fund segregation, deposit protection schemes, and institutional banking relationships, are not extensively detailed in available documentation. Similarly, information about company financial transparency, including audited financial statements and corporate governance structures, is not readily available, which would provide additional confidence. More transparency in these areas would strengthen the trust assessment.

The broker's 25+ year operational history provides evidence of business continuity and stability through various market cycles and regulatory changes. This longevity contributes positively to the trust assessment, as it shows the company has survived different market conditions and adapted to changing regulations. However, additional transparency about risk management and financial safeguards would strengthen the evaluation and give clients more confidence.

User Experience Analysis (7/10)

User feedback indicates that iFOREX is generally regarded as a trustworthy and reliable broker. Clients express confidence in the platform's operational integrity, which is important for building long-term trading relationships. The broker's focus on serving experienced professional clients suggests a user base that values sophisticated trading capabilities over simplified interfaces.

Platform interface design and usability are not extensively documented in available materials. This limits the assessment of user experience quality, as the interface is crucial for daily trading activities and can significantly impact trading efficiency. Similarly, the registration and account verification process efficiency is not specifically detailed, though the professional client focus suggests potentially more comprehensive verification procedures that might take longer but provide better security.

Fund management experience, including deposit and withdrawal processing times and procedures, is not comprehensively documented in reviewed sources. The availability of multiple payment methods is mentioned, though specific options and processing characteristics require direct verification with the broker. Fast and reliable fund processing is essential for a good user experience.

Common user complaints and areas for improvement are not extensively documented in available feedback. This suggests either generally satisfactory service levels or limited public feedback availability, which makes it hard to identify potential issues. The broker's targeting of professional clients may result in a user base that provides feedback through private channels rather than public forums.

Conclusion

iFOREX presents itself as a well-established forex and CFD broker with over 25 years of industry experience. The company primarily serves professional clients seeking access to extensive market coverage and competitive leverage ratios, making it a good choice for experienced traders. The broker's offering of over 750 financial instruments across multiple asset classes, combined with maximum leverage of 400:1 for professional clients, positions it favorably for experienced traders who can handle sophisticated trading conditions.

The broker is most suitable for experienced traders who can effectively use professional-grade trading conditions and appreciate the breadth of available market access. iFOREX's regulatory standing under CySEC supervision and its Trust Score of 80/100 provide a solid foundation for client confidence, though more transparency would strengthen this further. The combination of regulatory oversight and positive industry reputation makes it a relatively safe choice for qualified traders.

Key strengths include the extensive instrument selection, high leverage availability for qualified clients, comprehensive training materials, and round-the-clock trading support. However, the lack of detailed public information about account structures, cost frameworks, and specific platform capabilities represents areas where enhanced transparency would benefit prospective clients and help them make better-informed decisions. Overall, iFOREX appears well-suited for professional traders seeking a regulated broker with extensive market access and established operational history, though potential clients should conduct thorough due diligence before opening accounts.