Regarding the legitimacy of iFOREX Europe forex brokers, it provides CYSEC, FSC and WikiBit, (also has a graphic survey regarding security).

Is iFOREX Europe safe?

Business

Risk Control

Is iFOREX Europe markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ICFD Ltd

Effective Date:

2011-05-23Email Address of Licensed Institution:

info@iforex.euSharing Status:

No SharingWebsite of Licensed Institution:

www.iforex.eu, www.iforex.pl, www.iforex.nl, www.iforex.es, www.iforex.fr, www.iforex.it, www.iforex.gr, de.iforex.eu, https://hu.iforex.eu, www.iforex.huExpiration Time:

--Address of Licensed Institution:

Corner of Agiou Andreou and Eleftheriou Venizelou Str, Vashiotis Agiou Andreou Bld, 2nd Floor - Office 202, CY-3035 Limassol or P. O. Box 54216, CY-3722 LimassolPhone Number of Licensed Institution:

+357 25 204 600Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Formula Investment House Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is iFOREX A Scam?

Introduction

iFOREX, established in 1996, positions itself as a significant player in the forex market, offering a range of trading services including CFDs on various asset classes. As the financial landscape becomes increasingly complex, traders must exercise caution when selecting a broker. The choice of a trading platform can significantly impact trading outcomes, making it essential to evaluate the trustworthiness and reliability of brokers like iFOREX. This article aims to provide an objective analysis of iFOREX, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety measures. The assessment is based on a thorough review of available online resources and user feedback, structured around key evaluation criteria.

Regulation and Legitimacy

Regulation is a critical aspect of any brokerage, as it serves as a safeguard for traders' funds and ensures compliance with industry standards. iFOREX operates under multiple regulatory jurisdictions, which adds a layer of credibility to its operations. Below is a summary of iFOREX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 143/11 | Cyprus | Verified |

| British Virgin Islands Financial Services Commission (BVI FSC) | SIBA/L/13/1060 | BVI | Verified |

iFOREX is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is recognized for enforcing strict regulatory standards within the European Union. This includes requirements for transparency, client fund protection, and fair trading practices. However, it is essential to note that CySEC is not classified as a top-tier regulator like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). Additionally, while iFOREX holds a license from the BVI FSC, this regulatory body is often viewed as less stringent compared to its European counterparts. Historical compliance issues have also surfaced, including fines for providing unlicensed services, which raises concerns about the broker's commitment to regulatory adherence.

Company Background Investigation

iFOREX is part of the Formula Investment House Ltd group, which has a long-standing history in the financial services sector. Founded in 1996, the company has evolved to cater to a global client base, reportedly serving over 8 million clients across more than 150 countries. The ownership structure of iFOREX is relatively opaque, with limited publicly available information about its management team. However, the company claims to employ experienced professionals from the banking and financial sectors.

Transparency is crucial for building trust with clients. iFOREX provides various educational resources and market analysis tools to assist traders. Yet, the depth of information regarding its management and operational practices is somewhat lacking, which could be a red flag for potential investors. The absence of detailed disclosures about the management team's qualifications and experience may lead to skepticism among prospective clients regarding the broker's reliability.

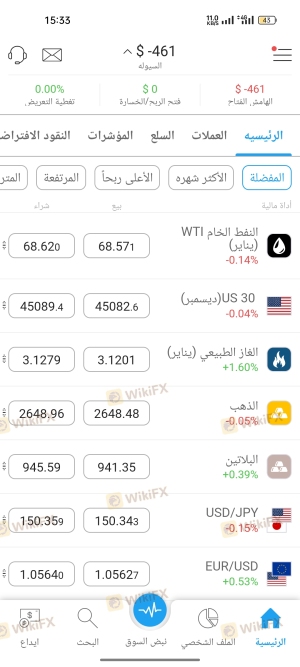

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. iFOREX offers a single live account type with a minimum deposit requirement of $100. The broker does not charge commissions on trades; instead, it generates revenue through spreads. Below is a comparison of key trading costs at iFOREX:

| Cost Type | iFOREX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.8 pips | From 0.6 pips |

| Commission Model | None | Varies (0-0.5%) |

| Overnight Interest Range | Varies | Varies |

While iFOREX does not impose withdrawal fees, clients may incur costs from payment service providers. The spreads offered by iFOREX are generally higher than the industry average, which may deter cost-sensitive traders. Furthermore, the lack of a tiered account structure limits flexibility for traders seeking tailored trading conditions based on their experience and trading volume.

Customer Funds Security

The safety of customer funds is paramount in the forex trading industry. iFOREX employs several measures to protect client funds, including segregated accounts, which ensure that client deposits are kept separate from the company's operating funds. This practice is crucial for safeguarding traders' investments in the event of company insolvency. Additionally, iFOREX offers negative balance protection, meaning that clients cannot lose more than their deposited amount, which is a significant advantage for risk management.

Despite these protections, it is essential to consider the historical context of fund security issues within the company. Past complaints and regulatory fines raise questions about the effectiveness of iFOREX's security measures and its commitment to protecting client interests. Traders should weigh these factors carefully when deciding whether to trust iFOREX with their capital.

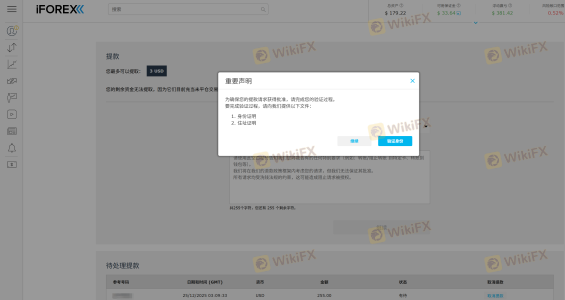

Customer Experience and Complaints

User feedback regarding iFOREX is mixed, with some traders praising the platform's user-friendly interface and customer support, while others have reported significant issues. Common complaints include difficulties with fund withdrawals, poor execution speeds, and lack of responsiveness from customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Order Execution Problems | Medium | Limited communication |

| Customer Service Delays | High | Inconsistent support |

For instance, some users have reported that their accounts were blocked without clear explanations, leading to frustration and financial losses. One trader mentioned that after successfully trading and withdrawing funds, their account was suddenly frozen, and subsequent communications with iFOREX were unhelpful. Such experiences highlight potential operational inefficiencies and raise concerns about the broker's reliability.

Platform and Trade Execution

The trading platform provided by iFOREX is proprietary, which means it lacks the familiarity of popular platforms like MetaTrader 4 or 5. While the platform is designed to be user-friendly, some traders have expressed dissatisfaction with its performance, particularly during periods of high volatility. Issues such as slippage and order rejections have been reported, which can adversely affect trading outcomes. The absence of advanced features commonly found in established trading platforms could limit traders' ability to execute strategies effectively.

Risk Assessment

Engaging with iFOREX comes with inherent risks, primarily due to its regulatory status and user feedback. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Operates under less stringent regulations |

| Fund Security | Medium | Segregated accounts but historical issues |

| Customer Support Reliability | High | Mixed feedback on responsiveness and support |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts to start trading, and remain aware of the potential for operational issues.

Conclusion and Recommendations

In conclusion, while iFOREX is a regulated broker with a long history in the industry, there are several areas of concern that potential traders should consider. The combination of higher-than-average spreads, mixed customer feedback, and regulatory scrutiny could indicate potential risks. While iFOREX offers some client protections, the historical compliance issues and operational inefficiencies may warrant caution.

For traders seeking reliable alternatives, it may be prudent to consider brokers regulated by top-tier authorities such as the FCA or ASIC, which generally offer higher levels of oversight and investor protection. Always ensure that your chosen broker aligns with your trading needs and risk tolerance before committing your funds.

Is iFOREX Europe a scam, or is it legit?

The latest exposure and evaluation content of iFOREX Europe brokers.

iFOREX Europe Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

iFOREX Europe latest industry rating score is 5.73, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.73 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.